Temple Bar

Investment companies | Update | 27 March 2024

Foundations for success

We are now more than three years into the tenure of Ian Lance and Nick Purves as managers of the Temple Bar Investment Trust. In that time, the Redwheel team has aimed to establish a well-diversified portfolio of value-orientated holdings, which it says is positioned for a long-overdue reversion to more normal market conditions, after a decade of what the managers believe was exceptional economic policy and quantitative easing. They say that slowing growth and stubborn inflation in the UK have weighed on returns over the past 12 months. However, the trust remains well ahead of both benchmark and peer group averages since the change in management. They say that the current negative sentiment surrounding UK markets has allowed them to pick up a number of market-leading companies at historically low multiples. The managers believe that while there remain challenges in the short term, their value strategy should leave the trust increasingly well positioned.

UK equity income and capital growth

TMPL aims to provide growth in income and capital to achieve a long-term total return greater than its benchmark (the FTSE All-Share Index), through investment primarily in UK securities. The company’s policy is to invest in a broad spread of securities, with the majority typically selected from the FTSE 350 Index.

Market background

Targeted, bottom-up approach looking for stocks that are trading at a discount to their intrinsic value

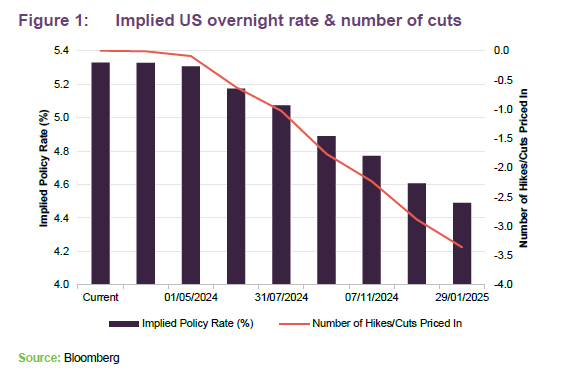

Global markets continued to rally through the start of 2024, the managers suggest that sentiment in the US (which now makes up almost 60% of the MSCI All Countries World Index) has approached peak euphoria. Given that, the managers say it is now hard to argue against calls that equity valuations in the world’s largest economy are becoming stretched.

The surge over the past four months is one of the largest in recent history, which they say is reminiscent of the 2021 growth bonanza that drove valuations for all manner of low-interest rate beneficiaries, including SPACs, unprofitable tech, and crypto to extremes. This time around, Ian and Nick suggest that AI is carrying the baton, dragging the usual suspects along for the ride, as market pricing reflects an end to the Fed’s tightening cycle and a series of rate cuts throughout the coming year. Although they do point out that there have been some speed bumps along the way as persistent inflation continues to disrupt the market’s Goldilocks narrative.

Ian and Nick add that so far, however, core price inflation – which remains above target and has accelerated over the past couple of months – has failed to ruin the party, with the S&P 500 and Nasdaq printing fresh highs, thanks especially to the rally in NVIDIA, which is up 84% YTD, and 280% in the last 12 months.

The managers say that, for value-focused strategies such as TMPL’s, the AI-driven rally in equity markets has been a headwind for its relative performance when compared against global benchmarks and has not been aided by TMPL’s UK focus, where inflation, albeit reduced, remains higher than expected. However, with inflation now passed it peak, bar the odd blip, TMPL’s exposure to cyclicals has the potential to give it a significant boost once there is more certainty that the economic outlook is improving.

Value still a winner

Investments are made over at least a five-year time horizon

Despite this, the managers remain optimistic, noting that investments are made over -at least a five-year time horizon, with little focus on the month-to-month or quarter-to-quarter fluctuations that can lead many traders into the troubled waters of knee-jerk reactions and ultimately, long-term underperformance. Ian and Nick instead use sentiment driven swings – such as the current US rally – as opportunities to invest in what they believe are strong and stable companies at heavy discounts, leaving the TMPL portfolio well positioned to benefit from what they think is a long overdue reversion to more normal market conditions after a decade of exceptional policy and quantitative easing.

