Polar Capital Technology

Investment companies | Annual Overview | 9 January 2024

The AI’s have it

Polar Capital Technology’s (PCT’s) manager Ben Rogoff’s conviction levels on the potential of artificial intelligence (AI) have risen, reflecting the all-encompassing possibilities of the technology. His bullishness is displayed in the make-up of PCT’s portfolio, which is weighted almost 80% towards stocks that he believes are AI beneficiaries or enablers. The potential for huge productivity gains – which could boost global GDP by 7%, according to Goldman Sachs – and seemingly few barriers to mass adoption puts the technology sector at a profound moment in time, with corporate spend on AI set to rocket, he adds.

While the mega-cap technology stocks outperformed in 2023, Ben expects a broadening of performance among mid- and small-cap AI beneficiaries this year. He states that PCT’s active management style could prove valuable after several challenging years. PCT’s 10.7% discount could be attractive given what seems an improved investment landscape – with the Fed indicating several rate cuts this year – and the substantial upside potential in the portfolio’s exposure to what Ben believes are AI beneficiaries.

Global growth from tech portfolio

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors within the overall investment objective to reduce investment risk

Fund profile

PCT aims to maximise long-term capital growth through investing in a diversified portfolio of technology companies around the world, diversified across both regions and sectors. PCT launched in December 1996 as Henderson Technology Trust and, following a change of manager, became Polar Capital Technology Trust in April 2001.

More information can be found at the trust’s website: www.polarcapitaltechnology

trust.co.uk

Hear about the fund

Management arrangements

PCT’s AIFM is Polar Capital LLP and the lead manager assigned to the trust is Ben Rogoff, a partner in Polar Capital LLP. He is supported by a team of 10 technology specialists, including another partner, Nick Evans, and deputy fund manager Alastair Unwin. Polar believes that this is one of the best-resourced teams dedicated to this sector within Europe. In addition to PCT, the team also manages two open-ended funds, Polar Capital Global Technology Fund and the Artificial Intelligence Fund. Collectively, these funds had AUM of $8.3bn at 30 November 2023.

Ben joined the team from Aberdeen in 2003, having started his career in the years running up to the technology boom. He believes that the events surrounding the collapse of the tech bubble have influenced the way in which he manages money. Ben says that one important lesson is that there is limited permanence in the technology sector; it is forever engaged in a process of creative disruption. He feels that change in the sector is a non-linear process. Once-great companies can disappear and minnows can become giants.

Nick Evans joined the team from Framlington in 2007. He complements Ben in that Nick has a more bottom-up approach to selecting stocks, whereas Ben has a bias to a top-down stance.

Hear about the manager

Market overview

The investment landscape appears to have improved significantly in recent months. The interest rates hike cycle seems to have ended and multiple cuts appear to be on the cards this year in the US and other prominent markets as inflation looks set to continue its downward trend, with headline CPI moving to 3.1% in the US and 2.4% in the eurozone. The Federal Reserve (Fed) held interest rates for the third straight time in December and indicated that it foresees several cuts in 2024 and beyond.

Fed indicates interest rate cuts on the cards in 2024

Cooling inflation has, so far, been matched by a cooling in employment, rather than a hard crash, which suggests there is a greater prospect of a soft economic landing and the avoidance of a significant increase in unemployment. Just 199,000 jobs were added to the US economy in November, above the 150,000 added in October but below the 297,000 added in September, while average hourly earnings increased by just 0.4% month-on-month perhaps tempering concerns around wage inflation. US 10-year Treasury yields dropped 60bps in November to 4.27%, while the US dollar has weakened against almost every major currency.

Signs of an improved investment environment appear to have been accompanied by an improvement in investor risk appetite return. Global equity markets have rebounded, with the MSCI All Country World Net Total Return Index up 5.1% (in sterling terms) in November, while the S&P 500 Index gained 5.1%, and the DJ Euro Stoxx 600 Index was up 5.7%.

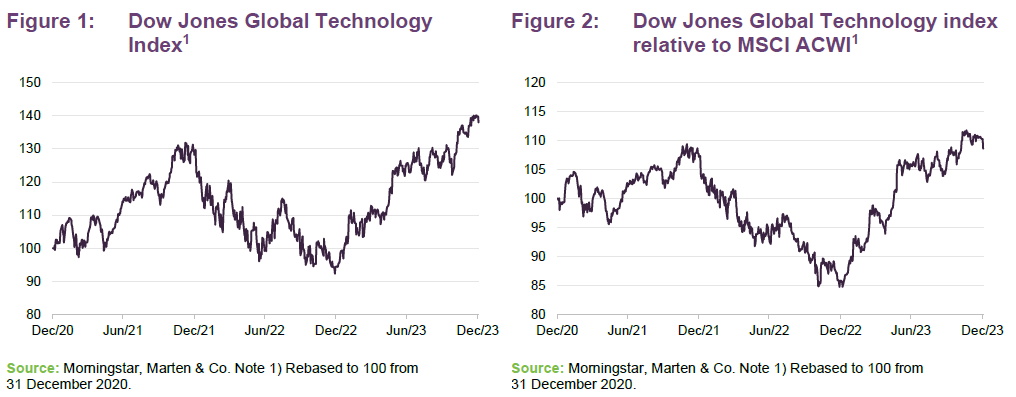

This has also been reflected in the technology sector. Having witnessed an intense compression in valuations over the past 18 months in the higher interest rate environment, investor sentiment towards the technology sector appears to have rebounded, as shown in Figures 1 and 2. It should be pointed out, however, that the seven largest technology stocks (Microsoft, Apple, Amazon, Alphabet, Meta, NVIDIA and Tesla) have driven broader markets and continue to dominate global technology indices.

With a seemingly improving investment landscape and investor risk appetite, PCT’s manager, Ben Rogoff, is extremely bullish. He comments that the basis of his bullishness is the profound moment that artificial intelligence (AI) finds itself at. He says that the pace of current AI innovation is incredible, and he feels that we are at a unique moment in the evolution of the technology landscape, with generative AI as important, if not more so, than the internet and the smartphone.

AI at an inflection point

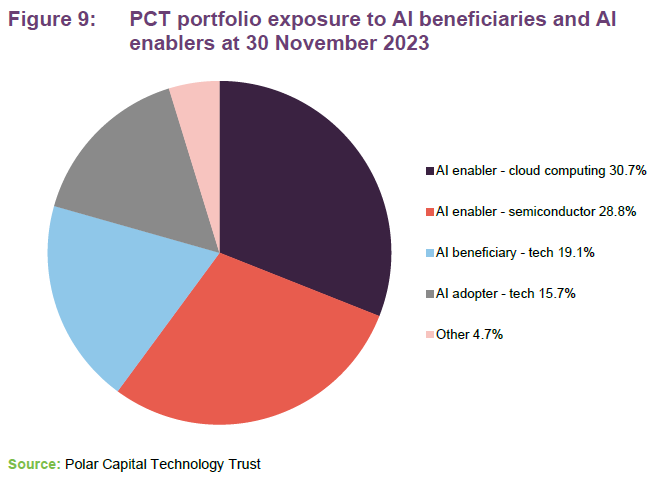

In our most recent update note on PCT, Me, myself and AI (published six months ago), we discussed Ben’s absolute conviction on AI and how the portfolio had been repositioned to reflect this. Since then, he tells us that his conviction levels have gone up and now almost 80% of PCT’s portfolio is positioned in companies that he believes are AI beneficiaries or enablers (a detailed look at the portfolio can be found from page 11).

