Caution wins out in the end

After another challenging six months since our last note, with initially unscathed Asia finally being hit hard by COVID-19, Aberdeen New Dawn (ABD) has maintained its strong performance, showing it can still be resilient in falling markets.

However, the manager says the numbers also reflect ABD’s long-standing caution over China, which experienced one of its worst market sell-offs for some time this year. A greater state interference in key sectors has raised questions about the country’s regulatory environment and even spooked some investors.

ABD continues to focus only on those Chinese companies that its manager believes can adapt to the changing environment, and its exposure to the country remains lower than its MSCI AC Asia Pacific ex Japan Index performance benchmark.

Capital growth from Asia Pacific ex Japan

ABD aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. The trust holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies. ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms).

At a glance

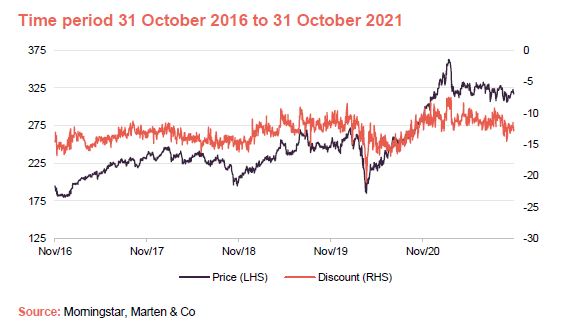

Share price and discount

Over the 12 months to 31 October 2021, ABD has traded within a discount range of between 7.5% and 14.5%, with a one-year average of 11.1%.

As at 1 November 2021, ABD is trading at a discount of 12.85%. This is wider than that of the Asia Pacific sector, which is trading at an average discount of 6.23%.

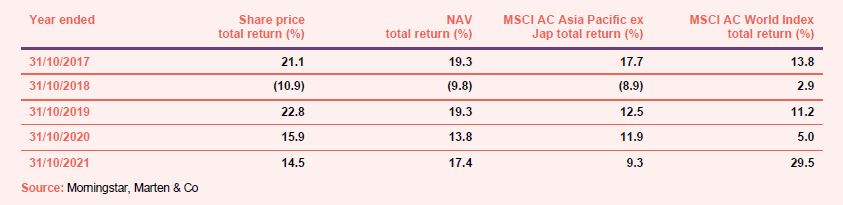

Performance over five years

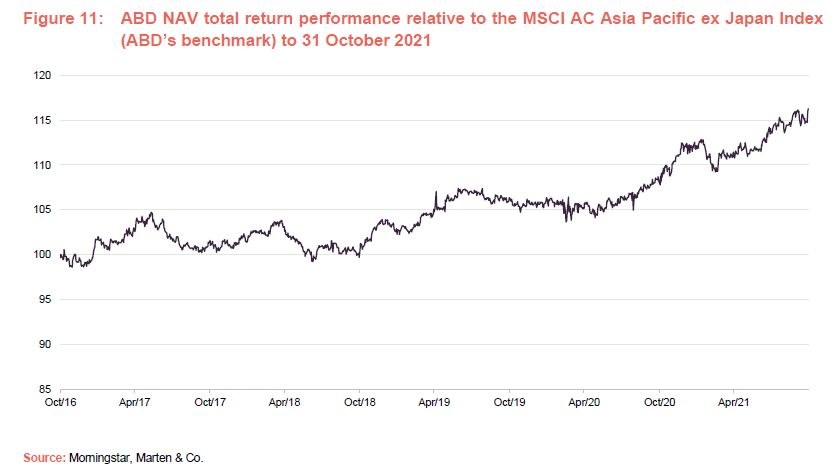

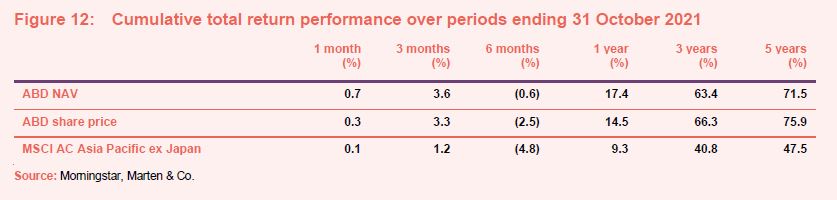

In terms of performance, ABD continues to enjoy strong long-term numbers but year-to-date it is up by only 1.55%.