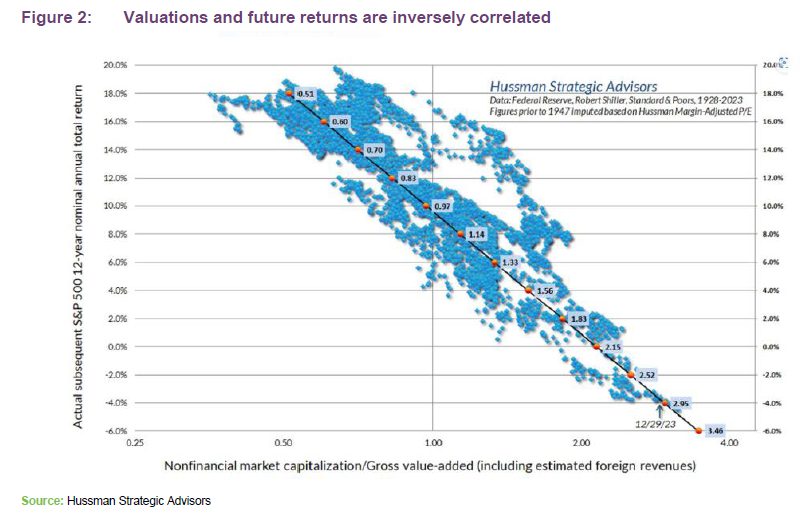

They say that such a strategy is born out of long-term evidence, such as that illustrated by Figure 2 below from US fund manager John Hussman. Portfolio manager Ian Lance describes this as one of the most important charts in finance.

The chart aims to show the correlation between the valuation of the US equity market and the subsequent returns that were earned from it by investors over the next 12 years, with the steep, negative slope indicating a fall in returns as valuation increases. In fact, with a R-squared value of -0.93, the chart points to what the managers describe as an overwhelmingly strong relationship between the two variables (particularly, they say, if you consider that as a rule, a value of 0.5 could be considered relatively strong in many statistical analyses).

The valuation of the US stock market at the end of 2023 was one of the highest-ever observed in the period since 1928.

To highlight the relationship, Ian notes that a valuation point of 0.60 tends to produce returns of about 16% per annum. Contrast this with the data on the right-hand side of the chart, where Ian suggests that a valuation of 2.95 has historically resulted in annualised losses of 4% per annum over the subsequent 12 years.

The notation towards the bottom right-hand side of the chart highlights the valuation of the S&P 500 at the end of 2023 (with the index up some 9% since this was calculated). Historically, Ian says, paying this valuation has led to long-term losses for investors. Secondly, he points out the lack of dots to the right of this valuation point. This is because the valuation of the US stock market at the end of 2023 appeared to be one of the highest-ever observed in the period since 1928.

Long-term view

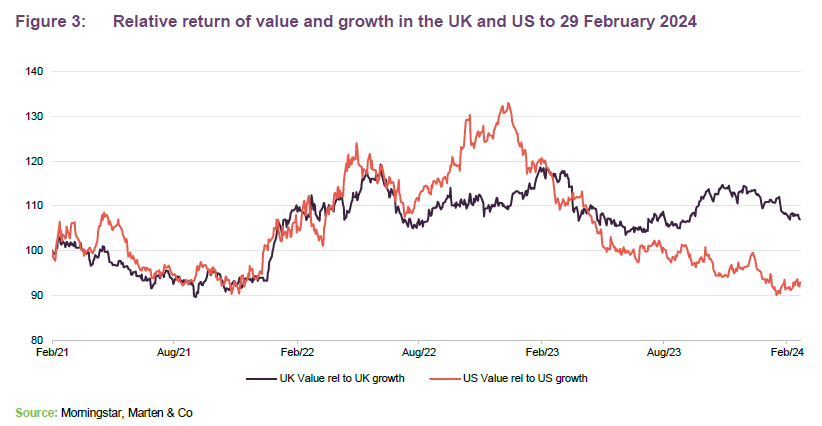

In order to justify current valuations, Ian and Nick say many proponents believe that we have entered a new paradigm thanks to AI and the productivity gains it is expected to bring. Whilst the managers hold a healthy respect for the potential of AI, they maintain their view that fundamentals will continue to drive prices over the long term. They say that with valuations at historic lows in many sectors, they believe the opportunity to invest in established leaders in these markets is as good as it has ever been. As recently as 2022, they say that this proved to be a winning strategy as value dramatically outperformed, and whilst they believe it is easy to get caught up in the hype, since the end of 2021, value appears to have still comfortably outperformed its growth counterparts in the UK and has only recently been surpassed in the US, as shown in Figure 3.

Whilst they say that market sentiment remains heavily weighted against value, as we saw only 18 months ago, it is possible that this can swing dramatically. TMPL’s managers also highlight the problem of recency bias, noting that the success of growth companies through the 2010s is far and away the exception, and not the rule over the long term. In fact, they say, lowly-valued stocks have outperformed their growth counterparts in every decade bar two in the last 110 years, with the other previous period of outperformance occurring in the 1920s.

