Opportunity knocks

The share prices of many logistics-focused real estate investment trusts (REITs), including Tritax EuroBox (EBOX), have been hit as interest rates have risen and the investment market has cooled. Inevitably, valuations in the low-yielding logistics property sector will fall (and property yields rise) as the higher cost of debt chokes off investment.

However, the occupier market is still a landlord’s market, with record low supply and robust demand putting owners in an advantageous position, meaning rental growth is very much in the picture. This will have an offsetting effect on softening (rising) property yields. EBOX has announced a number of leasing deals at significant uplifts to previous rents and with superior terms, such as annual uncapped inflation-linked uplifts.

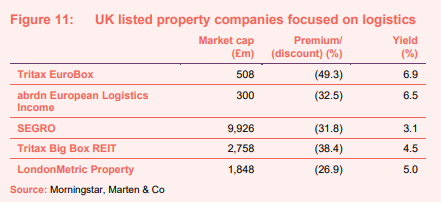

The market sell-off of logistics-focused companies has seen EBOX’s share price fall to a 49.3% discount to net asset value (NAV). This is staggering, given that the fundamental characteristics in the European logistics market are still favourable.

Big box logistics in Europe

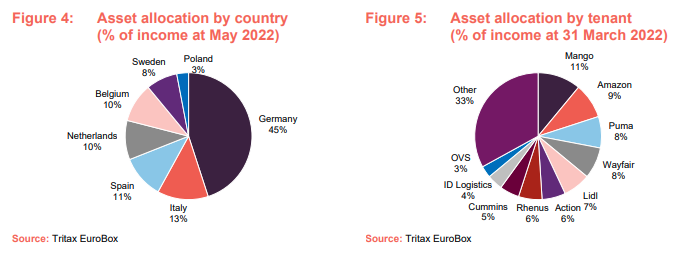

EBOX invests in a portfolio of logistics assets in continental Europe, diversified by geography and tenant, targeting well-located assets, within or close to densely populated areas. The strategy aims to capture market rental value growth and deliver an attractive capital return and secure income. EBOX is targeting a total return of 9% per annum over the medium term.

Market overview

The share prices of many logistics-focused REITs and property companies have tumbled in recent months, as the higher interest rate environment puts pressure on property valuations. The European Central Bank announced in September a record rise in eurozone interest rates to 1.25% to help fight inflation. The five-year Euribor swap rate (the typical floating rate on which banks add their margin for lending to real estate in Europe) increased from -0.099% to 2.985% in the 12 months to October 2022. This pushed the total cost of debt close to or higher than the prime real estate yield for many segments of the logistics property market, where yields had compressed to sub-3% in some prime markets.

Without the availability of low-cost finance, which had pushed property yields to new record low levels, many leveraged investors (those that finance their purchases at least in part using borrowings) have been taken out of the market and the pressures that underpinned pricing have been taken away. Falling capital values and a softening (rising) of investment yields are inevitable.

EBOX’s share price has fallen around 33% over the last three months, seeing it move to a discount to NAV of almost 50%. Its manager believes that property yields will move out by around 50-100 basis points (bps) from their peak in the summer. The occupational market in Europe is still going strong (as we describe below) and any yield movement will be somewhat offset by rental growth that is expected to come through from the group’s inflation-linked leases and the letting-up of its development assets.

Brakes on investment

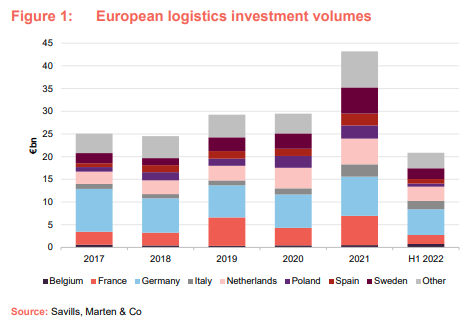

The rising cost of debt, stemming from interest rate rises to curb soaring inflation, has seen investment transaction volumes fall and prime yields soften from their nadir point, which according to Savills was an average of 4.1% across Europe at the end of June 2022. There is anecdotal evidence of large logistics transactions falling out of bed and others being pulled from the market amid a lack of interest at the quoted price. A general reluctance to make capital investment decisions while investors take stock of the macro-economic/geopolitical situation is expected to continue.

