The outbreak of war between Israel and Iran, the US intervention, and the subsequent ceasefire dominated headlines but appeared to have only very temporary effects on markets and oil prices.

Amid heightening geopolitical uncertainty, June saw the Federal Reserve navigate carefully between growth support and inflation control during key policy meetings. The Trump administration proposed the “One Big, Beautiful Bill Act,” aiming to combine tax cuts, infrastructure spending, and tariff protections into a sweeping legislative package. The plan drew criticism for worsening the federal deficit and fuelling inflation expectations, which may have been a factor in the Federal Reserve pausing interest rate changes. The S&P 500 showed resilience despite ongoing volatility from trade tensions and policy uncertainty. Economic data suggested moderate expansion with stable labour markets, though elevated borrowing costs continued pressuring interest-sensitive sectors.

‘This shift (away from US investments) is a sign

of renewed confidence in the UK market’

Richard Houston, CEO of Deloitte UK

In the UK, there are concerns that after a good start to the year, growth is faltering. Inflation and activity data are being watched closely by policymakers. In the government’s spending review, Chancellor Rachel Reeves set out a fiscally cautious plan focused on investment in key areas like the NHS, education, and green infrastructure. Bank of England meetings drew investor attention as markets sought clarity on future interest rate paths. UK employers are less confident about hiring (a measure of hiring intentions fell to its lowest level since 2012), influenced by increased costs and economic uncertainty.

The Eurozone’s narrative balanced measured optimism against structural challenges and trade tensions. The EU’s policy focus was on accelerating its Green Industrial Plan, with new subsidies and regulatory support for clean energy and advanced manufacturing. However, economic growth forecasts were downgraded by the OECD due to external trade tensions and persistent inflation pressures, particularly in the eurozone periphery.

Chinese industrial growth figures are being affected by tariffs, but retail sales are coming in ahead of expectations.

Foresight Environmental Infrastructure Group

‘The wider governmental and societal push for more sustainable practices is further resulting in a broad opportunity set across sustainable resource management’

Montanaro UK Smaller Companies

‘UK equities as a whole are trading at just 12x earnings, one of the cheapest global stock markets’

JPMorgan China Growth and Income

The experience of the first Trump administration (2017-2020) were a dress rehearsal for his second term

At a glance

| Exchange rate | 30 June 2025 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.3732 | 2.0 |

| Pound to euros | GBP / EUR | 1.1651 | (1.8) |

| US dollars to Japanese yen | USD / JPY | 144.03 | 0.0 |

| US dollars to Swiss francs | USD / CHF | 0.7931 | (3.6) |

| US dollars to Chinese renminbi | USD / CNY | 7.1638 | (0.5) |

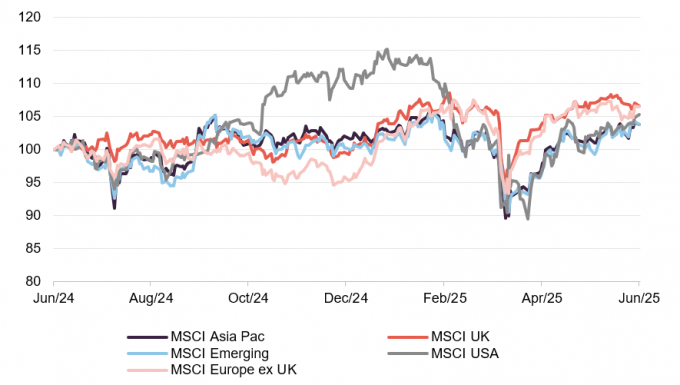

MSCI Indices (rebased to 100)

The US dollar weakened on rate cut expectations and fiscal concerns, while the euro and pound edged higher. Emerging market currencies were mixed, reacting to trade policy risks and commodity trends.

Gold rose sharply mid-month on Middle East tensions, before easing slightly by month-end. Oil prices spiked toward $87.55 but then retreated as the ceasefire held and supply fears eased. Copper edged higher on steady industrial demand, while agricultural commodities remained stable thanks to favourable conditions.

Time period 30 June 2024 to 30 June 2025

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 30 June 2025 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 67.61 | 5.8 |

| Gold (US$ per Troy ounce) | 3303.14 | 0.4 |

| US Treasuries 10-year yield | 4.23 | (3.9) |

| UK Gilts 10-year yield | 4.49 | (3.4) |

| German government bonds (Bunds) 10-year yield | 2.61 | 4.2 |

Global

Edinburgh Worldwide, 25 June 2025

Market anticipation of pro-growth policies of tax-breaks and deregulation in the US has shifted to grappling with the global uncertainty around tariffs and trade wars. Policy volatility and how to respond to it, has left consumers, companies, and political decision makers alike in a state of limbo – all of which has a knock-on effect to the appetite for spending and investment.

The impact of headline announcements on global supply chains – answering the questions of “if,” “how,” and “when” – remains difficult to predict. The overarching theme underscores the ongoing need for businesses to question their resilience and cost structures in a world which looks increasingly protectionist.

History might provide some precedent and guidance here. A similar situation emerged in 1930 in the US with President Hoover signing into law the ‘Smoot-Hawley Tariff Act’. This was a piece of legislation intended to protect domestic US jobs and manufacturing recovering from the great depression, with tariffs on foreign goods. Other nations followed suit with tariffs of their own. However, I suspect you, like us, did not have name recognition for this bill until very recently, if at all. Instead, what ultimately proved much more relevant and resilient from this period were the innovations and innovators which shaped the world and the economy around them.

This was the time when mass electrification of factories enabled a scale of production unseen before, Ford’s new auto financing business paved the way for larger credit markets to exist in retail goods, the discovery of penicillin led to a revolution in treating infection, the proliferation of commercial radio stations created a new form of popular entertainment, the invention of liquid fuelled rockets opened up new frontiers in aeronautics, and the foundations of quantum mechanics and nuclear physics were laid down.

We appreciate the greater significance of these much more keenly today and with the benefit of time. With the world being drawn ever more short-term in its outlook, the opportunities for those willing to take a long-term view increase.

. . . . . . . . . . .

Alex Crooke,Fund Manager, Bankers Investment Trust, 24 June 2025

It is notable that share prices have recovered most of their fall this year despite any real certainty on trade negotiations between the US and their trading partners. Bringing manufacturing back to the US is likely to be impractical in some key sectors like textiles and is certain to depress margins in sectors like pharmaceuticals and technology. If tariffs end up in the 10% to 20% range, then the market is likely to move its focus to the more business friendly policies in the US, such as tax reforms and deregulation. Elsewhere in the world, economic growth is recovering from last year’s slowdown and interest rate cuts are supporting easier monetary conditions. Valuations are lower than the US and may improve as confidence in growth increases.

. . . . . . . . . . .

Sebastian Lyon and Charlotte Yonge, managers, Personal Assets Trust, 17 June 2025

Our investment views in recent years have been shaped by an expectation of regime change. This began with policy decisions made during the pandemic. The shift to substantial monetary expansion by central banks, combined with fiscal spending by governments led to a more inflationary environment. Since the blow out of inflation in 2022 and 2023, in which UK RPI peaked at 14% and US CPI peaked at 9%, central banks have struggled to get inflation back to target, despite the tightest monetary policy in almost two decades. The fiscal genie is out of the bottle and government spending has grown, despite recent attempts (in the United States) to reverse fiscal commitments. Elon Musk’s attempt via the Department of Government Efficiency (DOGE) to rein in federal spending appears to have failed. Government debts have grown dramatically across the developed world. This was fine whilst interest rates were close to zero but today, with interest rates and bond yields at 4%-5%, the interest burden has become a material part of government spending. In the US, this cost has ballooned in the past three years from 8% of federal government tax receipts in 2022 to 19% in 2025 (source: Jefferies). Globalisation, which provided growth and helped depress inflation, appears to be firmly in reverse. President Trump’s recently announced trade war and isolationist inclinations have only accelerated the deglobalisation trend. Finally, the war in Europe, now in its fourth year, is leading to a wholesale change in defence spending. All these factors have led to a world of greater uncertainty, higher inflation and a bond bear market, which began in the summer of 2020. Thus far, the 2020s are looking very different from the 2010s.