PCT’s conviction levels on AI has gone up, with 80% of the portfolio in companies that it believes are AI beneficiaries or enablers

We discussed the evolution of AI in our last note, but it is worth briefly recapping here. Vast improvements in the capability of AI have been witnessed over a short timeframe. Early incarnations driven by deep learning have been superseded by transformer models – a type of neural network primarily used for natural language processing tasks, which was launched by Google in 2017. The model weighs the importance of different parts of the input (by applying a set of mathematical techniques called self-attention) and allows for massive parallel processing. Unlike previous models, transformers can handle longer documents and maintain longer conversations without context being lost and, most importantly, performance does not plateau as model complexity becomes exponentially larger. This is a significant improvement over earlier models that had a tendency to unlearn when trained to undertake new tasks.

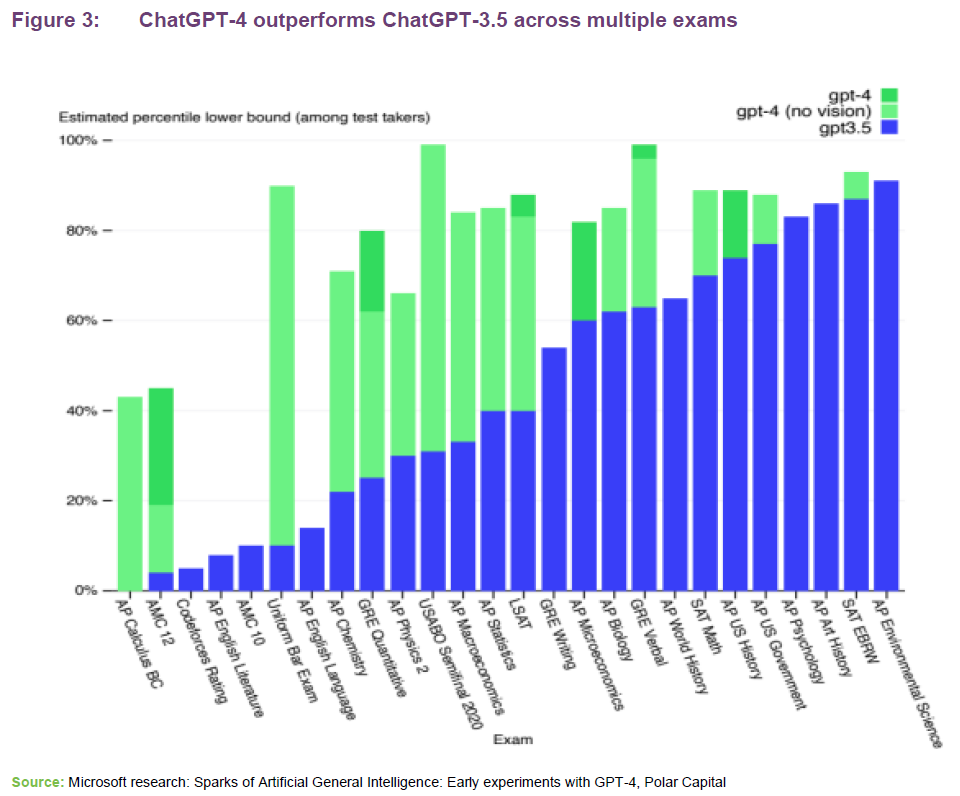

An example of the speed of change in AI capability can be observed in ChatGPT (the language model developed by OpenAI) between its 3.5 version and the ChatGPT-4 iteration (which was launched in March 2023). GPT-4 is larger, smarter and more efficient than its predecessor model (estimated to be trained on 100 trillion parameters, versus the 175 billion in the 3.5 version). Figure 3 illustrates the improvement in the performance of ChatGPT-4 when sitting a series of exams, versus that of GPT-3.5.

In a Microsoft research paper on ChatGPT-4, published in April 2023, it said that its performance is “strikingly close to human-level performance” and concluded that it could “reasonably be viewed as an early (yet still incomplete) version of an artificial general intelligence (AGI) system” – one that can learn to accomplish any intellectual task that human beings can perform.

AI could facilitate a productivity boom

Ben likens the current state of play for AI as similar to the ‘Bessemer moment’ in the mid-1800s, where Sir Henry Bessemer developed a process for the inexpensive mass production of steel. The result was a substantial fall in the price of steel (by a factor of five) and a period of deflation (US prices fell on average by 4% per annum during the 1870s), followed by a pronounced and prolonged rise in real wages that gave birth to the middle class. For AI, the substantial productivity gains that are likely to come from its mass adoption across industry and sectors – a Goldman Sachs report estimates that widespread adoption of AI could raise annual US labour productivity growth by nearly 1.5 percentage points over 10 years, potentially boosting annual global GDP by 7% – may exert a similar, significant downward pressure on prices and rise in real wages, Ben says.

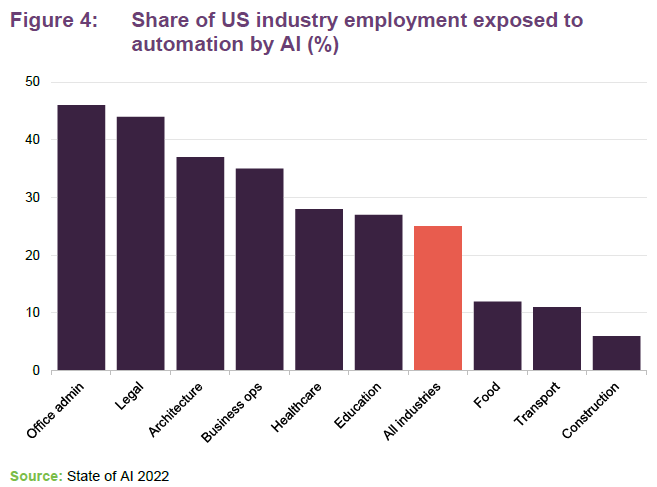

There appears to be huge implications for the labour market, the scale and ramifications of which are as yet unknown. Goldman Sachs estimates that two-thirds of US jobs are exposed to AI automation. A further study, the State of AI, published in October 2022, estimates that a quarter of current employment tasks across industries in the US could be automated by AI, as shown in Figure 4.

Job roles in back-office administration, the legal profession, and architecture and engineering are most at risk of being replaced by AI, according to the research. Ben believes that AI will most likely aid people in their work, giving them the tools to boost efficiency in job roles across sectors, rather than displace workers. Knowledge workers in sectors such as science, education and healthcare (where Gartner has predicted that more than 30% of new drugs and materials could be systematically discovered using generative AI, up from 0% today) could see a boom in productivity, he adds.

