Share price out of sync?

Share price out of sync?

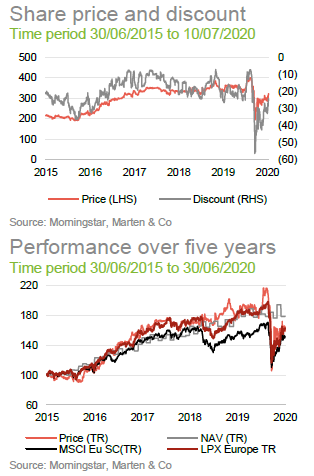

Private equity fund of funds, like Standard Life Private Equity (SLPE), have been on the periphery of the recovery in global stocks. Investors have attempted to anticipate the COVID-19 impact on net asset value (NAV), given the lag in valuing private companies, but have failed to reflect the rebound in markets. With its discount widening to nearly (25%), SLPE’s shares appear to have been penalised disproportionately.

Annualised returns over the past five years have been in the double- digits, while nearly half of SLPE’s portfolio is in the more resilient consumer staples, technology, and healthcare sectors. SLPE provides underlying company exposure to European success stories such as Action (non-food discounter) and TeamViewer (remote support software). The bulk of its primary fund commitments made over the past year or so have been to strategies with a strong tech-focus. SLPE is also one of the few listed private equity funds to have a specific dividend policy.

Private equity fund of funds with a European bias

Private equity fund of funds with a European bias

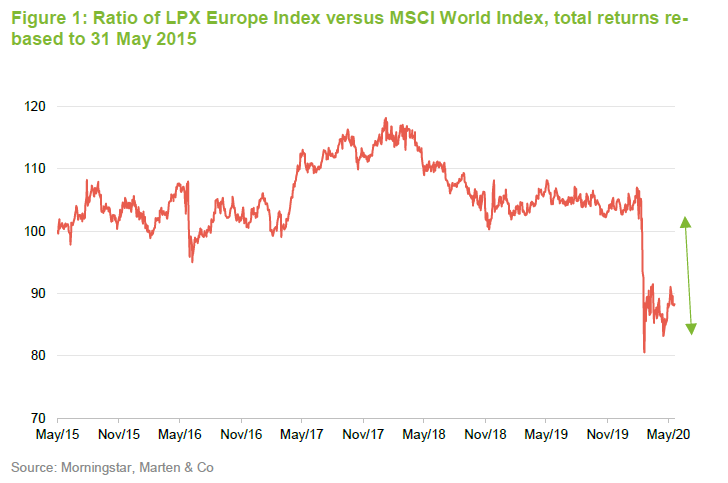

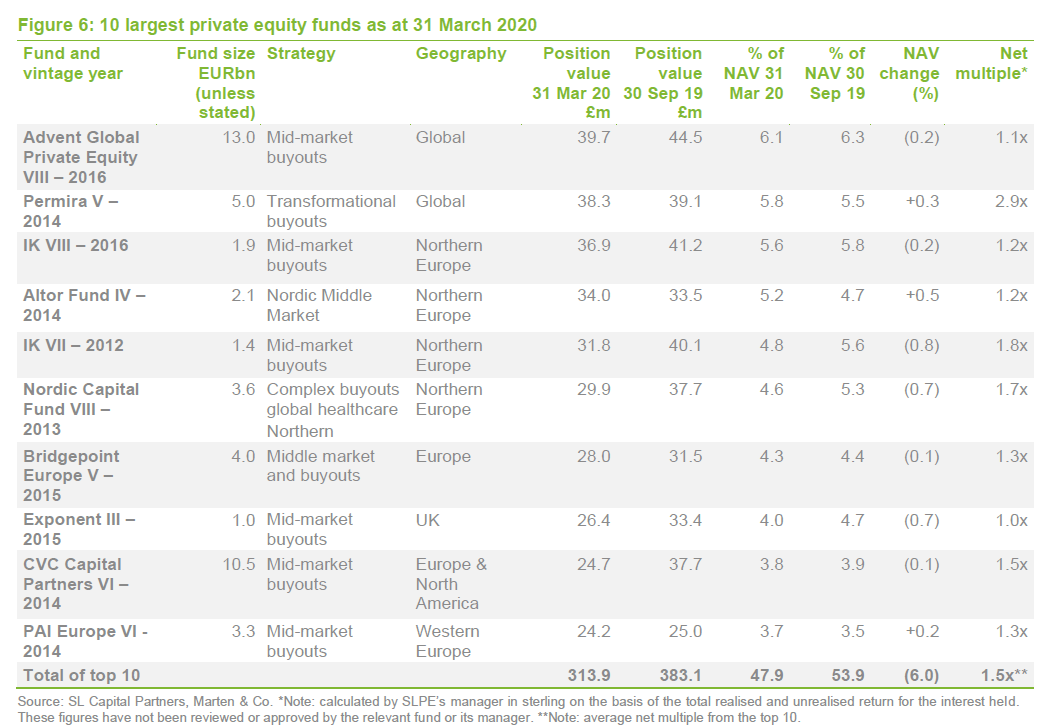

SLPE aims to achieve long-term total returns through a diversified portfolio of private equity funds, and direct investments into private companies alongside private equity managers (co-investments), the majority of which will have a European focus. Its portfolio is more concentrated than those of most of its peers; the top 10 underlying private equity funds accounted for 47.9% of NAV, as at 31 March 2020. Like many private equity funds, SLPE has no formal benchmark. Historically, the portfolio has been most-closely correlated to European small-cap indices.

