A trust for all seasons

Alliance Trust (ATST) underwent a major overhaul three and a half years ago, refocusing on its global equity portfolio. Non-core parts of the company have been sold and overheads slashed. Today, the trust’s assets are managed by what the manager believes are nine of the world’s best stock pickers. Investing sustainably is a strong theme within the fund, but the manager, Willis Towers Watson, seeks to blend managers with different styles so that the trust should not be beholden to any particular fashion in markets.

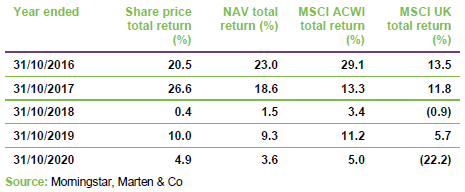

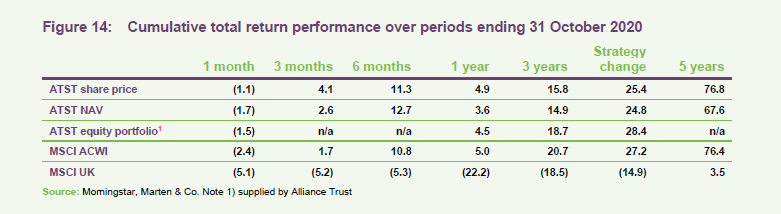

While the new approach has outperformed the trust’s benchmark since the strategy change, ATST has not matched its benchmark over 2020. We examine what might be behind that on pages 13 and 14. The manager remains convinced that the approach will continue to deliver outperformance in the long run. In the meantime, the board is keen to maintain ATST’s 53-year track record of increasing dividends each year, and the trust has substantial revenue reserves available.

Global, high conviction, stock-picking portfolio

Alliance Trust aims to be a core equity holding for investors that delivers a real return over the long term through a combination of capital growth and a rising dividend. The company invests primarily in global equities across a wide range of industries and sectors. The investment manager has appointed a number of stock pickers with different styles, who each ignore the benchmark and only buy a small number of stocks in which they have strong conviction.

Fund profile

Alliance Trust (ATST) aims to be a core equity holding for investors that delivers a real return over the long term, through a combination of capital growth and a rising dividend. The company invests primarily in global equities across a wide range of industries and sectors. The investment manager, Willis Towers Watson (WTW), has appointed a number of stock pickers with different styles, who each ignore the benchmark and only buy a small number of (around 20) stocks in which they have strong conviction. For performance measurement purposes, the trust is benchmarked against the MSCI All Countries World Index in sterling terms (MSCI ACWI). The board also monitors ATST’s returns relative to similar investment companies.

A bit of history

ATST has a long history dating back to 1888. It is an AIC Dividend Hero, having increased its dividend in each of its last 53 financial years. The trust merged with its sister trust, Second Alliance Trust in 2006.

By 2015, ATST was a self-managed trust, with a number of executive directors. Its investment approach had evolved over the years and the trust was investing in a range of different asset classes, including private equity and property. It also owned a trading platform, Alliance Trust Savings. Despite moves to improve its offering and to educate the market, ATST continued to trade on a stubborn double-digit discount. This led to an activist investor taking a stake in the trust and agitating for change. The board undertook a review and decided that, in the interests of all shareholders, the investment approach should be simplified with a focus solely on global equities, the trust should move from being self-managed to externally-managed and the various subsidiary businesses should be sold off.

A new approach

A new ‘manager of managers’ investment approach, described in more detail on page 5, was announced in late 2016 and adopted with effect from 1 April 2017. Alliance Trust Investments (the trust’s internal management company, which also ran 11 funds and had AUM ex-ATST of £2.5bn) was sold to Liontrust. WTW was appointed as the new external investment manager and, initially, eight new sub-managers were allocated portfolios. The process of discount control, described on page 17, was changed and the activist investor sold its stake, with the help of the company.

ATST’s legacy assets continued to distort its NAV returns for a while. However, almost all of the trust’s private equity investments had been sold by the end of 2019. The trust also had a portfolio of mineral rights in North America, the last of which was also sold in 2019.

Alliance Trust Savings proved to be a drag on performance until about a year ago, when it was sold to Interactive Investor Limited. This sale completed on 28 June 2019. The £40m consideration included the company’s office premises in Dundee.

Investment process – ‘manager of managers’

The investment approach can be summed up as that of a ‘manager of managers’. WTW allocates the trust’s capital to a number of separate specialist accounts, managed on a committed basis by what the manager believes are some of the world’s best stock pickers.

