Laying the foundations for future returns

abrdn Private Equity Opportunities (APEO) has recently been trading at discounts to net asset value (NAV) in excess of 40%, way above its long-term average of around 16-17%, suggesting that the market is pricing in an NAV fall comparable to that seen during the global financial crisis.

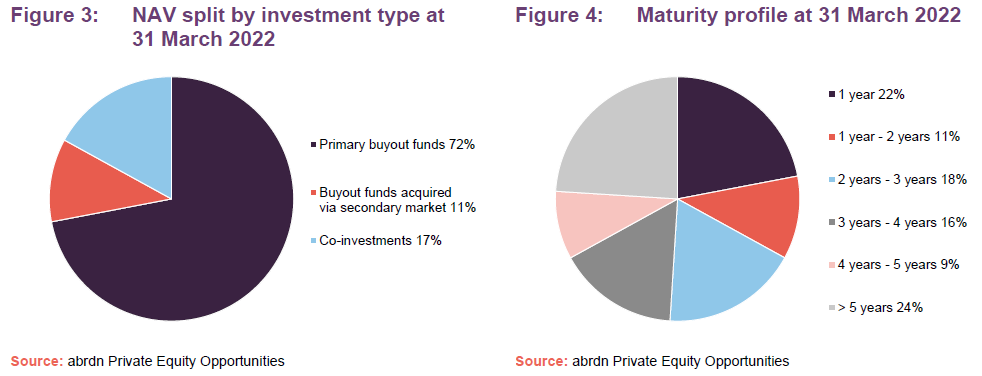

Alan Gauld, APEO’s lead portfolio manager, thinks that the discount is nonsensical, and we agree. The listed private equity sector has changed immeasurably since the crisis and APEO’s portfolio is focused on managers of funds invested in cash generative businesses that are able to finance their growth. Add in APEO expanding its direct co-investment side (17% of NAV as at 31 March 2022), an increased focused on sector specialist managers that are better able to add value, conservative valuations for private equity positions and a focus on the mid-market where there is less competition, and the current discount adds to an already compelling opportunity.

Private equity fund of funds with a European bias

APEO aims to achieve long-term total returns through a diversified portfolio of private equity funds, and co-investments, the majority of which will have a European focus. Its portfolio is more focused than many of its peers; the top 10 underlying private equity funds accounted for 44.3% of NAV, as at 30 June 2021. Like many private equity funds, APEO has no formal benchmark. Historically, the portfolio has been most-closely correlated to European small-cap indices.

Manager’s view

Primary and co-investment market seeing record levels of activity

APEO’s manager observes that the primary market has been very active, with private equity houses raising record levels of funds. The manager has been putting capital to work (it aims not to try to time the market when it comes to primary fund investment) laying the foundations for future outperformance in its view. However, against the headwinds of rising inflation and interest rates, and a slowing global economy, the manager has remained disciplined in choosing who to allocate fresh capital to.

Increasingly focused on smaller specialist managers

Alan Gauld, APEO’s lead portfolio manager says that they have been shifting APEO’s focus away from the large cap managers in favour of smaller sector specialists (the team is looking for private equity managers who have a narrow focus and deep knowledge, backing those that have trade buyer-type knowledge of their space), citing that such managers are better placed to get to grips with a business, make quick changes and add more value.

Alan comments that not only are such specialists better placed to weather a more challenging economic environment, but they are also typically factoring in the prospect of an economic slowdown into their calculations already, and are not relying on rising markets and multiple expansions to make their investment theses work. APEO is also buying market leaders. While you have to pay up for these, they have more pricing power, and therefore staying power, when the backdrop becomes more difficult.

Private equity is not about high debt low cash flow businesses

Alan says that there is a strong misconception – possibly a hangover from the global financial crisis – that private equity is largely focused on high-growth businesses with low or negative cash generation, heavily financed with debt, that are vulnerable to rising interest rates, particularly when the economy is slowing. He says that, while there will be some growth equity-type investments in the portfolio at the margin, these type of high-growth, non-cash generative investments are very much the exception. APEO does own some growth businesses that are on the cusp of profitability, but over 90% of the portfolio is profitable established businesses.

Buyout managers typically look for businesses with strong growth runways but are also looking for cash generative businesses that can fund their growth internally and, where necessary, are able to support leverage (debt). In reality, the perception that private equity is high-risk due to financial engineering is nonsensical; it is difficult to borrow large sums of money against a business that doesn’t have the cashflows to support the debt, as banks and the wider debt market will not entertain this.

Alan comments that buyout managers, as majority owners of their underlying businesses, are also active in terms of the businesses they own, a fact that he believes the wider market under-appreciates.

Less competition in the mid-market

As noted above, APEO’s manager has been avoiding the large and mega cap managers. For example, there is no KKR, or Blackstone in APEO’s portfolio and, more recently, there has not been any new investment with CVC, even though this manager has performed very strongly for APEO historically.

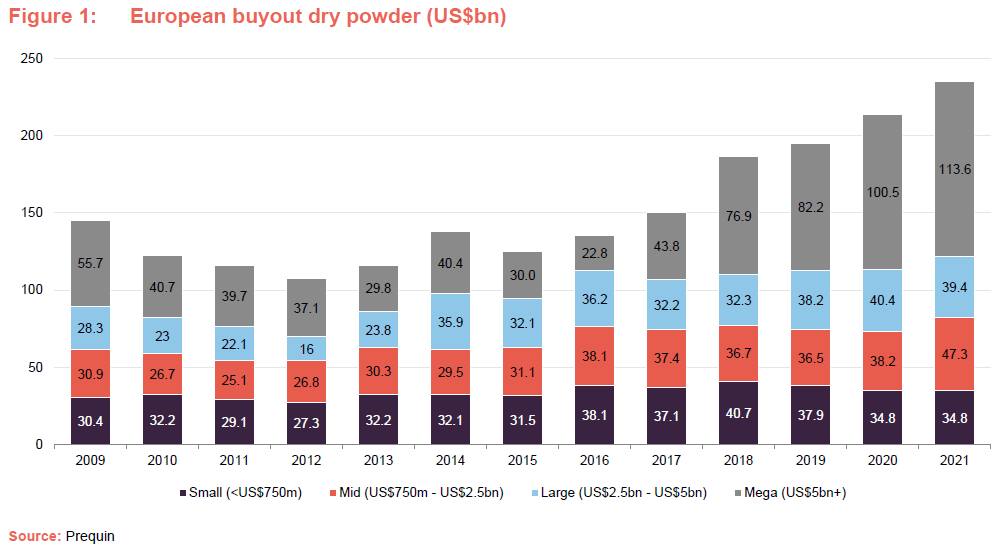

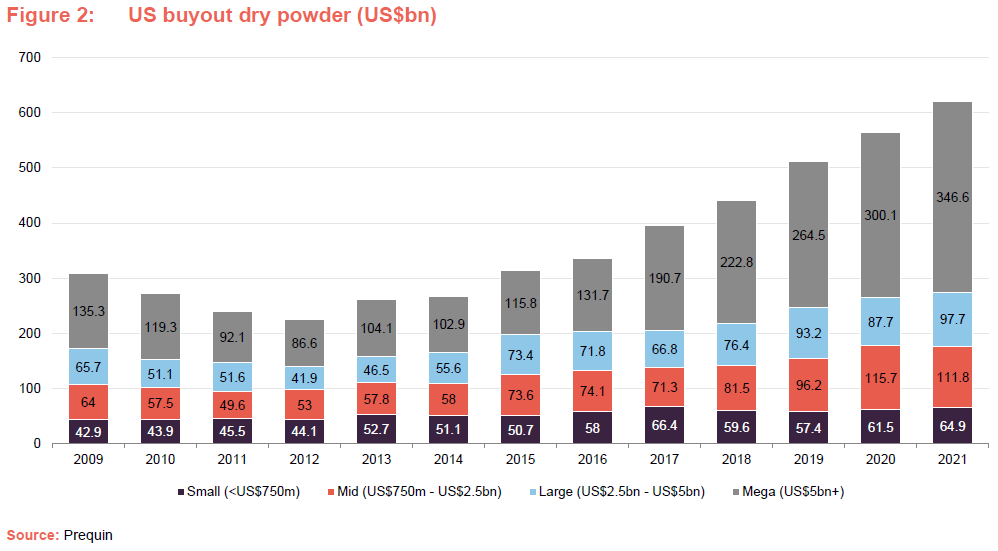

Investors have liked the returns that private equity has been providing and, consequently, a lot of money has flowed into private equity in recent years, increasing competition for investment opportunities. However, as is illustrated in Figures 1 and 2, the major impact from these inflows has been felt in the mega cap space, where the level of ‘dry powder’ (uncommitted cash) has ramped up significantly. The levels of dry powder in the large and mid-cap spaces have increased, particularly in the US, but have been much more stable.

Alan comments that the majority of the inflows are from big institutional investors, who find it easier to put money to work in the larger funds. This means that there has been a marked increase in competition in the US$5bn and above space, while the US$1bn to US$5bn space has not been growing by anything like the same extent and is likely to remain this way over the long term.

