A short-term opportunity?

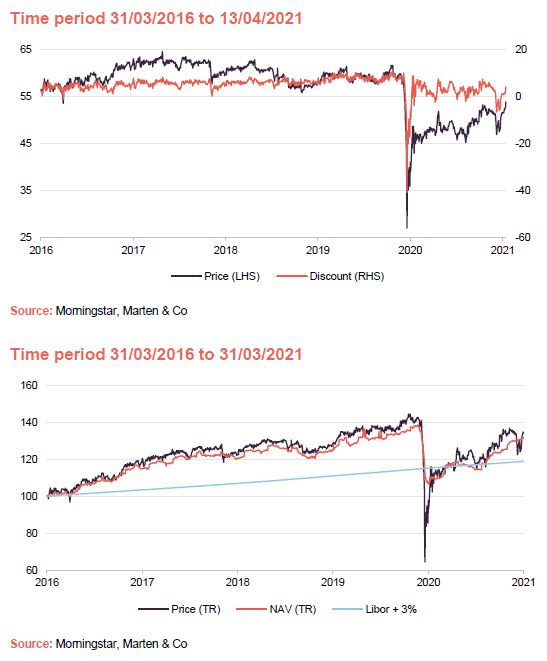

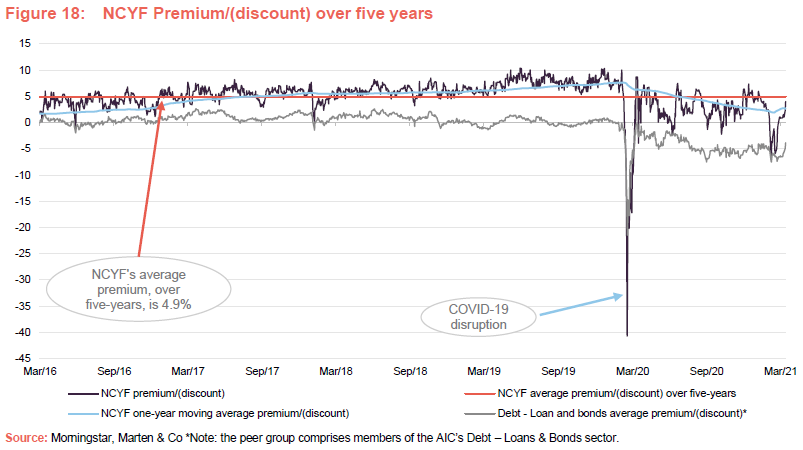

Reflecting sustained strong demand for its strategy, CQS New City High Yield Fund (NCYF) has traded at an average premium to net asset value of 4.9% over the last five years. Whilst the discount to net asset value spiked out in the depths of last year’s market trough, it quickly bounced back and NCYF was until very recently trading at premiums in excess of 5%. However, it has drifted out to trade around par since February’s modest steepening of the yield curve (where the yield curve steepens, longer term interest rates rise relative to shorter-term interest rates).

Overall, this steepening should be positive for the bulk of NCYF’s financials holdings, which make up around 50% of its portfolio. In addition, with an improving outlook for 2021 as COVID-restrictions are eased, there is scope for recovery in some of NCYF’s other holdings. We think the current lower-than-average rating of the fund may prove to be short-lived and may offer an opportunity.

High-dividend yield and potential for capital growth

NCYF aims to provide investors with a high-dividend yield and the potential for capital growth by investing mainly in high-yielding fixed interest securities. These include, but are not limited to, preference shares, loan stocks, corporate bonds (convertible and/or redeemable) and government stocks. The company also invests in equities and other income-yielding securities. The manager has a strong focus on capital preservation and is conservative in his approach to growing NCYF’s capital.

NCYF has traded at an average premium to NAV of 4.9% over the last five years. Following February’s modest steepening of the yield curve, NCYF drifted out to trade around par (the discount widening trend was in common with its peers – see Figure 18 on page 22). It is once again trading at a premium, but below this is still below its longer term average.

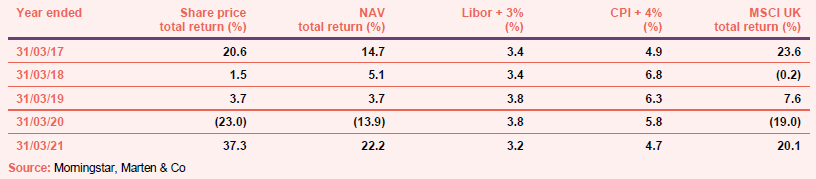

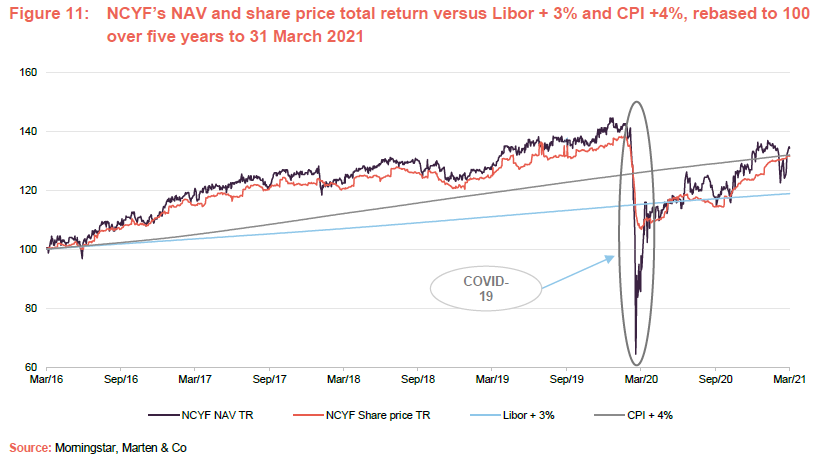

NCYF’s NAV and share price total returns were comfortably ahead of our chosen benchmarks (Libor + 3% and CPI +4% – see Figure 11 on page 14) until the market crash. However, both NCYF’s NAV and share price have both since recovered. Furthermore, with some holdings still impinged upon by COVID-related restrictions, there is the potential for further outperformance once lockdowns are eased, although it is always possible that some may not recover.

Fund profile

A predominantly higher-yielding fixed income exposure

NCYF’s aim is to provide a high level of quarterly income, with the prospect of capital growth, through investment in a portfolio of predominantly higher-yielding fixed income securities, with the flexibility to invest in equities and equity-related securities.

Investments are typically made in securities which the manager has identified as undervalued by the market and which it believes will generate above average income returns relative to their risk, thereby also generating the scope for capital appreciation. The manager seeks to exploit opportunities presented by the fluctuating yield base of the market and from redemptions, conversions, reconstructions and take-overs to generate capital growth.

CQS Group and New City Investment Managers

New City Investment Managers (NCIM) has been NCYF’s investment manager since its launch in March 2007. NCIM also managed NCYF’s immediate predecessor (NCYT) from 2004 until its assets were rolled over into NCYF in March 2007. On 1 October 2007, NCIM joined the CQS Group, a global diversified asset manager running multiple strategies with assets under management (AUM) of US$21.8bn as at 26 February 2021.