In adopting this style of investing, the board sought to avoid being beholden to the success of a single manager and the fashionability of a particular investment style. Instead, individual investors in ATST get to profit from the expertise of a range of managers, many of which they would not be able to access in any other way.

If poorly designed, this style of investing can result in over diversification and can be expensive, as fees are layered on fees. This is where WTW earns its keep. It has a substantial manager research team keeping track of managers across the globe. It manages over $148bn (as at the end of June 2020) of delegated assets, giving it the wherewithal to negotiate access to top-flight managers at attractive fee levels on behalf of ATST. A core part of its role is to manage ATST’s risk exposures.

20-stock portfolios

The underlying managers (described in more detail on pages 9 to 12) each run portfolios of up to 20 stocks, comprised of the managers’ best ideas. At the outset, ATST’s portfolio was divided between eight managers, running nine separate portfolios. A ninth manager/tenth portfolio was added last year. One portfolio is restricted to investing in emerging markets. The remainder are free-ranging, ‘go-anywhere’ funds. In WTW’s experience, this latter approach has a natural bias towards developed markets; the dedicated emerging markets portfolio helps redress this.

WTW looks for individuals with a long track record, across multiple investment cycles, usually established while working in large organisations. Commonly, these individuals will then set up on their own or move to a boutique.

It is important to WTW that the managers are in control of their own destinies – in other words, that they are not under pressure to grow assets under management or forced to fixate on short-term performance. The managers should invest with a long-term time horizon. Typically, their turnover will be in the 20% – 40% range per annum, equating to a two and a half-to-five-year holding period. The managers should think about risk in terms of permanent loss of capital rather than performance relative to benchmark indices.

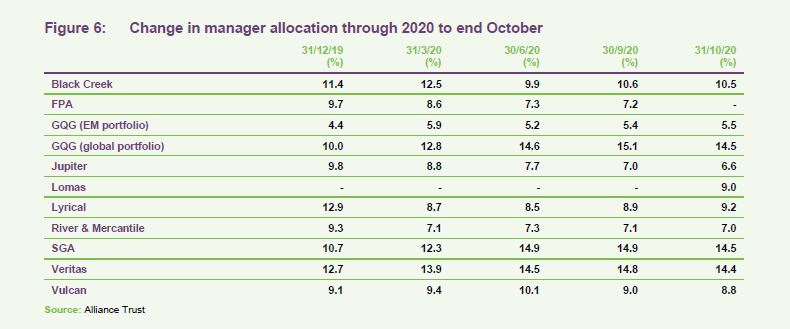

At any point, WTW will have a list of 20–30 managers that would be suitable for managing a part of ATST’s portfolio. However, they know that the managers want a long-term commitment from them and they get this. Initially, managers will be allocated between 7% and 14% of ATST’s portfolio. WTW will rebalance the overall portfolio fairly frequently, but managers will be evaluated over the long term and replaced relatively rarely.

The day-to-day role

Portfolio construction starts from a premise that each manager will provide the same risk-weighted exposure. A large part of WTW’s day-to-day role involves monitoring the portfolio’s risk exposures and keeping tabs on what the underlying managers are doing. WTW has quarterly update calls with all the managers, but this represents the bare minimum of contact. They are usually talking to them much more frequently.

Part of the role is to stress-test the managers’ assumptions, making sure that they are doing their job properly and not falling into behavioural traps, for example.

There is a low degree of overlap between the underlying portfolios. The nature of the approach means that the overall portfolio has a relatively high active share by comparison with the MSCI ACWI. However, WTW attempts to manage the beta within a fairly narrow (0.9–1.1) range.

A monthly investment committee reviews the portfolio’s factor risk exposures. The aim is to have a natural balance of risk, and the allocation to the underlying managers will be adjusted, if necessary. As an example, from a style point of view, two of the managers (Jupiter and River & Mercantile) have both a value and small-cap bias. The higher recent volatility of stocks within these areas means that the size of their portfolios is restricted.

The aim is to be style neutral. However, the portfolio will have a natural underweight to size and a small underweight exposure to the very largest ‘mega cap’ companies. Otherwise the trust should have a fairly neutral exposure to industries and regions relative to the MSCI ACWI.