Portfolio management: More than just value

The managers say that this distinction between value and growth is useful for illustrative purposes, however it is important to note that the TMPL portfolio exists as much more than a simple value fund. They say that valuations do provide the basis for portfolio selection; however, there remains an exhaustive, bottom-up approach to investment, with the managers outlining that they identify companies not only trading on attractive valuations but also generating stable earnings and capable of producing what they believe are long term, structural upside. As noted, Ian and Nick say they look to take advantage of short-term swings in sentiment to identify stocks that they believe are trading at a discount to their intrinsic value, and this quality overlay helps weed out the potential for value traps.

Asset allocation

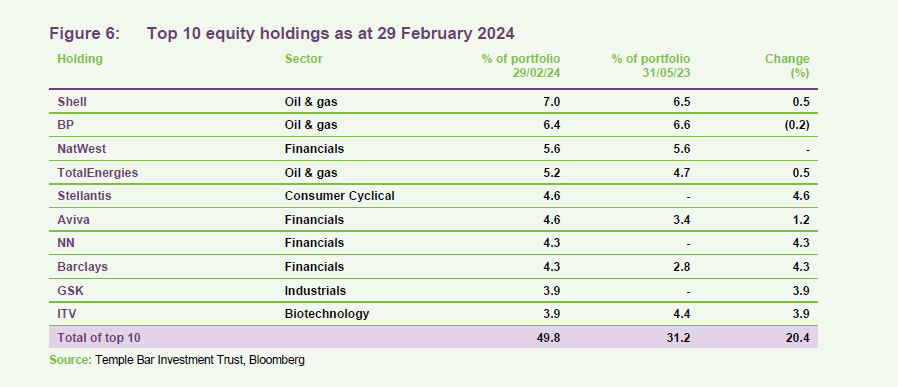

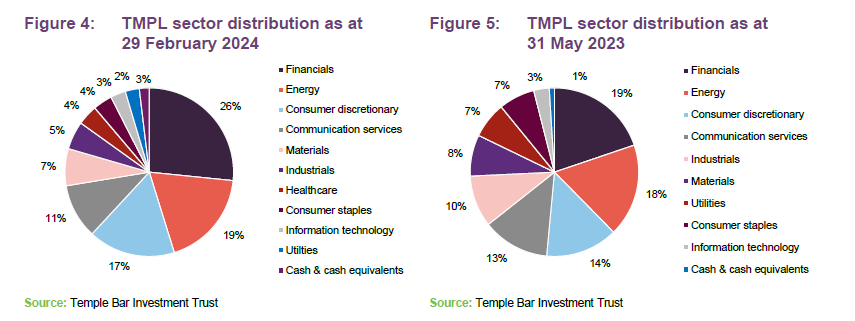

Since our last note (using data from 31 May 2023), TMPL has seen an increase in financial exposure including a new holding in NN, and an increased weighting for Barclays. The sector now accounts for more than a quarter of the fund. Both the energy and consumer discretionary sectors also saw increases, with the weightings of many of the company’s smaller exposures falling.

Gearing

Gearing for the fund increased to 8.0%, up from 7.2% at the time of our last note in June 2023, with the managers noting the balance between the cost of additional leverage and current depressed valuations in the market.

Top 10 holdings

The top 10 holdings make up 49.8% of the fund. Since our last note, there has been a reshuffle with five changes to this group, with Stellantis, Aviva, NN, Barclays, and GSK featuring in place of Marks and Spencer, Centrica, Standard Chartered, Pearson, and WPP, although all five remain in the portfolio.

Barclays

In our last note the managers provided some background on the UK financial sector and the long-term divergence in the valuations of many of its constituents compared to counterparts in US. The managers say that whilst there have been signs of this narrowing in recent years, which they believe reflects the growing resilience of the UK banks, the gap appears to be as large as ever.

The issue appears to have confounded many, including Bank of England governor Andrew Bailey, who told a recent gathering that the low valuations of UK banks puzzle him. He noted that, though better capitalised than ever, shareholders refuse to pay anything close to book value for them.

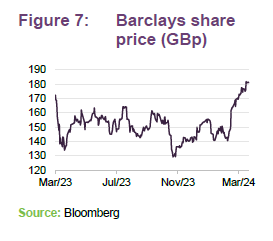

Ian and Nick say that nowhere is this truer than for British bank Barclays, which trades at 0.5x the value of its shareholders’ equity, which they say is one of the worst valuations of any major western lender. They note that shares have trailed global benchmarks by more than five percentage points a year over the last five years, even with a recent rally, as the bank has failed to match its strategic objectives, underperforming financial targets while appearing to stumble from what has seemed like one public relations disaster to another. They feel that much of the focus over this period has been on the operations of its investment banking arm (the largest of its type outside the US) which now accounts for almost three quarters of the bank’s assets while struggling to deliver returns consistently in line with its Wall Street counterparts.