EBOX decided against acquiring an asset in Paris that it had under offer subject to due diligence, due to the state of the market. It has around €130m of available resources and the manager says that it is assessing the market and expects to see a lot of attractive buying opportunities in time (more details on page 9).

At the end of the June 2022, European logistics investment reached €30bn, following a record year in 2021, as shown in Figure 1, with prime yields compressing to record lows. Although third-quarter investment statistics have yet to be released, they are almost certainly going to be at suppressed levels.

Still a landlord’s market

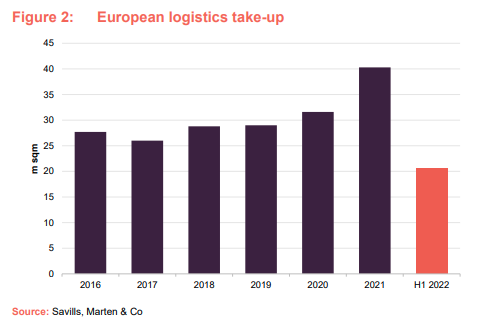

Record low vacancy rates across Europe and continued strong demand for space has led to an upwards pressure on prime rents, with an increase of 8.2% observed over the 12 months to the end of June 2022, according to Savills. Vacancy rates hit an all-time low average of 2.9% across Europe at the end of the first half of 2022, following a record decline in 2021. Dublin (1.1%), Denmark (1.5%), Barcelona (1.7%), Czech Republic (2.0%), the Netherlands (3.2%) and Poland (3.1%) continue to be among some of the most undersupplied markets, according to Savills’s data.

Take-up of logistics space has remained robust in 2022, reaching just over 20m sqm at the half year, as shown in Figure 2. Savills predicts that take-up in Europe will match the record year of 2021 due to the diverse range of occupier requirements. Take-up is not reliant on one industry or sector, while the impact of supply chain resilience and pressure to shorten supply chains/re-shore manufacturing after several disruptions in the past two years (including continued COVID lockdowns in China, the Suez Canal incident and the war in Ukraine) is predicted to be a major factor in the coming years for an increase in demand.

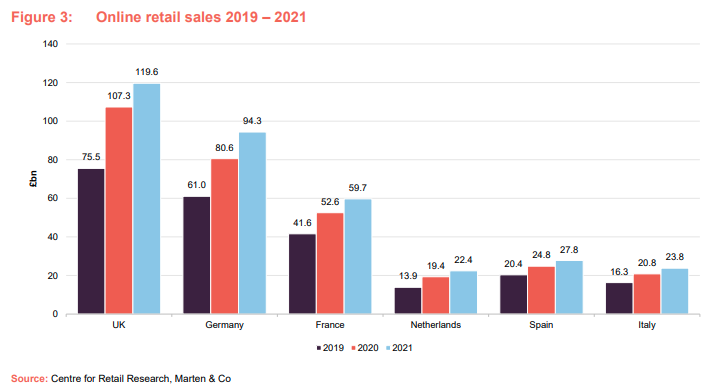

A lot of attention was given to a downbeat earnings update by Amazon in April, in which their chief financial officer, Brian Olsavsky, said that the company had overextended and that its aggressive expansion would slow. The online retail behemoth has been responsible for a large proportion of take-up of logistics space in both the US and UK, accounting for around a quarter of all new leases in the past two years. However, in continental Europe it is less of a market leader in online retailing, which is reflected in its occupation of logistics space – accounting for around 10% of the market.

Soaring inflation and the cost-of-living crisis is almost certainly going to result in a decline in total retail sales as consumers’ disposable income is hit. It remains to be seen what the impact of declining retail sales will have on online retail percentages. In previous economic downturns, these were largely shielded from volatility.

EBOX’s manager says that it has not seen a slowdown in the occupational market, and that Amazon’s statement flies in the face of what it is seeing on the ground with other occupiers. In two recent deals, the company secured lettings at 24% and 14% above the previous rental level on the property (more details on page 9). The manager says that the market dynamics mean that it can negotiate hard with current and prospective tenants. For example, the negotiating position has tipped so far in landlords’ favour in Germany that customary leasing terms (which include contractual hurdles to overcome in order to raise rents) are being scrapped for annual uncapped inflation uplifts. This was the case at EBOX’s Hammersbach asset in Germany, where the tenant not only renewed the lease at a far greater rent but with uncapped annual consumer price index (CPI) uplifts. Around 55% of EBOX’s rental income is now subject to annual uncapped inflation increases, with this number likely to grow as it renews leases and leases developments.