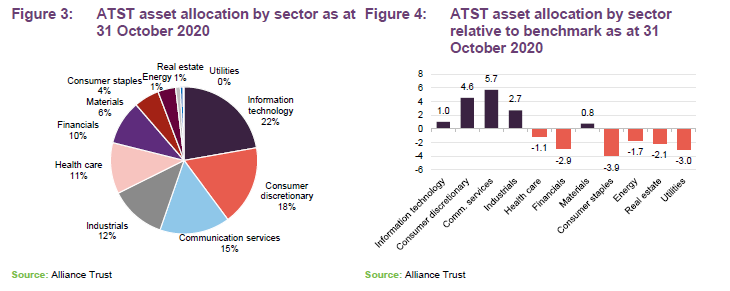

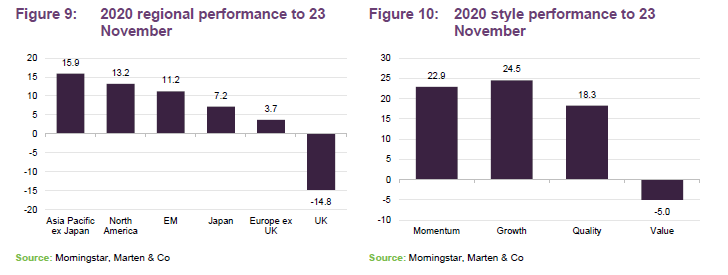

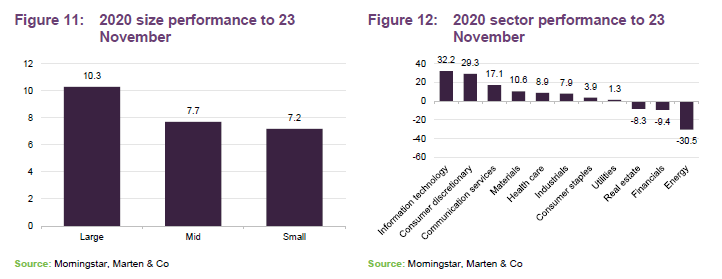

As is discussed on page 14, the size bias has had a negative allocation effect in recent years, reflecting a market where a narrow group of very large stocks is driving market returns.

Investing sustainably and responsibly

The board and manager have a strong view that sustainability themes can have real impacts on returns and risks. The effects of climate change and the policy responses to this threat are one example of this. As an illustration, China’s decision to target net zero carbon emissions by 2060 is likely to have significant consequences for many companies. The underlying managers are aware of the need to factor this into their decision-making. ATST’s portfolio has 39% lower carbon emissions per $1m invested than the MSCI ACWI (based on an analysis conducted as at 30 June 2020).

The board has not imposed any restrictions on the sectors that the managers can invest in, beyond an outright ban on holding companies that manufacture armaments made illegal under international law via the Inhuman Weapons Convention, and those weapons covered by standalone conventions.

ATST’s intent to reduce its exposure to risks associated with sustainability themes should mean that its portfolio exhibits lower climate-related risk than an index-tracking exchange traded fund (ETF) mirroring the MSCI ACWI.

ATST is not an activist fund, but the board and the manager take its stewardship responsibilities seriously. They believe that, by engaging with the companies in which ATST invests, the trust can contribute to their long-term success; help reduce the negative impacts that they may have on the environment and society; and manage downside risks.

In support of that objective, WTW has engaged EOS at Federated Hermes (EOS) to advise on voting the trust’s shareholdings. The underlying managers, who do the actual voting, do not have to follow EOS’s advice, but if they dissent, they must explain their reasoning. EOS has adopted the UN Principles for Responsible Investment, as have WTW and seven of Alliance Trust’s underlying managers. Alliance Trust discloses aggregated data on voting of the shares it holds and examples of engagement activity undertaken by EOS on its behalf.

EOS acts for many other investors and its combined might gives it more influence with companies. Over the third quarter of 2020, it engaged with 327 companies on 893 environmental, social, governance and business strategy issues and objectives.

Other practicalities

The board has set out some rules that must be adhered to.

- No single investment may exceed 10% of the trust’s total assets at the time of investment.

- Where market conditions permit, the trust will use gearing of not more than 30% of its net assets at any given time.

- The trust can use derivative instruments to hedge, enhance and protect positions, including currency exposures. However, in practice the manager makes no attempt to hedge currencies or markets.

- While the primary focus of the trust is investment in global equities, the trust may also invest from time to time in fixed interest securities, convertible securities and other assets.

