Riding the wave of shifting interest rates

CQS New City High Yield Fund (NCYF) is consistently one of the highest-dividend-yielding funds in its debt – loans and bonds peer group and, over the longer term, is also one of its best-performing (see page 17). NCYF has benefitted from an uplift in capital values as the headwind of higher interest rates that weighed on bond valuations in 2022 and 2023 has turned tailwind – a trend which its manager, Ian “Franco” Francis, thinks has further to go.

NCYF looks the best-positioned of its peers to benefit from this, helped by Franco’s locking in of decent yields in advance of interest rate falls (see page 7).

NCYF is conservatively managed with a strong emphasis on capital preservation. The portfolio retains its high exposure to the UK. Ian feels the economy is looking a lot healthier and the political outlook is improving. He sees some challenges ahead, but thinks the UK is better placed to manage this turbulence and that the sort of credits that NCYF focuses on will perform well in this environment.

High-dividend yield and potential for capital growth

NCYF aims to provide investors with a high-dividend yield and the potential for capital growth by investing mainly in high-yielding fixed interest securities. These include, but are not limited to, preference shares, loan stocks, corporate bonds (convertible and/or redeemable) and government stocks. The company also invests in equities and other income-yielding securities. The manager has a strong focus on capital preservation and is conservative in his approach to growing NCYF’s capital.

At a glance

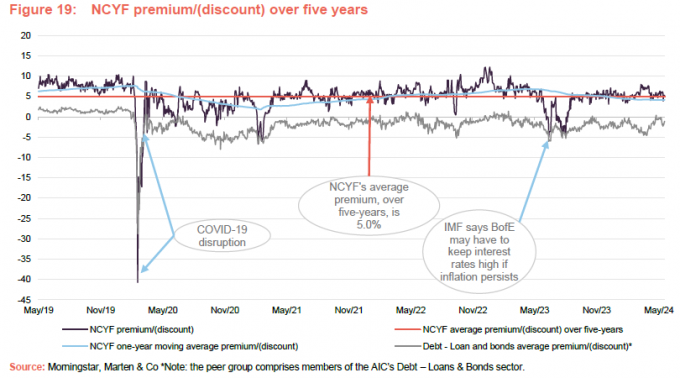

Share price and discount

NCYF has predominantly traded at a premium to net asset value (NAV) during the last five years, which has tended to be in the band of 0% to 10% and has averaged 5.0%. There has been greater discount volatility post-COVID, particularly when uncertainty around inflation and interest rates has increased, but it has been more stable recently as inflation has receded. NCYF’s premium rating has reflected strong underlying demand for its strategy. That has made an ongoing programme of share issuance possible.

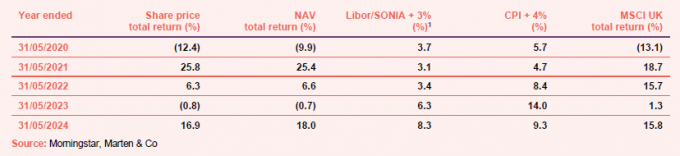

Performance over five years

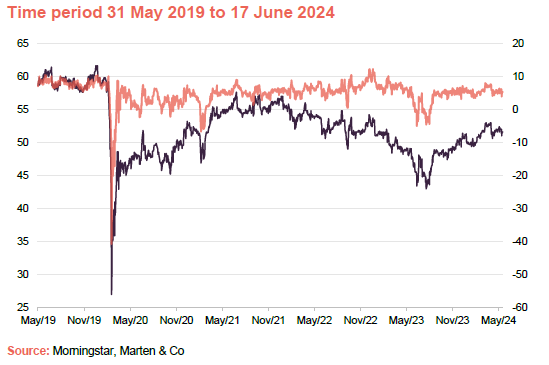

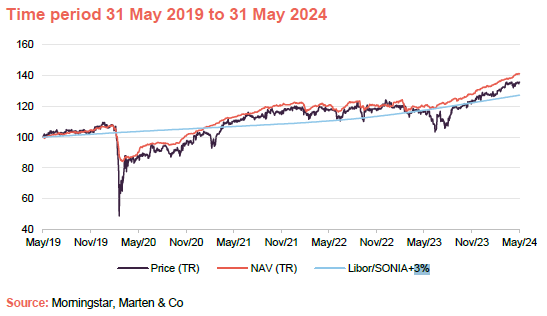

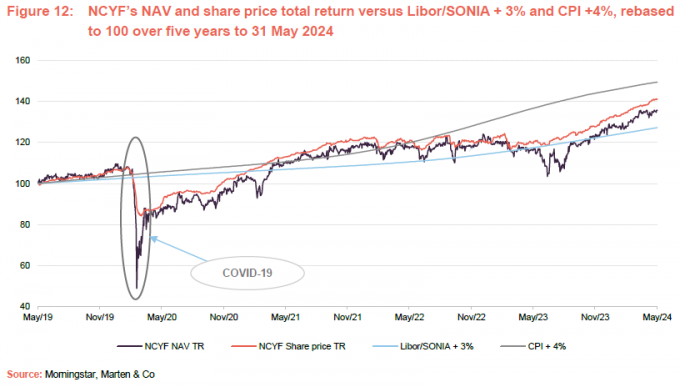

NCYF’s share price and NAV have recently been closing the gap on our inflation-related benchmark of CPI+4% and moving ahead of our benchmark linked to official UK interest rates of Libor/SONIA+3%. As is discussed in the manager’s view section, this trend may have further to run and so there is still upside potential, although a new shock to the economy could delay this. NCYF has also provided NAV total returns ahead of the UK equity market by some margin (see Figure 13 on page 16).

Fund intro

Predominantly higher-yielding fixed income exposure

Further information can be found at: ncim.co.uk

NCYF’s aim is to provide a high level of quarterly income, with the prospect of capital growth, through investment in a portfolio of predominantly higher-yielding fixed income securities, with the flexibility to invest in equities and equity-related securities.

The manager seeks securities that are undervalued by the market.

Investments are typically made in securities which the manager has identified as undervalued by the market and which it believes will generate above-average income returns relative to their risk, thereby also generating the scope for capital appreciation. The manager seeks to exploit opportunities presented by the fluctuating yield base of the market and from redemptions, conversions, reconstructions, and take-overs to generate capital growth.

CQS Group and New City Investment Managers

NCIM has managed NCYF since its launch in March 2007.

New City Investment Managers (NCIM) has been NCYF’s investment manager since its launch in March 2007. NCIM also managed NCYF’s immediate predecessor (NCYT) from 2004 until its assets were rolled over into NCYF in March 2007. On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies.

On 15 November 2023, CQS, which then had assets under management (AUM) of US$13.5bn, announced that it was being acquired by Manulife Investment Management, which has US$746bn in AUM. On 3 April 2024, CQS and Manulife announced that the transaction had completed and NCYF’s board reiterated that there are no planned changes to the investment management team, investment strategy or the company’s name. NCYF’s managers say that one of the attractions for Manulife was CQS’s alternative credit investments expertise and that the two entities should be a good fit together. Manulife has said that it intends to align the newly acquired CQS brand with its own, using the co-branded logo – Manulife | CQS Investment Management.

Ian “Franco” Francis – “still loves running the fund”

Lead manager Ian Francis has over 35 years of investment experience.