Another consideration is that the mid-market space is less beholden to initial public offerings (IPOs) as an exit route, which tends to be the choice for large and mega caps exits. In the US$1bn to US$5bn space, you can readily exit a business by selling it to a trade buyer or a large cap private equity fund, but, as the target size becomes bigger, the alternatives to an IPO become harder to execute. Trade buyers with the necessary resources become harder to find and, if a transaction is really big, only a few private equity firms will have the cash to do the deal. Consequently, as targets get larger, IPOs become the key exit route. Alan thinks that in five to 10 years’ time, many of the current crop of large and mega cap portfolio companies will have to be listed for the managers to achieve an exit. This can be a problem if markets are challenged, and the IPO window is shut.

Co-investment market also seeing record deal flow

APEO’s manager says that deal flow has also been at record levels in the co-investment market and, while it has been very busy increasing APEO’s exposure to co-investments (it had 22 of these at the half year end), it has turned away a lot of opportunities. Alan thinks that as the economy slows, deal flow for co-investments will slow as well. He notes that, increasingly, banks are not prepared to lend to finance leveraged buyouts, due to market uncertainty, and this will reduce the deal flow for co-investments for the remainder of 2022.

Alan says that a lot of private equity houses have been financing investments using their own credit lines, and these will likely get paid back with interest rates on the rise. Instead, these investments will be funded by calling on the commitments that have been made to them by investors such as APEO. Distributions from the underlying funds will likely slow in this environment, but the underlying managers that have access to liquidity will likely be selecting opportunities from a more price competitive market, thereby laying the foundations for future outperformance.

At the end of May, APEO had £185m of liquid resources at its disposal, which it estimates equates to over a year of forecast fund drawdowns, meaning that it is well positioned to meet its commitments. As at 31 March 2022, APEO’s manager estimates that it had around £91.9m held on underlying fund credit facilities

(30 September 2021: £47.3 million), and expects that this will all be drawn over the next 12 months.

Potential for opportunities as end June valuations come through

Alan observes that earnings have started to moderate for some companies. He comments that first quarter (Q1) earnings were very good, and these underpinned the March valuations, but he thinks that we may see some softening of earnings as the year progresses, which, along with lower public market comparables, could pull down some valuations. The denominator effect of falling public markets portfolios may lead to some investors needing the trim their private equity portfolios. Indeed, there could distressed investors that have overcommitted to private equity too. APEO has been less active in the secondary market recently, reflecting a dearth of opportunities, but Alan believes there will be more opportunities as end June valuations come through.

Taking a more balanced approach

As we have previously discussed, APEO’s managers have been tilting the portfolio towards tech and healthcare since 2013. This benefitted the trust in the aftermath of the pandemic as investors, in an environment of exceptionally low interest rates, sought growth opportunities.

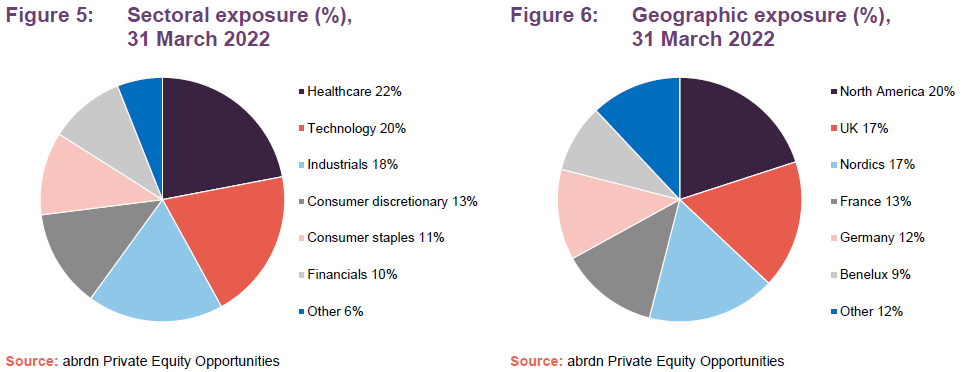

For both the financial years ended 30 September 2020 and 30 September 2021, this trend continued with most new investments having a technology or healthcare focus (collectively these account for 42% of APEO’s portfolio as at 31 March 2022 (see Figure 5 on page 10), but reflecting a shifting macroeconomic environment, the manager has been much more balanced when making investments in the first half of the current financial year, and this trend looks set to continue.

Extreme private equity discounts are nonsensical

Alan notes that, with interest rates rising and markets receding, private equity houses need clear strategies on how to add value to their assets. Whilst private equity has some insulation against falling markets, valuations will not hold up indefinitely if listed equities continue to fall. However, if you look at transaction values, which remain strong, and contrast these with the discounts to NAV that listed private equity funds (particularly the funds of funds) are trading at, the discounts are nonsensical.

As at 6 September 2022, APEO was trading at a discount of 41.6%, which is way above its long-term average of 16-17%, suggesting that the NAV would need to fall by over 20% to justify the current valuation. Alan acknowledges that private equity has had a great run in an environment with exceptionally low interest rates, and this is now changing, but comments that APEO is backing specialists that can really add value, which is key in a higher interest rate environment. He adds that its over-commitment ratio – the ratio of APEO’s commitments relative to its liquid resources and borrowing facilities – (44% as at 31 May 2022) is still at the lower-middle end of its range (30-75%) and readily manageable.

Alan comments that APEO has levers it can pull if it needs to raise liquidity (it had £185m worth of liquid resources available to it at the end of May 2022) and could sell some secondaries if it needed to. Interestingly, having not deployed leverage for many years, APEO has now started to utilise its credit facility. This reflects the increased allocation to co-investments, which require funding up front. In addition, APEO’s facility has very competitive terms – less than 2% on amounts drawn down and 80 basis points (bp – equivalent to 0.8%) on the unutilised portion.

Alan also notes that APEO has a long history and has been through many market cycles – it has added value in 18 out of the last 21 years, which should give investors some comfort. Furthermore, private equity valuations tend to be conservative – Alan says that there is typically a circa 25% uplift on exits to the carrying value two quarters prior to an exit, suggesting a further buffer. He adds that a little-understood point is that private equity has no incentive to inflate valuations, as its fees are not linked to these, and investors generally like to see an uplift when an exit occurs.

Acknowledging the changing market dynamics, Alan says that a repeat of the returns of the last five years is unlikely on an absolute basis. APEO’s 20-year average return is 11.6%, so he is not expecting a repeat of the 37.9% achieved in the last financial year any time soon, but says that good active private equity managers will still hit internal rates of return (IRRs) of 20% plus on their investments and will outperform the listed market. He comments that economies do slow down and banks will curtail their lending, but very good-quality assets continue to change hands.

Despite this, current discounts suggest that we should expecting NAV falls comparable to those that occurred in the aftermath of the global financial crisis. This is unlikely, given the way that private equity has changed in the intervening period.

Asset allocation

Readers interested in APEO’s investment process should see our September 2021 annual overview note, which describes this in more detail. However, to summarise, APEO’s manager tends to build a portfolio of core underlying managers whom it knows and trusts and has established relationships with over many years. Since 2019 this has been complimented by co-investments and APEO’s allocation to co-investments has seen a significant expansion during the last 12 months. Fund turnover is inherently low, although opportunities from new and existing managers for APEO are under constant scrutiny. Near-term changes in allocations tend to be driven by realisations and the pace of reinvestment.

As at 31 March 2022, 68% of the fund’s NAV was attributable to 13 core managers. The core manager line up has seen a reduction during the last year (as at 31 March 2021, there were 17 core managers that accounted for over 70% of NAV) both as APEO’s manager has given greater emphasis to its co-investments (discussed further on pages 19 and 20) and de-emphasised some of the larger underlying managers to give greater emphasis to those focused on particular niches.

Focused on the mid-market segment

As noted on page 5, the portfolio remains focused on the mid-market segment as this is where there is significantly less dry powder, when compared to the large and mega cap segments, meaning that pricing is much more competitive for buyers.

Interestingly, the manager also says that the underlying managers have been able to exit their portfolio companies at a premium to the large and mega cap funds.

Well diversified by vintage sector and geography

As at 31 March 2022, the portfolio provided exposure to over 600 underlying private companies, through around 50 funds. Out of these funds, the top 10 funds account for 37.5% of NAV, while the co-investments portfolio had 22 investments and accounted for 17% of NAV. The manager considers that these sorts of concentration levels should provide sufficient diversification, without overly diversifying away potential returns.

As is illustrated in Figure 4, the portfolio is well diversified by vintage. 33% of the underlying portfolio is over four years old, with around a quarter in excess of five years old, this being the sweet spot for realisations. The less-mature vintages typically drive value accretion.

As is illustrated in Figure 6, APEO’s portfolio retains its bias towards northwest Europe. The geographical allocation is well-balanced and no single country dominates, which has helped to spread out APEO’s country-specific risk. There has been a process of gradually broadening the trust’s exposure to North America. At 20%, this is now a sizeable allocation and at what the manager considers to be a natural level for APEO over the longer term.