Ian “Franco” Francis – “not giving up the day job”

Ian Francis, a partner at CQS and Head of New City, has day-to-day responsibility for managing NCYF’s portfolio. Ian joined NCIM in 2007. He has well over 35 years’ investment experience, primarily in the fixed interest and convertible spheres, having worked for Collins Stewart, West LB Panmure, James Capel and Hoare Govett. Ian is able to draw on the expertise of a 23-strong credit analysis team at CQS.

In past notes we have commented on Ian’s ongoing commitment to the fund. He recently reiterated that. In his own words, he continues to enjoy what he’s doing, has no plans to retire and is “not giving up the day job”.

Constructed without reference to a benchmark

Reflecting its fixed income focus, the manager’s absolute return mindset and the diversity of its holdings, NCYF’s portfolio is not constructed with reference to any benchmark index. NCYF uses the FTSE 100 index for performance comparison purposes in its reports but its board explicitly says that this is used in the absence of a meaningful benchmark index. We have included comparisons against the MSCI UK index in this report. We also believe that, over the longer term, NCYF should be able to provide both a real return (one that exceeds consumer inflation by a margin) as well as a return that exceeds the Libor rate by a margin. We are therefore including comparisons against Libor + 3% and the consumer price index (CPI) + 4% but we would stress that these are not formal benchmarks for NCYF.

Managers’ view

The value of experience

As we have discussed in our previous notes, NCYF’s manager felt, prior to the onset of the pandemic, that the global economy was increasingly late-cycle. Ian thought that there were many reasons for investors to be very wary of markets and, while he could not have predicted the outbreak of the virus, his concerns about the economy meant that he continued to keep the portfolio “conservative and boring”. Consequently, it was partly positioned for what followed.

Ian’s long experience also helped him to keep a cool head and not panic last March. He says that this is absolutely crucial in minimising permanent capital loss when markets are in a spin. Specifically, he did not trade the portfolio too much, as he considers that trading at the wrong price can also cost you a lot of money.

Potential for synchronised global economic recovery

One effect of the pandemic is that it appears to have turned the tide on the global economic cycle, moving us from late-cycle to early-cycle in around six months. Much has been made of the recent steepening of the yield curve, which, overall, should be broadly positive for NCYF’s banking and other financials holdings. Hawkish monetary policy and the prospect of significant interest rate rises in more developed markets look a long way off, which should help to keep their economies moving forward and ease pressure on indebted companies. With many governments pumping significant stimulus into their economies simultaneously, in an attempt to stave off the economically crippling effects of the virus, there is now the prospect of synchronised global economic recovery. This could be particularly beneficial for a more outward-looking UK which, despite a strengthening of sterling during the last 12 months, still looks cheap relative to history.

Looking across the Atlantic, with President Joe Biden now firmly installed in the White House, Ian thinks that there will be a much more sensible and less combative approach to international relations and trade, which should be good for economic growth. Furthermore, having secured control of the senate, Biden’s administration is in a position where it should be able to move forward with implementing its policy agenda. However, Ian does not expect Biden to have an easy time. In his view, Trump’s highly divisive approach caused a political split in the US on a scale that has not been seen in a very long time and this will take considerable time to heal.

Looking to the exit

The discovery of effective vaccines against COVID-19 and their successful deployment is a key element in allowing countries to move away from periodic lockdowns and the economic damage this causes. The UK, having been a serious laggard in its ability to control the virus, has been successful in both securing vaccine supplies and rolling these out across its population. Clearly there are challenges ahead, and it is possible that we will have to deal with social distancing measures for some time, particularly during the winter. Nevertheless, lockdowns are easing and we should move away from the most economically choking restrictions. Europe, while initially more effective at controlling its case numbers, has suffered well-publicised problems in securing vaccine supplies and this has acted as a brake on its progress. Nonetheless, it does appear to be heading in the right direction, albeit behind the UK.

UK travel, leisure and retail may benefit from foreign holiday restrictions

One major concern for governments globally is the risk of importing new variants of the virus, for which existing vaccines might offer less protection, and lead to a new wave of infections and restrictions. While it is already illegal to travel abroad for foreign holidays, the government has recently brought in new legislation that both clarifies the restrictions and toughens up the penalties (up to £5,000 per person). This suggests that a tough stance on foreign travel is likely to remain in place for some time and whilst vaccine passports may offer a solution to this problem, these appear to be some way off.

As things currently stand, Ian thinks that travel companies offering holidays in Europe will likely struggle in this environment. However, UK holdings in travel and leisure are likely to perform strongly as people who would otherwise holiday abroad are forced to holiday in the UK. Ian thinks that could also bolster domestic spending, which will hopefully feed through to retail companies as well. However, not all retail will be able to remain afloat, and Ian thinks that the bigger question will be whether the UK High Street can be rejuvenated by the survivors? Ian thinks that these companies will have to change and adapt, but it is possible. He also thinks that out-of-town shopping facilities will get back to profitability quickly and that new business start-ups could do quite well.

An additional question mark remains over how quickly demand will return for restaurants and other food outlets. The government’s “Eat out to help out” programme appeared to have some short-term success and there is likely to be an initial surge in demand as restrictions are eased, allowing people to finally get together. However, there is evidence that, out of necessity, people have been forced to be more inventive at home, upskilling themselves in the kitchen and saving money in the process. Ian thinks that this behaviour may be enduring, as people have experienced some obvious benefits.

Refilling the hopper

We have previously commented on the availability and quality of new issues coming to market, as well as those available in the secondary market. This is important for NCYF because as issues amortise (that is, the debt is paid down) and mature, they will need to be replaced with issues that offer both an appropriate credit quality and yield to be suitable for inclusion within NCYF’s portfolio. The pipeline of opportunities varies over time. For example, during 2019 and early 2020, the manager said that whilst there was an abundance of new issues coming to market, particularly from Scandinavia, he felt that most were not of sufficiently high quality and investors needed to be selective. Fortunately, at that time, he said that it was quite easy to add to existing holdings, which he was already comfortable with.

As things stand, the manager says that there continues to be reasonable deal flow, particularly from Scandinavian issuers, and that whilst these are of variable quality and care is required, credit quality has been on an improving trend. He is nonetheless very selective, taking around one in 20 issues that he is offered. However, closer to home, Ian was able to take advantage of the sale of an institutional stake in a property fund, which is well-understood, of decent quality and provides a yield of around 12%.

Bottom-up investment process

NCYF’s portfolio is constructed using a bottom-up process that is based on extensive fundamental analysis of the credit risk and return prospects for potential investments. This analysis, which is conducted in house, includes:

- an assessment of the free cash flow available to the various security holders within a corporate’s capital structure (for example, equity holders, debt holders, preferred stockholders and convertible security holders);

- the prospect of changes to cash flows (for example, from changes in interest rates or the competitive landscape); and

- an assessment of the company’s track record in managing its obligations and the quality of the company’s management.