Ian Francis, a partner at CQS and head of New City, has day-to-day responsibility for managing NCYF’s portfolio. Ian joined NCIM in 2007 and has well over 35 years’ investment experience, primarily in the fixed interest and convertible spheres, having worked for Collins Stewart, West LB Panmure, James Capel and Hoare Govett. He is able to draw on the expertise of a 23-strong credit analysis team at CQS.

In past notes we have commented on Ian’s ongoing commitment to the fund. He recently reiterated that. In his own words, he has no plans to retire and “still loves running the fund”.

Constructed without reference to a benchmark

We believe that, over the longer term, NCYF should be able to provide both a real return as well as a return that exceeds Libor by a margin. We are therefore including comparisons against Libor/SONIA + 3% and CPI + 4% in this report.

Reflecting its fixed income focus, the manager’s absolute return mindset and the diversity of its holdings, NCYF’s portfolio is not constructed with reference to any benchmark index. NCYF uses the FTSE 100 index for performance comparison purposes in its reports, but its board explicitly says that this is used in the absence of a meaningful benchmark index. As a substitute, we have included comparisons against the MSCI UK index in this report.

We also believe that, over the longer term, NCYF should be able to provide both a real return (one that exceeds consumer inflation by a margin) as well as a return that exceeds interest rates as measured by SONIA (previously Libor) by a margin. We are therefore including comparisons against Libor/SONIA + 3% and consumer price index (CPI) + 4%, but we would stress that these are not formal benchmarks for NCYF.

Market backdrop

Manager’s view

UK economy looking a lot healthier and political outlook improving

Ian has previously been vocal in his view that inflation and interest rates would remain higher for longer than many market participants were expecting, and he has broadly been proven to be correct. However, he thinks that bar the odd blip, UK inflation should continue to trend downwards, likely reaching the Bank of England’s 2% target next year, and possibly dipping below that level, although he recognises there are some risks to this – specifically potential supply chain issues.

The Houthi Rebels’ attacks on shipping in the Red Sea are an ongoing concern as they reduced traffic through the Suez Canal significantly (this is down by more than 40% since The Red Sea Crisis began in October last year and is at its lowest level since the Ever Given blocked the canal in March 2021). This is pushing up the cost of products from the Gulf states (think oil and energy more generally) and India. Meanwhile, drought conditions in Panama are restricting the flow of traffic through the canal.

The collapse of the Francis Scott Key Bridge in Baltimore triggered further trade disruption and supply chain issues. The Port of Baltimore is important to the US economy – it is the eighth-largest port by tonnage, and the largest for coal exports and car imports. Whilst Europe and specifically the UK have been less affected by this, they will still feel an impact as global supply chains incur delays and increased costs as freight is re-routed.

Despite these concerns, Ian comments that the UK economy is looking a lot healthier now and should be able to navigate a period of increased turbulence. Interest rates have come down, but with inflation coming in a bit higher than expected, Ian thinks it will be the third quarter of this year before the Bank of England makes any more interest rate cuts. He comments that these may come even later, depending on inflation’s trajectory, noting that service sector wage inflation is proving to be quite persistent, but manufacturing wage inflation is coming down to more sensible levels.

On the political front, he thinks there is little doubt that the upcoming general election in the UK will see the Conservatives suffer heavy losses, leaving Labour in government with a large majority. Given the turbulence of recent years, Ian thinks this will represent a marked improvement, noting that the Labour leadership has so far been very centrist in its approach. A large parliamentary majority could allow it to continue on this path for some time, as it will not need to pander to the hard-left elements of the party to pass legislation.

Another key challenge Ian sees ahead is the ‘triple lock’ that applies to the state pension in the UK, which the Conservatives have pledged to maintain in their manifesto (although it is unlikely they’ll need to honour this pledge). Ian says that the government needs to deal with the cost implications of the triple lock, but a key challenge is that, unlike in Australia, where the system is increasingly seen as the model for other countries, the state pension in the UK is paid out of current income, rather than from a pot that was built up historically to meet this obligation.

An often-overlooked but related issue is that the triple lock also applies to civil servant pensions and the number of civil servants has ballooned post-Brexit (502k as at end December 2023 – over 6,000 up on the previous quarter). He points out that while a fully paid-up state pension will cost £11.5k a year from 6 April 2024, civil servants’ pensions will also get a 6.7% increase and, with a ballooning civil service earning salaries at a multiple of this, the cost is huge. Ian thinks the only option that is realistically open to the government is to break the index-linking.

Ian thinks that the UK’s spring budget was a bit of a non-event. He thinks that the reduction in national insurance is a small help in the short term but if fuel bills come down in April as expected, people will feel better off anyway. There was no positive news for defence (see below) although we are still one of the largest in terms of defence spend in Europe.

Security remains a key issue in Europe

European elections and French elections are coming up, and this is increasing uncertainty. Germany, in particular, had a challenging start to the year with farmers protesting, a budget crisis, far-right parties polling well and the emergence of a new populist hard-left party, Bündnis Sahra Wagenknecht (BSW), that is splitting the vote of most parties.

Ian says that Europe is finally waking up to the danger that a Trump presidency could pose to its security with Trump’s wavering support for NATO. In response, Germany has increased its cap on defence expenditure, allowing it to produce more internally and, crucially, it is not exporting to non-NATO-member states. Security remains an ongoing issue in Europe and an expansion of hostilities would likely disrupt supply chains again and lead to an uplift in inflation, at least in the short term (longer-term supply chains continue to adjust).

Trump versus Biden – expect lots of white noise from the US

Ian thinks that the US presidential election, due in November, will generate a lot of white noise over the next six to nine months, in a contest that looks set to be closely fought (as at 18 June 2024 the economist’s US election poll had Biden and Trump neck and neck at 44% Trump’s 44%). This reflects the fact that, while both are the last man standing from their respective parties’ nomination processes, neither is popular.

On balance, Ian is more concerned about a Trump presidency, noting that it will likely be characterised by similar chaos to what was seen during Trump’s last tenure. Ian adds that Trump tends to take a very isolationist and confrontational approach (at least with allies) although he also thinks that, in this scenario, the Republicans are unlikely to have majority control of both the upper and lower House, which would limit a Trump presidency’s ability to do significant harm.

Market pulling back towards par as interest rates fall

Following a challenging period where higher inflation and interest rates have weighed on the capital value of bonds, a weakening of inflation and interest rates has seen a reversal of this trend lifting the price of bonds in recent months. Ian comments that this trend still has some way to go, assuming inflation and interest rates continue on their path of descent as widely expected (while accepting there will likely be some price volatility along the way).

Ian highlights two bonds in particular – Co-Op Bank and Virgin Money – which are discussed in the top 10 holdings that have benefitted from corporate actions that have accelerated this trend and have been particularly beneficial to NCYF’s recent performance. Despite this, Ian comments that he is still seeing plenty of opportunities to put capital to work at very attractive yields and has been deploying capital where he can in advance of further interest rate cuts.

