The IMF sounded an upbeat note in July, upgrading its global growth forecast on the back of the weakening US dollar

Tariffs featured prominently in headlines as the extended 1 August deadline for a return to tariffs imposed on Liberation Day loomed and countries scrambled to do deals. The big news was an agreement with the EU to set tariffs at 15%.

The Federal Reserve held interest rates steady despite growing pressure from the White House for cuts. US inflation rose to 2.7%. The One Big Beautiful Bill (OBBB) was approved and looks set to exacerbate wealth inequality in the US.

GDP growth numbers for the EU are anaemic, just 0.1% up in Q2 2025, but that was a bit better than some had feared. There are hopes that when Germany’s promise to ramp up infrastructure and defence spending gets going, its economy will pick up. The ECB kept rates at 2%. Talks to secure a trade agreement between the EU and China rumbled on.

“Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen. A reasonable base case is that the effects on inflation could be short lived – reflecting a one-time shift in the price level. But it is also possible that the inflationary effects could instead be more persistent, and that is a risk to be assessed and managed.”

Jerome Powell at 30 July FOMC meeting

After recording monthly falls since the start of 2025, China’s export numbers were good in June, up 5.8% year-on-year, the indications are that firms were taking advantage of a temporary drop in tariffs. Q2 growth numbers looked good (GDP +5.2%) but China is still struggling with deflation.

In Japan, the ruling party lost its majority in both houses of parliament in the latest elections. Japanese government bond yields hit new post-GFC highs.

In the UK, jobs numbers were disappointing, the blame for this is being pointed at National Insurance rises introduced in the last budget. A poll by the Institute of Directors suggested that business leaders are pretty pessimistic about the state of the UK economy.

The Brunner Investment Trust

‘We share the general enthusiasm for American businesses. The US is home to many of what can objectively described as the world’s best, most profitable, fastest growing companies. However, we also posit that whilst it is possible to believe a business is excellent, this clearly does not mean it is worth an unlimited amount of money. There is a point at which the importance of quality and growth bangs its head on the ceiling of price‘.

MIGO Opportunities Trust

‘Trusts continue to go through their Schumpeterian phase*, with mergers, wind-ups and takeouts continuing apace. We believe we are in a healthy “clean up” phase after vast sums of paper were issued when interest rates were effectively zero’.

Polar Capital Technology

‘McKinsey believes AI could automate 30-50% of tasks in about 60% of occupations by 2030. In the longer term, the opportunity is likely to be significantly greater should AI begin to substitute rather than augment human labour.‘

At a glance

| Exchange rate | 31 July 2025 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.3207 | (3.8) |

| Pound to euros | GBP / EUR | 1.1570 | (0.7) |

| US dollars to Japanese yen | USD / JPY | 150.75 | 4.7 |

| US dollars to Swiss francs | USD / CHF | 0.8123 | 2.4 |

| US dollars to Chinese renminbi | USD / CNY | 7.2000 | 0.5 |

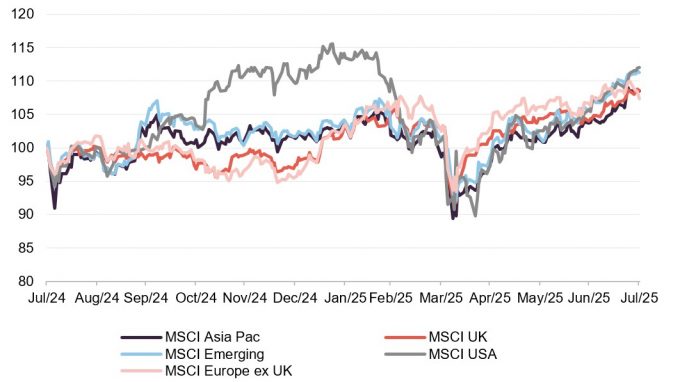

MSCI Indices (rebased to 100)

The decision to hold US rates steady meant that the US dollar bounced a bit over the month, particularly relative to the Japanese yen.

Equity markets were strong, with the US reasserting its dominance helped by good earnings numbers from mega cap stocks. Europe was the laggard over July. A big jump in the oil price over July has since unwound. The gold price remained fairly flat, seemingly unaffected by the speculation – later denied – that tariffs would be placed on imports into the US. Bond yields edged up over the month. There is some nervousness about the impact of the OBBB on US debt levels

Time period 30 June 2024 to 30 June 2025

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 31 July 2025 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 72.53 | 7.3 |

| Gold (US$ per Troy ounce) | 3289.93 | (0.4) |

| US Treasuries 10-year yield | 4.37 | 3.5 |

| UK Gilts 10-year yield | 4.57 | 1.8 |

| German government bonds (Bunds) 10-year yield | 2.69 | 3.4 |

Global

David Warnock, chairman, CT Global Managed Portfolio, 25 July 2025

While the economic backdrop remains relatively benign, there is a prevailing level of elevated uncertainty thanks, in the main, to the tariff policies of the US administration. While many tariff levels are likely to ultimately be lower than those threatened at the start of April, the global economy is still facing the highest level of tariffs since the 1930s. This means there are still notable downside risks to growth and upside risks to inflation, though precise forecasting remains especially difficult until there is more clarity on the size, scope and duration of the aforementioned tariffs. Provided the impact on growth, inflation and corporate earnings is limited, equity markets have the potential to continue to ‘look through’ the worst of the tariff headlines on the assumption that economic pragmatism will prevail.

Towards the end of the financial year, European, Asian and UK stocks showed signs of outperformance versus the US market, as the notion of ‘US exceptionalism’ was challenged. Whilst foreign exchange markets may well adjust, the US stock market, due to its wealth of technology stocks and deep capital markets, is likely to generate continued superior earnings growth versus the rest of the world.

. . . . . . . . . . .

Adam Norris and Paul Green, managers CT Global Managed Portfolio, 25 July 2025

Whilst policy uncertainty and geopolitical risks remain elevated, we continue to see value in equity markets and risk assets more broadly. We believe US equities have scope for outperformance with superior growth rates versus their rest of the world competitors, with its concentration of technology- related stocks, deep capital markets and vibrant economy.

After a tough three-year period, we are also a little more sanguine on the outlook for Asia and Emerging Markets. A weakening dollar, perhaps an intention of the US administration rather than a symptom, low valuations and rebounding earnings growth could make a potent mix for equity returns. Chinese technology companies, for instance, are demonstrating impressive innovation and trade at considerably lower multiples than their US equivalents.

UK equities appear cheap. However, once adjusted for sector composition, the discount versus continental European and Asia-equity markets becomes less pronounced. Whilst it is encouraging to see continuing merger and acquisition (‘M&A’) activity within small and medium sized companies which is beneficial for short-term performance, the UK issuance market remains moribund, implying the UK equity market is not yet replacing its most attractive companies. Further still, high profile re-listings of stocks away from UK market leaves fewer exciting companies for active managers to own.

Listed private equity portfolios, on the whole, are ripe with value. Once US capital markets reopen more fully – only a matter of time in our opinion – then exits will materialise, and shareholder returns delivered. Despite large discounts to net asset values, overall, the UK listed private equity market is comprised of top-quality private equity managers.