Ian Francis makes the final decision on what enters NCYF’s portfolio, but he is able to draw on the expertise at CQS of a 23-strong team of credit analysts globally when assessing and comparing potential investments.

When selecting candidates for the portfolio, he seeks to identify securities that he considers to be undervalued by the market. Ian expects these to generate superior income returns relative to their risk, with the scope for capital appreciation as the market rerates them. Whilst income generation and the sustainability of income are key, capital preservation is also a major focus and the manager is not prepared to sacrifice capital in the pursuit of income.

Low turnover portfolio

The manager maintains a portfolio of around 110–120 issues. This tends to be moderately concentrated, with the top 10 issues accounting for around 25%–30% of the portfolio. The manager maintains a core set of holdings that are well understood, with the top 10 being relatively liquid in normal market conditions. The portfolio is inherently low turnover, excluding called positions. Many positions do not have an active secondary market and so the manager selects positions based on the view that they offer an attractive return, relative to their risk, all the way through to their ultimate maturity. As such, the manager is not looking to trade positions. If holdings leave the portfolio prior to their maturity, it is usually because they have been called by the issuer, although the issuer frequently pays a decent premium for the privilege of doing so. Turnover for a typical year is in the region of 50%, but Ian expects that 30% to 40% will be due to forced redemptions.

The portfolio tends to have a relatively short duration, of around three-and-a-half to four years and earns a geared return of around 8% per annum, while paying out a 7% yield. This has been achieved without the use of options or dividend stripping. The manager does not hedge currency risk although he will take a macro view on currencies and avoid those that he does not favour. For example, NCYF’s portfolio has not held any Australian dollar-denominated assets since 2014/15.

Exposure to niche issues and unrated bonds

The manager’s ability to calculate its own internal ratings on any bond allows it to properly assess smaller niche and unrated issues. These issues will tend to earn a premium of 150–200 basis points for an equivalent level of risk, which is key in allowing NCYF’s portfolio to generate superior risk-adjusted returns.

Investment restrictions

In addition to fixed income securities, NCYF also invests in equities and other income-yielding securities. There are no defined limits on type of securities, countries, issue size or sectors, although the board has set a limit whereby NCYF will not invest more than 5% of its total investments in securities issued by the same investee company.

NCYF may invest in derivatives, financial instruments, money market instruments and currencies, for the purpose of efficient portfolio management, although it is not obliged to do so. NCYF can invest in both closed-ended and open-ended funds but will not invest more than 10% of its total assets, as at the time of investment, in such collective undertakings.

NCYF may invest up to 10% (calculated at the time of any relevant investment) of its total assets in other securities that are neither listed nor traded at the time of investment. It may also acquire securities that are unlisted or unquoted (at the time of investment) but which are about to be convertible, at the option of NCYF, into securities which are listed or traded on a stock exchange. NCYF is permitted to hold securities that cease to be listed or traded if the manager considers this appropriate, but such securities are limited to 10% of NCYF’s total assets (calculated at the time of any relevant investment).

NCYF is permitted to borrow and the board has set a gearing limit of 25% of net assets, at the time of borrowing, which it reviews periodically (see page 20). The manager expects that NCYF’s portfolio will normally be fully invested. However, during periods in which changes in economic circumstances, market conditions or other factors so warrant, NCYF is permitted to reduce its exposure to securities and increase its positions in cash, money market instruments and derivative instruments in order to seek protection from stock market falls or volatility.

Risk management

In addition to the above investment restrictions, the board monitors the spread of investments to ensure that it is adequate to minimise the risk associated with particular countries or factors specific to particular sectors. The manager also employs risk management disciplines which monitor NCYF’s portfolio and to quantify and manage the associated market and other risks.

CQS has established a permanent department, independent of the portfolio manager, to perform the risk management function. This risk management and performance analysis team (RMPA) is not involved in the performance activities of NCYF and has policies, processes and procedures designed to identify, quantify, analyse, monitor, report on and manage all material risks relevant to NCYF’s investment strategy. The systems include third-party vendor applications such as Tradar, Sungard Front Arena and MSCI Risk Metrics, complemented by a number of proprietary applications.

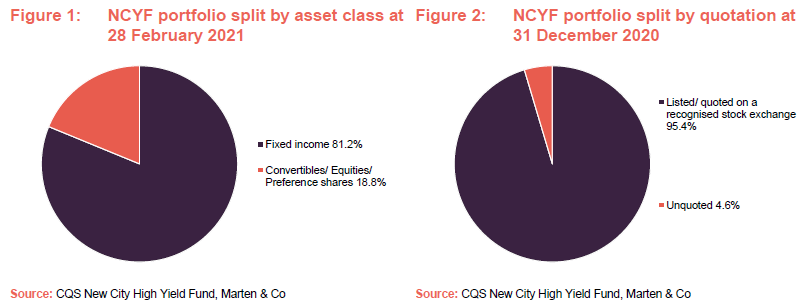

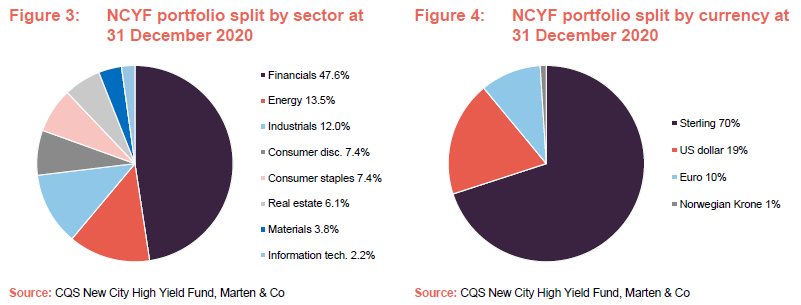

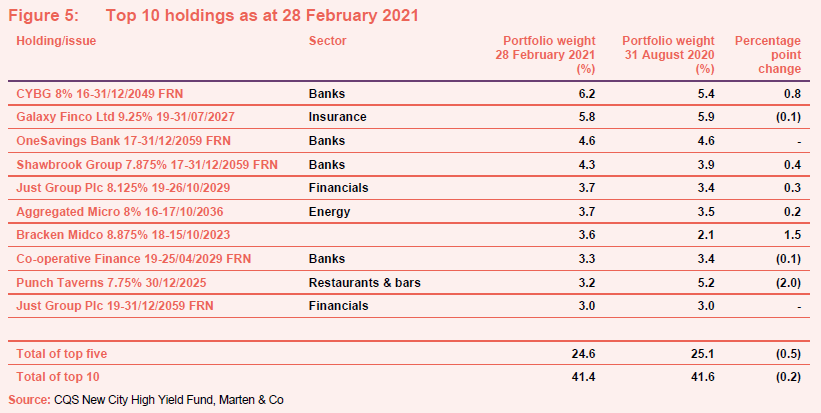

Asset allocation

As at 28 February 2021, NCYF’s portfolio had exposure to 108 issues (down modestly from the 111 issues it had exposure to as at 31 August 2020) and, as illustrated in Figure 5, the top 10 issues accounted for 41.3% of the portfolio (barely changed from August 2020’s 41.6%). Figures 1 to 4 show various splits of the portfolio (asset class, quotation, sector and currency), with the data provided being the most recent data that is publicly available.

