The UK economy grew slightly slower in Q2 than previously thought, with an expansion of 0.5% as opposed to the expected 0.6%. The Bank of England maintained its 5% interest rate in its September meeting, citing assumptions of slight rises in inflation, spurred on by higher energy prices. Despite improved stability since July’s change of government, there has been a considerable fall in consumer sentiment, indicated by the GfK consumer confidence barometer, which fell from 7 points to -20 points. This is thought to be caused by fears of potential changes brought on by the October budget. Although, it is worth noting that this drop comes during enhanced wage growth, longer term falls in inflation and forecasts for a turnaround for UK equities.

“I think interest rates are going to come down. I’m optimistic on that front, but we do need to see some more evidence.” – Andrew Bailey, BoE

The Fed’s Jerome Powell has signalled that cuts to interest rates are now on the horizon, whereby a move towards ‘a more neutral stance’ could lower rates to around 3%, substantially lower than the current level of 4.75%. Powell’s optimism that the American economy is ‘in solid shape’ has seemingly uplifted the equity market, with the Dow Jones and S&P 500 both closing at record highs on 30 September. As of the same day, the presidential race seemed to be marginally led by Kamala Harris’s campaign, as an aggregation of polls compiled by analyst Nate Silver, showed a 49.3-46.0 lead against Donald Trump’s Republican party. In terms of the market’s reaction, Maxwell Grinacoff of UBS, observed that investors are focused on the S&P 500’s movements in tandem with the uncertainty of the election’s outcome.

In his September report, ‘The future of European competitiveness’, former ECB president Mario Draghi outlined the EU’s need for better coordinated industrial policy and improved investment in its pursuit of keeping up with the US and China. The also former Italian prime minister voiced that ‘the situation at the moment is really worrisome’. Yet, the European Commission expressed its faith in mergers in catalysing economic growth, presumably producing greater resilience and endurance from banks.

There is a lot to be positive about in the U.S. economy, with unemployment remaining low and solid job growth

The North American Income Trust

With real wage growth and expectations that monetary policy is on a downward trajectory, the outlook for UK equities appears to be positive

Henderson High Income Trust

China continues to have a challenging time with lower than expected growth, driven mainly by the deteriorating property market and resulting fall in consumer confidence

Schroders Capital Global Innovation Trust

At a glance

| Exchange rate | 30 September 2024 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.2856 | 5.4 |

| Pound to Euros | GBP / EUR | 1.1875 | 2.8 |

| US dollars to Japanese yen | USD / JPY | 149.98 | 0.4 |

| US dollars to Swiss francs | USD / CHF | 0.8780 | (4.0) |

| US dollars to Chinese renminbi | USD / CNY | 7.2266 | (1.0) |

Source: Bloomberg, QuotedData

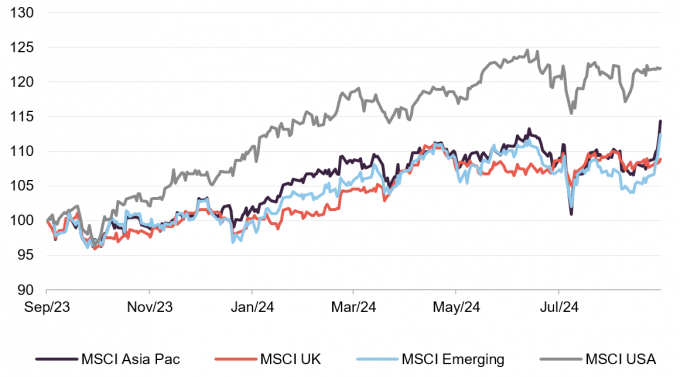

MSCI Indices (rebased to 100)

Market returns were modest across the board in August, however this masks a brief period of panic as weak macro data in the US helped spark a global volatility shock.

On average, the MSCI indices faced a peak to trough dip of over 6%. While these losses were recovered over the course of the month, the scale of the move highlights the vulnerabilities of the US centric, global market. This uncertainty is reflected in the steep drop in US treasury yields and the ongoing rally in gold, as well as the market volatility we have seen in early September.

Time period 30 September 2023 to 30 September 2024

| Indicator | 30 September 2024 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 80.72 | (15.4) |

| Gold (US$ per Troy ounce) | 2447.60 | 31.2 |

| US Treasuries 10-year yield | 4.03 | (11.9) |

| UK Gilts 10-year yield | 3.97 | (11.5) |

| German government bonds (Bunds) 10-year yield | 2.30 | (21.4) |

Source: Bloomberg, QuotedData

Global

Managers, JPMorgan Global Growth and Income, 27 September 2024

Over the past 12 months the market has been largely driven by three key factors: the trajectory of inflation, and its implications for central banks’ interest rate policy; the impact of artificial intelligence (‘AI’) on individual companies, and entire industries; and the ongoing disruption, excesses and cyclical opportunities generated by the Covid pandemic.

Starting with inflation, since its peak in early 2022, we have been on a downward trajectory towards target inflation of around 2%. However, the path has not been smooth and has taken longer than investors hoped. Two distinct trends underlie the headline inflation reading. Inflation in services sectors such as bars and restaurants has remained stubbornly high, driven by wage inflation and a relatively resilient labour market. However, prices for physical goods such as consumer electronics, home appliances and household items were the first to register high levels of inflation, as lockdowns increased demand for PCs and other devices, home comforts and online entertainment. Rising prices allowed these sectors to expand margins and profitability, but this was always an unsustainable trend, as much of the spending was funded by consumer credit and government support payments made to help households through the pandemic. Inevitably, goods prices have begun to fall as demand dissipated, and we see downside risk to corporate revenues and profit margins, which will, in turn, increase the risk of slower growth.

Indeed, we believe we are seeing other early warning signs of a US recession. Unemployment is rising, credit card and auto loan delinquencies are on the rise and demand from low-income households has been weak since mid-2023. While these issues will be problematic for certain parts of the economy, they won’t impact all businesses equally. We are most concerned for corporate profits in the low-growth, cyclical parts of the economy such as US banks, where we believe earnings have been above trend. Elsewhere, industrial cyclicals are benefiting from re-shoring and government policies such as President Biden’s Inflation Reduction Act, which are attracting investment, but these favourable influences are likely to run out of steam at some point, and corporate earnings are vulnerable accordingly.

Meanwhile, AI has emerged as a major structural theme. A surge in interest in its potential capabilities has already invigorated global stock markets, and looks set to underpin economic growth, productivity increases and market gains for the foreseeable future. IT budgets are now focused on efforts to incorporate AI-driven processes into workflows and business practices. To achieve this, businesses must have all relevant data in one location, and we expect this requirement to drive growth in cloud computing and storage for many years. Semiconductor manufacturers are another obvious beneficiary of the AI revolution.

The other significant impact on the market over the past year has been the lingering effects of Covid. The pandemic affected nearly every corner of the economy. In addition to increasing demand for consumer goods, at the expense of services, the pandemic also caused supply chain disruptions for semiconductor producers, retailers and auto manufacturers, which are ongoing in some sectors. As a result, industry cycles are unfolding at different speeds, and this is offering bottom-up investors such as ourselves great opportunities. For example, while demand for consumer and household goods is now declining, after a strong surge early in the pandemic, as discussed above, demand for medical care has strengthened over the past year as health systems strive to clear the backlog of appointments and procedures that built up during the pandemic. Demand for assisted living accommodation has also increased.

The two key areas where we continue to see attractive opportunities are high growth stocks, in particular those exposed to semiconductor production, and defensive sectors, where, in our view, valuations have not looked this attractive for over 15 years.

Demand for semiconductors will be supported not only by the burgeoning demand for AI tools, discussed above, but also by the ongoing spread of digitalisation and technology in its many other forms.