Ian and Nick believe that the ongoing underperformance has led many investors to lose faith, as various strategic reviews have failed to revitalise performance. However, they say there are those who believe that its diversified asset base, improving profitability and strong capital position leave it capable of a positive inflection. They suggest that this optimism was rewarded during the pandemic as what they describe as an active M&A environment drove profitability in its investment banking arm, while other more retail- and commercially focused banks suffered. More recently, the managers note that Barclay’s has announced a plan to address its long-depressed valuation, boost revenues, and cut expenses while shifting the banks reliance away from investment banking. This included a pledge to return £10bn to shareholders over the next three years (in addition to $3bn delivered in 2023).

The managers think that while there remains plenty of work to be done to repair the bank’s damaged reputation among investors, they believe that the initial reaction to the recent announcement has been positive and there is cause for optimism, particularly given the current valuation and what they view as the underlying quality of Barclay’s assets. For Ian and Nick, they see the new strategic direction as increasingly promising, and while they expect there to be speed bumps given the breadth of changes undertaken by the bank, over the next few years they expect the results to drive considerable upside.

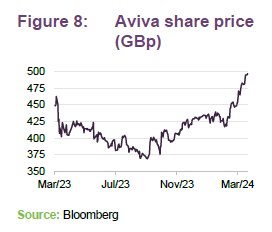

Aviva

Ian and Nick say that much like Barclay’s, British multinational insurer Aviva has been a perennial underperformer, with the company struggling to balance its operations across the UK, Europe, and Asia, along with its composite model of general insurances, life businesses, and asset management. They suggest that a lack of strategic direction and an unsustainable increase in costs saw shares trade sideways for almost a decade, which appears to have dragged the company’s valuation well below peers such as Axa and Allianz. The managers say that the performance has been increasingly frustrating for investors given they believe it remains a dominant, high-quality business at its core, particularly in the UK where its composite insurance model appears to provide a strong competitive advantage.

Over the years, Ian and Nick say there have been several attempts to leverage this strength, with various strategic reviews and structural overhauls; however, these do not appear to have had a lasting impact, at least until recently. In 2020, the company appointed Amanda Blanc as chief executive, in a move which the managers say accelerated a push to streamline operations and focus more on its core assets in the UK, Ireland, and Canada. They say that this has led to a raft of foreign asset sales, including businesses in Singapore, Italy, and France. Ian and Nick add that additional shareholder friendly interventions from active investor Cevian Capital have helped drive cost cutting measures and shareholder returns, with the company delivering on its £750m cost reduction target a year ahead of schedule while returning over £5bn to shareholders.

The managers say that despite this, investors have remained sceptical, having seen the company over-promise and underdeliver in the past. However, the shares appear to have tacked steadily upwards in recent months, with the managers noting that the company appears to have delivered on its commitment to drive sales growth, cut expenses, and increase shareholder payouts. They say that this momentum will need to be sustained if the company is to recover the ground lost over the last few years, although as the managers note, the outlook for the stock looks increasingly positive, which they say is underpinned by a dividend yield which now sits at 8%.

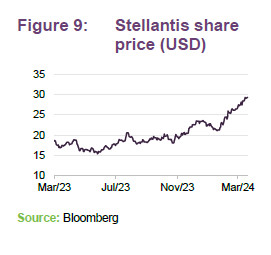

Stellantis

A recent addition to the portfolio that now sits in the top 10 holdings is Stellantis, a company formed by the merger of Fiat Chrysler and Peugeot in 2020. Ian and Nick say that the rationale for the merger was to combine the European strength of the Peugeot business with the North American strength of Fiat Chrysler. So far, the managers note that this has proven to be a resounding success, saying the company has gone from strength to strength, particularly over the past 12 months. with shares up 86%, surpassing rival Volkswagen in market cap in the process. The managers say that the performance of Stellantis is particularly notable given the current challenges faced by the auto industry, which they say include technological uncertainty, deglobalisation, geopolitics (particularly relating to demand in China), and supply chain upheaval stemming from the pandemic.

In what the manager observe is a recurring theme among the new positions in the TMPL portfolio, Stellantis has successfully emerged from its strategic overhaul with what the managers describe as a focus on optimising margins and achieving operational efficiencies. They say that combining the entities has allowed for significant cost savings and created a larger and more diversified business. They also add that the company has a strong balance sheet with around €30bn of net cash which they say provides ample financial flexibility, boosted further by what appears to be solid free cash flow growth. The managers say the company’s financial stability was reinforced during its recent annual results, with a 53% increase in shareholder returns from 2022 (including dividends and buybacks totalling €6.6bn) in addition to a proposed dividend increase of 16%.

