Urban Logistics REIT

REITs | Update | 17 May 2023

Fundamentals strong as market stabilises

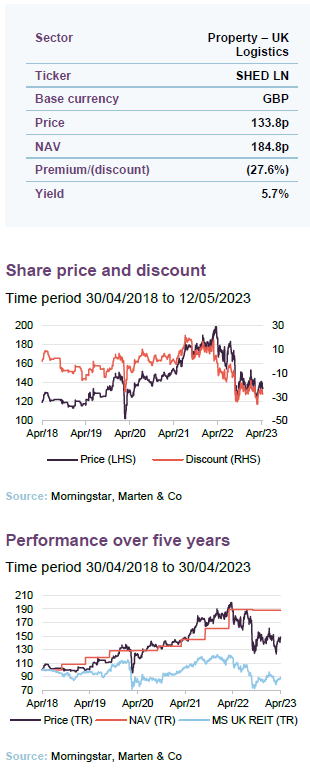

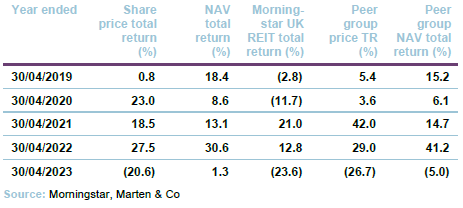

The industrial and logistics sector suffered its largest fall in value on record in the second half of 2022, even eclipsing that of the global financial crisis, as investment yields moved out rapidly to keep pace with interest rates. The re-rating of Urban Logistics REIT’s (SHED’s) share price was at an even greater velocity, putting it on a wide discount. However, evidence that values have bottomed out is building, with MSCI reporting uplifts in March for the first time in months. Whilst SHED has yet to announce its end of March NAV (due in June), its current discount of 27.6% seems very attractive.

This is especially the case given that the fundamentals supporting rental growth in the last mile, urban logistics sub-sector remain strong. Demand for space, specifically from third-party logistics (3PL) operators (which make up a large portion of SHED’s tenant base), is robust (see page 5), while supply constraints remain.

A fifth of the company’s leases are either expiring or have a rent review by September 2023, presenting SHED with the near-term opportunity to capture the compelling rental growth still evident in the sector.

‘Last mile’ logistics

SHED invests in a diverse portfolio of single-let, urban logistics properties located in the UK, with the aim of providing its shareholders with a 10% to 15% total return per annum.

Market outlook – steepest value falls on record

Capital values fell 26% in the industrial sector in the second half of 2022.

Commercial real estate valuations have been heavily impacted by market volatility and economic uncertainty, as interest rates rise and financing conditions have tightened. The pace at which values have declined has been extraordinary, with UK real estate returns in the fourth quarter of 2022 falling by 11.9% – the largest quarterly fall since 2008, according to MSCI’s quarterly UK property index. In fact, capital values have fallen faster during the current period of uncertainty than during the 2008 global financial crisis.

For 2022 as a whole, UK property returns fell 8.9%, the MSCI data showed. The quarterly property index measures returns across 7,375 properties – mostly industrial, office and retail buildings – worth £140bn.

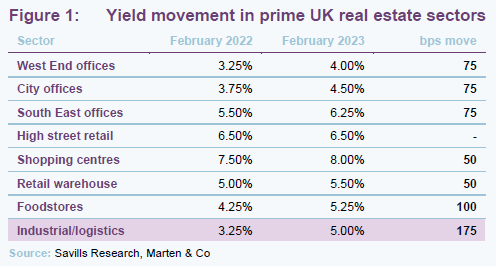

The investment yields used to value property moved out to keep pace with the Bank of England base rate, which has moved from 0.25% in January 2022 to 4.5% in May 2023. Figure 1 shows the yield movement of different prime property sectors between February 2022 and February 2023.

The industrial and logistics sector has witnessed the largest yield shift due to it being one of the lowest yielding property sectors, following years of yield compression as investor flocked to the sector attracted by the rental growth prospects. UK industrial property capital values fell by 26% in the second half of 2022, the steepest fall for the sector on record, MSCI’s index showed. Industrial and logistics property yields increased by more than 120 bps, while the prime segment recorded an outward shift of 175 bps, from 3.25% to 5%, in just five months.

