Back in December, we published a note on BlackRock Throgmorton, which we called “Infectious enthusiasm”. In it, we tried to bring out the excitement that its manager, Dan Whitestone, had about the future of the companies in his portfolio, and by implication the future of the trust. Over the two months since, the trust’s share price has gone from 694p to 800p. The trust has also issued over £17m worth of new shares (all issued at a premium to asset value, so that the NAV for existing shareholders benefits).

Catch up with Dan Whitestone

On Thursday this week, we got to catch up with Dan, who was presenting on the trust’s annual results. We covered these in our news section on Wednesday. You might have thought, given the strong run of performance that the trust has continued to have, Dan’s optimism might have waned a bit; far from it. Over the course of about 45 minutes he rattled off numerous examples of stocks in the portfolio that he thinks are emerging from the pandemic period stronger than when they went in. He is backing these businesses to take market share from weaker rivals and participate in the anticipated economic recovery that should ensue once we are finally and permanently free of lockdowns.

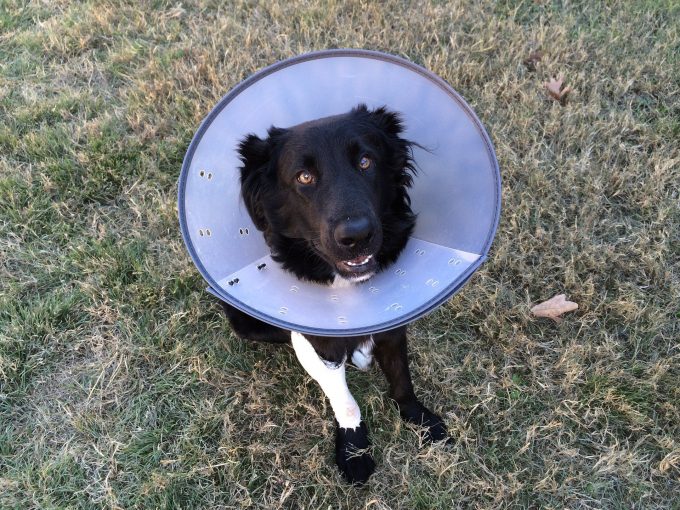

Many of the stock examples that he used were ones that we referred to in the note. BlackRock Throgmorton is benefiting from the trend towards greater pet ownership by backing CVS (the veterinarian chain) and Pets at Home, for example. Dan likes Watches of Switzerland because he thinks that it is deepening its relationship with Rolex. He sees distributors such as Electrocomponents and Diploma taking market share. Dan also also waxes lyrical about the fortunes of Games Workshop, the largest holding in the trust now, which managed the transition from physical retail to online fairly seamlessly (to the benefit of margins). One of the best performers in the portfolio recently has been Treatt, a manufacturer of fragrance and flavourings. BlackRock Throgmorton backed the company when it was looking for finance to upgrade its manufacturing facilities.

Dan believes that these companies are in the sorts of niches and have the strength of market position to grow even without economic growth.

More IPOs recently

We have seen a few more IPOs in recent weeks, with companies like Moonpig and Dr Martens coming to market, and a fair few IPO announcements in the investment companies market. Funnily enough these names also cropped up when we were talking to Alan Gauld, manager of Standard Life Private Equity, on Friday. Private equity funds that he invests in were the ones selling.

Dan thinks that we are likely to see an acceleration in the rate of IPOs this year. He also expects to see more takeovers. Recently, BlackRock Throgmorton has benefitted from a bidding war for Codemasters, which was won by Electronic Arts. It is also profiting from a bid for Scapa by an American rival, Schweitzer-Maduit International. The latter stock was bought for BlackRock Throgmorton in May 2020, when the company was looking to shore up its balance sheet with a placing of shares at 105p. The bid values the company at 210p.

Dan thinks that the key to unlocking the logjam that beset corporate activity last year was the Brexit deal. Beforehand, there was just too much uncertainty for foreign investors to get their heads around, now at least we know where we are. Both he and Alan highlight the sizeable cash piles of private equity firms (often referred to as dry powder). It is also relatively cheap to borrow money if you need to as part of the financing package for a deal.

For BlackRock Throgmorton, takeovers are not always good news. Dan observes that many targets of bids are the sorts of failing companies that he prefers to short. For now, the portfolio’s exposure to short positions is relatively low. This is largely a reflection of Dan’s belief that the UK stock market is going to carry on recovering – there’s no point fighting a rising tide.

The outlook is bright

We could see more cash calls from some companies. Many of them have been burning cash and/or racking up debt as the pandemic progresses. Dan is determined that he will not inject cash into companies just so they can keep going. That does not mean that some of these businesses will fail to find backing elsewhere. Dan sees this as setting the stage for a fertile period for shorting stocks down the line. Perhaps, this will happen once investors realise that they have been chucking good money after bad. He warns that the market is not discriminating enough between good and bad companies. It is also not properly factoring in how stretched balance sheets have become. Iain Pyle, manager of Shires Income told us the same thing recently. Eventually, chickens will come home to roost but, for decent quality companies the outlook is bright.