For instance, trends towards remote working and on-line entertainment, triggered during the pandemic, have created increased demand not only for PCs, tablets and consoles, but also for the computer memory capabilities that drive them. AI processes also require more powerful memory, as well as associated hardware. The transition to renewable energy sources and electric vehicles will provide further impetus to this growing demand for semiconductors and related tech, and we see many attractive structural investment opportunities in this arena.

Our concerns about the near term economic and corporate outlook, discussed above, have prompted some portfolio adjustments over the past year. The most significant change has been to move from an underweight in defensive consumer businesses such as food and beverage producers, to an overweight. These new purchases have been funded by the disposal of a number of defensive, asset-light, service businesses.

Elsewhere, we are positive on the outlook for suppliers of aircraft components. The aerospace industry is struggling to meet strong demand. Airbus’s order books are filled until 2030, and after a series of fatal accidents and equipment failures, production at Boeing is below its historical peak. As a result, airplanes are getting older, and need more maintenance and replacement parts accordingly.

. . . . . . . . . . .

Manchester & London, 25 September 2024

Market Risks

The primary challenges to equities remain inflation, recession, regulation, energy prices and war. The Fed’s preferred measure, the PCE price index, has fallen but history has seen reversals before. We are hopeful that over time productivity gains from Ai can assist in further reducing inflation. There is the possibility that countries that undertake material Ai investment such as the USA, will be rewarded with a decade or so of both productivity gains and relatively strong economic growth. Should that scenario be combined with contained geopolitical risks, then we could see a period of sustained stock market returns.

In the shorter term, recession risk is always a concern when the Fed has been so active in attempting to slow the economy. Geopolitical risks, such as the conflict in Ukraine and US-Sino relations, also pose very material concerns. China, Iran, N Korea and Russia are all bad actors that can cause numerous horrific events that could cause material downside for the markets. The companies in our portfolio have a material exposure to China and Taiwan, hence we have been active at various times during the year at laying on hedges against this risk (via EWT US and MCHI US). We are constantly watching the oil price with anxiety.

Technology Outlook

IT spending is expected to increase by ~4% over the next 12 months. By 2028, the value of Ai accelerators used in servers may be more than $32.8 billion, up from $14 billion in 2023, growing at a CAGR of 18.5% according to Gartner. The Nasdaq composite is projected to deliver above-market growth in 2025 with projected revenues and earnings progress of 10.7% and 17.7% respectively. Our portfolio holdings are forecast by Bloomberg estimates to see weighted average projected revenues and earnings progress of ~25.3% and 50.9% respectively for their next financial year. Forecasts are mainly useless apart from providing some relative indications, hence the figures provided purely illustrate that our portfolio could be considered relatively faster growth. Technology stocks have seen their valuations more than recover but a lot of the overhyped stocks from 2021/22 are a long way from fully recovered in terms of valuations. We see a lot of these names ultimately being disrupted by Ai and hence they look expensive “Value Traps” to us.

. . . . . . . . . . .

Managers, Ruffer Investment Company, 17 September 2024

The Big Picture

Over the past 18 months, our expectations for the global economic cycle have not yet happened. However, in our assessment, the end game is becoming ever clearer. Our structural view that the world has entered a new regime of higher and more volatile inflation remains unchanged.

It has been laid out in previous reports, and in multiple Ruffer Reviews, but the shorthand is that we have reached the end of cheap energy, cheap goods, cheap labour and cheap capital – all of which have been powerful disinflationary forces in the last couple of decades.

Government and policymakers, despite their protestations, are not serious about fiscal discipline. Normally, governments run larger deficits when the economy is weak to try and stimulate demand. Today’s politicians (and the electorates which choose them) seem to believe in a magic money tree.

Unemployment is near all-time lows, workers are enjoying real wage growth, equity markets and household net-worth are at all-time highs and yet we are running fiscal deficits at levels only seen in wartime, the GFC or the pandemic. Crisis level stimulus met a boom-time market and a strong economy. Perhaps then, we should not be surprised we avoided recession last year, but we should also not be surprised when inflation remains persistent. We have now endured over 36 consecutive months of above target inflation in the US – a long time by any definition of ‘transitory’. On the Fed’s own forecasts headline PCE inflation will remain above target for another 18 months.

If you are running crisis level policies in the good times, what do you do when a crisis eventually appears?

The bitcoiners and gold bugs are perhaps not wrong – it’s not assets going up, it’s money going down! Long term investors need to own what can’t be printed. This leads to a preference for real assets over hyper-financialised ones.

The fly in the ointment is that inflation and inflation uncertainty are kryptonite for asset prices, particularly when the starting point for valuations is as high as it is today.

Barack Obama’s advisor Rahm Emanuel repeated the line ‘Never let a good crisis go to waste’ in 2009 and it revealed a truth – only in a crisis does the Overton Window sufficiently expand for governments to do previously inconceivable things – think furlough schemes and direct stimulus cheques.

We think the printing press really gets going from the bottom of the next market crash or recession. That’s when governments get serious about tackling the big societal issues like climate change, energy independence, reliance upon China and OPEC, inequality and crumbling infrastructure.

From a traditional portfolio construction perspective this is all problematic because government bonds, so long the safe haven, are now often the epicentre of the problems – as we saw with the Truss/Kwarteng budget in Q3 2022, the US debt sustainability wobbles of Q3 2023 and French government bond sell off in Q2 2024. Simply, supply is outstripping demand.

If the traditional safe haven asset is the problem rather than the solution to hedging a portfolio then investors need something else.

From a wall of worry to an echo bubble

We believe the bull market in equities is running out of positive surprises and that is a dangerous setup given starting valuations. There is no doubt that there was a wall of worry to be climbed since 2022 when recession and inflation fears loomed large. Since then, markets have enjoyed almost eighteen months of positive economic surprises. In the last couple of months, the data has started to come in a little softer, versus raised expectations, and there are signs of the economy slowing, as the fiscal impulse of 2023 wears off.

The danger lies in the market context – markets have looked through the weak data and fixated upon a soft landing. The wall of worry has been climbed and the bears have been vanquished.

Markets seem to be in an echo bubble of 2021 – the last time rampant fiscal stimulus met a strong economy, consumers felt flush with cash and there was a strong narrative capturing the market’s imagination. However, what is remarkable is that this is happening with interest rates at 5%.

In 2021 it was cryptocurrencies, unicorns, and the FANG stocks; today it is the Magnificent Seven and AI but they have a similar flavour. We know that 2021 was followed by the multi-asset car crash of 2022.

It may not be the top of the market – but if it was, how would we know? Here’s a few indicators of the market temperature –

- Retail investors are piling billions of dollars into leveraged exchange-traded funds (ETFs), they are also buying record numbers of call options. Retail isn’t just long, they are leveraged long. Remember, retail always buys more at the top than at the bottom.

- It has now been 380 days without a 2% down day in the S&P 500.

- According to the Merrill Lynch Global Fund Manager Survey – only 5% of investors are worried about a recession in the next 12 months. One year ago that was greater than 50% of investors (including us) – that is the wall of worry, as each of those bearish investors threw in the towel and bought equities.

- The same survey has investor willingness to take risk at its highest level since 2021, cash levels are correspondingly low despite interest rates being at c. 5%.

- In May 2024 we saw the highest ever monthly flows into US growth and Tech-focused equity funds.

- There is an adage that when markets are broad, they are strong, when they are narrow the opposite is true. The US is now 70% of MSCI World. The five largest companies are 28% of the S&P 500.

. . . . . . . . . . .

Louis Florentin-Lee and Barnaby Wilson, fund managers, Mid Wynd International, 6 September 2024

Global stock markets rose sharply during the nine months following Lazard’s appointment as the Company’s Investment Manager, with investor optimism appearing to shift with each release of inflation data. Yet it is important to note that this rise was not simply a story of markets’ strength: it was also a story of their unusual narrowness.