Since 2013, the sector exposure has been shifting more towards higher growth areas, such as information technology (IT) and healthcare, as APEO’s managers have sought to invest in managers and investments focused on less cyclical sectors and subsectors that are subject to long-term growth. This has proved especially useful in the aftermath of the pandemic, as investors sought investments that offered growth in a low-growth, lower-interest-rate-for-longer environment. More recently, it has likely been a contributory factor as APEO’s discount has opened up (see pages 25 to 28) but, as noted in the manager’s view section above, the manager has been making a more balanced sectoral allocation when making investments recently.

We note that 10 years ago, healthcare and IT accounted for a combined 14% of the portfolio. Commitments made during the last two financials years had a technology focus and, as at 31 March 2022, these accounted for 42% of APEO’s portfolio. However, the investments made in the first half of the current year have been more balanced.

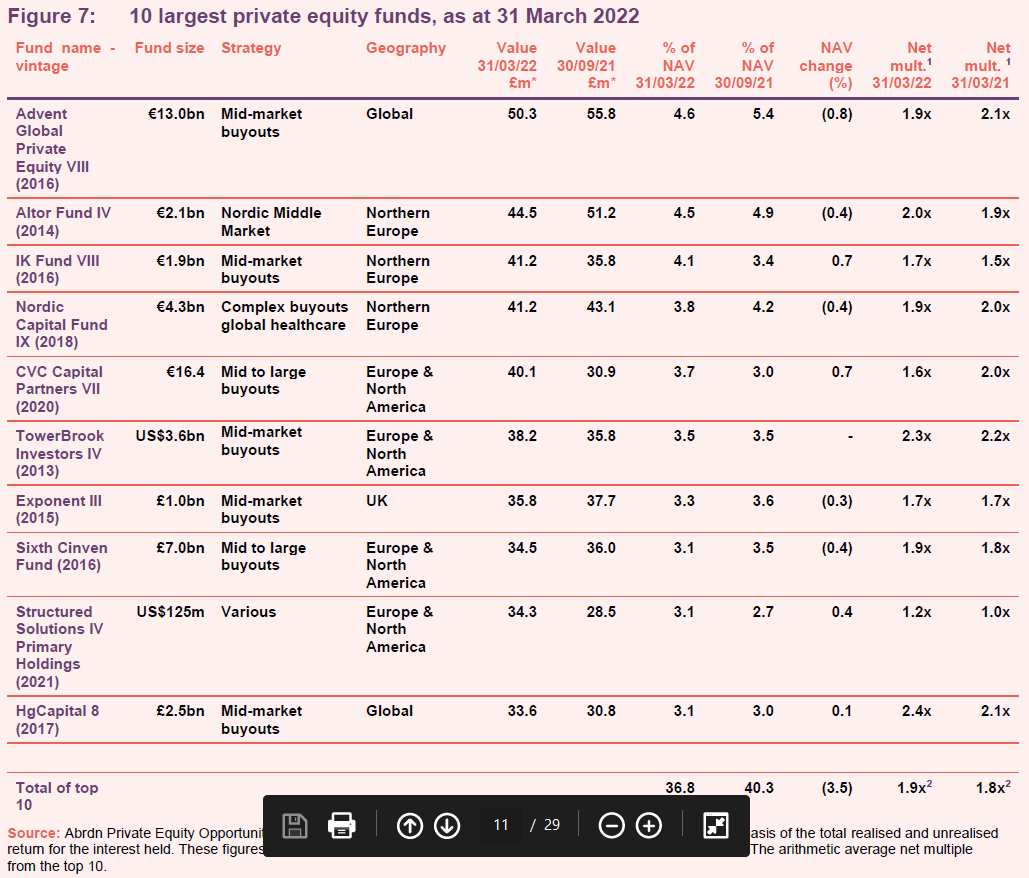

Top 10 fund exposures

Short-term changes to fund allocations tend to be driven by realisations, the pace of reinvestment, and the frequency of revaluation by the underlying managers. Reflecting the managers’ long-term fund of funds approach, the names of the underlying managers and their funds will be familiar to followers of the trust and regular readers of our notes on APEO. Names that have moved up to the top 10 funds over the course of the first half of the financial year are IK Fund VIII, Structured Solutions IV Primary Holdings and HgCapital 8. Names that have moved out of the top 10 are Permira V, Investindustrial Growth and Nordic Capital VIII (as at 31 March 2022, these held the 12th, 18th and 14th positions respectively).

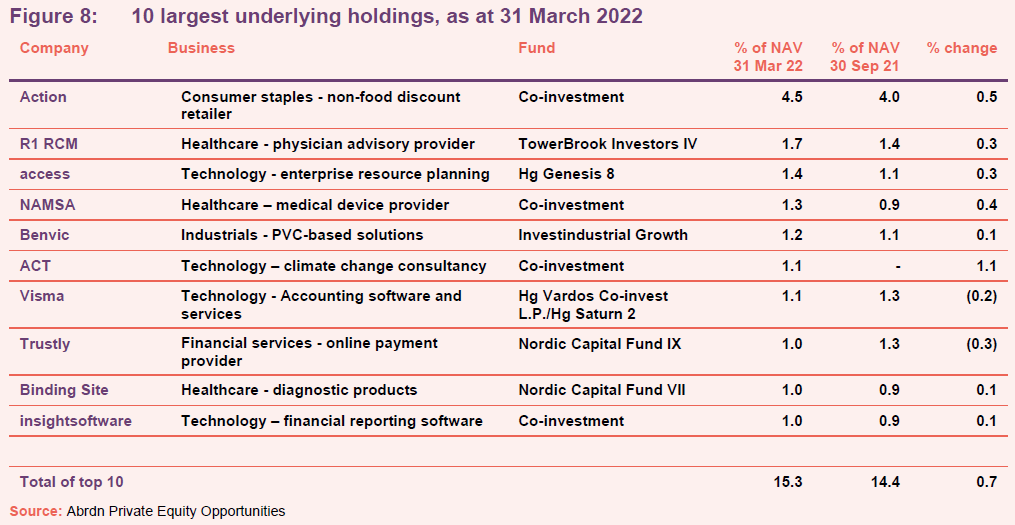

Top 10 underlying company exposures

Readers familiar with APEO will note that changes to the top 10 underlying company exposures tend to be common. Movement is often a function of holdings within the underlying funds moving closer to realisation. Names that have moved up into the top 10 are Access Group, NAMSA, ACT, Binding Site and insightsoftware. Names that have moved out of the top 10 are PhotoBox, Itiviti, Dr. Martens, Adenza (formerly Calypso) and Intrum.

Action remains the largest underlying company exposure. This has long featured in APEO’s largest underlying holdings, having occupied the number one position for a number of years, and is a position we have discussed in previous notes. To recap, Action is a highly successful non-food discount retail business in the Benelux, French and Germanic markets. APEO re-deployed £22.6m into a co-investment in Action from the £51.1m proceeds (over 5x its initial investment) it realised when 3i Eurofund V sold its investment in Action to the 3i Group (at over 30x its initial investment).

Names that have moved up into APEO’s top-10 look-through holdings

The Access Group (www.theaccessgroup.com) provides business management software to small and mid-sized organisations in the UK, Ireland, and Asia Pacific. Its product offering includes financial management systems, human capital management software and industry specific software solutions, and is used by over 60,000 customers across the commercial and not-for-profit sectors. APEO has exposure to The Access Group through its investment in HgCapital 8, which owns The Access Group alongside TA Associates. The company has offices in nine countries and provides services to a range of industries.

On 8 June 2022, HgCapital announced that The Access Group had secured new financing from it and TA Associates, including an incremental borrowing facility for over £1bn, along with a minority investment from GIC, a global institutional investor. The new financing is to be used to support further strategic acquisitions. At the time of the announcement, the company had an enterprise value of £9.2bn, making it one of the largest UK headquartered software providers. HgCapital says that, since 2020, Access has more than doubled in size driven by double-digit organic growth, combined with strategic M&A.

North American Science Associates, Inc or NAMSA (namsa.com) is an Ohio-based healthcare contract research organisation (CRO) specialising in providing preclinical and clinical services to medical device companies. Founded in 1967, NAMSA pioneered the medical device CRO industry, growing consistently to become the global market leader in the space. APEO has direct exposure to NAMSA through a co-investment made alongside the private equity healthcare specialist ArchiMed during the last financial year (it was the third largest drawdown during the year ended 30 September 2021). ArchiMed, the lead investor, initially acquired a majority stake from the founding Gorski family in September 2020, with APEO investing €9.9m in December 2020.

The bulk of NAMSA’s business is in North America (79% of total sales) but it also has a presence in Europe (19% of total sales) and a smaller presence in Asia (2% of total sales). APEO says that the business is performing well; it completed a recapitalisation last year that saw it return around 36% of invested capital back to the limited partners (LPs) within 12 months of the original investment.

Prior to its investment, the lead manager had been actively seeking an opportunity within the subsector. It has significant direct sector experience that it can bring to bear where it sees both attractive market growth and a consolidation opportunity via M&A. APEO has backed ArchiMed as it is a healthcare specialist acquire a global leader in a highly fragmented sub-sector which the lead manager knows well. APEO’s manager believes that ArchiMed can build the global leader in the medtech CRO space and that this will be a rare and strategically valuable asset.