Although the market has witnessed strong rental growth, with more expected in the coming years, the proportion of rent as an overall cost to the occupier is minimal and rental growth can be swallowed. Greater costs include labour and transport. For parcel delivery companies, for instance, transport accounts for 75% of total costs, according to Savills. A 12% rise in transport costs would see total operating costs increase by 9%. In contrast, a 12% jump in rent would only lead to a 1% rise in total costs. This means that location is mission critical for logistics occupiers and they are willing to pay more to secure it.

Asset allocation

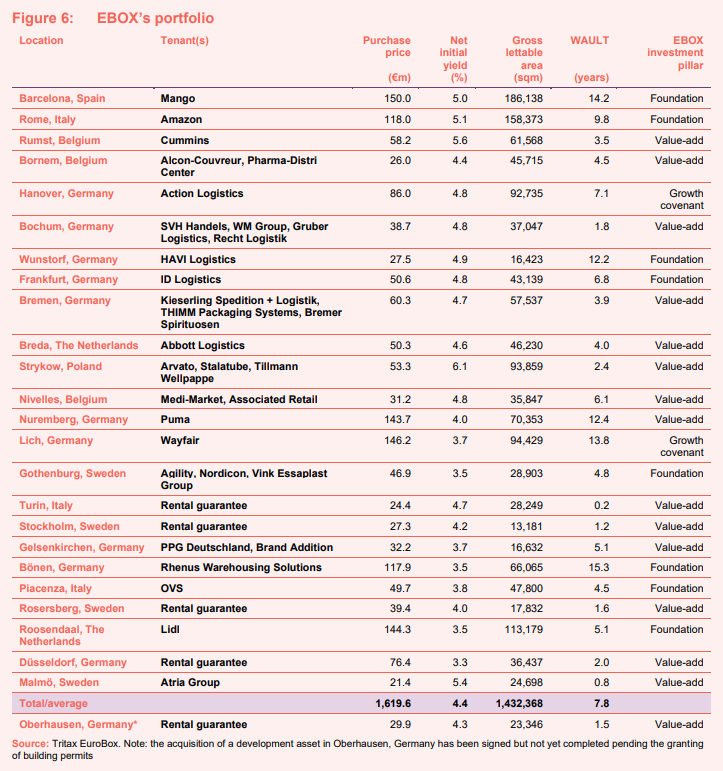

EBOX has a portfolio of 25 assets worth around €1.8bn located across seven European countries. The portfolio has a weighted average unexpired lease term (WAULT) of 7.8 years, with a spread of short- and long-term leases, let to 36 tenants. The majority of leases are subject to some form of annual uplift, with 55% linked to uncapped local CPI. 10% of leases have a fixed yearly uplift at an average of 0.9%, while 23% has a combination of inflation linkage (capped at 4%) and a fixed uplift element. Around 10% of EBOX’s income is currently through rent guarantees with the developer on its development assets.

EBOX’s most recent acquisitions are detailed below. See our last note and initiation note (links on page 14) for details on the assets in the wider portfolio.

Rosersberg

EBOX will fund the development of a 17,832 sqm logistics asset in Rosersberg, just north of Stockholm in Sweden after agreeing a forward funding deal with Verdion worth SEK 402m (€39.4m) in January 2022. The deal reflects a net initial yield of 4.0% based on the income from a 12-month rental guarantee of €1.6m from completion of construction. EBOX will also receive from the developer an income return equivalent to the agreed net initial yield during the construction of the building, which commenced in June 2022 and is expected to complete in May 2023.

The asset is located adjacent to EBOX’s 13,181 sqm Stockholm property, which it also acquired in a forward funding deal with Verdion in September 2021. Rosersberg is located close to Stockholm Arlanda Airport, on the E4 motorway to Stockholm city centre and has strong occupier demand characteristics. The development is targeting a minimum BREEAM Very Good certification, and the construction will include a range of energy-saving initiatives and staff wellbeing measures.

Roosendaal

EBOX paid €144.3m for this pre-let development from LCP, one of the company’s development partners. The property will comprise a single property, divided into three units, built in three phases, with a total net rentable area of 113,179 sqm. All three units are pre-let to Lidl, the German discount grocer, on a single lease that expires in November 2027. The annual rental income is €5.1m, which will be linked to Dutch CPI. The lease incorporates a rent review and option to extend for a further five years at the end of the lease term, allowing EBOX to capture the prevailing open market level (with a cap of 10% above the rent at that time).