The MSCI ACWI, a broad global index, returned 12% during the first half of 2024 and is up around 30% since the end of 2022. The US market, represented by the S&P 500 Index, gained 16% during the first half of 2024 and is up almost 40% since the end of 2022. Such figures are well worth placing in broader context.

Since 1985, in US dollar terms, the US stock market has returned more than 40% over an 18-month period on only a handful of occasions. All have tended to be clustered around key events in market history, including Black Monday (1987), the dot-com bubble (late 1990s/early 2000s), the recovery that followed the global financial crisis (2010) and the recovery that followed the COVID-19 pandemic (2021).

The extraordinary performance of NVIDIA underlines how the recent boom has been driven largely by stocks related to artificial intelligence (`AI’). The chip designer’s weighting in the MSCI ACWI grew from 0.6% at the start of 2023 to 4.2% at the end of Q2 2024.

NVIDIA’s stock is up 745% over the past 18 months. This is nearly 20 times the return of the MSCI ACWI and 70 times that of the MSCI ACWI Equal Weighted Index – a disparity that has caused a historically wide spread in returns between the two indices.

Fewer than a quarter of the S&P 500’s constituents outperformed the MSCI ACWI in the first half of 2024. This is the lowest figure since at least 1980. This underscores the remarkable narrowness of markets.

Against this backdrop, developed markets, in particular the US, have outperformed Emerging Markets equities. Information Technology and Communication Services have been the best-performing sectors, Real Estate and Materials have underperformed the wider index.

. . . . . . . . . . .

Dr Sandy Nairn, Global Opportunities trust, 3 September 2024

The first six months of 2024 broadly followed the pattern of 2023 albeit that equity returns were particularly skewed towards the artificial intelligence (‘AI’) theme and a small number of US technology stocks in particular. Whilst AI has been widely used since the 1980’s the ‘new’ AI relates to its ability to process the written word through ‘large language models’ (‘LLMs’). This element of AI is still in the early stages and whilst it will inevitably bring productivity improvements in a range of areas it is not the economic panacea that markets seem to believe. We remain in an environment with elevated valuations and meaningful government debt overhangs which have to constrain policy. This reality is dawning on electorates which are reacting to the realisation that incumbent governments cannot satisfy all the promises that have been made. This will lead to more political instability with France as an early example. Against this backdrop the UK stands out as an area of relative stability.

Whilst bond markets have corrected, equity market valuations remain at historically high levels which implies substantial risk, even if the economic and political background were more supportive. For this reason, the portfolio remains conservatively positioned. However, the composition is more nuanced since we still see opportunities, particularly outside of the mega-caps. In the first half we initiated positions in Qinetiq and Jet2 for example. Qinetiq has leadership positions in a number of defence related areas and Jet2, whilst affected by the economic cycle, combines a low valuation with a high-quality management team. This has been part of increasing exposure to the UK equities. The portfolio also reoriented part of the Japanese exposure from larger companies which had performed well into the AVI Japan Special Situations Fund to take advantage of the value in the over-capitalised Japanese small-cap companies.

We anticipate that the stark economic choices facing the major economies will prove increasingly difficult to ignore and will become ever more evident in company results/ forecasts. Combining this with an unfolding election season and the global geopolitical tensions suggests that the seemingly unshakeable optimism of equity markets will be severely tested.

. . . . . . . . . . .

UK

Colin Clark, chair, The Merchants Trust, 26 September 2024

In terms of the domestic market, it is positive to see the external factors such as politics that have turned in its favour and we can only hope that similar positive drivers persist. It would be good to see a greater level of recognition of the potential of the businesses in the UK market, and some subsequent re-rating from such low valuations. How much of this can be stimulated by policy and changing regulation remains to be seen, but hopefully a realisation of the value available will see additional buying interest and a return of the market to greater favour.

In the interim and as we have pointed out before, investor avoidance of the UK market does provide a greater opportunity for keen stock pickers – where great companies trading on attractive valuations are being overlooked simply because of their listing location.

. . . . . . . . . . .

Jeremy Rigg, chair, Henderson High Income Trust, 26 September 2024

The immediate outlook for markets is dominated by speculation over the timing of interest rate cuts with the US Federal Reserve having just instigated its first reduction. The Bank of England has made its first cut from 5.25% to 5% and there have been a number of reductions across Europe. Inflationary pressures are abating and with early signs of weaker labour markets across the globe it is now likely that monetary policy will loosen further over the remainder of 2024.

The UK equity market continues to look relatively attractively priced in a global context and is currently in the midst of the half year results season; generally it is showing the UK economy in robust shape compared with other European neighbours and UK banks in particular are seeing low levels of distress across both the corporate and personal sectors although there are undoubted pockets of weaker activity, particularly in UK construction and housebuilding. Overall, however, with real wage growth and expectations that monetary policy is on a downward trajectory, the outlook for UK equities appears to be positive.

There are of course continuing geopolitical tensions to be mindful of and as we near the US presidential election in November we should expect further volatility. The first Labour government budget at the end of October may also result in higher levels of personal taxation which could prove a headwind, but the new government has made positive noises around focusing on growing the economy.

. . . . . . . . . . .

Peter Tait, chair, Murray Income Trust, 17 September 2024

In addition to the significant widening of discounts across the investment trust sector, we have also witnessed unprecedented corporate actions and mergers over the past year with eight transactions completed and two more announced in 2024 to date. If discounts remain high, that trend is likely to continue. In some cases the activity is due to potential corporate buyers seeing the value in the underlying assets. In some cases, this is due to investment trust boards, themselves, reviewing their own policies, the overall trends in their sectors and the scope for greater liquidity and economies of scale through judicious merger.

On a longer term basis, however, despite all the turbulence, UK equities have returned 9.6% p.a. over the past 50 years. Crucially, about 40% of this return has derived from dividend income – highlighting the genuine attractions of long term income investing. This is especially important for shareholders in this Company. There remains significant demand for a reliable income stream from many investment trust shareholders, and Murray Income Trust is well placed to fulfil this with its current yield of 4.5% and its record of consistent dividend growth over more than half a century.

It is also the case, as observed by Charles Luke in his report, that UK equities are cheap by international standards. Whilst few commentators would argue that there is good value in the UK equity market and in those investment trusts trading at higher than average discounts, there is still the question of what might be the catalyst to unlock that value. I mentioned above the impact that lower interest rates could have. I also make no bones about the fact that the UK Government can play a big role in creating the conditions for making the UK equity market a more attractive long-term place to invest. There are many initiatives which can be undertaken. I can report that I, as Chair of your Company, have written to Tulip Siddiq, the new Economic Secretary to the Treasury, urging her to reform the rules governing cost disclosures for investors. This is a somewhat arcane, technical issue, but the way in which costs are currently assessed and disclosed is a big disincentive for investors to invest in investment trusts. Previous governments had promised reform since 2021, but no action has yet been taken. The new government can quickly and easily correct this misleading and discriminatory cost disclosure regime.

I also welcome the steps taken by the Government to encourage more companies to list on the UK stock exchange, by making the listing requirements more similar to those on the European and US stock exchanges. The new Chancellor, Rachel Reeves, wants to encourage more investment in British industry. Anything she can do to make it more attractive to invest in UK listed companies would be welcome. Given that it is unlikely that the Government will be pursuing the idea of a separate British ISA, it would still be worthwhile simplifying the existing range of different ISAs and an increase in the annual investment limit to £25,000 would also be welcome. Encouraging pension funds to invest a certain minimum percentage of their assets in the UK market might also be worth considering. Finally, and I realise that this is unlikely to be top of the Chancellor’s agenda, a commitment to scrapping the 0.5% stamp duty charge on the purchase of UK shares would go a long way towards levelling the playing field against other major equity markets which do not impose such a charge.