Property returns were positive in March – the first time for eight months.

However, positive data from the MSCI for March 2023 may point to a bottoming-out of values in the UK. Total returns for UK real estate were positive in March, the MSCI data showed, the first positive return since June last year. The month-on-month total return in March was 0.67% (a 0.46% income return from rental income and a 0.21% capital return). The MSCI says that the rebound was led by an increase in values for the industrial sector, as well as residential and retail property.

SHED’s manager says that the market has improved week on week since February, with a weight of capital still looking to invest in the industrial and logistics sector, underpinned by the supply and demand imbalance. The bid for Industrials REIT by Blackstone in April (at a 42% premium to its share price and “material” premium to its NAV) has lent significant confidence to the market, the manager adds. Despite this weight of capital, the manager says that market pricing is still very sensitive to the effects of monetary tightening and all-in finance yields.

Investment levels returning after hiatus

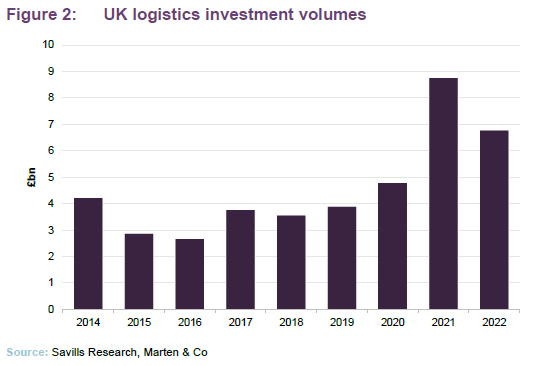

Investment volumes dropped in second half of 2022, but still ahead of long-term average.

Logistics investment volumes in 2022 were the second-strongest ever recorded, as shown in Figure 2, reaching £6.76bn. However, the largest proportion of this was transacted in the first half of the year (71%), reflecting the decline in investor sentiment as interest rates rose. Investment in the final quarter of the year was just £946.6m, according to Savills, the lowest fourth quarter level since 2012. Despite logistics investment being curbed in the second half of the year, volumes in the final six months of 2022 still comfortably exceeded the long-term average by 41%.

Many of the sales in the second half of the year were made by UK institutions and open-ended property funds bringing stock to the market in a bid to transact quickly to meet fund redemptions. In the third quarter, 96% of vendors were classified as UK institutions, according to Savills, a figure which normally averages 55%.

As mentioned earlier, the speed at which logistics pricing has readjusted has been staggering and offers hope that the bottom has been reached. That pace of change has created opportunities for investors to deploy capital with greater confidence that a nadir point has been reached and returns in the new environment can be met. There has been anecdotal evidence of transaction volumes picking up again in the market.

Demand still strong

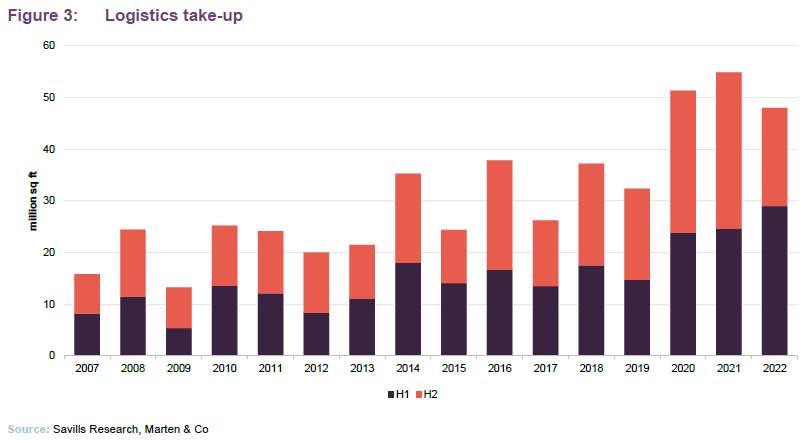

Take-up of logistics space at the end of 2022 reached 47.99m sq ft, making it the third-strongest year ever, 56% above the long-term annual average, and comfortably above the pre-COVID average of 37m sq ft. The second half of the year saw take-up fall by 34% compared to the first half to reach 19.01m sq ft, which in a long-term context is 22% ahead of the average in the second half of a year.

