March 2024

Monthly | Investment companies

Kindly sponsored by abrdn

Winners and losers in February 2024

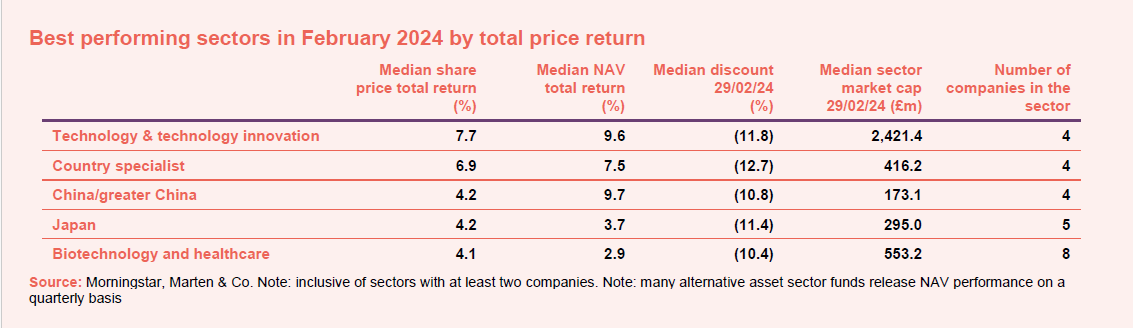

The key drivers of market moves in February can be summarised as: a renewed fixation on AI; rising yields in response to higher than anticipated inflation in some markets; and rebounds in a number of markets that suffered during January. The enthusiasm for AI-winners seems to continue unabated, with NVIDIA becoming America’s fourth largest company on the back of its impressive earnings results. The impact of the AI rally can be seen clearly in the best performing sectors, as technology & technology innovation was the top performer for the month, having generated a median share price return of 7.7%.

Having been amongst the worst performing regions in January, East Asia has shown a clear rebound, now ranking amongst the best, with China and Vietnam (which is a large portion of the country specialist sector) being the clear winners as can be seen by the top five. Asia Pacific and global emerging market sectors also showed strong performance over the month.

Following a difficult January, China’s rebound in February was the result of greater intervention by the government, with state-backed funds buying domestic stocks to prop up China’s equity market ahead of the Chinese New Year. The impact was clear, with the MSCI China Index gaining 9% during the month (in sterling terms), going some way to offset the 10.5% loss the index experienced in January.

The Vietnamese equity market also saw a similarly strong month, up 6.8% in sterling terms. Vietnamese companies have been reporting strong earnings and profit growth for the fourth quarter of 2023; with the region’s secular growth potential continuing to motivate both domestic and overseas investors to deploy capital.

Japan’s year-long market rally, which has been fuelled by cheap valuations and ongoing corporate governance reforms, continued into February, with the Japan sector making its second consecutive appearance in the top five performers. The Nikkei index passed a record breaking 40,000 level during the month, buoyed in part by continued interest in AI. Japan is home to dozens of companies that are critical to the semi-conductor supply chain and its tech stocks followed their Wall Street peers higher.

Following a difficult 2023 for healthcare (the COVID-related bubble in the sector deflated, sales declined, and bond yields rose), healthcare rallied in January, and this continued into February with Eli Lilly and Novo Nordisk, recently dubbed the ‘Magnificent Two’, posting explosive performance reflecting the success of their obesity drugs.