Process

Bottom-up investment process

NCYF’s portfolio is constructed using a bottom-up process that is based on extensive fundamental analysis of the credit risk and return prospects for potential investments. This analysis, which is conducted in house, includes:

an assessment of the free cash flow available to the various security holders within a corporate’s capital structure (for example, equity holders, debt holders, preferred stockholders and convertible security holders);

the prospect of changes to cash flows (for example, from changes in interest rates or the competitive landscape); and

an assessment of the company’s track record in managing its obligations and the quality of the company’s management.

NCYF maintains a moderately concentrated portfolio. The top 10 holdings account for 25–30% of the portfolio.

Ian makes the final decision on what enters NCYF’s portfolio, but he is able to draw on the expertise at CQS of a 23-strong team of credit analysts globally when assessing and comparing potential investments.

When selecting candidates for the portfolio, he seeks to identify securities that he considers to be undervalued by the market. Ian expects these to generate superior income returns relative to their risk, with the scope for capital appreciation as the market rerates them. Whilst income generation and the sustainability of income are key, capital preservation is also a major focus, and the manager is not prepared to sacrifice capital in the pursuit of income.

Low turnover portfolio

NCYF’s portfolio has a duration of around three-and-a-half to four years. It earns a geared return of around 8% per annum and pays out a yield in the region of 7%.

The manager maintains a portfolio of around 110–120 issues. This tends to be moderately concentrated, with the top 10 issues accounting for around 25–30% of the portfolio. The manager maintains a core set of holdings that are well understood, with the top 10 being relatively liquid in normal market conditions. The portfolio is inherently low-turnover, excluding called positions (loans that are repaid early by the borrower). Many positions do not have an active secondary market and so the manager selects positions based on the view that they offer an attractive return, relative to their risk, all the way through to their ultimate maturity. As such, the manager is not looking to trade positions. If holdings leave the portfolio prior to their maturity, it is usually because they have been called by the issuer, although the issuer frequently pays a decent premium for the privilege of doing so. Portfolio turnover for a typical year is in the region of 50%, but Ian expects that 30–40% will be due to forced redemptions.

Exposure to smaller niche issues and unrated bonds allows NCYF to earn a yield premium.

The portfolio tends to have a relatively short duration of around three-and-a-half to four years, and earns a geared return of around 8% per annum, while paying out a 7% yield. This has been achieved without the use of options or dividend stripping (buying issues or equity before they pay a coupon or dividend, which is classified as income and selling shortly thereafter). The manager does not hedge currency risk, although he will take a macroeconomic view on currencies and avoid those that he does not favour. For example, NCYF’s portfolio has not held any Australian dollar-denominated assets since 2014/15.

Exposure to niche issues and unrated bonds

Exposure to smaller niche issues and unrated bonds allows NCYF to earn a yield premium.

The manager’s ability to calculate its own internal ratings on any bond allows it to properly assess smaller niche and unrated issues. These issues will tend to earn a premium of 150–200 basis points for an equivalent level of risk, which is key in allowing NCYF’s portfolio to generate superior risk-adjusted returns.

Investment restrictions

There are no defined limits on type of securities, countries, issue size or sectors.

In addition to fixed income securities, NCYF also invests in equities and other income-yielding securities. There are no defined limits on type of securities, countries, issue size or sectors, although the board has set a limit whereby NCYF will not invest more than 5% of its total investments in securities issued by the same investee company.

A maximum of 10% of total assets can be invested in collective investment vehicles.

NCYF may invest in derivatives, financial instruments, money market instruments and currencies, for the purpose of efficient portfolio management, although it is not obliged to do so. NCYF can invest in both closed-ended and open-ended funds but will not invest more than 10% of its total assets, as at the time of investment, in such collective undertakings.

NCYF may invest up to 10% (calculated at the time of any relevant investment) of its total assets in other securities that are neither listed nor traded at the time of investment. It may also acquire securities that are unlisted or unquoted (at the time of investment) but which are about to be convertible, at the option of NCYF, into securities which are listed or traded on a stock exchange. NCYF is permitted to hold securities that cease to be listed or traded if the manager considers this appropriate, but such securities are limited to 10% of NCYF’s total assets (calculated at the time of any relevant investment).

Gearing is currently limited to 25% of net assets by the board. This limit is reviewed periodically.

NCYF is permitted to borrow, and the board has set a gearing (borrowing) limit of 25% of net assets, at the time of borrowing, which it reviews periodically (see page 23). The manager expects that NCYF’s portfolio will normally be fully invested. However, during periods in which changes in economic circumstances, market conditions or other factors so warrant, NCYF is permitted to reduce its exposure to securities and increase its positions in cash, money market instruments and derivative instruments in order to seek protection from stock market falls or volatility.

Risk management

NCYF’s board monitors the spread of investments.

In addition to the above investment restrictions, the board monitors the spread of investments to ensure that it is adequate to minimise the risk associated with particular countries or factors specific to particular sectors. The manager also employs risk management disciplines which monitor NCYF’s portfolio and to quantify and manage the associated market and other risks.

Oversight is provided by the risk management and performance analysis team within CQS.

CQS has established a permanent department, independent of the portfolio manager, to perform the risk management function. This risk management and performance analysis team is not involved in the performance activities of NCYF and has policies, processes and procedures designed to identify, quantify, analyse, monitor, report on and manage all material risks relevant to NCYF’s investment strategy. The systems include third-party vendor applications such as Tradar, Sungard Front Arena and MSCI Risk Metrics, complemented by a number of proprietary applications.

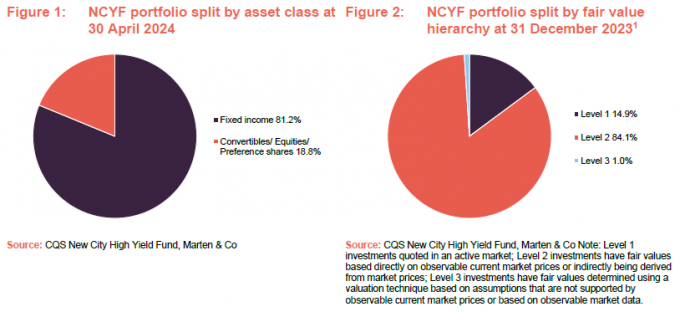

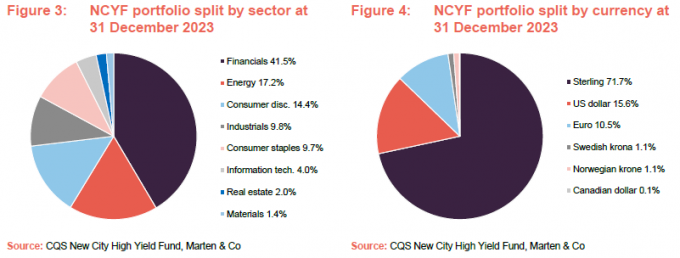

Portfolio

As at 30 April 2024, NCYF’s portfolio had exposure to 82 issues (up modestly from the 80 issues it had exposure to as at 30 April 2023) and, as illustrated in Figure 5, the top 10 issues accounted for 42.8% of the portfolio (0.4 percentage points higher than the end April 2023’s 42.4%). Figures 1 to 4 show various splits of the portfolio (asset class, fair value hierarchy – see description in the notes to that chart, sector and currency), with the data provided being the most recent data that is publicly available. We continue to observe that there is no exposure to utilities in NCYF’s portfolio. Ian has some long-held concerns as to how safe their dividends might be.