As discussed in our June 2020 note, the manager used the market turbulence created by COVID-19 to shift the portfolio towards higher-quality names, particularly in the banking sector. However, there was limited liquidity in most of the names that NCYF holds, which limited the manager’s ability to take advantage of the market disruption.

Figures 1 to 4 show various splits of the portfolio (asset class, quotation, sector and currency), with the data provided being the most recent data that is publicly available. Looking at Figure 3, it is also noteworthy that there is no exposure to utilities in NCYF’s portfolio, as Ian has some concerns as to how safe their dividends might be.

These charts continue to illustrate a number of themes:

- The portfolio is overwhelmingly invested in pure fixed income securities.

- All but a tiny percentage of the portfolio is quoted on a recognised exchange (although around 70% trades OTC and so will be relatively illiquid, even in normal market conditions).

- The portfolio has exposure to issues from companies in a diverse range of sectors, with a heavy concentration in financials that reflects the manager’s views on bank and insurance issues (see page 6).

- The portfolio is predominantly exposed to sterling (around 70%), but also has a significant US-dollar exposure (around 20%).

- NCYF’s investments are generally located in jurisdictions that are developed and are being supportive of businesses in the current climate.

Top 10 holdings

Figure 5 shows NCYF’s top 10 holdings as at 28 February 2021 and how these have changed since over the six months from 31 August 2020. Reflecting the manager’s long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular followers of NCYF’s portfolio announcements and our notes on the company.

New entrants to the top 10 are Bracken Midco 8.875% 18-15/10/2023 and Just Group Plc 19-31/12/2059 floating rate note. Names that have slipped out of the top 10 are REA Finance 8.75% 15-31/08/2025 and Garfunkelux Holdco 11% 15-01/11/2023. We discuss some of the more interesting developments in the next few pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been discussed previously (see page 28 of this note). For example, Just Group, Aggregated Micro Power Holdings, Co-Operative Bank Finance, were all discussed, along with other names, in our June 2020 note.

Just group – “nice boring paper”

Just Group Plc (www.justgroupplc.co.uk) is a UK-based financial services group that specialises in retirement income products and services. We last discussed it in our June 2020 note (see page 5 of that note), where we commented that, with a reasonably high coupon, Just Group’s notes are exactly the sort of “boring” paper that NCYF’s manager likes.

Just Group provides financial advice, guidance, products and services to individuals, financial intermediaries, corporate clients and pension trustees. It operates through a number of different brands. Ian says that it is very well-managed and is well-positioned to benefit from the structural trend of an ageing population that should see growing demand for its services. Overall, he says that, as would be expected, not much has changed with the company since we last wrote and it has moved up NCYF’s rankings more recently on the back of good performance. NCYF has £6.5m of the 8.125% 2029 notes, £5.8m of the 9.375% 2059 and 1m of the equity, which has also recovered nicely. Ian says that Just Group continues to do its job and its securities have recovered from what Ian felt where absurdly low levels. He thinks that at some point, Just Group could be a potential takeover target, most likely from a pension fund or an insurance company.

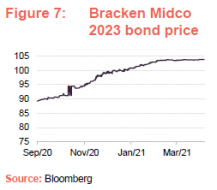

Bracken Midco 8.875% 18-15/10/2023

Bracken Midco is an indirect holding company for Together Financial Services Limited (togethermoney.com), which offers a range of mortgage and secured loan products, to private individuals and businesses. Its products include residential mortgages, commercial mortgages, secured loans, buy-to-let mortgages, bridging loans and auction finance. Ian says that it is a good, steady business. Its bonds pay an 8.875% coupon that, from mid-2020, was paid as a PIK (a payment in kind – that is, the interest has been paid as an additional debt rather than as cash) in response to the regulator suspending dividends for financial companies. However, the company has returned to paying cash again.

Ian says that the bond suffered heavily when the company was forced to suspend its dividend (falling below 80) but has recovered since and is now trading at around 104. Ian was partially able to take advantage of the collapse, purchasing £2m of the bonds at 96.75 towards the end of 2020. Ian says that their internal analyst is also very happy with the credit, which is rated by Fitch as a B, and by S&P as a B+. Ian says that it is still yielding 8.6%, which is right on target for the fund.

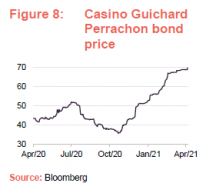

Casino Guichard Perrachon – capital appreciation from a new holding

Casino Guichard Perrachon (www.groupe-casino.fr/en) operates the Casino supermarket chain in France. Ian says that these supermarkets have, like their UK counterparts, provided very solid and stable revenues, during the pandemic. Ian purchased €5.1m of the company’s 3.992% perpetual bonds at less than €0.4 and they are now trading around a bid price of €0.69. He has recently top sliced the holding, around this level, locking in a decent gain (on part of the position) for NCYF.

Anecdotally, Ian feels that the topco is not well funded or managed but that it needs to keep paying the coupons on the bond, if it wants to pass money up through the topco to shareholders, which provides considerable confidence around the coupon payments. Ian says that the bond is not particularly expensive and is trading at around half its face value as it is junior subordinated debt (it has a CCC rating).

Although it is a perpetual bond, Ian doesn’t expect to hold the bond indefinitely (it is not a core holding) and expects that, as France moves into a post-COVID period and the outlook improves, the credit could spike 10 points or more upwards. At this point, he would look to take profits and sell out of the position.

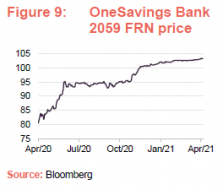

OneSavings Bank 17-31/12/2059 floating rate notes

OneSavings Bank has been a constituent of NCYF’s portfolio for some time, and a holding that we have talked about in previous notes. When we last discussed it in our June 2020 note, we commented that, in the manager’s view, banks and insurance companies (including OneSavings Bank) still represented an opportunity. As 2020 has shown, these institutions are now much better-capitalised than they were as we approached the top of the last cycle in 2007-08, but the market’s attitude towards them has seen remarkably little change. This continues to make them natural candidates for NCYF’s portfolio, as their issues tend to pay a relatively-high yield for their level of risk. Ian says that OneSavings Bank is performing as expected and its 2059 FRNs, having fallen as low as 76.5 in March last year, have seen a strong recovery and are once again trading above par.

R.E.A. Holdings preference shares – palm oil price has recovered strongly

Long-term NCYF holding, R.E.A. Holdings (www.rea.co.uk) is engaged in the cultivation of oil palms in the Indonesian province of East Kalimantan and in the production and sale of sustainable crude palm oil, and associated palm products, from the fruit harvested from its oil palms. We last discussed the holding in our June 2020 note, where we explained that, due to a low palm oil price, R.E.A. had suspended the dividends on its preference shares. We commented in our June 2020 note that the team at CQS felt that R.E.A.’s management was being cautious because of the low palm oil price, but with this recovering, it expects preference share dividends to resume later in 2020, which proved to be the case.