Mass adoption likely to be far quicker than previous technologies

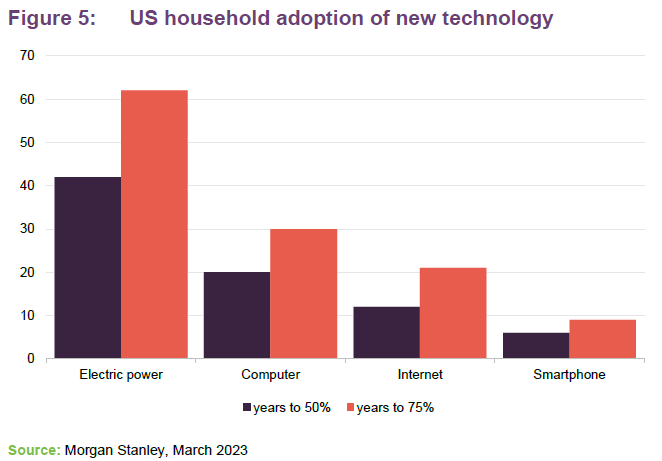

Historically, 50% workplace adoption of new technologies has driven an inflection in labour productivity, according to the Goldman Sachs report. Ben believes that the mass adoption of AI will be far quicker than previous general purpose technologies, such as electricity (which took 42 years to reach 50% general adoption), the computer (which took 20 years) and the internet (which took 12 years).

Rapid adoption likely due to very few barriers

Unlike previous technologies, infrastructure and cost barriers to adoption do not exist as users need just a smartphone and the internet to access AI, which puts the technology in the hands of 6 billion people worldwide, Ben states. Reflecting this, ChatGPT took just five days to reach one million users in 2022, just two months to reach 100 million in January 2023 and the website had 1.7 billion visits in October 2023. By comparison, Instagram took two-and-a-half years to reach 100 million users.

Around a third of S&P 500 company executives mentioned AI in earnings calls – a precursor to capital spending

Workplace adoption could follow a similar path to general adoption. Ben says that between 30% and 35% of S&P 500 companies mentioned AI on earnings calls in the second and third quarters of 2023 – up from 10% to 15% during both 2021 and 2022. This, he adds, shows that AI is becoming a top priority among company executives and mentions have tended to be followed by increases in company-level capital spending. More than a third of organisations in the US are already using generative AI regularly in at least one business function, according to McKinsey’s State of AI 2023 report, while three-quarters expect it to drive significant or disruptive change in the next three years.

However, significant spend on infrastructure is required to support the mass adoption of AI, Ben says. This is why he is so excited by both the short-term and long-term prospects of stocks that are AI beneficiaries or enablers.

Infrastructure spend – a profound moment for AI

Ben states that the infrastructure required to support AI is massive. A substantial shift from general purpose computing to mass parallel processing (a large number of computer processors simultaneously performing a set of co-ordinated computations in parallel) is required to fulfil the needs of generative AI. An AI server is eight to 10 times more expensive relative to a cloud server, Ben says, while five times more power is required versus a standard cloud computer. This shift from general purpose to mass parallel was borne out in NVIDIA’s third quarter earnings results, with record revenue of $18.12bn up 34% on the previous quarter and 206% over the year. Founder and chief executive Jensen Huang confirmed that the growth reflected the “broad industry platform transition from general-purpose to accelerated computing and generative AI”. Ben says that we are only really three-quarters into the AI story and are at a profound moment with substantially more to come.

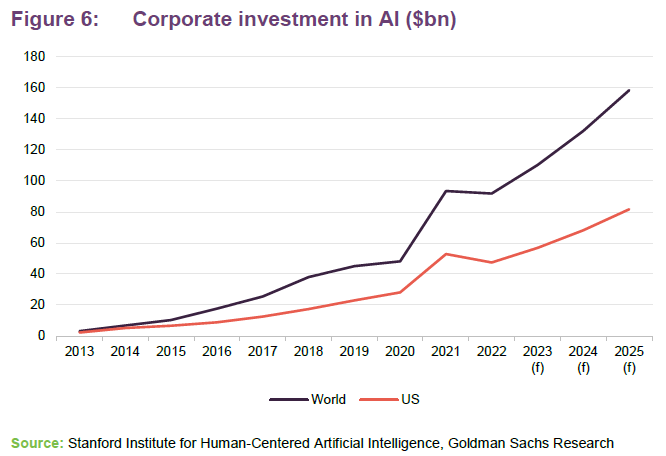

Goldman Sachs forecasts corporate investment in AI could reach $200bn by 2025

He adds that, for large-scale transformation to happen, businesses will need to make significant upfront investment in physical, digital, and human capital (to acquire and implement new technologies and reshape business processes). Those investments could amount to between $160bn according to a conservative estimate by Goldman Sachs (as shown in Figure 6) and $200bn globally by 2025.

Over the longer term, AI-related investment could peak as high as 2.5% to 4% of GDP in the US and 1.5% to 2.5% of GDP in other major AI leading countries, if Goldman Sachs’s AI growth projections are fully realised.

Goldman Sachs expects AI investment to be concentrated in four key business segments: companies that train and develop AI models; those that supply the infrastructure (for example, data centres) to run AI applications; companies that develop software to run AI-enabled applications; and enterprise end-users that pay for those software and cloud infrastructure services.

Ben believes that spend on cyber security will also increase to combat more sophisticated cyber-attacks using AI.

Regulation

The potential increase in volume and sophistication of phishing and impersonation-based cyber-attacks using AI (such as deep fake news), as well as the potential impact on the employment market, could result in strict regulation of AI. Italy was the first western country to ban ChatGPT over privacy concerns. It quickly lifted this ban, but its data protection authority, Garante, now plans to review other AI platforms and hire experts to ramp up scrutiny of the technology. The AI Act will soon come into law in the EU to regulate the use of AI in the bloc. The new law will set rules to establish obligations for providers and users depending on the level of risk from AI. More government scrutiny is likely to follow, Ben believes, especially given the potential impact on privacy and jobs.

There are also ongoing debates around the ownership of copyright and IP that have yet to be resolved. Ben says that he remains sanguine about it and believes regulation may follow that of the aviation sector, where industry pushed standards on safety and accident prevention in order to prevent regulation. AI companies are incentivised to prevent or limit the negative impacts of AI, he adds.

Having said that, Ben says that no major global economy or government can afford to stifle domestic innovation and lose talent, given the stakes at play in the global AI race that is now underway.

Investment process

PCT’s management team (profiled on page 20) carries out many hundreds of meetings a year, not just with portfolio companies, but also their competitors and suppliers. The team uses surveys and speaks to domain experts to cross-reference what customers think of products, where appropriate.

Identify companies that can earn super-normal profits

The manager selects from a universe of more than 4,000 stocks and looks to construct a diversified portfolio with about 100 stocks in aggregate. The intention is that these should represent the best opportunities within the investment themes that the manager has identified, and should come at the right price. The team looks at the value chain and identifies areas where it believes it is possible to generate super-normal profits (where companies have an unfair advantage) and recurring revenue.

On average, the stocks that are selected for the portfolio should be capable, in the manager’s view, of generating 30% to 50% higher growth than the average stock in the benchmark index and the manager is prepared to pay up for this expected growth – roughly 20% to 30% more than the benchmark, on average.

Valuation is a secondary consideration

There is little merit in first screening for value, in the manager’s opinion. It is better to think about which companies PCT should have exposure to, and only then about what is the price he is prepared to pay. The team is much more likely to screen for improving business fundamentals or stocks that it may have missed at the periphery of PCT’s investment universe that may not be perceived as tech stocks today, but might be in the future. They say that an important part of this process is to think about the potential downside in a stock. For many of these stocks, missing an earnings forecast can be devastating to their rating.