Asset allocation

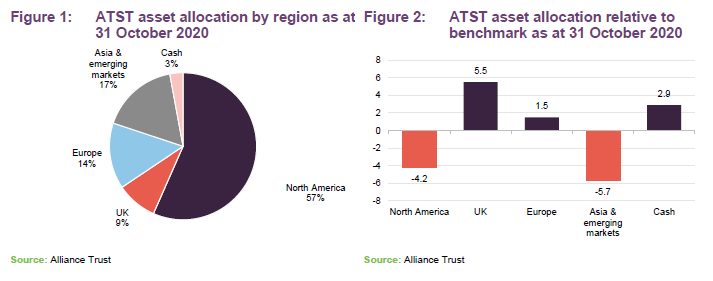

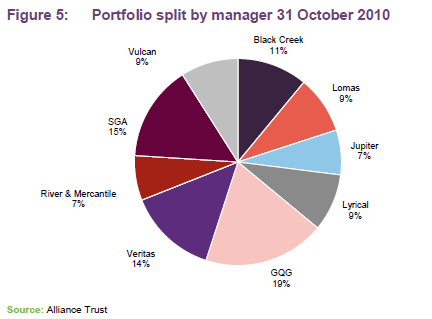

ATST’s asset allocation is driven largely by the stock selection decisions taken by the underlying managers. However, as we explained on page 5, WTW can adjust the portfolio’s exposures by reallocating money between the managers, if it feels that this is warranted.

Relative to the MSCI ACWI, at the end of October 2020 the portfolio had a bias to the UK and Europe and away from North America and Asia/emerging markets.

ATST’s portfolio has underweight exposures to some of the sectors that have been hit hardest by COVID-19, such as financials, energy and real estate and overweight exposure to some areas that seem to have been favoured by investors such as technology and consumer services.

The managers

The lead manager working on ATST’s portfolio is WTW’s CIO, Craig Baker. He chairs an investment committee otherwise comprised of Stuart Gray and Mark Davis. Between them, they have over 62 years of investment experience. They are backed up by a team of 109 global research associates (as at end 2019).

There are currently nine underlying managers. FPA was effectively replaced by Lomas Capital Management during October 2020, after the individuals responsible for managing ATST’s portfolio (Pierre Py, Greg Herr and their team) left FPA to set up Phaeacian Partners.

Black Creek

This portfolio is managed by Bill Kanko, founder and president of Black Creek Investment Management. He focuses on global leading businesses (typically ranked first or second in their niche), that are taking market share rather than resting on their laurels, and that are misunderstood or misinterpreted by the market. The approach is essentially a contrarian one – buying stocks that are out of favour. Fundamental analysis, taking a long-term (five-to-10-year) view, and extensive due diligence have a central role in the investment process.

GQG

Rajiv Jain runs both a global portfolio and ATST’s dedicated emerging markets portfolio. Rajiv founded GQG Partners in June 2016 and is its chief investment officer. GQG is named for global quality growth, which sums up what he is looking for in an investment. Quality is represented by factors such as strong balance sheets, businesses with high barriers to entry, and good management aligned with investors. Value is assessed based on long-term earnings potential. An analysis of the macroeconomic situation helps inform this. Rajiv acknowledges that there are periods where a focus on quality will mean that you lag markets – notably in exuberant markets where investors favour riskier investments.

Jupiter

Jupiter Asset Management’s Ben Whitmore may be one of the managers who is more familiar to UK-based investors. He has been working at Jupiter since 2006, following a long spell at Schroders. He adopts a contrarian value approach to managing money but the companies that he invests in should also have prominent franchises, sound balance sheets and be cash generative. Stocks are screened based on their long-run (10-year) average earnings and also on the returns that they generate on their operating assets. Although he is running a high-conviction portfolio, Ben is conscious that he wants to end up with a diverse set of stocks.

Lomas

Lomas Capital Management is the newest of ATST’s managers, having been awarded a portfolio in October 2020. Dan Lascano and Ronald McIntosh are the lead managers on ATST’s portfolio. They look for big themes within industries, often focused on changes or trends at the company or industry level, and then select stocks that best represent those themes. They would not classify themselves as either growth or value investors. WTW believes that Lomas’s style will mean that its portfolio has a relatively low correlation with those of other managers.

Lyrical

The portfolio managed by Lyrical Asset Management is overseen by Andrew Wellington. They are fundamental value investors, looking to buy businesses at a discount to their true value. They screen the 1,000 largest US stocks using a range of value measures and then undertake more intensive research on those that pass the screen. They favour companies with good returns on invested capital and avoid overly complex businesses. Lyrical say that the breadth of opportunities available to them is quite narrow and so they are ideally suited to running concentrated portfolios.

River & Mercantile

The lead manager on the River & Mercantile portfolio is its CIO, Hugh Sergeant. He is looking to invest in recovery situations using a PVT approach, where PVT stands for potential, value and timing. These are companies with the potential to grow, that are valued cheaply relative to their intrinsic value and where the timing is right in that the manager can see a path to that valuation gap being closed.