Amid this environment, we have attempted to avoid the trap of rising bond yields, which affects the valuations of fixed income securities and some equities. We have sailed close to the shore with a relatively low equity exposure and short bond duration; preferring index-linked to nominal bonds.

Gold bullion has played a critical role in the portfolio as a diversifier and an offset to falls in other asset prices, when they occur. We hold plenty of liquidity for when we see selective and more wholesale opportunities in the stock market.

The US dollar has been kind to us over many years, especially during periods of stock market turbulence such as 2008, 2020 and 2022. The greenback has ridden to our rescue in these times of trouble. More recently the currency has not stuck to the script. Our view is that this may prove to be a lasting change as investors increasingly question the dollar’s position as the world’s reserve currency. We have reduced the dollar exposure in favour of the yen, which we expect to behave more reliably as a safe haven in periods of market stress.

Gold remains a cornerstone of the portfolio. As no one’s liability, bullion has a special place, and it is once again being appreciated as the ultimate reserve asset. In a world of heightened geopolitical risk, and the desire to diversify away from the US dollar, central banks continued to add to their holdings during the past year. There are very rational reasons for the recent rise in the price, when compared to paper money. Charlie Munger used to say, “Always invert”. Consider the gold price not rising but the value of paper currencies, like sterling and the US dollar, depreciating in value when compared to gold.

During the past year, the investment narrative has changed from ‘American exceptionalism’ to one best summed up by the acronym ‘ABUSA – anything but the USA’. We are not convinced life is so simple. Such views demonstrate changes to sentiment and a voting machine mentality, over the weighing machine of substance. The US stock market remains very fully valued, yet it also hosts some of the very best companies.

. . . . . . . . . . .

Davina Walter, chair, abrdn Diversified Income & Growth, 5 June 2025

Over the past six months, the global economic landscape has been marked by significant geopolitical and economic shifts. This has been dominated by policy change in the United States where President Trump is seeking to challenge long-established trading agreements and introduce higher tariffs for some key trading partners as was proposed in March 2025 before a full scale tariff announcement on “Liberation Day” at the start of April.

These moves have introduced significant uncertainty into the global economy and raised the prospect of slowing economic growth and increased trade friction, most notably between China and the U.S. The U.S. Federal Reserve held interest rates steady at 4.50% for a third consecutive meeting in May 2025 in line with expectations as officials adopted a wait-and-see approach amid concerns that President Trump’s tariffs could drive up inflation and slow economic growth. Policymakers noted that uncertainty about the economic outlook had increased further and that the risks of higher unemployment and higher inflation had risen.

China announced an aggressive fiscal expansion in 2025, including record debt issuance and strategic investments to maintain a 5% GDP growth target. Inflationary pressures persisted globally, with headline inflation rising in many countries, posing challenges for central banks trying to balance growth and inflation.

In the UK, the new Labour government focused on resetting relations with the EU, aiming to reduce trade barriers and enhance security cooperation. The Spring Statement in March 2025 announced fiscal measures, including increased public spending and tax reforms, seeking to support economic growth. In May the outline of a new trade agreement with the US and consequential reduced tariffs was announced following quickly on from an historic free trade agreement between the UK and India. Meanwhile, the Bank of England reduced UK interest rates by a quarter point to 4.25% and the European Central Bank continued its gradual easing of monetary policy, reducing interest rates to support economic recovery and manage inflation.

The private markets space is navigating a complex landscape due to the recent U.S. tariff announcements, which have introduced significant uncertainty and affected valuations and exit strategies. The already-fragile European economy is facing a significant negative demand shock from US tariffs, specifically Germany is heavily exposed. European and German fiscal policy is set to ease significantly. EU defence spending will increase up to €800bn (5% GDP), and Germany has announced a plan to spend €500bn on infrastructure (12% of GDP). Some retaliation is possible, but the overall impact is likely to be disinflationary.

Private equity firms are extending due diligence periods and incorporating more flexible deal structures to mitigate risks from the US tariffs. Despite these challenges, there is cautious optimism within the industry with expectations that private equity activity in 2025 may sustain its recent activity level and exceed that of 2024. Private debt continues to expand globally, and infrastructure investments, particularly in AI-related data centres and power, are accelerating. Real estate valuations appear to be nearing the bottom, presenting opportunities for recovery. Overall, private markets are poised for growth, with higher investment activity and greater demand for long-term capital, underscoring the sector’s resilience amid geopolitical and economic shifts.

. . . . . . . . . . .

Graham Kitchen, chair, AVI Global Trust, 12 June 2025

While predictions are often difficult to make, and equally often prove not to be very accurate, I wrote last November in our 2024 Annual Report “The level of geopolitical uncertainty could be exacerbated by the result of the US election”. That certainly proved to be accurate but, looking forward, market movements are anything but easy to predict. We experienced an extreme negative reaction to the initial announcement of widespread tariffs imposed by President Trump, followed by a recovery which may in large part have been due to the President stepping back from more extreme measures due to the market reaction. The President has modified or put most of the proposed tariffs on hold but much uncertainty remains.

. . . . . . . . . . .

UK

Harry Morely, chair, Schroder UK Mid Cap Fund, 27 June 2025

UK mid-cap companies are attracting renewed interest, supported by attractive valuations, strong financials, and a wave of M&A activity. Emerging signs of an end to the era of the dominance of US technology stocks in global market returns may herald a return of equity investors to help to correct the valuation dislocation which has developed among UK mid-caps. Furthermore, the UK economy’s emphasis on the service sector may allow it to avoid the worst effects of the Tariffs imposed by the US.

Although PMI (“Purchasing Managers’ Index”) data has been weak, the UK consumer’s real household disposable income growth and strong balance sheets have been able to support some good growth in certain pockets of the economy and the resilience of the housing market has helped to offset some unease in the labour market as a result of unexpected changes to the National Insurance regime.

Companies are facing extreme pressures on profit margins, in part related to higher taxes and other costs of doing business, but also due to weak consumer confidence given the uncertainty hanging over the UK jobs market and disruption to established trading patterns, as the US seeks to reshape global supply chains. In this environment, investors need to focus on businesses with strong market positions, or those able to take market share, perhaps as a result of a disruptive technology.

. . . . . . . . . . .

Graeme Proudfoot, chair, BlackRock Income and Growth, 19 June 2025

The UK has by no means been immune to the global geopolitical disruptions, however, given that services make up around 80% of our economy the US trade negotiations on goods were predominately focused elsewhere. The more recent trade deals struck with both the US and India have supported sentiment towards UK equities and improved the general economic outlook. In fact, one could make a case that the UK is now in a relatively better economic position than its European neighbours. As I mentioned in the annual report, the valuations of UK equities remain very low versus both their own history and the other developed economies while their dividend yield is higher. This, coupled with a more benign economic backdrop, a recent upward revision for UK GDP, falling interest rates and a stable labour market may mean the UK is now more attractive to foreign investors seeking to reallocate capital.

The UK Government’s commitments to reignite growth through investment and spending, coupled with improving productivity through innovation and technology, are indeed admirable. However, several headwinds remain; not least any belated impact of the trade disruptions discussed above, rising inflation and wage growth, and the impact of current fiscal constraints on the UK Government’s plans to boost economic growth. Overall, however, greater political stability and an improving macroeconomic backdrop may well give investors cause to re-evaluate their opportunity set and view the UK as a more attractive place to invest.