These charts illustrate a number of themes:

- The portfolio is overwhelmingly invested in pure fixed income securities.

- All but a tiny percentage of the portfolio is either quoted in an active market or its valuation is based on observable market prices (although around 70% trades over-the-counter and so will be relatively illiquid, even in normal market conditions).

- The portfolio has exposure to issues from companies in a diverse range of sectors, with a heavy concentration in financials that reflects the manager’s views on bank and insurance issues.

- The portfolio is predominantly exposed to sterling (around 70%), but also has a significant US-dollar exposure (around 15%).

- NCYF’s investments are generally located in jurisdictions that are developed and are being supportive of businesses in the current climate.

Top 10 holdings

Figure 5 shows NCYF’s top 10 holdings as at 30 April 2024 and how these have changed since over the prior year (it should be noted that the prior year comparison may use the equivalent security from the same issuer where a security has been replaced – perhaps because it has matured or been called). This is in contrast to equities which, at least in theory, have indefinite lives. Reflecting the manager’s long-term, low-turnover approach, most of the issuer names within the top 10 portfolio holdings will be familiar to regular followers of NCYF’s portfolio announcements and our notes on the company. As noted above, Figure 5 shows there has been limited change in the portfolio concentrations in the top stocks, as would be expected.

We discuss some of the more interesting developments in the next few pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been discussed previously (see page 27 of this note).

Co-Op Bank Holdings 11.75% 23-22/05/2034 fixed rate reset callable subordinated Tier 2 notes

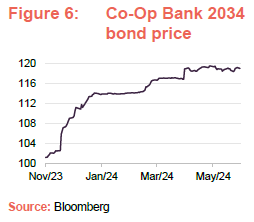

These sterling-denominated subordinated bonds are issued by the Co-Operative Bank (www.co-operativebank.co.uk), which offers a range of retail banking services (current accounts, savings accounts, credit cards, mortgages, insurance etc.) to customers in the UK. Co-Op Bank bonds have long had a presence in NCYF’s portfolio. Ian considers that Co-Op Bank is a high-quality issuer that, from an environmental, social and governance (ESG) awareness perspective, is one of the best, if not the best, UK banks that you can invest in. NCYF’s portfolio had some of the 2029 bonds, which were purchased in the mid-90s, and these were rolled into the 2034 bonds when the refinancing took place in November 2023.

The 2034 bonds, which have a Ba2 credit rating from Moody’s, have an issue size of £200m and an initial coupon of 11.75%. The coupon (the regular interest payment received on a debt security such as a loan or bond), which is paid semi-annually in May and November, has a reset on 22 May 2029. While the bonds have a maturity date of 22 May 2034, they can be called at par on 22 November 2028. The bonds were issued as Basle III Tier 2 capital (Basle III is the EU’s standards for ensuring that the banking sector has adequate capital and, under this framework, Tier 2 capital is considered as ‘gone-concern capital’ – when a bank fails, Tier 2 instruments must absorb losses before depositors and general creditors do).

December 2023 saw Coventry Building Society launch a surprise bid to buy Co-Op Bank from its hedge fund owners and, in April 2024, both parties announced that they had reached an agreement on a non-binding heads of terms for the merger to proceed. Assuming that full terms can be agreed and the merger proceeds it will create a combined entity with some £90bn in assets and re-mutualise one of the UK high street’s largest lenders. Ian previously commented that the 2034 would go to 120 if the deal goes through and with the bonds now trading at 119, this seems to be largely priced in. On 26 March, Co-Op bank announced plans to cut 400 jobs as part of a cost-cutting and restructuring programme, which it says is unrelated to the bid from Coventry.

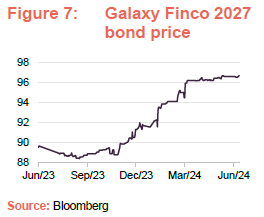

Galaxy Finco Ltd 9.25% 19-31/07/2027

Galaxy Finco is the holding company for Domestic and General Insurance (www.domesticandgeneral.com). It was formed by funds advised by CVC Capital Partners in August 2013 to acquire Domestic & General (D&G) from Advent International. The core of Domestic and General’s business is providing warranties and warranty services for domestic appliances and other consumer electronics products (its appliance cover is available for over 100 brands and includes washing machines, dishwashers, cookers, and fridges) but it also offers cover for domestic boilers as well as domestic plumbing. D&G employs around 3,000 people and operates across 12 markets, including the UK, Spain, Germany, France, Portugal, Italy, Australia, and the US.

Ian says that D&G is a well-managed business with strong cashflow generation that is resilient, making it well positioned to meet its debt obligations. It benefits from a simple and transparent product range as well as a strong position in its home UK market, which provides a strong base as it grows its business in Europe and the US. The bonds have re-rated significantly during the last six months as inflation expectations have moved reduced, moving from the high-80s to the mid-90s.

The 2027 bonds are secured, have an issue size of £150m and are rated Caa1 by Moody’s and CCC+ by S&P. They are sterling denominated and pay semi-annual coupons in August and February.

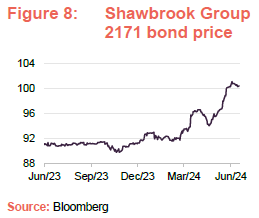

Shawbrook Group 22-08/06/2171 floating rate note

Shawbrook Group (www.shawbrook.co.uk) is a UK challenger bank that specialises in lending and savings. It was founded in 2011, with the aim of servicing small and medium enterprises (SMEs) and individuals. It offers a range of loans; residential and commercial mortgages; business finance; and savings products. These are segments in which it believes it has a competitive advantage through its specialist knowledge, judgement, and personalised approach to underwriting.

Its bonds have featured in NCYF’s portfolio for a number of years – for example, Shawbrook’s 7.875% variable perpetual notes regularly featured in amongst NCYF’s top 10 holdings, until these were called in 2022 and replaced with another perpetual note with a 12.1% coupon.

NCYF has conducted considerable analysis on the company over a number of years and considers Shawbrook to be well capitalised and focused on its core competencies. Ian continues to trust the management team to deliver good results, while growing the business at a sensible rate.

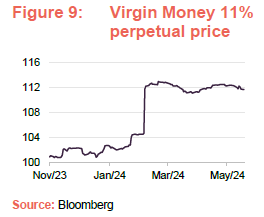

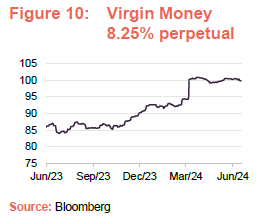

Virgin Money 22-08/12/2170 floating rate note

Virgin Money (uk.virginmoney.com) is a British banking company that is focused on retail and SME banking services in the UK. It offers a full range of services to its customers (current accounts, savings accounts, credit cards, mortgages, investment and insurance products) and whilst it is primarily focused on the UK, it also offers its services in Australia. For 2023, Virgin Money was the UK’s eighth-largest bank by total assets at £91.79bn, behind Nationwide in seventh place with £274.5bn. Nationwide is the UK’s seventh-largest building society. It has grown significantly through acquisition, having absorbed over 250 other organisations in its bid to grow.