Valuations to remain under pressure

Valuations to remain under pressure

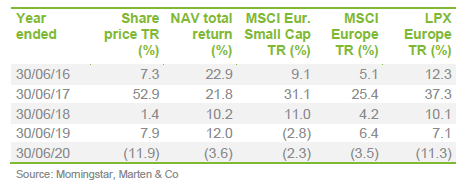

For most of the past five years, the LPX Europe Index (representing the performance of Europe-listed private equity companies) has outperformed the MSCI World Index. Until March this year, the normalised five-year returns (31 May 2015 = 100) of European-listed private equity funds had not been below the world index, for any length of time. The relative underperformance of listed private equity through the pandemic period reflects an attempt by the market to anticipate the ultimate impact on the value of unlisted companies.

SLPE’s lead manager, Alan Gauld, expects valuations to remain under pressure over the coming months, due to COVID-19. As with public markets, most of the impact has been felt by bricks and mortar-based businesses. Some of SLPE’s underlying company exposures have benefitted from the sea change, notably the remote working software platform, TeamViewer (see page 7 in the enclosed PDF version). Alan anticipates that valuations may suffer further falls over the coming months, ahead of SLPE’s financial year-end results to 30 September. Distributions (cash flows generated by the underlying funds) will inevitably slow, with the decline in merger and acquisition (M&A) activity making it harder for SLPE’s underlying managers to realise investments. Alan expects a slowdown in drawdowns (when the underlying managers draw on the capital committed by investors) as well, but this will take longer, for reasons that include underlying managers’ financing deals made before the outbreak of COVID-19 and capital injections into portfolio companies, where required.

Alan says that, encouragingly, most managers have not requested follow-on investments, to support existing portfolio companies. Where needed, most of the underlying European companies held by the third-party funds have been able to access state financing. In Spain, for example, where several sectors were shut by royal decree, there was more onus on the state to provide support.

Ultimately, the manager says, private equity is best judged over longer time periods. While SLPE’s managers will largely continue to focus on helping companies mitigate the pandemic’s impact, history has shown that private equity tends to perform very well through periods of market dislocation.

Not the great opportunity 2008 was

Not the great opportunity 2008 was

In hindsight, private equity, as an asset class, benefitted profoundly from the global financial crisis of 2008. Depressed valuations provided what was probably a once-in-a-lifetime opportunity for the buyout market to generate very strong returns. Alan says that the conditions for a repeat are not there this time. The valuation opportunity is not currently comparable, owing in part to the unprecedented recovery in the stock market since the March nadir. Alan also notes that these days, companies generally have much more covenant-lite balance sheets. The 2008 crisis is also still relatively fresh in the memory for many managers and the wider corporate world, so even with more attractive valuation opportunities available, the financial modelling would probably need updating. Alan adds that for those displaying creativity, opportunities will still present themselves over the coming months, for fund of funds managers, like SLPE, and the underlying funds they invest in.

Historically, private equity has shown its ability to adapt and deliver strong returns. The sheer volume of capital that was being committed to the industry (to a lesser extent in Europe versus the US), up to 2019, as we moved nearer the end of the economic cycle, reflected how well the industry had performed since 2008. The opportunity set accessible via private equity was being reinforced by the structural trend of companies staying private for much longer. Access to private funding, predominantly from private equity, drove this. As the world re-models itself through the pandemic, Alan says the industry will look to adapt to maximise returns from existing investments, and source new ones. He mentioned corporate carve-outs (selling minority stakes in existing businesses) and public to private transactions as two likely avenues.

Opportunities likely to re-appear in the secondary market

Opportunities likely to re-appear in the secondary market

Before the pandemic, the secondary market for private equity funds had become much less attractive. The buoyant exit market made it increasingly difficult to find value in acquiring secondaries, which was a factor behind SLPE introducing the capacity to make co-investments (direct investments into private companies made alongside a private equity manager). For more on co-investments please refer to our most recent update note – click here to access it.

However, as a result of the pandemic, Alan says that SLPE will pivot its focus to secondaries over the coming months. Though activity will clearly be lower in aggregate, opportunities to add quality funds to the portfolio, at distressed prices, are likely to appear. Whilst returns from secondary investments can appear lower when a multiple of cost is used, as the investor typically enters later in the process, we note that from an internal rate of return (IRR) perspective, typically shorter holding periods compared to primary investments can lead to relatively higher returns. For example, an equivalent return from a multiple of cost perspective, will always have a higher IRR if said return is generated over a shorter time period.

By comparison, Alan expects there to be little activity in the co-investment space over the rest of the year.

Asset allocation

Asset allocation

As at 31 March 2020, the portfolio provided exposure to over 400 underlying private companies, through 54 funds. Out of these funds, the top 10 funds account for 47.9% of NAV. These levels are seen by the manager as a sweet-spot, providing sufficient diversification, without overly diversifying away potential returns. SLPE predominantly makes primary commitments (the commitment to invest a specific sum in a new fund), though the secondary market (for stakes in existing rather than new funds) could provide some interesting value-based opportunities going forward.

SLPE tends to work with underlying managers whom it knows and trusts, making use of relationships that have been cultivated over many years. We note that as at 31 March 2020, over 70% of the fund’s NAV was attributable to 17 core managers.

