In December, the post-election uplift in US stock markets came to a juddering halt as, alongside another 0.25% interest rate cut, the Federal Reserve sounded a note of caution on its outlook for 2025. However, the Dow Jones Global Technology Index posted gains, as investors continued to back the AI story that was the main driver of markets over 2024.

Bond yields across the developed world jumped on the back of the Federal Reserve’s comments, hitting interest rate sensitive sectors.

In the UK: ‘A post-Budget slump in business optimism persisted in December, with output growth expectations for the year ahead unchanged from November’s 23-month low.’– Tim Moore, S&P Global Market Intelligence

The UK’s economic landscape in December was marked by a slowdown in business activity, with service sector firms reducing staff at the highest rate in nearly four years. The S&P Composite Purchasing Managers’ Index (PMI) edged down to 50.4 from 50.5 in November. This deceleration is largely attributed to the government’s recent budget, which introduced significant business tax hikes to fund public spending.

In the face of these challenges, there was a slight uptick in business leaders’ confidence towards the end of the month. The Institute of Directors reported an increase in its economic optimism index, rising from -65 to -61 in December. However, concerns persist regarding rising costs and the impact of upcoming fiscal policies on growth ambitions.

Inflation remained a key focus in the Eurozone, with Germany reporting a 2.9% annual rate in December, up from 2.4% in November and exceeding the forecast of 2.6%. This rise was driven by higher food prices and a slower decline in energy costs. Analysts warn that inflation could stay elevated due to additional factors like increased CO2 emission charges. The European Central Bank faces the challenge of guiding inflation back to its 2% target, while maintaining that current pressures are manageable, with a gradual return expected by 2025.

In China, the government promised to lower interest rates and make vigorous efforts to boost consumption, but weak retail sales figures for November illustrated the challenge involved with achieving this. The Australian government warned of the impact of weak Chinese demand on its tax revenues.

Polar Capital Technology

‘The market has taken Trump’s election and the Republican clean sweep in its stride, with the expectation of lower taxes and a deregulatory agenda provoking hitherto elusive ‘animal spirits’.’

MIGO Opportunities Trust

‘We are focusing on a market that has become wildly dislocated from fundamental value’.

Henderson European Trust

‘Fundamental active investors now account for only 10-20% of daily traded volumes in the European equity market. The result is outsized reactions to economic, market or company news that are not reflective of long-term prospects or value.’

At a glance

| Exchange rate | 31 December 2024 | Change on month % | |

|---|---|---|---|

| Pound to US dollars | GBP / USD | 1.2516 | (1.7) |

| Pound to euros | GBP / EUR | 1.2085 | 0.4 |

| US dollars to Japanese yen | USD / JPY | 157.20 | 5.0 |

| US dollars to Swiss francs | USD / CHF | 0.9074 | 3.0 |

| US dollars to Chinese renminbi | USD / CNY | 7.2993 | 0.7 |

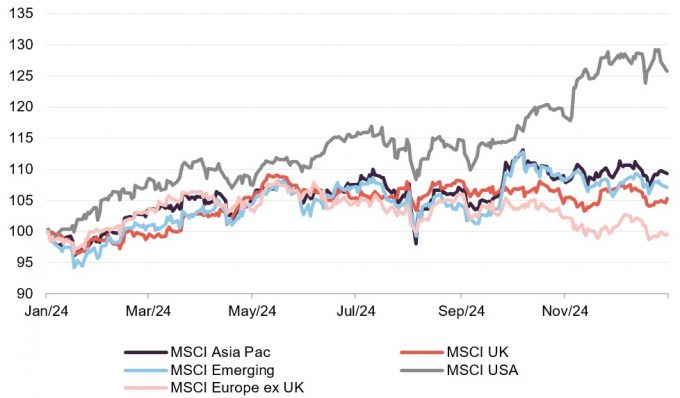

MSCI Indices (rebased to 100)

In a turnaround from the usual story, emerging markets and PAN-Asian indices led the way in December. The upset of the Federal Reserve’s comments pulled back US markets, but it was the UK that took the wooden spoon. Over the year, Europe was the worst-performing region and, as the chart clearly shows, the US left other markets trailing in its wake.

The jump in government bond yields that we referred to previously is shown in the table below. Gold was flat.

Time period 31 October 2023 to 31 October 2024

Source: Bloomberg, QuotedData. Converted to pounds to give returns for a UK-based investor.

| Indicator | 31 December 2024 | Change on month % |

|---|---|---|

| Oil (Brent – US$ per barrel) | 74.64 | 2.3 |

| Gold (US$ per Troy ounce) | 2624.50 | (0.7) |

| US Treasuries 10-year yield | 4.57 | 9.6 |

| UK Gilts 10-year yield | 4.57 | 7.7 |

| German government bonds (Bunds) 10-year yield | 2.36 | 13.3 |

Global

Dan Higgins, manager, Majedie Investments, 20 December 2024

With inflation seemingly under control, the Federal Reserve is mindful of a softening labour market and has implied that further cuts will follow if the unemployment rate rises to 4.5%. This, in turn, could pave the way for lower policy rates in Europe and the U.K. With the notable exception of Japan, the world’s major central banks have commenced an easing cycle.

It is received wisdom that, when central banks loosen simultaneously, the implications for risk assets are bullish. However, the current environment for investors is more nuanced than in previous cycles because (a) U.S. markets have already risen in anticipation of monetary easing, and (b) the rally has been concentrated in a small number of mega-cap tech companies. As long-duration investments, growth stocks are not usually considered the greatest beneficiaries of lower policy rates and steeper yield curves.

Allocators also need to evaluate the implications of a Trump presidency on their portfolios. Although we do not have exposure to any of the obvious Trump trades (such as bitcoin, shale stocks or Tesla), we see a considerable upside and a margin of safety in our underlying portfolio investments. As interest rates fall, we expect some of the trillions of dollars that have been earning attractive income from short-dated government bonds and money-market funds to flow back into riskier assets. Given the divergence in valuations while this capital has been on the sidelines, it would not surprise us to see it come into smaller-cap stocks, value plays and international equities.

Our central case for the year ahead is that GDP in the developed world will grow, albeit at a modest pace. The fixed-income bond market warrants careful monitoring, as rising yields on long-dated Treasuries could present the greatest threat to equity markets.

In late September, Chinese stocks surged when Beijing sent an unmistakable message it would prioritise economic and social stability over ideology. These announcements should be taken seriously. With some RMB 120 trillion (US$ 17 trillion) locked in household savings, a recovery in consumer confidence is essential if China’s economic fortunes are to turn. Hence, the PBOC released RMB 1 trillion (US$ 140 billion) of liquidity by cutting its Reserve Requirement Ratio by 50 bps, the short-term repo rate for banks by 20 bps, lowering mortgage rates, and injecting Tier-1 capital into the state banks to provide more liquidity for lending. While this does not quite constitute an open-ended commitment, it is clear the authorities have changed course.

We also have a positive view on copper, underpinned by a projected imbalance between demand and supply. The next few years will see new appetite from the adoption of electric vehicles, the electrification of industry, and related transmission and distribution power-grid investment. Meanwhile, supply will be constrained by mine disruptions, decreasing ore grades, and the impact that environmental considerations have on the timelines for bringing new mines onstream.

Concluding Thoughts

Many markets, however, stand close to all-time highs, buoyed by heavy concentration in a few AI-related mega cap names and we see better return potential and less risk outside of these areas. Although the uncertainty of the U.S. presidential election has passed, we should expect a degree of unpredictability in policy and personnel in the months and years ahead. This, alongside uncertainty about the effectiveness of monetary policy on slowing economies and troubling geopolitical developments, gives us plenty of concern as 2024 draws to a close.