Headquartered in the Netherlands, ACT (www.actcommodities.com) is the largest specialist intermediary in the global environmental certification market. Founded in 2009, ACT helps companies and organisations around the world reduce their carbon footprints and transition towards net-zero emissions. It provides market-based sustainability solutions and has a portfolio of more than 80 products in over 40 countries.

ACT has a recognised and trusted brand and is a leader in emission markets (it encourages emission reduction, negative emission solutions tied to carbon removal, and cross-border carbon pricing); renewable fuels (allowing for the substitution of fossil fuels with lower or zero-carbon sources, for example with biofuels/biotickets); renewable energies (driving the substitution of fossil-energy based power generation with renewables); and energy efficiency markets (delivering improvements through state-of-the-art technologies in production processes and machinery).

APEO has direct exposure to ACT through a co-investment made alongside the Bridgepoint, during the first half of the current financial year. Bridgepoint made its initial investment in July 2021, taking a minority position in a transaction that valued ACT in excess of €1bn. APEO’s manager says that ACT is operating in a growth market and is expected to benefit from an expanded market share and international growth. With the increase in pace on climate change, increasing regulation, market complexity, and a growing voluntary corporate buy-in to addressing these matters, it thinks that ACT is well placed to benefit from this.

Binding Site (www.bindingsite.com) provides specialist diagnostic products to clinicians and laboratory professionals worldwide, principally for the diagnosis of blood cancers and immune system disorders. The company was founded in 1986 by a group of researchers, based at the University of Birmingham’s Medical School, who had been looking at innovative ways to produce immunoassays to detect specific proteins. The company has continued to build on its strong scientific foundations, and extensive expertise in antibody specificity technology, and now has a wide range of specialist protein diagnostic tests.

Of its 1,100 staff, around 700 are located in the UK. The UK head office houses all product development, manufacturing, global distribution and marketing, while worldwide customer support is provided by a further 10 offices in the US and Europe. The company has a direct presence in over 25 countries and has over 3,000 customers spread across 100 countries. There are over 1,500 binding site instruments across the globe with around 34m binding site tests produced each year (around 90% of which are exported).

APEO originally gained its exposure to Binding Site through its investment in Nordic Capital VII, a 2008 vintage fund, which acquired the company in 2011. In April 2018, Nordic Capital Fund VII completed the transfer of its remaining nine unlisted portfolio companies, including Binding Site, to a continuation vehicle, Nordic Capital CV1. Fund VII’s original term expired in December 2017 and, in undertaking this transaction, Nordic Capital says that it took the opportunity to maximise the value creation potential of these nine companies, providing them with active support and fresh capital over an additional five-year holding period. Nordic Capital’s ambition is to grow Binding Site’s existing products through increased market penetration, especially for the main product, Freelite.

insightsoftware (insightsoftware.com) is a North Carolina-based provider of financial reporting and enterprise performance management (EPM) software that is used by over 28,000 customers worldwide. The company was founded in 2018 by the private equity investor TA Associates and ST6 (a consultancy firm formed by software executives that advises private-equity funds) and, since its formation, has completed 17 acquisitions and grown its revenue base around 10x (from around US$35m to around US$350m today). During this time, the business has grown rapidly, building a suite of software products across reporting, budgeting & planning, close & consolidation, tax, disclosure and equity management.

In July 2021, HgCapital made a US$1bn investment, via the Hg Saturn 2 fund, valuing insightsoftware at around US$4bn. Following this transaction, Hg Capital and TA Associates owned around 40% of insightsoftware each, with ST6 and Genstar Capital, a private equity firm that invested in 2019, remaining as minority shareholders. APEO has direct exposure to insightsoftware through a

co-investment made in August 2021 for £7.1m. HgCapital and TA Associates, who have worked alongside each other on similar deals in the past, are looking to expand insightsoftware both through organic growth and further M&A. The majority of the company’s customers are currently in the US, but Europe and Asia are seen as key target markets. In its most recent interim results presentation, APEO said that insightsoftware was performing to plan.

Names that have moved out of APEO’s top 10 look through holdings

APEO has exposure to Photobox (www.photobox.co.uk) through its investment in Exponent Private Equity Partners III. Exponent acquired Photobox, a market leader in Europe’s personalised gifts space, alongside Electra, for around £400m in 2015. The company has grown considerably in recent years and weathered the pandemic well. It previously owned Moonpig, having purchased it from its founder for £42m in 2011, but the two were split into separate businesses in 2019 and Moonpig/Greetz subsequently listed on the LSE in January 2021.

In August 2021, Photobox sold its UK printing facility, located in London, to The Precision Proco Group, which reflected a trend of increasing consolidation among the vertically integrated photo companies. This has continued with the merger in January 2022 between albelli (owned by Gilde Buy Out Partners) and Photobox, with the aim of create a leading player in the online European Photo Product and Gifting market. Gilde and Exponent have retained ownership of the combined business alongside both management teams.

Itiviti Group (www.itiviti.com) is a Swedish software company that describes itself as offering world-class electronic trading platforms and connectivity solutions, that enable sell-sides and buy-sides to seize opportunities faster. The company, which was previously owned by Nordic Capital VII, was sold to a trade buyer, Broadridge Financial Solutions, in May 2021. The transaction, which valued Itiviti at €2.14bn, was one of a number of full exits during the last financial year that underpinned the uplift in APEO’s valuation during the year. Nordic Capital created in 2015 by combining Orc Group, which it acquired in 2012, with its 2015 investment in CameronTec Intressenter. Further companies were bolted on, including Ulink, which was acquired in 2017 from HgCapital. The sale earned Nordic Capital a 6.4x return on its investment.

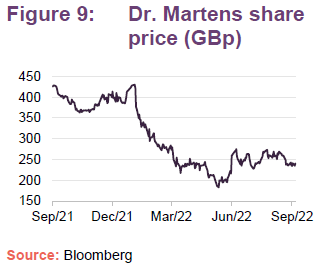

APEO has exposure to Dr. Martens (www.drmartens.com/uk) through its holding in Permira V. As we have previously discussed, Permira – which is focused on four key sectors (technology, consumer, services and healthcare) – has sought to unlock value in Europe’s footwear and apparel industry, with companies such as the UK’s Dr. Martens and Italy’s Golden Goose (Golden Goose was acquired for €1.3bn in early 2020, while the fund made its initial investment in Dr. Martens in 2017).

Dr. Martens has been a very successful investment for Permira. The company was listed on the London Stock Exchange, in January 2021, with a market capitalisation on admission of £3.7bn (as at 6 September 2022, it had a market cap of £2.4bn).

As we have previously discussed, Dr Martens has developed a strong following amongst celebrities for its products and has doubled its operating margins to more than 25% since 2019, significantly increasing the value ascribed to the holding. In its full-year results, which were published in June, the company reported an increase in its gross margin by 2.8 percentage points to 63.7%, driven by direct-to-consumer offering (DTC revenue share was up to 49%). Dr Martens benefitted from strong performances in the Americas and Europe, the Middle East and Africa (EMEA), with reported revenue up 29% and 19% respectively, although Asia-Pacific (APAC), its smallest region, was heavily impacted by ongoing COVID-19 restrictions and saw revenue fall 10% to £127.1m.

Having paid its maiden dividend of 1.22p in February 2022, Dr Martens paid a final of 4.28p in July, bringing the total dividend for the year to 5.5p per share. This is a dividend yield of 2.3% on its share price of 240.60p as at 6 September 2022. In its strategic highlights, the company said that it envisages further pricing headroom as it continues to invest in its brand and product proposition. APEO’s exposure to

Dr Martens was reduced in January 2022 when Permira sold 65m shares in a secondary placing, at 395p per share, raising gross proceeds of £257m. The January sale price was above the IPO price of 370p per share and markedly above the current share price. Following the placing, Permira still owns 46.4% of

Dr Martens’ issued share capital.

Adenza (adenza.com – formerly Calypso Technology) provides trading, treasury, risk management and regulatory compliance software to the full spectrum of financial institutions. Its solutions, which are written entirely in Java and serve front, middle and back-office applications, are designed to help its customers streamline their operations. The company was acquired by Bridgepoint and Summit Partners in June 2016 and APEO had exposure to Calypso through its investment in Bridgepoint Europe V. In July 2021, the company was sold to Thoma Bravo, reportedly for $3.75bn, generating a 6.5x money multiple and a 48% IRR.

Intrum (www.intrum.com) describes itself as Europe’s largest credit management services company. Headquartered in Stockholm, Sweden, Intrum has a presence in 24 European markets plus Brazil and purchases unpaid loan, credit card, store card and other debts from banks, credit card companies, retailers, and utility & telecom providers and then works to collect these debts. It also collects debts on behalf of other lenders and goods and service-providers. APEO has exposure to Intrum through its investment in Nordic Capital VIII.

In 2014, Nordic Capital acquired the majority of Lindorff, a full-service European credit management service provider, with the ambition to grow the company to become a global player in its industry. In November 2016, Stockholm-listed Intrum Justitia and Lindorff announced their intention to merge. The transaction completing in June 2017 and made Nordica Capital the largest shareholder in the combined entity with around 45% of the company’s then issued share capital. In January 2021, Nordic Capital sold 10m Intrum shares through a secondary placing. This raised SEK2.72bn (around US$330m) and reduced Nordic Capital stake in Intrum to around 39% of its issued share capital.