Construction of the first phase completed in December 2021, with completion of the second and third phases expected by 1 December 2022 and 1 April 2023 respectively. During the construction phase, LCP will pay EBOX income equivalent to the expected rent until practical completion.

Roosendaal is located in the south-east of the Netherlands, and provides good connections to the ports of Rotterdam, Antwerp and Amsterdam. The property will be developed to a BREEAM Very Good certification.

Düsseldorf

EBOX agreed to forward fund the speculative development of a 36,437 sqm property in Düsseldorf in March 2022. It will pay Dietz €76.4m for the asset, which is currently being developed and will comprise three units offering flexible leasing options to multiple tenants or a single tenant.

Dietz will pay EBOX an 18-month rental guarantee reflecting €204,047 per month (€67.20 per sqm per year) during the construction of the property. Based on the rental guarantee, the purchase price reflects a net initial yield of 3.3%. The manager says that it expects market rental levels will exceed €72 per sqm.

The site is located between Cologne and Düsseldorf, which is considered one of the principal logistics areas in Germany and, where there is a scarcity of available development land and available buildings and strong occupier demand. The developer is targeting a DGNB Gold Certificate for sustainability standard.

Malmö

In April 2022, EBOX acquired a site in Malmö for the speculative development (one without a tenant signed up to take the space) of a new 60,700 sqm scheme for SEK 223m (€21.4m). The company, in partnership with Nordic developer MIGS, will embark on its first development project, building the new unit at an estimated cost of €65.3m. It expects the completed building to be worth €115m, based on an annual estimated rental income of €4.4m – equating to an expected yield on cost of 5.1% and an anticipated development profit of 32%.

The site was acquired from the current occupier of the building, Atria Group – a Scandinavian food processing group, which will continue to occupy the current building until February 2024, before relocating. It will pay an annual rent of €1.25m until its relocation. Completion of the new building is targeted for early 2025.

The manager says that the site is located in a prime Swedish logistics market, in the Fosie industrial area south of Malmö, where there is a shortfall of available development land. Demand from tenants is strong, given its location between Malmö’s two major ring roads that link the city to the rest of Sweden and Denmark.

Investment pipeline

As with the wider market, EBOX has paused its investment activity as it assesses the market. It has around €130m of available resources (debt and cash) for new investments and the manager says that it is keen to deploy the resources to drive earnings growth but would not rush into doing deals before it fully assesses the impact of recent economic and sentiment changes on the investment market. The investment market has very quickly become a buyers’ market, with prices coming off their peak, the manager states, adding that it was seeing good opportunities to buy from forced sellers (for example those that need to refinance because of higher costs).

Asset management initiatives

Whilst the investment market may have cooled, the leasing market is still a landlord’s market, the manager says, with unabating strong demand and lack of supply. This was displayed in two recent lettings made by EBOX. The company agreed a lease renewal with ID Logistics at its asset near Frankfurt, Germany, at a rent 24% above the previous level – growing the annual income from €2.5m to €3.1m. The new seven-year lease includes annual and uncapped CPI-linked uplifts (reflecting the strong negotiating position of the landlord and changing dynamic in the German market, as mentioned earlier) and a tenant option to extend the lease by a further five years (subject to a market rent review at extension).

EBOX also leased 15,000 sqm of newly developed space at its Bornem asset in Belgium to an online grocery retailer. It signed a nine-year lease, with tenant break options at years three and six, including annual indexed rent of €0.7m per annum. This represents a 14% increase on previous rents secured on the site. The letting of the 15,000 sqm building, which is on the site of EBOX’s existing 30,780 sqm asset and completed in September 2021, delivered a yield on cost of 7% and profit on cost of 70%.

Many of the assets in EBOX’s portfolio have expansion and development opportunities. At its largest asset – in Barcelona – the construction of a 93,931 sqm extension on an adjacent plot of land for the tenant, Mango (at a cost of €31.5m and a yield on cost of 8.8%), is continuing to progress, with a practical completion target date of November 2022. The extension will be incorporated into the existing lease, which runs until December 2046. Expansion or development opportunities also exist on plots of land at the Rome, Rumst, Strykow, Wunstorf and Nuremberg assets.