. . . . . . . . . . .

Rockwood Strategic, 18 June 2025

Finally, for the first time since March 2020 interest rates started falling. This is an important development as what Ed Chancellor calls “The Price of Time” has such an influence over the cost of capital, asset allocation decision-making and return expectations.

It also signalled that the main Central Banks were happy the recent inflationary period was behind us. However, in their culturally conservative approach, the pace of cuts has been pedestrian and during the year the Bank of England reduced the base rate from 5.25% to 4.5%. For many mortgage holders and businesses used to the extended period of zero rates, this remains a challenging policy setting.

The adoption of aggressive Tariffs by the U.S. are widely expected to create an inflationary impulse, despite equal unanimity that they will lead to weaker economic activity, which could offset this (for illustration the oil price has fallen from c.$82 in March 2024 to $61 at time of writing). This may temper further cuts, its frankly unclear. However, in the UK the Consumer Price Index hit 2.6% in the 12 months to March; broadly on track to reach, but still above, the target of 2%. Our expectation is that slowing global economic activity as a result of policy uncertainty around Tariffs and the lack of fiscal headroom to provide stimulus, will enable interest rates to continue falling, probably at an accelerated pace, which historically has been supportive for the performance of UK smaller company shares. The U.K.s small (only 1.9% of GDP) exports to the US appear to have received some friendly (e.g. vs Europe) treatment, but the wider inevitable economic slowdown combined with domestic sluggishness is supportive of lower rates and a challenging backdrop for many businesses.

In the UK, a General Election occurred resulting in a large majority for the Labour Party, despite a low level of the popular vote, as traditional Conservative support tired or splintered into the Reform Party. Labour, in a serious attempt to prove they are worthy of government (having been in power only 13 of the 46 years since 1979), have issued ‘fiscal rules’ which is important given government debt interest payments now exceed £100 billion, more than the education budget. Clearly ‘talk’ needs to be translated into ‘action’, however clear policy support for more UK infrastructure investment, reduced public sector costs and improved productivity, less and easier regulation, reduced welfare benefits and closer ties with Europe sit well with the desires of business, who will power any future improvement in economic growth. The funding conundrum to solve remains difficult given very high levels of taxation already relative to history and post war highs in government debt-to-GDP ratios.

The first Budget in the Autumn was constrained by election tax promises and the increase in National Insurance Contributions alongside higher minimum wages and, in advance of enhanced employee protections, has clearly knocked the wind out of many businesses. For context the national living wage is now higher than Germany, France, Ireland, Japan, Spain and of course the U.S. We expect further fiscal gymnastics over the next year, not least because changes to non- domiciled tax residents are seemingly causing an exodus of some of the wealthiest. One needs to generate a lot of tax elsewhere when the top 1% of payers contribute 29% of all taxes (when compared to 11% in 1979) and decide to leave the country.

. . . . . . . . . . .

Charles Montanaro, chair, Montanaro UK Smaller Companies, 16 June 2025

UK equities as a whole are trading at just 12x earnings, one of the cheapest global stock markets. UK SmallCap is even cheaper, languishing at around 10x depressed profits.

For long-term investors, this has the hallmarks of a generational buying opportunity.

We are not alone in this view. Around the world, the investment community is reassessing its exposure to Wall Street. The return of Donald Trump and “Liberation Day” politics have reignited concerns around deficits, US dollar stability and the sustainability of the dominance and so called “excellence” of America. Is it still a reliable trading partner? It may no longer be the obvious safe haven for investors – Wall Street underperformed the rest of the world by 10.5% in the first quarter of 2025, the most in 23 years. This is remarkable and may signal a change in the world order never seen before in our lifetime. As the risk premium on US equities rises, capital is beginning to search for alternative homes. The UK is on the radar once again.

Consensus earnings for UK SmallCap companies forecast a rise of over 17% in 2025, outpacing larger peers by some margin. The combination of a valuation discount and an improving earnings outlook bodes well. Currently, UK smaller companies are unloved and under-owned. Over the past thirty years, we have seen sentiment change dramatically almost overnight – March 2003 and March 2009 come to mind – which heralded several years of strong returns. It pays to remain patient and keep the faith.

. . . . . . . . . . .

Iain McCombie and Milena Mileva, Baillie Gifford UK Growth Trust, 12 June 2025

Closer to home, the new Labour Government has been unable, so far at least, to shake off its initial faltering steps and the frankly uninspiring narrative has been made no easier with events outside their control in the form of increasing concerns about the health of the global economy. With the domestic economy still unable to break out of its low growth trajectory with higher business taxes looming, consumer confidence has remained low, with cost-of-living pressures curbing discretionary spending. The Chancellor’s Spring Statement did emphasise fiscal restraint but also lowered the UK growth forecast from 2% to 1%. It’s important to remember that many of our businesses are only marginally impacted by this but a fair number are seeing a tougher demand backdrop despite their long-term strengths and growth potential.

. . . . . . . . . . .

Europe

Robert Schramm-Fuchs and Nick Sheridan, Interim Fund Managers, Henderson European Trust, 30 June 2025

The big picture – A re-ordering of global trade by the US administration

Much has been discussed regarding the tariffs introduced by the Trump administration on what has been termed ‘Liberation Day’. Although this announcement was made just after the close of the Trust’s interim period, its significance warrants discussion in this report. We are likely witnessing a stark decoupling of the US economy from China and its sphere of influence, including countries like Vietnam which serve as indirect conduits for Chinese exports.

Implications for Europe

In the upcoming months, EU Trade Ministers and the Eurogroup are expected to commence trade negotiations with the US, wherein they will need to decide their strategic alignment vis-à-vis the US and China. Europe has found itself disadvantaged under the previous trade frameworks, running a substantial annual trade deficit with China that has increased significantly, even turning former export leader Germany into a net importer from China over the last four years. Rapid deindustrialisation has occurred, with the transfer of manufacturing bases and intellectual property advantages to China, which continues to subsidise its industries heavily.

While some suggest that the EU could retaliate against US tariffs, we deem this unlikely to happen in any significant way due to the limited fiscal leeway across European nations, except perhaps Germany. Moreover, Europe should focus on diminishing its dependencies and ties with China rather than increasing them. Unprepared for a potential influx of Chinese goods initially destined for the US market, Europe faces a strategic decision: aligning closer with the US might entail losing some trade battles but aligning with China could risk losing a larger economic war. The direct exposure of the European stock market to the 20% tariffs is manageable, concentrated within a few industries such as consumer discretionary sectors and freight, where the Trust’s exposure is very selective.

A trade agreement with the US might form part of a broader Mar-a-Lago Accord over the next six months. This accord could address numerous outstanding issues including defence spending and the security framework under US leadership, with a commitment to maintaining the US Dollar as the sole reserve currency. This could represent a significant reordering of global economics, comparable to historical agreements like the Bretton Woods, the Treaty of Versailles, or the Plaza & Louvre Accords, outlined by Secretary Bessent in 2024. The objective is clear: to establish a new commonwealth of trade, defence, and prosperity as a counterbalance to China and its sphere of influence.

A more competitive and higher growth Europe

It is now widely acknowledged that Europe has spent many years prioritising incorrectly, becoming the world leader in bureaucracy and regulation without adequate focus on maintaining competitiveness. This trajectory needed to shift, with the US tariffs acting as a catalyst for EU-wide deregulation. Although not as radical as the changes seen in the US, the shift is nonetheless significant. European Commission President Von der Leyen, re-elected in July 2024, has committed her second term to rapid deregulation, presenting the first of two Omnibus packages in February 2025. These packages aim to streamline sustainability reporting, simplify due diligence for responsible business practices, and strengthen the carbon border tax mechanism, collectively aiming to reduce administrative burdens significantly by the end of her mandate in 2029.

