Full throttle

Tritax EuroBox (EBOX) has been firing on all cylinders as it looks to cement its place as the leading logistics investor in continental Europe. It has checked off several key milestones in the past six months, as it looks to take advantage of favourable demand-supply dynamics in the sector (which should result in rental and capital value growth). In March 2021, it raised €230m in a bumper equity issue and attained an investment grade credit rating, which will give it access to alternative and cheaper debt.

Utilising its exclusive partnership with leading developers, EBOX has already secured two investments in off-market deals and has a strong near-term acquisition pipeline that should result in both NAV and earnings growth. The investment grade credit rating has opened access to alternative forms of financing and the group is working on issuing a green bond (secured against highly sustainable buildings in its acquisition pipeline and existing portfolio) that will be used to refinance existing debt on far superior terms.

Big box logistics in Europe

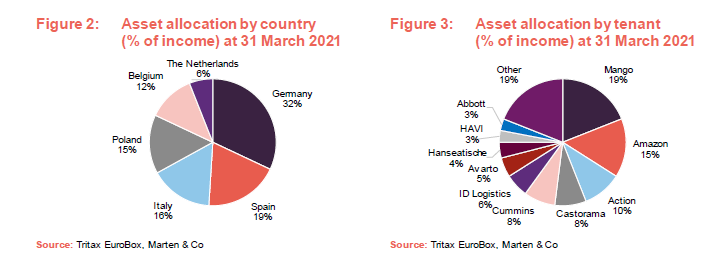

EBOX invests in a portfolio of logistics assets in continental Europe, diversified by geography and tenant, targeting well-located assets in established distribution hubs, within or close to densely populated areas. The strategy aims to capture market rental value growth and deliver an attractive capital return and secure income. EBOX is targeting a total return of 9% per annum over the medium term.

Growing at pace

Since we published our initiation note on EBOX in November 2020, which you can read here, the company has reached several milestones on its growth journey. It has moved at pace to take advantage of the burgeoning logistics sector in Europe, which is characterised by strong occupational demand – especially from online retailers – and extremely low supply of property. It raised €230m in March 2021 in a substantially oversubscribed equity issue and attained investment grade credit rating that not only reduces the cost of its current debt but also opens access to cheaper, long-term financing.

The investment manager, Tritax Management, has acquired two newly-built properties in Germany on EBOX’s behalf for €290.9m (more detail on page 7) as it looks to deploy the proceeds of the equity raise (plus proceeds from the €65.5m sale of an asset in Poland) in short measure. With new debt facilities close to being agreed, further acquisitions are expected to be announced in the coming months. EBOX refined its investment strategy in December 2020 to a more value add approach, with the aim of acquiring assets earlier in the development cycle or with opportunities to add value through leasing or future development. This, the manager says, should deliver greater income and capital value growth.

As we explained in our initiation note, EBOX has access to a significant pipeline of investment opportunities in prime locations through its exclusive relationship with two logistics developers – Dietz and Logistics Capital Partners (LCP). This gives EBOX first right of refusal over developments being brought forward by the two companies, giving EBOX a distinct advantage over its peers.

With the rapid deployment of the equity raise and further acquisitions anticipated to complete in the near term (more details on page 7), significant net asset value (NAV) and earnings growth is expected to be captured in the next year.

Interim results

EBOX published interim results for the six months to the end of March 2021 in May, in which NAV increased to €1.22 per share from €1.19. The value of the portfolio grew 3.4% in the period to €843.4m, while adjusted earnings grew 2.2%.

he equity raise towards the end of the period, which increased the capital of the company by 45%, impacted the financial figures somewhat. A subdued total return for the period of 2.3% reflects the short-term dilution of the capital raise. However, the group said it expects to achieve its medium-term annual total return target of 9% as the proceeds are deployed.

The group declared dividends in the period of 2.50 euro cents – a 13.6% increase on the previous six months. These were not fully covered by earnings due to the dilution of the equity raise. The manager said that it expects an increased dividend next year will be fully covered by earnings as income from new acquisitions and asset management initiatives on the existing portfolio come through.

The European logistics market

The characteristics of the European logistics market were explained in detail in our initiation note, but to recap the sector is at the epicentre of a hugely favourable demand-supply imbalance that is leading to prolonged rental growth and capital value rises.