Since then, the palm oil price has continued to strengthen and the company is emerging from the crisis with a superior market position (R.E.A. was one of the few palm oil producers that was able to continue to put fertiliser on its oil palms, which is crucial to maintaining the plantations’ health and yield) and the price rise is largely falling through to the company’s bottom line. In turn, this is feeding through into the arrear payments on the preference shares. Ian says that, at current palm oil prices, R.E.A. should be able to clear the arrears on its preference shares in less than two years.

As we have discussed previously, R.E.A. is focused on sustainable palm oil cultivation and, in the manager’s view, is one of the best palm oil producers in terms of its ESG credentials. More information on its sustainability can be found at www.rea.co.uk/sustainability/certification. With the company selling into a market that is seeing both growing demand and a supply shortfall that is not quickly eliminated, the manager expects to see a favourable pricing environment for some time which should ultimately lead to a recovery in the preference share price as well. While the CQS team also like and hold R.E.A. equity, they consider that, at present the preference shares are the optimal component of the capital structure to hold.

Other holdings

Ian says that there is little change for Aggregated Micro Power Holdings (see page 6 of our June 2020 note for more information). The company, which provides biomass boilers for schools and council offices has performed very well throughout lockdown. Ian thinks that there is a good chance that the bond could be called in October.

Diversified Gas and Oil has benefitted from a colder-than-normal winter and has done very well as a consequence. It keeps ticking along and has a nicely protected book of business. Euronav and American Tanker have moved down NCYF’s rankings largely due to sterling appreciation and their businesses are otherwise performing as expected.

Performance

In our previous notes, we have commented that we think a strategy such as NCYF’s (one that is focused on generating a high level of income while protecting and modestly growing capital) is best assessed by looking at the size and consistency of its total returns over longer-term horizons. We would highlight that, in the short term, at least, it is somewhat inevitable that NCYF will lag equities, particularly when these markets surge ahead in risk on phases. Similarly, it is likely to lag cash returns in difficult periods when both fixed income and equity markets are struggling.

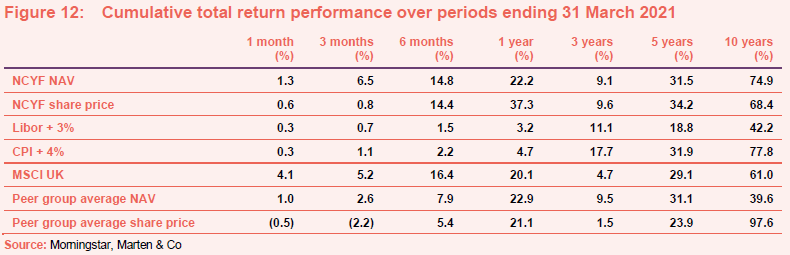

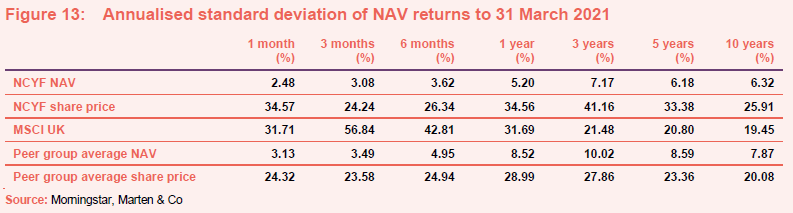

However, as we discuss in the peer group section below, following the unusual disruptions of 2020, we think that some emphasis might be placed on NCYF’s more recent performance. Specifically, the three-year period in Figures 12 and 13 includes the market crash during which, as discussed in previous notes, NCYF suffered heavily as it was perceived to be of higher risk due to its higher-yield focus. More recently, it has benefitted as vaccine roll-outs have progressed and further signs have emerged that its holdings, particularly those that are experiencing more-challenging trading environments due to current restrictions, may benefit from a further relaxing of restrictions as economies re-open.

Looking at Figure 11, it is clear that prior to the market rout, NCYF’s NAV and share price total returns were comfortably ahead of our chosen benchmarks (Libor + 3% and CPI +4%) until the market crash. However, both NCYF’s NAV and share price have both since recovered. Furthermore, with some holdings still impinged upon by COVID-related restrictions, there is the potential for further outperformance once lockdowns are eased, although it is always possible that some may not recover. The manager reiterates his view that, with limited exceptions, most of the credits should pull to par over time, and so there remains further upside potential provided there is no new shock to the economy.

As illustrated in Figure 12, NCYF has provided NAV and share price total returns that, almost without exception, are ahead of both the UK equity market (as represented by the MSCI UK Index), Libor + 3% and CPI + 4% – all by some margin. The most obvious exception is the three-year period which, as discussed above, includes the effects of the market collapse (the one-year period largely captures the recovery, but emits the effects of the fall). NCYF’s performance relative to the various comparators, including its peer group, is particularly strong over the five and 10-year periods (although NCYF’s NAV and share price fall modestly behind CPI +4% over 10 years).

Whilst all of NCYF’s peers are fixed-income-focused, most do not have the same emphasis on generating high income. As is illustrated in Figure 12, NCYF’s NAV has outperformed that of the average of the peer group over all of the periods provided with the exception of the one-year period (as noted above, this incorporates the market crash). The same can be said of its share price, although rather than mildly underperforming over one year, NCYF’s performance markedly ahead the peer group average (this reflects the fact that NCYF briefly moved out to a significant discount, albeit on very limited liquidity, during the depths of the market collapse).

A comparison of Figure 12 and 13 shows that, despite its longer-term record of NAV outperformance of the various comparators in Figure 12, this has not come at the expense of higher volatility. Specifically, NCYF’s NAV volatility is below that of the peer group NAV and that of the MSCI UK Index. With regards to share price, the picture is a little more mixed. Recent share price volatility (over one-month) appears to have pulled up NCYF’s averages over most time frames (the same can be said of its performance versus the MSCI UK index).