In addition, the new German government has announced a €1 trillion infrastructure and defence package, effectively releasing the country’s self-imposed fiscal debt break. This has the potential to lift economic growth materially with it approximately equating to 22% of GDP deployed over the next ten years. We are also hopeful of more to come from the new German government, with reforms to the labour market and pensions on their agenda, although the parliamentary arithmetic in Germany may see these watered down.

. . . . . . . . . . .

Marc van Gelder, chair, JPMorgan European Discovery, 18 June 2025

The market environment remained supportive over the past year. An easing in inflation pressures and a gradual reduction in interest rates combined with rising wages, lifted consumer spending across the region leading to increased investment. On the political front, developments over the past year have been dramatic and historically significant. The new US administration’s aggressive tariffs and other policy pronouncements threaten to upend the post-World War II economic and political order. Consequently, European countries have been forced to reassess their relationship with the US and in particular, commit to higher defence spending. As an example, the new German government elected in February 2025 has promised a major increase in domestic defence and infrastructure investment.

Most major equity markets saw sharp declines in early 2025 due to concerns that higher US tariffs would slow global growth, raise inflation and delay or curtail investment plans. However, since the beginning of 2025, European small and mid-cap companies have fared better than most market sectors, including European large caps. This is supported by the fact that they generate much of their revenue from domestic sales and are thus relatively insulated from the impact of a global trade war. Investors are also clearly mindful that small cap and mid-cap companies will benefit from increased spending on defence and infrastructure.

. . . . . . . . . . .

George Cooke, Lead Porfolio Manager, Montanaro European Smaller Companies, 18 June 2025

As 2024 drew to a close, the prevailing investment consensus – that US mega-caps were the only place to be – reached a crescendo following the election of Donald Trump as President. However, events since then have cast doubt over this view. The tariffs announced on “Liberation Day” shocked the world. The United States has made it increasingly clear that they now view its relationships with the rest of the world – including Europe – as adversarial or, at best, purely transactional.

Yet with change comes opportunity. Investor sentiment has shifted towards European equities this year as they have seen improved performance. They remain under-owned and still appear attractively valued.

Since the peak in August 2020, the forward P/E of SmallCaps in Continental Europe has fallen from over 23x to around 13x at the end of March 2025. This substantial de-rating leaves them trading at a discount to their long-term historical average.

Moreover, European SmallCaps are valued at a discount to the wider market, which is unusual. Indeed, the discount is at a level last seen in the depths of the Global Financial Crisis of 2008.

We must, however, acknowledge that increasing global trade barriers and indeed policy uncertainty are likely to hinder rather than support economic growth. In this environment, owning a portfolio of very high quality, structurally growing companies provides us with a strong degree of comfort. One of the defining features of such quality companies is their ability to invest for the future and capture market share in more challenging economic environments, while weaker competitors have to focus on day-to-day survival.

In summary: European smaller companies have a long track record of delivering strong returns to investors. Today, they are trading at a significant discount to both their own history and to their larger counterparts. The previous overwhelming investment consensus favouring the US over Europe has been challenged and investor sentiment has shifted towards European equities.

. . . . . . . . . . .

Rita Dhut, chair, 20 June 2025, JPMorgan European Growth and Income

European equity markets fell significantly following the announcement of the new US tariff regime in early April 2025, mirroring falls across global equities. Since then, the ongoing US tariff negotiations have continued to dominate the global economic outlook and cause large intraday movements in equity markets creating disruption and uncertainty. Despite the recent volatile backdrop, there are positive signs. Europe’s forecast economic growth is projected to move closer to the levels of growth currently forecast in the US. The German government’s €500 billion infrastructure fund, announced in March 2025, aims to revitalise the economy with construction, defence and energy sectors expected to benefit. Inflation in the Eurozone is close to the ECB target of 2% and the ECB’s vigorous reductions in interest rates signify a positive intent. These are several of the reasons why some forecasters are upgrading their expectations for the Eurozone economy.

. . . . . . . . . . .

China

Mike Balfour, chair, Fidelity China Special Situations, 9 June 2025

A year ago, sentiment was undeniably poor – the Chinese economy, stock market and property market were all depressed, and the private sector was not outwardly being supported by the government. While a change in sentiment during the year under review has powered a very strong year for the Chinese stock market, we now need to see the follow-through.

While the macro picture remains uncertain with the property market still struggling and consumer sentiment fragile, the Chinese authorities could pull the lever of more monetary and fiscal stimulus, which could in turn provide a catalyst to unlock the high level of savings accumulated during the Covid lockdowns. The geopolitical backdrop, and particularly the trade issues between the US and China, should not be underestimated, but as confidence in American exceptionalism recedes there is potential for a genuine shift in market sentiment from the US-dominated global equity market to ‘unloved’ China. In the first quarter of 2025, the Nasdaq was down by 15% while Hong Kong’s Hang Seng Index was up by 15%.

While the trade problems may be making headlines, I would posit that the bigger story for the long-term is the Chinese government’s willingness to engage with the private sector and acknowledge the role it has to play in the country’s future prosperity. From a bottom-up perspective, these businesses are vibrant, entrepreneurial and inventive, and the growing dominance of Chinese companies in certain global sectors is likely to be a continuing theme. For many years, people have been used to buying goods that are made in China but with Western brands attached, but now Chinese brands are gaining traction globally. It is no longer rare to see BYD cars on British driveways or Haier and Hisense appliances in European homes.

. . . . . . . . . . .

Rebecca Jiang, Howard Wang and Li Tan, investment team, JPMorgan China Growth and Income, 2 June 2025

The geopolitical developments that have unfolded over the past six months, especially the new US administration’s aggressive tariff policies, have fuelled a major escalation in tensions between China and the US. Trade negotiations between the two countries have commenced but the situation remains fluid. The uncertainty generated by the lack of clarity regarding the scope of possible future tariffs, however, has already undermined consumer and business confidence in the US and other developed economies, and a slowdown in growth appears inevitable, while tariff increases, if imposed, will drive inflation higher.

However, despite this unhelpful backdrop, we still see reasons for cautious optimism about the outlook for Chinese economy, Chinese equities and for our portfolio, over the remainder of this year and well beyond. For one, the escalation of trade tensions between China and the US was not unexpected. The experience of the first Trump administration (2017-2020) were a dress rehearsal for his second term, and Chinese companies have been preparing themselves over the intervening years by diversifying their end markets and supply chains away from reliance on the US. Chinese companies are therefore already relatively well positioned to weather a full-blown trade war, should one come to pass.

We draw further reassurance from the recent, more pro-growth stance of the Chinese government, which suggests that it will backstop Chinese domestic consumption with further stimulus if tariffs do have an adverse impact on activity. The regulatory environment has also become more pro-business following a meeting between President Xi and private entrepreneurs in January this year, which resulted in some positive signals regarding private enterprise and innovation.

It is important to stress the significance of DeepSeek’s recent AI breakthrough, which will support the Chinese economy for many years to come. Business confidence, especially in tech sectors and other companies set to benefit from the wider application of AI, has already been buoyed by high expectations about the productivity gains and cost savings this technology will deliver.

China will also benefit from other structural changes playing out across the economy. One of the potentially most meaningful change for equity investors is corporate reform. As we discussed in the FY24 Annual Report, the government and regulators are encouraging businesses to improve their capital allocation and shareholder returns via higher dividends and share buybacks. These efforts have been greatly welcomed by domestic and international investors, as they view dividends to be a more predictable source of return. Corporate reform is likely to remain a strong positive for the market as companies adopt better governance practices.