Virgin Money is another issuer whose bonds have regularly had prominent position in NCYF’s portfolio for a number of years (when we last spoke to Ian, it had positions in both the 11s and 81/4s). The manager has added to the 11s recently, building on a position that was established in January (Ian felt that this was one of a number of good opportunities to invest in the high-yield sector before the central banks start to cut rates).

On 7 March 2024 it was announced that Nationwide was making an offer for Virgin Money of 220p per share. This followed a series of undisclosed offers that were rejected, which began in January 2024. The bid values Virgin Money at £2.9bn and has been unanimously recommended by Virgin Money’s board. Shareholders still need to approve the deal but Sir Richard Branson, who founded Virgin Money in 1995 and has a 14.5% stake, has said he will back the deal. The price of Virgin Money bonds has strengthened on the back of the deal announcement. Nationwide has said that it will not be putting a vote to its members but is facing pressure to do so. On 31 May 2024, The Competition and Markets Authority (CMA) announced that it was launching an investigation into whether the deal could result in a “substantial lessening of competition” in the UK.

Aggregated Micro 8% 16-17/10/2036

AMP Clean Energy (www.ampcleanenergy.com – formerly known as Aggregated Micro Power Holdings Limited) describes itself as a company that focuses on practical solutions that tackle the challenges of climate change and the energy transition. It began by funding and developing low-carbon heat and power solutions (biomass heat installations, solar photovoltaic and flexible energy plants) for UK businesses and organisations (typically local authorities – for example pellet-burning boilers that are used in schools, hospitals, etc), but has expanded into owning and operating assets that are designed to provide increased flexibility to the grid to deal with the problem of intermittency, which increases as the level of renewable generation increases within the grid. Its aim remains to unlock the potential of decentralised, sustainable energy for its customers, which supports the UK’s transition to a net zero carbon economy.

NCYF has had a holding in this sterling-denominated bond since the first tranche was issued in October 2016. The bond is unrated, pays quarterly coupons and has a sinkable call feature whereby it could be called at a price of 125p on 30 July 2020 and can now be called 13 May 2024 at 102p. Although it has expanded its remit, Ian still thinks of it as a “great boring business with an 8% coupon”. AMP’s cash flows are very reliable and predictable. Its assets are long-lived in nature, critical to the organisations that use them, and some of them are quasi-government-backed.

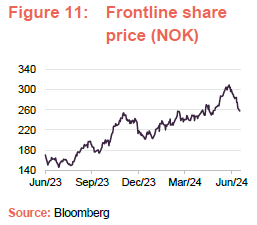

Frontline (3.4%) – swapped out of Euronav into Frontline equity

Frontline (www.frontlineplc.cy) is a global leader in the market for the international seaborne transportation of crude oil and refined products. The company, which operates in the same segment as Euronav, had built up a significant stake in that company in an attempt to take it over (Frontline and its affiliates owned just over 26% of the company). However, Frontline was not the only interested party, and Compagnie Maritime (CMB) and its affiliates had also built up a significant stake (just under 23%), putting both in a strong position to block the other from progressing. A solution to overcome the impasse was eventually brokered, with CMB agreeing to acquire all of Frontline’s and Famatown’s shares in Euronav. Frontline also acquired 24 modern very large crude carriers (VLCCs) from Euronav, making Frontline the largest pure-play publicly trader tanker owner measured by deadweight tonnes (Frontline already had 22 VLCCs in addition to its Aframax and Suezmax tankers).

The team at CQS felt that, in acquiring the 24 ships in the current market, Frontline has extracted considerable value from the deal. It is now the largest crude shipper in the world, with the best fleet, in their view, and is able, with very little capital expenditure needed, to generate very strong returns on the back of the high day rates that are prevailing in the current market environment. The company also benefits from a strong management team, which is supported by its billionaire backer John Fredriksen, which the CQS team says accounts for the company’s strong following and premium valuation.

Following the announcement of the Euronav deal, the managers decided to sell that holding into strength and rotate the proceeds into Frontline, reflecting what they see as its superior long-term prospects (both in NCYF and its sister fund, CQS Natural Resources). Ian comments that Euronav shares are still sitting around the price he sold them at, and whilst he has trimmed NCYF’s position by around 10%, the remaining holding is up around 25%.

Performance

Up-to-date information on NCYF and its peers is available on the QuotedData website.

We have previously commented that we believe a strategy such as NCYF’s (one that is focused on generating a high level of income while protecting and modestly growing capital) is best assessed by looking at the size and consistency of its total returns over longer-term horizons. We continue to think this is the case, but think that some care will be required when assessing numbers around the COVID-market collapse of March 2020, reflecting the severe dislocation caused in bond and equity markets at that time, and the subsequent recovery, particularly in bond-markets, as governments and central banks turned on the funding taps.

A general observation that we continue to highlight is that, at least in the short term, NCYF will almost certainly lag equity markets in periods where they are surging ahead when investors are risk on phases. Similarly, it is likely to lag cash returns in difficult periods when both fixed income and equity markets are struggling.

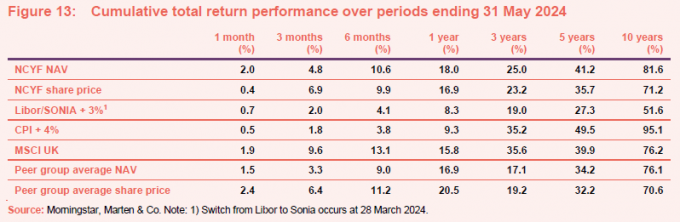

Looking at Figure 12, it is clear that prior to COVID, NCYF’s NAV and share price total returns were comfortably ahead of our chosen benchmarks (Libor/SONIA + 3% and CPI +4%) until the market crash. However, whilst these both initially fell significantly behind, they quickly recovered and remained ahead until inflation started to rear its head and interest rates increased to combat this. The short-term periods in Figure 13, particularly the six-month period, illustrate the benefits of the pull-par trend that was highlighted in the manager’s view and asset allocation sections, which have been accrued as interest rates have dropped in response to falling inflation. This can be seen graphically in Figure 12, where NCYF’s share price and NAV have recently been closing the gap on CPI+4% and moving ahead of Libor/SONIA+3%. As was discussed in the manager’s view section, this trend has further to run and so there is further upside potential, although a new shock to the economy could delay this.

As illustrated in Figure 13, NCYF has provided NAV total returns that, almost without exception, are ahead of the UK equity market by some margin. The most obvious exception is the three-year period which reflects the fact that, after a difficult period, UK equities performed particularly strongly during 2022 with value stocks outperforming growth against a backdrop of higher interest rates, aided by its strong exposure to commodity producers and defensive consumer staple, along with a relatively low exposure to technology.

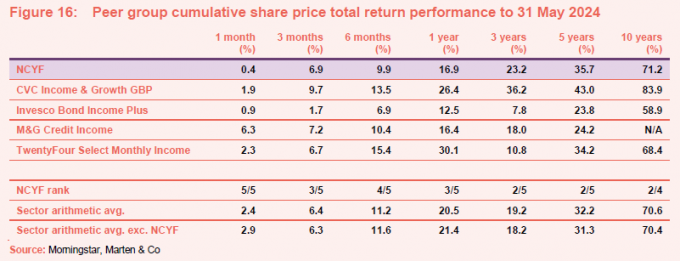

Whilst all of NCYF’s peers are fixed-income-focused, most do not have the same emphasis on generating high income. As is illustrated in Figure 13, NCYF’s NAV has outperformed that of the average of the peer group over all of the periods provided. It is a similar story for share price, with NCYF only falling behind over some of the short-term periods up until one-year.