The universe is screened to identify likely candidates and then more detailed work is done to verify the results of that screen.

SGA

Sustainable Growth Advisers (SGA) was founded in 2003 by George Fraise, Gordon Marchand and Rob Rohn. They are looking for high-quality companies that also have strong growth. These companies have pricing power and predictable, recurring revenues. They then determine whether these stocks are trading at attractive valuations before making an investment.

Veritas

Andy Headley is the head of global strategies at Veritas Asset Management and the lead manager on this part of ATST’s portfolio. He is looking for companies that have long-term sustainable advantages that enable them to grow their cash flows over long periods of time. These stocks often grow steadily rather than in bursts and these steady-growth companies perform well when markets are nervous or falling. They look out for recovery situations as these present opportunities to buy stocks cheaply. They first seek to identify quality businesses, then they evaluate whether the stock is attractively valued. They are prepared to sit on cash until the right opportunity presents itself.

Vulcan

The lead manager on Vulcan’s portfolio is C.T. Fitzpatrick, the CIO at Vulcan Value Partners. Mostly focused on large-cap stocks, they look for companies where they believe there is a margin of safety between the value the market is attributing to the company and its intrinsic value. These companies tend to have strong balance sheets and high levels of recurring cash flow – making them easier to value in their opinion. They are contrarian investors and are used to running very concentrated portfolios, typically around 14 stocks, believing that the opportunity set is limited, and it is not worth compromising on their investment criteria to achieve a more diversified portfolio. They are also patient, long-term investors, with a time horizon of at least five years. The approach is to identify companies that they would like to own and then wait for a value opportunity to present itself.

Top 10 holdings

In a portfolio where every stock is a best idea, an analysis of the top 10 holdings is arguably less insightful than it would be for most other trusts. Readers will be familiar with most of the stocks in the top 10. Baidu is a leading search engine in China (the equivalent of Google). Its share price has been depressed since it lost market share to ByteDance (owners of TikTok and its Chinese equivalent Douyin). It has also been investing heavily in areas such as artificial intelligence and self-driving electric vehicles, which is depressing profits in the short-term.

Market background

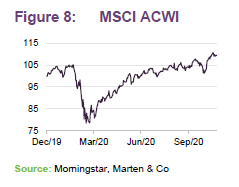

COVID-19 has been the dominant factor affecting markets this year. Panic took hold in February and March, but central banks and governments acted swiftly to reassure investors, and confidence began to return. Whilst nowhere escaped unscathed by the economic effects of the virus, China and some other Asian countries appear to have handled the pandemic well, and their economies are generally recovering. By contrast, the US, Europe and Latin America have been hit hard, and in many cases are now in the throes of a second wave. Lockdowns have taken their toll on businesses and jobs, interest rates have been slashed and substantial fiscal stimulus injected into economies. Inflation remains subdued in most developed markets.

Against this backdrop, investors have generally favoured large-cap companies. Value has suffered relative to growth as investors have sought companies that can thrive despite or even because of the situation. Technology, communications and healthcare companies have been strong beneficiaries. Businesses exposed to energy, physical retail, leisure and travel have been hit hard.

Performance

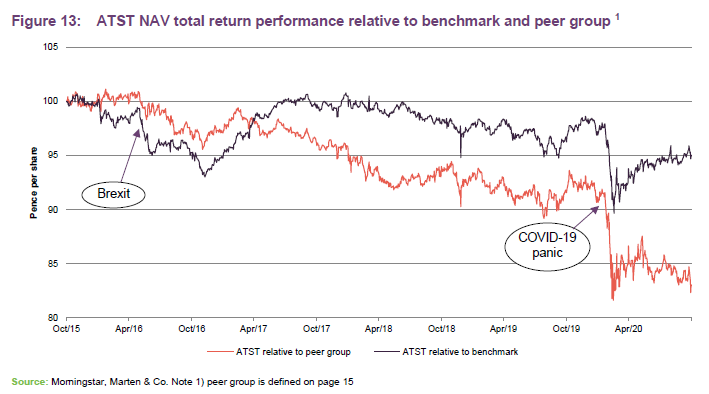

ATST has an overweight exposure to the UK relative to the MSCI ACWI and some of its peers. This has weighed on performance, as since the run-up to the Brexit vote in 2016, the UK has been one of the world’s worst-performing markets. The shift downwards in ATST’s relative performance this year, in particular following the outbreak of COVID-19, may reflect the market’s narrow focus on fairly few, large-growth stocks. Some of ATST’s peers have a sizeable bias to these growth stocks.