Recent months have seen headwinds from the property market ease significantly. Excess inventory levels have declined, supported by targeted government measures such as direct funding to clear unsold homes, further reductions in mortgage rates, and relaxed purchase rules in key cities. These interventions are expected to mitigate the drag on consumer sentiment and support a gradual recovery in housing demand. While banks continue to manage non-performing loans tied to the property sector, systemic risks remain contained, with no major capital shortfalls observed. The Ministry of Finance’s recent recapitalisation plan for state-owned banks further strengthens their capacity to absorb losses, reinforcing financial stability. Together, these developments underscore Beijing’s commitment to addressing structural risks in the property sector while fostering a more balanced, consumption-driven economic recovery.

. . . . . . . . . . .

Japan

Richard Aston, CC Japan & Growth, 23 June 2025

The election of Donald Trump as the 47th President of the United States has been eventful. The early policy pronouncements of his administrative term have caused geopolitical tensions and raised the prospect of a new era of international trade friction. Although there are many rational reasons why Japan could be expected to benefit from its long standing economic and political ties with the US, the immediate implications of the “Liberation Day” tariffs place it at risk of the direct and indirect consequences of this punitive trade realignment. Japan was the first country to send a negotiating team to counter the initial edict, but, along with the rest of the world, currently seeks clarification and a resolution.

Global equity markets responded in dramatic fashion as the situation in the US evolved, and Japan was not alone in its negative initial response. The TOPIX Index, in Yen, fell from a seven-month high of 2,815.5 on 27 March to 2,288.7 on 4 April, representing a fall of 18.8%, before rebounding to 2,667.3 at the end of April, as hopes for less draconian solutions were raised. Currency markets were also subject to high degrees of volatility with the Yen strengthening against Sterling from 198.9 to 190.7 over the reporting period. As a Sterling denominated fund holding Yen assets, this has had a positive impact on the NAV, all else being equal.

The domestic economy has remained relatively robust which has allowed the Bank of Japan (“BoJ”) to continue its path of monetary normalisation. The policy rate was raised from 0.25% to 0.5% following the BoJ board meeting held in January and they have clearly expressed an intent to continue the path of steady increases, subject to the impact of the US trade policy.

. . . . . . . . . . .

Global emerging markets

Oleg I. Biryulyov, Luis Carrillo, Portfolio Managers, JPMorgan Emerging Europe, Middle East and Africa Securities, 23 June 2025

Concerns about the US’s trade policy under the incoming administration and the associated risk of recession led investors to seek opportunities in emerging markets. This rotation was encouraged by a decline in the US dollar. Emerging market equities attracted significant inflows, with emerging European equities being amongst the main beneficiaries. Demand from local investors also remained supportive over the period. Pervasive economic and geopolitical uncertainties also ensured a surge in demand for gold. The gold price increased by more than 20% over the six months to end April 2025, giving a significant boost to South Africa’s gold mining stocks.

Country specific drivers provided support for other markets. The Hungarian market was buoyed by positive earnings surprises from portfolio companies like OTP Bank and Magyar Telecom, while Greece and Portugal saw gains of more than 30%, due to better earnings momentum and strong results. Greece was the main contributor to performance at the country level over the past six months. The Kuwaiti market benefited from speculation about mortgage law, although it faces ongoing challenges due to its poor fiscal situation and high debt levels, while Egypt continued to struggle due to capital controls and currency devaluation.

Like their developed market counterparts, emerging markets dropped sharply in early April 2025 as investors’ concerns about the ramifications of US tariffs intensified. However, markets rebounded equally swiftly, regaining most of their lost ground, when the severe market reaction to the proposed tariffs prompted the US government to delay threatened tariff hikes subject to negotiations with China, India and other key trading partners.

Emerging market gains over the past six months were made despite a decline in oil prices. Fears that a trade war would lead to global recession saw the oil price drop by more than 15%, from US$76 to US$63 pbbl, during review period. However, unlike equity markets, oil prices have continued to trade around this lower level, thanks to recent overproduction by some OPEC+ members.

. . . . . . . . . . .

Martin Shenfield, chair, Ashoka WhiteOak Emerging Markets, 20 June 2025

Whilst one can certainly have a legitimate debate about fair trade and free trade and the use of targeted sanctions to address mercantilist nations or specific overly subsidised export industries, unequivocally blanket tariffs are not good for global trade or global economic growth.

Given the mercurial nature of White House policy announcements, it is hard to determine at what level tariffs will ultimately be settled, but beyond any transactional or geopolitical imperatives, a significant level of tariffs will be required to generate sufficient fiscal revenue to fund the proposed tax cuts. The challenge to growth is that the pain from tariffs is front-loaded before any potential benefits of tax cuts, deregulation or reonshoring are likely to be seen. Meanwhile the Fed is in somewhat of a bind while inflation remains so sticky and the labour market hitherto surprisingly resilient. A further concern with the US administration’s trade shock policies is that in potentially disrupting trade flows it could also impede the international capital flows necessary to fund the US budget deficit, and the much-touted private capex manufacturing renaissance.

The White House this time seems less concerned with equity market corrections in the short term, although the very unusual trifecta of a collapsing equity market alongside rising bond yields and critically a weakening US dollar does seem to have induced a more accommodative stance for now in pursuing trade deals. This shot across the bows has undoubtedly accelerated the diversification of international investors away from a disproportionate exposure to US dollar assets and towards more geographically balanced portfolios. This is all to the considerable longer-term advantage of Emerging Markets as an asset class given how relatively cheap and under-owned they remain, notwithstanding any intermediate tariff disruption. Moreover, traditionally a weaker dollar is generally supportive for global trade finance and growth and Emerging Market companies, many of which borrow heavily in the US dollar. Indeed, for the period from 31 December 2024 to 31 March 2025, Emerging Market equities have outperformed the MSCI All Country World Index. Further, many Emerging Market central banks have a greater scope to cut local interest rates, which will support local asset prices. Recent market turbulence also reinforces the case for the long-touted shift from passive index investing to more nimble active fund management in which the Investment Manager is particularly skilled. In this respect it is noticeable how high a percentage of portfolio holdings continue to outperform.

China, of course, is at the epicentre of the tariff standoff and in theory is most vulnerable to the new, more aggressive US policy. However, China has the scope to offset the potential major blow to its export growth through a further ramping up of fiscal and monetary stimulus such that overall CY 2025 GDP growth may not be that negatively impacted. China would likely prefer a deal tactically, but is prepared for a protracted geopolitical conflict with the US supported by its rapid technological advances. There is a dual risk of both a major decoupling between the US and Chinese economies and, in a worst-case scenario, a financial unwinding as well, particularly if US investors are forced to disinvest from Chinese ADR’s. This may also negatively spill over into neighbouring Asian economies perceived to be a backdoor for China’s exports into the US. However, China’s shift to a greater fiscal stimulus flagged last October was further reinforced at the March NPC meeting together with an overall policy pivot to focus again on growth, house prices and the equity market. So, a broad policy put is in place to put a floor under the economy and the equity market this year.

. . . . . . . . . . .

Mark Bridgeman, chair, Utilico Emerging Markets, 13 June 2025

Navigating through all the political noise is likely to be the biggest headwind, with market risk premiums remaining high until there is more certainty on the direction of US growth and US interest rates. President Trump’s obsession with tariffs will potentially weaken the US Dollar further. While this should be positive for EM, the President’s actions will likely be limited by the US bond market acting as a brake, in light of the potentially higher cost of borrowing and US debt to GDP now over 120%.

Geopolitical pressures will also remain high in both the Russia-Ukraine conflict and the Middle East. Relations between China and the US appear to be marginally thawing post the President’s U-turn on tariffs; although they have a long way to go, with the relationship likely to remain highly volatile with neither nation willing to concede.