However, the trust enjoys strong long-term numbers having outperformed its MSCI AC Asia Pacific ex Japan benchmark, over one, three and five years.

Market outlook

Despite reportedly being the origin of the coronavirus, the Asia Pacific regions did not suffer as badly from the outbreak in early 2020 as Western regions did. These countries were, with their experience of similar pandemics, successful at implementing controls to restrict the spread of the virus and they initially appeared to escape the worst ravages of the pandemic.

However, more recently, the region has had to cope with second waves that have forced further lockdowns and threatened economic recovery, with some countries experiencing the deadliest waves that have been recorded globally. India, for example, suffered more than 400,000 deaths and over 30m cases during its second wave earlier this year – and these are only reported instances. That being said, the country has bounced back relatively quickly and is back on track to proving its worth as one of the world’s up-and-coming superpowers. Last month, investment bank Jefferies said India’s economic cycle suggests conditions are ripe for a repeat of its 2004-2010 style upturn in the coming years, with annual economic growth forecast to be between 8% to 9%.

China and Vietnam have also performed well over the past 12 months, though more recently, the former has suffered fresh outbreaks of the virus. Meanwhile the latter has implemented regional lockdowns across the country as it attempts to halt the spread of the virus while it waits for the delivery of more vaccinations to arrive from other countries.

While fatalities and case numbers have risen, the economic damage at this stage has been far less than in the first wave as the response from governments has been less severe. Last year’s lockdowns were punishing on economies, but this time restrictions have generally been more localised and less draconian, allowing economic activity to continue and growth to be sustained.

Year-to-date (3 November), the MSCI AC Asia Pacific ex Japan is down by 0.3% while the MSCI USA is up 24%, the MSCI United Kingdom is up 17 % and the MSCI World is up 21%. Over five and ten years, the MSCI AC Asia Pacific ex Japan has returned 51% and 138% respectively.

Manager’s view

abrdn (the new name for Standard Life Aberdeen) manages money using a team approach. However, for the purposes of preparing this note, we spoke to James Thom, a senior investment manager in the team.

James acknowledges that the past six months haven’t been great for Asian markets and there are still a number of concerns. Interestingly, inflation, which seems to be one of the biggest fears among investors globally, isn’t at the top of James’ priorities, as he believes this doesn’t weigh on Asian markets as much as it does upon others. He is more concerned with the development of the coronavirus pandemic and issues currently coming to a head in China.

Vaccination rates are now accelerating across the region and should gradually lead to easing restrictions and further economic reopening. This would help mitigate inflationary pressures tied to near-term supply chain bottlenecks. But though markets have been relatively resilient during the period and have, for the most part, avoided the huge sell-offs seen in the first wave, many countries remain in lockdown and a certain degree of uncertainty always hangs overhead.

The manager says this has been a tough environment to navigate, but good companies have continued to thrive. He feels governments across the region are moving towards treating COVID as endemic rather than a pandemic, particularly across Asian nations and while things are less positive relative to the rest of the world, the picture is improving. James notes that vaccination rates are accelerating across the region, which should gradually lead to easing restrictions and further economic reopening.

Chinese burn

While ABD’s caution towards China has meant that traditionally its exposure has been lower than the benchmark, the portfolio has still been affected in recent months from fresh outbreaks of the virus as well as regulatory pressures and as China becomes more assertive in its foreign policy.

Following on from measures such as the tightened regulation that led to the Ant Group IPO being pulled, in recent months we have seen an effective ban on providing education at a profit, heightened controls over the use of data, which hit relatively new listings – Full Truck Alliance (the world’s largest digital freight platform) and Didi Global (China’s equivalent of Uber), and attacks on perceived anti-competitive practices, which hit many large internet stocks.

James sees a trend towards greater state control of key sectors such as internet, technology, education, healthcare and real estate. The aim seems to be to reduce tension from extreme wealth inequality and ease the financial burden on young couples, allowing them to have larger families.

China’s largest real estate developer Evergrande is teetering on the brink of bankruptcy. Bond yields are soaring, and this is weighing on other heavily indebted companies.