. . . . . . . . . .

Nick Greenwood and Charlotte Cuthbertson, MIGO Opportunities Trust, 10 December 2024

Less than a week post period-end, Donald Trump secured a resounding victory in the US Presidential election. There was a rally in the stock market on the back of the result, but the effects of his policies will take time to digest. Tariffs and fiscal stimulus could hinder interest rate reductions, and we have already seen growing investor concern especially in regard to emerging markets, particularly Asia. We have already reduced our holding in VinaCapital Vietnam Opportunity Fund, which invests in private companies in Vietnam, as a result of these concerns.

In our full year results we talked about investment trusts coming out of a hostile environment. While that statement is still true, headwinds in the sector have not entirely dissipated. Rachel Reeves’ budget and Trump’s re-election in the US are likely to mean that interest rates stay higher for longer.

Investor focus remains on the “Magnificent 7” in the US and precious little else; it has not broadened as we had hoped. In the words of the Scottish poet Charles Mackay “Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, one by one.” It is too soon to judge whether the lofty valuations for these companies constitute a bubble, or if they will continue to grow at the rates demanded by the market. We are not looking to compete in this area. Instead, we are focusing on a market that has become wildly dislocated from fundamental value and where increasing corporate activity is a catalyst to extract that value and produce returns for shareholders.

. . . . . . . . . .

The Global Smaller Companies Trust, 17 December 2024

In the US, the economy was supported by a robust services sector. A resilient labour market underpinned consumer confidence, although signs of stress did emerge within the lower income cohort and this led to some earnings disappointments from consumer facing companies. Global manufacturing has been in the doldrums for almost two years now. Encouragingly though, recent data showed signs of stabilisation in the UK and China. Germany struggled, especially its auto sector because of sluggish demand in the face of lower subsidies for electric vehicles and increased competition from Chinese imports. Growth remained strong in India. In China, the malaise in the property sector spread to the consumer and this necessitated vast amounts of fiscal and monetary intervention by the authorities in order to lift sentiment.

Employment across most countries weakened a little but still remained healthy. With inflation coming down, central banks started to cut interest rates and bond yields fell initially, providing welcome relief to the more interest rate sensitive parts of the world economy such as housing. As the Federal Reserve grew confident that inflation was normalising it cut the US interest rate by 0.5% in September in order to maintain a healthy labour market. The pace at which interest rates were expected to change differed by region and this led to significant movements in currencies with the Japanese Yen and British Pound strengthening over the period and the Euro and US Dollar weakening.

Equity markets delivered strong returns over the six months, once again dominated by large caps, although small caps did show signs of life with strong outperformance in the month of July. Growth stocks led the market again as bond yields fell. Commodity markets were mixed with industrial metals weaker, oil volatile and gold up on the prospect of lower interest rates. The best performing sectors were technology, communication services and utilities. The laggards were energy, materials and consumer staples.

Corporate earnings were on the whole better than sell side analyst forecasts, however this outperformance often did not result in share price appreciation, indicating high expectations from investors. Equity market valuations of smaller companies expanded over the period, but not as much as their larger counterparts. Credit spreads of corporate bonds tightened to very narrow levels, particularly for the least credit worthy borrowers.

. . . . . . . . . .

James Harries, manager, STS Global Income & Growth, 4 December 2024

Given the material and rapid rise in interest rates globally the resilience of the US economy has been impressive. COVID distortions which, remarkably, are still working their way through the global economy, together with the fiscal policy response to that shock, may explain some of this persistent momentum. To us this means the effects of the change of the cost of capital may have been delayed but are unlikely to have been avoided entirely. Indeed, outside of the US, economies have been less buoyant, notably in Europe.

To this uncertain outlook must be added our observation that on many long-term measures the US equity market is very fully valued. This not only suggests that returns from the broader market may be constrained but that many of the high-quality global income franchises we would love to own in the trust currently remain too expensive in our judgement. Conversely the businesses we do own continue generally to be good value and will be resilient should the economic picture darken.

The recent US election result is potentially more impactful, although even here the Presidential 4-year term should be compared to our average holding period for an investment of over 10 years. The emphatic victory by President-Elect Trump has caused some short-term reaction in global markets. These have reflected an upbeat attitude in capital markets to the perceived benefits of a Trump administration, notably around deregulation. Hence, we have seen strength in areas of the equity market such as banking, technology, Bitcoin and European defence. The US Dollar has been strong, spreads tight and equity volatility has declined.

At the same time less favoured areas have struggled, most obviously renewable energy and non-US currencies, including Sterling, but most impactfully perhaps the US Treasury market. The yield on the US 2-year note has climbed from a recent low of 3.54% to 4.17%, similarly the US 10-year yield has moved from 3.64% to a recent high of 4.45% as the bond market correctly anticipated a Trump win and the likelihood of greater inflation. The enactment of unfunded tax cuts, stricter treatment of migrants and especially the imposition of tariffs will all contribute to this risk. When this is combined with a greater questioning of the independence of the US Federal Reserve, a more balanced view than is implied by recent excitement may be wise.

Much is uncertain as rhetoric may not predict policy outcomes. However, markets have been quick to price in the positive attributes of the Trump agenda while potentially ignoring the negatives.

. . . . . . . . . .

Sebastian Lyon, manager, Personal Assets, 4 December 2024

The summer saw the first cut to UK interest rates since March 2020, with the Bank of England cutting from 5.25% to 5.0% in July. The Federal Reserve followed in September with a 0.5% cut to 5.0% interest rates. Some market participants are cheering the fall in rates as the start of the next bull market cycle; history suggests they may be disappointed. The first cuts in the US rate cutting cycle occurred in January 2001, August 2007 and July 2019. On each of these occasions, the US stock market was trading close to its highs and subsequently fell -44%, -53% and -25% respectively. Our view is that central banks are cutting interest rates as they see early indicators of the economy slowing. While it is possible that this is a rare ‘soft-landing’ situation, where interest rates are cut without the economy entering a recession, experience suggests an economic downturn is the more likely outcome. In this context, it is concerning that valuations remain stretched with the market capitalisation of the US equity market at 205% of GDP, close to a 20-year high. The elevated starting valuations today suggest equity markets are likely to deliver poor returns for investors if a recession materialises or if interest rates are not cut as expected.

In the UK, investors have spent much of the last six months considering the potential impact of Labour’s first budget in 14 years. Markets were quick to digest the news once it arrived. UK gilts sold off aggressively (yields higher, with prices lower) with 10-year yields rising around +0.3% to 4.5%. Bond investors are likely questioning the impact on inflation in the UK, as two thirds of the additional spending announced is on current expenses as opposed to capital spending. Question marks also remain as to whether the gilt market can absorb an additional £32bn of debt issuance (bringing the total to ~£300bn this fiscal year, a record excluding Covid) as well as how much tax will actually be raised, since some of the increase in tax revenue relies on changes to capital gains where owners are generally not forced to sell assets. The yield differential between German and UK 10-year debt rose to above 2%, close to the highs seen after the Truss mini-budget two years ago. According to Louis XIV’s finance minister, Jean-Baptiste Colbert, “the art of taxation consists in so plucking the goose as to obtain the largest possible amount of feathers with the smallest amount of hissing”. Judging by the response to the rise in Employer’s National Insurance, the new government is reaching a point of resistance. The decision is likely to suppress the demand for labour in the UK, although the direct impact on the portfolio from the budget was limited, with the average company held deriving only ~3.5% of sales from the UK. We also do not own any UK bonds with a duration over three years. The volatility in domestic assets has strengthened our long-held preference for owning businesses with geographically diverse sales.

