Temple of performance

Temple Bar Investment Trust (TMPL) is continuing to deliver for its shareholders. Over each of the past three years, both its NAV and share price total return have been ahead of the UK market and global equities, as well as the closest comparator, the MSCI UK Value Index.

This marked outperformance has been achieved by the managers, Ian Lance and Nick Purves, staying true to their core investment philosophy. While this is rooted in a deep belief in value investing, more importantly it means identifying companies that have a credible path to recovery, rather than just simplistically targeting beaten-up stocks in the hope that they will eventually return to par. There is clear potential for this trend of outperformance to continue. Absolute valuations across the market remain low, but more importantly, Ian and Nick still see numerous opportunities to invest in individual companies.

We welcome TMPL’s adoption of a new dividend policy that reflects the increasingly important role of share buybacks in returns. Future dividends will be enhanced to reflect a portion of the buybacks of those companies held by the trust.

UK equity income and capital growth

TMPL aims to provide growth in income and capital to achieve a long-term total return greater than its benchmark (the FTSE All-Share Index), through investment primarily in UK securities. The company’s policy is to invest in a broad spread of securities, with the majority typically selected from the FTSE 350 Index.

| 12 months ended | Share price total return (%) | NAV total return (%) |

MSCI UK total return (%) | MSCI UK Value TR (%) |

MSCI World TR (%) |

|---|---|---|---|---|---|

| 30/04/2021 | 57.1 | 50.9 | 20.8 | 21.4 | 18.6 |

| 29/04/2022 | 4.2 | 4.6 | 15.6 | 19.5 | 8.4 |

| 28/04/2023 | 9.1 | 9.0 | 7.8 | 7.7 | 8.2 |

| 30/04/2024 | 14.5 | 14.8 | 8.2 | 9.3 | 5.2 |

| 30/04/2025 | 19.7 | 14.0 | 8.1 | 9.7 | 5.7 |

Highly volatile markets, but TMPL has shone

Donald Trump’s tariffs have caused extreme volatility this year, but TMPL has continued to perform very strongly.

Markets have been on a rollercoaster ride so far in 2025. Initially, there was a continuation of the optimism seen after the decisive US presidential election result, on hopes that President Trump would prioritise the cutting of taxes and regulation to the benefit of businesses. However, this soon gave way to growing concerns about tariffs and trade. After an initial skirmish with Canada and Mexico, these worries turned to panic on “Liberation Day” on 2 April as Trump announced a baseline 10% tariff for all countries, and additional reciprocal levies, the levels of which were calculated based on bilateral deficits with the US.

A week later, the dramatic fluctuations in equity, currency and bond markets eventually prompted a 90-day pause from the White House on the additional tariffs above the base line 10% level (excluding China, which was hit with punitive tariff levels in response to its retaliatory measures). Since then, the administration has focused on securing bilateral trade agreements; the first to be announced was with the UK, while a much more significant agreement with China saw tariffs on both sides reduced from the eye-watering levels above 100% that they had reached.

What happens from this point is unclear to everyone – probably including the president himself. Nonetheless markets have generally returned to a sanguine mood, with the S&P 500 erasing all of its losses since 2 April, albeit still being below its recent high in February.

Figure 1: Markets year-to-date to 30 April 2025, indices rebased to 100

Source: Bloomberg, Marten & Co

Although this period of higher volatility has not been helpful for any except the most risk-averse managers, it has nonetheless been relatively advantageous for value investors. The sell-off was particularly pronounced in growth-oriented sectors, led by the “Magnificent Seven” technology behemoths in the US, with companies with relatively higher earnings in the present appearing more attractive. This has been helpful for the UK market, which, after some difficult recent years, has outperformed the US and global indices (which are dominated by US equities). For example, the MSCI UK Index returned 4.1% in the first four months of the year, against a fall of 5.3% for the S&P 500.

Against this more favourable backdrop for value stocks, TMPL performed very strongly. During previous periods when value was out of favour, Ian and Nick focused on their strategy of investing in companies at heavy discounts that were well positioned to recover with the right catalysts. As is covered in detail in the Performance section starting on page 7, this approach has recently paid off for TMPL.

Ian and Nick generally look to take advantage of periods of market volatility, as opportunities are presented when investors overreact. On this occasion, however, the recovery was so swift that few such opportunities emerged. Nonetheless, they did still take advantage at the margins, for example by adding to the new holding of Johnson Matthey (see below) on short-term weakness.