From the date of the strategy change up to the close of business on 31 October 2020, ATST’s new equity portfolio outperformed the benchmark by 1.2 percentage points.

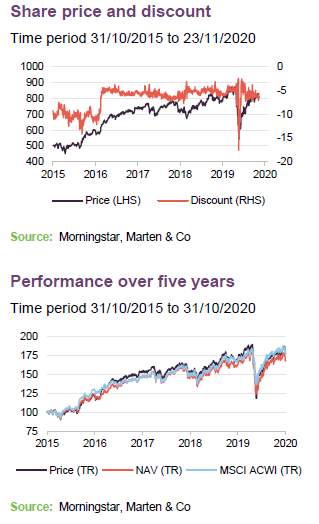

Looking at ATST’s share price returns, as we explain on page 17, ATST’s discount narrowed after the board announced the shift to the new approach and a new discount control mechanism. Since then, the discount has been fairly stable.

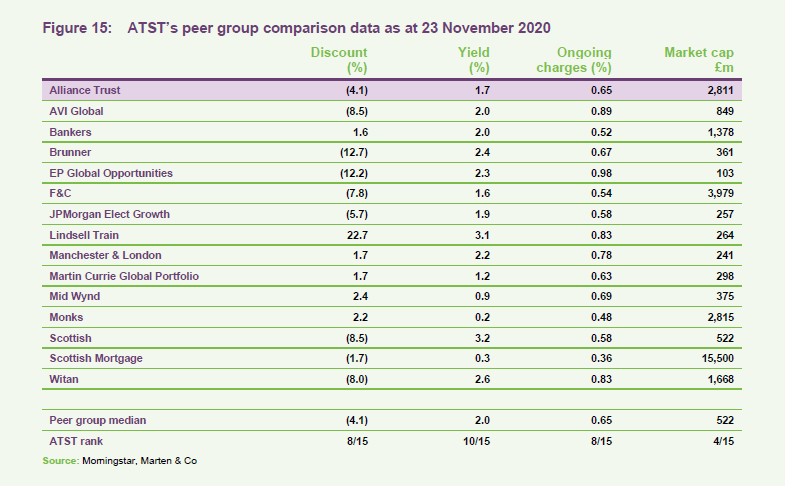

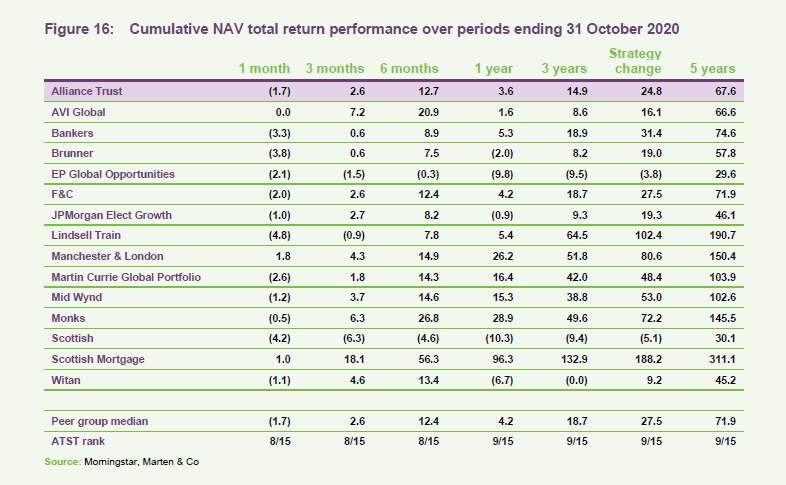

Peer group

For the purposes of this note, we have compared ATST to the other constituents of the AIC’s global sector. With a few exceptions, most of the discounts in the sector are fairly tight and a few trusts trade at premiums. While marginally wider than the median, ATST’s discount is not especially wide.

ATST’s has a progressive dividend policy, as we explain in the next section. However, it is not managed to generate a high level of income. The trust’s ongoing charges ratio is competitive (ranked fourth of fifteen funds). ATST’s scale helps in that regard.

ATST’s balanced approach, incorporating both value and growth elements, may have held it back relative to the peer group, over this year in particular. Once the market becomes less narrowly-focused, its relative performance could improve. However, ATST is not looking to top these tables. It has a “Steady-Eddie” style, more tortoise than hare, that is intended to provide reliable long-term outperformance without taking on too much risk.