Gold continued to contribute strongly to returns, rising +15% in sterling over the last six months. More remarkable is that this return was achieved through a period of relatively high real yields, an environment that has typically been a headwind to the gold price. Western investors also appear to have been selling gold in recent years, with ETF holdings falling 226 tons since the start of 2023. The key buyers have been central banks. Since the freezing of Russia’s dollar assets in 2022, central banks around the world have acquired record amounts of gold. Large buyers include the central banks of India, Poland, China and Turkey. We expect central bank purchases to continue for several years, although in the short-term demand could be variable after gold’s very strong price rise. In order to manage this risk, we have reduced the holding.

In our view, the equity market fails to reflect the rise in the cost of capital in recent years or the risks from the economy slowing. We are keen to increase the allocation to equities when we feel prospective returns are good. It is essential to avoid being sucked into a long-running bull market at what may prove to be close to the top. The environment can change quickly and the Company holds substantial ‘dry powder’ that we expect to add to existing and new equity holdings when the opportunity arises.

. . . . . . . . . .

UK

W. Scott, chair, Worsley Investors, 11 December 2024

After storming ahead in the first five months of this year, before the Government called a surprise general election, U.K. stock market prices have largely tracked sideways, but nonetheless are up some 7.9% in 2024 and remain close to their all-time highs, as the positive impact of the commencement of well anticipated Western Central Bank interest rate cuts has been largely dissipated by economic uncertainty, which intensified as speculation built around the incoming Labour Government’s policy changes, the U.K. Budget and the November US presidential election.

This is consistent with the observation in the Annual Report that, although positive factors for U.K. earnings growth continued to build, those had to be weighed against the uncertainties around potential changes of government in the U.K., Europe and the US, heightened geopolitical risk and the carryover effect of the recession at the end of 2023. Indeed, employment related changes announced in the U.K. Budget will be a headwind for smaller U.K. companies until at least the end of the first half of calendar 2025.

The interim profit figures for British companies released in the period came in generally in line with previously diminished expectations, although there were 84 profit warnings in the September quarter, which is well up from 49 in the June quarter. Once more, a multitude of stocks with capitalisations below £150 million saw their prices drop substantially.

In the majority of cases these falls are the consequence of a pronounced deterioration in the outlook for the relevant sector, natural resources and technology most recently being the most prominent. However, a proportion of the prices of well-founded companies unsurprisingly suffer such consequences, and typically some become gravely mispriced and, as such, prospective portfolio contenders.

. . . . . . . . . .

Charles Montanaro, manager of Montanaro UK Smaller Companies, 5 December 2024

As we write these lines, the much-anticipated Budget announcement has come and gone. Despite a range of tax increases – including those on capital gains, National Insurance and Inheritance Tax on AIM – the changes were less severe than feared, and we believe smaller companies will adapt.

Many of these factors are arguably already reflected in current share prices. UK SmallCap valuations look attractive across multiple metrics and, at 15.6x, the Shiller P/E ratio points to the potential for strong returns in SmallCap over the next five years. Earnings expectations are also promising: while SmallCap lagged behind LargeCap in EPS growth in 2022 and 2023, it is projected to catch up in 2024 and move decisively ahead in 2025, with an anticipated 15% growth versus 7% for LargeCap (source: FactSet).

It feels as though the headwinds of the past three years are finally easing. Disinflation is taking hold, political uncertainties have subsided and M&A activity is picking up. SmallCap as a whole has outperformed LargeCap over the past six and twelve months, suggesting that the worst may indeed be behind us.

. . . . . . . . . .

Robbie Robertson, chairman, Lowland, 4 December 2024

A meaningful re-rating of the UK market, and smaller companies in particular, has not really happened.

We had hoped that a decisive UK election result would remove the uncertainty isnherent in a Conservative Government with a propensity to self-destruct but the new Labour Government seems pre-occupied with painting an Armageddon-like picture of the economy it inherited. Ours is a bottom-up approach to investing, but the economic landscape in which our companies are operating is disappointing given initial optimism after the UK election. The long build-up to the budget, and its eventual content, were not helpful, with many facing substantial cost increases as a result of the increase in the minimum wage and National Insurance costs. The prospects for inflation and interest rates are less benign than they had appeared. Confidence, optimism and economic growth have suffered, and the uncertainties implicit in the result of the US election have not helped.

Despite this backdrop, we believe good, well managed UK companies will continue to prosper. A revaluation of the UK market, and particularly a portfolio such as ours, may be further deferred, but should come in time with a material capital uplift when the fundamentals of UK equities are more widely appreciated.

. . . . . . . . . .

Chelverton UK Dividend Trust, 3 December 2024

The stock market for the last six months has felt like it has been “waiting”. Firstly, it was waiting for the general election, even though the outcome was entirely as expected, and then almost immediately it seemed like everything was on hold until the recent budget was announced. Since then, of course we have had the much talked about and debated US presidential election with its well documented potential impact on the UK and European economies.

The one common theme through all of this is that UK equities continue to remain relatively undervalued, and this undervalue is more pronounced in Small and Midcap companies, the area of the market the Company invests in. More recently, prior to the Budget, there was great concern that AIM shares would no longer enjoy Business Relief, being exempt from Inheritance Tax, and these experienced widespread declines in their share prices whilst shareholders voted with their feet. Consequently, we were able to buy some shares at much lower prices in fundamentally strong companies at what we believe will be seen to be low valuations.

During this reporting period inflation declined as sharply as it increased the previous year. This was entirely predictable, although seemingly something of a shock to the Bank of England, who still seem to be behind on cutting interest rates. Despite the continual “noise” about the desperate state of the UK economy the reality is inflation is on target, the UK Gross Domestic Product (‘GDP’) is growing, albeit it could be doing better, the bulk of people who can and want to work are working and following this recent budget there will be an injection of funding which will certainly provide a boost around the country. Real wages have been rising for most of this year and it is therefore expected that consumers will continue to increase spending.

The election of the Labour Government with an extraordinary majority from such a small share of the popular vote at least means there should, logically, be political stability for the next few years. The Labour Government have also clearly and oft said that they are going to do everything they can to grow the economy. It will be interesting to see how they propose to achieve this objective.

I said last year that our portfolio has and continues to experience an unprecedented level of share buy-backs by portfolio companies. This de-equitisation process, whilst rewarding for shareholders, will ultimately be damaging for the London Stock Market. The headlong rush by wealth managers to switch from UK equities to Global Funds has been part of the problem leading to the general decline in share values. When this trend reverses there will be a sharp upward correction in UK share prices.

Whilst we await the effects on economic growth of the measures delivered by the Budget, we believe that as we move into the new year and all of the elections are left behind there are prospects for growth in the UK economy, further modest interest cuts and a stable level of inflation. These market conditions are historically very good for UK equities and in particular the Small and MidCap sector.

. . . . . . . . . . .

The managers, Schroder British Opportunities, 29 November 2024

The aftermath of the UK election has brought greater economic certainty, with political resolution boosting business confidence in both the private and public markets. Additionally, prospective interest rate cuts by the Bank of England are expected to maintain a favourable financing environment, benefiting private businesses and small-cap performance by reducing borrowing costs and attracting growth-seeking investors.

In private equity markets, we continue to believe that strategies focused on identifying companies that exhibit strong underlying financial performance are poised to do well. This may be achieved by the expansion of product lines, geographic footprint and professionalising companies to improve profit margins, which is all easier to do in small and medium-sized companies, and typically harder to achieve in larger companies, which have often been through several rounds of private equity or institutional ownership.