A combination of some or all of these measures, together with the current relative undervaluation of UK equities could significantly help to make the UK market the natural home for many UK investors, particularly income investors, once again.

. . . . . . . . . . .

Sir Laurie Magnus, chairman, City of London, 17 September 2024

The US has been the engine of world economic growth over the last year, but there have been recent signs of weakness, for example in new jobs creation, which have introduced a degree of volatility into stock market confidence. There is scope for the US Federal Reserve to cut interest rates, but it is unclear how far the Federal government can maintain its current high expenditure funded from borrowings given that the fiscal deficit is already at record levels relative to GDP. Neither of the two US Presidential candidates seem likely to focus on cutting the deficit, but its continuing increase is only feasible if the dollar’s status as the world’s reserve currency continues.

UK economic growth has picked up during the second half of 2024 following a “technical” recession, with two quarters of declining GDP, in the second half of 2023. The recent General Election has ended a period of political uncertainty, delivering a majority government in contrast to the instability facing various European countries. The new government is aiming to increase economic growth, but will need to address major challenges which include static productivity and significant underinvestment in infrastructure. Recent public sector pay awards, which do not appear to be linked to productivity improvements, may in the short term make it more challenging to keep inflation at the 2% Bank of England target.

Geopolitical tensions remain heightened. The war in Ukraine continues and the conflict in the Middle East has the potential to escalate more widely. Relations between China and the western developed countries remain adversarial, with China’s excess manufacturing capacity in areas such as electric vehicles becoming an increasing source of tension. The outcome of the US Presidential election in November, which clearly will have considerable implications for global markets, is currently very uncertain.

Although there has been some improvement in the performance of UK equities relative to their overseas equivalents, they continue to trade at a valuation discount. It is therefore not unreasonable to expect that the trend of takeover bids for UK companies by overseas buyers and private equity investors will continue.

The dividend yield from UK equities remains attractive relative to the main alternative investment options, particularly with UK bank deposit savings rates starting to decline. It is also notable that there have been satisfactory dividend increases announced during the recent half-year results season. Investors continue to be “paid to hold on” to UK equities.

. . . . . . . . . . .

Andrew Henton, chair, Onward Opportunities, 5 September 2024

ONWD was launched at a point in the economic cycle when the Board identified more upside opportunity for small cap stocks than downside valuation risk. The results of recent elections in France and the UK surely portend change in both countries, and the possible prospect of a second Trump Presidency in the US makes the risk of a trade war with China, via the imposition of tariffs, more possible.

It is a truism that financial markets can find it difficult to price in (geo)political risk, but equity markets in the US and UK have remained essentially buoyant. Of interest is the growing divergence between forward looking earnings growth expectations for larger and smaller companies and associated valuation multiples (indicating lower valuations for the smaller company sector).

The optimist will hope this divergence is a lead indicator of a catalysing “catch up” for smaller company valuations and will be a source of greater asset weightings towards smaller UK company stocks. It remains the view of the Board that there is more upside opportunity in smaller company valuations than downside risk, and any market rerating which does take place will represent a fillip.

. . . . . . . . . . .

Abby Glennie and Amanda Yeaman, managers, abrdn UK Smaller Companies Growth, 4 September 2024

We wrote last year about the overhang of the market waiting for a recession which didn’t really materialise. Since the market turn in October 2023, UK stock markets have been buoyant and consistent in delivery. We believe a driver of that turn was the awareness of how cheaply valued UK equities were; relative to international peers, their own history, and their earnings prospects. These points still remain true as we go through the second half of 2024 and should continue to support rising markets. This is further evidenced by the frequency and premium level of bids for UK listed assets. The level of premiums that companies are being bid for is evidence of the value inherent in these markets, and the return of a more positive sentiment towards UK equities that we expect to continue. There will always be examples where shareholders feel the premium should be higher or they would have rather continued to be invested for the long term, but overall it is helping to drive awareness of the returns potential. To combat this market shrinkage we have also seen the IPO market open up again, with the Raspberry Pi listing (in which we took part) being heavily oversubscribed by investors. It has been encouraging to see such a high quality unique asset choosing to list in its home market.

What other catalysts lie ahead for UK markets? The domestic economic data has continued to turn more positive, both across business and consumer aspects. We expect to see interest rates come down, and history would suggest this to be positive, not just for absolute market levels, but in particular for small cap relative to large cap. The number of elections, particularly the US Presidential Election, might act as a short-term market overhang, but outcome dependent this could also drive markets further onwards once the results are known. In the UK, the new Labour government has made a point of highlighting its awareness of the need to stimulate the economy. However, it is too early to predict whether the government or any regulatory body can successfully enact meaningful changes that will actually stimulate UK markets, something we would very much support and have been active in sharing views on.

Markets tend to anticipate improvements, and turning points in the past have been when the outlook is often close to being at its most pessimistic. The first half of the period was in that category; inflation was persisting, interest rates remained high, and the consumer squeeze was ongoing. A combination of that environment easing and improving, as well as the market looking towards the future, has helped to drive this turn in markets. Smaller companies will always be an asset class with relatively high volatility, but we believe the current time is an attractive entry point for new capital, where investors are able to take a longer-term investment horizon.

. . . . . . . . . . .

Asia Pacific

Roger Yates, chair, Pacific Horizon Investment Trust, 16 September 2024

The past year saw weakness in the Chinese economy, the recent unwinding of the Yen carry trade (borrowing Yen at a low rate of interest to invest in higher-yielding assets) and regional tensions on Taiwan. Notwithstanding these challenges, there remain a wealth of opportunities for the patient investor. These are based on both superior long-term economic growth rates and the range of attractive companies in the region. Valuations are at multi-year lows relative to developed markets. The very diversity of opportunities should encourage investors, as demonstrated in the range of Asian/Indian market returns in the past year – from 30 per cent. plus in Taiwan and India to negative 12 per cent. in China.

. . . . . . . . . . .

. . . . . . . . . . .

Japan

Managers, Schroder Japan, 25 September 2024

We believe that the Japanese equity market continues to provide one of the most attractive opportunities globally, particularly for long-term investors. Several developments that are unique to Japan should combine to support corporate earnings growth and increasing valuation multiples in the years ahead.

At the heart of this positive investment thesis are the increasingly widespread corporate governance reforms that are driving improved profitability and returns across large swathes of the Japanese stock market. After a long period of apathy towards Japanese equities, these reforms are resulting in renewed interest from the global investment community. Meanwhile, rising wages, increased business investment and export growth are combining to offset some recent weakness in consumer sentiment, in what continues to resemble a more supportive domestic economic environment than we have seen in several decades.

In the near term, there are reasons for caution, as reflected in the significant stock market volatility we have witnessed since period end. The Japanese stock market saw its second largest one-day decline on record on 5 August 2024, amid growing concern about the US economy and the risk of further interest rate hikes from the BOJ. Markets have quickly regained their poise, but this represents a timely reminder of what can happen when short-term, speculative money reverses.

In some respects, such a setback should be seen as healthy in the long run. From a valuation perspective, the recent volatility has taken the market back to a reasonably undervalued level. Meanwhile, the sudden strengthening of the yen which accompanied the sell-off highlights the attractiveness of investing in domestic demand-oriented companies and the opportunities in small and mid-cap stocks that have lagged behind the overall market.

Furthermore, with corporate governance reforms already driving a record amount of share buy-backs, Japanese companies can take advantage of the recent weakness in their share prices to actively buy back even more shares. This should ultimately support the market as well as contribute to a better capital structure for individual companies.