Some interesting trends developed from the take-up data in 2022. Third-party logistics (3PL) companies, which typically run contracts for e-commerce companies from their sites (think DHL and the like) and make up the majority of SHED’s tenant base (see page 8), continued to race for space and took 14.8m sq ft of new space in 2022, which at 30% of the market, was the highest proportion of overall take-up ever recorded. Savills notes that 86% of the new leases signed by 3PL companies in 2022 were for units considered Grade A, against a long-term average of just 60%. This, it says, highlights that 3PLs are putting a higher degree of emphasis on high-quality space to provide better staff welfare and ESG-compliant facilities in order to retain key client contracts.

ESG-compliant logistics units most sought after by occupiers.

Overall, just 22% of take-up was for second hand units, the lowest level ever recorded. This suggests that occupier requirements for modern, well designed, and well-located warehouse space is increasing and that ESG continues to play a greater role in requirements. Savills states that it believes that Grade A stock will continue to be in high demand in 2023.

Whilst the logistics sector is not immune to wider issues in the economy and a recession, which would put downward pressure on take-up, demand remains robust. Savills recorded 38.7m sq ft of new requirements at the end of 2022, which it says suggests take-up in 2023 will return to the pre-COVID level of around 30m sq ft.

The effect of manufacturers beefing up their supply chain resilience through ‘near-shoring’ and holding more inventory, after encountering many disruptions over the past three years, is starting to feed through into take-up, with manufacturing-related leases reaching its highest level ever in 2022 at 11.4m sq ft, 73% ahead of the long-term average. Savills expects this trend to continue over a number of years as manufacturers change from a ‘just-in-time’ supply chain model to a ‘just-in-case’ model.

Historically low supply

Supply creeping up, but still at historically low levels.

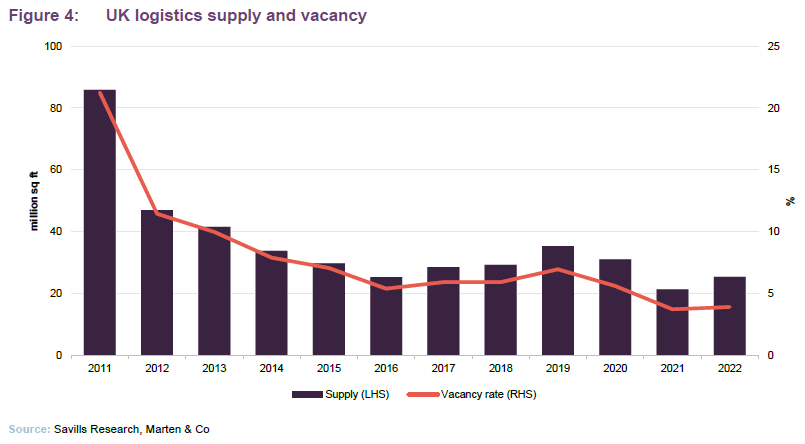

Supply of logistics space stood at 25.5m sq ft at the end of 2022, as shown in Figure 4, reflecting a nationwide vacancy of 3.94%. Unofficial figures from Savills for the end of the first quarter of 2023 show that supply increased to 32.7m sq ft and the vacancy rate to around 5%. The upward trend is alarming but, as also shown in Figure 4, this is still at historically low levels. 10.5m sq ft of the vacant space at the end of March 2023 is currently under offer, which Savills says bodes well for strong take-up in the second quarter. There is also a further 20.77m sq ft of speculative development due for delivery across 2023 and 2024, 12% of which is already under offer. It is likely that vacancy and total supply will trend upwards, although there is a strong possibility that developers will re-evaluate previously announced schemes given construction cost increases and less availability of debt.

Demand and supply characteristics more pronounced in urban sub-sector.

SHED’s manager says that the supply and demand characteristics are more pronounced in the ‘last mile’ urban logistics sub-sector that the company operates in. There is a severe shortage of supply of urban logistics facilities close to cities and towns due to the low availability of appropriate land (unfortunately, data for the smaller end of the logistics sector is sketchy), while demand for space from 3PLs is strong, as mentioned earlier. SHED’s intensive asset management approach should also generate greater returns than the wider market (more details on the asset management initiatives that has driven valuation growth is on page 9). A large portion of capital value growth since the company launched in 2016 is attributed to asset management.