Meanwhile, geopolitical tensions rumble on, especially between China and Taiwan and the US, which James says has been reflected in markets at the margin.

The manager says he is generally avoiding companies that may be vulnerable and is identifying companies that can navigate and adapt to the changing Chinese policy environment, which seeks to further Chinese governmental priorities in areas such as digital innovation, green technology and greater social equality.

More recently, there have been power outages in China as part of a government environmental policy push to curb carbon emissions from the burning of coal, which has resulted in a spike in commodity prices. Blackouts and electricity rationing have hit around 20 provinces since September, affecting factories, hospitals, schools and people’s homes. According to reports, provinces in north-eastern China have been hit particularly hard. The problem has been worsened by flooding in the coal mining province of Shanxi, which is driving up coal prices. James says that over the past six months he has been grateful that he had reduced exposure towards the country.

India on top

By comparison, James says he regrets not having more exposure to India, despite the 1.7% weighting increase since the start of the year. Even though it suffered significantly from its second coronavirus wave earlier this year, James says the government has since got a better grip on controlling the spread of the virus, having ramped up its vaccination programme, which has allowed the economy to largely remain open.

That being said, James points out that India has now entered the festive season and the upcoming Diwali celebrations in early November could prove challenging for social distancing. As at 30 September 2021, a collective fund, Aberdeen Standard Sicav I – Indian Equity is ABD’s largest holding.

Meanwhile, in Australia and parts of South East Asia, Covid-19 lockdown measures have been hurting sentiment lately while the better-performing regional markets included Indonesia, buoyed by commodity price strength, and India.

There has also been a clear momentum on environmental issues, with more countries committing to climate change goals and lower carbon futures. Japan and South Korea have set long-term net-zero emission targets, while India and Singapore have increased investment in renewable energy and clean-energy vehicles. James says Asia is well positioned for this trend, which should create opportunities for quality companies across segments, including electric cars, batteries and alternative power generation. In recognition of these structural changes, the team has been adding several quality stocks to the portfolio that are leaders in these areas.

On the negative side, export growth slowed more severely than expected in Thailand due to restrictions disrupting manufacturing activity during the summer which has continued. The tourism industry remains under huge pressure, as the government had previously stipulated that Bangkok will open to visitors when 70% of the population has been fully vaccinated. However, this has been relaxed in an attempt to revive the ailing sector. Vaccination programmes in neighbouring countries such as Indonesia and the Philippines lag even further behind that of Thailand.

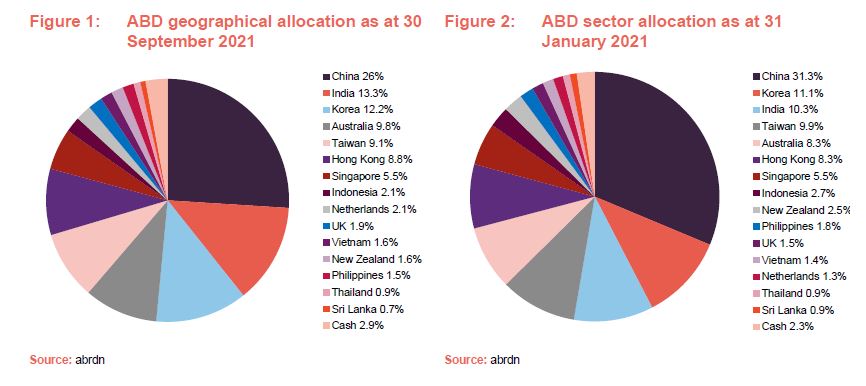

Asset allocation

There have been some notable changes to ABD’s geographical allocation since our last note which looked at figures at the end of January 2021. Exposure to India, Australia and Korea has increased during the eight-month period.

The biggest change however has been towards ABD’s Chinese allocation which has fallen from 31.3% as at 31 January to 26% as the changing regulatory environment has spooked investors and caused the ABD team to approach with more caution than ever.

James says there had been some concern about the rising risk of Chinese regulation of the internet sector ever since the Ant Group IPO was scrapped at the last minute in November last year. However, in July, the Chinese Government clamped down on the education and internet sector aggressively, resulting in a significant market sell-off. ABD has therefore benefited from its manager’s decision to reduce the portfolio’s exposure to China in advance of this correction.