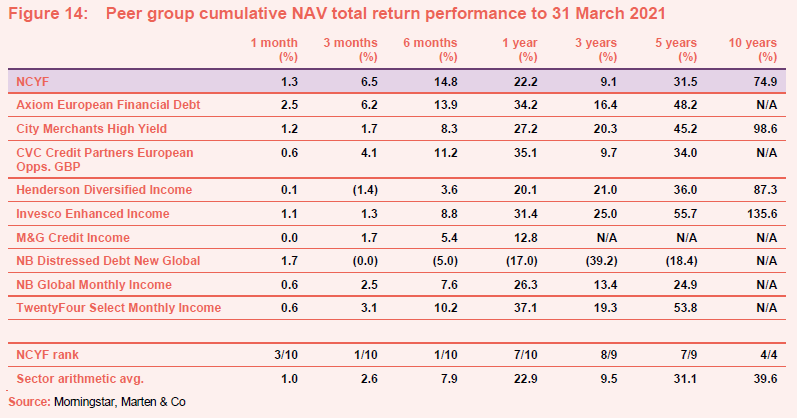

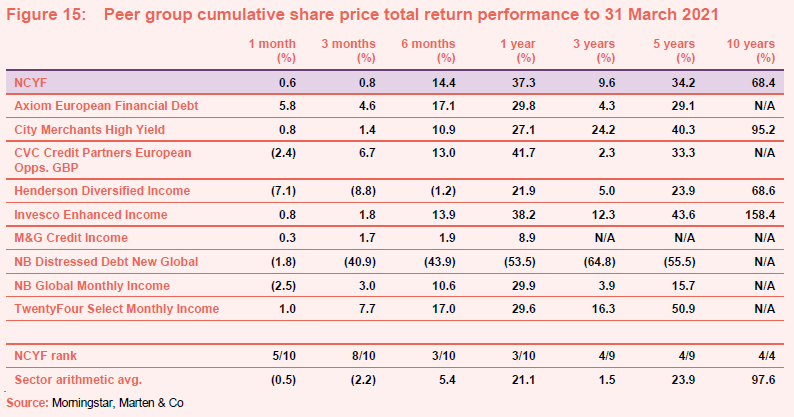

Peer group

NCYF is a member of the AIC’s Debt – Loans & Bonds sector, which, following a recent reshuffle, comprises 10 members. All of these are illustrated in Figures 14 through 16. As noted in the performance section above, NCYF’s is distinctly different from the rest of its peers in that the peer group has less focus on generating high levels of income than NCYF.

Members of Debt – Loans & Bonds will typically:

- have over 80% invested in general debt instruments such as secured loans and bonds and syndicated lending; and

- an investment objective/policy to invest in general debt instruments such as secured loans and bonds and syndicated lending.

As illustrated in Figure 14, NCYF with its higher-yield focus, suffered more heavily than the peer group average during the COVID-related market rout of March 2020. This is most apparent in the three-year numbers (the one-year numbers largely capture the recovery), which has also eaten into NCYF’s longer-term performance record. However, it is also clear from Figure 14 that NCYF has benefitted strongly as markets have recovered and good news has come through regarding vaccine development and the prospects of easing tensions on its underlying holdings, which is clearly visible in the improvement in its performance ranking over the shorter-term time-frames (that is, over one, three and six months).

Ordinarily, we would argue that longer-term time-frames are the most relevant with which to assess NCYF’s strategy but the last 12 months have been particularly unusual and so we would highlight that some credence should also be given to more recent performance as this might be more illustrative of what investors might receive assuming that economies continue to re-open as this should be supportive of a further recovery in NCYF’s holdings, particularly those that are experiencing more challenging trading environments due to current restrictions.

Comparing Figure 14 (NAV total returns) and Figure 15 (share price total returns) shows that longer-term NAV and share price total returns are reasonably comparable, reflecting the fact that NCYF has for some time tended to trade around par or at a sensible premium. Over one, three and six months, it is clear that premium narrowing/discount widening has meant that NCYF’s share price total return performance has not kept pace with that of its NAV total return. However, as noted on page 1, this may be a short-term phenomenon.

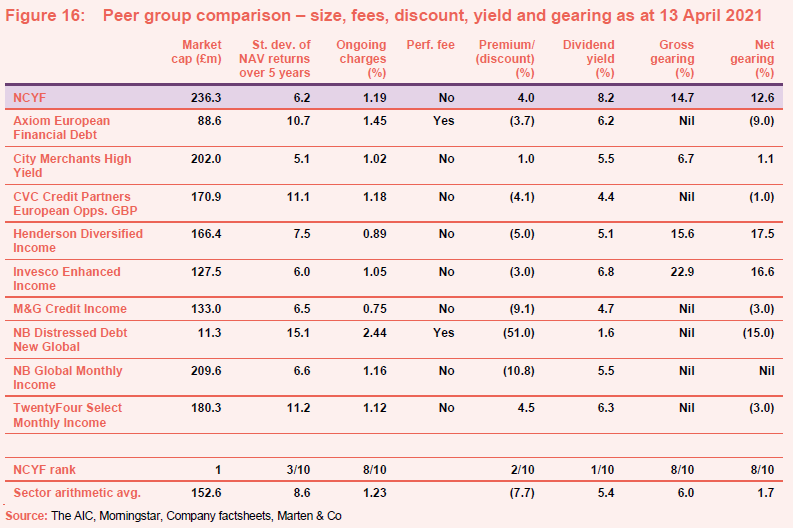

NCYF is one the largest funds in the peer group – it is the second-largest in terms of market capitalisation (combining the two share classes of CVC Credit Partners European Opportunities). NCYF’s higher-than-average rating (second only to TwentyFour Select Monthly Income) most likely is a reflection of it offering the highest yield.

NCYF’s ongoing charges are below the sector average for the peer group (the peer group average of 1.23% is pulled up by NB Distressed Debt) although they are modestly above the sector median (1.19% versus 1.14%). Most ongoing charges ratios within this subsector have ticked up recently, reflecting the fact that asset values dropped last year, which meant that fixed costs were spread over a smaller asset base, but this should correct itself if asset values continue on their path of recovery. NCYF is currently trading around par but when its premium is in excess of 5–6%, it has tended to issue stock. We expect that if it is able to get back to a premium rating, it will continue to expand and this should, all things being equal, continue to exert downward pressure on NCYF’s ongoing charges ratio (the reverse is also true). NCYF, like most of the funds in this peer group, does not pay a performance fee.

Gearing is another consideration and this can be more of a concern for investors when markets are at more elevated levels. Most of NCYF’s peers appear to be running net cash positions and are therefore less exposed in the event that markets fall back but will suffer more heavily from cash drag if markets continue to progress.

The volatility of NCYF’s NAV returns is the third-lowest in the peer group and markedly below the sector average, which is perhaps surprising given its higher-yield focus. This suggests that the extra yield does not come at the expense of higher volatility.

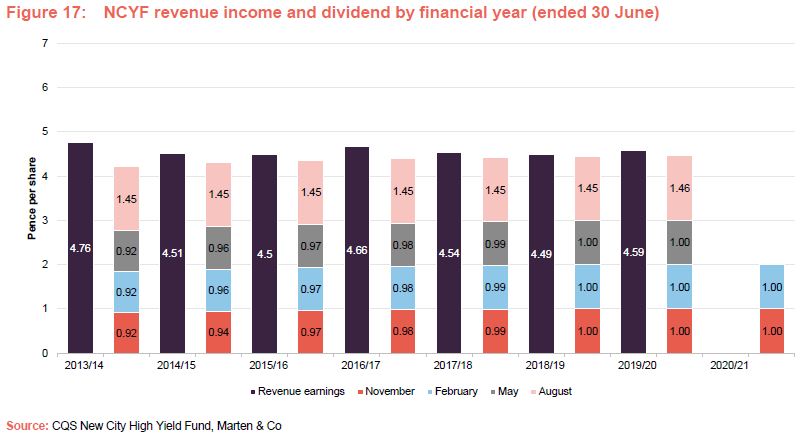

Quarterly dividend payments

Subject to market conditions and the company’s performance, financial position and financial outlook, the board intends to pay an attractive level of dividend income to shareholders on a quarterly basis. The company intends to pay all dividends as interim dividends.