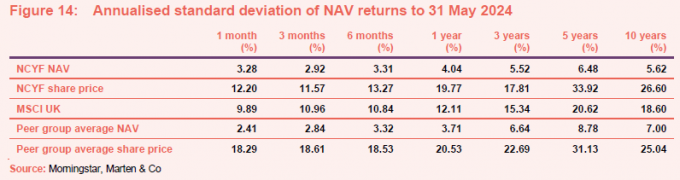

A comparison of Figure 13 and 14 shows that, despite its longer-term record of NAV outperformance of the various comparators in Figure 14, this has not come at the expense of higher volatility. Specifically, NCYF’s NAV volatility has either been close to or below that of the peer group NAV and significantly below that of the MSCI UK Index. With regards to share price, the picture is a little more mixed. Recent share price volatility appears to have pulled up NCYF’s averages over most time frames.

Peer group

Please click here to visit QuotedData.com for a live comparison of the Debt – Loans and bonds peer group.

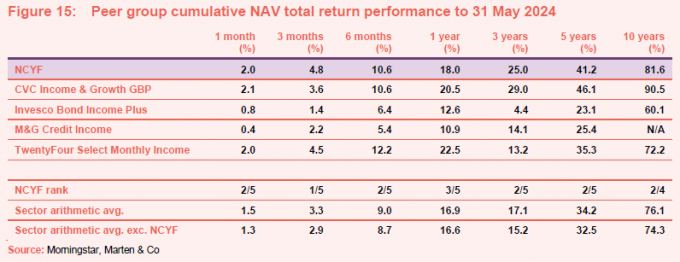

NCYF is a member of the AIC’s debt – loans & bonds sector, which comprises seven members. Five of these are illustrated in Figures 15 through 17. This peer group has shrunk in recent years as a few funds have been wound up or merged. The most recent exits were Axiom European Financial Debt, which was wound up in August 2023; and Henderson Diversified Income, which saw 55% of its shares rolled into its sister trust, Henderson High Income (now the sole constituent of the UK equity and bond income sector). We have excluded NB Distressed Debt and NB Global Monthly Income as both are being wound down and each has shrunk to the point where we do not think either makes a useful comparison for NCYF or for the other members of the peer group (both are sub-£10m market cap).

Members of debt – loans & bonds will typically have:

- over 80% invested in general debt instruments such as secured loans and bonds and syndicated lending; and

- an investment objective/policy to invest in general debt instruments such as secured loans and bonds and syndicated lending.

As noted in the performance section above, NCYF’s is distinctly different from the rest of its peers, in that the peer group has less focus on generating high levels of income than NCYF.

As we have discussed previously, NCYF, with its higher-yield focus, suffered more heavily than the peer group average during the COVID-related market rout of March 2020 but then benefited strongly as markets so that, over five years it is one of the best-performing funds in NAV total return terms – as is illustrated in Figure 15. Another feature of Figure 15 is that, over all of the time frames provided, NCYF always appears in the top half of the performance rankings and NCYF’s NAV total return exceeds the peer group average. This suggests that NCYF’s emphasis on providing a high yield has not come at the expense of total return.

Comparing Figure 15 (NAV total returns) and Figure 16 (share price total returns) shows that longer-term NAV and share price total returns are reasonably comparable, reflecting the fact that NCYF has for some time tended to trade around par or at a sensible premium to NAV.

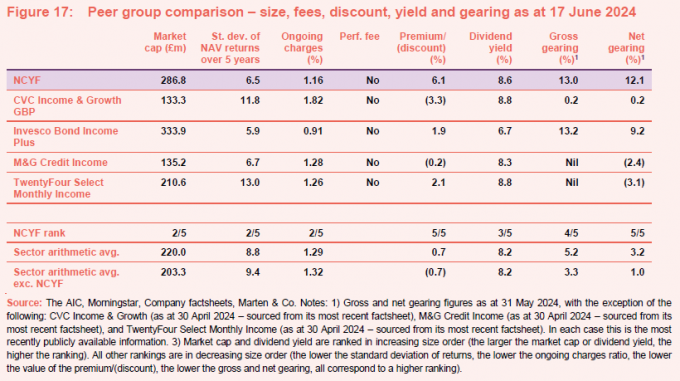

NCYF is one the largest funds in the peer group – it is the second-largest in terms of market capitalisation (combining the two share classes of CVC Credit Partners European Opportunities). NCYF’s higher-than-average rating (it is trading at the highest premium in Figure 17, but tends to be in the top two most highly-rated funds in the peer group) most likely is a reflection of its consistently high yield.

NCYF’s ongoing charges ratio (OCR) are the second-lowest in the peer group and modestly below the sector average. The only fund with a lower OCR is M&G Credit Income, which is the only fund in the peer group that is larger than NCYF. However, assuming that NCYF continues to grow in a similar way to how it has in recent years, we would expect it to continue to close the gap in terms of size and OCR with M&G Credit Income (NCYF has tended to issue stock when its premium is in excess of 5–6%). NCYF, like most of the funds in this peer group, does not pay a performance fee. NCYF is running the highest level of net gearing (borrowings less cash as a proportion of net assets) in the sector, but given the relatively stable nature of the underlying strategies in the peer group, they should all be well positioned to operate with gearing. If interest rates continue to recede and capital values increase, NCYF will benefit from having this higher exposure to the market (the reverse is also true).

The volatility of NCYF’s NAV returns is the second-lowest in the peer group and markedly below the sector average, which is perhaps surprising given its higher-yield focus. This suggests that the extra yield does not come at the expense of higher volatility.

Dividend

Quarterly dividend payments

The board intends to pay an attractive level of dividend income.

Subject to market conditions and the company’s performance, financial position and financial outlook, the board intends to pay an attractive level of dividend income to shareholders on a quarterly basis. The company intends to pay all dividends as interim dividends.

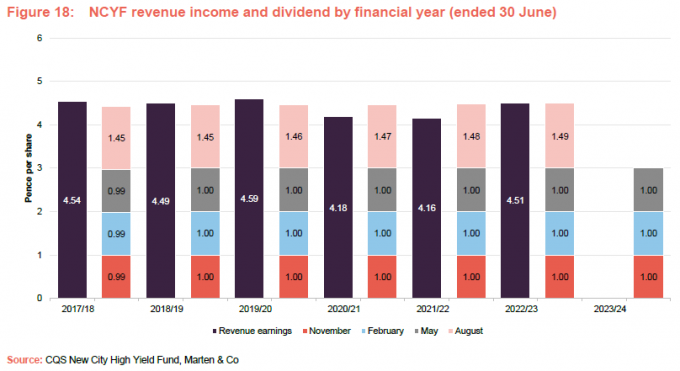

The total annual dividend has increased every year since launch.