Asset allocation

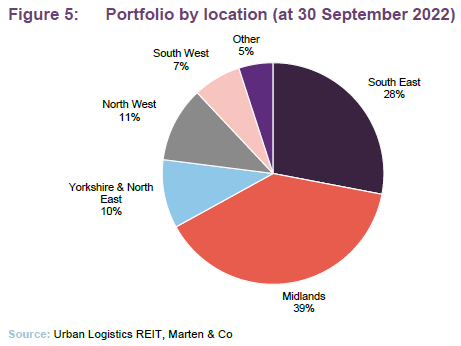

Portfolio now worth over £1.1bn, with a focus on the South East and Midlands.

SHED has a portfolio of 125 assets worth £1,132m (at 30 September 2022) located across the UK, with a focus on the South East and the Midlands. The portfolio has a WAULT of 8.3 years, with a spread of short- and long-term leases. Around half of SHED’s portfolio (48%) is categorised as ‘active asset management’ assets, which have shorter leases (average WAULT of 3.6 years) and provide the manager with opportunities to increase rent (ERV 25% above current rent). Meanwhile 50% is ‘core assets’, typically let on longer leases (average WAULT of 12.8 years) and strong tenant covenants. The remaining 2% of the portfolio is forward-funded developments, either pre-let or speculative, with a target yield on cost of 7%.

SHED’s manager deliberately slowed the pace of investment in 2022 to assess the impact of rising interest rates on the investment market and to potentially take advantage of opportunities that may arise. In January 2023, the company announced the acquisition of five properties for a total of £48m, reflecting a net initial yield (NIY) of 6.0%. The acquisitions comprised:

- A portfolio of four assets bought from Columbia Threadneedle for £39.5m at blended 6.1% NIY. The portfolio was made up of:

- a 95,352 sq ft unit in Redditch, Worcestershire, let to Carpet and Flooring (Trading) Limited, on a lease expiring in 2027;

- a 112,586 sq ft unit in Droitwich, let to Amazon UK Services on a lease expiring in 2026;

- a 113,071 sq ft unit in Southampton, let to Delamode Logistics Limited, on a lease expiring in 2024; and

- a 81,699 sq ft unit in Rugby, let to the Volvo Group UK Ltd, on a lease expiring in 2026.

All of the properties were immediately income producing, with short or medium-term asset management opportunities to grow the low rents; and

- A 63,488 sq ft warehouse in Aylesford Way, Thatcham, bought for £8.7m at a NIY of 5.8%. It is located near junction 12 of the M4 motorway and is let to Offsite Storage and Integrated Services Ltd, on a lease expiring in 2029.