Emerging markets are expected to be well placed as they should be able to capitalise on this dislocation in the markets. It is already clear that foreign investors are beginning to look for alternatives to the US to invest, which can only be positive for the rest of the world. With EM valuations remaining relatively cheap, these markets are likely to benefit from increasing investor demand playing very well to our core investment thesis..

. . . . . . . . . . .

Angus Macpherson, chair, Templeton Emerging Markets, 6 June 2025

The announcements on “Liberation Day” were shaped long before this year. Some retreat from globalisation and decoupling of the United States from China was likely whichever party formed the administration after the last election. Those disadvantaged by the deflationary forces of trade and immigration represent a significant political bloc which cannot be ignored in a democratic state.

The imposition on the American people of a significant import tax burden, higher consumer goods prices and their consequent inflationary impact is unlikely to be electorally compelling in the US mid-term elections without some evidence of compensatory economic benefit. Even if the current propositions prove sustainable, their impact on the US is likely to be much greater than on their targets’ economies. China’s exports to the United States, for example, are estimated to be less than 3% of its GDP.

We maintain a positive outlook on emerging markets, supported by a combination of improving macro conditions, structural growth trends, and a shifting geopolitical landscape. The backdrop of lower U.S. interest rates and a weaker dollar creates a more favourable environment for capital flows and local currency strength across many emerging economies.

It should be borne in mind that the imposition of punitive tariffs on China and other emerging markets is a sign of the economic strength, not the weakness, of these high growth countries. Having continued investment exposure to them may well turn out to be even more important than before.

. . . . . . . . . . .

India

James Thom and Rita Tahilramani, abrdn New India Investment Trust, 24 June 2025

Since September 2024, when the Indian stock market hit an all-time high, we have witnessed a significant pullback and profit taking. We have seen a more acute correction in the small-and-mid-cap (“SMID”) space, which is not surprising given valuations in that segment were getting frothy. In contrast to developed markets, discounts for SMID stocks are lower than those for large-cap stocks in India with domestic investor interest sustaining higher valuations for the former. While our portfolio is skewed more towards large cap, our considerable SMID exposure delivered strong performance in calendar 2024, and considering this market correction, we are evaluating these stocks through a bottom-up quality lens.

In this environment, quality stocks have been resilient across the portfolio, including the core positions that contributed to relative returns, particularly in the last three months of the year.

There were several factors that drove the stock market lower in the second half of the year under review. On the domestic front, weaker consumer spending, lower government expenditure, and tight liquidity weighed on market sentiment. Externally, US President Donald Trump’s re-election to the White House triggered a broad-based rotation of capital out of emerging markets on the fear of imminent tariffs, geopolitical tensions, and the impact of a strengthening US dollar on emerging market currencies. India was no exception.

The central bank took steps to boost liquidity in the market, cutting interest rates by 0.25% in February 2025 and by another 0.25% in April 2025. Subsequently, in June 2025, it cut rates by a deeper-than-expected 0.5% and also announced a 1% cut to the cash reserve ratio that will inject additional liquidity into the financial system in a phased manner over the course of the fourth quarter. We expect this to act as a boost to the banking sector and to the economy more broadly.

Meanwhile, on the fiscal side, the Indian Government’s FY2026 budget focused on consumption support for the middle class through readjusting income tax brackets to provide relief to taxpayers.

We continue to believe that India is structurally well placed, in terms of its demographics, relatively supportive macroeconomic environment, and political stability. This holds true in light of the current uncertainties surrounding President Trump’s “reciprocal” tariffs on US trading partners, including India – in our view, India is relatively better placed compared to other emerging markets.

. . . . . . . . . . .

Amit Mehta and Sandip Patodia, portfolio managers, JPMorgan Indian, 18 June 2025

Given heightened volatility as we write we are reminded of that famous Buffett saying that it’s wise for investors “to be fearful when others are greedy and to be greedy only when others are fearful.”

Through last year, we were worried and cautious about certain parts of the Indian equity universe, particularly, small and mid-cap companies and highly valued growth businesses. We were less, if at all, concerned about the quality of the underlying franchises but we questioned how we would make attractive returns in a lot of these businesses given starting valuations and the distance we perceived they were from their underlying intrinsic value. The last six months have certainly started to show some restoration of value in both these segments, which makes us more interested.

We are cautious about the outlook for the Indian economy over the remainder of 2025, but we want to stress that we do not see reason to be concerned about the risk of even a mild recession. In the last couple of years, the Indian economy has been growing above its normal trend rate, thanks in part to tailwinds provided by the strong performance of capital markets. In our view, the current economic slowdown reflects the economy’s inevitable convergence back to trend, which is likely to take more time to run its course.

The global macroeconomic backdrop is unlikely to be supportive as this process plays out. We are more concerned than most Indian investors about the potential economic and market risks associated with the new US administration’s aggressive and unpredictable tariff policy. Even if US threats against its trading partners do not fully materialise, tariffs at any level are inflationary and the uncertainty generated by the US administration’s on-off approach to trade negotiations will likely dampen consumer and investor confidence in many markets, to the point that a global slowdown appears inevitable.

However, it is important to bear in mind that the Indian economy is well-positioned to cope with such challenges. It is one of the world’s most stable and resilient economies, with less exposure to a global economic slowdown. This is evidenced by the fact that since 1980, India has largely avoided full-blown recessions (except during the pandemic). The country has a low level of export dependence – exports account for only 11% of GDP, one of the lowest dependency levels among its emerging market peers, while its domestic consumption accounts for approximately 60% of GDP, vs only c 40% in China. In addition, corporate and bank balance sheets are healthy, banks’ non-performing assets are at a record low of less than 3%, and the RBI is becoming more supportive as growth slows, inflation eases and geopolitical uncertainties escalate. India’s rural economy is also relatively insulated from global cycles and will provide a further safety buffer against a worldwide downturn.

Although any further slowdown in activity is likely to be relatively shallow, it will nonetheless impact margins and earnings as demand weakens, and businesses are forced to absorb at least some of the costs associated with higher tariffs. This suggests that although Indian equity valuations have already fallen significantly – they are currently around 20% below their end of September 2024 peaks – there is scope for some further de-rating across the market cap spectrum as markets factor in a deterioration in the earnings outlook, and multiples revert to their long-term averages. Yet there are positives associated with this somewhat gloomy market prognosis. As ever, and as we have already seen over the review period, near-term disruption inevitably generates interesting investment opportunities at more attractive prices.

. . . . . . . . . . .

Biotechnology and healthcare

Sven H. Borho and Trevor M. Polischuk, portfolio managers, Worldwide Healthcare Trust, 10 June 2025

In terms of ramifications of the new administration on healthcare, it is impossible not to start with the appointment and confirmation of Robert F. Kennedy Jr. as Secretary of Health and Human Services (“HHS”), the presiding federal agency responsible for protecting the health and well-being of all Americans and provides essential human services. Whilst we believed RFK Jr. would be part of President Trump’s inner-circle post-election, we did not originally foresee his rise to the #1 healthcare seat in the country. His controversial views on healthcare and conspiracies on vaccines did not sit well with investors, who initially sold the sector late in 2024 after then President-elect Trump nominated him for HHS Secretary. However, since that time and through his February 2025 Senatorial confirmation, the rhetoric and commentary coming from RFK Jr has become much less controversial and, in some cases, constructive. It has become clear that his top priority is on food, food safety, nutrition, and obesity – putting the “F” back in FDA. One area of controversy he has not backed down on, however, is vaccines and vaccine safety, in particular paediatric vaccines. These views and potential legislative changes to clinical trial requirements, regulatory overview, and usage recommendations are negative and have created an overhang to the industry. We have, in turn, reduced exposure to vaccines in the portfolio to effectively zero as a result.