Notably, the managers say that the company has not rushed into the EV race to the same extent as some of its rivals, choosing to focus on the consolidation of its existing markets and a more diversified approach to investment across electric, hybrid and ICE vehicles. For the moment, Ian and Nick say this has proven to be a winning strategy given the slowing adoption of EVs and the intense competition and tight margins that exist in the current market.

The managers do highlight that there remain challenges, both for the overall automotive industry and internally at Stellantis as the company manages the ongoing integration of its French, Italian, German and US operations. However, Ian and Nick say that with the company still trading on an earnings multiple under five, despite the recent rally in shares, the risk certainly appears weighted to the upside.

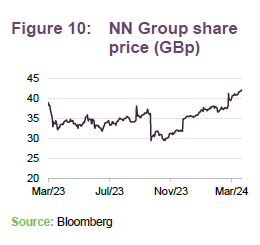

NN Group

Ian and Nick say that continuing the theme of structural overhauls is NN Group, the Dutch insurer which was spun off from ING following the financial crisis. They say that the foundations for it to become a dominant player in the European insurance market had been set back in 2016 following a spate of investment activity totalling around €3bn with the acquisition of domestic rival Delta Lloyd, and Vivat’s general insurance arm. The managers mote that much like Aviva, however, the company has faced criticism for its lack of strategic direction and overall conservatism. They say that this prompted well-known activist investor Elliott Advisors to take a 3% stake back in 2020, with what they describe as a focus on cost-cutting, the disposal of non-core businesses, and an overhaul of its investment portfolio.

The managers believe that the more targeted approach driven by Elliott in combination with an increasingly stable domestic position in the Netherlands helped drive a solid period of outperformance for the company following the pandemic. Despite this, they say that the transition remains a work in progress, with improving operational performance yet to make up for a long period of mediocrity.

Still, Ian and Nick believe that the outlook continues to improve as the company accelerates its shift towards more shareholder-friendly policies, including an increased focus on buybacks, and a progressive dividend policy with the latest earnings announcement highlighting a 15% increase in dividend payments and an annual share buyback allocation of at least €300m, up from €250m in 2023. The managers say that the company has also remained active in its efforts to streamline operations, with the recent sale of its asset-management business to Goldman Sachs and the acquisition of MetLife’s businesses in Poland and Greece appearing to further cement its competitive position in life insurance and pension products across Europe.

The managers also note that operational performance has also continued to improve, with the company announcing that operating capital generation (a key profitability metric for insurance companies) for 2023 was up 13%, exceeding the 2025 target of EUR 1.8bn well ahead of plan. The managers say that the positive results have helped build on the company’s steadily improving share price, adding that with its long-running structural overhaul now appearing to flow through to the bottom line, its price to book value of just 0.59 – which remains well below peer group averages – looks increasingly attractive.

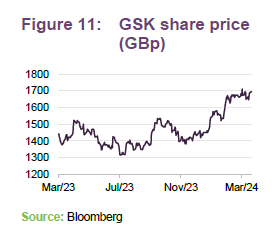

GSK

Closing out the new additions to the top 10 holdings is GSK, the British multinational pharmaceutical and biotechnology company. Ian and Nick say that GSK has struggled with a range of issues over the last few years, including impending patent expiries – most notably, they say, is HIV medicine Dolutegravir, which contributes almost 20% of total revenue. They believe that a lack of confidence in the company’s pipeline to offset these changes has seen shares underperform both peer group and broader market benchmarks in recent times. They believe that this has been compounded further by ongoing litigation related to the now-discontinued heartburn drug, Zantac, once the world’s bestselling medicine, which is claimed to have caused cancer.

Positively, the managers say, is that the company has already settled numerous lawsuits in the US and continues to accept no liability, which has been supported by federal level hearings, based on a lack of credible scientific evidence. Despite this, Ian and Nick note that the market appears to have priced in an almost worst-case scenario relating to the lawsuits, providing what they view as significant room for a re-rating going forward.

They say the overhang from the Zantac case also appears to have distracted from an increasingly positive outlook for the company’s pipeline, following what the managers describe as a significant transformation to address its growth concerns. In 2022, GSK spun off its consumer health unit to help fund what Ian and Nick describe as an aggressive M&A strategy which saw five deals completed over 2023, with the same number planned for 2024. They also note that recent performance has also been promising, with the company outperforming expectations for 2023, while increasing its 2024 forecasts on the back of what appears to be strong momentum from its vaccine and cancer drugs.

With what the managers describe as improving fundamentals and the overhang from the Zantac case receding, they expect there could be considerable upside at current prices, particularly given an earnings multiple almost 50% below peer group averages.