Tenants

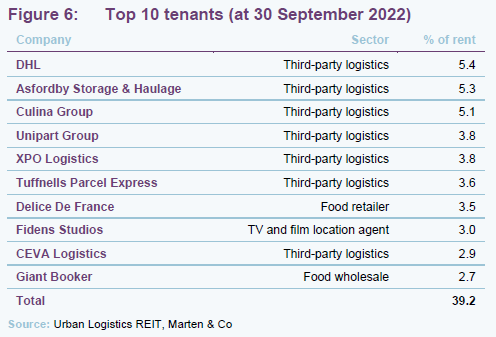

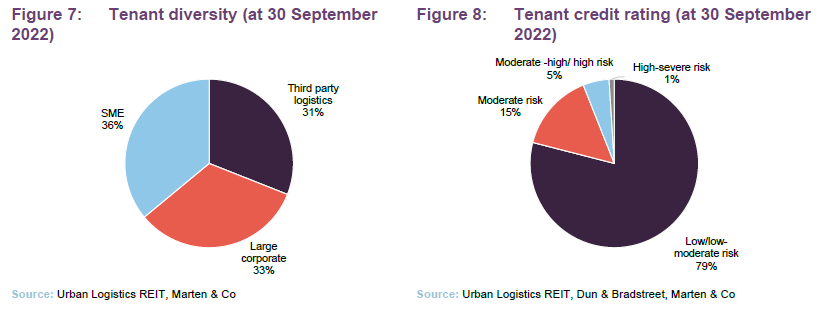

SHED’s top 10 tenants account for 39.2% of its contracted rent and are made up of largely global 3PL operators, as shown in Figure 6. The manager states that a large proportion of the SME category (36% of portfolio – as shown in Figure 7) is also made up of smaller 3PL companies. ‘Third-party logistics’ refers to the outsourcing of e-commerce logistics processes and includes inventory management, warehousing, and fulfilment. They typically run contracts for e-commerce companies from their sites. SHED’s third largest tenant, Culina Group, is the logistics arm of the Müller Group – the multinational dairy giant. The Unipart Group is running a contract on behalf of the NHS. SHED’s current second largest tenant is Asfordby Storage & Haulage, which is the tenant at its recently acquired East Midlands Logistics Hub asset. The company will move out at the end of its lease in 2023, with SHED’s manager in discussions with prospective tenants. Other top 10 tenants that may not be household names include Fidens Studios, which provides production space for a large US studio.

Figure 8 shows that 79% of tenants across SHED’s portfolio have been rated low/low-moderate risk (as a percentage of contracted rental income) by Dun and Bradstreet (down from 86% on 31 March 2022). The fall reflects recent, planned acquisitions of assets with higher risk tenants on short-term leases that provide asset management and re-letting potential.

Asset management initiatives

As mentioned previously, around half of SHED’s portfolio is classified as ‘active asset management’ assets, where the manager can increase rental income over a short period. In the first quarter of 2023, the company completed 15 new lettings and regears, covering 490,188 sq ft of space and generating £1.6m of additional rental income, with a like-for-like rental uplift of 24% for new lettings and 5% for regears. The new lettings included at the company’s recently completed developments at Nottingham and Rochdale, which are now fully let at a blended yield on cost of 7.7%. Four further deals have been agreed post quarter end covering 237,163 sq ft of space and generating £0.8m in new rent.

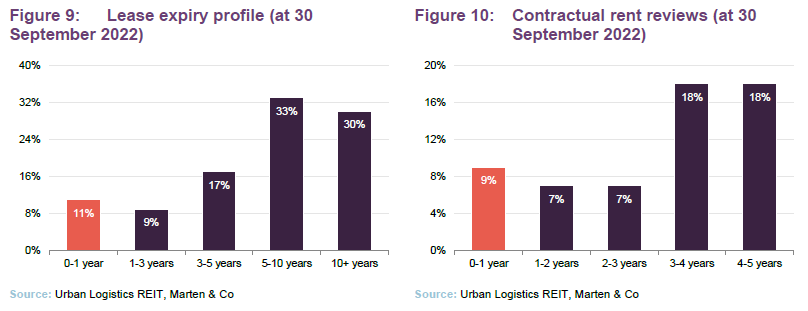

Around 20% of the portfolio is subject to a rent review or expiry over the 12-month period to September 2023, as shown in Figures 9 and 10, providing the manager with further opportunities to grow rent and in turn capital values.

Being able to grow the valuation of its portfolio through asset management (a large portion of portfolio valuation uplift since inception has been due to asset management initiatives) means that the value of the portfolio is less reliant on the wider market and it is somewhat shielded from a turn in market conditions and valuation falls. This has been borne out recently during the revaluation of property due to higher interest rates. SHED’s portfolio fell in value by 1.9% over the six months to 30 September 2022, which was better than its peers and almost all of the REIT sector. This was due to the 5.5% rental growth in its portfolio largely offsetting the impact of an outward yield movement of 35 bps.

SHED has also driven value through speculative and pre-let developments. Two forward-funded development projects have recently reached practical completion, comprising five units across 239,355 sq ft of space. The Kingsway Business Park in Rochdale is now fully let (as mentioned earlier), while a 120,815 sq ft development in Golborne was pre-let during the construction phase to Master Removals, achieving a yield on cost of 8.0%.

The risks associated with inflation rises in construction and wider supply chain issues is met by SHED’s developer partners, with fixed-price forward funding costs set at the outset.

