Civitas updates on portfolio – Civitas Housing Advisors has published an update on the Civitas Social Housing portfolio and some commentary on the social housing sector. This follows the release of a report on the sector from the Regulator. Coincidentally, The Regulator has announced the findings of its review of Encircle Housing.

At the end of March, Civitas had invested £767m in 587 properties accommodating 4,119 tenants. Civitas was working with 113 care providers, 15 registered providers (RPs) and 157 different local authorities.

The adviser’s statement reinforces the message about the shortage of specialist supported housing. Addressing the Regulator’s comments about the levels of rent charged by providers of specialist supported housing, Civitas notes that its rents “fall within the average for the sector”, pointing out that it buys properties where rents “have been determined at an average or median level for equivalent properties” and “in dialogue with local authorities, care providers and RPs.” To put some hard numbers on this, Civitas says that the average weekly rent for specialist supported housing in its portfolio is £178 per week, which compares to Mencap’s estimate of an average between £185.60 and £194.43 (depending on whether the housing is in a shared unit or a standalone one). To get the £178 a week figure, Civitas excluded its high acuity and more specialist properties – adding these in would bring its average to £211 a week.

To tackle a perceived risk that a change of government policy calls into question the ability of RPs to meet their rental commitments, Civitas is changing its rental agreements to include a clause that brings all parties together, presumably to formulate a united response. Civitas is also highlighting the long-term agreements that are in place between many care providers and RPs that the care providers will cover some of the cost of vacancies within the RP’s portfolios (as a way of ensuring that space is available when the care providers need it).