For a given financial year, the first interim dividend is paid in November (2020: 1.00p) with the second, third and fourth interims paid in February, May and August. As illustrated in Figure 17 below, the quarterly dividend rate paid for the first quarter has been maintained for the second and third interims in December and March, which is followed by a larger ‘balloon payment’ for the fourth quarter. Although not a formal aspect of NCYF’s dividend policy, the total annual dividend has increased every year since launch.

Approximately one year’s worth of dividends in reserve

As Figure 17 shows, NCYF’s revenue income has also exceeded its dividend in recent years allowing the company to build on its revenue reserve. As at

30 June 2020, NCYF had a revenue reserve of 4.15p per share (30 June 2019: 4.09p). This was a little over one year’s worth of dividend payments. Although the board has not indicated an intention to do so, these reserves could be used to maintain the dividend should it become uncovered in future years. It should also be noted that the board is conscious of the diluting effects of share issuance on the revenue reserve and avoids issuing stock close to ex-dividend dates.

In its interim results announcement on 26 February 2021, NCYF said that, in the absence of unforeseen circumstances, its board expects to follow the same pattern of dividend payments as declared last year and maintain or slightly increase the total level of dividends for the year.

Premium/(discount)

As illustrated in Figure 18, NCYF has predominantly traded at a premium during the last five years and, in the four years prior to the outbreak of COVID-19, it predominantly traded at a premium of between five and 10 per cent. The discount spiked to ridiculous levels in March 2020 but recovered swiftly. However, since then NCYF’s premium has tended to be in the zero to five per cent range.

As discussed previously, NCYF’s premium has reflected strong underlying demand as for its strategy, which has allowed an ongoing programme of share issuance. Despite NCYF’s tending to trade at a tighter premium during the last 12 months, it was still able to issue stock and grow. For example, NCYF most recently issued stock on 1 February 2021 – 8,580,000 shares at 51.6p per share, bringing its total shares in issue to 439.2m (it has no shares in treasury). During the year to 31 March 2021, NCYF issued 7.1m shares, adding 1.6% to its issued share capital. During the 12 months prior, NCYF issued 20.6m shares (an increase of 5.0%). NCYF has tended to issue stock when its premium is in excess of 5 to 6%.

As we discussed on page 18, NCYF has tended to trade at a marked premium to the Debt – Loans and bonds sector average, and this continues to be the case. However, in early March 2021, as markets focused on a steepening yield curve, NCYF’s moved from trading at a premium to a discount of around 6%. While this move was larger than that seen in the broader Debt – Loans and bonds sector, it can be seen that the average sector discount also widened at the same time and, while NCYF’s discount has narrowed since, so that it is currently trading around par, much of the sector’s widening has been maintained.

NCYF has the authority to issue up to 10% of its issued share capital and repurchase up to 14.99% of its issued share capital, which gives it mechanisms through which it can moderate its premium or discount. The board says that it monitors the level of the company’s discount or premium to NAV, although there is no formal target for either and there is no formal discount control mechanism in place.

As we have discussed previously, NCYF’s managers are keen to see the fund grow in a measured way. Considerable care is taken not to dilute the revenue account, and the managers want to be sure that any new issuance can cover itself in terms of revenue income generated until the next ex-dividend date. It would appear that the board is open to providing liquidity to the market at the 5% to 6% premium level, although this is by no means guaranteed. However, issuing new shares at a premium to NAV is accretive to existing shareholders.

Fees and costs

Base management fee of 0.8% per annum; no performance fee

Under the terms of the investment management agreement, CQS is entitled to receive a basic management fee of 0.8% per annum of total assets (less current liabilities other than bank borrowings) up to £200m and 0.7% per annum above this. The management fee is paid monthly in arrears and there is no performance fee element. The management agreement can be terminated on 12 months’ notice by either side.

Secretarial and administrative services

Company secretarial and administrative services are provided by BNP Paribas Securities Services S.C.A., who replaced Maitland Administration Services (Scotland) Limited with effect from 27 November 2019. Secretarial and administration fees were £202,000 for the year ended 30 June 2020, which includes a one-off fee of £20,000 set-up fee in relation to changing the administrator, company secretary and custodian (2019: £168,000).

BNP Paribas Securities Services also acts as NCYF’s custodian, banker and depositary in place of HSBC Bank Plc. Bank and custody fees were £56,000 for the year ended 30 June 2020 (2019: £53,000), while the depositary fees were £52,000 (2019: £50,000).

Allocation of fees and costs

In NCYF’s accounts, the investment management fees are allocated 25% to capital and 75% to revenue. The ongoing charges ratio for the year ended 30 June 2020 was 1.20% (2019: 1.19%), and, with ongoing share issuance it seems likely that it will have fallen further over the year ended 30 June 2021.

Capital structure and life

Simple capital structure

NCYF has a simple capital structure with one class of ordinary share in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 13 April 2021, there were 423,901,858 in issue with none held in treasury.

NCYF is permitted to borrow and the board sets borrowing limits, which it reviews on a regular basis, to ensure gearing levels are appropriate to market conditions. As at 30 June 2020, the maximum gearing level was set at 25% of net assets. NCYF has a £35m loan facility with Scotiabank, which bears an all-in rate of 1.39% and expires in December 2021. As at 31 March 2021, NCYF had gross gearing of 14.7% and net gearing of 12.6%.

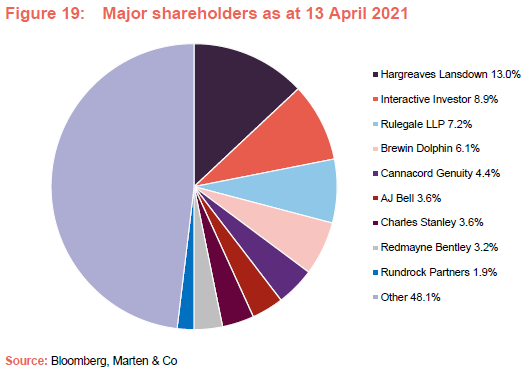

Major shareholders

Unlimited life with an annual continuation vote

NCYF does not have a fixed winding-up date, but at each annual general meeting (AGM), shareholders are given the opportunity to vote on the continuation of the company as an investment company. This is an ordinary resolution. If this resolution were not passed, the board would put forward proposals to liquidate or otherwise reconstruct or reorganise the company.