Small and mid-cap exits in private equity have remained relatively stable when compared to 2019 levels. We expect to see the increased economic certainty to provide improved market conditions and a favourable backdrop for future exits.

The pipeline for attractive unquoted UK opportunities remains robust and we hope to see an increase in activity with these improved market conditions.

Domestically focused public equities have rallied since the UK election. Small and mid-caps are benefitting from policy clarity following the recent budget announcements and the partial retention of inheritance tax relief has especially benefited AIM listed companies. Indicators have reached their highest levels in over two years, suggesting a strong economic recovery.

UK small-cap companies, relying on domestic economic resilience, are poised for further re-rating as they historically deliver substantial gains following periods of underperforming the larger FTSE 100 companies. Additionally, UK small-caps are drawing takeover offers with premiums around 50%, showcasing their value.

. . . . . . . . . . .

Asia

Sir Richard Stagg, chairman, JPMorgan Asia Growth and Income, 12 December 2024

The global landscape is currently marked by significant unpredictability. A growing number of political leaders are moving away from the Bretton Woods consensus and the belief that free trade is a key driver of global economic growth. The President-elect of the United States has indicated plans to implement a series of tariffs on imports, with a particular emphasis on China. Meanwhile, the conflict in Ukraine persists and uncertainty in the Near East has been further exacerbated by recent events in Syria (however potentially welcome) , while recent developments in Korea caught markets unaware. Additionally, President Xi’s public declarations suggest a steadfast commitment to the reunification of China and Taiwan, by any means deemed necessary.

Nonetheless, I believe the prospects for Asian economies remain positive – more so when compared to the relatively lacklustre growth projections of developed markets. The Chinese government’s autumn stimulus packages suggest that it is becoming more serious about boosting consumer spending and supporting the still ailing property sector. If these measures are effective, they have the potential to provide fresh impetus to growth across the region. So too does monetary easing by Asian central banks, which appears imminent. The US Federal Reserve cut rates by more than expected in September, and further cuts can be expected this year and in 2025. This would open the way for Asian central banks to follow suit.

Elsewhere on the policy front, Korea’s corporate governance reforms, which are aimed at improving capital efficiency, are already lifting shareholder returns via increased dividends and share buybacks albeit the recent political turbulence there requires careful watching. The Chinese authorities have also increased their focus on shareholder returns. If Japan’s experience is any indication, the favourable ramifications of these reforms for shareholder returns will continue for years. Indeed, the early success of Korea’s reforms, and the Japanese market’s impressive, dividend driven rebound over the past year, are inspiring other Asian countries to focus on improving shareholder returns in their markets. Several other key structural and social changes will also continue to support Asian growth, and equity markets, over the longer term. These include the rapid development of artificial intelligence and the more general trend towards digitalisation, urbanisation, infrastructure development and the expansion of the middle class.

All these factors suggest that Asian markets remain extremely attractive in both absolute and relative terms. The Board shares the Portfolio Managers’ excitement about the many opportunities, this rapidly expanding region is generating to invest in innovative, often world-leading businesses.

. . . . . . . . . . .

Richard Sennitt and Abbas Barkhordar, managers, Schroder AsiaPacific, 2 December 2024

Although Asian markets lagged global equities through the end of last year and start of this year, over the last six months they have done better, producing strong absolute gains exceeding global market returns, despite several ongoing but well-known headwinds.

Amongst these, geopolitics has continued to be a concern in the region, with tensions around US-China relations, Taiwan, Ukraine and the Middle East all contributing to investor caution. Although regional elections (Taiwan, Korea, Indonesia and India) have all passed reasonably smoothly this year, the re-election of President Trump in the US election in early November 2024 is likely to result in considerable uncertainty in the trade and geopolitical background for the region in coming years.

President Trump’s policy proposals, on the face of it, appear quite inflationary (tariffs raising import prices, fiscal loosening) and could therefore end up with a ‘higher for longer’ interest rate outlook. This would likely be a tailwind for many Asian financial stocks, but a headwind for those countries with weaker external balances, including some of the ASEAN markets. Although stronger US growth is a positive for exports from Asia, any increase in tariffs could be an offset to that, particularly if the suggested 60% tariff on Chinese exports is implemented. This could ultimately end up benefiting other exporting countries across Asia who will become more competitive. Given this, China is likely to be more aggressive on domestic stimulus to try and counter any potential impact from weaker exports. Although there are clear differences between President Trump’s first term and now (particularly around the starting level of interest rates, as well as the geopolitical backdrop), it is worth remembering that under President Trump 1.0 similar stimulus measures were introduced together with increased tariffs and protectionist measures and, despite that, Asia performed well as a region, albeit after an initial wobble.

Within the region, the Chinese economy remains weak as consumer confidence is still extremely low, with this increasingly being reflected in poor retail sales and greater evidence of downtrading. This weak confidence in part reflects a weaker job market together with falling property prices. All this has meant the consumer has become more risk averse which has resulted in a meaningful increase in savings versus consumption.

With China’s domestic and external sectors both facing uncertainty, we have been cautious in adding to our exposure to the market, despite the emergence of seemingly better value in a number of stocks there during the period. Consensus expectations had clearly been lowered versus a year ago (at least until the recent optimism about stimulus), and valuations had become more attractive, but several companies which disappointed on earnings still sold-off sharply, suggesting not all the weakness had yet been discounted.

The key domestic overhang remains the property market, where activity and prices are yet to recover from earlier significant falls. Although the government has made some announcements to try to put a floor under the property market, in reality the fiscal sums backing these interventions are (so far) very small compared to the scale of the problem, and unlikely to make more than a marginal difference. Given this, and the structural challenges facing stock-pickers in China (poor capital allocation, structurally lower nominal growth, unpredictable regulatory and policy shifts, high debt levels), we remain significantly underweight the market, albeit less so than where we were 12 months ago.

It is noteworthy that the most recently announced stimulus measures, at the time of writing, appear more substantive and coordinated and have provoked a meaningful rally in the stock market. Whilst we also view the stimulus as positive, in our view, the rally has already started to discount further easing and, therefore, whatever is eventually announced risks disappointing investors’ expectations.

Aside from the size of any further spending, it is also how it is allocated that is key, with a need, in our view, to have more of a focus on the demand side of the economy if the consumer is to get out of its malaise, rather than continuing to drive up capital investment.

The Hong Kong market continues to suffer not only from the spillover impacts of a weak China, but also the high level of interest rates, which are inappropriate for the weak domestic economy. Whilst we have reduced our overweight to real estate held via the Hong Kong market, we have also taken advantage of weak stock prices to add to other areas, such as non-bank financials. US interest rates have now started to be cut, which should help to ease monetary conditions in Hong Kong and be supportive for the economy and market, although the pace of such cuts is more uncertain in the wake of the US election results.

India remains a bright spot in the region in terms of growth and optimism among investors, but this has been increasingly reflected in share prices, with the market now looking outright expensive on most metrics.

In the South-East Asian region, we are most exposed to Singapore, which is benefitting from its increasing status as a regional wealth management hub, as well as the growth of its ASEAN neighbours. We have also increased direct exposure to some of the smaller ASEAN markets, such as Thailand and the Philippines.

From a sector perspective, we remain overweight IT, given our positive view on the structural growth drivers behind global demand for technology, particularly advanced semiconductors. Valuations have moved higher on cyclical improvements as well as the surge in demand for AI-related hardware. However, we remain comfortable with the valuations of what we hold in the portfolio, at present but are mindful we do not want to overstay our welcome here.