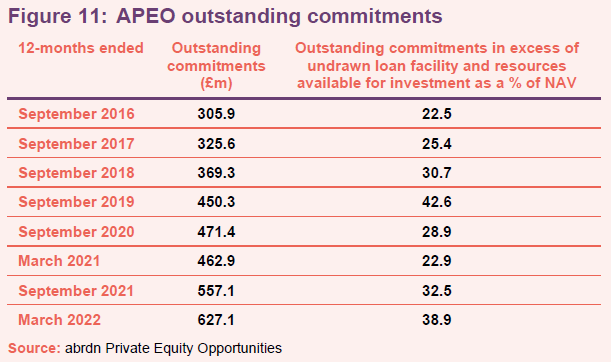

Commitment levels – plenty of room for more commitment

As is illustrated in Figure 11, during the year to 31 March 2022, APEO’s over-commitment ratio moved from being below its long-term target range of 30% to 75% to being within, but towards the bottom end of this range, allowing plenty of room to make more commitments. However, the trend of net deployment continued so that, as at 31 May 2022, APEO had total outstanding commitments of £664.6m, including an estimated £56.4m unlikely to be drawn. This equates to an over-commitment ratio of 44% (this being the value of APEO’s outstanding commitments that were in excess of its liquid assets, as a percentage of net assets), which is higher than at the interim stage, but still at the lower-mid end of its long-term target range.

In its interim results for the previous year (for the six months ended 31 March 2021), APEO said that its particularly low over-commitment ratio was expected to be a short-term phenomenon, with new investment activity likely to drive an increase in the second half of that financial year. This has come to pass with the trend continuing into the current financial year. Nonetheless, there is plenty of room for APEO’s manager to expand its commitment levels and for these to remain within the trust’s long-term range.

During the year ended 30 September 2021, APEO made new commitments totalling £307.1m (2020: £140.0m). This comprised: £175.7m invested in eight new primary funds, £54.5m invested in two secondary transactions and £76.9m invested in 10 co-investments. Most of these new investments have a technology or healthcare focus and so are expected to increase APEO’s exposure to these sectors over time. Against this significant level of new commitments, APEO also had a record year in terms of realisations receiving distributions of £187.7m (2020: £140.7m), which the manager says reflected a relatively quick return to private equity deal-making and exits once the initial impacts of the global pandemic were overcome.

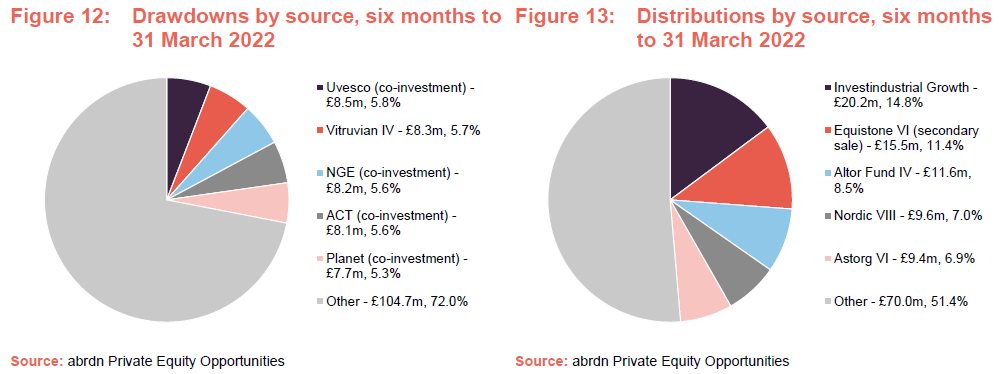

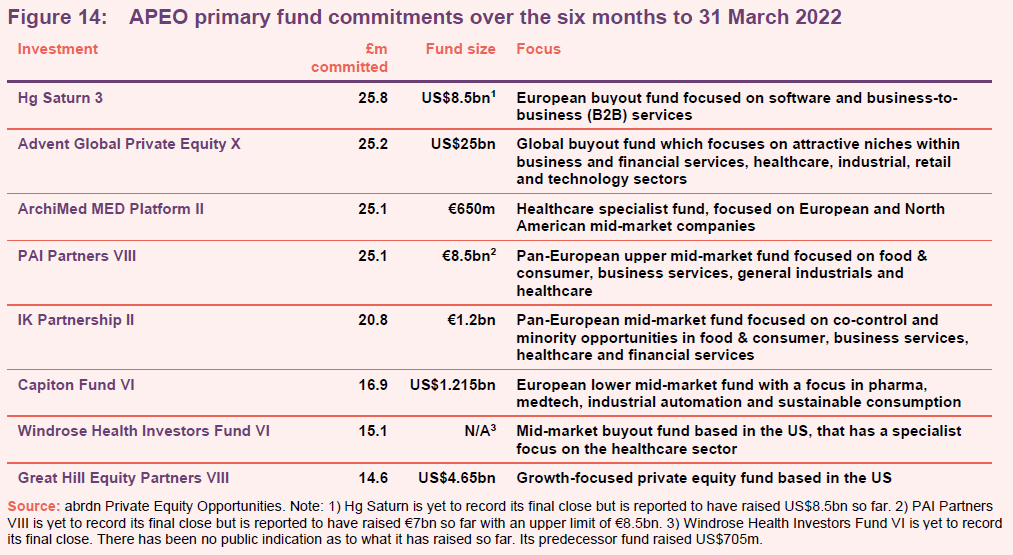

The strong trend of deployment has continued into the current financial year with APEO making commitments totalling £239.7m in the first half (31 March 2021: £88.4m), which is broken down in further detail below. £168.6m was committed to eight new primary investments, £65.8m was invested/committed into nine new co-investments, one follow-on investment of £0.3m was made into an existing co-investment and £5.1m was invested into one new secondary investment.

During the first half, £145.5m was invested into both new and existing positions. Drawdowns were primarily used to gain exposure to European-headquartered companies. Notable new investments included:

- Uvesco (co-investment) – food retail operator in the North of Spain;

- Medison Pharma Group (Vitruvian Fund IV) – global pharmaceutical company focused on highly innovative therapies;

- NGE (co-investment) – independent player in the construction and public works sector in France;

- ACT (co-investment) – largest specialist intermediary in the environmental certification market globally (see page 13); and

- Planet (co-investment) – provider of integrated digital payment services.

During the first half of the current financial year, APEO received distributions of £120.6m (31 March 2021: £92.7m) and made secondary sales equating to £15.7m (31 March 2021: £nil). The gross realised return from divestments in APEO’s portfolio equated to 2.2 times cost (31 March 2021: 2.6 times).

As we have discussed previously, the opportunity set for secondary market activity, tends to be opportunistic by nature and activity was muted during the first half of the current financial year (as noted above, there was just the one new secondary investment). However, despite this lull, APEO’s manager is confident on the outlook for secondaries. It says that there has been a massive amount of new capital has flowed into private equity in recent years and there have also been some dramatic shifts recently in the shape of investor portfolios. Consequently, it suggests that it is almost inevitable that institutional investors will look to rebalance their asset allocations and portfolio weightings over the coming quarters, which it expects to drive activity in the secondary market.

Co-investments – edging towards its 25% maximum allocation

During the last financial year, APEO significantly expanded its allocation to

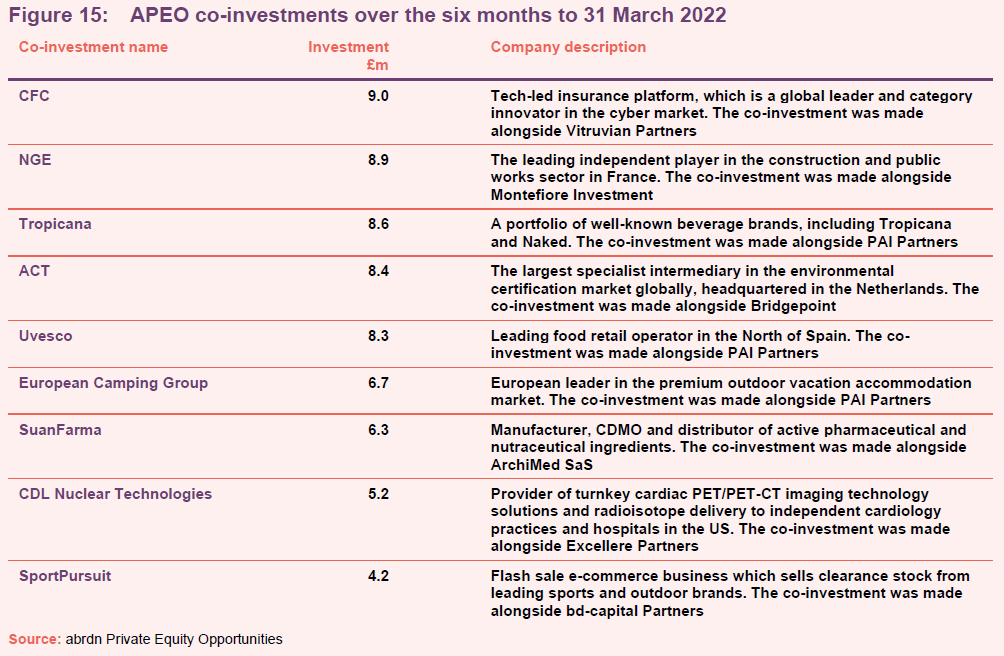

co-investments and the trend has continued into the current financial year. APEO committed £65.8m to nine new co-investments, which has increased the number of co-investments in the portfolio to 22. The proportion of co-investments in the portfolio at the half-year stage stood at 17%, up from 11% at the last financial year end, and the board of APEO increased its limit on co-investments to 25% from 20% as a result. A breakdown of the co-investments made in the first half is provided in Figure 15.