Nevertheless, concerns about the outlook for the US economy are likely to remain in the months ahead, as are worries about a significant “hawkish” shift from the BOJ. On both of these fronts, we believe the market has become overly concerned about the risk of an earnings downturn. The Federal Reserve has significant scope for interest rate cuts in the US and looks focused on achieving a soft economic landing. Meanwhile, although the BOJ’s interest rate hike in July was a surprise to many, we do not believe it signals a move away from a sensible, flexible and well-balanced monetary policy stance. Based on the soft-landing scenario for the US economy and the solid fundamentals of the Japanese economy, we expect the robust pace of earnings growth for Japanese companies to continue this fiscal year and next.

To conclude, there are many reasons to believe that we may be entering a period of sustained outperformance from the Japanese stock market. We have seen renewed appetite for Japanese equity from global investors and this demand should continue to grow as the positive domestic story becomes better understood.

Furthermore, local investors have also started to invest more in Japan, supported by the new NISA, a tax-exempt investment scheme that was revamped earlier this year. With growing interest from a wide range of long-term investors, this continues to represent a fertile environment for active, high conviction stock pickers.

. . . . . . . . . .

Managers, Baillie Gifford Shin Nippon, 19 September 2024

Japanese high growth small caps have endured a tough time since the end of the COVID-19 pandemic. A rotation into value and cyclical stocks has led to weak share prices despite strong operational performance. In previous reports, we have noted some of the macro headwinds responsible for this weakness and consistently maintained that these headwinds will eventually abate. Whilst these headwinds remain, there are signs that they are moderating.

It might seem odd to express enthusiasm despite continued underperformance. Higher interest rates in the US and a weak yen have been two significant headwinds. In both cases, there are signs of a reversal.

Apart from positive macro developments, there are also fundamental factors that make small caps compelling relative to large caps in Japan. Based on current consensus estimates for next year in sterling terms, the MSCI Japan Small Cap Index has a lower valuation, but faster sales growth compared to the TOPIX large cap index.

We recently spent five weeks in Japan meeting senior executives at 61 companies. We noted several positives, and a few negatives, during this trip. Firstly, inbound tourism is absolutely booming despite fewer Chinese tourists than before. As of June this year, Japan had nearly 20 million tourists as against 25 million in 2023, and nearly 32 million in 2019. At the current rate, Japan remains on track to attract a record number of tourists this year. Secondly, many Japanese companies are raising prices. A combination of market dominance and a desire to improve profitability have emboldened management teams to exercise their pricing power. And finally, artificial intelligence-based software solutions are being used in various parts of Japan’s economy.

There were also some areas of concern. Labour shortage was highlighted by numerous companies, especially those in labour-intensive sectors like construction and manufacturing, as the most serious headwind. These companies are struggling to replace an ageing workforce as these sectors remain unpopular with graduates and younger workers. However, this is providing growth opportunities for smaller companies.

Another common concern was China. Historically, China has been a massive growth market for many Japanese companies. However, a slowing economy, rising domestic competition, geopolitical tensions, and pricing pressure have all resulted in a souring of the “China dream” for many Japanese companies.

. . . . . . . . . .

North America

Jeremiah Buckley, The North American Income Trust, 27 September 2024

As we enter the second half of the year, there is a lot to be positive about in the U.S. economy, with unemployment remaining low and solid job growth. Households are feeling the impact of inflation and are being more selective in their consumption, however, we still believe consumer balance sheets remain relatively healthy and should contribute to a strong overall economic backdrop.

Equity markets have embraced this optimism, pricing in a soft landing scenario. Year-over-year S&P 500 earnings estimates are up over 10% for this year and next, which appear realistic based on our company interactions. However, we believe the realisation of these estimates hinges on two critical factors: productivity and innovation.

Recent gains in U.S. labour productivity are particularly encouraging. Nonfarm labour productivity has increased from 2.4% to 2.9% year over year in each of the past three quarters, significantly above the 1.5% 10-year average. This uptick bodes well for corporate margins and may help mitigate inflationary pressures. The productivity gains are particularly evident among tech and internet firms, many of which streamlined operations while still growing revenues.

To capitalise on productivity trends, we’re focused on two key areas: AI infrastructure providers, which offer enabling technologies like semiconductors and AI services, and large-scale companies with large enough R&D and capital spending budgets to fully leverage these technologies. Companies across various sectors are finding new ways to leverage AI to improve efficiency and customer service and accelerate the pace of bringing new products and services to market.

While AI dominates innovation discussions, we see breakthroughs extending beyond tech into sectors like health care. Innovations are emerging in gene editing, antibody drug conjugates, Car T therapies and cell therapies for autoimmune diseases. The continued investment in R&D within healthcare is expected to drive growth and differentiation among companies in the sector.

Key economic risks we are watching include consumer spending trends and the dampening effects that higher interest rates can have on long-cycle capital spending. Consumer spending, while still resilient, has shown signs of a slight slowdown in certain areas. High-income consumers with strong asset positions continue to spend, particularly on travel and experiences, while more leveraged consumers are being selective in their spending choices. The construction industry is another area of focus, with weakening data outside of data centers. This includes housing, multifamily homes, and manufacturing capacity. However, government and nonresidential spending has remained robust, due to data center and chip manufacturing plant buildouts.

. . . . . . . . . .

Stephen White, chairman, Brown Advisory US Smaller Companies, 20 September 2024

So far in 2024, the US economy has continued to perform well, and the recession forecast by many has again failed to materialise. Consumer spending has been the linchpin of the economy, driven by jobs growth, rising wages and the drawdown of savings accumulated from the pandemic period. At the same time, investment spending has held up well due to government incentives and the move towards reshoring given the rising geopolitical and supply chain risks. The Board sees these trends continuing and the US economy remaining resilient.

At the same time, market expectations are for inflation to move back towards the Fed’s targeted range, enabling the latter to embark on its much-anticipated programme of interest rate cuts as of the autumn. Certainly, the tone of the US central bank has been softening over the summer, as evidenced by Jerome Powell’s speech at the recent Jackson Hole symposium where the chair of the Fed declared that ‘the time has come for policy to adjust’.

Against a background of a reasonably healthy economy and falling interest rates, US equity markets will hopefully continue nonetheless to perform well. More importantly for us, we see this as a generally favourable background for smaller companies, particularly given their long period of underperformance relative to their larger peers. Smaller companies tend to have higher amounts of debt and at floating rates and thus benefit proportionally more as interest rates fall. They tend to be under-owned by investors, particularly true of late given the massive exposure that many have built up in the ‘Magnificent Seven’ stocks and the technology sector at the expense of all other areas.

They are likely to benefit more from the reshoring trend given their domestic economy bias and finally they offer greater value trading at multiples well below their larger peers and their own long-term averages. That is not to say that the US smaller company sector won’t be affected by bouts of volatility in world markets resulting from the ongoing geopolitical issues, notably tensions in East Asia and Ukraine, not to mention closer to home with the forthcoming presidential election in November in the US.

In conclusion, after a period of dull returns from US small cap, we see a more favourable picture going forward, for all the reasons cited above.

. . . . . . . . . . .

Michael Phair, chair, Middlefield Canadian Income, 19 September 2024

With the Bank of Canada officially entering a cycle of policy easing on 5 June, 24 July, and 4 September, we are optimistic that the relative performance of Canadian equities will improve in the second half of the year.

Several of the Fund’s core sector exposures, including Real Estate, Utilities, Pipelines and Financials, are poised to benefit from lower interest rates. As of early September, markets are pricing an additional two interest rate cuts from the BoC before the end of 2024, which should serve as a powerful tailwind for margins in these sectors. More importantly, as long as we avoid a severe economic slowdown, we believe falling rates should boost investor sentiment in these areas and result in capital flows returning to dividend-paying equities in Canada.