Asset allocation

TMPL’s overall sector allocation has remained relatively stable since our last note (which used data from 30 September 2024). Financials remain the largest sector, accounting for three of the four biggest holdings, and five of the top 10. There has been particularly strong performance from the likes of Barclays, NatWest, Standard Chartered and Aviva. The managers used this strength as an opportunity to trim some of the holdings, hence the slight overall reduction in the sector’s allocation. This capital was redeployed into stocks that had been oversold, notably the new holdings of Macy’s and Johnson Matthey (see page 6).

Figure 2: TMPL sector distribution as at 30 September 2024

Figure 3: TMPL sector distribution as at 30 April 2025

Source: Temple Bar Investment Trust

Source: Temple Bar Investment Trust

Gearing

TMPL’s gearing was 5.7% as at 30 April, down from 6.7% at the time of our last note in October 2024.

Top 10 holdings and recent additions

Figure 4: Top 10 holdings as at 30 April 2025

| Holding | Sector | % of portfolio 30/04/25 |

% of portfolio 30/09/24 | Change (%) |

|---|---|---|---|---|

| Shell | Oil & gas | 5.0 | 5.7 | (0.7) |

| NatWest | Financials | 5.0 | 5.7 | (0.7) |

| Aviva | Financials | 4.9 | 4.4 | 0.5 |

| NN | Financials | 4.8 | 4.1 | 0.7 |

| ITV | Communications | 4.7 | 4.9 | (0.2) |

| Barclays | Financials | 4.6 | 5.3 | (0.7) |

| Marks & Spencer | Consumer Staples | 4.0 | 4.0 | – |

| BP | Oil & gas | 4.0 | 4.6 | (0.3) |

| Standard Chartered | Financials | 3.6 | – | N/A |

| Johnson Matthey | Materials | 3.5 | – | N/A |

| Total of top 10 | 49.0 | 38.7 | 10.3 |

TMPL’s top 10 positions account for very nearly half of the portfolio, which is slightly more concentrated than when we published our last note in October. Johnson Matthey is a new holding in the portfolio, while Standard Chartered has moved from just outside the top ten to just inside. The two names to drop out of the top 10 were Anglo American and TotalEnergies, in keeping with the reduction in the portfolio’s exposure to the energy sector, as per Figure 3.

We wrote about the investment case for Standard Chartered in some detail in our last note. Since then, the shares have performed very well, and Ian and Nick have taken some profit by trimming the position.

Johnson Matthey

Figure 5: Johnson Matthey (GBp)

Source: Bloomberg

Johnson Matthey (matthey.com) is a new purchase by Ian and Nick, and their conviction in the company is shown by its immediate appearance within the top 10 holdings. The chemicals company is listed in the UK, but serves markets across the globe. In recent years it has focused increasingly on sustainable technologies, and operates through four primary segments: clean air, platinum group metals services, catalyst technologies and hydrogen technologies.

Some of these segments have been challenged, and the TMPL managers believe that the company has not been run to its full potential. The clean air business currently makes a 10% margin, when the company’s competition makes double that figure. Furthermore, as a c.£2bn market cap company, they feel that Johnson Matthey is simply too small to compete effectively in hydrogen, an inherently uncertain market, and they believe that a strategic exit is required, for example through a joint venture. If these two areas can be addressed, the company’s EPS could rise significantly.

The presence of a vocal activist shareholder on the register could be the catalyst for these changes in the managers’ view. US-based Standard Investments holds an 11% stake in the company and has been highly critical of Johnson Matthey’s management; this pressure has already led to changes such as the announcement from the chairman that he will step down later this year.

Johnson Matthey is a useful example to illustrate Ian and Nick’s approach of identifying a company whose price has fallen precipitously from its past high but where the issues can be identified and there is a clear path for these to be addressed to the benefit of shareholders.

Macy’s

Figure 6: Macy’s (US$)

Source: Bloomberg

Whilst not yet a top 10 position, a notable new addition to TMPL’s portfolio is US department store Macy’s (www.macys.com). Bricks-and-mortar retail – particularly department stores – has struggled under the weight of online competition, though the shift has been less aggressive in the US than in some places. Macy’s has not delivered profit growth, but it remains highly cash-generative. Unfortunately, capital allocation has been poor. With the shares trading at just 4–5x earnings, cutting capex and buying back stock could unlock significant value.