The manager notes that its co-investment pipeline remains strong and so we may see the co-investment allocation continue to expand.

As we have previously discussed, co-investing carries advantages, such as greater control over the deployment of capital and lower costs compared to the fee levels and carried interest associated with the primary fund allocation model.

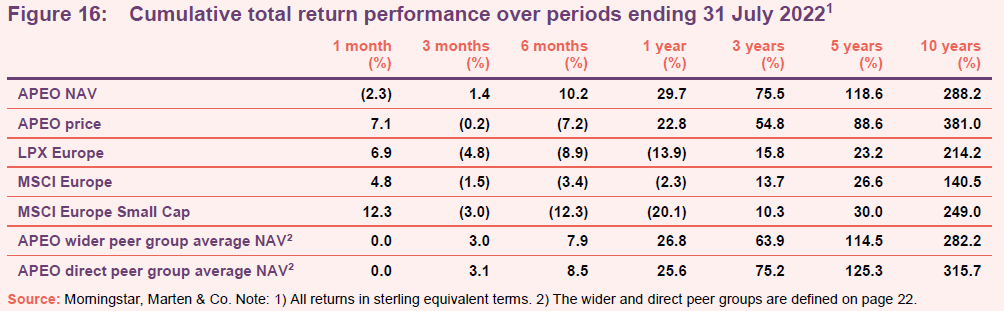

Performance

The widening of APEO’s discount that has occurred since the beginning of 2022 is reflected in the stark differences between APEO’s NAV and share price performances in six months and one-year periods, as illustrated in Figure 16. This share price underperformance during the last six months has inevitably led to some modest erosion of APEO’s long-term performance numbers but is less marked.

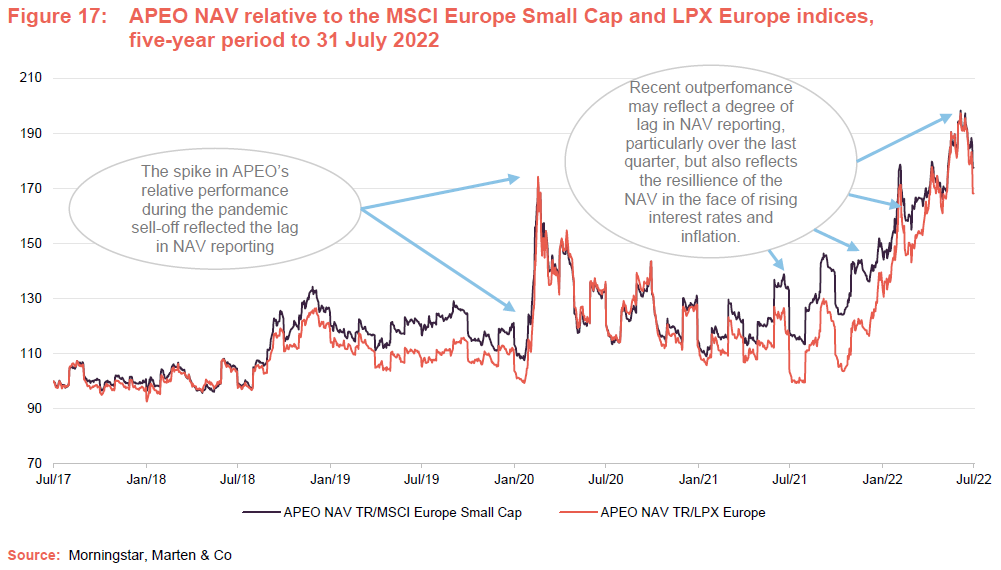

APEO’s last published NAV is as at 31 July 2022 (710.4p per share) and almost 100% of the underlying portfolio valuations in that NAV were as at 31 March 2022. Consequently, its NAV returns do not reflect the negative market moves over the second quarter of 2022 (the MSCI Europe and MSCI European Small Cap fell 6.9% and 13.0% respectively, while the UK market saw around a quarter shaved off its value) but, as discussed on page 4, APEO’s manager thinks that APEO’s portfolio is not focused on the more speculative growth companies that the market has rotated away from and so is not expecting to see a sharp hit to the NAV as the end June valuations of the underlying funds feed through to its NAV in future periods.

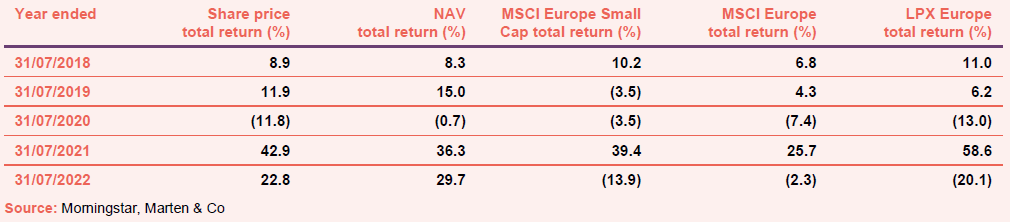

We continue to believe that, for a long-term strategy such as APEO’s, longer-term periods are more relevant in assessing its performance and it is noteworthy that APEO’s NAV and share price both outperform the LPX Europe, MSCI Europe and the MSCI Europe Small Cap over the three-, five- and 10-year periods (the LPX Europe is an index of listed private equity companies in Europe and its returns reflect the share price returns of those companies rather than NAV). Furthermore, APEO’s share price and NAV total returns have also outperformed those of its wider peer group, over all of the periods provided three months and above.

On an annualised basis, over the five years to 31 July 2022, APEO delivered total NAV and share price returns of 16.9% and 13.5%, respectively. Over the same period, the MSCI Europe, MSCI Europe Small Cap and LPX Europe provided annualised returns of 4.8%, 4.3% and 5.4% respectively.

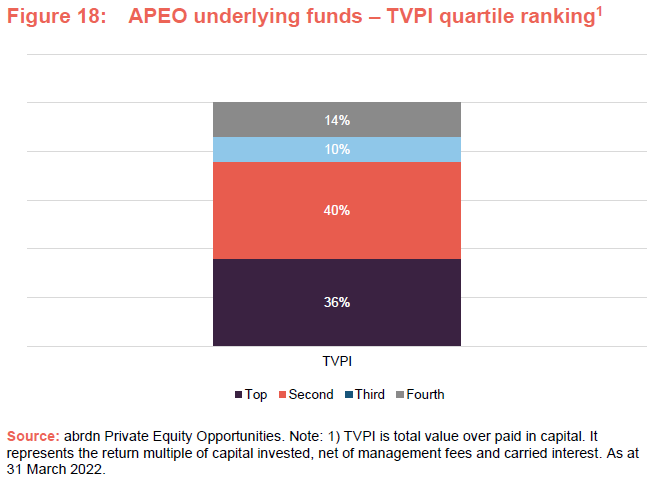

As illustrated in Figure 18, a key driver of APEO’s superior performance over the long term is the manager’s process for selecting investments – 76% of APEO’s investments lie within the top or second quartile from a total value to paid-in multiple (TVPI) perspective.

Interim results – six months to 31 March 2022

Over the six months to 31 March 2022, APEO delivered a NAV total return of 6.8% (2021: 14.9%; 2020: -6.3%) and a share price total return of 5.8% (2021: 38.8%). Realisations amounted to £120.6m (2021: £92.7m), which was well ahead of the manager’s forecast of £98.1m, and continues the trend of strong realisation from recent years (note: the year to 30 September 2021 saw £198.7m of realisations – the highest since APEO’s inception in 2001 – reflecting a relatively quick return to private equity deal-making once the initial impacts of the pandemic were overcome; 2020 saw realisations of £140.7m, the second-highest on record).

In addition to the £120.6m of distributions that APEO received during the six months to 31 March 2022, it also completed the sales of two fund positions, receiving a further £15.7m in proceeds, so that it received in aggregate £136.3m during first half of the current financial year.