Performance

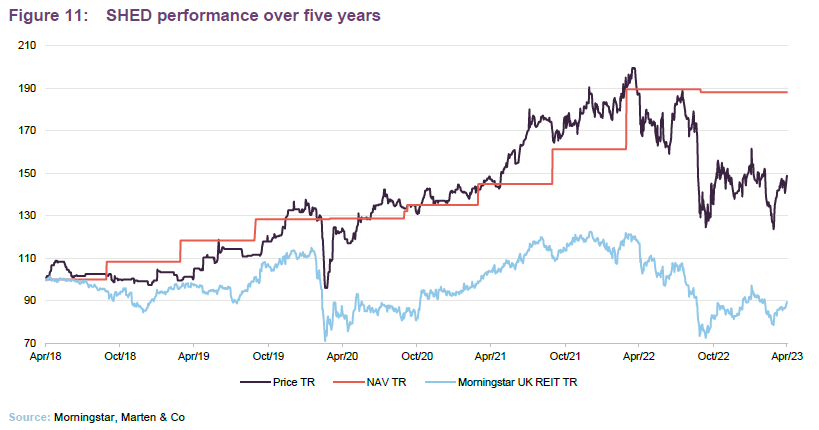

SHED’s NAV increased steeply throughout 2021 and the first half of 2022 as the manager expanded the portfolio and valuations increased through a combination of asset management initiatives and market movement. The NAV fell 3.0% at the end of September 2022 as rental growth in its portfolio largely offset the impact of valuation declines. The company is due to announce its March 2023 NAV in interim results in June. In terms of share price performance, the group’s share price had been trending upwards but plummeted at the end of September due to fears of a steep increase in interest rates following the chancellor’s mini budget. It has yet to recover as investor sentiment continues to wane. It is still way ahead of the Morningstar UK REIT index over five years, however.

Peer group comparison

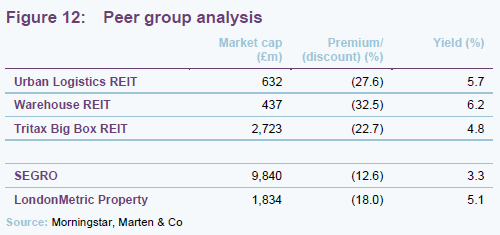

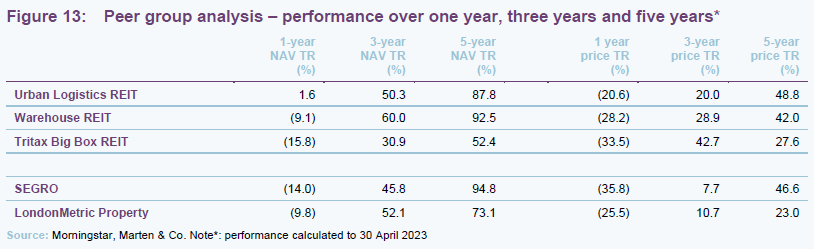

SHED has been allocated to the Property – UK Logistics sector by the AIC, a sector that also comprises Warehouse REIT and Tritax Big Box REIT. As previously mentioned, there is no other listed company that is exclusively focused on the urban logistics sub-sector and therefore it is difficult to make a like-for-like comparison.

Warehouse REIT’s portfolio is more focused on multi-let industrial assets (which have a completely different tenant base type and is more exposed to SMEs), while Tritax Big Box REIT is focused on the larger end of the logistics market (warehouses in the 500,000 sq ft plus size range), which perform a different role in the supply chain to urban logistics.

We have included other listed property companies focused on the industrial and logistics sector for further comparison. SEGRO is by far the largest and has a mixed portfolio of big box assets, urban logistics and developments. LondonMetric has a big weighting to urban logistics assets, but also owns big box and a separate long-income portfolio.

Click here for an up-to-date comparison of SHED and its Property – UK Logistics peer group.

SHED has a comparable NAV and share price total return performance to its peer group (it is due to announce its March 2023 NAV in June). Given the acute supply and demand characteristics in the urban logistics sector (as described in previous sections), the strength of SHED’s tenants, and the manager’s ability to add value through asset management, the company’s discount and dividend yield seem particularly attractive.