Meanwhile, U.S. FDA staffing cuts and the departure of some senior agency officials in early 2025 caused investor fears about potential drug approval delays to come to fore. That said, a look back at the drug approvals in 2024 and there was a near record number at 59. It is too early in the new administration to determine if the recent changes will have an adverse impact or not, but we are supportive of the new FDA Commissioner, Dr. Martin Makary a British-American surgeon, professor, author, and medical commentator. Dr. Makary’s accomplishments as a researcher, clinician, and prolific author are numerous. We believe he will bring a pro-innovation platform to the FDA which could prove positive for new drug approvals, efficiency, and industry engagement.

The situation of FDA leadership also took a turn at the end of March 2025, when the long time (and industry friendly) head of the Centre for Biologics Evaluation and Research (“CBER”) announced his resignation. CBER is the Centre within FDA that regulates biological products for human use, such as vaccines, blood products, cell & gene therapies, tissues products and certain diagnostics. Dr. Peter Marks served as the Director of CBER since 2016, after joining the division in 2012. Whilst not completely unexpected, his departure was a disappointment for the industry and investors alike, as Dr. Marks had been a leading advocate for the advancement and approval of gene and cell therapies, a supporter of vaccine development and utilisation, played a pivotal regulatory role during the COVID pandemic, and was an unequivocal patient advocate. However, he openly disagreed with Robert F. Kennedy Jr.’s views on vaccines and openly said so in his public resignation letter.

Dr. Mark’s replacement, Dr. Vinay Prasad, was named in May 2025. New to the FDA, Dr. Prasad has been an outspoken critic of both the Agency and the biopharmaceutical industry and rose in public prominence during the COVID pandemic with sharp criticism of the mandatory usage of COVID vaccines. Dr. Prasad’s agenda for his new position had yet to be revealed at the time of publication but investor reaction to this news was decidedly negative as it was assumed that this appointment was a blow to innovation and a new headwind for biological drug development and new biologic launches. Whilst we wait for transparency about the course of CBER in the coming months, we do note that CBER has no regulatory authority on small molecules or antibodies. We would also pause and hope that Dr. Prasad, like Dr. Makary, may bring some progressive ideas to the Centre, such as novel benefit/risk analysis for new drugs, more appropriate checks and balances on the regulatory front, and new ways to bring new therapies for rare and severe diseases to market.

Whilst Biotech is largely insulated from the impact of tariffs, the prospect of potential tariffs still diminished investor enthusiasm for the bio-pharmaceutical sector generally. The month of March 2025 brought further weakness in the broader markets due to concerns about President Trump’s tariff policies and a possible economic slowdown in the U.S. Through the first quarter reporting period of 2025, however, we have deduced from multiple company commentaries that the overall impact of tariffs – both those enacted and potentially industry specific – appear to be manageable and all companies are already undertaking mitigation strategies to reduce the potential impact of any future tariffs.

. . . . . . . . . . .

Biotech Growth Trust, 3 June 2025

One of the longstanding drivers of biotech sector performance has been M&A activity. Emerging biotech companies rarely stay independent over the long term; at some point, they are acquired by a larger strategic player. Figure 10 (on page 23 of the Annual Report) shows the company announced M&A transactions for publicly traded biotech companies since the beginning of 2018. M&A was generally strong throughout 2023 and the early part of 2024 before tapering off for the balance of 2024. We attribute the reduced M&A activity in the latter part of 2024 to four factors: 1) acquirors were still digesting the acquisitions they had already made so were not prepared to make new ones; 2) acquirors were waiting for the results of the Presidential election, which would impact the tax implications for companies contemplating acquisitions as well as Federal Trade Commission (FTC) views on potential transactions; 3) target companies were waiting for share prices to recover before agreeing to a sale; and 4) some acquisition dollars have actually been spent on acquiring private biotech companies that have been unable to go public given the tepid state of the IPO market.

Our conversations with investment bankers indicate that strategic interest in acquiring biotech companies remains strong among large pharmaceutical companies, in large part due to the expected loss of exclusivity for many of their blockbuster products by the end of this decade (as shown in Figure 11 on page 24 of the Annual Report). Pharmaceutical companies have an urgent need to make acquisitions that can replace the lost revenue from the patent expirations of those blockbuster products.

However, Trump’s recent tariff announcements, including an upcoming pharmaceutical tariff that has yet to be announced, have increased uncertainty among large pharmaceutical companies about what their financial situation may be in the near future. Trump has also discussed closing the tax advantages for pharmaceutical companies that choose to domicile their manufacturing and intellectual property in ex-US locations like Ireland in order to take advantage of lower tax rates in those jurisdictions.

Uncertainty about these policies has likely contributed to a temporary pause in biotech M&A activity. Because the cost of goods sold for pharmaceuticals is generally very low (less than 10% in many cases), any tariff on drugs should theoretically not have a dramatic impact on pharmaceutical margins. Any tariffs that are enacted should also have a minimal impact on biotech companies. Pre-revenue companies will have time to structure their commercial manufacturing operations in an optimal way to minimise the impact of tariffs prior to generating product revenue. If Trump succeeds in lowering the US corporate tax rate from 21% to 15%, the benefits of offshoring pharmaceutical manufacturing become less compelling regardless.

Once there is greater clarity on Trump’s pharmaceutical tariffs and economic policies, we believe M&A activity will resume for the balance of this calendar year.

While most of the M&A activity will be larger pharmaceutical companies acquiring smaller biotech, we also expect an uptick in large-scale M&A activity by pharmaceutical companies. During the Biden Administration, FTC Commissioner Lina Khan took a very aggressive stance in blocking large scale mergers across industries. This effectively discouraged large pharmaceutical companies from making large (>$15 billion) acquisitions, as the prevailing expectation was that any large merger would be stopped by the FTC. Now that Lina Khan is no longer head of the FTC, investors believe this should pave the way for increased large-scale merger activity in the biopharmaceutical sector.

. . . . . . . . . . .

Commodities and natural resources

Keith Watson and Robert Crayfourd, Geiger Counter, June 2025

Underpinned by a structural supply shortage and combined with favourable government policies aimed at increasing nuclear’s share of the global energy mix the outlook for the sector remains extremely positive. Furthermore, after a period of absence from the market since the panic buying of early 2024, western utility inventories appear to be once again approaching minimal levels.

Together with improved clarity on energy policies, notably in the US, currently the largest nuclear power market globally, nearer-term prospects for a pick-up in buying activity by utilities is also extremely positive and should drive a recovery in commodity prices following a period of consolidation from early 2024 highs and with it a recovery in sentiment towards related mining equities which have followed a similar trajectory. With its own unique investment cycle and given the price inelasticity of demand, the uranium market outlook remains extremely bright.

. . . . . . . . . . .

Infrastructure

Sequoia Economic Infrastructure Income, 25 June 2025

Demand for private debt continues to grow

Infrastructure has emerged as one of the fastest‑growing asset classes globally, with assets under management (“AUM”) increasing at an average annual rate of 19.7% since 2015 (Macquarie).

Looking ahead, this momentum is expected to continue, as Preqin forecasts that total private infrastructure AUM will grow from USD1.17 trillion in 2023 to USD1.88 trillion by the end of 2027 (Preqin). Within this expanding asset class, infrastructure credit is gaining traction among institutional investors drawn to its defensive characteristics, consistent cash flows and attractive risk-adjusted returns. While growing investor interest may lead to increased competition for high-quality private infrastructure debt opportunities, we believe SEQI is well positioned to navigate this dynamic, as the Company benefits from its established track record, deep origination networks and the specialist expertise of its Investment Adviser.

Moreover, although the supply of debt capital is growing, it is very likely that the demand for debt capital is growing at least at the same rate, cancelling out largely or entirely the effect of competition.