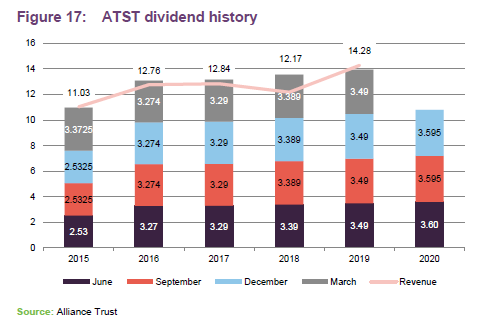

Dividend

ATST pays quarterly dividends in June, September, December and March. Each year, shareholders are asked to approve the trust’s dividend policy. In accordance with this, subject to market conditions and the company’s performance, financial position and outlook, the board will seek to pay a dividend that increases year on year.

This year, with effect from the June dividend, the board introduced a dividend reinvestment plan (administered by the Registrar). This is designed to enable shareholders to increase their holding in the trust in a cost-effective way.

At the end of 2019, ATST had revenue reserves of £109.2m, equivalent to around 34.0p per share and has substantial distributable capital reserves. These distributable reserves may be expanded further as there is a proposal to convert the trust’s £645.3m merger reserve into a distributable reserve (this needs to be approved by shareholders and the court).

In light of the widespread dividend cuts triggered by COVID-19, the board said in the interim report: “Even with an income stream that may fall in the short term, we expect to continue to pay an increasing dividend and to extend our current record of year-on-year increasing dividends to 54 years and beyond.”

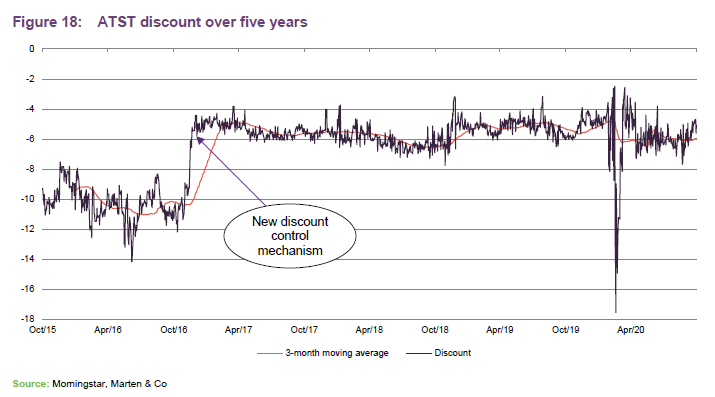

Discount

In December 2016, the board adopted a policy of seeking to defend a discount around a 5% level in normal market conditions. To that end, the trust deploys share buy backs when necessary. The board has also stepped up efforts to raise awareness of the trust.

Each year, the board asks shareholders for permission to buy back shares, and in April 2020 they approved the repurchase of up to 14.99% of ATST’s issued ordinary share capital. Shares that are bought back are cancelled although ATST does have permission to hold these in treasury.

Over the year ended 31 October 2020, ATST’s discount moved within a range of 17.6% to 2.5% and averaged 5.8%.

The market gyrations that occurred as investors started to panic about COVID-19 in March are evident in Figure 18 as is the tightening of the discount following the policy change in December 2016.

Fees and costs

The trust’s AIFM is Towers Watson Investment Management Limited (TWIM). TWIM is entitled to a fixed fee of £1.5m per year (increasing, from 1 October 2019, in line with inflation calculated with reference to CPI each year) plus 0.055% of ATST’s market cap (after deduction of the value of non-core assets and the value of the company’s subsidiaries – both of which are now negligible). TWIM is also entitled to an administration fee for the provision of certain administrative services outsourced by the company. This is capped at £920,000 (again increasing each year in line with CPI, but from 1 April 2017).

Each of the underlying managers is entitled to a base management fee rate, generally based on a percentage of the value of assets under management. The fees to the underlying managers are not disclosed, but the manager has indicated that their fee rates are in line with what an institutional investor would pay for the service.

No performance fees are payable.

The management agreement is terminable by either party on the receipt of six months’ notice (or the trust may pay compensation in lieu of this).

The trust has a small executive team of five, two of which work part-time. These employees are not members of any share-based incentive arrangements, nor of any long-term share award schemes.

For accounting purposes, one quarter of the management fees, financing costs and other indirect expenses are charged against the revenue account and three-quarters against the capital account.

The trust’s ongoing charges ratio has been falling in recent years, as the business has been simplified, and stood at 0.62% at the end of 2019.

Capital structure and life

Alliance Trust has 321,597,681 shares in issue and no other classes of share capital.

At the end of December 2019, there were 266,783 options outstanding over ATST’s shares but these had a weighted average remaining contractual life of 198 days and we believe there are no longer any options outstanding.