PCT may miss out on the odd stock as a result, but the manager believes that this is an acceptable price to pay for avoiding the worst of the downside.

Sell discipline

The manager thinks that it is important to run your winners, but also to sell when an investment thesis did not play out as anticipated. Fair value is a moveable target and the potential upside and downside from any position needs to be reassessed regularly, in his view. The team has a bull, bear and base case for each stock, with a weighted probability to each of these scenarios.

Holdings will be trimmed as they approach the team’s target price. Sometimes Ben will hold onto a small position in a stock that he feels it is important to stay in touch with. The ability to have exposure to this type of opportunity is a benefit of PCT’s closed-end structure.

Portfolio construction

PCT’s portfolio is managed very much with an eye to risk. It is designed to deliver 3%+ annual outperformance versus its benchmark after fees on a consistent basis, with typical active share of 40–50%. The manager rarely makes outsized stock-level bets, preferring to add value by avoiding losers (often mature or blue-sky companies) and correctly identifying the most important secular themes (and allocating between them where value is perceived to be most compelling). This means that PCT ends up holding around 100 stocks. Whilst this means that other, less risk-aware funds may perform better over shorter periods, this risk-adjusted/diversified approach should allow PCT to outperform over the medium/longer timeframe.

PCT aims to manage its risk relative to the benchmark

From time to time, a handful of stocks can dominate the benchmark index. The board allows the manager to take a neutral position in any stock that accounts for more than 10% of the index (up to a maximum of 20% of the portfolio) but PCT cannot have an overweight exposure to these companies.

PCT is emphatically not a closet-tracking fund. If the manager does not like a company, PCT will have no exposure to it, regardless of its weight within the benchmark. This is currently true of Intel, Cisco and Oracle, for example (see Figure 13).

Typically, the maximum exposure to a stock will be a 3.0%-3.5% active weighting. The portfolio’s active share has ranged from about 30% to just over 50% max.

Investment in emerging markets is permitted but this is capped at 25% of gross assets. The board has also given the following indicative ranges for PCT’s asset allocation:

- North America up to 85%;

- Europe up to 40%;

- Japan and Asia up to 55%; and

- rest of the world up to 10%.

It has set specific upper exposure limits for certain countries where it believes there may be an elevated risk.

The remit allows investment in unquoted companies (subject to prior board approval and capped at 10% of gross assets) but in practice, this has not been used.

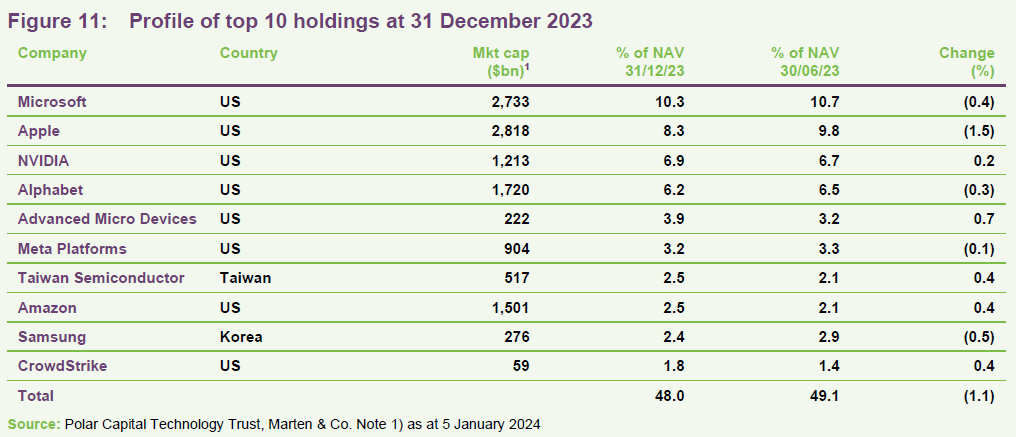

Asset allocation

At the end of November 2023, there were 100 stocks in PCT’s portfolio (up from 89 six months ago as the manager increases exposure to mid- and small-cap stocks that are AI beneficiaries or enablers). The portfolio remains benchmark-aware to express the best that the index has to offer, and to help manage risk. The portfolio’s active share has trended higher over recent years, in part due to higher concentration in the index as well as larger individual stock bets. Due to their leading position in AI, unique market positions and strong cash flow generation, PCT has large exposures to Microsoft and Apple stocks (see Figure 11). Nevertheless, at the end of November, these two stocks were still PCT’s largest underweights (see Figure 13). The portfolio may be managed in a benchmark-aware style, but the manager is happy to have zero weightings in index names when he feels that their growth prospects do not merit their inclusion within the portfolio.

Cash and equivalents, which includes puts on the Nasdaq, was 4.0% of the portfolio at the end of December. PCT has a call option in Microsoft, with an exposure of 1.8%, as well as three lines of puts. The cash position is 1%.

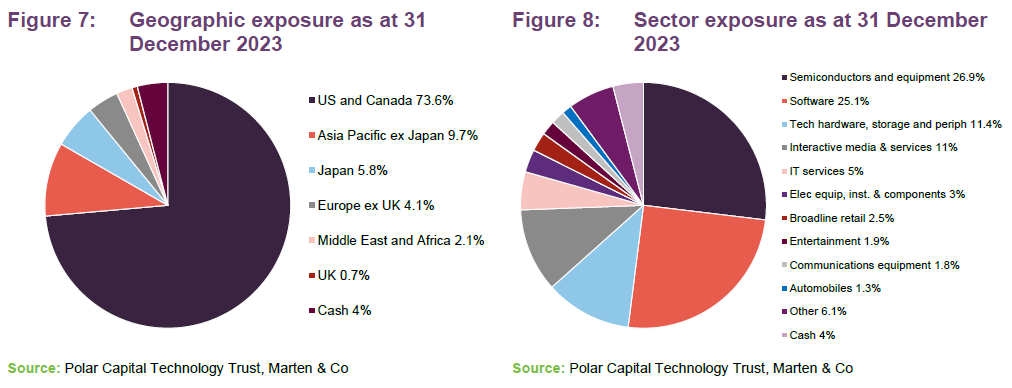

Ben does not try to add value through geographic asset allocation. PCT’s exposure to the US and Asia has remained static over the last six months, but its exposure to Japan has grown from 4.2% to 5.8%. Ben believes that there are a number of companies in Asia and Japan that are AI beneficiaries or enablers that are undervalued. In Figure 8, the most significant change has been an uplift in exposure to software and semiconductor sectors – reflecting the fund’s amplified focus on AI.

AI – the core theme of the portfolio

Over the last year, PCT has narrowed its exposure, with the portfolio overwhelmingly positioned towards stocks that are AI beneficiaries or enablers. As Figure 9 illustrates, 79.5% of stocks in the portfolio are categorised in this way, which increases to 95.3% when stocks that are classified as ‘AI adopters’ are included.