As Figure 3 illustrates, 45% of the portfolio is in funds over four years old. In ordinary circumstances, these funds would be nearing their ‘exit zones.’ The pandemic is clearly going to have a material impact on distributions by SLPE’s underlying managers, over the near-term at the very least. Alan believes that having a sizeable chunk of the portfolio nearing maturity will be an advantage, once the exit environment returns to something approaching normality.

We note that as at 31 March 2020, investments that were five years or older, were valued at an average multiple of 2.0x. This compares with a multiple of 2.9x at the last financial year-end. The difference can be attributed to a mix of realisations since, most notably from 3i Eurofund V, which held Action (www.action.com), at a high multiple (see below), and the pandemic’s initial impact on valuations. As a result of the Eurofund V transaction, SLPE realisation multiple for the interim period was 5.0x.

Northern and Western Europe make up more than 75% of the portfolio. SLPE’s manager expects to see the allocation to the US continue to move up gradually over time, perhaps up to around 20% of the portfolio, aided by the additional resource that the combined ASI team has dedicated to this area.

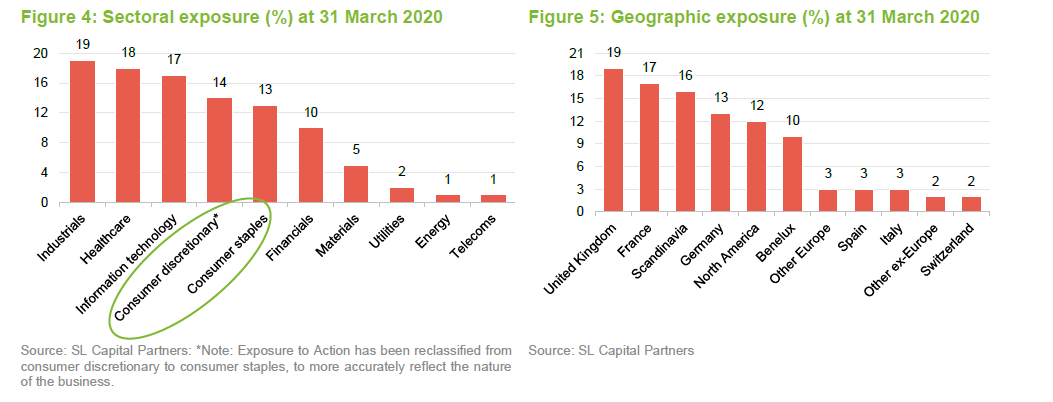

With respect to the sector mix, illustrated by Figure 4, readers of our previous notes on SLPE will note the lower weight attributed to discretionary consumer spending. Over the most recent interim period, SLPE re-classified Action, a highly successful non-food discount retail business, with a core presence across the Benelux, French and Germanic markets, from the consumer discretionary to consumer staples. Alan believes the business is more appropriately considered a staple, given that more than half of its sales can be classified under essential goods. Although Action does not operate an online sales channel, lower footfall, during the pandemic, has been balanced out by higher spending per visit.

More broadly, fund allocation decisions over recent years have seen the sector exposure shift more towards higher growth areas, such as information technology and healthcare, which have been and appear set to continue to perform resiliently in the current and post-pandemic world. As at 31 March 2020, the relatively more resilient consumer staples – information technology and healthcare sectors – accounted for 48% of SLPE’s portfolio. Alan expects the negative impact on COVID-19 to be disproportionately felt by the consumer discretionary and industrials sectors, which most recently were 33% of the portfolio. However, he notes that pockets of success, such as ecommerce, makes it difficult to apply a broad brush approach.

Top 10 fund exposures

Top 10 fund exposures

Near-term changes in allocations tend to be driven by realisations and the pace of reinvestment. Over the most recent interim period to end-March, the most notable change within the largest fund allocations was 3i Eurofund V dropping out of the top ten. In November 2019, a transaction was announced that saw the Eurofund V realise its investment in Action. The acquiring party was the wider 3i Group, taking its ownership to around 80%.

Eurofund V realised over 30x its initial investment in Action, in what is regarded as one of the most successful European private equity buyouts ever. SLPE realised £51.1m from the transaction (over 5x its investment), which it followed up by re-investing £22.6m back into Action, in a co-investment, with the 3i Venice Partnership. In doing so, material exposure to a company with still-attractive growth prospects was maintained, while bringing down the size of the investment as a percentage of NAV to a level more in proportion with the other top underlying company exposures (see Figure 7).

The 3i fund was replaced in the top-10 by PAI Europe VI (2014 vintage). The fund targets the upper mid-market and is mainly active in the healthcare, business services, consumer staples, industrials, and retail sectors.

Top 10 underlying company exposures

Top 10 underlying company exposures

Figure 7 illustrates SLPE’s top 10 underlying company exposures at 31 March 2020 and how these compare against 30 September 2019. The largest company in the portfolio continues to be Action (discussed above).

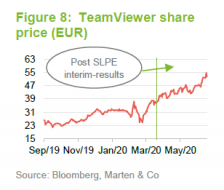

Remote support software TeamViewer (www.teamviewer.com), held via Permira V, will likely see its contribution to NAV continue to rise, given just how much its model is suited to the work-from-home environment, which is likely to be a long-lasting structural trend.

TeamViewer offers a software solution that is easy to install and use, which incorporates remote access administration, multi-user web-conferencing, desktop, and file sharing. Permira exited 42% of its holding last September, with a Frankfurt-listing that valued the TeamViewer at €5.3bn. It was the 2019’s largest European IPO at the time and one of the largest European software IPOs in history. We note that as at 10 July 2020, TeamViewer’s shares had increased by more than 50%, since 31 March 2020.