Top 10 holdings

Since our last note there have been three new entries to ABD’s top ten, including BHP, Bank Central Asia and Yunnan Energy New Material. Consequently, Aberdeen Standard Sicav I – China A Share, Alibaba and Ping An Insurance have fallen out. While Alibaba remains in the portfolio at 2%, the other two companies have been exited completely.

BHP

BHP (www.bhp.com/) is an Anglo-Australian multinational mining, metals and petroleum dual-listed public company headquartered in Melbourne, Australia. It has been in the portfolio for well over a decade but was promoted to its top ten holdings in recent months. James says the key story here has been iron ore which, until recently, has had a stellar run driven by the reopening of nations and Chinese demand. He says the company is well-positioned in its sector and offers A-class assets with its high-grade iron ore. It also has the scale to produce enough to meet Chinese demand. James adds that BHP – along with fellow ABD holding, Rio Tinto, are the top two companies with the best quality commodity reserves and track record of managing profitably and returning cash to shareholders.

Yunnan Energy New Material

Yunnan Energy New Material (www.cxxcl.cn) is a China-based supplier of film products, packaging and printing products, as well as paper packaging products. The company also joined ABD’s top ten recently as a play within the electric vehicle (EV) theme. James is positive on the EV sector, with China leading the way in the growth of electric vehicles globally, even ahead of the US and Europe. Yunnan is a global leader in ‘separators’, which are critical components in an EV battery. James says the company has a technological edge and benefits from demand in China due to its low cost. Other manufacturers are more focused on Tesla and European demand, so Yunnan is well positioned. Valuations remain challenging as Yunnan has indeed become a thematic story and attracted some capital, so James says he is remaining cautious.

ASML

ASML (www.asml.com), which makes semiconductor equipment, moved into ABD’s top ten recently and is a holding that James says has been a big driver of performance over the past six months. It is listed in the Netherlands, but the vast majority of its revenues come from Asia and so is eligible for a place in ABD’s portfolio. ASML has a strong industry position and competitive advantage in its niche which supplies kit into the semiconductor manufacturing supply chain. James says the company has more or less a monopoly in its niche, given its tech prowess and that very few other companies can match it.

Thematic plays

Much of ABD’s holdings play a part in a number of wider themes in the portfolio, while some stocks were also reduced or removed to comply with these plays.

Green energy

Sungrow Power Supply (www.sungrowpower.com), for example, is market leader in providing solar inverters globally and is part of ABD’s exposure towards the global transition to a greener environment. James says it is not a cheap stock but has been robust and enjoyed strong growth.

ABD also owns LONGi Green Energy (www.longi.com), a major Chinese manufacturer of photovoltaics and a developer of solar projects, and which James says is another global market leader. LONGi, along with other names in ABD’s portfolio in the renewable energy space, are examples of Chinese companies that have held up well and are less vulnerable to current broader macro events.

Biotech

Another theme to be found in ABD’s portfolio centres on the biologics pharma industry, particularly in China, which is one of the fastest growing segments in the pharmaceuticals space. James says there is a lot of research and development (R&D) being pumped into the sector along with a run of new launches. He says this can pose a challenge as there are a lot of Asian companies at an early stage, whose products are somewhat conceptual in nature. He says some are doing a lot of research and development but not making any money yet. For this reason, the team has struggled to find high quality, stable companies directly in the space but has found plenty that are related to it.

For example, he considers WuXi (www.wuxibiologics.com), a contract development and manufacturing organisation (CDMO) that provides open-access, integrated technology platforms for biologics drug development, as being in the ‘discovery’ section of the theme and a holding that has been a particularly strong performer in recent months.

Another ABD favourite is medical laboratory company Tigermed (www.tigermed.net) which is on the next step of the value chain and is a leader in testing products to launch and preparing them for regulatory approval. James says the companies’ unique selling point is these trials.