The country’s population has grown by more than 8 per cent. since before the pandemic, resulting in the highest population growth of any developed nation in the world. This should continue to support robust consumer spending and opportunities for growth in domestic end-markets. Canada is also a global leader in responsible energy production, led by several world-renowned energy producers and infrastructure companies. The Investment Manager believes that oil, gas, and other commodities produced in Canada will have firm price support over the coming years – especially if geopolitical tensions in Eastern Europe and the Middle East do not de-escalate soon. Canadian companies in the Energy and Materials sectors have accrued decades of technical expertise and operate their businesses under global best-practices, offering unique, high-quality exposure to resources.

Despite having similar expected earnings growth over the next two years, Canadian equities are trading at an unprecedented valuation discount to U.S. stocks. With a dividend yield of more than 5 per cent, the Fund also provides a stable and growing stream of income to investors in the form of quarterly distributions. We believe the current valuation discount embedded in Canadian equities offers a compelling entry point into high-quality Canadian companies. We continue to advocate that U.K. investors seeking North American equity exposure should allocate capital to Canada.

. . . . . . . . . . .

Global emerging markets

Sam Vecht and Christoph Brinkman, BlackRock Latin American Investment Trust, 27 September 2024

Latin America has endured a very tough start to 2024, declining -15.5% in the first six months of the year where Brazil (-18.7%) and Mexico (-15.7%) were the primary drivers of the region’s underperformance. For reference, the MSCI AC Asia Pacific ex Japan Index was up 7.2% while the MSCI Emerging Markets EMEA Index climbed 2.9% in the first six months of 2024. The region also underperformed the MSCI USA Index, which was up 14.9%, and developed market equities, as represented by the MSCI World Index, up 12.0%. All performance figures are calculated in US Dollar terms with dividends reinvested.

Strong economic data out of the US at the beginning of the year weighed on emerging markets more broadly as expectations of a Federal Reserve rate cut were pushed out. This negatively impacted sentiment, particularly in Brazil, as it raised concerns around the central bank’s ability to cut rates further. In May, Brazil faced additional challenges with severe flooding that disrupted agricultural output, leading to inflation concerns. More recently, fiscal uncertainty has also put pressure on the market after a larger-than-expected fiscal deficit was reported in June.

Mexico held presidential elections in early June and welcomed their first ever female president. Claudia Sheinbaum, leader for the ruling party Morena, won a landslide ~59% of the votes in what turned out to be the highest voter turnout in Mexican (democratic) history. The outcome of the elections has created a lot of volatility for Mexican financial assets, with the peso depreciating significantly. Investors are concerned that the landslide win of president-elect Sheinbaum and the Morena party will result in reduced checks and balances for the government and detrimental judicial reforms.

Elsewhere in our universe, Argentina was the strongest performer, returning +21.4%. The market has been excited about Milei’s push for economic reforms which, coupled with easing inflation pressures and rising commodity prices, has helped support the stock market. Peru was also among the best performing markets, climbing +18.1%, helped by higher copper prices.

. . . . . . . . . . .

Aidan Lisser, chair, JPMorgan Global Emerging Markets Income, 25 September 2024

In the short term there are some interesting potential tailwinds, given that historically a lower interest rate environment in the US and a weaker dollar, has heralded a favourable investment environment for emerging markets. In addition the appeal of allocating towards emerging markets and away from the US may be growing, given the more attractive macro fiscal context, future earnings growth prospects and relative valuations.

Meanwhile the Board also remains optimistic regarding the long-term case for investment in emerging markets. Growth will be reinforced by advantageous demographics in certain geographies, where rising incomes and the burgeoning middle classes remain powerful drivers of consumption. Additional opportunities will develop with the onset of new technologies and the inputs and raw materials that they require, such as AI-related chips. Most importantly, emerging markets are home to many high-quality, innovative businesses and increasingly with share price valuations more attractive than they have been for some time. In turn this has led to a growth in potential investment propositions, as Austin [the manager] has remarked recently ‘there are more ideas on the slate than for a long time’.

. . . . . . . . . .

Cuba

John Herring, chairman, CEIBA Investments, 26 September 2024

Cuba’s economy remains critically impaired, and the failed 2021 monetary reforms initiated by the government have provoked serious distortions in nearly all segments of the economy, including the tourism sector. Family remittances to Cuba also remain depressed as a result of continued U.S. restrictions, the weakness of the local payment infrastructure and other issues. Consequently, the hard currency income of the country continues at a critically low level and Cuba has difficulty in making required international purchases and other payments.

As a result of the above factors, the country experiences serious difficulties in securing an adequate supply of fuel for its aged oil-fired electrical generation plants, which has resulted in the return of near-daily revolving blackouts throughout the country, including in the capital city, Havana.

The Cuban government has publicly acknowledged that the economy desperately needs further reform and has announced that new measures are imminent, including new monetary rules to deal with the distribution of hard currency resources throughout the economy, partial dollarisation, devaluation of the official peso exchange rate, and the use of new technology and digital payment methods. Over the last six months, very few new measures have been implemented but in August 2024, Cuba’s Prime Minister Manuel Marrero said that the set of new economic reforms will begin with the implementation of “nearly thirty plans to correct distortions and boost the Cuban economy,” to be accompanied by a related political and communications support programme. To date, no details have been made available.

In the face of sustained economic headwinds and inefficiencies in the state sector of the economy, the government continues to approve new small and medium-sized enterprises (SMEs) in the rapidly growing private sector of the economy. Between September 2021 and May 2024, over 11,000 SMEs have been incorporated. These SMEs are quickly replacing state-run businesses in the provision of basic goods and services to the population and are becoming a critical element of the economy given that government businesses are no longer able to secure goods for lack of funds and other difficulties.

U.S. relations

Overall, the relations with the United States have seen some marginal improvement over the past few months.

In mid-May, Western Union restarted the flow of family remittances to Cuba through ORBIT S.A. (the primary Cuban entity dealing with inbound family remittances) and it also announced that it will be expanding the remittance options for Cuba through a new partnership with Katapulk, a popular Cuban American online marketplace for sending goods to Cuba.

Also in May 2024, the U.S. removed Cuba from the list of countries that do not fully cooperate with the U.S. government in matters of terrorism. Although this is clearly contradictory with maintaining the designation of Cuba as a SST, this list is different from the SST list, which has a higher impact on banking and other matters. However, the removal of Cuba from the non-cooperating list is seen by many as a preliminary step to the removal of the country from the very damaging SST list.

In addition, in a surprise move, at the end of May 2024, the Biden administration adopted a series of changes to the Cuban Assets Control Regulations aimed at helping the Cuban private sector by giving independent private Cuban entrepreneurs access to the U.S. banking system and certain digital payment platforms, a variety of cloud, internet and electronic services and other measures. However, these changes are expected to have a limited impact, at least initially, since their success will depend to a large degree on Cuba’s removal from the list of SST and the willingness of banks to offer these services, which is far from certain. As long as U.S. policy towards Cuba is subject to such a large degree to the political winds of the moment, it seems unlikely that the banking system will react quickly to this type of measure.

Now that President Biden has withdrawn from the November election, it remains to be seen what statements Democratic candidate (Vice President) Harris will make regarding Cuba. There seems little doubt that a second Trump administration, if it came to pass, would not be favourable.

Tourism

Tourism is critical to Cuba’s economy and although tourist arrivals grew slowly but steadily over 2022 and 2023, growth appears to have stagnated so far in 2024. Arrivals remain far below those achieved prior to the Covid-19 pandemic and the Cuban government target of 3 million for the current year appears unlikely to be met.