New entrants to the top 10, over the interim period, include Froneri, Colisee, Signature Foods and Benvic:

- Froneri (froneri.com) – Froneri is a global ice cream manufacturer, with market leadership across branded and private label ice cream. SLPE is attracted to the resilience of the sector and Froneri’s high cash generation.

- Coliseé (groupecolisee.com) – Coliseé is involved in the elderly care sector, mainly in France, Italy and Spain. It has expanded to China too. The company is a major provider of services within nursing homes and homecare.

- Signature Foods (signaturefoods.com) – previously known as Salad Signature, Signature Foods is a leading branded and private label manufacturer of spreads, dips and salads. The company holds a market leading position in the Benelux region, and more recently has been expanding its presence in Northern Europe, in markets including France, Germany and the UK.

- Benvic (benvic.com) – based in France, Benvic is active across the development, production and marketing of polyvinyl chloride (PVC)-based thermoplastic solutions. PVC is one of the world’s leading synthetic plastic polymers. Benvic’s products are used across many industries, including construction, automotive, aerospace and packaging and the transport of fluids.

Readers interested in more information on some of the other names within SLPE’s top 10 underlying should see our previous notes, where many of these have been discussed (see the ‘previous publications’ section). For example, Mademoiselle Desserts (SLPE’s first co-investment – an investment of €6m, made alongside IK Investment Partners) and R1 RCM were discussed in our May 2019 note.

Tech-focus dominates primary commitments six-months to 31 March 2020

Tech-focus dominates primary commitments six-months to 31 March 2020

As at 31 May 2020, SLPE had net assets of £657.5m, including outstanding commitments of £457.6m and a cash balance of £57.7m. A £100m credit facility also remains undrawn.

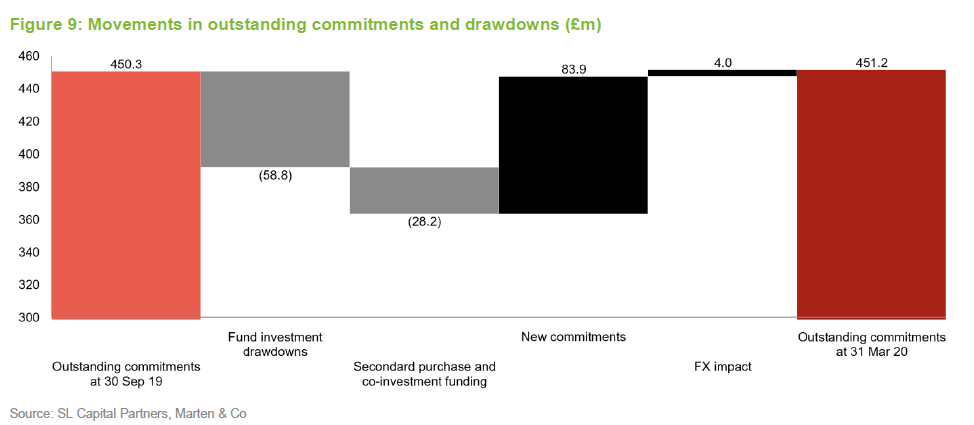

We note that over the six months to 31 March, four primary fund commitments were completed, as well as one secondary transaction and the aforementioned Action co-investment. Cumulative new commitments amounted to £83.9m – the movement in drawdowns and commitment are summarised in Figure 9.

Out of the four new primary commitments, £37.4m was allocated to European-focused funds and £17m into those focused on the US. These are summarised as follows:

- Hg Saturn 2 (£12.2m committed) – a $4.9bn fund that invests mainly in the upper midmarket, with an emphasis on large software companies based in Europe and US.

- Hg Genesis 9 (£13.8m committed) – a €4.4bn fund that targets mid-market software and tech-enabled services businesses based in Europe.

- Hg Mercury 3 (£11.4m committed) – a circa €1.3bn fund investing in lower mid-market software and tech-enabled services businesses based in Europe.

- Seidler Equity Partners VII (£17m committed) – an $800m fund focused primarily on lower mid-market North American companies. We note that SLPE has steadily been increasing primary commitments in the US. Previously, US exposure was generally delivered through Europe-based managers or global groups.

The one secondary transaction over the interim period was a £6.7m investment in PAI Special Partnerships. It was created following a secondary transaction involving the two remaining assets in PAI Europe V, notably Froneri.