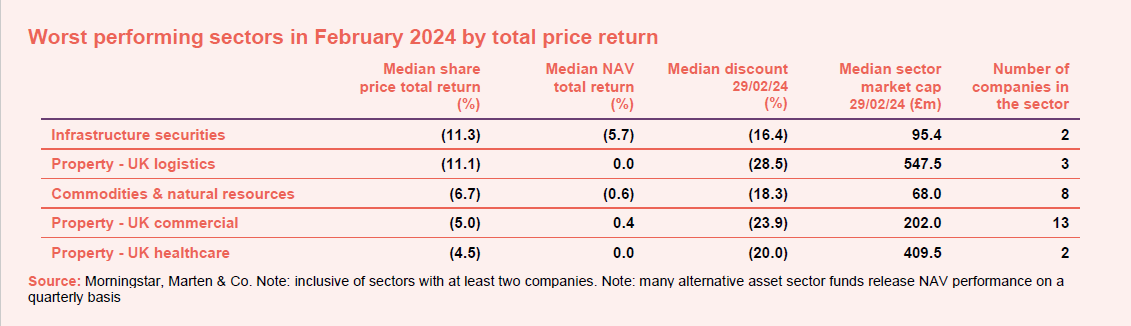

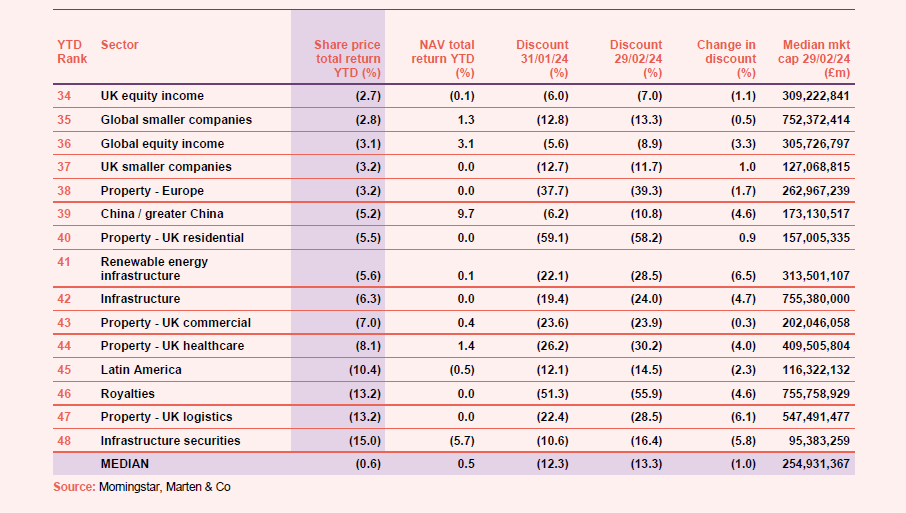

UK property dominated the worst performing sectors with higher than anticipated inflation being the main cause. This has increased uncertainty around the timing of interest rate cuts, which it is hoped could be a catalyst for a recovery in the space, and has depressed demand from investors in the process.

The Infrastructure securities sector was also impacted by the sticky inflation numbers, reflecting the fact that infrastructure valuations tend to be sensitive to interest rates.

Commodities on the other hand were a casualty of the dampening economic outlook for 2024, particularly the increasing slowdown of China’s economy (notwithstanding its stock market bounce), as well as an oversupply of certain resources; with the Bloomberg Commodity Index down 1.1% over February.