Takeover targets

The managers also noted in February 2024 that two of the company’s holdings were approached for a possible takeover, Currys and Direct Line Group. The managers say that this stands as further evidence that the largest market participants in the UK have been allocating away from UK equities, which appear to be close to all-time low valuations, and therefore should have the potential to offer attractive returns. Ian and Nick believe that this has resulted in pockets of the UK equity market being valued significantly below the true value of the businesses, which they believe has led to a number of overseas corporate buyers stepping in to take advantage of what they view as the depressed valuations of UK equities.

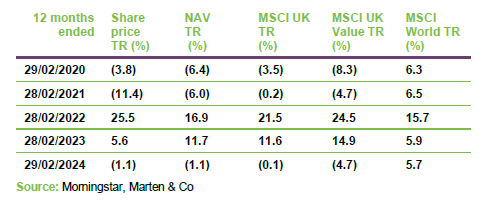

Performance

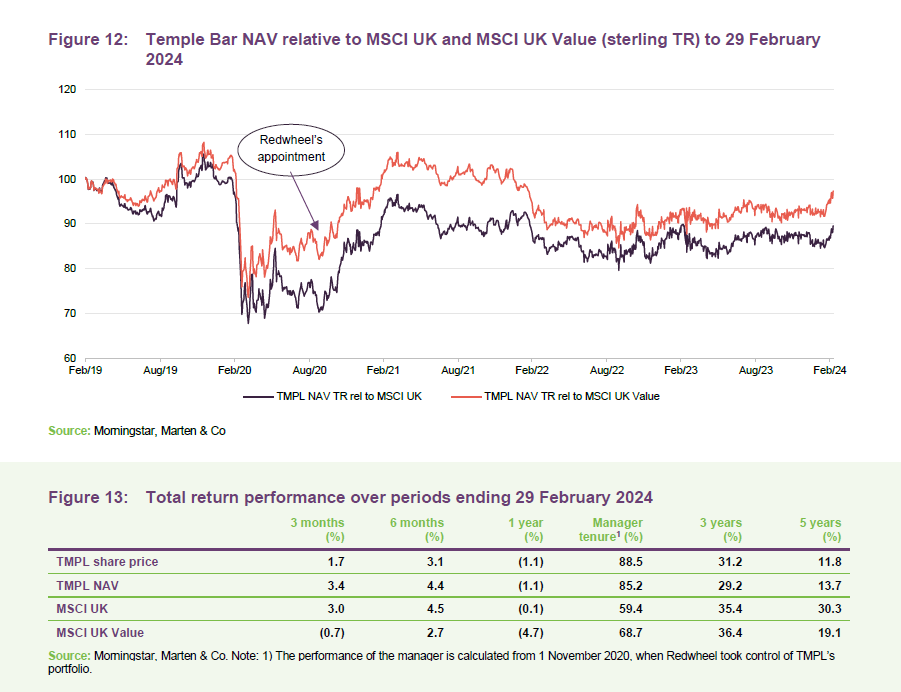

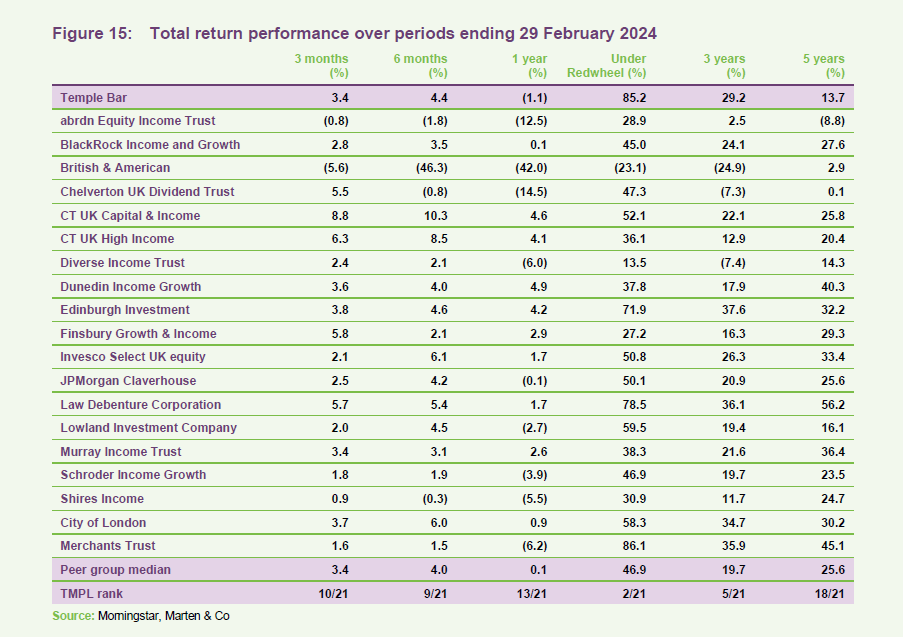

The NAV total return of the trust since Redwheel’s appointment in November 2020, is 85.2%, almost double the peer group’s median return.