A surge in occupier demand comes on two principal fronts – the growth of online retailing and the need for increased supply chain resilience. The trend towards online retail consumption had been building for many years prior to the COVID-19 pandemic, but has accelerated exponentially over the past 18 months as physical retail stores were forced to close as countries tried to compress the spread of the virus.

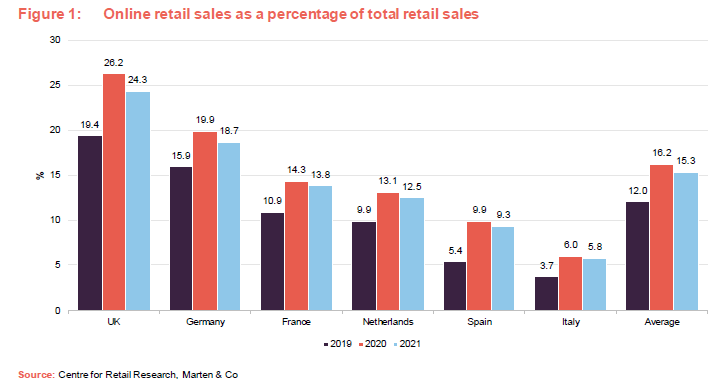

The Centre for Retail Research has forecast that online retail sales as a percentage of total sales increased from 12% in 2019 to 16.2% in 2020, as shown in Figure 1. It predicts online penetration rates will ease back to 15.3% during 2021 when shops reopen, and consumers return to the high street.

The manager believes that although ecommerce penetration levels may abate slightly as shops reopen, consumer behavioural changes have been established and will endure. Demand for logistics space close to large populations from both pure-play online retailers, such as Amazon, and retailers in general, has increased in line with ecommerce rates. In 2020, 26m sqm of space was let in the European logistics market, a record year – 12% up on 2019 and 19% above the five-year average, according to Savills.

Although online retailing has been a major source of the rise in logistics demand, it is by no means the only factor. In the wake of the COVID-19 pandemic, when travel restrictions cut off supply chains from the Far East and significantly hampered production, and more recently the Suez Canal incident, occupiers are increasingly looking to strengthen their supply chain efficiency and resilience. A re-think of supply chains has seen an uptick in ‘reshoring’ production facilities to Europe and increasing inventory capacity to deal with shocks.

On the supply side, planned developments are not keeping pace with the levels of demand. This could be down to a number of reasons, including developer caution in the wake of COVID-19, but the manager believes the main reason to be the constraint on land and the complexity of the development process. For example, in Germany and the Netherlands it is particularly hard to gain planning permission for new projects due to strict controls which limit the development of logistics property.

On average, European logistics vacancy rates stood at 5.3% at the end 2020, according to Savills, which is low by historical standards and well below the 12% equilibrium for stable rental growth observed within the UK. The state of play in prime locations near to big cities, which EBOX targets, has witnessed the tightest level of supply.

The favourable demand-supply characteristics have not been lost on investors. 2020 was a record year for investment volumes in the European logistics market, with €39bn transacted – 5% above 2019 and 24% above the five-year average, according to Savills. When you consider a large proportion of the year was impacted by COVID-19, that figure becomes even more astounding. The second half of the year saw €25.7bn transacted alone.

With the weight of investment demand continuing in 2021 and a number of big-ticket deals recently transacted, the 3.4% uplift on EBOX’s like-for-like portfolio in the six months to 31 March 2021 feels a little conservative. The manager believes that more comparable deals (which are used by valuers as evidence on which to base values) will start to be evidenced over the next few months, which should lead to greater valuation gains in the next six to 12 months.