For a given financial year, the first interim dividend is paid in November (2023: 1.00p) with the second, third and fourth interims paid in February, May and August. As illustrated in Figure 18 below, the quarterly dividend rate paid for the first quarter has been maintained for the second and third interims in December and March, which is followed by a larger ‘balloon payment’ for the fourth quarter. Although not a formal aspect of NCYF’s dividend policy, the total annual dividend has increased every year since launch.

Over half a year’s worth of dividends in reserve

The board avoids issuing stock close to ex-dividend dates to protect NCYF’s revenue reserve.

Over the longer term, NCYF’s revenue income has tended to exceed its dividend income, allowing the company to build a revenue reserve. The board can draw on this reserve where there is a shortfall to at least maintain the dividend, as it did for the years ended 30 June 2021 and 2022 (see Figure 18). As at 31 December 2023, NCYF had a revenue reserve of 2.71p per share (30 June 2023: 3.05p), which is equivalent to 60% of the total dividend for the 2023 year. It should also be noted that the board is conscious of the diluting effects of share issuance on the revenue reserve, and avoids issuing stock close to ex-dividend dates.

NCYF’s board expects maintain or slightly increase the total level of dividends for the year ending 30 June 2024.

In its annual results for the year ended 30 June 2023, NCYF’s board said that, as things stand, it intends to follow the same pattern of dividend payments for the year ending 30 June 2024 as declared last year and maintain or slightly increase the total level of dividends for the year.

It is worth noting that during the first half of the current financial year, NCYF generated a revenue return of 2.18p per share, which is down slightly on the prior year (for the six months ended 31 December 2022: 2.27p) and reflects the timing of the payment of the REA preference share arrears, but if an adjustment is made for this, revenue income is comparable (note that 7p of arrears is being paid in April and May 2024, which will clear all of the arrears).

Structure

Fees and costs

Base management fee of 0.8% per annum; no performance fee

NCYF has a tiered management fee – 0.7% for total assets in excess of £200m.

Under the terms of the investment management agreement, the manager is entitled to receive a basic management fee of 0.8% per annum of total assets (less current liabilities other than bank borrowings) up to £200m and 0.7% per annum above this. The management fee is paid monthly in arrears and there is no performance fee element. The management agreement can be terminated on 12 months’ notice by either side.

Secretarial and administrative services

Company secretarial and administrative services are provided by BNP Paribas Securities Services S.C.A. Secretarial and administration fees were £206,000 for the year ended 30 June 2023 (2022: £207,000).

BNP Paribas Securities Services also acts as NCYF’s custodian, banker and depositary in place of HSBC Bank Plc. Bank and custody fees saw a rebate of £53,000 for the year ended 30 June 2023 (2022: a fee of £110,000), while the depositary fees were £45,000 (2022: £45,000).

Allocation of fees and costs

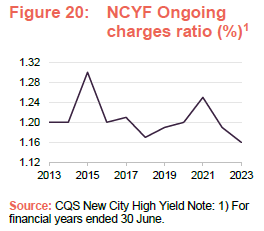

In NCYF’s accounts, the investment management fees are allocated 25% to capital and 75% to revenue. The ongoing charges ratio for the year ended 30 June 2023 was 1.16%, down from 1.19% for the year prior and 1.25% for the year ended 30 June 2021.

As is illustrated in Figure 20, the broad trend has been one of a reduction in NCYF’s ongoing charges during the last decade. This reflects the growth in NCYF’s total net assets that is primarily a result of considerable share issuance that has been possible due to the strong demand for NCYF’s strategy. There are two clear exceptions to this trend – the 2015 financial year (a turbulent period in financial markets that included the Greek debt crisis) and the period surrounding COVID, both of which saw bond yields stretched, pushing down capital values. However, with NCYF’s ongoing share issuance and a reduction in interest rates which has pushed up capital values during the last six months, NCYF looks well positioned for a reduction during the current financial year and beyond.

Capital structure and life

Simple capital structure

NCYF has one class of ordinary share in issue.

NCYF has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 17 June 2024, there were 551,451,858 shares in issue with none held in treasury.

The board has set a borrowing limit equal to 25% of NCYF’s net assets. NCYF has a £35m loan facility with Scotiabank.

NCYF is permitted to borrow and the board sets borrowing limits, which it reviews on a regular basis, to ensure gearing levels are appropriate to market conditions. As at 30 June 2023, the maximum gearing level was set at 25% of net assets. NCYF has a £45m loan facility with Scotiabank, with an interest margin of 2.00% per annum over SONIA that expires on 18 December 2024. The facility has an option for NCYF to extend it by £5m to a total of £50m and the commitment fee is 0.675% per annum on the daily available commitment. As at 31 May 2024, NCYF had gross gearing of 13.0% and net gearing of 12.1%.

The following covenants apply to the loan facility:

- the adjusted asset coverage must not be less than 4 to 1;

- total NAV must not be less than £95,000,000 at any time; and

- the additional adjusted asset coverage must be least 1.5 to 1 at all times.

NCYF has comfortably met these covenants (the asset coverage ratio is in the region of seven times, for example).

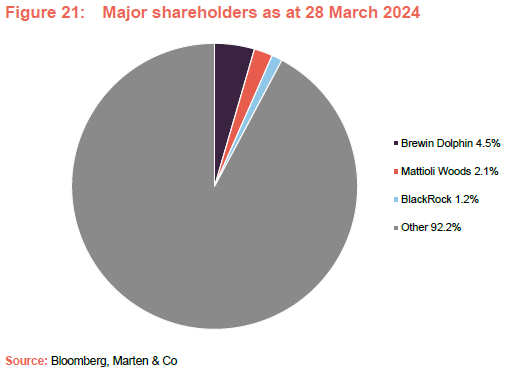

Major shareholders

NCYF has a strong retail presence on its share register, with platforms accounting for about 60%.

Unlimited life with an annual continuation vote

NCYF does not have a fixed winding-up date, but at each annual general meeting (AGM), shareholders are given the opportunity to vote on the continuation of the company as an investment company. This is an ordinary resolution. If this resolution were not passed, the board would put forward proposals to liquidate or otherwise reconstruct or reorganise the company.

Financial calendar

NCYF’s year-end is 30 June. The annual results are usually released in October (interims in March) and its AGMs are usually held in November of each year. As discussed on pages 19 and 20, NCYF pays quarterly dividends in November, February, May and August.

Corporate history

NCYF was established for the purposes of moving the domicile of its predecessor vehicle, New City High Yield Trust.

NCYF is a Jersey-domiciled closed-ended investment company incorporated on 17 January 2007. Its shares, which have a premium main market listing, have been listed on the London Stock Exchange since 7 March 2007. NCYF was established for the purposes of moving the domicile of its predecessor vehicle, New City High Yield Trust Plc (NCYT), from the UK to Jersey. On 6 March 2007, the net assets, which totalled £52.9m, were transferred from NCYT into NCYF and an additional £15m of new capital was raised at the same time. The primary rationale for this change was to enhance net distributable income and increase investment flexibility. Prior to becoming NCYT, the trust had been through a number of iterations, but always had a high-yield focus. The original vehicle was launched by Lazards in 1993.