Performance

Performance

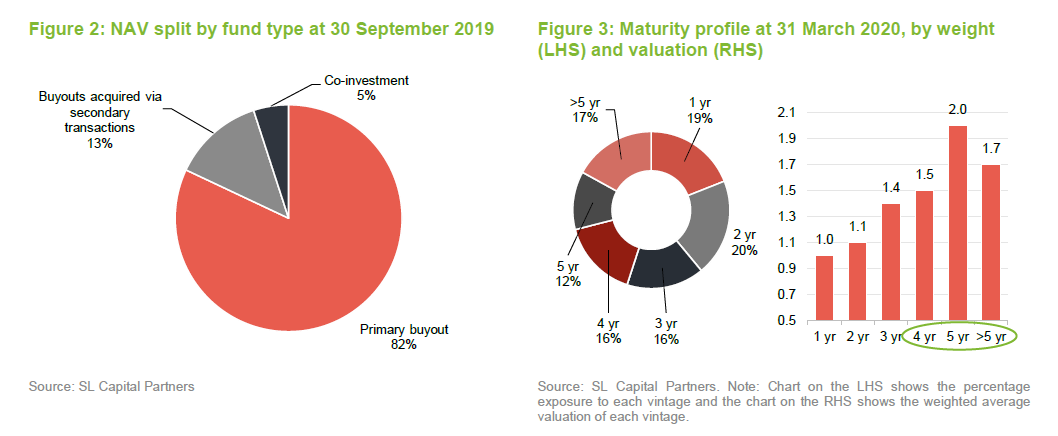

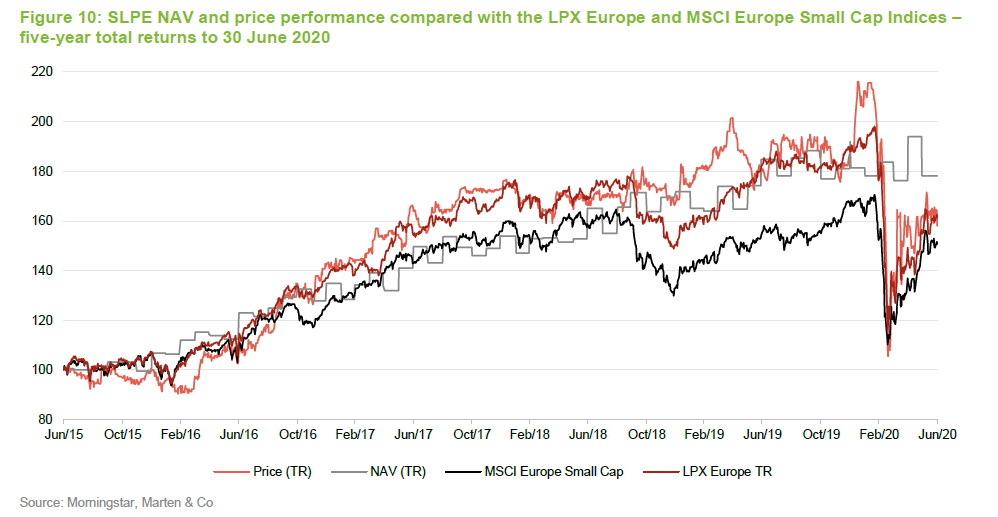

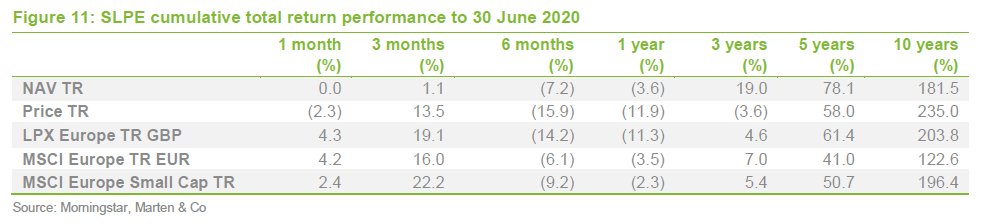

In NAV and share price total return terms, over the five years to 31 May 2020, SLPE has comfortably outperformed the LPX Europe, MSCI Europe, and MSCI Europe Small Cap indices. SLPE’s shares have underperformed the MSCI Europe Small Cap index over one, three and six months, as well as over one year.

On an annualised basis, over the five years to 30 June 2020, we note that SLPE delivered total NAV and share price returns of 12.2% and 9.6%, respectively. The LPX Europe index returned 10.0%, over the same period.

Results for the interim period to 31 March 2020

Results for the interim period to 31 March 2020

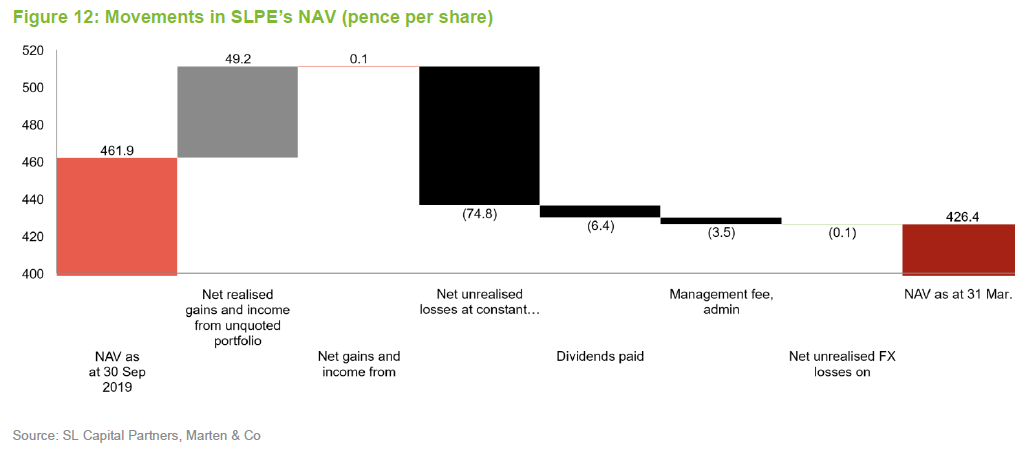

Over the six months to 31 March 2020, SLPE delivered an NAV total return of (6.3%). This was the first quarter where the impact of the pandemic fed through to the portfolio, where there was a (12.5%) valuation impact, without taking currency moves into account. Given the lagged impact on NAV, as the pandemic’s impact on the values of unlisted companies flows through to the managers of the underlying funds (general partners), Alan expects valuations to continue to be negatively impacted by COVID-19 over the second half of the financial year. The impact is difficult to estimate, at this stage. We note that the pandemic impact on earnings, across the underlying companies, is likely to be materially offset by the increase in market comparable valuations, as a result of the broader rally in equities since. The contributors and detractors to NAV, over the interim results period, are illustrated in Figure 12 below.