This overall trend is also driven by a persistent funding gap in global infrastructure, particularly in sectors like energy transition and digitalisation, where private debt plays a vital complementary role to equity. As bank retrenchment continues and capital demands increase, the favourable structural tailwinds for infrastructure credit are expected to endure, supporting long-term investor appetite.

Tariffs

Recent tariff measures and trade policy shifts between the US and the rest of the world have renewed volatility in international financial markets. With these geopolitical frictions and protectionist strategies back in focus, the Investment Adviser believes prolonged tariffs could pose a drag on global economic momentum and fuel inflationary pressures across the US, UK and Eurozone in the short to medium term.

. . . . . . . . . . .

GCP Infrastructure Investments, 12 June 2025

Infrastructure plays a key role in supporting how the UK addresses society’s current challenges. The UK Government is seeking to support economic growth through infrastructure investment across housing, transport, energy and the digital economy. This supports the UK’s industrial strategy, promoting the onshoring of supply chains associated with designing, building, owning and operating infrastructure.

The UK Infrastructure Bank has become the National Wealth Fund with an expanded remit, and has made several investments across ports, energy, raw materials and providing investment to local authority initiatives. GB Energy has been established and will be headquartered in Aberdeen, with its future role still to be confirmed in detail.

The recently published Planning and Infrastructure Bill 2025 seeks to reform planning in England and Wales to ‘get Britain building again’, including supporting the Government’s target to build 1.5 million new homes and fast-track planning decisions on 150 major infrastructure projects. The Clean Power 2030 Action Plan, prepared by ‘Mission Control’ for the Government’s 2030 low carbon electricity target, was also published in the period. This sets out an ambitious plan that requires investment of £40 billion per annum for the next six years, with the objective of reducing the emissions intensity of the electricity grid to less than 50 gCO2/kWh as part of a plan that would see up to 50 GW of offshore wind, 29 GW of solar energy and 27 GW of battery energy storage capacity.

The TM04+ grid connection reforms were approved by Ofgem in April 2025, updating the grid connection process from a first‑come, first-served model to a ‘ready and needed’ model in which projects that are close to being ready to build and are geographically favourable are provided with firm grid connection arrangements. The UK Government has committed to updating the market on its long-running review of electricity market arrangements, in which locational pricing has been proposed, later this summer.

Overall, these reforms are needed, and subject to final decisions and successful implementation, have the potential to support infrastructure investment. However, uncertainty around market arrangements and legislative processes and frameworks make investment more difficult, which in turn makes ambitious targets unlikely to be achieved.

It has been positive to see that the first phase of projects in the UK’s carbon and hydrogen business model clusters have been announced at Teesside and HyNet (Merseyside): a combination of the regulated asset base and contract‑for‑difference models that have supported CO2 transport and storage infrastructure and the decarbonisation of large emitters respectively. Similarly, the Silvertown Tunnel, the first new crossing of the River Thames east of Tower Bridge since 1991, opened in April 2025.

. . . . . . . . . . .

Private equity

Alan Devine, chair, Patria Private Equity Trust, 25 June 2025

The private equity market has so far not recovered in 2025 as many, including myself, anticipated towards the end of 2024. Suffice to say, it is hoped that, when the broader uncertainty subsides, we will begin to see the return of healthy levels of buying and selling activity. Currently, we are planning for subdued market conditions to persist for the remainder of FY25.

Once there is greater certainty in the broader market, I can foresee structural reasons why private equity activity will return in the short-term. Bain & Co estimates that there is $1.2 trillion of ‘dry powder’ (capital raised but not yet invested) in the buyout market and around 24% of that is ‘aging’ (held for four years or more). Most of that dry un-invested capital is managed by the large and mega-cap private equity firms, and will need to be deployed, which will help drive a market recovery. Notwithstanding a blip during the peak of tariff uncertainty, credit conditions are generally improving and interest rates are expected to fall modestly from current levels, both of which are helpful for buyout activity and the convergence of buyer and seller expectations. I also expect to see the continuation of the long-term trend of companies staying private for longer.

. . . . . . . . . . .

Renewable energy infrastructure

Ed Warner, chair, Foresight Environmental Infrastructure Group, 24 June 2025

Environmental infrastructure assets represent one of the most significant investment opportunities of this generation. The market for environmental infrastructure continues to grow rapidly, both in respect of renewable generation and infrastructure assets with environmental benefits outside of low-carbon electricity.

It is estimated that $47 trillion of new energy investment is required by 2030 to reach net zero, representing a 3x increase in low-carbon investment annually to 2030 over the $1.8 trillion invested in 2023, and also 4.5x required investment in low-carbon energy supply by 2030 for every dollar invested in fossil fuel supply1. This is driven by the increased demand for electrification and the cost competitiveness of renewables.

In addition to clean power generation and the supporting infrastructure required to deliver that clean power efficiently, governments are also addressing a wider range of environmental challenges faced by society than just generation of low-carbon electricity. As the charts show, decarbonisation consists of many facets, and the electrification of transport and heat is an integral part of the route to net zero.

And finally, the wider governmental and societal push for more sustainable practices is further resulting in a broad opportunity set across sustainable resource management, for example water and waste.

FGEN’s objective is to leverage this massive investment opportunity set by investing across three key themes of environmental infrastructure – renewable energy generation, other energy infrastructure and sustainable resource management – to help address a wider range of environmental challenges faced by society than just generation of low-carbon electricity.

This is strongly supported by market and regulatory tailwinds that are supercharging the transition to net zero and improved sustainable resource management – for example, in the UK, the Energy Act 2023, Simpler Recycling legislation, and Ofwat’s Asset Management Period 8 (“AMP 8”) with a £104 billion2 investment requirement between 2025 and 2030, and in the EU, the Net-Zero Industry Act and the REPowerEU Plan.

. . . . . . . . . . .

Tony Roper, chair, SDCL Efficiency Income, 23 June 2025

Over the past year, there has been a marked and well-documented dislocation between the share prices of UK investment trusts and their underlying net asset values. Despite sound investment strategies and good performance, prevailing market uncertainty – fuelled by evolving regulatory frameworks, fluctuating interest rates and broader economic headwinds-has driven share prices to trade at significant discounts relative to their published valuations.

This divergence is indicative of a market that is increasingly influenced by transient sentiment and liquidity concerns, rather than solely by the long-term quality of the underlying assets.

. . . . . . . . . . .

Property

David MacLellan, chairman of Custodian Property Income REIT

A changing and more challenging global political landscape during the year has resulted in tensions and uncertainty running high in parts of the world. In the UK, it is still early days for the new Labour government but uncertainty is never good for any economy, including the real estate sector.

While commercial property in the UK is showing signs of recovering value on the back of increased occupier activity and growing rents, the share prices of listed real estate companies do not yet reflect this recovery with many shares in these companies continuing to trade at discounts to net asset values. As a result of these, in some cases, quite wide discounts there has been increased corporate activity in the listed real estate sector with mergers, take-privates and managed wind downs a feature of the last twelve months following the arrival of more activist shareholders.

In my chairman’s statement last year, I reflected that the company could soon be one of only a few active and genuinely diversified property investment companies available to investors in the listed sector. It would appear that this reflection has proved prescient, however, as I note in the following paragraphs, the company is well positioned with a diversified portfolio of performing real estate assets which are providing a strong yield from a fully covered dividend.

Income and income growth are likely to form the greater component of total return over the next phase of the property cycle if long-term interest rates continue to stay high with persistent inflation.

. . . . . . . . . . .

Bradley Biggins, fund manager of Schroder REIT

In May the Bank of England implemented its fourth 25bps cut to the base rate this cycle, bringing it to 4.25%. The market is now expecting the base rate to end the year at 3.75%-4.0%, lower than earlier in the year given increased uncertainty and softening growth expectations. The five-year Sonia swap rate has declined to 3.8% from the recent January peak of 4.6%.