Whilst the new managers say that they had benefitted initially from a degree of timing, with the appointment coinciding with a rally in value orientated sectors of the market, they believe that their strategy since the takeover has continued to add value, even over a relatively short period of time. Most recently, they say, substantial positions in Stellantis and Barclays have been key contributors.

The managers do acknowledge that the portfolio has struggled over the last 12 months, with over 70% invested in the UK, which they say continues to battle with slowing growth and high inflation. However, they say they have seen a solid inflection over the last few weeks, which they say is highlighted in Figure 14.

With the previous manager’s deep value proposition, TMPL’s long term NAV performance has struggled versus its peers (see Figure 15 on page 14). However, with just over three years at the helm, the managers say that it still remains early in their innings and comment that, given their long-term strategy, investors may be encouraged by the initial performance of the portfolio and the clear strategy that they have implemented.

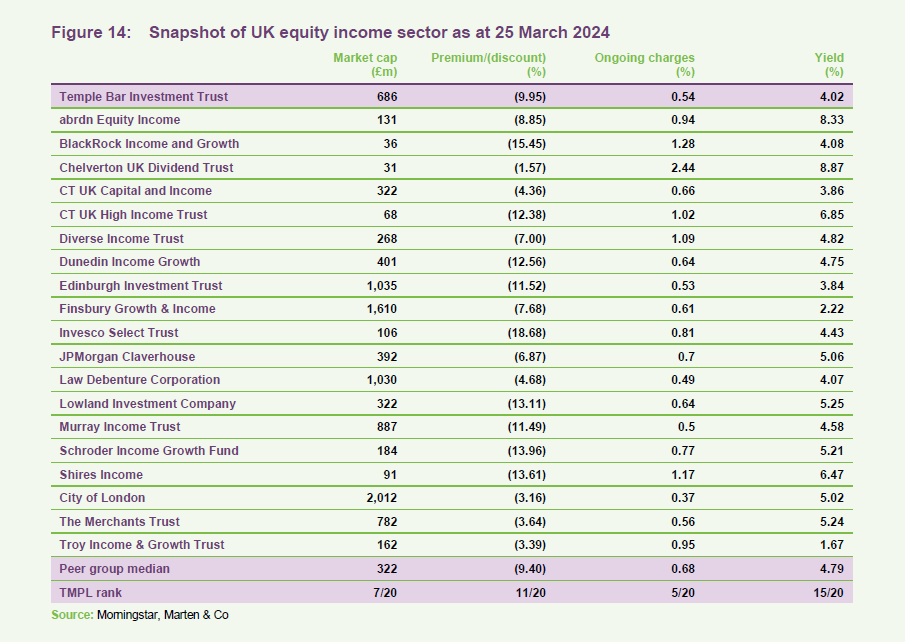

Peer group

TMPL is one of 20 funds in the AIC’s UK equity income sector. With a market cap of £686m, it is one of the larger funds within the peer group and this may be a factor in its competitive ongoing charges ratio. At 0.54%, it is the fifth-lowest in the sector and is below the sector median of 0.66%.

The managers observe that discounts have continued to widen since our last note, reflecting what they describe as the broader challenges faced by the UK market. TMPL’s discount is in line with the median. A dividend yield of 4% puts the company toward the bottom of the peer group and the managers have noted the strong earnings yield of the portfolio and the potential for this to flow through to improved shareholder returns going forward. Notably, they say the dividend yield has grown considerably over the last couple of years, and they expect this momentum to continue.

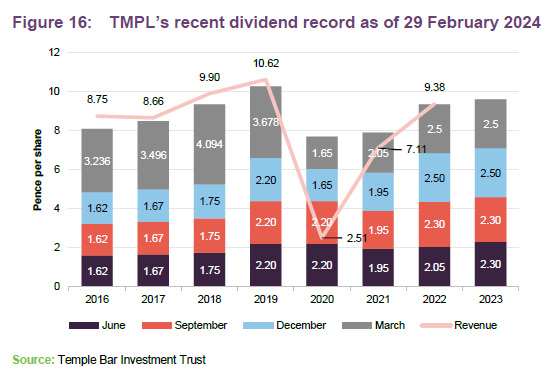

Dividend

TMPL pays dividends quarterly. The managers note that the company’s income account has been more robust than expected. As a result, the company paid out a total dividend of 9.6p per share for the year ended 31 December 2023. The board has also noted that it is confident the dividend will increase from this level over time. As publishing TMPL had a TTM yield of 4.02%.