Best performing companies

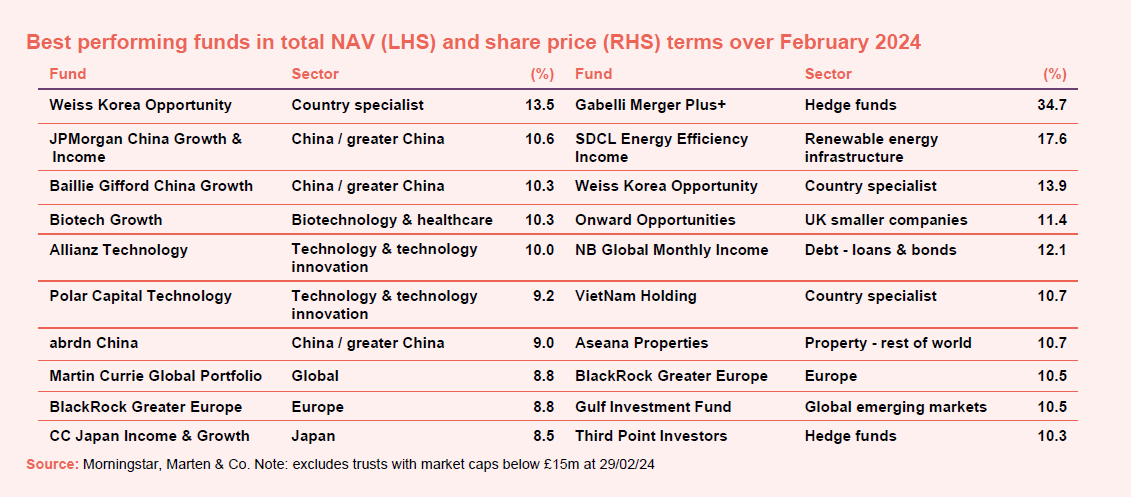

Looking now at the best performing companies, those with the greatest exposure to China and the technology sector were amongst the top NAV performers, for the reasons we mentioned prior. CC Japan Income & Growth (CCJI) was once again the best performing trust within the Japanese sector, capturing many of the tailwinds we outlined the previous section.

Weiss Korea (WKOF) generated the highest NAV performance over February. WKOF is the only fund offering exposure to Korean preference shares and it effectively offers a discounted play on the underlying equity market as the preference shares provides the same levels of income but frequently trade at a marked discount to the equivalent equities. The Korean equity market rallied 8.9% during the month, helped by the launch of Korea’s ‘Corporate Value-up Program’, which aims to encourage more shareholder-friendly behaviour. Reflecting successful stock selection by WKOF’s management and its structure, WKOF it was able to leverage the rally to generate some impressive performance – for example its top holding, Hyundai Motor, was up 28.7% over February.

As noted earlier, healthcare has seen a resurgence during 2024 and the biotech sector is expected to benefit following a significant uptick in novel drug approvals by the FDA in 2023, which appears to have reinvigorated the sector. Biotech Growth with its broad sector exposure looks well positioned to benefit.

Martin Currie Global Portfolio (MNP) and BlackRock Greater Europe (BRGE) were also beneficiaries of rally in tech stocks, as both have large allocations to the sector, albeit through their regional mandates. MNP’s has large weightings in NVDIA, Microsoft, and ASML allowing it to benefit directly, while BRGE benefited indirectly due to the rally in European semiconductor stocks. BRGE also benefited from the excitement around weight loss treatments, with Novo Nordisk (the current leader of obesity treatments) being its largest holding.

In terms of share price movements, Gabelli Merger Plus+ Trust (GMP) saw its share price surge on the back of an announcement that it would repurchase 5% of the shares held by its minority shareholders, or 3.7% of the current circulation.

SDCL Energy Efficiency Income (SEIT) share price rallied after the board indicated that the trust had received several credible offers for some of its assets. These offers were at valuations which are within its range of pricing expectations and support SEIT’s most recently published net asset value.

Onward Opportunities (ONWD), having launched only last year, is a small trust at a mere £16m market cap. While there was no news surrounding the trust, its lack of liquidity means that individual trading activity can have an outsized impact on its discount, as was likely the case this month.

NB Global Monthly Income Fund (NBMI) announced a partial compulsory redemption in February, repurchasing £23m of shares, or 69% of existing shares held by shareholders. These shares will be redeemed at 79.04p (the NAV as of 16 February 2024); NBMI’s share price jumped in response to the announcement.

Aseana Properties (ASPL) shares rallied after the company announced that it had reached a deal that sees it withdraw its legal action against Ireka Corporation Berhad (ICB), the parent company of its former development manager, that includes reparations that increase its NAV per share NAV by 14% (from $0.35 to $0.40). As part of the deal, ICB will transfer 38.8m shares of ASPL back to the trust, plus a 30% stake in another venture.

Gulf Investment Fund (GIF) has faced selling pressure in recent months as investors have been concerned that the war in Gaza could spill over to the wider region. However, it seems that investors have reappraised this risk for now. GIF is very tightly held and shifts in buying/selling pressure can have outsized effects on its share price.

There was no news regarding Third Point, other than it continuing to buy back shares regularly over the month. With respect to WKOF, VNH, and BRGE, their share price returns were a reflection of their strong NAV performance.

