Aberforth Smaller Companies has published results for the year that ended on 31 December 2023. Its NAV return lagged that of its index benchmark (Deutsche Numis Smaller Companies ex Investment Companies), returning 8.2% to the index’s 10.1%. A small widening of the discount meant that shareholders got a return of 8.0%. The dividend was upped from 39p to 41.5p and the company declared an additional special dividend of 9.0p (up from 8.3p for the prior year). Revenue per share was 59.79p, helped by seven special dividends. 9.29p will be added to revenue reserves to take them to 80.1p per share, which would cover the ordinary full year dividend just under two times.

The chairman notes that inflation and monetary policy weighed on markets, but towards the end of the year, favourable inflation data in both the UK and the US encouraged the view that the next move in interest rates would be downwards. This triggered a powerful rally into the year end. In the UK, this has so far been led by the mid cap stocks, but this trust’s focus is more on smaller companies.

In the year to 31 December 2023, 930,000 shares were bought back and cancelled. The total value of these repurchases was £11.6m, on an average discount of 13.3%.

Extracts from the manager’s report

Despite the backdrop of higher interest rates and borrowing costs, M&A continued apace in 2023. The takeovers of twelve NSCI (XIC) constituents were completed in the year. ASCoT had holdings in six of these. The average EV/EBITA multiple at which the deals were executed was 12.4x, while the average premium to the pre-announcement share prices was an unusually high 66%.

Somewhat surprisingly, private equity houses were the bidders in seven of the twelve deals. The managers had expected the higher cost of borrowing to limit this source of interest. However, the very low valuations accorded to small UK quoted companies by the stockmarket give private equity the opportunity. At these valuations, it would appear that debt is not needed at the outset to make M&A models work. This remarkable situation highlights a risk to ASCoT and other investors in the asset class – in many cases, even a large takeover premium may not bring the valuation to a level that reflects the true worth of the target company.

In such circumstances, the managers are prepared to vote against under-priced deals and did so in 2023. The best M&A experiences are often those in which boards of directors consult shareholders well in advance. Such consultation reduces the risk of embarrassment, should shareholders find proposed terms unacceptable, and can lead to better outcomes, which may be that the company in question retains its independence. The managers make it clear to the boards of the investee companies that they should be consulted in such situations and that they are willing to be insiders for extended periods.

Value, valuation discount

Aside from concern about the near term outlook for corporate profits, three other factors contribute to the particularly attractive levels of valuation currently accorded to Aberforth Smaller Companies’ portfolio. These are the prevailing malaise with the UK and its stockmarket, the concern about the liquidity of smaller companies, and the effect of the managers’ value investment style. The following paragraphs address each of these factors.

At 31 December 2023, the All-Share’s price/earnings ratio (P/E) was 35% lower than Panmure Gordon’s calculation of the P/E for the rest of the world. Since 1990, the average discount of UK equities has been 16%. Several justifications for today’s larger than usual discount are regularly offered.

First, since the EU referendum in 2016 and with the subsequent succession of Prime Ministers, the UK’s reputation for political stability has been impaired. However, the UK does not have a monopoly in political uncertainty. The UK’s flirtation with populism may prove to be behind it, while elections over the coming years may cast other countries in a relatively unfavourable light.

Second, there is a widespread view that the UK’s economic performance in recent years has been comparatively poor, from Brexit through a proportionately tougher lockdown experience to a more intransigent problem with inflation. However, Brexit’s impact is largely in the past – the companies with which the managers engage have learned to live with it. Turning to the pandemic, recent revisions by the ONS to its calculation of GDP reveal that the UK’s recovery compares well with other members of the G7. Finally, the gap between the UK’s inflation rate and that of comparable countries is now narrowing to undermine arguments that the UK is the “sick man of Europe”.

Third, there is a concern that the UK stockmarket itself is dysfunctional. Evidence cited includes its lack of technology companies, infrequent and unsuccessful IPOs, low valuations, and outflows from pension and open-ended funds. Some of this reasoning is circular, but the issue has caught the attention of government, for better or worse. Mooted solutions are mandated investment in UK listed companies by pension funds, lower governance standards for UK listings and the dilution of EU inspired regulation on UK capital markets. For the managers, it is not clear that the UK stockmarket is broken and well-intended legislation is often undermined in due course by the unintended consequences.