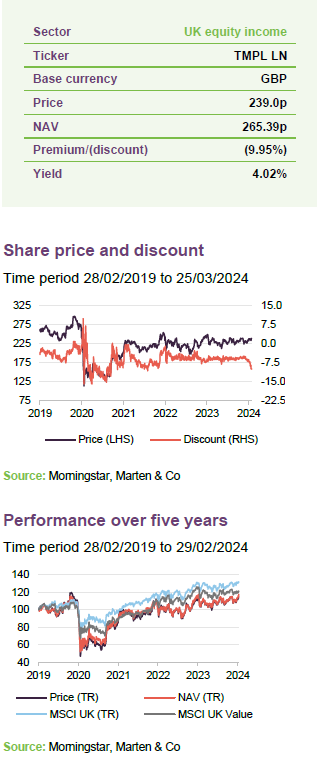

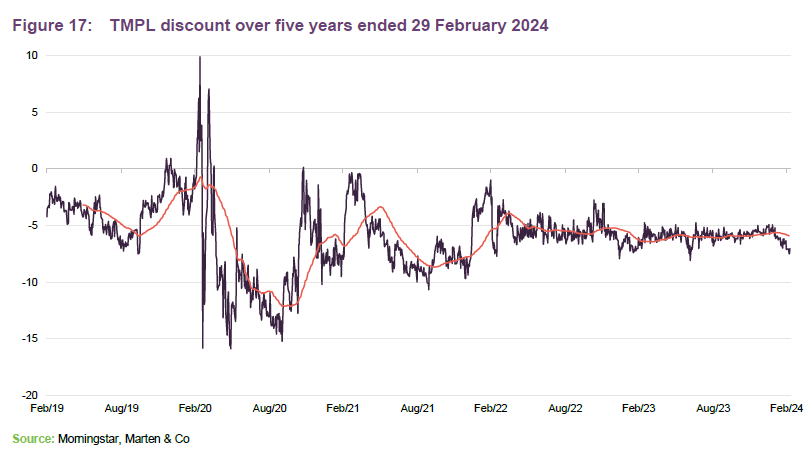

Premium/(discount)

Over the last 12 months TMPL’s shares moved to trade between a discount of 8.1% and 4.7%, averaging 5.9%. As of publishing, the company was trading on a discount of 9.95%.

The managers note that the discount has been relatively stable over the past year, although they say a recent positive inflection in NAV has not resulted in a corresponding move in the share price, which has led to it widening. They say the board continue to proactively use buybacks to defend what they feel is a sensible level of discount on the trust. As of 26 March 2024, the issued share capital of the company was 334,363,825 ordinary shares, of which 47,244,258 shares are held in treasury.

Fund profile

You can access the trust’s website at: templebarinvestments.co.uk

TMPL aims to provide growth in income and capital to achieve a long-term total return greater than its benchmark (the FTSE All-Share Index), through investment primarily in UK securities. The company’s policy is to invest in a broad spread of securities with typically the majority of the portfolio selected from the constituents of the FTSE 350 Index.

Co-managers Nick Purves and Ian Lance aim to rotate the portfolio into those companies which they believe are available at a significant discount to intrinsic value. This involves buying the shares of attractively valued, out-of-favour companies and holding them for the long term until their share prices more appropriately reflect their true value, or until even more attractive ideas present themselves.

Redwheel became manager of TMPL on 1 November 2020

After 18 years under its previous manager, on 23 September 2020 the board announced that it had selected RWC Asset Management (which rebranded as Redwheel in 2022) as TMPL’s new investment manager. Redwheel took on responsibility for the portfolio with effect from 1 November 2020, with Nick and Ian named as co-managers. They have over 50 years’ experience between them and have worked together for more than 13 years. The two co-manage over £3bn of assets across a number of income funds. As of 1 July 2023, TMPL’s AIFM transferred from Link Fund Solutions to Frostrow Capital.

Previous publications

Readers interested in further information about TMPL may wish to read our previous note, True Colours, published on 26 June 2023, as well as our previous notes (details are provided in Figure 18 below). You can read the notes by clicking on them in Figure 18 or by visiting our website.

Figure 18: QuotedData’s previously published notes on TMPL

| Title | Note type | Date |

| Keeping faith | Initiation | 23 September 2020 |

| Just getting started | Update | 23 April 2021 |

| No compromise | Annual overview | 8 December 2021 |

| Time to Shine | Annual overview | 31 August 2022 |

| True Colours | Update | 26 June 2023 |

Source: Marten & Co

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Temple Bar Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.