Aquila European Renewables (AERS) has announced dividend guidance for its current financial year ending 31 December 2023. AERS is targeting a dividend of €c5.51 per share, subject to the portfolio performing in line with expectations. The 2023 target dividend represents an increase of 5% versus the prior year and follows a 5% increase in the 2022 dividend announced in April 2022. The company says that it expects strong dividend cover of approximately 1.8x in 2023.

AERS says that its portfolio has undergone a transformation during 2022, with two construction projects reaching completion, whilst also acquiring two additional operational assets during the period. As a result, AER’s portfolio of operating assets has increased by approximately 80% during 2022, resulting in a step-change in earnings capacity. The majority of assets added to the portfolio in 2022 comprised of solar PV in Iberia, which has also led to a more balanced allocation between wind and solar PV, in line with the Company’s portfolio diversification objectives. Following this investment activity, the capital raised in late 2021 has now been fully deployed.

Based on AERS’s 2023 Target Dividend and assuming P50 production forecasts and the latest analyst captured power price forecasts, AERS expects robust dividend cover of approximately 1.8x in 2023 and approximately 1.6x over the next five years (including 2023), both figures calculated net of debt amortisation and excluding the share buyback programme discussed below.

Buyback programme of up to €20m announced

AERS has announced that a share buyback programme for up to €20m has been approved in response to its current share price discount to net asset value (NAV), Members of its board and employees of its investment adviser have also committed to acquire AERS shares, whose price they say does not accurately reflect the inherent value in the portfolio. The buyback programme is part of a broader package of initiatives seeking to improve the marketability of AERS’s shares. The buyback Programme will be carried out under the existing shareholder authorisation granted at the last AGM. AERS says that its buyback programme is expected to be NAV accretive for existing shareholders, accretive to dividend cover and will provide additional liquidity for AERS shareholders. The buyback programme is expected to be funded from AERS’s surplus liquidity and operating cash flows from the portfolio.

Investment adviser fee is being paid in shares

As previously announced, AERS’s investment adviser has undertaken to receive its fee (net of any applicable tax) in ordinary shares rather than cash, for the period up until 30 June 2023, which helps to bolster the alignment between the adviser and shareholders. When AERS’s shares are trading at a discount, its investment adviser fee will be satisfied through the market purchase of ordinary shares. As at 31 December 2022, Aquila Capital holds approximately 7.3m AERS shares, equivalent to approximately 1.8% ownership in the Company.

Fourth interim dividend for the 2022 financial year

Separately, AERS has announced its fourth interim dividend for the year to 31 December 2022 at €c1.3125 cents per share. Of this amount, €c0.80 cents per share will be designated as an interest distribution. The fourth quarterly dividend will be paid on 17 March 2023 to shareholders who appear on the register on 17 February 2023. The ex-dividend date is 16 February 2023. The default payment currency for AERS’s dividend is the Euro, however, shareholders can elect to have their dividends paid in Sterling. The last day for currency elections to be registered is 20 February 2023. Currency elections are submitted via CREST.

Fourth quarter NAV total return of 1.6%

Separately, AERS has announced its unaudited NAV as at 31 December 2022, on a cum-income basis, was EUR 451,650,417 or €c110.64 cents per share. This represents a NAV total return of 1.6% per share over the quarter. AERS says that the key drivers of the NAV movement where:

- Increase in short-term CPI forecasts (+2.5 cents per Ordinary Share), Eurozone inflation assumption 6.2% in 2023.

- Marginal decrease in power price forecasts due to mild winter expectations and gas storage levels and implementation of clawback taxes (-0.5 cents per Ordinary Share).

- Sagres refinancing, updated tax assumptions for Tesla, completion of Jaén (+2.2 cents per Ordinary Share).

- Increase in risk-free rates partially offset by a reduction in construction risk premia, which resulted in an increase in the discount rate by 30 bps to 7.2% (-3.5 cents per Ordinary Share).

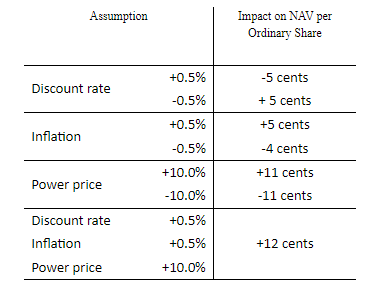

A sensitivity of NAV against discount rates, inflation and power prices can be found below.