The most important source markets for visitors remain Canada, Cubans living abroad, and Russia. All of the other traditional markets sending tourists to Cuba (the United States, Spain, Germany, Mexico, France, Italy, the UK and Argentina) remain well below pre-pandemic levels. A key deterrent for European travellers to Cuba is their inability subsequently to benefit from the U.S. electronic ESTA visa waiver program, as a result of the ongoing designation of Cuba as an SST. The Canadian tourism market, representing approximately 50% of the total number of tourist arrivals to Cuba, has fully recovered from the pandemic shock and is expected to continue on its present steady course going forward. Meanwhile, Cuba continues to promote itself to other countries including China from where regular flights have recently commenced.

. . . . . . . . . . .

India/Indian subcontinent

India Capital Growth Fund, 12 September 2024

The Indian economy continued to exhibit strong growth momentum. Real GDP growth for the financial year ending March 2024 exceeded expectations at 8.2%, which was reflected in earnings growth of corporates, leading to an upgrade in forecasts by most economists. The top 500 companies listed on the National Stock Exchange saw aggregate profit growth exceeding 30% for FY24. Overall, most sectors experienced growth; however, a few were hindered by global issues including Chemicals, Metals and Information Technology. In contrast, the Consumer sector faced domestic challenges, with high inflation impacting rural demand, resulting in modest single digit growth. This underperformance is considered temporary as recovery is already evident with controlled inflation and favourable monsoon rainfall.

The domestic economy has driven performance. Reforms, coupled with government initiatives aimed at accelerating growth through increased infrastructure investments funded by the Government, and ‘Make in India’ policy measures directed at the private sector to incentivise manufacturing, have led to an upswing in capital expenditure investment.

India has also been a net beneficiary of the reallocation of supply chains out of China, given its large domestic market with many global companies identifying India as an alternate sourcing base. This has provided Indian companies with new export market opportunities across multiple industries, illustrated in electronic manufacturing in which Indian companies are exporting cells phones worth of over US$ 1bn per month from negligible levels last year.

The General Election, which concluded in June after 44 days of voting during April and May, was widely expected to amplify the power of the ruling BJP Government led by Mr. Modi, however although the BJP has again formed the Government, it was unable to achieve a single party majority and had to seek the support of two coalition partners. This raised concerns that the Government would now be forced to focus more on welfare schemes and pander to its coalition partners at the expense of its development agenda. Fortunately, the budget presented in the first week of July allayed these fears. The focus remains on growth, with the Government continuing to prioritise infrastructure investment. Additionally, it maintained its fiscal consolidation path with a clear focus on ensuring macro stability, thereby ensuring policy continuity. A highlight of the Budget was the initiatives announced for upskilling the population, indicating that employment creation for nearly eight million people entering the workforce every year is one of the Government’s biggest priorities.

A key highlight in the first half of the year was the continued flow of domestic capital into equity markets from retail investors, directly or via Systematic Investment Plans (SIPs), Portfolio Management Schemes (PMSs) and Alternate Investment Funds (AIFs). This has led to a sustained rise in markets and concerns about valuations. During the six months to June 2024, Domestic Institutional Investors (DIIs) saw net inflows of US$28 billion. Since January 2021, these inflows have totalled approximately US$100 billion. In contrast, Foreign Institutional Investors (FIIs) have largely remained on the sidelines, with net inflows of only US$350 million in the past 6 months and a modest US$8.5 billion since January 2021.

A core driver of capital flows is the development of India’s digital infrastructure, which has elevated tier 3 and 4 cities. Sustained efforts by the mutual fund industry to educate residents of these smaller cities on the benefits of investing in equities has also contributed. Traditionally, household savings in these areas were invested in real estate, gold or fixed-term bank deposits, but have now shifted towards equity investing via mutual funds. These factors have led to significant personal savings flowing into equity markets. Today, the top five retail brokers by market share are new-age digital brokers, making it extremely easy to trade in the equity markets, either directly or through mutual funds. The majority of new clients for these brokers are from tier 3 and 4 cities. The number of Demat Accounts, for holding shares and securities in electronic form, has increased by 67% to 162million accounts in the last two years, reflecting the growing culture of equity investment. Despite this, today only 7% of household financial savings is invested in equities.

Regulators have raised concerns about the sustained flows. The Securities and Exchange Board of India (SEBI), the capital market regulator, has expressed concerns about excessive speculation in the derivatives segment, which has experienced high valuations. Similarly, the Reserve Bank of India (RBI), the central bank regulator, is concerned about credit growth, which is strong at 17% per annum, while bank deposit growth is only 13% per annum, leading to rising cost of funds. Part of this weaker deposit growth is being attributed to money being diverted to capital markets. Consequently, the RBI has imposed restrictions on credit to riskier asset classes, including unsecured loans, to ensure banks channel credit towards productive assets.

Strong liquidity is fostering a thriving capital market. There has been a surge in Initial Public Offerings (IPOs), with 35 IPOs raising US$ 4billion in the first half of the year, and another 55 IPOs lined up to raise significantly larger amounts. Additionally, a similar amount has been raised by listed companies through follow on offers (qualified institutional placements) to fund growth. This has helped absorb much of the liquidity and provide exits to Private Equity funds, ensuring a vibrant private capital market. Many company promoters have also used this opportunity to reduce stakes in their business.

. . . . . . . . . . .

South Korea

Weiss Korea Opportunity Fund, 23 September 2024

In May, the OECD increased its projected 2024 GDP growth rate for Korea from 2.2% (as of February) to 2.6%. President Yoon announced a 26 trillion KRW programme to further support the semiconductor industry, which has been a key driver of export growth. The OECD also revised its inflation forecast for Korea, expecting inflation to cool from 5% to under 3% during 2024. Should inflation ease, the Bank of Korea could reduce its policy rate over time which could have a meaningful impact on the Korean consumer, as household debt remains at close to 99% of GDP as of the first quarter of 2024 (the highest of 34 countries listed in a study by the Institute for International Finance). However, the Bank of Korea announced in May it was delaying policy rate cuts due to the more recent weakness of the won relative to the US dollar and the wide interest rate gap between the two countries.

Throughout the first half of 2024, North Korea continued to engage in hostile acts towards South Korea. As previously noted in the 2023 Annual Report, news articles have reported on North Korea’s increasingly aggressive actions, including conducting strategic cruise missile tests for “a super-large warhead”, as well as launching approximately 1,600 trash-filled balloons toward South Korea, which has recently led to a temporary suspension of international air travel over the Korean peninsula. Foreign policy experts have acknowledged the heightened tension and animosity in the region, even though missile tests, military drills, and rhetorical provocations are “nothing new” in North Korea. Over the years, the patterns for tit-for-tat exchanges between the Koreas have been well documented, and we expect North Korea to continue its current aggressive behaviour and South Korea to respond with its military drills near the border or even threats to develop an indigenous nuclear programme at least until the United States presidential elections later this year. With plentiful reasons for caution, WKOF continues to maintain a higher exposure in Korean sovereign Credit Default Swaps (“CDS”) protection compared to prior years.

. . . . . . . . . . .

Vietnam

Sarah Arkle, chair, Vietnam Enterprise Investments, 19 September 2024

Economic growth has continued to be robust and, following stronger than expected growth in the first half, the Government has revised up its forecast for the full year Gross Domestic Product (GDP) growth to 6.5-7.0%. This compares very favourably with both major global economies and other emerging markets. The manufacturing and service sectors together with consumption have led the way, benefiting from Vietnam’s favourable demographics, and newly registered foreign direct investment (“FDI”) has continued to see double digit growth as the global supply chain shifts from China.

Public spending and progress in infrastructure projects have been less impressive this year as corruption allegations resulted in some senior Government personal changes, including the Chairman of the National Assembly and President of Vietnam. These changes have meant that there have been delays in decision-making at the municipal level. Additionally, the General Secretary of the Communist Party, who was known for his anti-corruption policies, passed away following a prolonged illness in July 2024 at the age of 80. There has been a smooth transition with President To Lam being unanimously elected as the new General Secretary at the beginning of August and it was encouraging that in his inaugural address he reiterated his commitment to the continuity of pro-business policies.