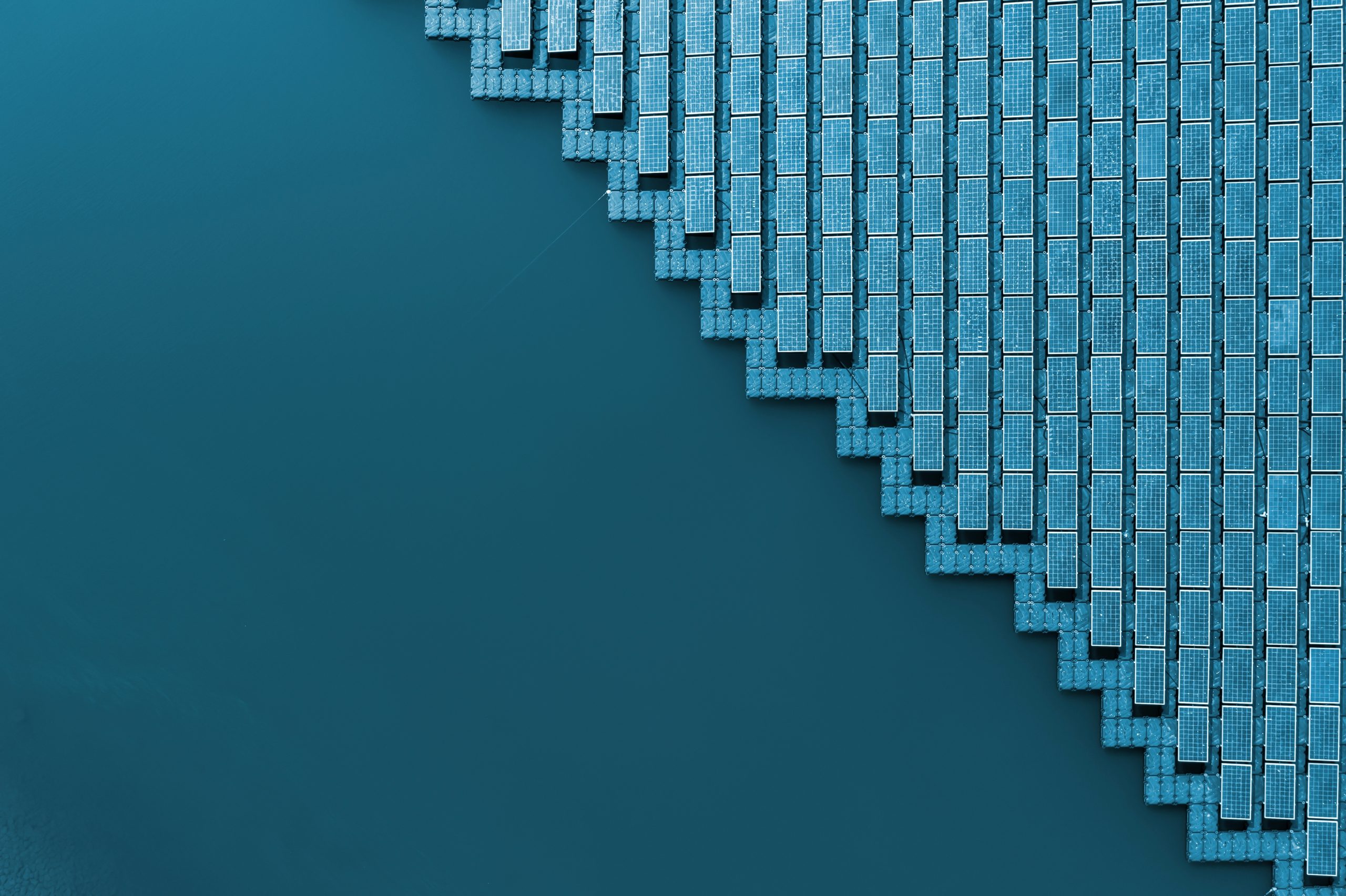

We see strong value in certain alternative asset classes which are offering both the opportunity for income and capital growth. Areas such as infrastructure, renewable energy generation and property have suffered due to sensitivities to interest rates and offer compelling total return opportunities. This is despite a pick-up in M&A activity, where prices paid for acquisition represent meaningful premiums to the undisturbed share prices. We expect this theme to continue until such time as a re-rating of the alternatives sector materialises. In addition, industry shareholders are requiring larger, more liquid investment companies and we would expect industry consolidation to continue.

We are further encouraged to see boards of directors continuing to promote more flexible capital policies. Board initiatives such as debt paydown, buy-backs or tender offers can be powerful tools in generating shareholder returns.

We believe there are pockets of tremendous value in the investment company sector and feel optimistic about the year ahead.

. . . . . . . . . . .

Carolan Dobson, chair, The Brunner Investment Trust, 22 July 2025

Looking ahead, the global outlook remains uncertain. Political risk is elevated, and the economic consequences of recent policy shifts – particularly in the US – are still unfolding. The reintroduction of tariffs, rising fiscal deficits, and the potential for inflationary pressures all present challenges. However, we take comfort in the breadth of market leadership seen this year, with both traditional sectors and cutting-edge technology companies contributing to returns.

. . . . . . . . . . .

Julian Bishop, Christian Schneider, managers, The Brunner Investment Trust, 22 July 2025

In Brunner’s 2024 Annual Report we wrote of the widening gap between valuations in the US and Europe. We disaggregated historical returns for the US vs UK market, showing that whilst earnings growth in the US had been higher, cash returns from dividends in the UK had largely compensated. Much of the reasons for America’s outperformance over the prior decade for UK-based investors was attributable to the strength of the dollar and relative multiple expansion – factors unlikely to repeat. Given the divergence in multiples, investors in America were paying ever more for a dollar of current profit whilst UK investors were paying less. At the time, enthusiasm for the notion of US exceptionalism seemed to be reaching a zenith, handicapping its market with the burden of high expectations.

We share the general enthusiasm for American businesses. The US is home to many of what can objectively described as the world’s best, most profitable, fastest growing companies. However, we also posit that whilst it is possible to believe a business is excellent, this clearly does not mean it is worth an unlimited amount of money. There is a point at which the importance of quality and growth bangs its head on the ceiling of price.

The first half of 2025 saw a sharp reversal of the American outperformance seen last year, largely as transatlantic currencies and valuations converged. The precise catalyst for this is unclear, but markets are ultimately elastic; when overstretched, they tend to spring back to shape. Asides from high valuations, reasons for the US market coming back to earth include concerns around the impact of US tariffs on consumer and business confidence, the contractionary impact of government efficiency (which sounds very similar to the era of austerity we had over here) and Washington’s ever widening budget deficit. At the same time, Europe appears poised to stimulate. Unlike many countries, prudent Germany can afford to do so, and announced measures to boost expenditures on both defence and infrastructure.

Over the six months to the end of May, the MSCI Europe was up 10% in Euros but 18% in USD due to dollar weakness. Over the same period the S&P500 was down slightly in local currency and down 7% in Euros. This is a huge divergence which badly hurt those who had placed all their eggs in the American basket. Americans have had little need to consider overseas equities for a long time. This short sharp burst of strong performance coupled with domestic disquiet about the dollar and lofty valuations has seen a renewal of interest in equities beyond their shores.

A King is crowned. To fund his agenda he raises taxes, which then crash the economy, and ‘all those who had enthusiastically welcomed his coming to power now decided he was useless’.

The ‘Anglo-Saxon Chronicles’ are a collection of annals in Old English and a key historical source for the period between the collapse of Roman authority and the Norman Conquest. The King mentioned above is Harthacnut. Harthacnut briefly sat on the Danish and English thrones some twenty years before Harold Godwinson was defeated at the Battle of Hastings in 1066.

We couldn’t fail to notice the similarities when investors dumped the US market after President Trump announced the imposition of very high tariffs on most of America’s trading partners. Tariffs are a form of tax and the vast majority of mainstream economists caution that they are detrimental to the wealth of all parties. The economic principle of ‘comparative advantage’, espoused by David Ricardo two centuries ago, is difficult to dispute and explains why trade is to the benefit of all. Nations should focus on what they are relatively most efficient at producing and then trade with others to maximise overall output. There are few logical arguments against this.

A key word here, perhaps, is logical. Economists are often utilitarians, focusing on the best overall outcome – the most units of wealth or general utility. This ignores the human factor. The vast majority of economic or political decisions involve trade-offs and inevitably some are left behind.

There are two books we would recommend to understand President Trump’s trade policy. The first is Vice President JD Vance’s ‘Hillbilly Elegy’, the book that bought him to prominence. It describes his upbringing in the deprived Appalachian Mountains of Ohio, an area crushed by deindustrialisation, the demise of the coal mining industry and now suffering from widespread unemployment, opioid addiction and other ‘diseases of despair’. The second is Robert Lighthizer’s ‘No Trade is Free’. Lighthizer was President Trump’s first term Trade Representative. His book is a diatribe against both China and the WTO. He squarely blames both for the demise of US manufacturing and calls for a partial repeal of the offshoring that has characterised the global economy in the era of the Washington Consensus. It is no coincidence that Lighthizer is also from Ohio and therefore acutely sensitive to globalisation’s discontents: the unsympathetically treated working classes who have seen their living standards stagnate or decline.