We also remain overweight to financials – a diverse sector spanning not only banks, but also insurers and exchange companies. The banks we own are generally well-capitalised with strong deposit franchises. Many of our holdings are in the more mature markets, such as Singapore, which in general trade at attractive valuations and decent dividend yields, but we also have exposure to their faster growing hinterland. Direct exposure to faster growing markets, where credit penetration is relatively low, includes ASEAN markets and India. Should interest rates continue to come down from recent levels, there may be some concern over the impact that this could have on bank margins. Though any further cuts are expected to have an impact on margins, this may also, in part, be offset by lower credit costs, potentially higher loan growth and an increase in wealth management revenues.

Historically, a weaker US dollar has been positive for Asia, rather than interest rate cuts per se, although the latter are clearly supportive of greater liquidity.

The other historically positive driver of Asian markets is the export cycle, as this tends to be correlated with underlying earnings per share growth and here we believe there has been an improvement. Inventory excesses from the post-Covid period have been run down and many industries have become more disciplined around production and supply additions. This has seen exports recover for many Asian countries and we believe a soft landing in the US would be supportive of that trend continuing, albeit at a slower rate. Here, we believe cuts in interest rates are key to avoid a sharper slowdown in US demand. Potentially higher tariffs and other barriers to trade under the incoming US administration could derail the export recovery, however, with winners and losers hard to predict at this early stage.

We believe aggregate valuations for the region are no longer particularly cheap and are now trading at slightly above long-term averages. However, this masks a large variation across individual markets where Singapore, Hong Kong, Korea, Indonesia and the Philippines, look relatively cheap versus history, whilst India and Taiwan look relatively expensive. Following its rally, China is no longer at the lower end of its valuation range having moved into the middle of its historic range.

In the short-term at least, shifting views on the likely policies of the incoming Trump administration and ongoing announcements around Chinese stimulus are likely to lead to heightened volatility in regional markets. While the outlook for interest rates is more uncertain following the US election, should they continue to fall, and the US dollar weaken, that could be a potentially positive catalyst for Asian markets, if history is any guide to go by. The outlook for exports has also been complicated by the likely policy changes to come under the incoming US administration. Stimulative policy leading to higher growth is likely to increase the demand for imported goods, but tariffs (particularly on China) could offset this to an extent. It is unlikely, however, that manufacturing of most goods currently being exported from China would shift onshore to the US – rather, other Asian countries are likely to be the main beneficiaries of any supply chain re-alignment.

. . . . . . . . . . .

Europe

Jon Ingram, Jack Featherby and Jules Bloch, JPMorgan European Discovery Trust, 12 December 2024

When considering the outlook for European financial markets, one uncomfortable reality is that political uncertainty is escalating, especially given the perceived binary nature of many national elections occurring around the region and world. However, we cannot second guess the impact of political events on financial markets. The Company’s investment strategy remains focused instead on identifying Europe’s ‘hidden gems’ – great companies with strong fundamentals that have escaped the attention of most investors.

Macroeconomic developments over the review period have been decisively positive. Looking across the asset class, we expect the easing of monetary headwinds and improving economic growth indicators to be favourable for economically geared smaller companies.

In addition, after a period of subdued deal flow, lower interest rates in concert with attractive valuations, are likely to catalyse an uptick in M&A within the European smaller companies space. We believe this should benefit both the asset class and the Company. Private equity investors and other participants in M&A activity tend to seek out the same kind of overlooked businesses that we seek, and we expect some of our portfolio holdings to be targeted by these investors.

We continue to hold a strong conviction that many of the companies that will be most successful in harnessing the AI revolution, pharmaceutical advancements, and other emerging structural trends, are likely to originate from the smaller companies space within Europe. Many of these future leaders are yet to be identified (or even conceived), but we are always on the lookout.

We anticipate that the combination of attractive valuations, supportive macroeconomic conditions, and long-term thematic drivers will serve as significant catalysts for European smaller companies. This sector of the market has outperformed most other major public asset classes globally over the past two decades, and after a protracted period of underperformance, these stocks are overdue for a resurgence. As we said in our last report, the outlook has rarely been brighter.

. . . . . . . . . . .

Montanaro European Smaller Companies Trust, 12 December 2024

We have previously commented on the outperformance of large companies versus their smaller counterparts in the last few years. This contrasts with the longer-term historical trend – termed the “SmallCap Effect” by academics – whereby smaller companies delivered higher returns than large ones (the excess return averaged 4.2% per annum in Continental Europe since December 2000). It is too early to say whether the recent underperformance of smaller companies has ended, but the headwind has certainly abated: in the six-month period to 30 September 2024, smaller companies in Europe outperformed their larger counterparts by 2%.

Perhaps we should not be surprised. Confirmation that inflation is back to a “normal” level has allowed the European Central Bank to start cutting interest rates once again, which is typically positive for smaller companies. In addition, as we have highlighted before, the valuation of smaller companies on the Continent looks cheap compared to its own history: at 12.3x, the forward P/E ratio is more than one standard deviation below its long-term average and at a record discount (13%) to the forward P/E of the broad European market. The backdrop of disinflation coupled with attractive valuations is in turn boosting M&A activity in the smaller companies space.

Not everything is rosy, however. The economies within Europe remain shaky and it is clear from speaking to companies that Germany in particular is grappling with a significant cyclical downturn, partly fuelled by the challenges faced by China, one of its key export markets.

. . . . . . . . . . .

Tom O’Hara and Jamie Ross, managers, Henderson European Trust, 11 December 2024

A more selective consumer

As a rule, stocks tend to matter more than sectors in our investment process. Nonetheless, at times events outside of our control can necessitate taking a top-down view. Over the last year, the travails of the consumer have been one such event.

The effects of inflation, following Covid and the Ukraine war, have continued to impact both consumer and corporate behaviour.

The impact on pricing, though, has varied widely within the consumer space. This variation has framed our perspective on consumer companies. We have chosen to specifically focus on ‘cumulative pricing’ since pre-Covid, as a metric through which we can usefully analyse how aggressive companies have been with pricing and the tolerance of consumers to accept these price hikes.

We have observed luxury goods companies pushing through significant price increases, of up to 40-60% for core product lines. Yet, roughly-speaking, economy-wide inflation – measured by CPI and wage growth – was closer to 15%. Consumers have demonstrably been squeezed, and they know it.

China’s economic challenges

Chinese companies and consumers have been a notable source of revenues for European businesses over the last decade and a half. With that in mind, a series of speedbumps in the road of Chinese growth has caused some concern for investors. This has been most evident in the failure of ‘cyclical’ stock prices to recover even as interest rates began to fall (historically, cyclical stocks – those most sensitive to economic growth – have seen their fortunes move in lockstep with rates).

At the same time, the Chinese government has made concerted efforts to establish a presence in premium export markets – notably electric vehicles, solar panels and wind turbines. These efforts have had the explicit goal of counteracting the slowdown in growth driven by a faltering consumer market. The prospect of further protectionism from Europe and the US therefore prompted a direct response from the Chinese authorities in the form of late September’s stimulus package.

How do we navigate such a critical theme for the global economy? We have generally avoided European automakers as the structural challenges from an efficient, competitive Chinese auto-complex look genuine. We reduced our luxury goods exposure, where so much growth in recent years has depended on Chinese wealth-creation.

As for China, we expect it to be a key determinant of market behaviour in 2025. We lean towards an improvement in sentiment, which should benefit those cyclical companies we own across industrials and materials, some of which have been the biggest laggards in the 2024 financial year due to their direct or indirect exposure to the country. We note some encouraging datapoints suggesting there may be sizeable stimulus ammunition already in the pipeline. Watch this space.