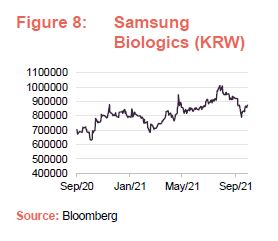

The final section of the theme is in the manufacturing space, and is where Samsung Biologics (www.samsungbiologics.com) fits in. James says the South Korean biotechnology company is also known for research and discovery but its strength is in its ability to manufacture at scale on a contracting basis. Samsung’s bread and butter is its semiconductor business but this means it can use its large factories and set-up for manufacturing at scale to make its biotechnology business another success under its belt. According to James, the company will take its expertise in the semiconductor space to dominate the biologics manufacturing space over time.

Insulating the portfolio

The recent events in China have had such an impact on its market that, as explained earlier, ABD has had to give greater attention to its Chinese holdings, which has meant trimming or exiting some holdings in their entirety. James said the team has taken efforts to insulate the portfolio over the past six months due to concerns over China’s near-term outlook.

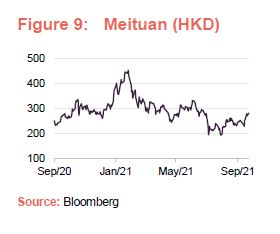

This has included exiting ABD’s position in Meituan (www.meituan.com) as regulatory scrutiny was intensifying. The company is a leading Chinese shopping platform for locally found consumer products and retail services, but its forte is in its food delivery service, where it is a dominant player in China. James says the company did a great job for the portfolio over the short-term and he would be happy to look at it again in the future but for now there lies broader regulatory issues which are impacting the sector as well as reported antitrust concerns as the company appeared to be abusing its market position. James says there is also an ESG element in the decision to exit the position as workers are reportedly not eligible for full benefits such as life insurance and social security. The manager says there is indeed a move towards changing this attitude in China as a whole which could significantly alter the economics of the food delivery industry.

Similarly, ABD has taken some money out of its Tencent (www.tencent.com) holding, though the Chinese multinational technology conglomerate remains in the portfolio’s top ten. James says he is confident in the medium-term outlook of the company as it remains a dominant business with great growth potential. But he is concerned about the near-term regulatory adjustment it appears to be going through. Other companies that have been hit hard by the changes, such as JD and Baidu are not held by ABD and James says being broadly underweight Chinese internet stocks has helped relative performance. Similarly, ABD does not hold anything in the education sector which was recently hammered by the government’s regulatory agenda and common prosperity agenda.

Ping An Insurance however (www.group.pingan.com), which was a top ten holding of ABD’s just six months ago, has disappointed and so the team has exited its position. The Chinese holding conglomerate whose subsidiaries mainly deal with insurance, banking, asset management, financial services, healthcare, auto services and smartcity has suffered from a broader issue around life insurance but also stock specific factors such as its attempts to restructure its agency which is taking longer than expected. James says there are also issues with its real estate investment book, a sector which is currently under pressure as a result of the Evergrande crisis.

Performance

In terms of performance, ABD continues to enjoy strong long-term numbers but year-to-date it is up by only 1.55%. James says that while absolute returns have been less exciting in 2021 compared to last year, the trust remains “above water”. He says this was to be expected given the performance of Asia Pacific markets but that the trust – which is described as a portfolio of quality companies – has proven it can still hold up in down markets. He says a lot of this has come from being underweight China given its performance over recent months and where there is Chinese exposure, stock selection is strong and so the trust has avoided the worst of regulatory pressures that have been a burden on the economy of late.

Attribution

As mentioned earlier, WuXi has been a strong performer in recent months, largely due to winning more contracts for the COVID vaccine or COVID-related therapies. It maintains a good-sized position in the portfolio and while James says the team is optimistic, it remains cautious on its medium-term outlook and so ABD has taken out some of its profits. The money has been used to fund positions in China’s Tigermed and South Korea’s Samsung Biologics, which sit in the same theme, but at different parts of the value chain.