The company was the subject of takeover interest for much of the first half of 2024, with a final bid of $24.80/share valuing it at $6.9bn. The board walked away from negotiations in July, citing undervaluation, but the shares have since halved, casting doubt on management’s strategy and opening the door to a renewed bid. Any fresh approach may find greater traction.

M&A activity

Ian and Nick are clear – takeover speculation alone is not enough to justify an investment. Even so, M&A can give performance a lift. Four of TMPL’s holdings attracted bids in 2024, underlining the value in the portfolio.

EP Group’s £3.6bn takeover of International Distribution Services, the parent company of Royal Mail, has now received shareholder approval, following earlier sign-off from the UK government, which retains a “golden share” with key veto rights.

After rejecting earlier bids from the Belgian insurer Ageas, Direct Line eventually reached an agreement with Aviva in December on a £3.7bn deal, which came at a 73% premium to the undisturbed share price. The deal is under review by the UK’s Competition and Markets Authority, with initial findings expected by July.

Anglo American was the subject of several bids from BHP, the world’s largest mining company. Anglo’s board rejected these as undervaluing the company’s prospects and BHP announced it had withdrawn from the process in May.

The UK’s leading electronics retailer, Currys, was the subject of takeover interest from US private equity firm Elliott Advisors and the Chinese e-commerce platform JD.com, with the former making two firm bids, the highest at 67p. Both were withdrawn after opposition from Currys’s board. The board’s position has since been validated, with shareholders enjoying a rally from under 50p before the takeover talk to over 120p at the time of writing.

M&A activity has been more subdued in recent months, reflecting heightened market volatility – much of it stemming from Trump’s unpredictable policy stance. Closer to home, the Labour government’s autumn budget – seen as business-unfriendly due to higher employer NICs – has not helped, either. This quieter period may persist for the rest of the year.

Performance

TMPL’s performance continues to be compelling on both an absolute and a relative basis. The current Redwheel management has extended the NAV total return since taking over in November 2020 to 135%, with a share price return of 145%.

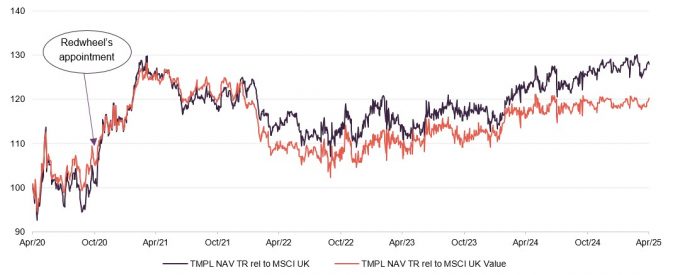

Figure 7: Temple Bar NAV relative to MSCI UK and MSCI UK Value (sterling TR) to 30 April 2025

Source: Morningstar, Marten & Co

The returns of the previous manager, which targeted a deep-value strategy in a period that was dominated by growth stocks, have largely fallen out of the five-year figures. Ian and Nick have outperformed the benchmark MSCI UK Index over all of the periods that come under their tenure in Figure 8. Furthermore, they have also outperformed the narrower MSCI UK Value index that better reflects their deep-value style. This outperformance illustrates the skill of the managers, in identifying companies that are unfairly undervalued by the market and have a credible path to recovery.

Ian and Nick report that the current portfolio remains at a discount to the UK market, at a weighted average of around 9x earnings, even with UK stocks being very lowly-rated. As such, there remains considerable upside for the portfolio from here.

The past year has been a decent period of outperformance by TMPL’s NAV, with even better share price performance reflecting a narrowing (and close to elimination) of the discount during the year.

Figure 8: Total return performance over periods ending 30 April 2025

| 3 months (%) |

6 months (%) |

1 year (%) |

3 years (%) |

Manager tenure1 (%) | 5 years (%) |

|

|---|---|---|---|---|---|---|

| TMPL share price | 6.4 | 15.2 | 19.7 | 50.0 | 152.4 | 144.8 |

| TMPL NAV | 0.6 | 8.4 | 14.0 | 42.3 | 135.4 | 125.1 |

| MSCI UK | (0.4) | 6.9 | 8.1 | 26.6 | 85.7 | 76.0 |

| MSCI UK Value | (1.0) | 7.4 | 9.7 | 29.7 | 106.1 | 87.3 |

It is worth looking in a little more detail at some of the existing holdings that have contributed to performance or have had significant newsflow in recent months.