The US trade deficit is a focus of Lighthizer’s book. In short, America imports more than it exports. Returning to the dawn of modern economics, in the eighteenth century Adam Smith wrote why trade deficits are not necessarily a problem, although this is contentious. However, the focus on bilateral trade balances (ie, those between two countries, such as South Korea and the US) really does make little sense. As argued by Tim Harford in the FT, most people have a large trade surplus with their employer; you are unlikely to spend everything you earn just with them. You may have a large trade deficit with the cheese shop at the bottom of your road, because you like cheese but have none to sell them. Returning to Ricardo, specialisation is key to the capitalist model and trade is what brings prosperity.

Since April’s ‘Liberation Day’ it appears that tariffs may settle at lower levels than at first feared. It seems likely that they are partly a negotiating tactic to extract concessions from others, including the repatriation of some manufacturing; fair enough. We are hopeful that their materiality will be reduced with time. Tariffs are a tax, and Lighthizer’s book ignores the benefits that Americans have enjoyed by importing goods at low prices from overseas and the higher prices that will inevitably follow should they be fully imposed.

Another controversial element of President Trump’s presidency is his ‘big beautiful bill’. Without wanting to dwell on the details, this budgetary policy is very regressive (ie, redistributes from the poor to the rich) and extends America’s significant and persistent fiscal deficit, which is currently running at more than 6% of gross domestic product. It is very unusual for a responsible nation to run such a substantial deficit in benign economic times, and ultimately unsustainable.

Ultimately, even President Trump is answerable to at least two constituencies: the electorate and the bond market. If tariffs unleash inflationary pressures his popularity is likely to wane. If his ‘big, beautiful bill’ is deemed too costly, the market may reject it and American could face its ‘Liz Truss moment’ as investors dump Treasuries. As Harthacnut’s father Cnut the Great famously discovered, even kings can’t control the tide.

. . . . . . . . . . .

Charlotte Cuthbertson, Nick Greenwood, managers, MIGO Opportunities Trust, 9 July 2025

Although there has been a considerable amount of back-pedalling since “Liberation Day” it is undeniable that President Trump is upending a world order that has stood since the end of WWII. US exceptionalism, which has dominated investing over the past 20 years appears to be in its death throes. For the first time since 2008, indices across the rest of the world are outperforming the US.

Government deficits, and thus bond yields, continue to concern us. Ageing populations and ballooning welfare budgets, as well as a new imperative to increase defence spending, leave us wondering how most Western governments are planning on reducing their deficits in the years to come. Ultimately, this will have an impact on GDP growth rates as well as hamstringing Central Banks on their ability to cut rates.

All this results in a backdrop for markets that is very different to the one that investors have been contending with since the global financial crisis. Although the bounce back, particularly in the US, has been fairly spectacular from the lows of early April we are already seeing cracks appear and investors questioning whether their large allocation to US equities is right moving forward. After such a long spell of low-cost, US index hugging products being the only game in town, we are quietly excited by the prospect of investors looking for other areas of the market for their returns. This new environment will suit MIGO much more than the one which we are departing.

Trusts continue to go through their Schumpeterian phase*, with mergers, wind-ups and takeouts continuing apace. We believe we are in a healthy “clean up” phase after vast sums of paper were issued when interest rates were effectively zero. For discount hunters who look for catalysts this period could be very profitable.

. . . . . . . . . . .

Karl Sternberg, chairman, Monks Investment Trust, 1 July 2025

Recent years have been difficult for active managers as stock market returns have been driven by a small number of companies, which have represented an increasingly large proportion of global stock market indices. This is now the longest sequential period in which the S&P500 has beaten its equally-weighted version. This has made the index difficult to beat.

. . . . . . . . . . .

Anja Balfour, chairman, Global Smaller Companies Trust, 30 June 2025

The outlook for the world economy is complicated by the presence of numerous crosscurrents. What seems clear is that uncertainty is likely to remain high and there is a wide range of potential future outcomes.

There are several unanswered questions on which we may have more clarity in the coming 12 months. We don’t yet know the final level of tariffs and what the impact of those might be on world economic growth and inflation. In recent years vast amounts of capital have been deployed on projects related to artificial intelligence and it will be interesting to see if those investments start to produce an adequate return this year. The size of fiscal deficits has been a concern for some time now and recent rising government bond yields suggest that the market is becoming more sensitive to this issue. This will be something to watch closely.

Positively, as deregulation takes hold, taxes are potentially cut and tariffs are finalised, the prospects for the US could improve. We now seem to have some political stability in the UK and strong consumer balance sheets, low exposure to tariffs and housing sector reform are all supportive factors for this economy. For Europe, rising fiscal spending and lower energy costs could also be helpful. Implementation of some of Mario Draghi’s proposals for increased European competitiveness would be very welcome. Our expectation is that over the longer term, Japan will continue to benefit from corporate reform and a return to inflation. Finally, the weakening of the US Dollar is not all bad news, as this has historically been helpful for Emerging Markets.

Many of the factors that kept inflation benign for several years now appear to be reversing. Financial markets continued to be affected by shifting geopolitics during the financial year ended 30th April 2025. Persistent inflation, wealth inequality and immigration were key issues leading to electorates unseating incumbent parties. Furthermore, the dramatic reorientation of American trade and foreign policy, following the election of Donald Trump, challenged the post-World War II international order and affects the outlook for inflation and economic growth. The new US government’s approach to peace negotiations between Russia and Ukraine and its proposed territorial expansions overseas alarmed European allies. This was compounded by the US no longer being unequivocally committed to NATO Article 5 (collective defence). Consequently, this prompted European governments to increase their spending on defence in the years ahead. Despite new approaches by the US administration, conflicts in Ukraine and the Middle East are still ongoing. Only time will tell if President Trump’s policies will work, however, it is clear that the benefits are uncertain and the costs are real. Recent events in Iran have further added to these difficulties.

In the UK the newly elected Labour government promised faster economic growth. However, tight budgetary constraints soon impacted progress on some of those initiatives, while ongoing imbalances in the labour market led to UK inflation remaining higher than hoped for. Populism was on the march in continental Europe, exemplified by the far right AFD party’s unprecedented 20% share of the vote in Germany’s general election.

For most of the financial year, major economies successfully navigated a higher interest rate environment and appeared to be on course for a ‘soft landing.’ Labour markets remained healthy with solid wage growth. Momentum in world economic growth slowed towards the end of the period as uncertainty over the new US administration’s trade and foreign policy weighed on business and consumer sentiment.

With inflation moderating across developed markets, central banks started to ease monetary policy. The European Central Bank led in June, followed by other major central banks, resulting in cumulative cuts of 2.00% in the Eurozone, 1.00% in the US, and 0.75% in the UK. Japan remained an outlier, with a long awaited return to inflation leading to two rate hikes in the year by the Bank of Japan.

Unusually, despite most central banks lowering interest rates, 10 year government bond yields remained at elevated levels compared to the last 15 years. This reflected investor concerns over the future path of inflation and the size of government deficits. In the case of the US, lower demand from foreigners and diminished confidence in the country’s ‘safe haven’ status and governance, raised yields on US Treasury bonds. Similarly, we saw a significant weakening in the US Dollar against major currencies.

The US economy was, however, supported by higher asset prices, fiscal spending and artificial intelligence-related capital expenditure. In contrast the US housing sector was hurt by higher interest rates. The UK economy was challenged by low productivity growth, stubborn services inflation and higher costs for businesses, although signs of life did appear towards the end of the financial year. European economies continued to be divided, with tourism-focussed countries performing well but the more industrial driven countries challenged by elevated energy costs, competition from China and now tariffs. However, Germany’s suspension of its “debt brake” and commitment to approximately €900 billion in spending on defence and infrastructure could prove to be a turning point for “The Old Continent”. Wage growth in Japan helped domestic consumption. In addition, the lower yen encouraged inbound tourism and the end of negative interest rates helped the country’s financial sector.

China continued to face challenges with weak consumer confidence, although during the year the government increased efforts to stimulate the economy and the property market showed signs of stabilisation. Taiwan benefitted from the ongoing investment cycle in artificial intelligence. Growth in India, which has been strong for some time, lost a little momentum this year and interest rates were cut as inflation moderated. In Latin America, stubborn inflation and concerns over the fiscal deficit held back Brazil. On the other hand, in Argentina, sentiment improved as President Javier Milei’s deregulation and deficit reduction efforts bore fruit.