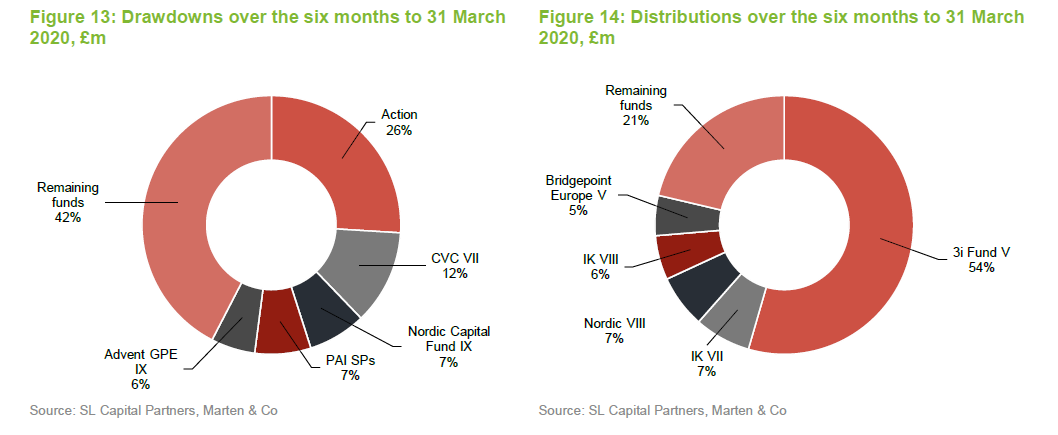

Realisations over the interim period amounted to £93.8m, mainly attributable to 3i Eurofund V, which held Action. Figures 13 and 14 highlight the main moves in drawdowns and distributions, over the period to 31 March. Distributions will continue to slow over the coming months. Excluding the Eurofund V realisation, SLPE’s realised return multiple was 2.3x cost.

Drawdowns totalled £87m over the same period, so SLPE was a net seller over the period, based on the difference between aggregate drawdowns and distributions.

Whilst it expects activity around new primary commitments to slow over the coming months, drawdowns are expected to continue at a fairly typical pace as the underlying managers pay down their credit facilities over the normal course of business. Drawdowns will then begin to slow down, in line with declining global M&A activity.

Peer-group

Peer-group

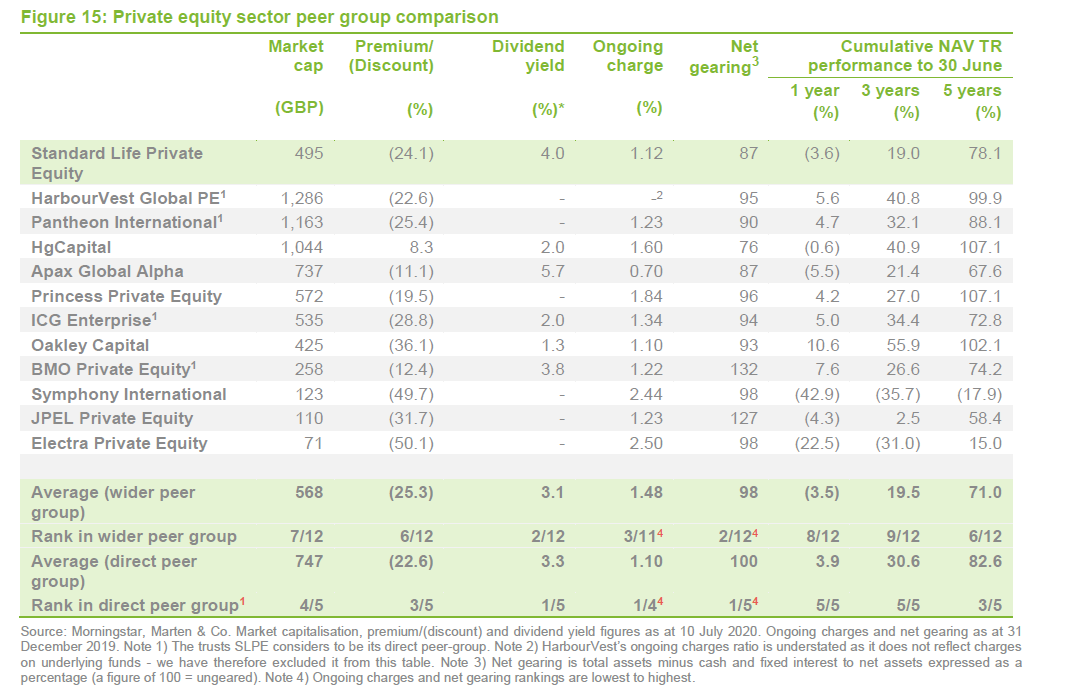

SLPE is a member of the AIC’s private equity sector, which comprises some 23 members. However, for the purpose of this analysis, we have narrowed down the wider peer group to 12 funds. 3i Group is among those excluded, as it considers itself to be an asset manager. It also has investment interests extending beyond private equity.