A changeable interest rate cycle

The catalyst for the summer turmoil in markets, or the ‘rotation’ to use the market vernacular, started with the US Federal Reserve more overtly indicating that interest rates could soon start coming down. Lower interest rates tend to be taken as good news for markets, increasing risk appetite.

It is reckless to chase short-term momentum in the markets, especially when so much of it is driven by short-term speculation, but we were certainly cognisant of the potential for lower interest rates to fundamentally improve the outlook for certain business models: those in which the cost of debt is a key determinant of profitability and equity value.

There is rampant speculation on the impact on the US interest rate cycle of the recent re-election of Donald Trump as US president. We believe that his sparse policy programme during campaigning provides limited evidence on which to base assumptions. Instead, we will be watching, along with the world, to see what emerges as his policy agenda in the early days of his presidency.

How today’s market structure informs our thinking

Fundamental active investors now account for only 10-20% of daily traded volumes in the European equity market. As such, we are minority participants in a market which is dominated by passive funds and hedge funds with very short-term strategies. Neither of these are equipped to take the long-term view, to take the other side of the trade when panic sets in. The result is outsized reactions to economic, market or company news that are not reflective of long-term prospects or value. Conversely though, that means there is opportunity for those of us with the ability – the luxury – to express a long-term view.

Outlook

We believe that we are seeing the conditions for a catchup in those underperforming cyclical areas of the equity market thanks to: 1) China’s recent efforts to stabilise its economy, 2) lower interest rates filtering through the global economy, and 3) encouraging datapoints suggesting ongoing vigour in the US economy. There is much geopolitical uncertainty across the globe, but, sombre as it may sound, that has been a constant in recent years and one that has, thus far, not constrained strong equity market performance.

Finally, a word on our home continent, which is suffering an identity crisis of sorts relating to its role in the world, its poor demographics, its high public debt levels and its lagging economic growth. While you may have expected us to dwell in this commentary on the state of the European political landscape at a time of great uncertainty, the impact of this is relatively limited [for] global operators that happen to be listed in Europe. The most pertinent factor is the geographies from which they draw revenues.

. . . . . . . . . . .

Japan

Nicholas Weindling and Miyako Urabe, managers, JPMorgan Japanese, 13 December 2024

The transformation underway in Japan has, in our view, only just begun. The gains to be realised from corporate governance reforms and other structural changes will be much more significant than those we have seen to date. The most important positive influence on the outlook for Japanese equities remains the ongoing reform of the corporate sector. With the encouragement of the government, regulators and shareholders, Japanese companies are adopting ever higher standards of independence and transparency and implementing best practices in their capital allocation decisions. Shareholder returns are increasing due to the resultant share buybacks and higher dividends, and we expect dividend payout ratios to continue to rise. These developments have the potential to lift the whole market to a higher valuation.

But there are several other reasons to be positive about the outlook for Japanese equities. For one, Japan is at a very early stage in the digitisation process compared to the rest of the world, and this, combined with the trend towards industrial automation, has the potential to help drive significant growth and/or productivity gains over the medium term. Deglobalisation, the transition to renewable energy and developments in medical technology are also contributing to rapid structural change – an ideal environment for the dynamic, quality businesses we want to own.

Japan’s labour market is also changing. Increasing wages is one indicator of the extremely tight conditions in this market, and the supply of labour is set to contract further as the country’s aging workforce retires. However, this situation has one major potential upside. Traditionally, Japan’s labour market has been characterised by a rigid mentality. But there are now signs that the high demand for labour is making workers bolder in their employment choices, with many more inclined to change jobs in pursuit of higher income. If this trend gains further traction, the resulting improvement in labour market flexibility should have a favourable effect on overall productivity and the long-term future of Japan’s corporate sector.

Increased demand from foreign investors also looks set to provide further support for the market. Many global investors are underweight Japanese equities. However, they are beginning to recognise the opportunities on offer in this market, especially since valuations, while not cheap, are still relatively attractive. At the end of September 2024, the market was priced at 14x earnings on a forward price to earnings basis and at 1.5x book value (in trailing price to book terms). With inflation now positive, and an enhanced Nippon Investment Savings Account (NISA) providing a greater incentive to invest, there are also signs that domestic retail investors are taking more interest in their home market.

Now that the BoJ has begun to raise rates, the yen has risen slightly from its mid-year lows of around 160 yen to the US dollar, and 200 yen to the pound. While the yen is still undoubtedly weak on an historical basis, and therefore potentially attractive, the recent victory by Donald Trump in the US election may yet cause the US dollar to strengthen further, as tariffs on imports may mean US inflation is higher and interest rates remain relatively elevated.

So, even though the Japanese market has had a very strong run over the past 18 months, this combination of corporate governance reforms, structural transformation and appealing valuations should help sustain and encourage investors’ appetite for Japan stocks. It will also generate many exciting investment opportunities, regardless of the economic backdrop.

In summary, there are many good reasons for our optimism regarding the Japanese market.

. . . . . . . . . . .

Global emerging markets

Martin Shenfield, chair, Ashoka Whiteoak Emerging Markets Trust, 12 December 2024

The global economic backdrop, notably in the US, is a broadly constructive one for EMs. Whilst the international geo-political environment remains challenging, the tilt towards a more accommodative monetary policy and cutting interest rates by the Federal Reserve together with the recently announced new stimulus measures in China are likely to support both underlying economic growth as well as improved sentiments for EMs.

Any potential slowdown in US economic growth is always a risk, but currently US economic resilience continues to surprise positively and, even if there is a temporary deceleration, growth may well subsequently reaccelerate. Nevertheless, individual EM economieswould be differently impacted by any changes in US growth or policies, with for example Mexico remaining highly integrated with US supply chains and India in contrast much less sensitive to US macroeconomic and market developments. This in turn allows the Investment Manager to construct a fully diversified portfolio to mitigate risk. Portfolio flows to the EM asset class could now recover, driven by spillovers from improved sentiment towards Chinese capital markets. However, the major uncertainty and risk revolves around the aftermath of the US election, together with the threat of more punitive tariffs.

In the largest EM economy, China, policymakers have recently introduced significant new policy measures to counteract the massive overhang of the property market excesses and associated bad debts. These potentially signal a positive change of direction which could support at least a tradeable equity rally if not a fully-fledged bull market given that, in a departure from previous policy, specifically targeted measures to support the equity market were promulgated. Although the size of the stimulus package is still small relative to previous crisis responses in 2008/2009 and 2015, further fiscal measures are anticipated via a combination of infrastructure spending, consumer demand initiatives and bank recapitalisations. It is not yet clear if finally we are to see the long-awaited significant fiscal stimulus from the government to restore animal spirits and re-engage the private sector’s propensity to consume and invest, but investors may well give policymakers the benefit of the doubt for now. A sustained pick-up in local government bond yields will be one of the best indicators as to whether local equity market sentiment has genuinely changed for the better. President Trump’s re-election may however raise the risks of a significant ramping up of tariffs and an inadvertent trade war.

. . . . . . . . . .

Barings Emerging EMEA Opportunities, 9 December 2024

Poland held elections that resulted in a clean break from eight years of populist rule under the Law and Justice party (PiS), in favour of the Civic Platform party led by Donald Tusk at the core of a new governing coalition. This pro-Europe shift has thawed tensions between Poland and the European Union, which in turn has permitted the release of substantial funding from the bloc’s post-pandemic recovery fund. Market valuations of the country’s financial sector companies have been a notable beneficiary of the resulting improvement in business confidence.