. . . . . . . . . . .

UK

Penny Freer, Chair, Henderson Smaller Companies, 30 July 2025

Macroeconomic news flow continues to be noisy. The path for monetary policy remains uncertain. Inflation remains above central bankers’ target range. Trump’s ‘America First’ policies have started to usher in a new world order and have already triggered significant policy responses from governments in Europe. These changes could induce both inflationary and reflationary impulses, while the spectre of a recession caused by the uncertainty brought by Trump’s tariffs would be deflationary. To compound the issue, geopolitics are still messy and conflicts in both Europe and the Middle East are bringing volatility to commodity prices. However, markets are forward looking and given the attractive starting valuations in the UK small and mid-cap equity market, less noise may be all that is needed to drive markets forward.

There is potential for the UK economy to beat GDP growth expectations. UK consumers continue to see real wage increases, corporates are benefitting from falling (but still restrictive) interest rates and both groups are sitting on strong balance sheets. Confidence is the catalyst needed to drive investment; hiring and spending decisions and recent sentiment gauges suggest that despite the noise, animal spirits are recovering, so we look to the year ahead with cautious optimism.

Amid these challenging conditions, in aggregate the Company’s portfolio continues to have quality bias and holds companies with robust business models which are soundly financed and being run by management teams whose incentives are aligned with our own. The attractive valuations in this part of the market are well-documented. These claims are validated by continued in-bound M&A and ongoing share buyback programmes being sanctioned by boards.

Over the long term, this Company seeks to capture the well-established small-cap premium: that is, the long-term outperformance of small caps over large caps driven by factors such as higher growth prospects and higher alpha-generating opportunities in this under-researched part of the market. Whilst the small-cap factor has proved elusive in the UK over the last 10 years – a period punctuated by the EU referendum vote, the protracted period of political and economic instability that ensued and ‘UK exceptionalism’ – we see good reasons for course correction. Stable politics puts growth back on the agenda in the UK. We see positive early indications of this through commitment to planning reforms, deregulation in the financial sector and most significantly, a resetting of the trading relationship with the EU. Improving sentiment towards UK plc would alleviate the acute technical pressure this part of the market has suffered from in terms of asset outflows, and we have seen the positive impact on performance that the inflows from global investors in calendar years 2015, 2017 and 2021 can bring. Smaller companies may underperform larger companies in periods of economic dislocation as investors flock to larger and more liquid asset classes, but history will show that they rebound most strongly after such periods.

We believe UK smaller companies continue to offer exciting growth opportunities to long-term investors.

. . . . . . . . . . .

Indriatti van Hien and Neil Hermon, Managers, Henderson Smaller Companies, 30 July 2025

After a year of elections across major economies it should come as no surprise that global markets are set to remain volatile. New governments are in the process of implementing the bold policy promises they campaigned on. In the US, the start of Trump’s second term has already brought trade policy shocks, foreign policy reversals, multiple U-turns and cast doubt over Federal Reserve independence with much of this being communicated via social media. Unpredictable policymaking from the world’s largest economy has raised concerns around a global economic slowdown. As base rates are still restrictive across major economies there is an obvious lever central bankers can pull to stimulate demand. However, inflation is still sticky and central bankers are taking a cautious approach to rate cuts while they wait to see how policy changes, tariffs and tax cuts in the US and labour cost increases in the UK manifest themselves in price growth. Lower oil and energy prices, despite continued military conflict, are helping keep headline inflation at bay.

Corporates and consumers are dealing with unprecedented uncertainty, which has precipitated volatile readings in sentiment indicators, albeit from a position of strength. Amongst UK consumers, savings ratios remain high and unemployment relatively low. Moreover, corporate management teams remark that since the pandemic they have become so accustomed to market upheaval that operating frameworks are already in place for new challenges they may face. We take comfort in this and the strong balance sheets of both corporates and consumers, noting that they are intrinsically healthier than they were ahead of the Global Financial Crisis in 2008-2009.

Geopolitics are set to remain challenging. Conflicts in Ukraine and the Middle East are struggling to reach stable resolutions and heightened tensions between China and the US persist. These themes are not new. What distinguishes this year is the emerging challenge to US exceptionalism. The country’s moral leadership and economic dominance being called into question has manifested itself in a weaker dollar and the potential for lower foreign investment in the region. It is too early to say whether or not this will be an enduring theme. In stark contrast, however, we believe UK exceptionalism is abating.

There is no denying that the Labour Government’s ‘honeymoon period’ following its landslide election victory was short-lived and that the Government is faced with the challenge of reviving economic growth while walking a fiscal tightrope. However, its recent focus on deregulation within the financial services sector suggests that there are signs the government understands the need to get the private sector back onside. Stable politics, a resetting of the UK’s relationship with the European Union, its largest trading partner, investment in capital projects and a real focus on supply side reform should attract business investment and foreign capital into the country. All else being equal, a 1% shift in global equity allocations away from the US and into the UK would drive a 25% uplift to assets in the market. The current dismal allocations to UK small-cap equities mean small changes can make a material difference in underlying valuations in this flows-driven part of the market.

After a lost decade in UK smaller companies, starting with uncertainty about the EU referendum vote, we see good reasons why fortunes could change and history will show that small caps perform best after periods of economic dislocation. UK small-cap valuations remain attractive and sit well below long-term averages. They also remain markedly depressed versus other developed markets, even on a sector-adjusted basis. The persistent in-bound M&A activity the market is experiencing tells you that many market players are already taking notice and boards have never been keener to signal value through share buybacks. The IPO market has remained quiet; a re-rating of the broader market can quickly change this. Once the flywheel starts, it will be hard to stop.

. . . . . . . . . . .

Managers, Aberforth Geared Value and Income, 30 July 2025

Twelve months ago, American exceptionalism was celebrated and gauged by the success of the US stockmarket. Today, the investment outlook has been complicated by Donald Trump’s convulsive second presidency and its challenge to some of the assumptions that have long underpinned the financial world. Dollar weakness may well be welcomed by the Trump administration and has been seen before, but the present bout is accompanied by debate about whether the dollar risks losing the exorbitant privilege of reserve currency status. There is also debate about the risk-free nature of US government debt, as fiscal spending looks set to rise under the “One Big Beautiful Bill Act” and as foreign governments, disconcerted by the tariffs, question the wisdom of parking their reserves in treasuries. Even the US stockmarket has lost some of its lustre. The potential impact of the tariffs on the profits of US businesses has seen European equities outshine their US counterparts so far in 2025. The uncertainty emanating from the US complicates investment decisions, whether for businesses considering capital projects or fund managers selecting stocks.

The UK is inevitably caught up in this, but its low reliance on exported goods and its trade deficits can be seen as a relative advantage in the context of trade war risk. The greater challenge for the UK economy is government policy and its fiscal position. Last year’s Budget highlighted the Chancellor’s difficulty in delivering growth while adhering to the fiscal rules. As this year’s Budget approaches and as the government struggles to implement its reforms, a degree of caution on the part of businesses and households is understandable. On the other hand, the government’s pragmatism and growth ambitions are encouraging, though it would be better to see more of the rhetoric turn into action.

Against this backdrop, UK equities have made headway, with the re-rating of larger companies taking the FTSE All-Share’s PE back to its long term average. The valuation anomaly remains smaller companies, whose PE is still well below its long term average. Over time, it would be reasonable to expect some of the renewed interest in the UK to filter down into the DNSCI (XIC) and, indeed, this started to play out through the final quarter of AGVIT’s financial year.

An important aspect of the recent performance of smaller companies is that it is not driven by fundamental factors. Dividend growth is a useful gauge of fundamental progress since there is a long history of data and it cannot diverge meaningfully from profit growth over time. Using the most recent London Business School data, dividend growth for smaller companies has outstripped that of large companies by 1.4% per annum since both 1955 and 1990. Over the past three years, the differential has been higher at 3.2% (9.7% versus 6.5%), which is clearly at odds with the total return data. Indeed, the differential has been higher than average over the last five and ten years as well, which indicates that smaller companies have coped better than many would expect with the familiar challenges of Brexit, the pandemic, the Truss Budget and the inflation spike of 2022.