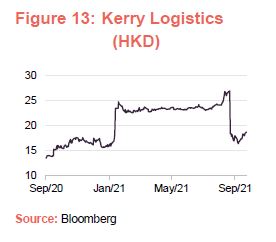

One of the biggest contributors to performance since the start of the year has been Kerry Logistics (www.kerrylogistics.com) which is listed on the Hong Kong Stock Exchange. The company is engaged in third party logistics, freight services, warehouse operations, and supply chain solutions and while its intra-country logistics have not performed that well, it has seen a huge pick-up in its international business. James says congestion at ports means it has benefited from higher rates. He adds that Kerry Logistics is also an example of the type of small-cap companies that ABD likes for being attractive acquisition targets. Rival SF Express announced at the end of September that it had acquired a 51.8% stake in Kerry Logistics for HK$17.6bn.

Another positive driver of performance for ABD has been being overweight India relative to its benchmark. James says India has by far been the best performing market in the region and in retrospect, the portfolio should have had greater exposure. While there is still uncertainty around the coronavirus, the economy is getting back on track though he says it is still not firing on all cylinders. Furthermore, there is a lot of capital rotating out of China and going into India and there has also been a huge number of IPOs in the Indian technology space which has attracted even further fresh capital. On a three-year view, James remains very positive on India.

On a sector basis, ABD’s top performance has come from the technology sector, particularly in the semiconductor hardware space which includes core holdings, TSMC and Samsung Electronics.

Peer group

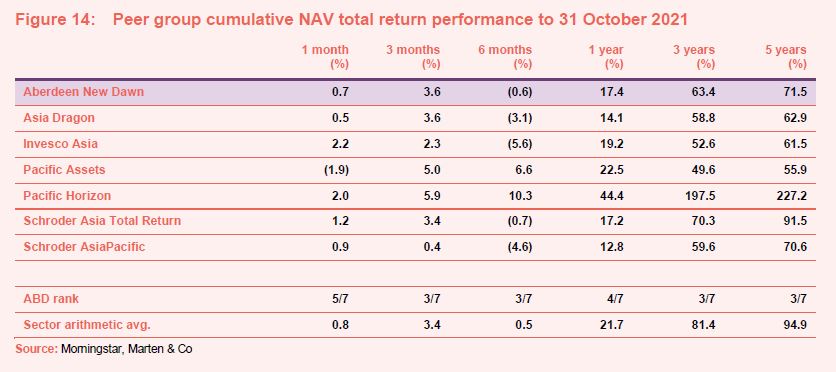

ABD is a constituent of the Association of Investment Companies (AIC’s) Asia Pacific sector. The Asia Pacific sector is comprised of seven members, as detailed in Figure 14.

Members of Asia Pacific sector will typically have:

- over 80% invested in quoted Asia Pacific shares;

- less than 80% in any single geographic area;

- an investment objective/policy to invest in Asia Pacific shares;

- a majority of investments in medium to giant cap companies; and

- an Asia Pacific benchmark

ABD’s cumulative NAV total return performance just about ranks in the top half of the table over most of the time periods provided.

As already discussed, James attributes this to the trust’s more cautious approach to China which has until recently, held performance back. Both ABD and its stablemate, Asia Dragon, have been mindful of China’s corporate structures that allowed access to its leading technology companies. Reflecting this, the manager of ABD had a long-standing conviction that it would not invest in companies such as Tencent and Alibaba that were only accessible to foreign investors through structures known as ‘variable interest entities’.

These structures had been established to bypass Chinese government restrictions on foreign ownership of internet licences. The manager has progressively relaxed this stance (Tencent was added to the portfolio towards the end of 2017 and, more recently, the decision was made to add Alibaba to the portfolio). However, as shown in the difference in geographical allocations in Figures 1 and 2 during the start of 2021 and at the end of August, the manager has reduced its exposure once again, which has finally proven fruitful.

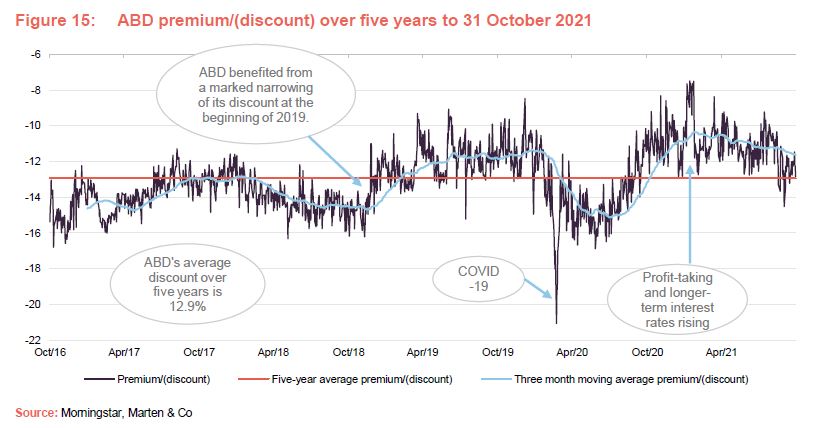

Premium/(discount)