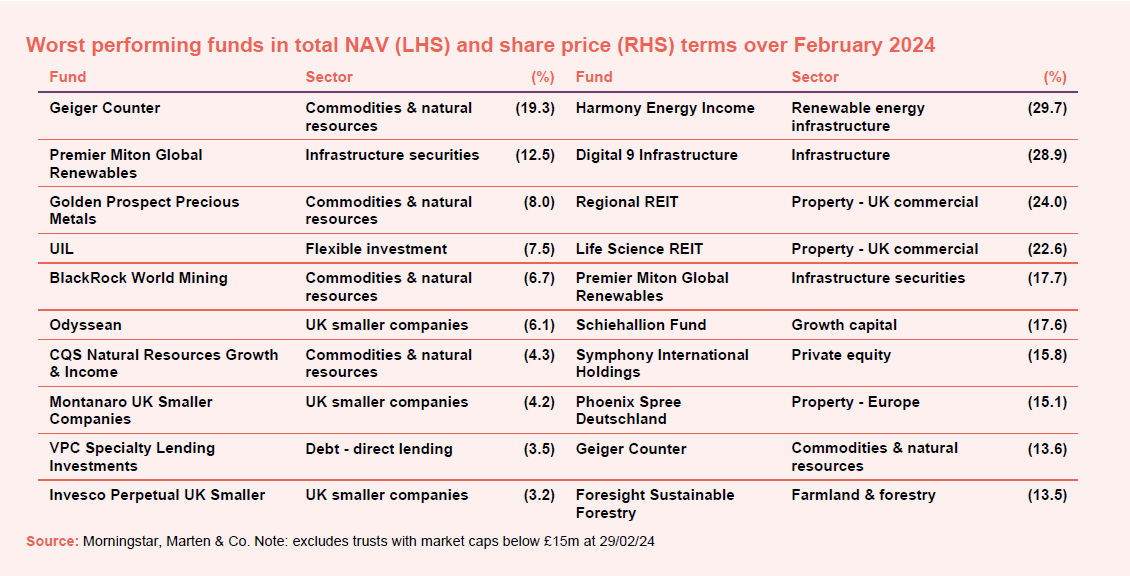

Worst performing companies

Names appearing in the list of worst performing funds during February are those that are more economically sensitive, such as the commodities funds, reflecting a deteriorating economic outlook at the margin, and funds that are better suited to an environment of lower interest rates.

Geiger Counter (GCL) continues to be volatile, reflecting swings in the uranium price, but the long-term story about increasing demand for nuclear power seems intact.

The spot price of gold climbed during February and has since hit a new high. However, Golden Prospect Precious Metal’s (GPM) share price tracked down during the month, reflecting a similar fall in its NAV. The decoupling of the share prices of gold miners from the gold price is one of the stranger phenomena of recent years and is hard to explain. Although part of the problem is attributed to higher mining-related costs. A weaker economic outlook with the potential for lower demand for commodities weighed on BlackRock World Mining Trust and CQS Natural Resources.

Reflecting increasing uncertainty around prospective interest rate cuts during the month, infrastructure and utilities sectors were out of favour (hitting Premier Miton Global Renewables) as were a number of UK smaller companies strategies, the Numis Smaller Companies ex Investment Companies Index was down 1.2% over the month.

UIL has quite a lot of exposure to economically sensitive sectors (51% in financials and 11% in resources) and its NAV tracked down in February most likely due to a weakening of the economic outlook. Its half year report reiterated its need to continue to pay down its bank debt – it has significant structural debt in the form of ZDPs with staggered maturities.

While VPC Specialty Lending Investments is being wound down, the returns from its fixed income investments are potentially less attractive if yields remain higher for longer.

In terms of share price movements, property funds were underperformers, with investors weighing the impact of higher yields. Regional REIT was hit particularly badly as a valuation reduction led to fears about covenant breaches on its debt.

Harmony Energy Income’s (HEIT) shares fell after the board announced it would be forced to cut its dividend due to a difficult market environment and deteriorating outlook, specifically postponing the payment of its first quarterly dividend for the current financial year. If the current environment continues, the board highlight that it may impact its ability to pay future dividends as well. Specific factors that lead to the cut include a reduction in wholesale power prices volatility and a saturation of some of its markets.