Judging by the valuations, the stockmarket is missing the resilience and superior growth of smaller companies. Rather, it seems distracted by their relative illiquidity and volatility, but this obsession risks missing the point of investment in the asset class. The small company premium – i.e. the long term out-performance by smaller companies against larger companies – is inextricably tied up with a willingness to take on liquidity and volatility risk. Those able and willing to commit their capital to smaller companies are rewarded over time for taking on that risk.

. . . . . . . . . . .

James Henderson and Laura Foll, managers, Law Debenture Corporation, 24 July 2025

Companies and individuals have reduced their debt levels as a response to global uncertainties. Therefore, the economy and investors are in a position to absorb volatility. Low expectations are a good background for investing, for, if events prove less bad, there is scope for relief and for share prices to move up. The investment approach will be for us to selectively increase our exposure to UK equities given the low valuations and good corporate management disciplines that are in place.

Despite many macro concerns, it is expected that the global economy will keep growing. Companies that have competitive products and services will experience sales growth. Valuations are in cheap territory.

. . . . . . . . . . .

Frank Ashton, chair, Athelney Trust, 24 July 2025

The UK’s outlook, according to many commentators, has contradictions: Tepid growth, persistent inflation and fiscal tightening arrayed against some compelling investment opportunities, including some undervalued equities.

UK fiscal policy and geopolitical uncertainties make it harder to forecast accurately, and we must wait for news from the Chancellor in the Autumn Budget, on whether she will raise taxes as many predict. These factors may dampen short-term growth prospects.

“Consumer Price Inflation is expected to remain broadly at current rates throughout the remainder of the year before falling back towards target next year”, the June Monetary Policy Committee notes said. The Bank of England said this would inevitably have an impact on interest rates. A short term increase in interest rates is expected, driven by energy price cap rises which distort headline inflation.

The Office for Budget Responsibility, the UK’s official forecaster, said as a result in its latest fiscal risks and sustainability report, that the UK’s public finances are in a ‘relatively vulnerable position’ and that ‘the scale and array of risks to the UK fiscal outlook remains daunting’.

. . . . . . . . . . .

David Horner, manager, Chelverton UK Dividend Trust, 10 July 2025

We have written repeatedly in recent years about our confidence in both the quality of the underlying companies in our portfolio and the ability of the respective management teams to navigate the continued macro shocks in such a way that our portfolio holdings will emerge leaner and stronger as the market recovers. This undoubtedly remains true, but has not been reflected in share prices/ratings. More recently however, the combination of global trade uncertainty and an improving UK domestic picture, led by falling mortgage rates, has resulted in a long-awaited pickup in demand for UK domestic stocks. While we expect the short-term uncertainty to result in some difficulty for names exposed to global GDP and frictionless trade, the natural domestic bias within this portfolio ought to leave it relatively well placed, especially if the recent positive shift in investor sentiment towards UK equities can be sustained. The past few years has seen a marked shrinkage in the available UK equity base through a combination of share buybacks, takeovers and a lack of IPOs. Any sustained shift in investor sentiment, combined with a stable domestic economy could see the small and midcap market in which we operate start to revert to its long-term outperformance versus large caps, reversing the trend of the last few years.

. . . . . . . . . . .

Managers, Oryx International Growth, 4 July 2025

In a world marked by growing uncertainty-driven by Trump-era tariffs and persistent regional conflicts-forecasting market trends for the coming year has rarely been more challenging or speculative. There is however, an emerging silver lining to President Trump’s erratic economic behaviour. UK focused investors have long observed domestic capital migrating to overseas markets, most notably the US. One unintended consequence of the President’s actions is the beginning of capital repatriation to UK and European markets as pension funds, historically overweighting the US, de-risk their exposure.

There have been a few green shoots in the UK Initial Public Offering (IPO) market as investment banks attempt to time the market recovery. It is clear that UK assets are materially undervalued by the high volume of takeovers that we have seen in the last few years and that continues today.

. . . . . . . . . . .

Asia ex Japan

Neil Rogan, Chairman, Invesco Asia Dragon 16 July 2025

After a prolonged period of uncertainty was capped off in spectacular fashion by President Trump’s tariff announcements, it is now possible to say that the worst appears to be behind us. Tariff levels now appear to be clearer and many companies will be able to work around them. Further sector by sector trade deals are likely to emerge. It was always the case that China would wait to see what the US would do before using up all of their firepower to reflate their domestic property market and consumer sector. The tariffs and trade uncertainty will cause economic slowdowns this year but the scene is now set for recovery from 2026. Domestic consumption growth in Asia combined with currency appreciation would be a powerful combination. With a starting point of attractive valuations, especially by comparison to world markets, and in the knowledge that foreign investors have historically low Asian weightings, the conditions for a new bull market are nearly all in place.

Asian equities currently offer double-digit earnings growth, with reasonable valuation levels across much of the universe.

Asian currencies have started to strengthen relative to the US dollar, which remains overvalued against most currencies, with the performance of Asian equity markets having historically tended to benefit from a weakening US dollar trend.

. . . . . . . . . . .

North America

David Barron, chairman, BlackRock American Income, 3 July 2025

This period has seen turbulence from strong geopolitical factors which have inevitable knock-on effects and the outlook for the US economy remains uncertain. The Trump administration’s tariff policies remain a significant factor impacting markets and while some tariffs have been paused and others reduced, there is still uncertainty surrounding future trade negotiations and trade deals which continue to weigh on investor sentiment and led to a decline in the US Dollar. The Federal Reserve has begun to lower interest rates but indicated a cautious approach to further cuts due to inflation concerns and trade policy uncertainty. However, the de-escalation in the trade war between the US and China in mid-May, with a mutual reduction in their respective tariff rates for an initial period of ninety days, has provided some relief to financial markets which had begun to reflect concerns that a collapse in US-China trade flows could cause disruption to supply-chains.

. . . . . . . . . . .

Travis Cooke and Muzo Kayacan, co-portfolio managers, BlackRock American Income, 3 July 2025

At the time of writing, geopolitical events loom large and trade tensions remain. Surveys of US consumer sentiment have rebounded from recent lows but remain depressed. Forward looking measures of business activity continue to point to an expansion in activity and our analysis of on-line job postings points to a slowdown in wage growth – but this could create room for interest rate cuts. Against this very mixed picture, it is worth returning to the discussion of the portfolio’s sector and underlying stock positioning above. The portfolio holds overweight positions in a variety of firms, some of which have highly diversified businesses or dominant market positions, or produce specialised goods, or show signs of financial resilience. Many of these companies are displaying positive momentum in their fundamentals. At the same time, there are sectors and firms where top-down views suggest that they may be vulnerable in the current economic environment, informing underweight positions. Uncertainty is often a source of discomfort, but it can also create compelling investment opportunities.

. . . . . . . . . . .

Financials

Simon Cordery, chair, Polar Capital Global Financials, 14 July 2025

Financials have proved to be a resilient investment during a period of intense market volatility and geopolitical uncertainty. This is a large and diverse sector that continues to trade on an attractive valuation relative to the wider market and to growth sectors such as technology. The sector is in good health and the outlook for earnings, including a less restrictive regulatory backdrop, remains positive.

. . . . . . . . . . .

Nick Brind, George Barrow and Tom Dorner, managers, Polar Capital Global Financials, 14 July 2025

First-quarter US bank results have remained solid, reflecting the US economy’s resilience and supported by strong trading revenues. The outlook however is one of slower growth and US employment appears to be weakening. The housing market has softened, with high US mortgage rates dampening demand. With the more uncertain outlook, US banks have taken the precaution of raising the level of provisions, even though delinquency trends in consumer lending have been improving. The other weak spot of office commercial real estate has also stabilised.

We believe the outperformance of Financials against wider equity markets over the six months in part reflected it being seen as relatively insulated from the direct impact of tariffs, notwithstanding that it would not be immune from the indirect impacts. As it is more diversified regionally, with around 50% of the sector comprising US-listed companies, versus 64% for global equities, it benefited in relative terms from the weaker US dollar. Another likely factor was that both the technology and healthcare sectors came under pressure for idiosyncratic reasons, the former most notably around the news in January of Deepseek’s latest AI model which led to a large sell-off in technology shares.