Asset allocation

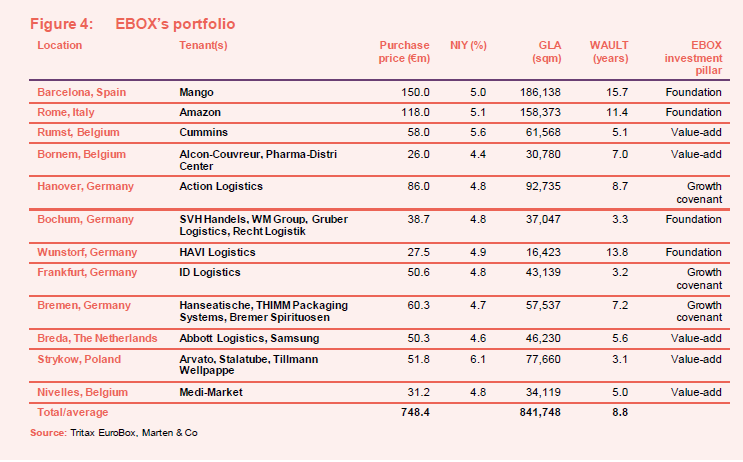

EBOX has a portfolio of 12 assets worth €843.4m located across six European countries. The portfolio has a weighted average unexpired lease term (WAULT) of 8.8 years, with a spread of short- and long-term leases, let to 21 tenants. The majority of leases are inflation-linked (71%), with a further 23% with fixed annual uplifts and just 6% with no uplifts. Since our initiation note, EBOX has acquired a property in Nivelles, Belgium, for €31.2m and sold a property in Lodz, Poland for €65.5m.

Equity raise and pipeline

The €230m equity raise in March and new debt facilities of around €188m that are close to being secured, along with the €65.5m proceeds from the Lodz sale, will give EBOX total capital available to deploy of around €483m. As mentioned earlier, it has agreed two acquisitions in Germany from its development partner Dietz for a total of €290.9m, reflecting a yield of just under 4%.

The first of these is a 70,353 sqm property in Nuremburg that is let to global sportswear manufacturer and retailer Puma. It serves as the European distribution headquarters for Puma, which signed a 15-year lease on the property in April 2020. The property produces an annual rental income of €5.78m, with the lease subject to annual indexation of 100% of German Consumer Price Index (CPI). The asset is categorised as a foundation asset by EBOX, due to the low-risk nature of the income (EBOX’s four investment pillars – foundation, value-add, growth covenant and strategic land – are explained in our initiation note).

The second acquisition, which is due to complete in June 2021, is a 94,000 sqm distribution unit in Lich, near Giessen, that is leased to online furniture retailer Wayfair. It is Wayfair’s first distribution centre in Germany as the US-based company continues its expansion in Europe. It has signed a 15-year lease on the property that commenced in May 2021 at an annual rent of €5.6m, linked to German CPI. The asset is categorised as a growth covenant asset by EBOX due to Wayfair’s growth potential.

EBOX has a further €99m of deals across three assets in exclusive terms, and expects to make announcements in the coming weeks. Two are value-add assets in Germany and Italy and have been sourced through development partner relationships. The deals will fit EBOX’s refined investment focus on assets with value creation potential, and in this case funding the development of the assets before practical completion. This offers EBOX a better entry price point than paying for the fully developed and let property, but it takes on some letting risk.

The third investment asset, in exclusive terms, is a foundation asset in Sweden. This would be the first foray into the Nordic region by EBOX and would further diversify its portfolio. The manager says that the region presents strong logistics and online retailing traits, characterised by several heavily populated cities and an affluent, technologically sophisticated population. It added that land supply is tight, which has led to supply shortages, while demand is strong.

Assuming these deals complete, EBOX would be left with around €94m of capital available to invest. It has several investment deals under appraisal in Germany, Spain and Italy.

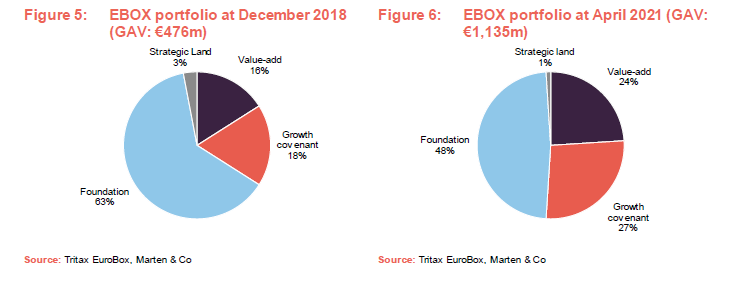

Once fully deployed, EBOX’s portfolio will have a gross asset value (GAV) of more than €1.3bn. The group’s refined investment focus on assets with some form of value-add characteristic is displayed in Figures 5 and 6. Value-add and growth covenant assets now account for 51% of the portfolio, following the acquisitions in Nuremberg and Lich, compared to 34% in December 2018.

Asset management initiatives

Many of the assets in EBOX’s portfolio have expansion and development opportunities, as well as leasing potential. The group is currently undertaking two expansion developments that will result in significant valuation uplifts. At its largest asset, in Barcelona, EBOX is funding an 88,000 sqm extension on an adjacent plot of land for the tenant, Mango, at a cost of €31.5m. The manager expects to secure the necessary building permits before the end of May 2021, enabling construction to start in June 2021. Practical completion is targeted for the final quarter of 2022.