The shares of Digital 9 Infrastructure (DGI9) fell after the company announced that its sale of Verne Global, which is key to it repaying its debt, was being reviewed by Nodic regulators. We note that has since been granted approval.

There were no specific announcements surrounding the Schiehallion Fund (MNTN) but given its focus on unlisted, high growth companies, it too has been impacted by higher than anticipated inflation extending the timeline for interest rate reductions. Symphony International Holding (SIHL) saw no important developments during the month, but it invests in private assets located in Asia and these markets tend to be negatively impacted by higher interest rates in the US, where inflation numbers came in modestly ahead of expectations. Foresight Sustainable Forestry is thinly-traded and this has increased the volatility of its share price.

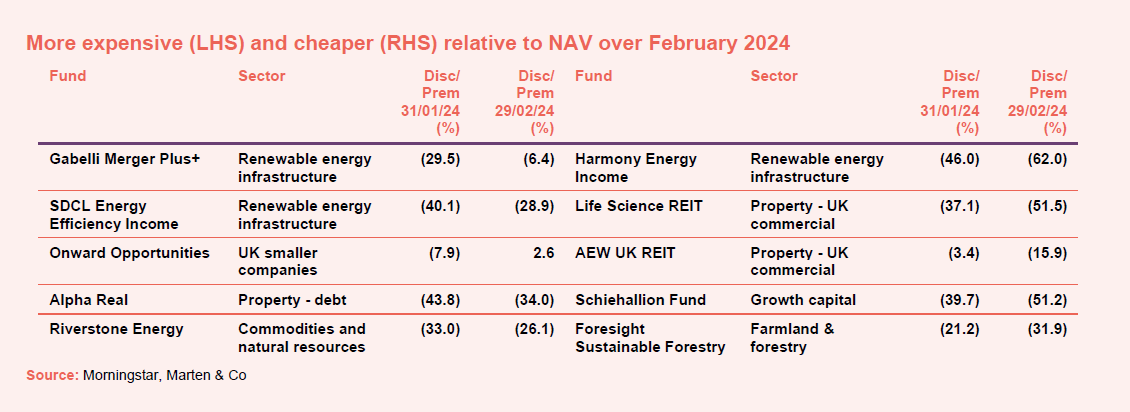

Moves in discounts and premiums

We have discussed many of these trusts already. Real estate debt lender Alpha Real Trust, which is a thinly traded stock with a market cap of around £83m, rose 17.6% following a large trade. Riverstone Energy announced a tender offer for its shares.

With respect to the cheaper shares, AEW UK REIT was another fund suffering from negative sentiment towards the UK property sector as higher than expected inflation pushed back the timeline for interest rate cuts.

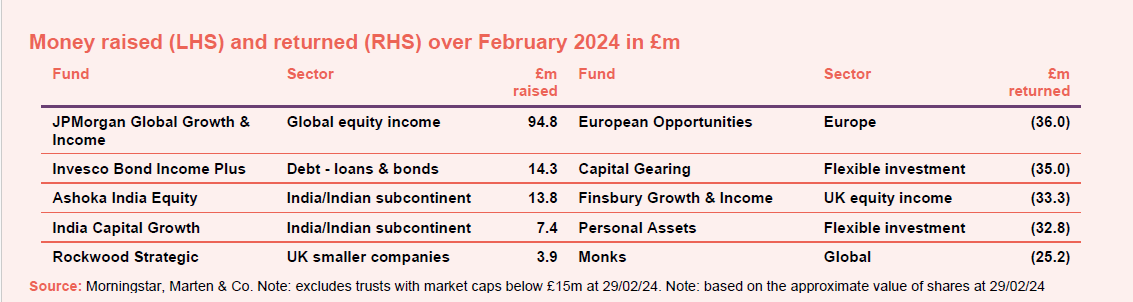

Money raised and returned

JPMorgan Global Growth & Income (JGGI), which regularly features in the list of top issuers, led the charge in raising new capital during February. In addition to its regular tap issuance, JGGI completed an oversubscribed placing, raising £34.5m in new capital form both retail investors and a large UK wealth manager. Invesco Bond Income Plus also completed a placing, raising £13.4m, while continuing its regular issuance, that is made possible by its premium rating. The two Indian funds are expanding on the back of strong performance from that market. Rockwood Strategic is re-expanding after posting strong performance last year.