Delays in US interest rate cuts and the domestic political transition have put pressure on the Vietnamese dong which depreciated by 4.9% over the period against the US$, in line with other emerging market currencies. The State Bank of Vietnam issued government bills and sold foreign exchange reserves to support the dong and domestic deposit rates rose. Against this background there were significant foreign outflows from Vietnam of US$2.1 billion in the first half of 2024, which was part of a broader emerging market trend with a number of emerging stock markets seeing negative returns over the period. Over the period under review, as well as over the last 3 years, emerging markets have, in general, underperformed the major global indices and, in particular, the US market which has been led by a number of high-flying technology stocks.

. . . . . . . . . . .

Biotechnology & Healthcare

RTW Biotech Opportunities, 12 September 2024

The Russell 2000 Biotech Index and the Nasdaq Biotech Index returned +1.7% and +4.0% respectively in the first half. Much of the first quarter continued the strong recovery which started in November last year. Small caps outperformed large caps and IPOs picked up materially. Public financing activity was also strongly up on last year, especially PIPEs (Private Investments in a Public Equity), which hit an all-time high of US$7.8 billion raised in the quarter. Several small acquisitions were announced. Johnson & Johnson’s acquisition of Ambrx and AstraZeneca’s acquisition of Fusion suggest that pharmas are still keen on Antibody Drug Conjugates (ADCs) and radiotherapy. Both have the potential for more durable pricing in the post Inflation Reduction Act world where Medicare can negotiate the prices for selected high-cost drugs used in their program. Sanofi and Gilead announced tuck-in acquisitions in rare disease: Inhibrx and CymaBay, respectively. In medtech, Boston Scientific announced the US$3.7 billion acquisition of Axonics to add to its neuromodulation business. This was all suggestive of a more normal market environment.

However, the start of the second quarter saw the sector swoon once more as the Fed adjusted its market signals in response to inflation data. Though painful, it was not long-lived, and in June positive news from four closely watched sector flag bearers boosted the sector. The FDA’s Peter Marks granted Sarepta’s Duchenne gene therapy full approval despite a failed Phase 3, standing firm on his push for regulatory flexibility. Zealand reported competitive weight loss for petrelintide, the most promising alternative to GLP1s. Argenx’s Vyvgart received approval for CIDP, its second blockbuster disease indication. And Alnylam’s Amvuttra cut the risk of adverse cardiovascular outcomes by nearly 30% in its landmark TTR cardiomyopathy Phase 3. All four companies posted strong gains.

There were two US biotech IPOs in the second quarter, bringing the year-to-date total to nine, compared to twelve for the whole of last year. There were also three M&A deals over US$1 billion in value, bringing the year-to-date total to thirteen. Despite the quarter-over-quarter slowdown after a bumper first quarter, the year-over-year trend remains positive and public and private financing rounds are significantly up year-over-year. Not all financings are performing well after the event, however, so a selective approach is needed, but the markets are rewarding positive catalysts and companies can finance their pipelines on the back of good news.

. . . . . . . . . . .

Growth capital

Tim Edwards, chair, Schroders Capital Global Innovation Trust, 30 September 2024

The macroeconomic backdrop has been mixed, driven by continued high interest rates, despite falling inflation. However, generally the economic environment continued to be resilient resulting in a mostly friendly economic environment.

In Europe, the macroeconomic environment improved overall with economic growth and a relatively tight labor market, even though the picture was more mixed for individual countries. China continues to have a challenging time with lower than expected growth, driven mainly by the deteriorating property market and resulting fall in consumer confidence. The US continued to defy expectations of a recession, even at higher interest rates, however the economy started to lose steam in the first half of the year. Globally, key concerns continued to be the lowering of interest rates by central banks as well as geopolitical tensions which includes both larger nations like the US and China, as well as the potential for a regional conflict in the Middle East.

Global equity markets enjoyed a generally positive environment in the first half of 2024, which followed the pattern of the market recovery that started in late 2023. Overall, it was largely technology stocks that benefitted the most from anticipated gains derived from the development of their AI capabilities.

Global venture capital activity continued to fall in the first half of 2024 with the number of deals declining by 24%, meaning that deal activity has dropped below levels seen prior to the COVID-19 pandemic. Deal making has shifted towards larger transactions with the average deal size being up 17% year to date (“YTD”). A key focus of all venture activity has been investments in AI which accounted for 28% of all capital raised. Key drivers of this were raises into companies like xAI, CoreWeave and Scale. In terms of geography, funding for new start-ups fell particularly in China, whilst other countries in Asia saw boosts to funding. In terms of exits, these have seen a slight decline versus the first half of 2024, with the US share of exits increasing to be on par with Europe.

. . . . . . . . . . .

Debt

Blackstone Loan Financing, 20 September 2024

Supported by a stable macroeconomic backdrop, global loan markets performed well in the first six months of 2024, despite challenges from rising geopolitical tensions and persistent inflationary pressure. Investor appetite for credit remained relatively strong up to the end of the period, driven by the prospect of potential rate cuts in the latter half of the year. Loans outperformed other credit asset classes over the period, with European and US loans returning 4.10% and 4.44%, respectively. A combination of resilient corporate earnings reports and companies slowing their debt growth have led to a slight contraction in loan spreads by 15bp to 490bp in Europe, and by 21bp to 507bp in the US. Across both regions, the loan market saw a notable rise in maturity extensions and refinancing activity, though new money loan volume remained subdued. The sustained scarcity of new issue loan supply, coupled with strong investor demand, pushed the prices of European and US loan indices to two-year highs of €97.16 and $96.06, leading to a renewed repricing wave. Rolling 12-month loan defaults ticked up to end the first half of the year at 2.6% in the US and 0.8% in Europe.

Heading into the second half of 2024, the macroeconomic outlook remains positive, supported by robust corporate balance sheets, fueling hopes for a soft landing. While recent data releases have been mixed and price pressures persist, the general trend is towards disinflation, strengthening expectations for the Fed and ECB to begin reducing interest rates after summer. We anticipate that the elevated rate environment will support performance in the near term, allowing floating rate loans to continue delivering strong returns.

. . . . . . . . . . .

Hedge funds

BH Macro, 13 September 2024

Entering 2024, we looked for slowing US growth, better balance between supply and demand in the labour market, and continued moderation in wage and price inflation. In the event, growth and the labour market did slow as the first half of the year unfolded, but there was a widespread surge in inflation in Q1. Higher inflation pushed back the Federal Reserve’s plans to dial back the degree of monetary policy restraint.

With the Federal Reserve (“Fed”) unexpectedly on hold, the exchange value of the US dollar continued to appreciate. The Fed’s surprisingly hawkish stance put the Bank of Japan (“BoJ”) in an especially awkward position. If the BoJ maintains easy monetary policy, then there is less support for the exchange value of the Yen, which has steadily lost value. If the BoJ raises rates, there is more support for the Yen but higher interest rates make debt service more costly and slows the economy. Throughout the first half of the year, the BoJ and the Ministry of Finance tried to navigate the macro tensions by exiting negative interest-rate policy, providing hints of further rate hikes, and foreign exchange intervention.

China faces similar tensions. The exchange value of the Renminbi is closely pegged to the US dollar. As the US dollar appreciates, the People’s Bank of China (“PBOC”) must seek to defend the peg, which limits policymakers’ flexibility to respond to weakness in the domestic economy with lower interest rates. Investors widely expect that the PBOC can defend the peg but that it may at some point revalue the Renminbi in order to stimulate the growth-oriented export sector.