EBOX is also funding the construction of 15,000 sqm of warehouse space at its Bornem asset in Belgium. Construction work began in January 2021 and is expected to complete in summer 2021. EBOX is actively marketing the property and the manager says that it has received a good level of interest.

Investment grade credit rating

In March 2021, EBOX attained an investment grade credit rating from Fitch Ratings that immediately resulted in a 30-basis point reduction in the cost of its current debt facilities. More significantly, however, is that the investment grade credit rating gives EBOX access to cheaper, longer-term debt financing and the bond market.

The group has adopted a new green finance framework and is working on plans to issue a circa €500m green bond. It is anticipated that the green bond will be used to acquire assets, or finance new developments, or refinance existing properties that have very high green credentials. The criteria includes buildings achieving a minimum BREEAM Very Good, DGNB Gold or equivalent rating.

Of EBOX’s existing portfolio, €508m by value would be eligible for green finance. Of the new and pipeline acquisitions and extensions, as outlined above, 94% would qualify, worth €555m. The green bond would be significantly cheaper and longer-term in nature than EBOX’s current debt, with an estimated cost of 1.6% versus its current average cost of debt of 2.3%.

Performance

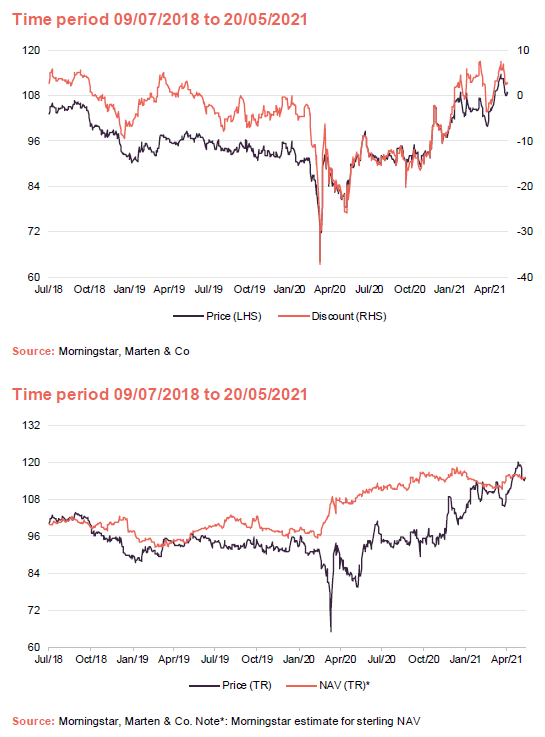

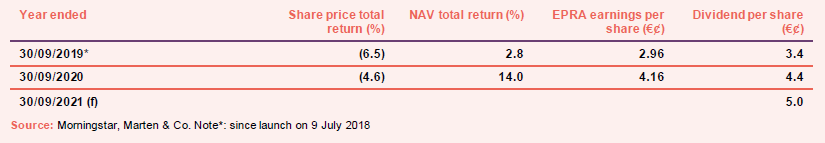

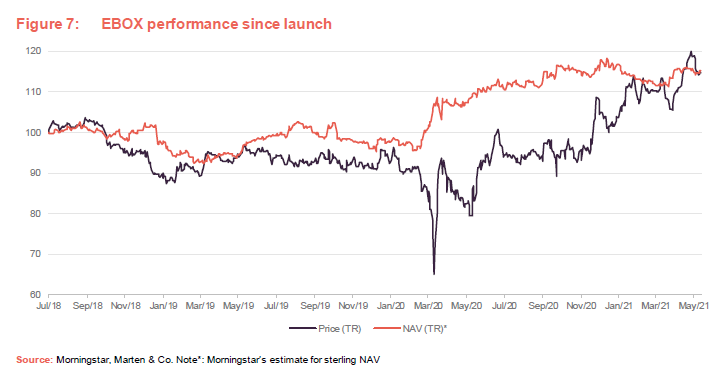

EBOX’s NAV has made steady progress from launch as it pieced its portfolio together. The manager expects the NAV to grow significantly with the deployment of the proceeds of the equity raise in March 2021. EBOX’s NAV is quoted in euro, and the NAV in Figure 7 is Morningstar’s estimate for sterling NAV based on the daily exchange rate.