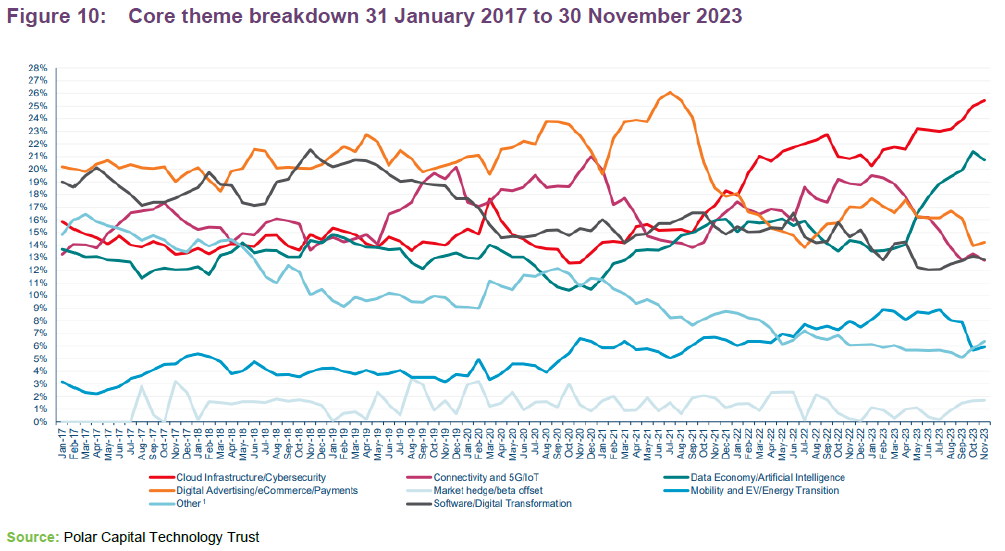

Figure 10 shows how the core theme of the portfolio has shifted over the last year, as Ben’s conviction on AI grew. Whereas previously there had been a fairly concentrated spread of exposures across five themes (with a number of secondary themes), the focus has clearly moved to cloud infrastructure/cyber security and data economy/AI.

10 largest holdings

There has been little change to the constituents of the top 10 list over the past six months, as Ben has remained focused on his conviction for AI. NVIDIA’s extraordinary growth since our last note six months ago has seen its market cap move from $958bn to just over $1.2trn likely due to its prominent role in supplying chips for AI processing.

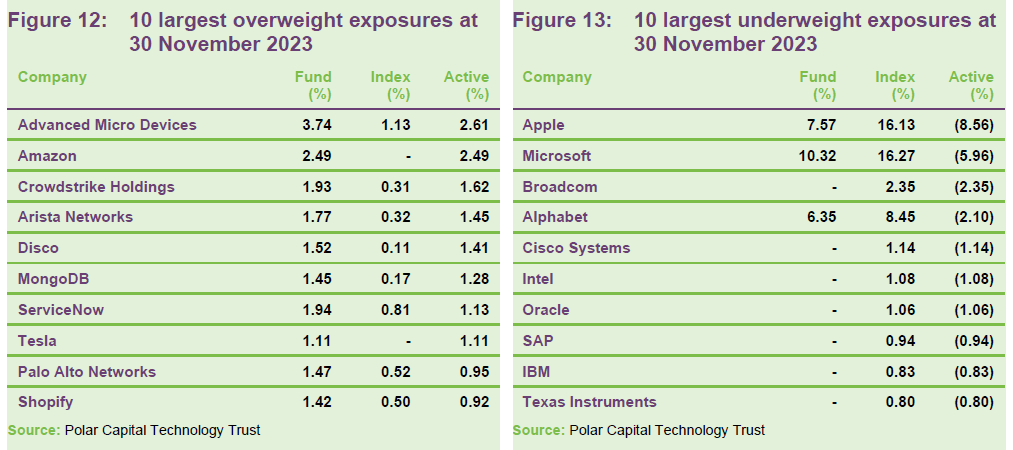

Figures 12 and 13 show PCT’s largest overweight and underweight exposures relative to the Dow Jones Global Technology Index at 30 November 2023.

We have discussed Ben’s views on many of PCT’s largest holdings in previous notes (links to which can be found on page 24). Some portfolio and benchmark exposure movements since our last note six months ago include:

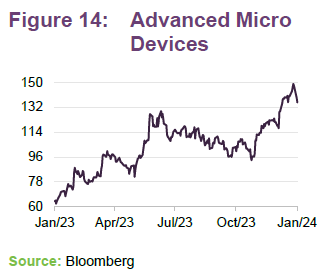

Advanced Micro Devices

Ben describes Advanced Micro Devices as PCT’s big bet. It is the largest overweight exposure relative to the benchmark, with an active share of 2.6%, and is the fifth largest stock in the portfolio, with a 3.9% exposure. Ben says that the company is set to benefit hugely as spend on infrastructure required to support AI grows, with a total addressable market of $400bn, and the industry looks for an alternative source to NVIDIA. Mass adoption of AI is likely to necessitate a shift from general purpose computing to parallel computing capable of processing multiple tasks simultaneously. Demand for its processors and chips should grow in step, Ben says. This was borne out by solid results announced at the end of October, where the company guided for its new MI300 chips to generate $2bn of revenue in 2024. The company is PCT’s ‘big bet’ because it is in competition with NVIDIA. Ben believes that Advanced Micro Devices has been unfairly overlooked by investors, with market expectations of NVIDIA elevated. Revenue for both companies could be impacted by a decline in demand from China due to increased restrictions from the US government.

Amazon

Amazon has perennially been a large overweight for PCT as it does not feature in the benchmark. PCT’s 2.5% exposure makes Amazon its eighth-largest holding and Ben remains positive on the company. In third-quarter earnings, Amazon Web Services (AWS) was boosted by a stabilisation of cloud workload optimisation, with public cloud revenue growth stable after eight consecutive quarters of year-over-year deceleration. Meanwhile, the company also revealed its new Graviton chip (optimised for cloud workloads) and Q chatbot (an AI-powered chatbot for a range of business tasks, offering an alternative to OpenAI). Perhaps due to the potential for future AI-related demand, Amazon delivered strong returns of 73.0% over the last 12 months (also reflecting its exceptionally weak 2022 performance). On the ecommerce side of the business, Amazon’s Black Friday and Cyber Monday shopping events delivered record sales, with over one billion items purchased. Amazon continued to consolidate ecommerce market share gains, with the higher cost of capital decimating smaller rivals.

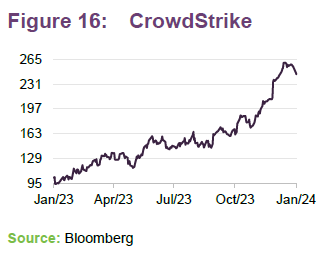

CrowdStrike

Ben has been bullish on cybersecurity for a long time, and PCT’s 1.8% position in CrowdStrike is well above that of the benchmark’s 0.3% exposure. Ben says that cybersecurity budgets have proved relatively robust amid several high-profile breaches and concerns that AI will increase the arsenal available to cyber-criminals, with more sophisticated attacks already on the rise. The scale and sophistication of phishing and impersonation-based breaches could also grow, he says. Within this context, future demand for CrowdStrike’s services should remain strong, Ben says.

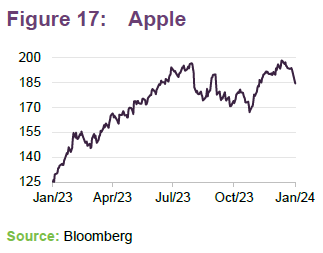

Apple

As mentioned previously, Apple is PCT’s largest underweight position relative to the benchmark. This has previously dragged on its relative performance, but Apple’s recent share price underperformance has benefited PCT. In recent results, Apple reported a slight decline in revenue of 1% year-on-year; with iPhone revenue in line with forecasts (up 3%) and services up 16%. However, it reported weaker trends for iPad and the Mac and guided revenue for the next quarter to be flat, which was below market forecasts. Ben says that the smartphone market is particularly weak and this plus the challenging macro environment saw him reduce PCT’s position in Apple. It is now underweight Apple compared to the benchmark by 856bps.