Gearing

The board sets the strategic level of gearing. Currently, this is around 10% gross and flexible around that. WTW operates within bounds of about 7% to 13%. If it wished to move outside this range, it would seek board approval. The level of gearing is driven by WTW’s view of market valuations, which is informed, in part, by the conversations that they have with the underlying managers.

The trust has two £100m multi-currency facilities provided by Scotiabank Europe Plc, which mature in December 2020 and December 2021. In addition it has £100m of 15-year unsecured loan notes, with a coupon of 4.28%, which mature on 31 July 2029; £20m of 15-year unsecured loan notes with a coupon of 2.657% that mature on 28 November 2033; £20m of 25-year unsecured loan notes with a coupon of 2.936% that mature on 28 November 2043; and £20m of 35-year unsecured loan notes with a coupon of 2.897% that mature on 28 November 2053.

At 31 October 2020, the company’s net gearing was 5.8%.

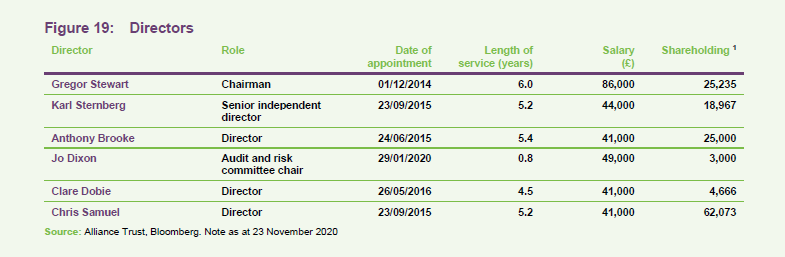

Board

The board consists of six non-executive directors, all of whom are considered to be independent of the manager and who do not sit together on other boards. The overall level of fees payable to the directors fell between 2019 and 2020 as the role of deputy chairman was abolished and the chairman took a substantial pay cut.

Gregor Stewart

Gregor joined the board in 2014 and chaired the audit and risk committee until his appointment as chairman in September 2019. He was also previously a non-executive director of Alliance Trust Savings Limited.

Gregor was finance director for the insurance division of Lloyds Banking Group, including Scottish Widows, and a member of the group’s finance board. He brings over 20 years’ experience at Ernst & Young, with ten years as a partner in the firm’s Financial Services practice.

Gregor is also a non-executive director of Direct Line Insurance Group Plc, chairman of FNZ (UK) Limited and a non-executive director of its holding company.

Karl Sternberg

Karl was a founding partner of Oxford Investment Partners. He has had an executive career in fund management at Deutsche Asset Management, latterly as both its global head of equities and chief investment officer for Europe and Asia Pacific.

Karl is also a non-executive director of a number of other companies including Jupiter Fund Management Plc, JPMorgan Elect Plc, Monks Investment Trust Plc (where he is chairman), Lowland Investment Trust Plc, Herald Investment Trust Plc and Clipstone Logistics REIT Plc

Anthony Brooke

Anthony was a vice chairman of S.G. Warburg & Co. Ltd and from 1999 to 2008 a partner in Fauchier Partners, a manager of alternative investments. Until 2010, Anthony was a non-executive director of the PR consultancy, Huntsworth Plc.

Anthony also sits on the investment committees of the National Portrait Gallery and Christ’s College, Cambridge and advises various endowments.

Jo Dixon

Jo is a chartered accountant and has previously held senior positions within the NatWest Group and was finance director of Newcastle United Plc. She was commercial director, UK, Europe and the Middle East at Serco Group and sat on various advisory boards in the education and charity sector.

Jo also chairs JPMorgan European Investment Trust Plc and is a non-executive director of BB Healthcare Trust Plc, Strategic Equity Capital Plc, BMO Global Smaller Companies Plc and Ventus VCT Plc.

Clare Dobie

Clare ran a marketing consultancy from 2005-2015. Before that she was group head of marketing at GAM (formerly Global Asset Management) and served on its executive business committee, and prior to that, she held a number of roles at Barclays Global Investors, including head of marketing.

Clare is also a non-executive director of BMO Capital and Income Investment Trust Plc and Schroder UK Mid Cap Fund Plc.

Chris Samuel

Chris was chief executive of Ignis Asset Management from 2009-2014 and was previously a director and chief operating officer of Gartmore and Hill Samuel Asset Management and a Partner at Cambridge Place Investment Management. He is a Chartered Accountant.

Chris is also chairman of BlackRock Throgmorton Trust Plc, JPMorgan Japanese Investment Trust Plc and Quilter Financial Planning, and a non-executive director of Sarasin and Partners LLP and UIL Limited.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Tritax EuroBox Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.