As the second largest sector in equity markets after technology, the Financial sector is the largest constituent of value indices, i.e. those companies that trade on lower valuations relative to the wider equity market. It stands to benefit from any rotation away from growth sectors where, we would argue, investors often pay a premium for promises while value stocks often trade on a discount to reality. Data in the US shows that value indices on a 10-year rolling basis outperformed growth indices since the mid-1920s until the global financial crisis. Since then, growth has been in the ascendency as the ingredients for its strong performance, in particular technology stocks from smartphones and the cloud to latterly artificial intelligence, have been the latest driver of share price performance.

Conversely, value sectors have struggled. For example, until the past couple of years the Financials sector faced significant headwinds. This included a significant increase in capital and liquidity requirements, increased regulatory and compliance costs as well as fines and litigation dating back to the global financial crisis, with shareholders paying for the excesses of the preceding years while the executives responsible for it escaped the consequences. However, low and negative interest rates that had the biggest impact leading to the profitability of many banks falling substantially and with it their share prices, while mispricing in bond markets led to a significant misallocation of capital that has only just unwound.

Today, Financials are far more attractive. Interest rates have normalised, providing a much better background for the sector to generate attractive returns for shareholders, and investors have been slow to realise that these higher returns are sustainable. Higher insurance and reinsurance rates have increased the profitability of the insurance sector. Significant investment in technology across the Financial sector will lead to the potential for a better customer experience, better risk pricing and increased efficiency, with automation helping to cut significant costs.

Furthermore, regulators, both in the US and elsewhere, are looking to simplify regulation which has built up over the past 15 years with Donald Trump appointing new heads to a number of regulatory agencies with that aim. As Michelle Bowman, the newly appointed Vice Chair for Supervision at the Federal Reserve, noted in April at the Senate Committee on Banking to review her nomination that: “The US regulatory framework has grown expansively to become overly complicated and redundant, with conflicting and overlapping requirements. The growth has imposed unnecessary and significant costs on banks and their customers.”

In the UK and Europe, policymakers are belatedly waking up to the realisation that the answer to growth cannot be more regulation, more capital and yet more acronyms. In June, the House of Lords produced a report stating that the UK’s two main regulators, the Prudential Regulatory Authority and the Financial Conduct Authority’s “international competitiveness and growth objective is being held back by pervasive risk aversion, regulatory uncertainty and inefficiency in the regulatory system.”

Some of the regulatory changes proposed in the US are likely to be enacted this year which will be positive for the sector and hence profitability. This is not a bonfire of regulations but sensible, prudent steps to alleviate the sand in the wheels of companies across the sector. Consequently, we see the background has improved markedly for the sector but, as importantly, so has the perception that it is an attractive area of the market to allocate capital, where it offers greater diversification in equity markets that are highly concentrated.

. . . . . . . . . . .

Tim Levene, manager, Augmentum Fintech, 30 June 2025

Earlier this year, my outlook for the global economy was decidedly more optimistic, with expectations of falling interest rates, the potential for deficit-reducing policies, and hopes for a lighter regulatory touch in key sectors. However, the intervening period has been marked by a rise in profound uncertainty, driven by macroeconomic volatility, political disruption, and rapidly shifting global dynamics. While the precise path of geopolitical events remains unpredictable, one thing remains clear, fintech’s potential in Europe remains undiminished. Paradoxically, a more protectionist US stance may enhance Europe’s relative attractiveness as a stable and outward-looking hub for innovation and capital deployment, with some investors who might traditionally focus on the US now redirecting capital into European markets.

Following the Covid-era surge, where abundant capital led to significantly inflated valuation multiples, the market has undergone a necessary recalibration. We have now entered a period of relative stability and, encouragingly, the underlying fundamentals of the fintech sector remain robust. For the first time in a while, we are seeing tangible signs of more favourable conditions for the thawing of the IPO market. The fintech sector continues to evolve and mature, particularly in Europe, where innovation remains strong and capital increasingly flows to companies with clear paths to profitability. The European fintech ecosystem has been further shaped by an active regulatory and policy environment, creating opportunities for early-stage businesses to thrive. Fintechs, both listed and private, have responded well, demonstrating resilience, adaptability, and, in many cases, significant progress toward profitability and scale.

We are encouraged by the continued policy support for the fintech and startup sectors, including a strong commitment to fostering innovation and domestic capital formation, across the markets in which we invest. The UK Government has been explicit with its endorsement of fintech as a key driver of economic growth, with the sector touted as a central pillar of the UK’s Financial Services Growth and Competitiveness Strategy. We welcome initiatives designed to unlock the £2 trillion of assets managed by UK workplace pensions schemes, including the updated Mansion House Accord, although on the latter, the sector remains frustrated around the lack of tangible progress in implementing these commitments. Across the EU, initiatives aimed at streamlining regulatory frameworks are creating more favourable environments for growth-stage companies. The evolving regulatory backdrop supports both innovation and exit opportunities, enhancing Europe’s position as a global fintech leader and bolstering investor confidence.

We believe that the next five years will mark a defining chapter for European fintech, a sector at the intersection of innovation, regulation and global capital flows. With rate cycles peaking and early cuts now behind us, the stage is set for a recovery in risk appetite. Market sentiment is already responding: fintech valuations are recovering, capital markets are stabilising and M&A activity is accelerating. Exit markets are poised to reopen, driven by pent-up demand and investor appetite for growth-stage businesses with strong fundamentals.

As Europe’s fintech ecosystems mature, generating repeat founders, deeper pools of talent, and more ambitious ventures, we remain confident that the best vintages lie ahead.

. . . . . . . . . . .

Infrastructure securities

Gillian Nott OBE, Chair, Premier Miton Global Renewables Trust, 31 July 2025

Headline inflation has proved sticky, in both the US and Europe. However, many economic indicators show a deteriorating backdrop, and this allowed the Bank of England and the European Central Bank to continue with cuts to policy rates which began in the second half of 2024. In the United States by contrast, stubborn inflation plus economic and policy uncertainty, caused the Federal Reserve to sit on its hands during the first half of 2025, keeping interest rates unchanged (to the consternation of the president). Overall, there is a feeling that the interest rate environment is becoming more benign.

Equity markets, particularly in the US, have experienced a relatively high degree of volatility. The new US administration’s tariff policies have caused much uncertainty and appear to have been calculated arbitrarily. The US continues to run a very high fiscal deficit and President Trump’s “One Big Beautiful Bill”, now passed into law, containing further tax cuts, is expected to exacerbate the situation.

It is unsurprising therefore that the US dollar has been weak over the period. The US dollar index, which measures the dollar’s value against a basket of other currencies, fell by 10.7% over the six months.

In the UK, the new Labour government is committed to encouraging renewable energy development. However, a complication in the period has been a review of the UK’s wholesale electricity trading arrangements, notably a potential shift to regional, or `zonal’, power markets designed to encourage higher power prices in areas where power demand exceeds supply. In July the government announced that a zonal pricing system would not be pursued, and the UK would continue with a single electricity market. Instead, the electricity system operator is tasked with setting out a plan to better spread energy projects across the country, together with changes to transmission network access charges. It is hoped this will lead to a more efficient electricity system.

. . . . . . . . . . .

James Smith, manager, Premier Miton Global Renewables Trust, 31 July 2025

The first half of 2025 saw a much-improved performance from both the renewable energy sector and the portfolio. A more benign interest rate environment has lowered perceived risks for sectors deemed by markets to be “bond proxies”, i.e. assumed to have fixed bond-like cashflows.

Given renewable energy is a growing sector, this is not a theory that I believe holds over the long term, but in the short term, the market believes it and as such the sector has shown a high degree of (negative) correlation to interest rates.

The new US administration hit its stride in the half year with a raft of tariff and trade measures. This has undoubtedly hurt the US’s global standing and is a factor behind the weakness in the US dollar seen in the first half of the year.

The US administration’s flagship legislation, now passed, will favour fossil fuels and phases out tax credits for renewable generation. To the extent this results in less renewable development and given the time scale required to build fossil fuel and nuclear alternatives, it is likely to increase US power prices in coming years as demand for power is not matched by an increase in supply.