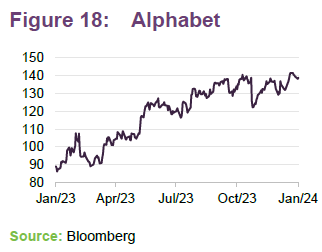

Alphabet

PCT’s holding in Alphabet has fallen 30bps to 6.2% over the past six months, mainly due to a large fall in the share price at the end of October following a disappointing third-quarter earnings announcement. Although overall earnings was up 11% year-on-year, revenue from its cloud business Google Cloud fell short of analyst forecasts, perhaps stoking investor concerns that the company is falling further behind competitors like Amazon and Microsoft. On top of this, economic headwinds have affected Alphabet’s advertising business – by far its biggest source of revenue – and a landmark antitrust lawsuit brought against the company by the US government over monopolisation of online search rumbles on. On the AI front, Ben says that Alphabet has made significant headway in integrating AI into its existing products, but he remains sceptical about the company’s ability to maximise revenue growth from it and thinks it has much to lose should AI disrupt online advertising.

Mid- and small-caps

As mentioned earlier, PCT has more exposure to mid- and small-cap technology companies compared to its benchmark. Although Ben expects robust growth from the mega-cap technology stocks, he does not believe a repeat of massive returns last year is likely, with returns more in line with underlying growth. Instead, he expects that a broadening of technology stock leadership as it becomes clear AI is benefitting more companies. Ben believes that the large spread between the large- and small-cap companies will move in.

PCT’s mid- and small-cap companies are selected through an AI lens and tend to operate in the AI infrastructure layer – chips, motherboards and packaging. Some of names highlighted by Ben are covered here.

Trade Desk

Advertising technology provider Trade Desk’s focus on using AI to match buyers and sellers with personalised ads makes it an interesting prospect for Ben. The company, which accounts for around 0.7% to 0.8% of the portfolio, released third-quarter earnings that were ahead of expectations, but guidance for the next quarter was softer than anticipated, with management highlighting more cautious advertising spending.

Image sharing and social media service Pinterest looks more interesting to Ben given its valuable proprietary dataset and the steps it has taken to monetise its product. It recently struck a deal with Amazon to match users (who generally search fashion, beauty, recipe and interior design images) with third-party vendors on Amazon using image search technology. The company accounts for around 0.7% and 0.8% of PCT’s portfolio.

Trustpilot

Trustpilot is a review platform that allows businesses to collect and respond to reviews. It offers specialised marketing and analytics features in their paid plans and generates income from subscribing companies who use its software to be reviewed by customers and gain insight from reviews. Ben believes that, like many UK stocks, the company is cheap and overlooked.

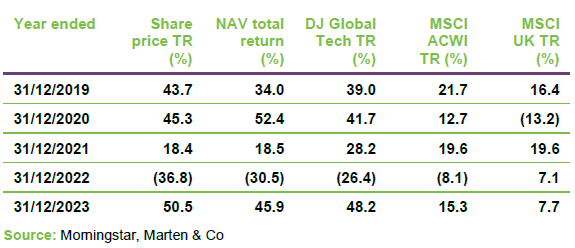

Performance

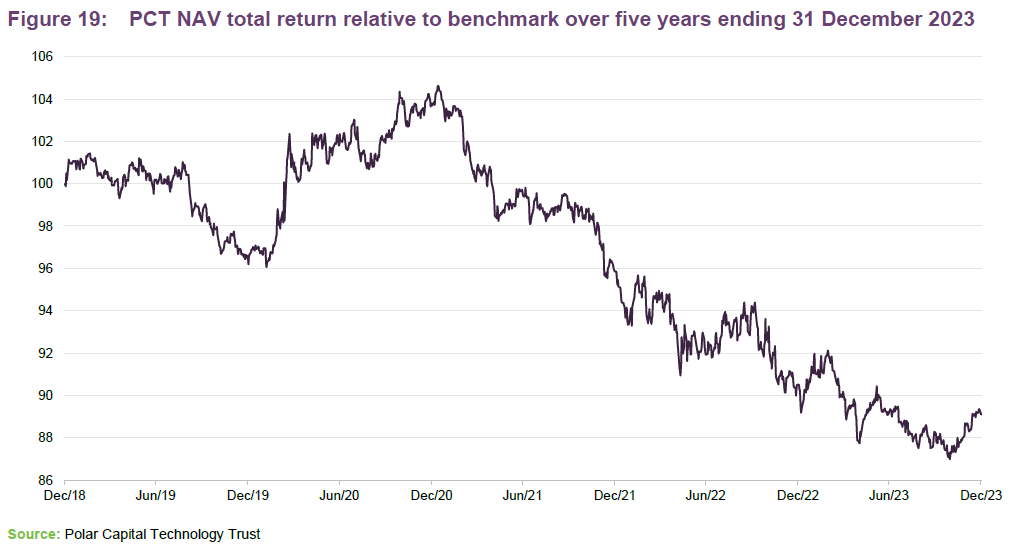

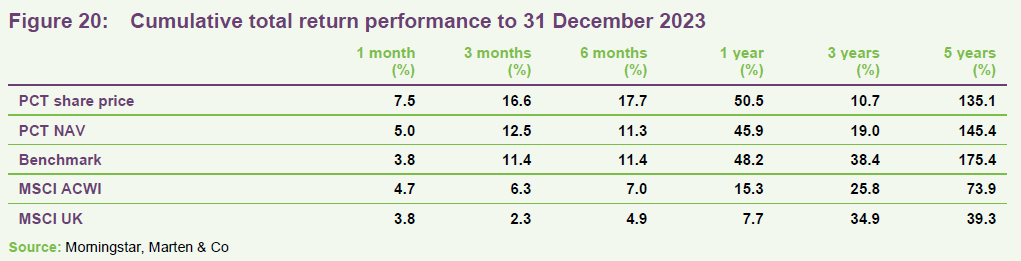

PCT’s underperformance of its Dow Jones Global Technology benchmark since early 2021 has largely been due to the effect of its two largest underweight exposures – Apple and Microsoft – performing strongly against a falling technology sector. In the year to the end of December 2023, PCT’s NAV returns were 2.3 percentage points lower. Prior to this, the trust had been outperforming relative to the benchmark, but the underperformance from January 2021 has seen its five-year NAV return fall below that of the benchmark, as shown in Figure 20.

Visit QuotedData.com for up-to-date information on PCT and its peer group

Ben points out that there has been a vast outperformance by large-cap versus mid- and small-cap technology companies – for example, the Russell 1000 index has returned 210.2% and the Russell 2000 index 77.3% over the last five years. The magnitude of divergence is highly unusual in historic terms and puts into context PCT’s performance. As mentioned earlier, Ben expects that this spread will narrow.