Peer group

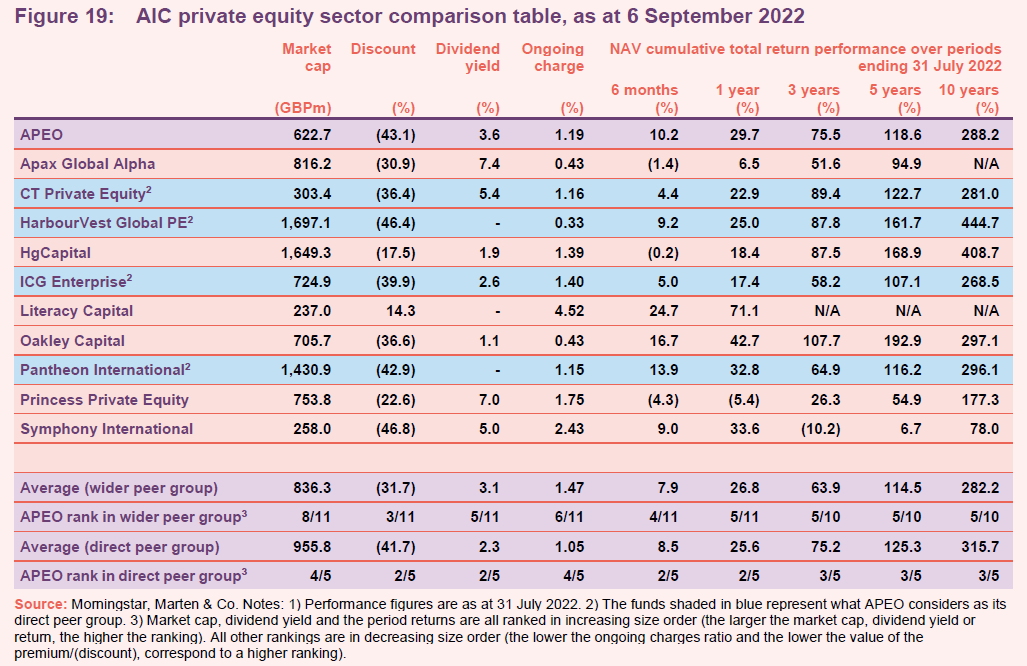

APEO is a member of the AIC’s private equity sector, which comprises some 19 members. Members will typically have over 80% of their assets invested in private equity/unquoted shares; and an investment objective/policy to invest in private equity or unquoted shares. For the purpose of this analysis, we have narrowed down the wider peer group to 11 funds illustrated in Figure 19. 3i Group is among those excluded, as it considers itself to be an asset manager and has investment interests extending beyond private equity. We have also excluded Dunedin Enterprise, EPE Special Opportunities, JPEL Private Equity, LMS Capital, Reconstruction Capital II and Seed Innovations Limited on size grounds, as all have market caps below £100m, making them less relevant comparators. In addition, Dunedin Enterprise and JPEL Private Equity are both in wind-down mode, which also reduces their usefulness as comparators.

As shown in Figure 19, we have also included rankings against a subset of fund of funds that APEO considers to be its direct peer group: CT Private Equity (formerly BMO Private Equity), HarbourVest Global Private Equity, ICG Enterprise and Pantheon International.

APEO ranks second, third and third, within its direct peer group, over the six-month, one-year and three-year periods to 31 July 2022. However, given that APEO’s – and indeed the wider sector’s – strategies are inherently longer-term, and APEO’s indefinite life structure, we think that the longer-term periods (five- and 10-year) provide the best basis for comparison. Here, APEO was the second- and second-best performer (out of five) on a total NAV return basis. Longer time periods provide a more accurate representation of the realised returns generated, although, as noted below, APEO’s discount has widened and so its share price performance has not reflected the underlying NAV performance during the past six months. Interestingly, while APEO has modestly underperformed the direct peer group averages over the five- and 10-year periods, it has outperformed the averages for the wider peer group.

As at 6 September 2022, APEO’s discount was 43.1% (based on Morningstar’s NAV estimate), which is modestly wider than the average of its direct peer group, and considerably wider than the average of its wider peer group. As discussed in further detail on pages 25 to 27, APEO’s discount, and that of the wider private equity peer group, are wide relative to their own histories.

With the obvious exception of the non-dividend payers, most of the listed private equity funds have seen some yield expansion recently as share prices have fallen relative to NAV and discounts have opened up. We note that at 3.6%, APEO’s trailing dividend yield remains above the averages of both its wider and direct peer groups.

APEO’s ongoing charges ratio of 1.19% is below the average of its direct peer group, despite being smaller than the peer group average. APEO’s ongoing charges ratio is above the average of its direct peer group but is nonetheless competitive and the differential in part reflects that APEO is below the average size of the direct peer group. We note that APEO, unlike most of its direct peer group, does not charge a performance fee at the fund level, on top of fees paid out to third-party managers. Interestingly, APEO’s ongoing charges are lower than some funds that are more than twice its size, in market cap terms.

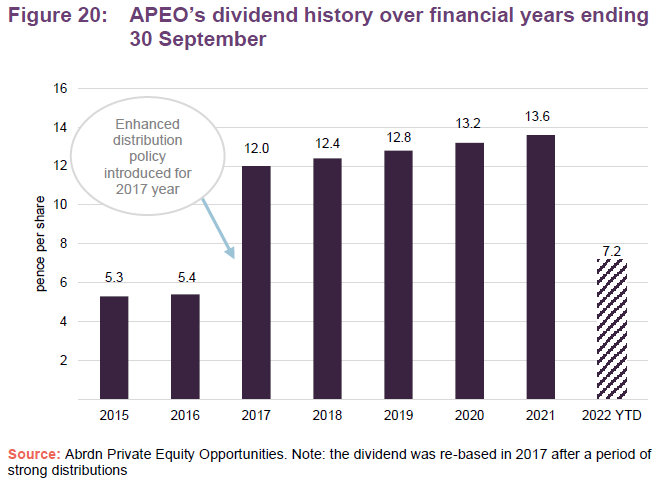

Dividend – 5.9% increase in quarterly dividend

APEO paid a total dividend of 13.6p per share for the year to 30 September 2021, which represented a 3.0% increase on the previous financial year (2020: 13.2p per share). The first and second dividends for the current financial year have been declared at 3.6p per share (versus 3.4p per share for the prior financial year), which represents a 5.9% increase in the quarterly dividend rate year-on year. Assuming that APEO maintains its quarterly dividend at 3.6p per share for the third and fourth quarters of the current financial year, this suggests a total dividend of 14.4p per share, which is a yield of 3.6% on APEO’s share price of 405p per share as at

6 September 2022.

APEO’s dividend policy sets it apart from its peers

As we have previously discussed, many of APEO’s peers do not pay a dividend and so its dividend policy sets it apart from its peers. For a given financial year, the first interim dividend is paid in April with the second and third payments made in July and October. The fourth payment remains a final dividend and will be paid in January following shareholder approval at the AGM. Ex-dividend dates and record dates occur the month prior to payment. The fund has historically aimed to retain the real, inflation-adjusted, value of the total annual distribution.

As illustrated in Figure 20, APEO’s dividend was reset to a higher level for the 2017 year, when its enhanced distribution policy was introduced. This feature has been well received by the market, which was reflected in a tighter discount following its announcement. Over the longer term, the manager expects that approximately 50% of the dividend will be covered by current year revenue, although the level of coverage will vary from year to year. The rest will be paid out of capital. It is noteworthy that APEO has a relatively mature portfolio and so generates relatively high levels of cash.

Premium/(discount)

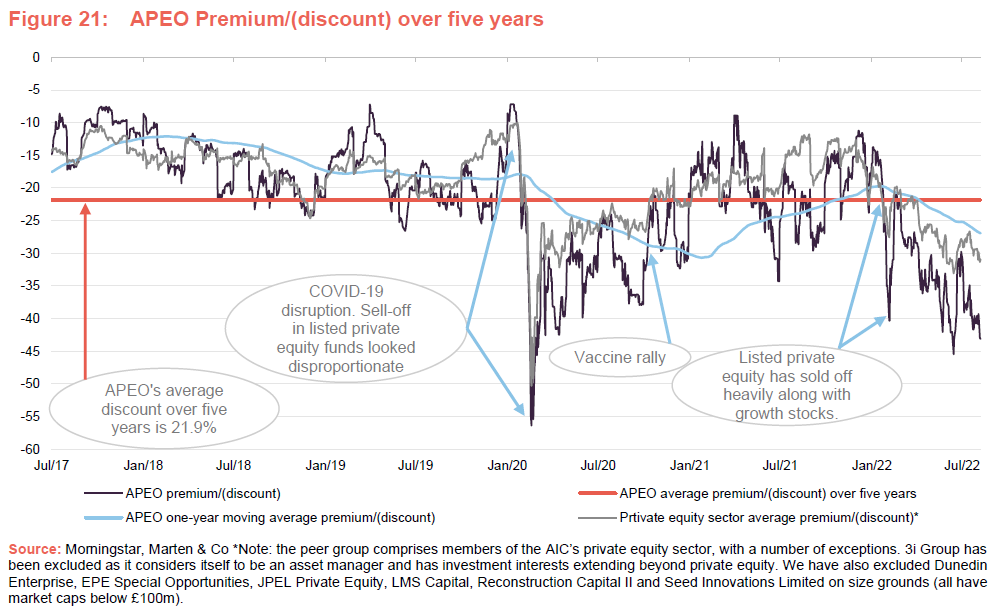

As we have discussed in previous notes, a combination of a strong NAV performance (driven by strong realisations) and a new dividend policy, revised investment policy and simplified fee structure (that were announced in late 2016), along with increased efforts to raise awareness of the trust with investors, led to APEO trading at a structurally tighter discount by the middle of 2017. Aided by an ongoing environment of strong realisations and increased investor relations resource following the merger of Standard Life Investments and Aberdeen Asset Management, the trend towards a tighter discount persisted until the COVID-related market collapse in March 2020, which saw a sharp sell-off in listed private equity, as illustrated in Figure 21.