Peer group comparison

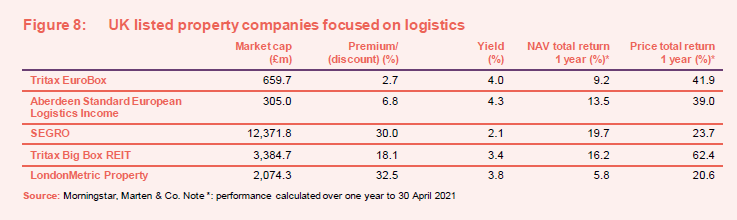

Most property companies investing in European logistics are unlisted funds or subsidiaries of larger groups. The listed peer group we have assembled consists of EBOX’s closest competitor Aberdeen Standard European Logistics Income (ASLI); SEGRO, which owns a mixture of ‘big box’, urban and industrial space, about a third of which is located in continental Europe; Tritax Big Box; and LondonMetric Property. The latter two are UK-focused.

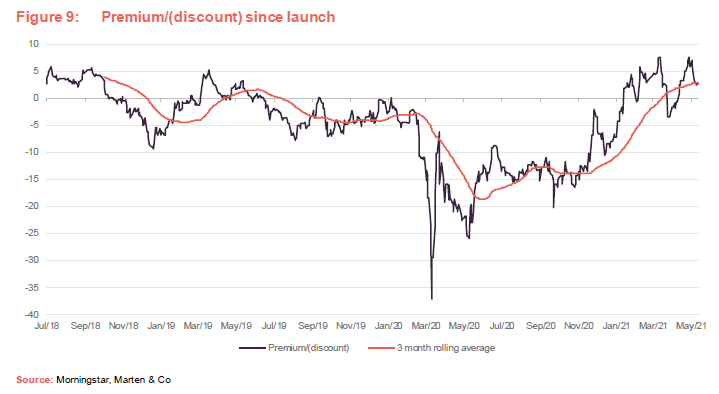

Premium/(discount)

EBOX’s rating had fluctuated between a 5% premium and a 10% discount for the first 18 months from launch, as it grew its portfolio. When the COVID-19 pandemic hit markets in early March 2020, EBOX’s discount widened to as much as 38% before narrowing considerably. As the market recognised the structural tailwinds at play in the continental logistics sector, exacerbated by the pandemic, its discount narrowed and moved to a premium rating this year. On 21 May 2021 it was trading at a 1.7% premium.

Fund profile

Tritax EuroBox (EBOX) was launched on 9 July 2018 after raising gross proceeds of €339.3m (£300m) at initial public offering (IPO). Following full deployment of the capital from the IPO into a portfolio of nine continental European logistics real estate assets, the company successfully raised additional gross proceeds of €135m (£119.1m) in a placing on 21 May 2019. It now has a portfolio of 12 assets in six countries, with 21 tenants, worth £843.4m, at 31 March 2021.

It invests in and manages a portfolio of logistics assets in continental Europe, diversified by geography and tenant, targeting well-located assets in established distribution hubs close to densely populated areas. The strategy aims to capture market rental value growth, which is becoming evident in the key distribution markets of continental Europe.

EBOX’s shares are traded on the premium segment of the London Stock Exchange, with both a sterling and euro quotation. These are the same class of shares and trading line, are fully fungible, and have no impact on overall liquidity of the stock. In June 2019, EBOX was included in the FTSE All Share Index. To enhance equity returns, the company uses gearing, with a medium-term target of 45% of gross assets and a maximum limit of 50%.

The manager – Tritax Management

The company’s manager is Tritax Management, part of the Tritax Group. Since 1995, the Tritax Group has acquired and developed around £6bn of commercial property assets across multiple sectors including big box logistics assets, industrial properties, office, retail and hotels.

Tritax Group manages just over £5bn of assets (including EBOX), consisting of more than 43 million sq ft of assets. Tritax has a particular specialisation in the acquisition and management of logistics portfolios, most notably through Tritax Big Box REIT, a UK FTSE 250 REIT launched in December 2013. Tritax is headquartered in London with over 30 professionals and is authorised and regulated by the FCA.

In December 2020, Aberdeen Standard Investments announced it was to acquire a 60% interest in Tritax Management. As part of the deal, Tritax will lead ASI Real Estate’s global logistics team.

Previous publications

QuotedData has previously published an initiation note on EBOX – Boxing Clever, on 23 November 2020. You can read it by clicking the link.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Tritax EuroBox Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.