Elsewhere in Emerging Europe, Greece was at one time perceived to be economically and fiscally dysfunctional, but the country’s debt bailout and subsequent investment by the EU have born fruit in revived economic vibrancy. This has resulted in international credit rating agencies returning Greek government bonds to investment-grade status, rewarding the business-friendly and fiscally responsible government led by Prime Minister Kyriakos Mitsotakis, which has won a strong mandate from the Greek electorate.

Another country in our region that saw a remarkable change in fortunes was South Africa, which generated a return of more than 20% (in GBP terms) in the final six months of the financial year. This positive development revolved around what has been a significant election for South Africa, ending the near 30-year uninterrupted sole rule of the African National Congress (ANC) party. By forcing the ANC to seek coalition partners to govern, this election result has led to the formation of a Government of National Unity (GNU), comprising the ANC and the centrist Democratic Alliance party. This has sparked hopes of growth-friendly structural reforms and prudent macroeconomic policies.

In Turkey and the Middle East, equity markets ended the year flat or marginally weaker, with returns to international investors dented by weaker currencies – stemming from the dollar pegs in Gulf countries (which are also exposed to geopolitical tensions) and persistent high inflation in Turkey.

. . . . . . . . . .

Templeton Emerging Markets, 9 December 2024

In the last Annual Report, we wrote that it is an interesting time to look at EMs. We believed that despite the volatility experienced in the recent quarters, the investment backdrop still remained conducive on the grounds of potential interest-rate cuts and better earnings growth.

As we head into the final quarter of 2024, we retain that optimism. We have emerged from a volatile period in which worries about economic recession dominated investor sentiment. We have also seen a change in the investment environment, where, although structural growth themes remain, we have had to make tweaks to the portfolio to potentially capture what we deem to be the best opportunities in the market. An example would be the Electric Vehicle (‘EV’) segment. While we remain aligned with the longer-term growth outlook for EVs, we have lowered our exposure to the EV supply chain as many consumers and governments have yet to fully embrace the advantages of EV deployment.

Tailwinds within EMs remain; interest-rate cuts, strong demand for semiconductors due to AI applications, and what we consider reasonable valuations in most EMs. These may negate some key risks such as geopolitical tensions, a meaningful economic slowdown in the United States and continued weakness in China’s demand.

Interest-rate cuts, in our view, are catalysts for growth, supporting both consumption and corporate earnings. Brazil’s central bank raised its key interest rate in September, in contrast with the policy decisions of other countries’ central banks; however, we believe that it will eventually follow the global trajectory. While Mexico’s judicial reforms have affected investor sentiment recently, in our view corporate earnings should remain intact.

Sustained demand growth from AI applications, in our assessment, should be beneficial for South Korea and Taiwan, which are home to several large semiconductor companies. While this is potentially beneficial for the earnings growth of these corporations, we believe that this growth opportunity has not been reflected in the valuations of some of the beneficiary companies. Conversely, while India has continued to see good economic growth and remains a bright spot, equity valuations remain a key concern for us. Although end demand in China could remain weak for a longer period, a low starting point could potentially prove helpful for earnings growth in 2025. China’s equity market rallied in the last few weeks of the quarter, supported by stimulus measures announced by the government. However, the weaker economic growth outlook in China has led to our selective approach; our key holdings in China are in internet companies that have given us comfort with their cash flows and improving shareholder returns.

. . . . . . . . . .

Sam Vecht, Emily Fletcher, and Sudaif Niaz, managers, BlackRock Frontiers, 4 December 2024

From the road

Over the past 12 months, our team has travelled extensively across emerging and frontier markets. Travel helps us form differentiated insights, where we look to understand the entire ecosystem around companies and countries. We speak to customers, competitors, suppliers, trade unions, journalists, students, professors, as well as diplomatic and political entities and individuals to form a comprehensive view of the top-down and the bottom-up.

These travels often take us away from the well-trodden investment path to places such as Guyana, Peru, Egypt, Kenya and Nigeria. We have also visited countries such as Bangladesh, Malaysia, Indonesia, Philippines and Thailand in Asia as well as Kazakhstan, Georgia and Saudia Arabia during the past 12 months.

Indonesia has seen a smooth transition to a new government under President Prabowo who has retained some seasoned cabinet members from President Jokowi’s administration, most notably Minister of Finance, Sri Mulyani. This has allayed some market speculation regarding some of the larger expenditure plans of the new administration and it also ensures continuity for in-progress reform within the state-owned-enterprises. Meanwhile, the external accounts of the country remain healthy with a small current account deficit that should be funded with foreign direct investment. The consumer sector has suffered from some of the uncertainty from the election process as well as higher interest rates. While concerns from the former are now reduced, the latter is still impacted by movements in global interest rates post the US presidential election. This has impacted liquidity conditions in the banking sector in the country and we are monitoring this closely. In the background, the Indonesian stock market remains relatively inexpensive given the country’s prospect of sustainable high single digit nominal growth and we are cautiously optimistic for the new year.

Saudi Arabia continues to undergo a significant social and labour force transformation. Both of these should enable greater productivity and support economic growth in the kingdom over the long-term. In the current energy pricing regime, the balance of payments for the country looks manageable, however, the fiscal account look stretched. For the recently announced 2025 budget, the break-even oil price (at current run-rate of production and export) is estimated at approximately US$90/bl, well above the current price of circa. US$70/bl. In addition, the liquidity in the domestic banking system is constrained with elevated loan-deposit ratios. Therefore, we expect the government to rationalize its expenditure plans. In particular, we expect some of the large ticket megaprojects to be revisited and reprioritized. The initial indications from the Ministry of Finance confirm the same. Therefore, we are cautious on the economic outlook for the kingdom for next year and expect more muted markets as the local economy softens.

Guyana’s GDP has grown by approximately 300% over the last four years, driven by its substantial oil reserves. There, we met with a range of stakeholders, including US diplomats, to better understand the investment opportunities on the ground in this fast-growing economy. Our goal is to be at the forefront and act as first movers when significant opportunities arise, for which our travels serve as a key tool. Peru is a country where we have been running an underweight position for most of this year, due to political and economic uncertainty on the ground. Our visit there reinforced our view of the challenging political landscape where both the congress and the president have record low approval ratings. Despite this, the economy is relatively stable, with inflation at 2.4% and the best trade balance in a decade. It is also a country that is benefitting from increased geopolitical fragmentation, exemplified by COSCO Shipping Lines’, the Chinese state-owned conglomerate, US$3.5 billion investment in the Chancay port in Peru.

The team visited Malaysia in July 2024, and this is yet another example of a market benefitting from increased geopolitical fragmentation, as well as the spill-over for power demand from Singapore. We saw evidence of re-shoring across various sectors, particularly in parts of the semi-conductor supply chain as both Chinese and US companies take advantage of the existing ecosystem in Malaysia and the availability of affordable land, power capacity and skilled labour.

We visited Thailand recently which was timely given the shift in the political backdrop there. The election of Paetongtarn Shinawatra as Thailand’s prime minister represents a return of her family’s political dynasty following the previous ousting of her father (Thaksin Shinawatra) and aunt (Yingluck Shinawatra). Given some political stability with the Move Forward party sidelined, there have been announcements of stimulus (handouts) to offset weak tourism revenues, high leverage at households, and persistent asset quality problems in the banking sector. While such fiscal measures by the government may offer short-term respite, we maintain our view that the country remains in a tough spot structurally.

Outlook

As higher global interest rates continue to feed through into the real economy, we expect some moderation of demand in developed markets. The commencement of the Fed’s easing cycle should be a net positive for emerging market assets, particularly amid reassurance that the September 50 basis points rate cut was to preemptively manage slowing growth and labour dynamics in the US. We continue to see improving activity levels in some frontier and smaller emerging markets. With inflation falling across many countries within our universe, rate cuts have started to materialise. This is a good set up for domestically oriented economies to see a cyclical pick up.