Dividend

PCT historically has not paid dividends, given the nature of its focus on longer-term capital growth. The board reviews this stance on a periodic basis and would declare a dividend if this was needed to maintain the company’s status as an investment trust. Over the years, PCT’s running expenses have exceeded its revenue and therefore the revenue reserve remains negative. To pay a dividend, PCT would need to eliminate its revenue reserve deficit (£137.4m at 31 October 2023).

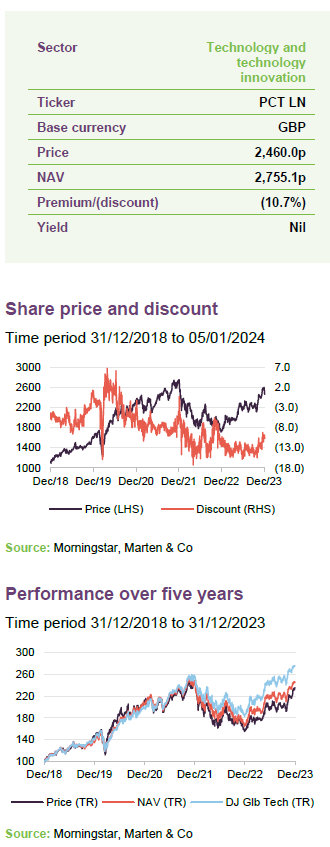

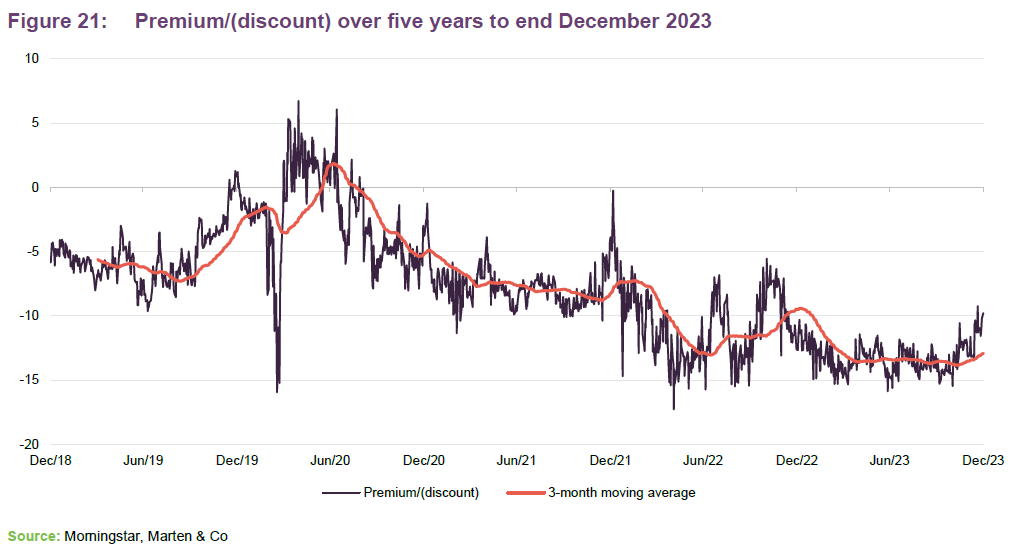

Premium/discount

Over the 12 months to 31 December 2023 PCT traded between a discount of 9.2% and 15.9%. The average discount over this period was 13.2%. At 5 January 2024, PCT’s shares were trading at a discount of 10.7%.

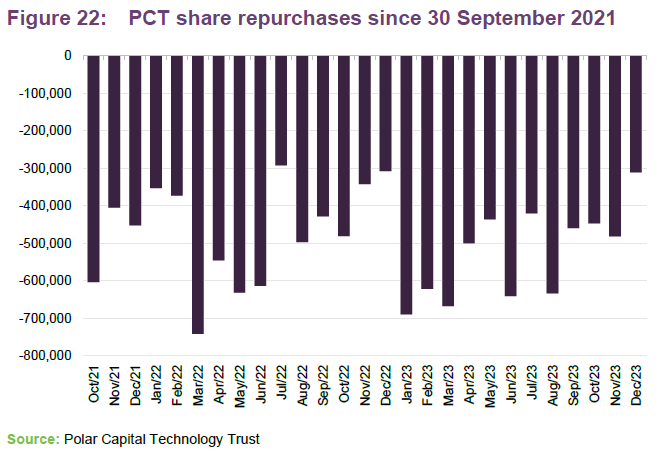

PCT issues and repurchases shares with the aim of ensuring that the shares do not trade at excessive premiums or discounts. Shareholders are asked at each AGM to approve the issuance of up to 10% of PCT’s issued share capital and the repurchase of up to 14.99% of its issued share capital. Shares are only issued at a premium to NAV. Shares repurchased may be held in treasury and reissued.

Fees and costs

The fee payable to the manager is tiered. PCT pays 0.8% on the first £2bn of net assets, 0.7% on net assets between £2bn and £3.5bn, and 0.6% on amounts above £3.5bn.

A performance fee of 10% of the fund’s outperformance of the benchmark is payable. The performance fee is subject to a high watermark and a cap of 1% of net assets. No fee is payable if the NAV fails to exceed the high watermark, but outperformance in such years is carried forward to subsequent years. The ongoing charges ratio is 0.81%, which does not include performance fees.

Capital structure

PCT has 122,379,596 ordinary shares in issue and admitted to trading plus a further 14,935,404 shares held in treasury, as at 5 January 2024. There are no other classes of share capital.

PCT’s financial year end is 30 April and AGMs are usually held in September. PCT has an unlimited life, but at the 2020 AGM, shareholders were asked whether they want the fund to continue. Shareholders backed the proposal overwhelmingly (99.8% of those voting). The same question will be put to shareholders in 2025 and every five years thereafter.

The use of gearing and derivative instruments is permitted and overseen by the board.

Derivative instruments such as financial futures, options, contracts-for-difference and currency hedges would be used for the purpose of efficient portfolio management. Any leverage resulting from the use of such derivatives will be subject to the restrictions on borrowings. PCT has no long-term borrowings and, at present, no short-term borrowings either.

Management team

Ben Rogoff

Ben is the lead manager of Polar Capital Technology Trust and is a fund manager of the Polar Capital Global Technology Fund and Polar Capital Automation and Artificial Intelligence Fund.

Ben has been a technology specialist for 25 years. Prior to joining Polar Capital, he began his career in fund management at CMI, as a global technology analyst. He moved to Aberdeen Fund Managers in 1998, where he spent four years as a senior technology manager. Ben graduated from St Catherine’s College, Oxford in 1995.

Alastair Unwin

Alastair is the deputy manager, having joined Polar Capital in June 2019 as a fund manager and senior analyst. Before joining Polar Capital, he co-managed the Arbrook American Equities Fund. Between 2014 and 2018 Alastair launched and then managed the Neptune Global Technology Fund, and managed the Neptune US Opportunities Fund. Prior to Neptune, he was a technology analyst at Herald Investment Management. Alastair has a BA (1st Class Hons) in history from Trinity College, Cambridge and is a CFA Charterholder.

Nick Evans

Nick Evans joined Polar Capital in 2007. He has 23 years’ experience as a technology specialist and has been lead manager of the Polar Capital Global Technology Fund since January 2008. He is also a fund manager on the Polar Capital Technology Trust and Polar Capital Automation and Artificial Intelligence Fund.