ABD’s discount significantly narrowed at the start of 2019 and maintained this level until the coronavirus outbreak during the first quarter of 2020. Like the rest of its peer group and global markets, its discount plummeted and hit a five-year low of 21.1% on 23 March 2020. The discount narrowed again quickly by the end of March 2020 and by 2021 appeared to have finally returned to its pre-pandemic levels. In recent months, the discount has widened again slightly, as markets have corrected through a combination of investors taking profits in the face of rising long-term interest rates (a potential signal of rising inflation expectations, which can lead to higher near-term rates, all of which can be negative for equities) that have taken the steam out of markets globally, and possibly on concerns around China’s regulatory environment.

Over the 12 months to 31 October 2021, ABD has traded within a discount range of between 7.5% and 14.5%, with a one-year average of 11.1%. As at 1 November 2021, ABD is trading at a discount of 12.85%. This is wider than that of the Asia Pacific sector, which is trading at an average discount of 6.23%.

ABD is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. In normal market conditions, ABD repurchases shares when the discount is wider than the board would like. However, the board has no specific discount target in mind. Instead, its aim is to provide a degree of liquidity for shareholders. The authority to repurchase shares is renewed at each AGM (and more frequently, if necessary).

Fund profile

Aberdeen New Dawn (ABD) aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. ABD holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies.

Investments may also be made through collective investment schemes and in companies traded on stock markets outside the Asia Pacific region, provided that over 75% of their consolidated revenue is earned from trading in the Asia Pacific region, or they hold more than 75% of their consolidated net assets in the Asia Pacific region.

ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms). We have also included comparisons against the MSCI AC World Index and its peer group within this report.

The manager is Aberdeen Standard Fund Managers Limited, which has delegated the investment management of the company to Aberdeen Standard Investments (Asia) Limited (abrdn or the manager). Both companies are wholly owned subsidiaries of abrdn plc.

ESG considerations

Environmental, Social, and Corporate Governance (ESG) considerations remain a core focus for ABD and play an increasingly important role in its stock selection process.

The board believes that integrating ESG best practice into the company’s strategy, operations and the manager’s investment processes helps to generate stronger, more sustainable returns for its shareholders and investors over the long term.

ABD’s portfolio now merits an AA score from MSCI’s ESG rating system, classifying it as a ‘Leader’ on ESG issues.

House approach

abrdn has its own ESG in-house scoring system, and every analyst can interrogate this database when making their decisions. They can also make use of external groups to check areas such as climate emissions.

abrdn selects and manages investments by embedding ESG into its process in four key ways:

- Assessing risk and enhancing value – a core element of the abrdn investment process appraises environmental, social and governance factors with the aim of generating the best long-term outcomes for the company’s shareholders.

- Researching companies – abrdn conducts extensive and high-quality fundamental and first-hand research to understand the investment case for every company in its global universe more fully. A key part of the process involves focusing its extensive resources on analysis of ESG issues.

- Rating company ESG credentials – a systematic and globally-applied approach to evaluating stocks allows abrdn to compare companies consistently on their ESG credentials – both regionally and against their peer group.

- Corporate engagement – abrdn actively engages with investee companies to maintain or raise their ESG standards further and to deliver long-term, sustainable value consistent with the company’s investment objectives.

Previous publications

| Title | Note type | Date |

| Market setback creates opportunities | Initiation | 4 October 2018 |

| Moving up the league table | Update | 8 July 2019 |

| Illuminating value | Annual overview | 7 February 2020 |

| COVID positive | Update | 20 August 2020 |

| An ESG Leader in Asian equities | Annual overview | 18 March 2021 |

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Aberdeen New Dawn Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.