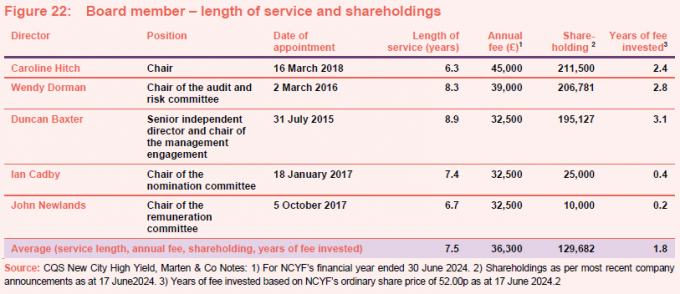

Board

NCYF’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. Other than NCYF’s board, its directors do not have any other shared directorships. The company’s articles of association limit the aggregate fees payable to the directors to a total of £250,000 per annum and all directors offer themselves for re-election on an annual basis.

Succession planning

Director’s average length of service is 7.5 years.

The average length of service is 7.5 years, and the longest-serving director is Duncan Baxter, who joined the board in July 2015 and has now served for 8.9 years. Board policy is that no director serves longer than nine years, other than in exceptional circumstances, and, reflecting this, it has a succession plan in place that is designed to allow for an orderly refreshment of the board.

Figure 22 below illustrates that all directors have now served for more than five years and, given the current lengths of service and the spacing between these, it is clear that the next couple of years will see two directors (Duncan Baxter and then Wendy Dorman) approaching the intended limit of their service, necessitating refreshment. NCYF’s board says that its succession planning takes into account gender and ethnic diversity targets.

Board diversity

Two of the three most senior board positions are held by women.

At the time of writing, the board has a 60/40 split in terms of gender identity (men/women), although two of the three most senior positions (board chair and chair of the audit committee) are held by women and one (senior independent director) is held by a man.

At present, the board is entirely composed of individuals that are classified as white British or other white (including minority-white groups). The board says that it is conscious that none of the board members are from minority ethnic backgrounds, which is below the target of one and that, alongside knowledge and expertise, this will form a key consideration when the board next recruits.

Alignment

As is illustrated in Figure 22, all of NCYF’s directors have personal investments in the fund, which we consider to be favourable as it helps align directors’ interests with those of shareholders. Three of the longer-serving directors have interests of over two years of their fees, which may also provide some additional comfort for shareholders.

Recent share purchase and disposal activity by directors

One director has purchased NCYF shares during the last 12 months: On 4 June 2024, Wendy Dorman purchased 57,252 shares at 52.22p per share. None of the directors have disposed of any shares during the last year.

Caroline Hitch (chair)

Caroline has worked in the financial services industry since the early 1980s, mostly with the HSBC Group, where she spent 24 years working in London, Jersey, Monaco and Hong Kong. During her time at HSBC, she had an investment focus on multi-asset portfolios and a particular interest in transparency and governance. Caroline also held several different investment roles, including managing institutional global fixed income portfolios. This included a period as head of wealth portfolio management at HSBC Global Asset Management (UK) Ltd. Prior to HSBC, Caroline spent a number of years with James Capel and Standard Chartered. She is also a director of Schroder Asian Total Return Investment Company Plc and Standard Life Equity Income Trust Plc. Caroline has a degree in Economics from the University of Cambridge.

Wendy Dorman (chair of the risk and audit committee)

Wendy is a chartered accountant with over 25 years’ experience in taxation, gained both in the UK and offshore. Initially an auditor, before specialising, her career has included time both in practice and in industry. Previously based in London, Wendy moved to Jersey in 2001 where she was the partner in charge of the Channel Islands tax practice of PwC until she retired in June 2015.

Wendy served as President of the Jersey Society of Chartered and Certified Accountants from 2008 to 2010. She also served as chairman of the Jersey branch of the Institute of Directors from 2014 to 2016. In addition to NCYF, Wendy is a non-executive director of 3i Infrastructure Plc, Jersey Electricity Plc and Jersey Finance Limited.

Duncan Baxter (senior independent director and chair of the management engagement)

Duncan is a retired senior banker with over 25 years’ experience of international banking, latterly as managing director of Swiss Bank Corporation in Jersey. He began his banking career in 1973 with Barclays International Bank in Harare, Zimbabwe, before joining RAL Merchant Bank in 1978. From 1988 to June 1998, he served as managing director of Swiss Bank Corporation and was responsible for developing its operations in Jersey. Duncan left following the merger with UBS AG and has undertaken a number of consultancy projects for international banks and investment management companies.

Duncan has considerable experience as a non-executive director. He is currently a director of Highland Gold Mining Ltd, but has in the region of 50 former directorships, which include a number of investment companies (for example, 3i Quoted Private Equity Limited, Aberdeen Asian Income Fund Limited, Alternative Investment Strategies Limited, American Income Trust Limited, Exeter Smaller Companies Income Fund Limited, and Premier Equity Income & Bond Trust Limited).

Duncan is a Fellow of the Institute of Chartered Secretaries and Administrators, the Securities Institute, the Chartered Institute of Bankers, the Institute of Management and the Institute of Directors.

Ian Cadby (chair of the nomination committee)

Ian has over 27 years’ experience as a board executive and investment manager within the hedge fund and derivatives trading industry, spanning a number of jurisdictions including Asia, USA, UK, and Jersey. He also has extensive experience in board strategy, corporate governance and risk management. Ian was formerly the CEO of Ermitage Ltd and has held senior positions at Cadby Wauton, Regent Pacific and Citibank. A Jersey resident, he is founder and group CEO of Sequential Ermitage Limited (a fintech company) and co-founder and CEO of Tiller Investments Limited (a wholly owned subsidiary of Sequential Ermitage).

Ian has a Combined Science degree from Coventry University, and has also completed the Advanced Management Programme, Business/Finance at Harvard Business School. He is also a director of Aberdeen Asian Income Fund Limited.

John Newlands (chair of the remuneration committee)

Following a 26-year career in the Royal Navy, John began his career in the city in 1995. Most recently, he was head of investment companies research for Brewin Dolphin from 2007 until his retirement in 2017, having previously held positions at Greig Middleton and Williams de Broë. John also formed his own consultancy, Newlands Funds Research, in 2003, and was a member of the Association of Investment Companies Statistics’ Committee from 2000 to 2017.

John has an MBA from Edinburgh University Business School and is a Chartered Engineer, having gained his degree in Electrical and Electrical Engineering from the University of Brighton. He is a member of the investment committee of Durham Cathedral and has written four books about financial history, the most recent charting the history of Dunedin Income Growth Investment Trust.

Previous publications

Readers interested in further information about NCYF may wish to read our previous notes (details are provided in Figure 23 below). You can read the notes by clicking on them in Figure 23 or by visiting our website.

| IMPORTANT INFORMATION | ||

|---|---|---|

| Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on CQS New City High Yield Fund Limited.This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.Marten & Co is not authorised to give advice to retail clients. The research does not have | regard to the specific investment objectives financial situation and needs of any specific person who may receive it.The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. | Nevertheless, they may have an interest in any of the securities mentioned within this note.This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

| QuotedData is a trading name of Marten & Co, which is authorised and regulated by the Financial Conduct Authority.50 Gresham Street, London EC2V 7AY0203 691 9430www.QuotedData.comRegistered in England & Wales number 07981621, 2nd Floor Heathmans House, 19 Heathmans Road, London SW6 4TJ |

|---|