Prior to joining Polar, Nick was head of technology at AXA Framlington and lead manager of the AXA Framlington Global Technology Fund and the AXA World Fund (AWF) – Global Technology from 2001 to 2007 (both rated five stars by S&P). He also spent three years as a Pan-European investment manager and technology analyst at Hill Samuel Asset Management. Nick has a degree in Economics and Business Economics from Hull University, has completed all levels of the ASIP, and is a member of the CFA Institute.

Xuesong Zhao

Xuesong joined Polar Capital in 2012. He has 14 years’ investment experience and is a lead manager of the Polar Capital Artificial Intelligence Fund. He is a partner fund manager on the Polar Capital Technology Trust and Polar Capital Global Technology Fund.

Prior to joining Polar Capital, Xuesong spent four years working as an investment analyst within the emerging markets & Asia team at Aviva Investors, where he was responsible for the technology, media and telecom sectors. Previously, he worked as a quantitative analyst and risk manager for the emerging market debt team at Pictet Asset Management and started his career as a financial engineer at Algorithmics, now owned by IBM, in 2005. Xuesong holds an MSc in Finance from Imperial College of Science & Technology, a BA in Economics from Peking University, and is a CFA Charterholder.

Fatima Lu

Fatima joined Polar Capital in 2006. She has 15 years’ investment experience and is a fund manager on the Polar Capital Technology Fund, Polar Capital Technology Trust and Polar Capital Automation and Artificial Intelligence Fund. Fatima is responsible for the coverage of European Technology, Global Security, Networking, Clean Energy and Medical Technology.

Prior to joining Polar, Fatima spent 18 months working at Citigroup Asset Management with a focus on consumer products and pharmaceuticals. She holds an MSc in Chemistry with Medicinal Chemistry from Imperial College of Science & Technology in London. Fatima is also a CFA Charterholder.

Paul Johnson

Paul joined Polar Capital in 2012. Prior to this, he helped manage a private investment fund between 2010 and 2012. Paul holds a BA in History and Politics and a Masters in History from Keele University. He has successfully passed all three levels of the CFA programme.

Nick Williams

Nick joined Polar Capital in June 2019 as an analyst on the Polar Capital Technology team. Prior to joining Polar Capital, he worked at Neptune Investment Management as the assistant fund manager on its US Opportunities growth fund. Previously, he worked in academia at the University of Oxford. Nick holds an MChem in Chemistry from the University of Oxford.

Patrick Stuff

After graduating in July 2016 from the University of Warwick with a BSc in Economics, Patrick joined Polar Capital as an operations executive, where he provided operational support to all fund management teams at Polar, including the technology team. During this period he successfully passed all three levels of the CFA program first time, and subsequently, after a successful eight months seconded to the Technology team, he joined on a full-time basis in May 2021 as an investment analyst with a focus on small- and mid-cap companies.

Lina Ghayor

Lina joined Polar Capital in September 2023 as an investment analyst in the technology team. Prior to joining Polar Capital, she worked at Exane BNP Paribas as an equity research analyst.

Fred Holt

Fred joined Polar Capital in July 2023 as an investment analyst in the technology team. Prior to joining Polar Capital, he worked at Janus Henderson Investors as a portfolio analyst on the global technology leaders and sustainable future technologies strategies.

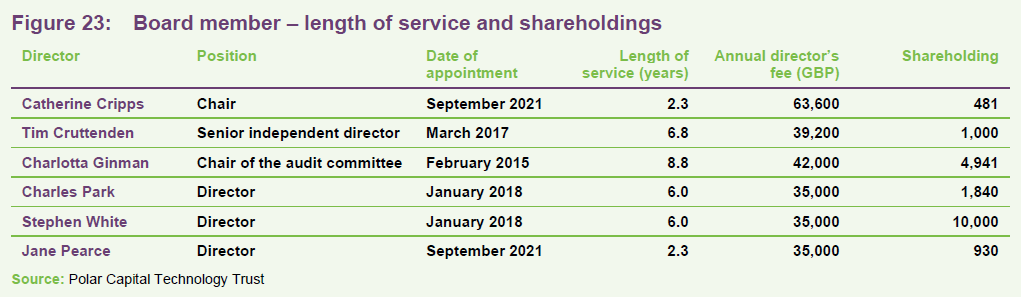

Board

PCT’s board comprises six non-executive directors, all of whom are independent of the manager and who do not sit together on other boards. Each of the directors stand for re-election at each AGM.

Catherine Cripps

Catherine was appointed to the board in September 2021 and took over as chairman in September 2022. She is a qualified Chartered Accountant with more than 30 years’ senior investment industry experience in a number of trading, risk management and investing roles including investment director and head of research at GAM. Catherine is also a non-executive director of Goldman Sachs International and Goldman Sachs International Bank, where she is chair of the risk committees and a member of the audit committees. Previously, she was non-executive director of CQS Management Limited where she chaired the remuneration and performance management committees and was a member of the audit committee.

Tim Cruttenden

Tim is currently chief executive officer of VenCap International Plc, having been with that company in various positions since 1994. VenCap invests in venture capital funds in the US, Asia and Europe, with a primary focus on early-stage technology companies. Tim is a non-executive director of Chrysalis Investments Limited.

Charlotta Ginman

Charlotta qualified as a Chartered Accountant at Ernst & Young before spending a career in investment banking and commercial organisations, principally in technology-related businesses. She held senior roles with UBS, Deutsche Bank, JP Morgan and the Nokia Corporation. Charlotta is a non-executive director and chairs the audit committees of Pacific Assets Trust Plc, Keywords Studios Plc and Gamma Communications Plc. She is also a non-executive director of Unicorn AIM VCT Plc and Boku Inc.

Charles Park

Charles has over 25 years of specialist investment experience and was a co-founder of Findlay Park Partners, an investment firm specialising in quoted American equity investments. Prior to this, he was a US fund manager at Hill Samuel Asset Management.

Charles is a non-executive director of North American Income Trust Plc and Evenlode Investments.

Stephen White

Stephen White qualified as a Chartered Accountant at PwC before starting a career in investment management. He has more than 35 years’ investment experience, most notably as head of European Equities at F&C Asset Management, where he was manager of F&C Eurotrust Plc and deputy manager of The F&C Investment Trust Plc. He also held the role of head of European and US Equities at British Steel Pension Fund.

Stephen is a non-executive director and chairman of Brown Advisory US Smaller Companies Trust Plc. He is also non-executive director and chairman of the audit committees of Blackrock Frontiers Investment Trust Plc and Aberdeen New India Investment Trust Plc. Stephen was appointed non-executive director of Henderson EuroTrust plc with effect from 1 December 2022.

Jane Pearce

Jane is an experienced non-executive director and Chartered Accountant with over 20 years’ financial markets experience. She has a number of years’ experience as a technology equity analyst and as an equity strategist at leading investment banks including Lehman Brothers and Nomura International.

Jane is a non-executive director and member of the audit committee of Shires Income plc and a co-opted external member of the audit and risk committee of the University of St. Andrews.

Previous publications

Readers interested in further information about PCT may wish to read our earlier notes. You can read them by clicking on the links below or by visiting our website.

| Figure 24: QuotedData’s previously published notes on PCT

Source: Marten & Co |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Technology Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

liability for consequential or special damages.

Governing Law and Jurisdiction:These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.