August 2024

Monthly | Investment companies

Kindly sponsored by abrdn

Winners and losers in July 2024

The S&P 500 index hit a new high mid-month but has been selling off since. July also saw US inflation falling to 3.0% (year-on-year), a bit better than expectations. The US Federal Reserve kept rates on hold, but chair Jay Powell said a cut could be on the table as soon as September; bond yields have been falling in anticipation. The Bank of England decided to cut interest rates to 5%, the first cut in over four years. This supported a rally in UK equities. The yen broke its losing streak, which seemed to trigger some aggressive selling of Japanese equities.

In terms of the best performing sectors, North American smaller companies benefited from a more broadly-based rally at the start of the month and held up better as the sell-off in highly rated tech stocks gathered pace. Amidst slowing inflation and subsequent hopes for rate cuts, investors may have directed their attention towards US small caps, at the expense of larger companies. That fed through into the performance of global small cap trusts. UK trusts and property companies did well, helped by the rate cut. The biotechnology and healthcare rally was driven by stock specific moves.

Best performing sectors in July 2024 by total price return

On the downside, the technology sector experienced a bout of profit-taking which focused on perceived AI beneficiaries. During the month, Nvidia fell by around 13% from its peak, and has continued to decline since. Activist fund managers Elliot Management and others have been warning that AI stocks are in a bubble. At the end of July, earnings from ‘magnificent 7’ companies such as Amazon and Alphabet disappointed investors.

For Chinese equities, deflation, weak consumer demand, and an ongoing housing crisis have strained the country’s economy. Investors may also concerned about the impact of a Trump presidency on US/China relations. MSCI China has now made virtually no headway over the past 10 years.

The knock-on effect of weakened demand from China and nerves around Trump have weighed on the rest of Asia. In addition, a considerable share of country specialist investment companies are focused on Vietnam, which has been affected by an ongoing corruption clampdown.

Worst performing sectors in July 2024 by total price return

Best performing

UK trusts including JPMorgan UK Small Cap Growth & Income, Rights & Issues, and Henderson Smaller Companies dominate the list of best-performing trusts by NAV. The valuation opportunity of cheap UK equities seems to have continued to attract investors, with the rate cut at the Bank of England’s end-month meeting contributing to returns. Smaller companies did particularly well, given their sensitivity to falling interest rates and to wider market growth.

International Biotechnology was boosted by double digit share price gains on three of its largest holdings – Intra-Cellular Therapies, Supernus Pharmaceuticals, and Beigene. JPMorgan Japan Small Cap’s NAV performance reflected a sharp appreciation of the yen relative to sterling, but also coincided with an announcement that it will be merged with JPMorgan Japanese, a move that should improve liquidity, whilst also providing JSGI investors with an uplift from a narrower discount.

Best performing funds in total NAV (LHS) and share price (RHS) terms over July 2024

The tentative small cap recovery in UK and US is reflected in the share price gains in the table. It is a shame that this has been snuffed out by nervous investors in August (you have not missed the small cap boat). It is unclear what drove JPMorgan Emerging Europe, Middle East and Africa’s share price performance. Perhaps some investors are speculating that Trump will be elected, cave into Putin, and improve the value of Russian assets.

On 4 July, Castlenau Group’s shares shot up by 16.5p to 92p, driven by a revaluation of its stake in Dignity, the funeral services company, which dominates Castlenau’s portfolio. Dignity cut its debts by transferring surplus money out of its funeral plan trusts and selling some freehold properties.

The wind-up process of Crystal Amber continues. Its portfolio is now dominated by two holdings – De La Rue and Morphic Medical. Morphic looks set to gain an FDA licence for its lead product. Andrew McHattie discussed it on our weekly show on 2 August. Syncona’s share price bounced, narrowing its discount a little. Amedeo Air Four published its results towards the end of the month. The news was encouraging and came with talk of ‘assessing the best way forward’ for the company.

Worst performing

Caught up in the downturn of tech stocks, Manchester & London, with its high portfolio exposure at end June 2024 to stocks such as Nvidia at 32.3% and Microsoft at 24.9%, took a hit to both its NAV and share price. Allianz Technology Trust and Polar Capital Technology were also affected, even Keystone Positive Change, which has exposure to stocks such as TSMC and ASML, was a casualty of the sell-off.

The uranium price is falling on fears of increased supply. This caused Geiger Counter’s NAV and share price to drop by over 8%. A few of the month’s underperforming trusts – including Henderson Far East Income and Pacific Horizon – were exposed to the weak Chinese market, which we discussed on page 2.

Worst performing funds in total NAV (LHS) and share price (RHS) terms over July 2024

New Star Investment Trust’s share price fall is misleading – it returned £17m to shareholders through a B share scheme. Regional REIT continued to fall following June’s announcement of a £110.5m capital raise at a steep discount to the prevailing share price. Riverstone Credit Opportunities has been hit after borrower Harland & Wolff was forced to try to shore up its finances with an emergency debt facility.

There was no new news from JPMorgan Global Core Real Assets that would justify its share price fall over July. Pershing Square was knocked after its largest holding Universal Music issued a disappointing trading statement.