As illustrated by Figure 15, we have also included rankings against a subset of fund of funds that SLPE considers to be its direct peer group: HarbourVest Global Private Equity, Pantheon International, ICG Enterprise and BMO Private Equity. While SLPE’s total returns appear lower than some of its peers over a one year period, we emphasise that the impact of COVID-19 is feeding through to the NAVs of funds at different points in time. SLPE has proactively revised down the value of some of its fund holdings, in cases where the underlying managers had yet to do so. Not all the funds listed in Figure 15 have adopted the same approach.

Given that SLPE’s, and indeed the wider sector’s strategies, are inherently longer-term and SLPE’s indefinite life structure, the five-year figures arguably provide a better basis for comparison. Here, SLPE has delivered the third (out of five) and sixth best (out of 12) returns against its direct and wider peer groups. Longer time periods can provide a more accurate representation of the realised returns generated.

SLPE’s ongoing charges ratio of 1.1% is the lowest of its direct peer group and competitive versus the wider peer group. We note that SLPE is the only fund, among those listed in Figure 15, whose manager does not levy a performance fee, in addition to performance fees paid out to third-party managers. SLPE’s ongoing charges are lower than funds that are more than twice its size, in market cap terms.

SLPE’s dividend yield at 4.0% is above the wider peer average of 3.1% (six of members of the wider peer group do not provide a yield at all). SLPE’s yield is also the highest within its direct peer group.

Notwithstanding the pandemic’s wider impact on valuation and exit schedules across the industry, cushioned more recently by the rising value of market comparables, SLPE’s discount does appear steep, relative to its peers. Few match its five-year return record, while its yield and ongoing charges also compare favourably. Finally, at the end of 2019, SLPE held net cash of around 13%, which only HgCapital bettered.

Dividends

Dividends

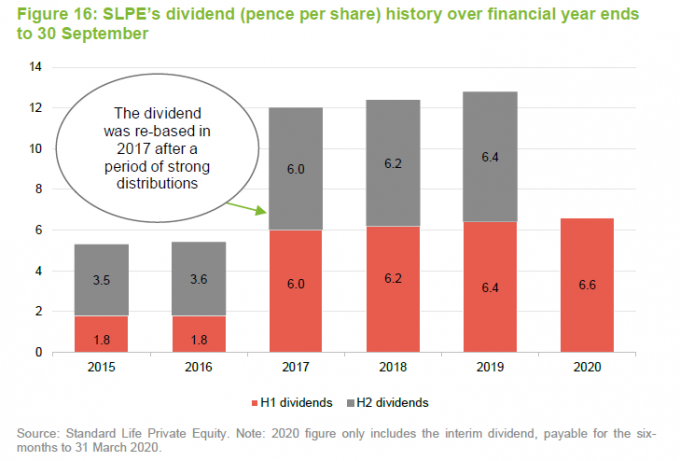

As noted above in the peer group section, many of SLPE’s peers do not pay a dividend. SLPE’s dividends are paid on a quarterly basis – the fund has historically aimed to retain the real, inflation-adjusted, value of the total annual distribution. As at 10 July 2020, SLPE’s shares were yielding 4.0%, on a trailing basis.

In April, SLPE paid out the first interim dividend, of 3.3p, for the current financial year. A second interim dividend of 3.3p will be paid out in July, with the 6.6p aggregate figure for the first half of the year ending 30 September, representing a 3.1% year-on-year increase. However, given ongoing uncertainty surrounding the outlook for distributions and realisations by general partners over the rest of the calendar year, SLPE’s board has said that it is reviewing its ability to fund the remaining dividend for the rest of the year, to what would have been the expected level at the beginning of 2020.

Referring to Figure 16, we note that the dividend was re-based to 12p for the year ended 30 September 2017 in order offer a much higher yield. Readers interested in more detail on the revised dividend policy can access our July 2018 annual note.

Premium/(discount)

Premium/(discount)