Following on from its 25% tender offer in January, European Opportunities Trust has continued to buy back shares in the market as it tried to address its discount. The other four trusts that returned capital accelerated their buybacks over the month in an attempt to rectify their widening discounts, or defend target levels, with Finsbury Growth & Income making a second consecutive appearance in our list.

In addition, RTW Biotech Opportunities (RTW) completed its takeover of Arix Bioscience, issuing 181m new shares as part of the process. It was a similar story for JPMorgan UK Small Cap Growth & Income, previously known as JPMorgan Mid Cap, as it issued new shares after taking over its sister trust, JPMorgan UK Smaller Companies.

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Major news stories and QuotedData views over February 2024

| QuotedData views | |

| · VIP access at bargain prices | · Inflation scare |

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

Research

A number of factors have combined to have a small negative effect on Aquila European Renewables’s (AERI’s) net asset value (NAV) and the share price discount to NAV in recent weeks, including nerves about when interest rates will be cut, lower power prices, and the imposition of new taxes on renewables in Norway and Spain. These have added to the broader economic pressures that have weighed on the share price over the past year, but the adviser observes that these are now mostly de-risked. The entire renewable energy infrastructure sector has been affected by widening share price discounts to NAV and, for the most part, we believe this is entirely unjustified, having gone well past the mechanical impact of rising interest rates on the sector.

NextEnergy Solar Fund (NESF) is almost 10 years old. Since launch, it has built a £1.2bn, 933MW portfolio of 100 operating solar assets, powering the equivalent of over 330,000 homes, declared dividends totalling £333m, and avoided the emission of about 2.2 Mt CO2e. NESF is on track to pay 8.35p in dividends, with forecast dividend cover of about 1.3x. Share price weakness that has afflicted the whole sector means that dividend translates to a dividend yield of 11.1%, one of the highest in its sector, and the share price’s near 30% discount to net asset value (NAV) provides the prospect of attractive capital appreciation when sentiment towards the sector recovers.

At just over two years old, the Pantheon Infrastructure Trust (PINT) can claim to have seen a lot in its short life. Its positive net asset value (NAV) return over this period, despite increasingly challenging economic conditions, is a testament to the execution of the fund’s advisers, and the stability of its assets. Whilst the company’s share price has fallen, this is more a reflection of negative market sentiment towards the broader infrastructure sector than any fundamental weakness on the part of PINT.

Polar Capital Global Healthcare (PCGH) is, as we show on page 17, the leading performer within its peer group over the long term. Its managers’ high-conviction approach and good stock-picking skills have helped it navigate a period of relative underperformance by the healthcare sector. The managers feel that the sector is overdue a re-rating.PCGH’s managers point to the long-term trends that are driving growing demand for healthcare (see page 5).

2023 has been a particularly noteworthy year for Japan, defined by impressive share price returns (at least in yen terms) and substantial progress in its path to improving corporate governance. The Tokyo Stock Exchange has implemented a series of new efforts to name and shame the worst governance offenders (such as pressuring companies to keep their price to book (P/B) ratio over one). These efforts have already borne fruit, with Japanese equities outperforming even the US in local currency terms. AVI Japan Opportunities Trust (AJOT) has been reaping the rewards of its own activism, with an outperformance versus its benchmark index over the year.

After a tumultuous period of interest rate volatility (with the rapid rise in interest rates reflected in investment yields, causing values to fall), real estate has entered calmer waters. Asset values are stabilising and occupier markets remain supportive of rental growth. Tritax EuroBox (EBOX) is sailing in these waters too, as demonstrated by a portfolio valuation that has changed little and a 30% uplift in earnings that now fully covers its 8.6%-yielding dividend.

Appendix 1 – median performance by sector, ranked by 2024 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.