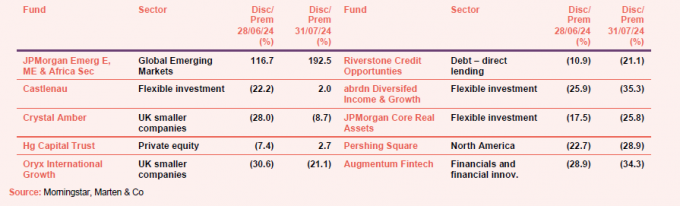

Moves in discounts and premiums

More expensive (LHS) and cheaper (RHS) relative to NAV over July 2024

Many of these have been discussed already. Hg Capital is interesting in that most trusts in the private equity sector trade on discounts that are far too wide. There are other trusts such as Oakley Capital Investments, CT Private Equity, and Patria Private Equity that have similarly good returns but can be bought much more cheaply. We think that their discounts should narrow rather than that Hg Capital’s should widen.

Oryx International Growth bounced after share price weakness in June. However as Andrew McHattie recently pointed out on our weekly show, its stablemates – Rockwood Strategic and Odyssean – trade on much narrower discounts despite having much the same investment approach. abrdn Diversifed Income & Growth’s discount widened after it completed its latest return of capital – a common pattern in funds that are winding down.

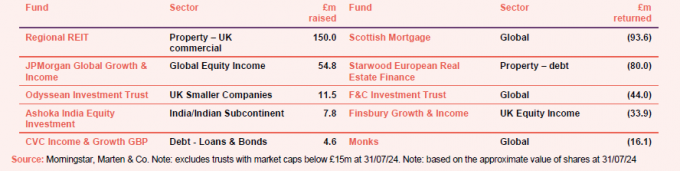

Money raised and returned

Money raised (LHS) and returned (RHS) over July 2024 in £m

Regional REIT’s rights issue puts it at the top of the fundraising table. JPMorgan Global Growth & Income continues to rake in investors’ cash. Strong performance this year is one reason for the demand. Odyssean raised money through a placing and retail offer, but maybe not as much as it would have hoped for.

It was largely the usual cohort for money being returned, as they continue to buy back shares in an attempt to tackle wide discounts. Starwood European Real Estate Finance, which is in wind down mode, made its sixth capital distribution, returning £80m.

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

- Tritax Big Box REIT Shareholder presentation – 08/08/2024

- TwentyFour Select Monthly Income AGM – 08/08/2024

- Renewables Infrastructure Group Shareholder presentation – 09/08/2024

- NextEnergy Solar Fund AGM 2024 – 12/08/2024

- JPMorgan European Growth & Income AGM- 13/08/2024

- The Global Smaller Companies Trust AGM – 13/08/2024

- abrdn Property Income Trust AGM – 13/08/2024

- Downing Strategic Micro-Cap AGM – 21/08/2024

- Premier Miton Global Renewables Shareholder presentation – 21/08/2024

- Partners Group Private Equity Shareholder presentation – 22/08/2024

- Finsbury Growth & Income Trust EGM – 23/08/2024

- Triple Point Energy Transition AGM 2024 – 27/08/2024

- BBGI Global Infrastructure S.A. Shareholder presentation – 29/08/2024

Major news stories and QuotedData views over July 2024

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Portfolio developments

- Chrysalis invests more in wefox

- HydrogenOne announces new TotalEnergies contract for portfolio company Strohm

- VH Global buys European solar and wind portfolio

- Octopus Renewables sells Swedish wind farm

- AI drives sky high returns for Polar Capital Technology Trust

- Chrysalis Investments realises 25% premium for Graphcore sale

- Marked turnaround for TwentyFour Income Fund

- Modest outperformance from Gulf Investment Fund

- Castelnau Group jumps on Dignity announcement

- Widening discount wipes out gains for Oryx shareholders

- Seraphim Space Investment Trust maintains momentum as portfolio continues to develop

- Optimism growing as Monks delivers strong gains

Corporate news

- Japan Small Cap Growth & Income to be merged into JPMorgan Japanese

- Jupiter Green’s board is “evaluating options for the future of the business”

- Oakley Capital Investments continues to build momentum

- Herald kicks off 2024 with a bang

- Bluefield Solar Income Fund executes phase 2 of its strategic partnership

- Baroness Bowles tables new cost disclosure bill

- Gore Street Energy Storage cuts dividend

- Big miss for Miton UK Microcap

- Downing Strategic Micro-Cap (DSM) updates on EGM requisition

- NewRiver REIT boosts capital partnerships business with acquisition

- Second half rally drives strong year for Artemis Alpha Trust

Property News

Portfolio developments

QD views

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

Research

JLEN Environmental Assets (JLEN) and the wider renewable energy infrastructure sector have traded at a persistently wide discount to net asset value (NAV) with investor sentiment continuing to wane. This has triggered the activation of a discontinuation vote at JLEN’s annual general meeting (AGM) in September. We strongly believe shareholders should vote against discontinuation, taking into account the strong long-term track record of the company, which has produced NAV total returns of 119.5% since its launch just over 10 years ago to the end of June and delivered dividend growth every year.

Caledonia Investments (CLDN) is a self-managed investment trust that, at its heart, is about backing companies, with strong market positions and fundamentals, for the long term. CLDN buys to hold, targeting long-term compounding real returns (after inflation) from its portfolio. Its investment strategy means that it can ignore the gyrations of fickle markets, exploiting secular growth rather than short term cyclical opportunities. CLDN’s £3bn of net assets is invested across a focused portfolio of: good-quality public companies; carefully-chosen and (as its history of realisations might suggest) conservatively-valued direct, predominantly UK headquartered mid-market private companies; and private equity funds, investing in North American and Asian private companies.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.