Barclays

Figure 9: Barclays (GBP)

Source: Bloomberg

Barclays (home.barclays) exemplifies the recent success TMPL has had with its financials holdings. In February 2024, at a share price of 140p, the P/E ratio stood at a very lowly 4x. This made share buybacks a highly attractive way of enhancing shareholder returns, which Barclay’s board took advantage of through a £1bn programme up to the end of July and a further £750m to the end of the year. This was as part of a broader strategy to return at least £10bn to shareholders through a combination of share purchases and dividends between 2024 and 2026. These proactive measures were taken alongside reporting good financial results to the market.

These trends were seen across many names in the sector and are the reason that, of the 19% overall return for TMPL over 2024, half came from the financials holdings, despite accounting for less than a third of the overall portfolio. Although Barclays did see a sharp correction in the immediate aftermath of “Liberation Day”, the shares have since recovered all those losses and are currently at their high point for the year.

Marks & Spencer

Figure 10: Marks & Spencer (GBP)

Source: Bloomberg

We have previously written about TMPL’s investment in Marks & Spencer (corporate.marksandspencer.com), and the strong share price performance achieved by the current management team at M&S. As is illustrated in Figure 10, M&S has benefitted from strong share price growth during the past year, although the last six months have been very volatile. The company has experienced a substantial drop in share price in response to a much-publicised cyber-attack that resulted in all online orders being suspended and the theft of some customer data. At the time of writing, the website is still not accepting any customer orders.

Whilst clearly a very unfortunate episode for the company, TMPL’s managers think that the long-term impact on the shares should be relatively minor. Although the financial cost is likely to be substantial in the short term, the company is protected by insurance and the power of the brand remains rock solid in their view – a YouGov survey earlier this year naming it as the top brand in the UK considering factors such as quality, value, reputation, and customer satisfaction. The managers believe that the buy case remains firmly intact – they highlight that the shares still look undervalued, despite the strong performance of recent years, at a trailing P/E of 14.8x against their five-year average of 19.1x.

SWOT analysis

Figure 11: SWOT analysis for TMPL

| Strengths | Weaknesses |

| Good NAV and share price performance over the long-term | ‘Risk on’ periods when growth outperforms value – potentially triggered by an environment of falling inflation and interest rates – can result in weaker performance |

| Strong record of increasing dividends | |

| Opportunities | Threats |

| UK equity market remains undervalued versus developed market peers with the potential for a significant re-rating | Reduced M&A activity due to market volatility |

| Further turmoil in the US and elsewhere could increase the relative attraction of UK equities | Market rotation away from value stocks |

| Still trades at small discount to NAV | Potential discount widening, in response to poor performance and/or poorer sentiment towards the UK and value stocks |

Peer group

You can find up-to-date information on TMPL and its peers on our website

TMPL is one of the larger trusts within the AIC’s UK equity income sector, where it compares favourably with its peers across a number of metrics. Discounts have generally narrowed across the sector in recent months, but the move has been particularly pronounced for TMPL and, as a result, its 2% discount is narrower than most of its peers (the median discount in the sector is 5.7%). The ongoing charges ratio at 0.61% is modestly below the peer group median of 0.63%.

The yield continues to be towards the bottom of the peer group. However, it remains a very respectable 3.5% and with the dividend payout having increased, the reason for the small fall in yield since our last note in October is the very strong share price rise since then. The board remains committed to steadily increasing the dividend payout each year, which will be greatly helped by the new dividend policy that is explained on page 11.