In contrast to recent history, global markets were led by Europe, including a strong performance by the UK market. Heightened concerns over fiscal sustainability, plus conflict in the Middle East between Israel and Iran, saw investors favour alternative stores of value, such as gold, which gained 25.9% over the six months.

Europe has now largely transitioned away from imported Russian natural gas, and both gas and electricity prices have continued to normalise, albeit at higher levels than “pre-Ukraine”. An on-going debate concerns high industrial tariffs, making industry uncompetitive. Reducing system costs, particularly through grid balancing and energy storage, will be key policy areas in coming years.

Renewable energy companies performed well in the half year, with most companies held making solid gains. Growth remains attractive, and power prices relatively well bid.

In addition, renewable energy companies have benefitted from being mainly domestically focussed and not therefore caught up in tariffs.

Well run companies, with modest debt and highly contracted revenues should remain in demand, particularly during periods of market turbulence. Any further monetary easing should also be of benefit to market sentiment.

. . . . . . . . . . .

Technology

Ben Rogoff & Ali Unwin, managers, Polar Capital Technology, 10 July 2025

The market backdrop is still likely to be driven by geopolitical developments in the near term, specifically the effective tariff level. Our base case is that the ‘tariff episode’ represents a recalibration rather than a full reset of the status quo. Our view remains that it is not in global policymakers’ interests to provoke a deep global recession and is within their capacity to avoid it. Recent political developments have led to an inherently more volatile market outlook, but not necessarily an unattractive one for investors with the capacity to absorb it. The growth outlook is now tepid but still positive, and the consumer and labour markets are broadly resilient for now. Deregulation and innovation (in the form of AI) offer significant upside potential, while stagflationary risks from disappointing tariff outcomes, immigration reform, geopolitical upheaval and growing public debt remain causes of concern.

The market impact of political change is perhaps unsurprising in the context of the widespread rejection of incumbent parties (and their policies) recorded in the ‘year of democracy’ across the globe in 2024. Every single incumbent party lost vote share in the 12 developed Western countries that went to the polls in 2024. The causes of this shift have been variously attributed to the impactof inflation, pressures arising from unchecked immigration and diminishing state capacity amid growing public debt burdens. The result is that equity markets have become more sensitive to political developments addressing these issues; inflation, labour market and economic growth trends are more exposed to trade and immigration policy dynamics than they have been in recent years.

In terms of economic growth, the International Monetary Fund’s April 2025 update noted that forecasts for global growth have been “revised markedly down” so far this year due to tariffs and global inflation is expected to decline at a slower pace. “Intensifying downside risks” dominate the outlook amid a “highly unpredictable environment”. A softer US outlook is the consensus view, although not a recession which is likely if there is limited progress on tariff negotiations: Bloomberg consensus in mid-May suggests 1.4% US real GDP growth in 2025 and a 40% chance of a recession within 12 months, although this number should fall as more trade deals are announced. The speed and quantum of change in the effective US tariff rate will likely be the largest swing factor in determining near-term growth.

On the inflation front, US core PCE (personal consumer expenditure) Price Index is sitting at 2.6% and has been broadly stable over the past six months, which should be a supportive backdrop for risk assets. Under the surface, while goods inflation is near zero, services PCE ex-energy and housing (3.25%) is holding up the stubborn ‘last mile’ to reach the 2% inflation target and appears to be due to lagged inflation in areas such as housing, healthcare and car insurance. Measures of long-term inflation expectations are generally benign, with the 5yr5yr (the market-implied average inflation rate for the five-year period that begins five years from today) remaining rangebound between 2.1% and 2.4%, although the University of Michigan’s 5-10-year inflation expectations outlook staying above 4% is more concerning as tariffs start to show up in expectations. This will get the Fed’s attention given the importance of maintaining well-anchored inflation expectations, but 5yr5yr and breakevens are not yet signalling anything too concerning.

Financial conditions more broadly have loosened after tightening sharply in early April and consumer spending remains “resilient, even with macroeconomic uncertainty”, according to Visa. Ten-year Treasury yields have been volatile but have not broken out in either direction and credit spreads tightened to below 2 April levels after blowing out during the Liberation Day disruption. Against this backdrop, we expect the Fed to remain vigilant on inflation but not in a hurry to cut rates until it has a better idea of the impact of Trump’s policies on the inflation and the labour market outlook. The disinflation trend has been occurring for a while which gives conviction in the overall process and, given most of the Federal Open Market Committee believe the neutral rate is below current Fed funds (4.25-4.50%), the bias will be to cut, should the inflation data allow it or the labour market data require it. We will continue to monitor US yields, particularly the dollar, for signs of a significant shift in the risk environment, as well as the realisation of Trump’s threats to curtail Fed independence.

Valuations appear extended given the geopolitical backdrop. High company valuations present a challenging starting point for long-term future returns but are poor predictors of near-term returns. We do not see valuations as so high that they preclude further expansion, although the high starting point does represent a long way to fall should the market environment deteriorate. We are also aware of other market and economic measures that appear extended. The rebound in the S&P 500 has been one of the strongest since 1928. US households’ allocation to equities has touched a record high and high levels of retail participation in financial markets leaves them vulnerable to a change in sentiment. The wealth effect also cuts both ways and a sharp drawdown in asset prices could lead to a loss of consumer confidence and a slowdown in spending.

The bull case centres on Trump’s deregulatory and pro- business agenda taking over as tariff headwinds fade and AI adoption supports an accelerating economic and earnings growth picture. Negative investor sentiment and light positioning also provide a more encouraging backdrop for forward returns.

The S&P 500 has registered two 20%+ years in a row, something which has only occurred 10 times since 1871. Only during the 1990s bull market and the Roaring Twenties did strong returns continue for another two years. On both occasions, technology-led productivity booms were taking hold. This remains central to the bull case for the market in our view. Productivity is notoriously hard to measure – let alone forecast – and is subject to frequent and material revisions. Technology plays a critical role but tends to appear in aggregate macroeconomic data much later than its visibility would suggest: “You can see the computer age everywhere but in the productivity statistics”, wrote economist Robert Solow in 1987.

Our base case is productivity gains from AI do not start to show up meaningfully in aggregate statistics (which has historically required >50% adoption), although at lower penetration levels there could be efficiency gains and economic impacts on the labour market and certain industries. AI adoption by end users has been faster than previous technology cycles. As per the Real-Time Population Survey, 40% of the US population (18-64) reported using generative AI to some degree in August 2024 and 28% used it at work. This 40% adoption point took 12 years to reach following the introduction of the PC and four years after the public launch of the internet. We are also hopeful that Trump’s deregulation agenda can enable faster adoption of AI technologies than would otherwise have been possible.

We also must consider the risk of an AI bubble forming. As BoA puts it: “We are far enough into the AI boom that equities will likely either accelerate towards a more bubble- like state or unwind their already significant gains”. Volatility and prices rising together signal a bubble (as opposed to a mere bull market), although these suggest we are closer to 1996-97 than 1998-99. The combination of a potential asset bubble in AI and public policy experimentation (tariffs; deregulation; tax cuts; immigration) could drive a boom/bust cycle at odds with the low-risk, low-return, low-rate era that has been in place since the GFC.

Market Risks

The main risks to our market outlook are political and include tariff policies weighing on growth and stoking inflation (stagflation), immigration reform weakening the labour market and the looming threat of rising Federal debt. Political instability and upward pressure on US fiscal deficits and national debt have placed significant downward pressure on the US Dollar, which weakened by -6.4% on a trade-weighted basis and by -6.3% versus GBP during the Trust’s fiscal year. Having benefited from USD strength over many years, the Trust was – and could continue to be – negatively impacted by GBP strength / USD weakness given the significant weighting of dollar-based assets in both the Trust portfolio and the Dow Jones Global Technology Index around which it is built. As a reminder, the Manager does not look to hedge this risk but does actively manage FX exposure relative to the benchmark.

There is also the potential for further setbacks to the AI story which has led markets higher, especially as it becomes more complex amid the frenetic pace of innovation. We expect volatility will become more elevated and the market environment more ‘fat tailed’; 2025 so far has not disappointed in this regard. Given the high valuation starting point, we expect – all else equal – more frequent significant drawdowns to be a feature of this equity bull market as policy uncertainty remains elevated.