In our September 2021 note, we commented that the sell-off in listed private equity fund of funds appeared disproportionately steep in the period from the middle of 2020 onwards, when it became increasingly apparent that the underlying companies were going to be a lot more resilient than initially expected. We concluded that, factoring this in, along with some of the lessons learnt from the 2008 financial crisis (including underlying companies building in significantly more covenant-lite debt facilities and a greater proportion of equity into balance sheets, as well as the diversification benefit embedded into the private equity asset class) meant that mid-2020 was a historically attractive entry point. It would appear that the current sell-off of listed private equity, over concerns of an increasing risk of recession, is providing a similarly attractive entry point.

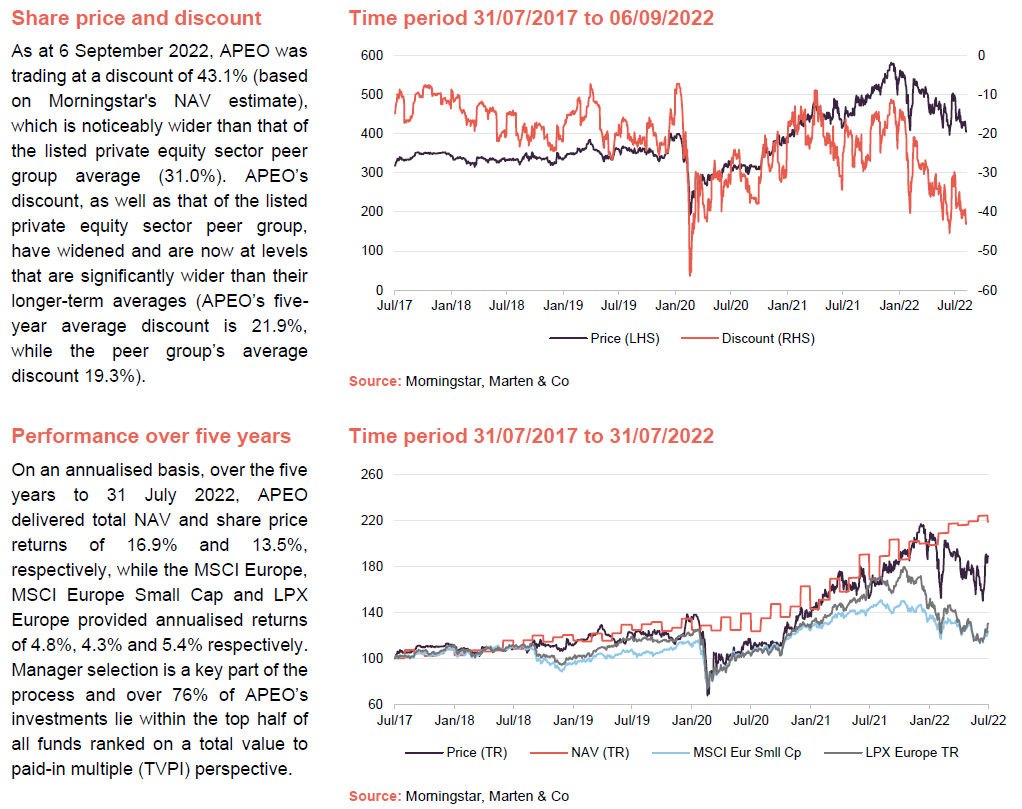

Current discount significantly wider than long-term averages

As at 6 September 2022, APEO’s shares were trading at a discount of 43.1% (based on Morningstar’s NAV estimate) and a 43.0% discount to APEO’s last published NAV as at 31 July 2022. APEO’s discount is noticeably wider than that of the listed private equity sector peer group average, which stood at 31.0% as at 6 September 2022. As is illustrated in Figure 21, APEO’s discount, as well as that of the listed private equity sector peer group, have widened and are now at levels that are significantly wider than their longer-term averages (APEO’s five-year average discount is 21.9%, while the peer group’s average discount 19.3%). APEO’s one- and three-year averages are 27.0% and 25.9% respectively, suggesting that the current discount offers an attractive entry point over most sensible time frames.

As illustrated in Figure 21, despite have a significant allocation to funds, which should offer additional diversification versus a fund focused solely on direct investments, APEO’s discount has, during widening phases, tended to widen at a faster pace than the private equity peer group. Similarly, during narrowing phases, it has tended to outpace the peer group. Given the discount level and pace of recent widening, it seems reasonable that there could be significant upside to APEO’s current discount both if outcomes prove to be less negative than the market is currently pricing in, or sentiment improves towards listed private equity more generally.

As noted above, listed private equity is much more than the traditional growth exposures (for example technology and healthcare) whose profitability is weighted to the future. Private equity companies tend to be much more mature and cash-generative and therefore should be more resilient in the face of a slowdown and, in some cases, strengthened by this where they are able to increase their market share.

Current discount leaves considerable headroom for NAV adjustment

As stated on pages 7 and 8, the market may be taking a view that APEO’s discount is potentially overstated given the setbacks in listed equity markets since the end of March 2022 (the valuation date for most portfolios in APEO’s end-May NAV). However, as we have discussed previously, private equity funds tend to value their holdings conservatively so that there is almost always a valuation uplift when there is a realisation event. We think that this continues to be the case and that the current high discount leaves a considerable amount of headroom that is unwarranted, given the limited risk to the NAV. APEO’s manager observes that the average value uplift upon exit has been more than 20% above the carrying value two quarters prior, and this level of uplift has persisted since 2010.

Repurchases permitted but board tends to preserve cash for investing

APEO retains the authority to repurchase up to 14.99% of its issued share capital, which is renewed annually. However, the board’s policy is generally to preserve cash for investment purposes and the trust has not repurchased any shares since August 2016.

Fund profile – underlying focus on primary commitments and Europe

APEO invests in what it deems ‘best-in-class private equity funds’; predominantly by making primary commitments, with a core focus on the European mid-market. The aim is to maintain a broadly diversified portfolio by country, industry sector, maturity, and the number of underlying investments.

Historically, APEO has been a fund of funds, making both primary and secondary investments. In January 2019, shareholders approved changes to the investment objective and policy to allow for co-investments (see pages 2 and 3 of our May 2019 note for more details) and the last 12 months has seen considerable growth in this area. As at 30 June 2022, APEO had 22 co-investments, up from five a year prior (see page 19 of this note).

APEO’s objective is to hold around 50 ’active’ private equity fund investments. This allows for a greater diversification within the funds element, which counter-balances the additional concentration risk from the increasing allocation to co-investments (which is permitted to account for up to 20% of NAV).

Previously, APEO previously made fund commitments in the £40m–£50m range, but this has reduced over time and £20m–£30m will be a more typical range going forward.

Previously, APEO’s name was Standard Life Private Equity Trust Plc (ticker: SLPE) but, following shareholder approval at its AGM on 22 March 2022, the trust adopted its current name with effect from 1 April 2022 and its ticker became APEO at the same time. The name change was undertaken to align the trust with its manager’s new brand.

abrdn Plc has £14bn of private equity assets under management

APEO’s AIFM is abrdn Capital Partners LLP (formerly SL capital Partners LLP), which is a wholly-owned subsidiary of abrdn Plc. As a group, abrdn Plc, managed £464bn of assets (as at 31 December 2021) across 80 countries. abrdn Plc is one of the top 10 largest private market asset managers globally by assets under management (AUM), with a team of more than 100 professionals focused on private markets. Within private equity specifically, abrdn Plc managed £14bn of assets, as at 31 December 2021.

APEO – now a FTSE 250 constituent

In March 2022, APEO was included in the FTSE 250 index for the first time and was deleted from the FTSE Small Cap Index. This followed a period of sustained growth in market cap (driven by growth in APEO’s NAV). APEO had been on the cusp of inclusion for some time, but was promoted following the removal of a number of companies with Russian interests that had suffered from difficult trading in the aftermath of Russia’s invasion of Ukraine.

Previous publications

Readers interested in further information about APEO may wish to read our previous notes (details are provided below). You can read the notes by clicking on the links below.

Sitting in a sweet spot, Initiation, published 10 May 2016

Reinvestment phase underway, Update, published 14 September 2016

Dividend doubled to 4.0%, Update 22 February 2017

Loading the portfolio, Update, published 3 July 2017

A good year; more to come?, Update, published 8 December 2017

Putting capital to work, Annual overview, published 17 July 2018

Now with co-investments, Update, published 29 May 2019

Share price out of sync?, Update, published 15 July 2019

Proving its mettle, Annual overview, published 16 September 2021

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on abrdn Private Equity Opportunities Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication.

Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.