Figure 12: Snapshot of UK equity income sector as at 27 May 2025

| Premium/(discount) (%) |

Yield (%) |

Ongoing charges (%) |

Market cap (£m) |

|

|---|---|---|---|---|

| Temple Bar Investment Trust | (3.2) | 3.4 | 0.61 | 894 |

| abrdn Equity Income Trust | 1.1 | 6.5 | 0.86 | 168 |

| BlackRock Income and Growth | (13.4) | 2.5 | 1.15 | 39 |

| Chelverton UK Dividend Trust | (2.5) | 9.3 | 2.73 | 31 |

| CT UK Capital and Income | (4.2) | 3.9 | 0.67 | 325 |

| Diverse Income Trust | (5.7) | 4.3 | 1.14 | 236 |

| Dunedin Income Growth | (8.2) | 4.8 | 0.56 | 384 |

| Edinburgh Investment Trust | (7.8) | 3.4 | 0.51 | 1,157 |

| Finsbury Growth & Income | (7.7) | 2.1 | 0.61 | 1,324 |

| JPMorgan Claverhouse | (5.6) | 4.6 | 0.63 | 428 |

| Law Debenture Corporation | 1.6 | 3.5 | 0.51 | 1,278 |

| Lowland Investment Company | (7.8) | 4.6 | 0.66 | 326 |

| Murray Income Trust | (9.7) | 4.6 | 0.5 | 840 |

| Schroder Income Growth Fund | (9.1) | 4.6 | 0.79 | 210 |

| Shires Income | (4.1) | 5.4 | 1.1 | 107 |

| The City of London Investment | 0.4 | 4.5 | 0.37 | 2,349 |

| The Merchants Trust | (3.7) | 5.2 | 0.52 | 839 |

| Peer group median | (5.6) | 4.6 | 0.63 | 384 |

| TMPL rank | 5/17 | 15/17 | 10/17 | 5/17 |

Figure 13: Total return performance over periods ending 30 April 2025

| 3 months (%) |

6 months (%) |

1 year (%) |

3 years (%) |

Under Redwheel (%) | 5 years (%) |

|

|---|---|---|---|---|---|---|

| Temple Bar Investment Trust | 0.6 | 8.4 | 14.0 | 42.3 | 135.4 | 125.1 |

| abrdn Equity Income Trust | (1.2) | 4.5 | 10.1 | 7.6 | 57.8 | 49.3 |

| BlackRock Income and Growth | (3.7) | 2.3 | 6.1 | 19.0 | 62.0 | 57.8 |

| Chelverton UK Dividend Trust | (8.4) | (8.5) | (6.1) | (14.1) | 52.0 | 55.9 |

| CT UK Capital and Income | (1.8) | 3.6 | 3.4 | 17.9 | 66.1 | 60.3 |

| Diverse Income Trust | 0.7 | 2.8 | 11.4 | 3.1 | 36.7 | 43.4 |

| Dunedin Income Growth | (1.1) | 3.6 | 4.8 | 22.2 | 47.8 | 47.7 |

| Edinburgh Investment Trust | (1.3) | 4.1 | 9.7 | 36.7 | 102.0 | 100.0 |

| Finsbury Growth & Income | (4.9) | 7.0 | 11.2 | 15.5 | 37.2 | 38.2 |

| JPMorgan Claverhouse | 2.1 | 9.3 | 10.6 | 27.7 | 79.5 | 81.4 |

| Law Debenture Corporation | (1.3) | 2.5 | 7.5 | 26.3 | 102.2 | 107.0 |

| Lowland Investment Company | (0.7) | 2.7 | 4.1 | 18.1 | 79.8 | 74.3 |

| Murray Income Trust | (3.5) | 2.1 | 1.3 | 12.6 | 46.6 | 44.8 |

| Schroder Income Growth Fund | (1.0) | 3.7 | 6.8 | 17.8 | 71.1 | 68.4 |

| Shires Income | (1.5) | 3.8 | 5.9 | 13.0 | 52.1 | 52.6 |

| The City of London Investment | 3.2 | 10.8 | 14.5 | 30.3 | 93.0 | 81.8 |

| The Merchants Trust | (1.5) | 2.3 | 3.8 | 16.0 | 111.0 | 96.8 |

| Peer group median | (1.3) | 3.6 | 6.8 | 17.9 | 66.1 | 60.3 |

| TMPL rank | 4/17 | 3/17 | 2/17 | 1/17 | 1/17 | 1/17 |

Dividend

The dividend payout has grown again, and we expect that trend to continue in the coming years helped by the new dividend policy.

TMPL continues to make quarterly dividend payments to shareholders. The final two payments for 2024 were each 3p, taking the full amount for the year to 11.25p, a 17.2% increase on 2023. The board has reiterated its intention to distribute, over time, substantially all of TMPL’s net revenue income, and hopes to continue sustainable dividend growth in future years.

Such growth has been made easier by a significant recent change in TMPL’s dividend policy that was approved at the most recent AGM. Companies are increasingly making returns to their investors through share buybacks rather than, or in addition to, income payments. This is particularly the case with many of the companies held by TMPL given their lowly valuations – half of those in the portfolio bought back stock in 2024. The board wishes for TMPL shareholders to benefit from this trend and, as such, will enhance the dividends being paid to reflect a portion of these buybacks by tapping into TMPL’s distributable reserves. The recently announced 3.75p first interim dividend for 2025 included such an enhancement, of 0.75p.