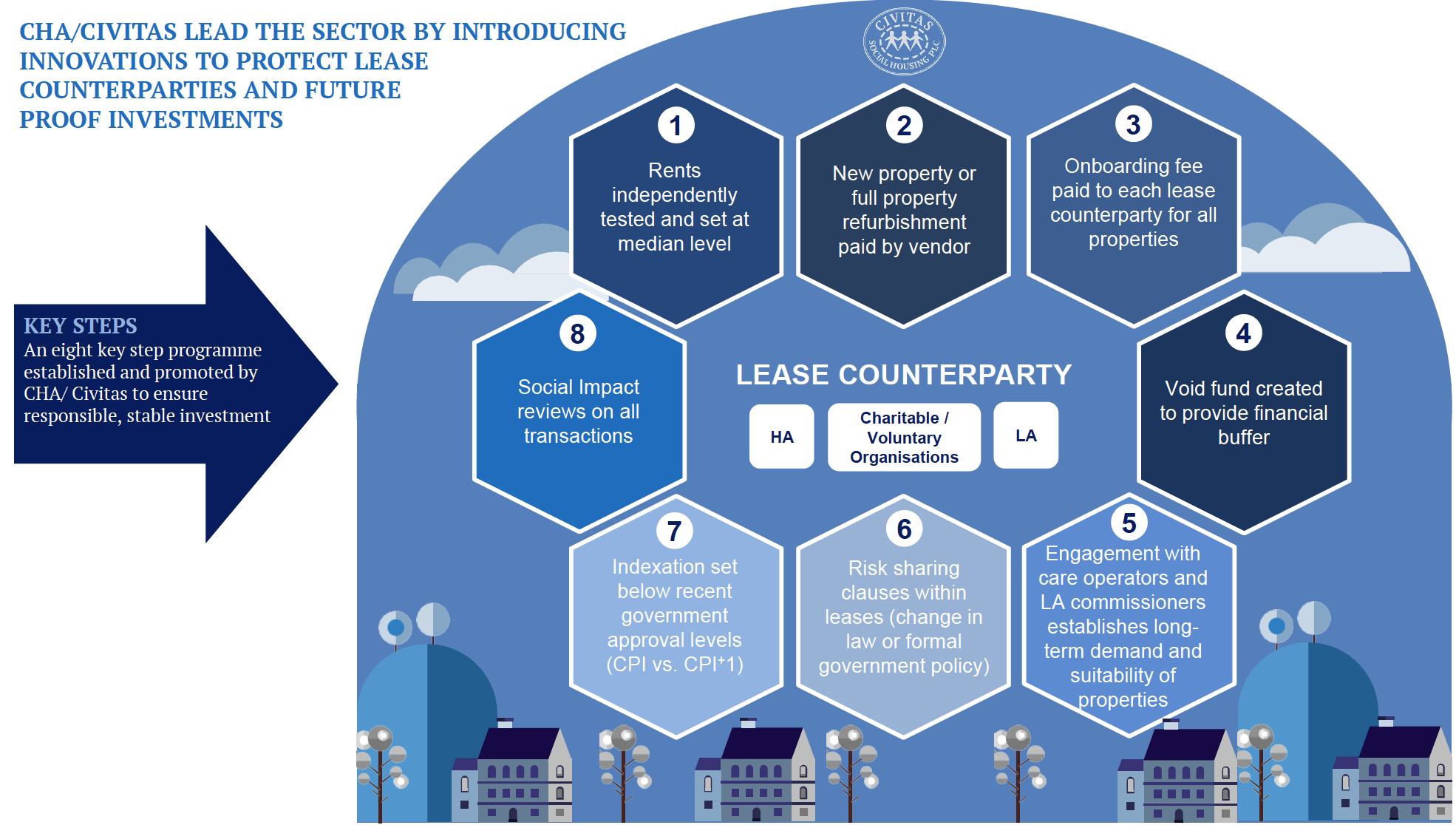

The Regulator also raised a potential problem of RPs cutting corners on building maintenance. Civitas is well aware that properties need to be well-maintained and fit for purpose. It rejects sub-standard properties when making acquisitions and checks each against an eight-step process, more detail of which is included within their report. When Civitas buys properties it makes the sellers bring the property up to scratch and monitors that this is done. The RPs are responsible for ongoing maintenance but Civitas has a budget for capital works on top of this.

One of the Regulator’s bugbears is the quality of corporate governance within the RPs. Civitas notes that it has recruited many senior figures from within the industry and is using their accumulated knowledge base to help the RPs improve standards. Civitas cite the example of Trinity Housing Association, an RP that they have been working closely with for about a year “supporting the strengthening of the board and the executive”. Civitas is working to set up a new community interest company that can act as a central resource for RPs and offer advice, support and guidance as the RPs go about improving their business models.

Finally, Civitas reiterates what should be the central message in all of this, a “Focus on the Tenant”. Whatever happens, the tenants’ needs must come first. Civitas did all it could to ensure that First Priority’s tenants were unaffected by the demise of that RP. It says it would reassign leases from a failing RP, ensuring continuity of care and accommodation.

Encircle Housing

In announcement released today, the Regulator has issued its verdict on Encircle Housing.

“The regulator has concluded that:

a) Encircle is non-compliant with the governance and viability elements of the Governance and Financial Viability Standard. Encircle has not managed its resources effectively to ensure its viability can be Regulatory Notice Encircle Housing Limited 4784 maintained, and has not ensured its governance arrangements deliver an effective risk management and control framework.

b) Encircle has not been able to demonstrate that it has managed its affairs with an appropriate degree of skill, independence, diligence, effectiveness, prudence and foresight.

c) Encircle has failed to ensure that it has an appropriate, robust and prudent business planning, risk and control framework that ensures sufficient liquidity at all times.”

Civitas said “As at 10 April 2019 Encircle represented 5.87% of the Civitas NAV and 4.84% of the Civitas GAV (based upon target leverage of 35%). As at 10 April 2019, Encircle remains fully up to date with all lease payments due to Civitas and this is expected to continue to be the case. Today’s regulatory announcements are expected to have no impact on Civitas’ portfolio or financial position.

The RSH announced in May 2018 a general review of housing associations engaged in the provision of property services for vulnerable people. The announcement issued to Encircle reflects similar judgements that have been issued in respect of all other recent regulatory reviews for comparable housing associations. Encircle has indicated that it is in dialogue with the Regulator and is working to improve its position whilst continuing to deliver high quality services to its residents.”

Paul Bridge, chief executive officer of Civitas Housing Advisors, said: “The announcement today is as expected and does not affect Encircle’s operations in respect of Civitas; nor do we anticipate any impact on our portfolio. Civitas is a firm supporter of the general review which the RSH is undertaking. It provides an opportunity for these housing associations, which provide vital homes for vulnerable people, to continue to evolve and improve, and reflects the growing maturity and sustainability of the sector as a whole.”

CSH : Civitas updates on portfolio