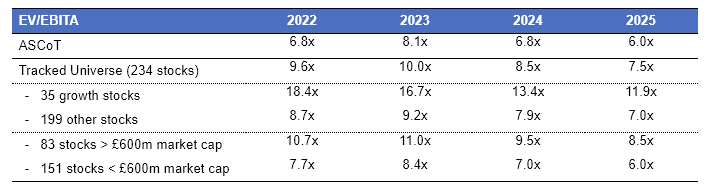

Within the UK market, there is a pronounced valuation discount for size – the lower the market capitalisation, the lower the valuation. Within the NSCI (XIC), the average 2023 EV/EBITA ratio of companies with market capitalisations above £600m (roughly the boundary between the FTSE 250 and the FTSE SmallCap) is 11.0x. For those below the £600m threshold, the “smaller small” companies, the average multiple is 23% lower at 8.4x.

For smaller companies, the general concerns about the UK are compounded by their greater reliance on the domestic economy. Around 50% of the aggregate revenues of NSCI (XIC)’s constituents are generated within the UK, higher than the 20-25% or so for the entire UK stockmarket. While companies close to the domestic housing market have reported more difficult trading conditions for the past nine months, it is notable that their share prices have often fallen by less than the extent of the downgrade to profit expectations. This is an indication that economic weakness is reflected in valuations, which is a necessary, though not sufficient, condition for recovery.

Against the background of disinvestment from UK equities, there is a heightened sensitivity towards liquidity on the part of many investors. This is likely to have penalised the valuations of the relatively illiquid asset class of smaller companies. However, such an investment stance risks missing the small company premium, which is the historical out-performance of small over large and which has averaged 1.6% per annum over Aberforth Smaller Companies’ 33 years. Investors are rewarded for taking on liquidity risk over time and relative illiquidity works both ways. Gaining exposure to the asset class when sentiment turns is not straightforward – as so often in investment, time in the market is more important than timing the market.

Turning to ASCoT’s portfolio, the 7.9x historical P/E at 31 December 2023 was 38% below that of the NSCI (XIC). This compares with an average discount of 12% since 1990.

Aberforth Smaller Companies’ portfolio is managed in accordance with the value investment style and so a discount to the overall valuation of smaller companies is to be expected. However, the discount today is unusually wide. Part of this is explained by the better value on offer among the NSCI (XIC)’s “smaller small” companies, to which Aberforth Smaller Companies has a relatively high exposure. Another factor is the Managers’ willingness to look through general concern about near term corporate profitability by investing in strong and growing but economically sensitive companies. Unburdened by these distractions, Aberforth Smaller Companies’ opportunity set within the investment universe is presently towards its widest in its history.

The following table sets out further detail about the forward valuations of the portfolio, the tracked universe and certain subdivisions of the tracked universe. The metric displayed is enterprise value to earnings before interest, tax and amortisation (EV/EBITA), which the managers use most often in valuing companies. The ratios are based on the managers’ profit forecasts for each company that they track. The bullet points following the table summarise its main messages.

- The higher multiples for 2023 compared with 2022 are consistent with earlier comments about lower company profits in 2023. The managers’ forecasts currently point to a profit recovery in 2024, but the precise timing of a rebound relies on the domestic and overseas economic backdrop.

- The average EV/EBITA multiples of the portfolio are lower than those of the tracked universe. This has been a consistent feature over Aberforth Smaller Companies’ history and is consistent with the managers’ value investment style.

- The portfolio’s 8.1x EV/EBITA ratio for 2023 is considerably lower than the average multiple of 12.4x at which the year’s completed M&A deals were struck.

- Each year, the managers identify a cohort of growth stocks within the NSCI (XIC). These stocks are on much higher multiples than both the portfolio and the rest of the tracked universe.

ASL : Value stocks unusually cheap says Aberforth