Figure 14: TMPL’s recent dividend record as of 30 April 2025

Source: Temple Bar Investment Trust

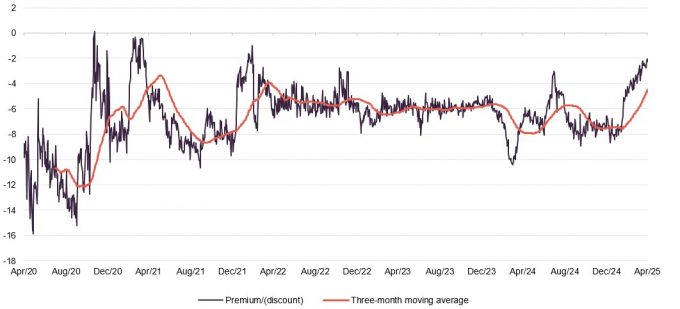

Premium/(discount)

Over the last 12 months, TMPL’s shares have traded at a discount between 2% and 9%, with an average figure of 6.2%. As can be seen in Figure 15, there has been a clear narrowing trend so far in 2025, such that the discount is the lowest it has been in over three years.

Figure 15: TMPL discount over five years ended 30 April 2025

Source: Morningstar, Marten & Co

We think that the recent discount narrowing is in part a reflection of the strength of TMPL’s performance, particularly the improvement in its relative performance in an environment of higher interest rates witnessed during the last three years, along with the board’s active approach to repurchasing shares (it aims to address demand and supply imbalances) when the discount is at more elevated levels. Although no shares have been repurchased since February this year, 5.218m shares were repurchased in 2024 – a period that exhibited greater volatility in the discount – at a cost of £12.7m. We think that there is the potential for the discount to narrow further from here, particularly if TMPL and value continue to outperform, and improved sentiment towards the UK could also trigger a narrowing of its discount, with the potential to push it to a premium rating.

Fund profile

You can access the trust’s website at: templebarinvestments.co.uk

TMPL aims to provide growth in income and capital to achieve a long-term total return greater than its benchmark (the FTSE All-Share Index), through investment primarily in UK securities. The company’s policy is to invest in a broad spread of securities with typically the majority of the portfolio selected from the constituents of the FTSE 350 Index.

Co-managers Nick Purves and Ian Lance aim to rotate the portfolio into those companies that they believe are available at a significant discount to intrinsic value. This involves buying the shares of attractively valued, out-of-favour companies and holding them for the long term until their share prices more appropriately reflect their true value, or until even more attractive ideas present themselves.

Redwheel became manager of TMPL on 1 November 2020

After 18 years under its previous manager, on 23 September 2020 the board announced that it had selected RWC Asset Management (which rebranded as Redwheel in 2022) as TMPL’s new investment manager. Redwheel took on responsibility for the portfolio with effect from 1 November 2020, with Nick and Ian named as co-managers. They have over 50 years’ experience between them and have worked together for more than 15 years. The two co-manage over £3bn of assets across a number of income funds. TMPL’s AIFM is Frostrow Capital.

Bull vs bear case

Figure 16: Bull vs bear case for TMPL

| Aspect | Bull case | Bear case |

|---|---|---|

| Performance | Marked improvement in relative performance in recent years | Outperformance may not continue if market conditions change |

| Dividends | Strong track record of increases, which the board are committed to continuing | Increases potentially not sustainable if conditions change |

| Outlook | UK market remains undervalued, and the managers see numerous opportunities available | UK’s valuation gap may persist or worsen |

| Discount | TMPL still trades at a small discount which could narrow further and potentially move to a premium rating | There is a systemic problem within the sector that has pushed discounts wider. TMPL has bucked this trend recently, but if the factors supporting a narrower discount reverse, there is the potential for significant discount widening |

Previous publications

Readers interested in further information about TMPL may wish to read our previous note, Historic opportunity, published on 22 October 2024, as well as our previous notes. You can read the notes by clicking on them in Figure 17 or by visiting our website.

Figure 17: QuotedData’s previously published notes on TMPL

| Title | Note type | Date |

|---|---|---|

| Keeping faith | Initiation | 23 September 2020 |

| Just getting started | Update | 23 April 2021 |

| No compromise | Annual overview | 8 December 2021 |

| Time to Shine | Annual overview | 31 August 2022 |

| True Colours | Update | 26 June 2023 |

| Foundations for success | Update | 27 March 2024 |

| Historic opportunity | Annual overview | 22 October 2024 |

This marketing communication has been prepared for Temple Bar Investment Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.