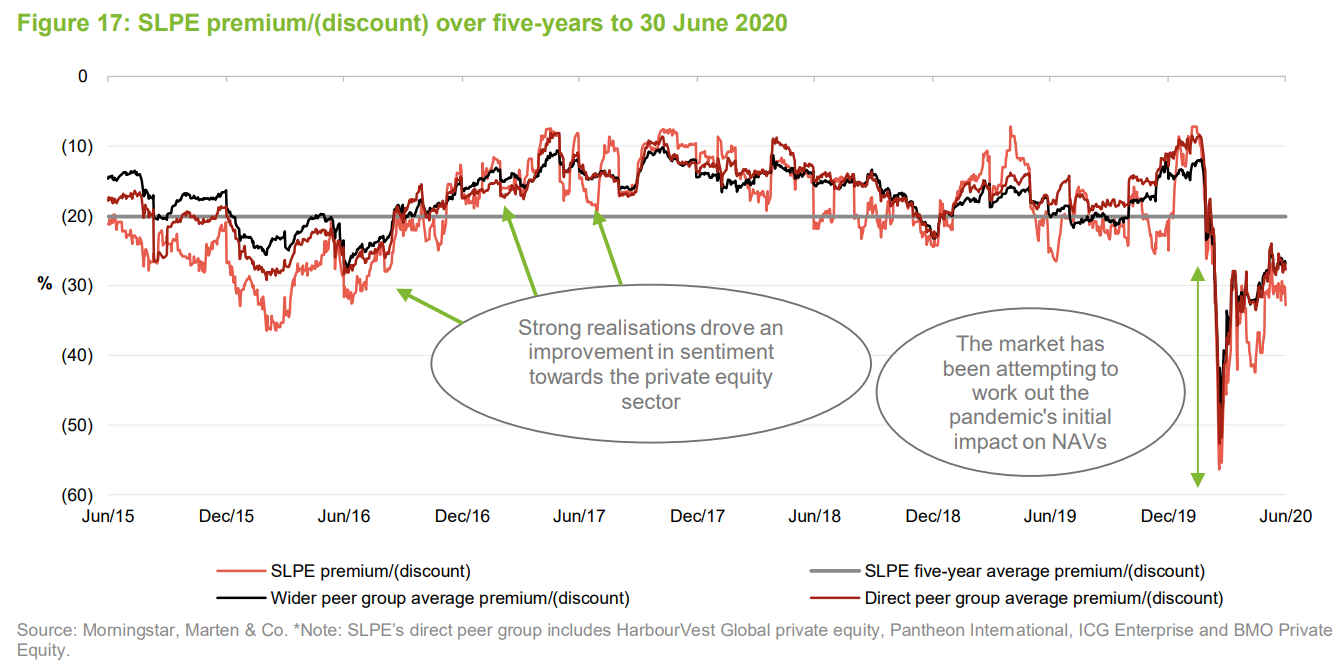

SLPE’s discount has historically been subject to fairly large fluctuations, though the past few months have clearly been unprecedented. As at 10 July 2020, SLPE was trading at a discount of (24.1%), about 4% below its five-year average. The relatively subdued performance of SLPE’s shares and that of the wider AIC private equity sector, over the quarter-ending 30 June, reflected the market’s attempt to work out the pandemic’s initial impact on NAVs. The NAVs of private equity fund of funds, like SLPE, are typically reported on a monthly basis, so there is some lag. This is led by the managers of the underlying funds.

Within the AIC universe, private equity has been among the hardest hit over recent months. It takes a while for changes in the valuation of unlisted companies to flow through. SLPE expects the impact of the pandemic on the turnover, income generation and balance sheet of portfolio companies, to become much clearer over the coming months.

SLPE retains the authority to repurchase up to 14.99% of it issued share capital, which is renewed annually. Given the importance of maintaining adequate cash flow, the board works closely with SL Capital in managing the buyback process. The trust has not repurchased any shares since August 2016. Most recently, the board’s view was that it would not have been prudent to intervene over recent months, given the unprecedented level of volatility. The board noted in June that it would review the case for buying back shares once market conditions normalise and the valuation impact on SLPE is clearer.

Fund profile – underlying focus on primary commitments and Europe

Fund profile – underlying focus on primary commitments and Europe

SLPE invests in what it deems ‘best-in-class’ private equity funds; predominantly by making primary commitments, with a core focus on the European mid-market. The aim is to maintain a broadly diversified portfolio by country, industry sector, maturity, and number of underlying investments.

Historically, SLPE has been a fund of funds, making both primary and secondary investments but, in January 2019, shareholders approved changes to SLPE’s investment objective and policy that allow it to make co-investments (see pages 2 and 3 of our May 2019 note for more details). SLPE has completed two co-investments to date: 1) investing in France-based Mademoiselle Desserts in 2019, alongside IK Investment Partners (see page 9 of our May 2019 note for more details) and 2) re-investing proceeds from a distribution into Action (see page 6 in the enclosed PDF version).

SLPE’s objective is to hold around 50 ’active’ private equity fund investments. This allows for a greater diversification within the funds element, which counter-balances the additional concentration risk from the increasing allocation to co-investments (which is permitted to account for up to 20% of NAV).

Previously, SLPE previously made commitments in the £40m–£50m range, but this has reduced over time and £20m–£25m will be a more typical range going forward.

Aberdeen Standard Investments has £10.7bn of private equity assets under management

Aberdeen Standard Investments has £10.7bn of private equity assets under management

SLPE is managed by Aberdeen Standard Investments (ASI), which as a group manages £486.5bn of assets (as at 31 December 2019) across 80 countries. ASI is one of the top ten largest private market asset managers globally by assets under management (AUM), with a team of more than 100 professionals focused on private markets. Within private equity specifically, ASI manages £10.7bn of assets, as at May 2020.

Alan Gauld is now the lead manager

Alan Gauld is now the lead manager

SLPE’s lead manager is Alan Gauld, an investment director in the private equity team at ASI. Alan succeeded Merrick McKay, ASI’s head of European private equity. Alan is supported by Patrick Knechtli (secondaries), Mark Nicolson (primaries), Simon Tyszko (investment manager), and Ramone Moody (investment analyst) with backup coming from the rest of ASI’s private equity team (which has 41 investment professionals).

Alan focuses on buyout funds, co-investments, and secondary investments. His fund portfolio includes a mixture of pan-European and mid-market French and Iberian funds, where he is involved in sourcing, appraising, and executing investments as well as portfolio monitoring. Alan is a qualified chartered accountant and holds a BSc (Hons) in Genetics from the University of Edinburgh.

Previous publications

Previous publications

Readers interested in further information about SLPE may wish to read QuotedData’s previous notes. You can read the notes by clicking on them in the links below.

- Sitting in a sweet spot – Initiation – 10 May 2016

- Reinvestment phase underway – Update – 14 September 2016

- Dividend doubled to 4.0% – Update – 22 February 2017

- Loading the portfolio – Update – 3 July 2017

- A good year; more to come? – Update – 8 December 2017

- Putting capital to work – Annual overview – 17 July 2018

- Now with co-investments – Update – 29 May 2019

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Standard Life Private Equity Trust PLC.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.