We have initiated small positions in a number of countries where we have not been invested for some time, including Bangladesh, Egypt, Kenya and Pakistan. With a combination of COVID-19, inflation and high global interest rates, the past few years have been difficult for smaller countries that are reliant on borrowing externally to fund their growth. However, we believe that these countries, having been through a recession already, unlike the West, are now likely at the point where they start to see economic growth pick up.

Given this backdrop, we remain positive on the outlook for smaller emerging and frontier markets relative to developed markets and believe that the commencement of the Fed’s easing cycle will allow for central banks within our universe to continue easing, which should be supportive of domestic activity levels. We find significant value in currencies and equity markets across our investment opportunity set, and we are particularly excited about the many opportunities we are seeing in some of the smaller markets. Our investment universe, in absolute and relative terms, also remains under-researched and we believe this should present compelling alpha opportunities.

. . . . . . . . . . .

China

Alexandra Macksey, chairman, JPMorgan China Growth and Income, 9 December 2024

The Board has recently returned from a visit to China. In addition to spending time with the locally-based Portfolio Managers and supporting analysts, the Board visited a wide range of companies and met with industry experts and business leaders in Hong Kong, Shenzhen and Shanghai. It was evident that, while many challenges remain, the major government economic initiatives announced in September and November have improved sentiment within China, with companies describing themselves as ‘cautiously optimistic’ about future prospects. As our Portfolio Managers highlighted in last year’s Annual Report, many companies have introduced regular dividend payouts and share buyback programmes designed to benefit shareholders. Amidst continued consolidation in the industrial sector, world-class companies are emerging, and many market-leading companies have expanded production overseas, both as a means of expanding into new markets to drive future growth, but also to give themselves a degree of protection from potentially punitive US tariffs.

Since the Company’s listing in 1993, the Portfolio Managers have often had to navigate testing market conditions. They may have to draw on these skills again in 2025. While our Managers welcome the recent significant government economic initiatives, concerns about economic growth, domestic consumption, unemployment, and the robustness of the Chinese property and financial markets are likely to remain and may again impact market sentiment. That said, central and local governments are widely expected to announce further initiatives to tackle the structural impediments to economic growth, news that will be welcomed by domestic investors. An escalation in anti-Chinese rhetoric following the election of US President-Elect Trump cannot be ruled out, particularly given President-Elect Trump’s pre-election comments about tariffs on Chinese imports.

The Board shares the Portfolio Managers’ optimism about the long-term prospects for the Chinese stock markets and the opportunities that will benefit the patient investor.

. . . . . . . . . . .

Dale Nicholls, Fidelity China Special Situations, 6 December 2024

Despite the rally in Chinese equities following the stimulus measures announced in late September, sentiment towards the market remains quite mixed. This has been evident in the early days of the second half of our financial year, with something of a retrenchment as investors await further details of the scale and deployment of some of the stimulus programmes. That said, there are signs of confidence growing among domestic investors who recognise the fundamental change in the level of commitment by the government to tackling economic challenges.

The widely anticipated China National People’s Congress (NPC) Standing Committee meeting on 8 November approved another series of stimulus measures, though their scale and detail may have fallen short of lofty market expectations. Key policies included raising the ceiling for local government special bonds and targets to reduce local government implicit debt by 2029. But the forward-looking signals from the Finance Minister were encouraging, particularly the emphasis on more proactive fiscal policy planning for 2025, suggesting a path of further easing. I anticipate more concrete actions in upcoming policy meetings, which will be important in addressing China’s domestic demand challenges. While the earnings outlook for China in aggregate is not weak in a global context, and we see improvement in areas like technology, until very recently the general trend of earnings revisions has been downward. The hope is that supportive policies can help drive a turn in economic fundamentals, leading to an improved earnings outlook. Such a virtuous circle would almost certainly drive a sustained improvement in market sentiment and further re-rating. Meanwhile, the announcements in late September have only moved the valuation needle in Chinese equities from ‘historically cheap’ to ‘still pretty cheap’ versus other global markets, and I believe there is still ample room for valuation multiples to expand further.

Of course, geopolitical worries persist, especially around US tariffs on Chinese goods, which are likely to increase following the US Presidential election. However, investors and companies are well aware of this prospect.

Chinese companies have been dealing with tariffs and import barriers for some time now. In fact, some of the export-focused companies we see on the ground have remained extremely competitive and have been taking pre-emptive actions for years, with many of them moving production offshore. The Company is already focused on companies that generate the vast majority of their revenues domestically, but I continue to pay close attention to the different scenarios and assess how these risks are reflected in valuations.

With so much focus on the macro considerations, it can be easy for investors to forget that what really drives superior returns are great companies executing well in growing industries where they have strong competitive advantages. While the headwinds – and indeed the tailwinds, given the impact of the recent stimulus measures on the stock market – are well recognised, your Company remains focused on finding opportunities amidst the volatility where fundamental value and value-creation should be recognised by the market over the medium-term.

. . . . . . . . . . .

India/Indian subcontinent

Amit Mehta, Sandip Potodia, managers, JPMorgan Indian, 12 December 2024

Can Indian markets continue to deliver?

Given the phenomenal run the Indian equity market has seen over the last decade, and more significantly, in the last couple of years, it is unsurprising to see commentary questioning the sustainability of the on-going rally, and the underlying factors that may support it going forward.

We think these are important questions, and we suspect many of our readers share this view. However, we remain confident that the long-term pillars that have allowed Indian companies to deliver superior operating performance and therefore attractive investment returns to equity investors remain firmly in place. Having said that, due to a variety of cyclical reasons (more on this later), there could be some challenges in the near-term. Any potential correction in the near-term we believe is an opportunity for longer-term investors to get/increase exposure to the structurally attractive Indian market.

Short-term cyclical challenges

The near-term challenges that India faces can be broken down into the 3 Es:

- Economic – We do not see a material risk to the Indian economy being able to grow around 6%+. It has been growing above trend post-Covid, and growth may slow towards trend, but that would still put India well ahead of any other large economy globally. However, some of the challenges the economy faces stem from a higher rate of inflation, which has kept the central bank from reducing interest rates. We maintain our long-held view that the central bank remains prudent and is in no hurry to start a rate-cutting cycle, especially as the Indian economy does not require stimulus. Inflation is not a new phenomenon, but it is something to keep an eye on, particularly if there are further knock-on effects from geopolitical events. In addition, there has been a notable slowdown in government capital expenditure (capex), which we believe is just a hangover from the general elections, but if this slowdown persists, it will represent a further challenge to near term growth.

- Elections – While this year’s national elections are behind us, important state elections lie ahead, and these can spark some market volatility. The state elections, particularly in the state of Maharashtra, will be a signal of whether the current ruling party BJP has lost sheen amongst voters and whether it will shift towards populist measures to shore up support in the future.

- Earnings – As we write, the earning season has disappointed market expectations which were elevated. We raise this issue in this section on short-term challenges, as we believe that earnings disappointments are just that – short-term. Once the post-election lull abates, we expect to see a resumption of strong earnings growth, although we will continue to monitor the situation.

Connected to this is the topic of valuations on which we engage significantly with internal colleagues and external observers and commentators. As with any purchase, price has to be considered alongside the quality you get in return. Equity markets are the same. That said, we do think there are certain pockets of the market where market valuations have become disconnected from the fundamentals of the business. In these areas, we would certainly advise caution, particularly in the small and mid-cap areas of the market.

Longer term opportunity remains intact