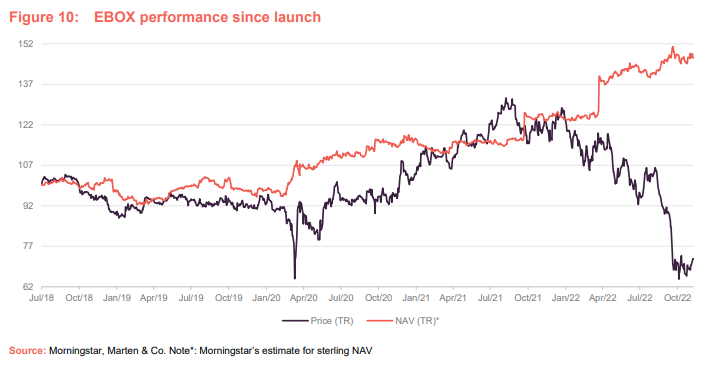

Performance

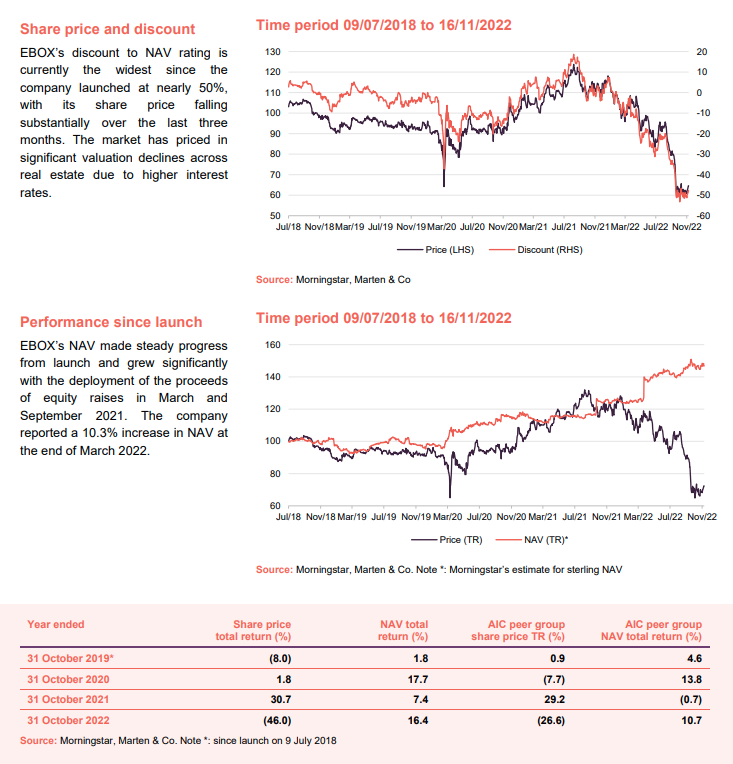

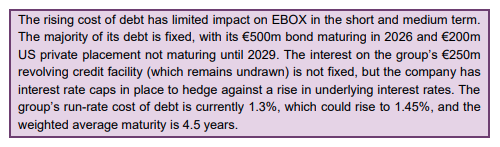

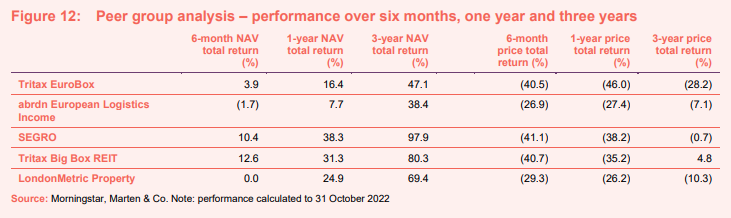

EBOX’s NAV made steady progress from launch and grew significantly with the deployment of the proceeds of equity raises in March and September 2021. The enlarged portfolio saw the company report a 10.3% increase in EPRA net tangible assets (NTA) per share at the end of March 2022, with an 8.1% like-for-like uplift in the value of its portfolio also feeding through. EBOX’s NAV is quoted in euro, and the NAV in Figure 10 is Morningstar’s estimate for sterling NAV based on the daily exchange rate.

Peer group comparison

Most property companies investing in European logistics are unlisted funds or subsidiaries of larger groups. The listed peer group we have assembled consists of EBOX’s closest peer, abrdn European Logistics Income (ASLI); SEGRO, which owns a mixture of ‘big box’, urban and industrial space, about a third of which is located in continental Europe; Tritax Big Box; and LondonMetric Property. The latter two are UK-focused.