The greatest risk to the market outlook near term is further arbitrary policy actions from the Trump administration which hurt the economy and undermine the institutions and behavioural norms which have underpinned political and market stability. This may include a failure to reduce effective tariff rates (or even a re-escalation), attempts to undermine central bank independence and/or a strategic miscalculation which provokes an unintended negative consequence.

Growing deficits and debt burdens are perhaps the biggest issue for the longer-term risk asset outlook. According to the Congressional Budget Office, the federal deficit is projected to increase to $1.93trn in 2025, up 5.5% from $1.83trn in 2024 and reaching 6.2% of GDP. Extending the 2017 tax cuts would leave the total and primary deficit at 6.4% and 3.1% of GDP in 2024, at uncomfortably high levels given that US debt-to-GDP is roughly 100% and could reach 130% within a decade. While this may support higher nominal growth near term, the risk of a rebound in inflation as well as the lurking threat of debt markets being unwilling to finance such fiscal largesse at prevailing rates could jeopardise the path of future interest rate cuts. Large government deficits can also crowd out private investment and slow the creation of jobs, thus driving further deficit spending to boost the economy and labour market.

If we were to look for imbalances in the economy that may need to be unwound, the fact that US government debt is up $12.7trn since the depths of Covid while nominal GDP is only up $9.7trn is sometimes cited as evidence that fiscal largesse has caused distortions. Yet there appears to be no public appetite for fiscal conservatism and public debt is set to rise above $100trn in 2024, or about 93% of global GDP, and is projected to reach 100% of global GDP by 2030, 10 points higher than in 2019. There are significant structural drivers of the growing public debt burden, including the costs of an aging population, increasing healthcare and climate adaptation costs and a step up in defence and energy security spending due to growing geopolitical tensions. This is not necessarily a problem for the market or the economy in the near term (“It’s a myth that expansions die of old age”, according to former Fed chair Janet Yellen), but rising debt-to-GDP should lead to higher interest rates which could crowd out private investment and raises the risk of fiscal dominance, constraining central banks’ freedom of manoeuvre.

Changes to immigration policy may also bring market headwinds, although this is by no means certain. Lower net immigration could put downward pressure on both the supply and demand sides of the economy. In industries that employ a high share of immigrant labour (e.g. food production; construction), sharply lower net migration might put upward pressure on domestic worker wages. The US economy has been able to grow faster than potential GDP growth over the past two years in part due to the immigration surge boosting labour force growth, so a reversal in that trend could prove a headwind – although this may be offset by higher productivity from technology adoption and workers remaining in jobs longer.

The Trump administration’s early geopolitical moves have provoked significant market volatility well beyond its tariff actions and have contained some shocking elements – not least the party of Ronald Reagan openly siding with the Russians in a war. The disastrous meeting between Zelensky, Trump and Vance raised significant questions about the future viability of NATO and the survival of Pax Americana. In terms of the impact on our outlook, we assume that Trump’s own instincts and preferences play an outsized role in historically strategic policy, resulting in leadership that is unpredictable and likely to further test the boundaries of executive authority.

The Middle East also remains in a fragile state with the potential for further conflict between Israel and Iran. Of most concern is Taiwan, where the potential risks associated with a miscalculation or accidental escalation are significant, as Taiwan accounts for 60% of global semiconductor shipments and more than 90% of leading- edge semiconductor manufacturing capacity. A war game simulation estimated the potential impact on the global economy of a war in the Taiwan Strait at c$10trn or 10% of global GDP, significantly larger than the GFC or the pandemic. Taiwanese and Chinese stocks represented 10.7 of PCT’s NAV at fiscal year end as opposed to 7.9% of the Dow Jones Global Technology Index. The potential impact of a deterioration in the political situation would likely be felt far more widely across the PCT portfolio, however, given Taiwan’s centrality to the AI story, as well as the size of the Chinese market as a source of end demand.

Despite overall constructive economic and company trends, the market outlook is more complex than a year ago and appears more vulnerable to setbacks. The nature of the US administration being both radical and mercurial has elevated the risk profile. As one analyst put it: “One should keep extremely wide confidence intervals in place when forecasting the administration’s actions and the downstream macroeconomic impacts”. We do not see meaningful imbalances in the economy that will require a sharp downturn to unwind, although we are of course watching tariff impacts, labour market and inflation trends very closely for signs of weakness that we can respond quickly to if required. We expect higher volatility to become a more embedded feature of the equity market.

We are also open to the potential that the move to a multi-polar world might presage a more structural market regime shift under the surface where the US moves from a disinflationary posture with secular stagnation headwinds (dominated by demand-side shocks) to a more inflationary regime more exposed to supply-side shocks. A higher- inflation/higher-growth/higher-volatility environment could also see sustained rebuilding of term premia, which was estimated to be negative for much of the past decade and would have significant investment implications. It is too early to call a new regime (and we will at best be fast followers in doing so), but we are alive to the idea that the conditions for such a regime shift are increasingly apparent.

However, our overall outlook is positive because the AI story – albeit more complex – remains the most exciting market (and perhaps even macro) story we have come across, and it feels a high hurdle for investors to move structurally away from equities when the optionality embedded in AI is material in size and likely to play out over the next five years.

Technology Outlook

Earnings outlook

Increased spending on AI infrastructure meant 2024 proved one of the best years for IT spending since the pandemic with growth of 7.7%, exceeding earlier expectations (+6.8%) and well ahead of the 3.5% recorded in 2023. For 2025, worldwide IT spending is expected to further accelerate to +9.8% y/y. While data centre systems spending is expected to decelerate to +23.2% y/y from 39.4%, this still represents remarkable growth, driven by AI-optimised servers where spending is forecast to exceed twice that spent on traditional servers next year. In addition, all other spending categories are expected to accelerate in 2025, led by software (+14.2%), devices (+10.4%) and IT services (+9%). While these forecasts might be subject to some tariff-related headwinds, 2025 was recently expected to be the best year for IT spending since 2021 while 2024-25 may still represent the best back-to-back growth since 1995-96.

For 2025, the technology sector is expected to deliver revenue growth of 11.7%, while earnings are expected to increase by 18%, the highest of any US sector on both metrics. These forecasts are well in excess of anticipated S&P 500 market growth, where revenues and earnings are pegged at 4.9% and 9% respectively. The technology sector’s outperformance is expected to continue in 2026 with early forecasts for 10.6%/16.6% comfortably ahead of market expectations (6.2%/13.4%). While these forecasts may appear at odds with tariff-related developments, corporate earnings have thus far proved more resilient than feared. First-quarter earnings season has been supportive, as (at the time of writing) 74% of S&P 500 companies have beaten on earnings per share (EPS, with the median earnings surprise of 8.5% while Q1 earnings growth is tracking at +12% versus the +6% consensus estimate at the start of the year. Tariff concerns have been flagged in virtually every earnings call, but the impacts have been largely contained so far. However, while macroeconomic conditions may create more significant crosscurrents, we believe technology fortunes this year will once again be determined by the path of AI progress.

Valuation

The forward P/E of the technology sector contracted modestly over the past year. Twelve months ago, valuations had rebounded to approximately 26x forward P/E, up from c24x at the end of FY23. This marked a full recovery from the post-pandemic compression, with valuations continuing to expand and reaching a peak of around 31x in the summer, before easing ahead of 2025. However, pronounced market weakness during 1Q25 caused a sharp correction, with valuations falling significantly before rebounding to 26x by fiscal year-end. Continued market strength post-period has driven valuations higher still, with technology stocks now trading at a forward P/E of 27.5x, above both the five-year (25.6x) and 10-year (21.7x) averages. This reflects elevated broader market valuations and the sustained momentum of AI as a central investment theme.

The relative P/E of the technology sector, having recovered to post-bubble highs (1.4x) in 2023, ended 2024 broadly flat. However, this stability was interrupted by the DeepSeek-led market selloff in 1Q25 which saw the sector’s premium compress to just 1.1x, its lowest relative level since the pandemic. The recent market recovery has helped lift this back to 1.35x. While this may suggest more limited near-term valuation upside, we believe that continued AI progress could support a structural re-rating of the sector, mirroring the upward valuation drift seen during the internet cycle of the mid-1990s.

Mag-7 update