Financial calendar

The trust’s year-end is 30 June. The annual results are usually released in October (interims in March) and its annual general meetings (AGMs) are usually held in November of each year. As discussed on pages 19 and 20, NCYF pays quarterly dividends in November, February, May and August.

Corporate history

NCYF is a Jersey-domiciled closed-ended investment company incorporated on 17 January 2007. Its shares, which have a premium main market listing, have been listed on the London Stock Exchange since 7 March 2007. NCYF was established for the purposes of moving the domicile of its predecessor vehicle, New City High Yield Trust Plc (NCYT), from the UK to Jersey. On 6 March 2007, the net assets, which totalled £52.9m, were transferred from NCYT into NCYF and an additional £15m of new capital was raised at the same time. The primary rationale for this change was to enhance net distributable income and increase investment flexibility. Prior to becoming NCYT, the trust had been through a number of iterations but always had a high-yield focus. The original vehicle was launched by Lazards in 1993.

Board

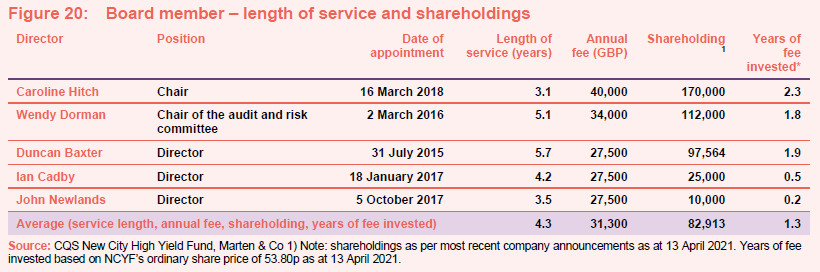

NCYF’s board is composed of five directors, all of whom are non-executive and considered to be independent of the investment manager. Other than NCYF’s board, its directors do not have any other shared directorships. The company’s articles of association limit the aggregate fees payable to the directors to a total of £250,000 per annum.

NCYF’s articles of association require that board members offer themselves for re-election at least once every three years. Board members that have served for nine or more years must offer themselves for re-election annually. The average length of service is 4.3 years.

The longest-serving director is Duncan Baxter, who joined the board in July 2015. He and Caroline Hitch are due to stand for re-election at this year’s in November; Wendy Dorman is scheduled to stand for re-election at the 2022 AGM; and Ian Cadby and John Newlands are scheduled to stand for re-election at the 2023 AGM. Caroline Hitch became chair at the conclusion of the company’s AGM on

14 December 2018.

As is illustrated in Figure 20, all of NCYF’s directors have personal investments in the fund, which we consider to be favourable as it helps align directors’ interests with those of shareholders. Three of the longer-serving directors have interests of over 1.5 years of their fees, which may also provide some additional comfort for shareholders.

Caroline Hitch (chair)

Caroline has worked in the financial services industry since the early 1980s, mostly with the HSBC Group, where she spent 24 years working in London, Jersey, Monaco and Hong Kong. During her time at HSBC, she had an investment focus on multi-asset portfolios and a particular interest in transparency and governance. Caroline also held several different investment roles including managing institutional global fixed income portfolios. This included a period as head of wealth portfolio management at HSBC Global Asset Management (UK) Ltd. Prior to HSBC, Caroline spent a number of years with James Capel and Standard Chartered. She is also a director of Schroder Asian Total Return Investment Company Plc and Standard Life Equity Income Trust Plc. Caroline has a degree in Economics from the University of Cambridge.

Wendy Dorman (chair of the risk and audit committee)

Wendy is a chartered accountant with over 25 years’ experience in taxation, gained both in the UK and offshore. Initially an auditor, before specialising, Her career has included time both in practice and in industry. Previously based in London, Wendy moved to Jersey in 2001 where she was the partner in charge of Channel Islands tax practice of PwC until she retired in June 2015.

Wendy served as President of the Jersey Society of Chartered and Certified Accountants from 2008 to 2010. She also served as chairman of the Jersey branch of the Institute of Directors from 2014 to 2016. In addition to NCYF, Wendy is a non-executive director of 3i Infrastructure Plc, Jersey Electricity Plc and Jersey Finance Limited.

Duncan Baxter (director)

Duncan is a retired senior banker with over 25 years’ experience of international banking, latterly as managing director of Swiss Bank Corporation in Jersey. He began his banking career in 1973 with Barclays International Bank in Harare, Zimbabwe, before joining RAL Merchant Bank in 1978. From 1988 to June 1998, he served as managing director of Swiss Bank Corporation and was responsible for developing its operations in Jersey. Duncan left following the merger with UBS AG and has undertaken a number of consultancy projects for international banks and investment management companies.

Duncan has considerable experience as a non-exec director. He is currently a director of Highland Gold Mining Ltd, but has in the region of 50 former directorships, which include a number of investment companies (for example, 3i Quoted Private Equity Limited, Aberdeen Asian Income Fund Limited, Alternative Investment Strategies Limited, American Income Trust Limited, Exeter Smaller Companies Income Fund Limited and Premier Equity Income & Bond Trust Limited).

Duncan is a Fellow of Institute of Chartered Secretaries and Administrators, the Securities Institute, the Chartered Institute of Bankers, the Institute of Management and the Institute of Directors.

Ian Cadby (director)

Ian has over 27 years’ experience as a board executive and investment manager within the hedge fund and derivatives trading industry, spanning a number of jurisdictions including Asia, USA, UK and Jersey. He also has extensive experience in board strategy, corporate governance and risk management. Ian was formerly the CEO of Ermitage Ltd and has held senior positions at Cadby Wauton, Regent Pacific and Citibank. A Jersey resident, he is founder and group CEO of Sequential Ermitage Limited (a fintech company) and is co-founder and CEO of Tiller Investments Limited (a wholly owned subsidiary of Sequential Ermitage).

Ian has a Combined Science degree from Coventry University, and has also completed the Advanced Management Programme, Business/Finance at Harvard Business School. Ian is also a director of Aberdeen Asian Income Fund Limited.

John Newlands (director)

Following a 26-year career in the Royal Navy, John began his career in the city in 1995. Most recently, he was head of investment companies research for Brewin Dolphin from 2007 until his retirement in 2017, having previously held positions at Greig Middleton and Williams de Broë. John also formed his own consultancy, Newlands Funds Research, in 2003, and was a member of the Association of Investment Companies Statistics’ Committee from 2000 to 2017.

John has an MBA from Edinburgh University Business School and is a Chartered Engineer, having gained his degree in Electrical and Electrical Engineering from the University of Brighton. He is a member of the investment committee of Durham Cathedral and has written four books about financial history, the most recent charting the history of Dunedin Income Growth Investment Trust.

Previous publications

Readers interested in further information about NCYF may wish to read our previous notes. You can read the notes by clicking on the links below.

“Conservative and boring” – Initiation – 28 March 2018

Escalators do not go to the sky! – Update – 13 November 2018

Same as it ever was… – Annual overview – 29 July 2019

Sitting pretty – Update – 30 June 2020

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on CQS New City High Yield Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.