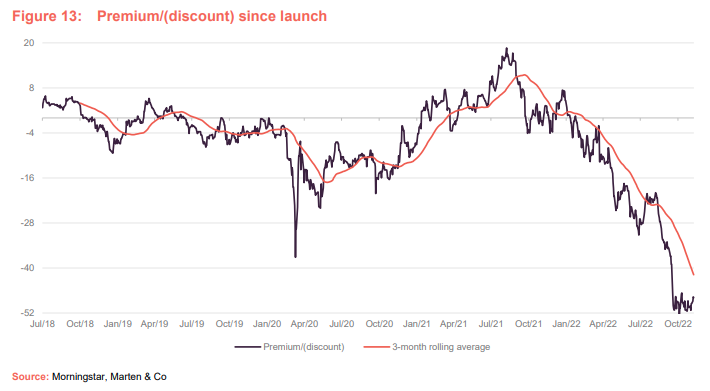

Premium/(discount)

EBOX’s premium to NAV had reached almost 20% in July last year as the market recognised the structural tailwinds at play in the continental logistics sector, exacerbated by the pandemic, and the work of EBOX’s manager to maximise growth through development. Its premium narrowed and moved to a discount after two considerable equity raises and significant growth in its NAV. As the market has started to price in significant valuation declines across real estate due to higher interest rates, EBOX’s discount has widened significantly and on 16 November 2022 the company was trading at a staggering 49.3% discount.

Fund profile

Tritax EuroBox (EBOX) invests in and manages a portfolio of logistics assets in continental Europe, diversified by geography and tenant, targeting well-located assets in established distribution hubs close to densely populated areas. The strategy aims to capture market rental value growth, which is becoming evident in the key distribution markets of continental Europe.

EBOX was launched on 9 July 2018 after raising gross proceeds of €339.3m (£300m) at its initial public offering (IPO). Following full deployment of the capital from the IPO into a portfolio of nine continental European logistics real estate assets, the company successfully raised additional gross proceeds of €135m (£119.1m) in a placing on 21 May 2019. In 2021, the group made two substantial capital raises, in March raising gross proceeds of €230m and in September €250m.

EBOX’s shares are traded on the premium segment of the London Stock Exchange, with both a sterling and euro quotation. These are the same class of shares and trading line, are fully fungible, and have no impact on overall liquidity of the stock. On 1 October 2021, the group was added as a constituent of the FTSE 250 index. To enhance equity returns, the company uses gearing, with a medium-term target of 45% of gross assets and a maximum limit of 50%.

The manager – Tritax Management

The company’s manager is Tritax Management, part of the Tritax Group. Since 1995, the Tritax Group has acquired and developed more than £6bn of commercial property assets across multiple sectors, including big box logistics assets, industrial properties, office, retail and hotels.

Tritax Group manages just over £7bn of assets (including EBOX), consisting of more than 50m sq ft. Tritax has a particular specialisation in the acquisition and management of logistics portfolios, most notably through Tritax Big Box REIT, a UK FTSE 250 REIT launched in December 2013. Tritax is headquartered in London with over 30 professionals and is authorised and regulated by the FCA.

In 2021, Aberdeen Standard Investments acquired a 60% interest in Tritax Management. As part of the deal, Tritax now leads ASI Real Estate’s global logistics team.

In September 2022 the company appointed a new fund manager, with Phil Redding taking over from Nick Preston. Phil joined Tritax in November 2020 as director of investment strategy. Prior to that he spent 25 years at SEGRO Plc, holding the position of chief investment officer from 2011 and was appointed to the board as an executive director in 2013. Phil was responsible for SEGRO’s pan-European investment strategy and implementation, playing an integral role in the company’s repositioning and growth.

In October 2022, EBOX amended its investment management agreement with Tritax Management. The key change was a reduction in the base management fee to 1.00% on NAV up to €1bn and 0.75% on NAV above €1bn. Currently the management fee is 1.3% on NAV up to €500m, 1.15% on NAV between €500m and €2bn, and 1% above €2bn. Based on the last reported NAV at 31 March 2022, the proposed changes would result in a net €2.4m reduction in the annual costs to the company.

Previous publications

QuotedData has previously published three notes on EBOX – Boxing Clever, on 23 November 2020, Full throttle on 25 May 2021, and Fast-tracked on 27 January 2022. You can read them by clicking the links or by visiting our website.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Tritax EuroBox Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.