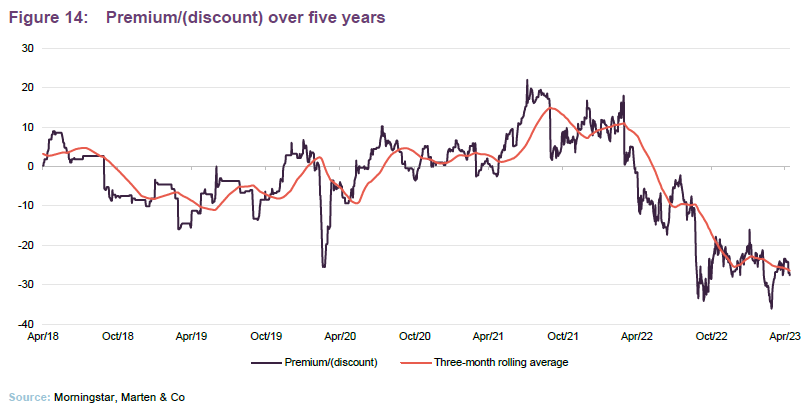

Premium/(discount)

SHED’s shares have fluctuated between trading at a discount to NAV and a premium for much of its existence (the early days were skewed by a lack of liquidity in its shares). It moved to a premium rating shortly after the COVID-19 pandemic hit, as the market recognised the strength of its portfolio and the logistics market. The impact of higher interest rates on the real estate sector (especially the logistics sector that had seen investment yields compress to around 3%) saw SHED’s rating move rapidly to a wide discount. At 12 May 2023, it was trading at a 27.6% discount.

Fund profile

The fund’s website is urbanlogisticsreit.com.

SHED invests in and manages a portfolio of urban logistics assets – defined as smaller single-let warehouses (in the 20,000 sq ft to 200,000 sq ft size range) located close to major conurbations across the UK – which is diversified by tenant. SHED is the only real estate investment trust (REIT) wholly focused on these assets. The strategy aims to capture rental value growth through active asset management initiatives and upward momentum in rents and capital value.

Initially, SHED was listed on the AIM market of the London Stock Exchange on 13 April 2016 as Pacific Industrial & Logistics REIT. The group deployed the capital (and debt) from its IPO into a portfolio of 11 urban logistics property assets across the UK and has since made several successful placings to grow its portfolio. It now has a portfolio of 125 assets, worth £1,132m at 30 September 2022. It changed its name to Urban Logistics REIT on 25 April 2018.

Moved to a premium listing on the London Stock Exchange.

SHED’s share capital was admitted to the main market of the London Stock Exchange on 7 December 2021. Since then, the company has been a constituent of the FTSE 250 Index. SHED has a conservative capital structure and a measured approach to the use of debt, with a target loan to portfolio value (LTV) of 30% to 40%. At 30 September 2022, the group’s LTV was 22.3%.

New management arrangements

The company’s current manager is PCP2 Limited – part of the Pacific Investments Group, which was founded by Sir John Beckwith. It is proposed that Logistics Asset Management LLP, which currently undertakes the day-to-day running of the company through asset management services to PCP2, will take over as investment adviser to SHED, with Pacific transferring its interests in the investment adviser to Richard Moffitt and Christopher Turner. This will mean that the existing management team – principally Richard and Christopher – will continue to lead the management of the company. The investment adviser’s appointment is to be extended for a further three years from 12 May 2024 and may be terminated on one year’s notice from 12 May 2026 onwards. As part of the plans, G10 Capital Limited will succeed PCP2 as the AIFM to the company.

Under the terms of the proposal, the annual advisory fee will also be reduced from May 2024. An annual fee will be calculated as follows: 0.9% of EPRA NTA up to £250m (previously 0.95%); 0.825% up to £500m (previously 0.9%); 0.775% up to £1bn (previously 0.85%); and 0.75% above £1bn (previously 0.85%). Based on the company’s 30 September 2022 EPRA NTA, the new arrangements would save around £414,000.

Both Richard and Christopher have considerable sector knowledge and have a long track record of success in logistics and real estate, built up over more than 25 years. The manager identifies and acquires assets (the majority of which have been sourced off-market, utilising its contacts and reputation in the sector) and implements its asset management strategy to create value for shareholders.

Previous publications

QuotedData has published three previous notes on SHED – our initiation note Shed load of growth to come, published on 10 August 2021, an update note In the sweet spot, published on 22 December 2021, and an annual overview note Long-term dynamics remain strong, published on 4 October 2022. You can read them by clicking the links.

Legal

This marketing communication has been prepared for Urban Logistics REIT Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.