Separating the wheat from the chaff

Separating the wheat from the chaff

COVID-19-related falls in markets have weighed on BlackRock Throgmorton Trust (THRG), although it has held up well relative to both its peer group and its benchmark. Its manager sees this as a defining moment for investors – one that could set the stage for many years to come.

Identifying industry change, investing in tomorrow’s winners and shorting unsustainable business models are core parts of THRG manager Dan Whitestone’s investment process. He believes that the economic disruption associated with measures to control the virus will accelerate the pace of change in many industries. Good stock selection will be paramount to future returns.

Both long and short positions in UK small- and mid-cap companies

Both long and short positions in UK small- and mid-cap companies

THRG aims to provide shareholders with capital growth and an attractive total return by investing primarily in UK smaller companies and mid‑capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction. Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks.

Brexit fears give way to COVID-19 reality

Brexit fears give way to COVID-19 reality

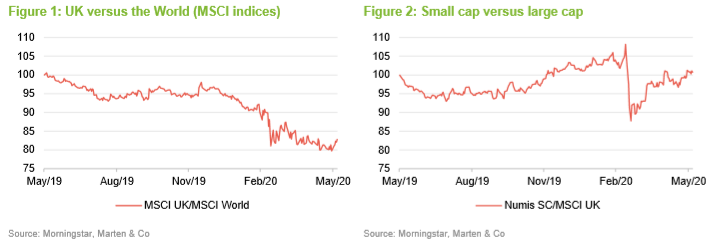

The bounce in the UK stock market that accompanied the decisive Conservative victory in December 2019’s general election proved relatively short-lived. The new government’s decision to impose an arbitrary cut-off on EU trade negotiations reignited fears of a no-deal Brexit and the lack of progress in talks to date has done nothing to ease this concern. As Figure 1, which shows how UK stocks have performed relative to global stocks over the past 12 months demonstrates, international investors appear to be shunning UK stocks.

However, all of this has been overshadowed by the COVID-19 pandemic and the associated lockdown. In response, interest rates have been cut again and substantial stimulus has been injected into the economy. Many large UK-based companies are appealing for direct government aid, but will not necessarily receive it.

For the most part, companies that serve the business-to-business market appear to be much better placed than businesses serving consumers. Asian manufacturing is returning to normal (as lockdowns have been lifted there), but there is a question mark over the strength of Western demand.

Initially, as Figure 2 shows, small and mid-caps underperformed, as investors’ kneejerk reaction was a flight to the perceived safety of large caps. Nerves are a little calmer today and the Numis Smaller Companies plus AIM ex-investment companies Index (THRG’s benchmark) is marginally ahead of the MSCI UK over the period since 31 May 2019.

Corporate Darwinism

Corporate Darwinism

Dan Whitestone (Dan) thinks we are in for a period of heightened “corporate Darwinism”. He expects to see some business failures, consolidation and stronger companies winning market share. Recessions and downturns tend to accelerate the pace of industry change and widen the gap between winners and losers. Many sectors will experience profound change in the wake of the pandemic, with significant withdrawals of capacity in some areas.

He also sees the lockdowns as a boost for the businesses that support working from home, ecommerce and digital payments. Some of the shift in the way in which we are working today will be permanent, in his view. For this reason, many incumbent, traditional businesses may never see a recovery in earnings back to pre-crisis levels. This presents new opportunities for short positions.

Dan expects that many companies will emerge from the crisis with much more debt on their balance sheets, and it is important to be aware of this when selecting stocks. The team has done a lot of work analysing the balance sheets and cash flows of companies in the portfolio. The best of those affected have cut their cash burn aggressively, have extended credit lines and, if needs be, issued equity. They can hunker down and prepare for the recovery when it comes. Dan cautions, however, that some businesses may find that sales take a while to pick up after they reopen – social distancing rules may restrict customer numbers, for example.

For the time being, banks seem prepared to waive loan covenants linked to profits (which might otherwise trigger demands for early repayments of loans). This may give investors false hope that some companies with unsustainable business models will be able to survive this. This is one reason why Dan has reduced THRG’s short exposure. He is conscious that, when sentiment recovers, poorer quality companies can rise first and fastest (in a ‘dash for trash’) and he wants to ensure that THRG is not caught out by this.

Dan is not expecting a rapid, ‘V-shaped’ recovery. He expects to see quite a bit of volatility over the coming months as investors begin to appreciate just how badly some businesses have been affected by the pandemic. Low inflation/deflation may act as a headwind in some sectors.

Future opportunities

Future opportunities

The BlackRock Emerging Companies team is working hard, meeting – virtually, rather than face-to-face – far more companies that it would ordinarily do. Dan sees this as a pivotal moment and an exciting time to be an active manager. The more cautious stance that Dan has adopted gives him the flexibility to take advantage of opportunities as they present themselves.

Historical earnings multiples are no guide to valuation, given that the potential for businesses to return to ‘normal’ will vary by company and industry. It may be that relatively few companies thrive in the coming environment. The key is to identify these and stick with them.

Fund profile

Fund profile

BlackRock Throgmorton Trust (THRG) aims to generate capital growth and an attractive total return, by investing primarily in UK smaller companies and mid‑ capitalisation companies traded on the London Stock Exchange. It uses the Numis Smaller Companies Index (plus AIM stocks but excluding investment companies) as a benchmark for performance purposes, but the index does not influence portfolio construction.

For the period between 1 December 2013 and 22 March 2018, the benchmark was Numis Smaller Companies Index, excluding both AIM stocks and investment companies. There used to be a restriction on the trust’s exposure to AIM companies, but this was removed in March 2018 and, at the same time, the manager was given permission to invest up to 15% of the portfolio in stocks listed on exchanges outside the UK.

Both long and short positions

Both long and short positions

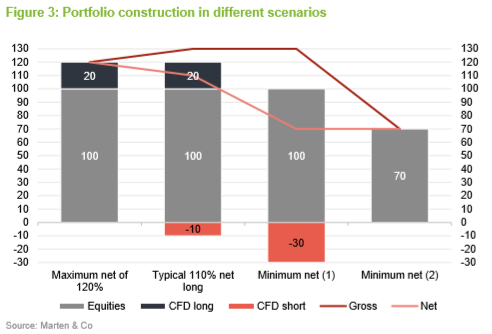

Uniquely among listed UK smaller companies trusts, THRG’s portfolio may include a meaningful allocation to short as well as long positions in stocks. Up to 30% of the portfolio may be invested in contracts for difference (CFDs), both long and short. Under normal market conditions, the net exposure will account for 100–110% of net assets.

The manager

The manager

BlackRock Investment Management (UK) Limited was appointed manager of the trust in July 2008. Dan Whitestone, head of the Emerging Companies team at BlackRock, has been sole manager of the trust since 12 February 2018 (he had been co-manager, alongside Mike Prentis, since March 2015). Dan heads a team of four. All members of the team manage portfolios, and between them manage or advise on about £3.8bn across a variety of different funds. The team shares research responsibilities between them.

Investment process – identifying differentiated quality and change

Investment process – identifying differentiated quality and change

When selecting long investments for THRG, Dan focuses on two types of opportunity: quality differentiated companies and companies leading industry change.

High-quality differentiated companies

High-quality differentiated companies

Dan believes that high-quality companies have certain characteristics for long-term success, based on:

• Management team;

• Product;

• Industry; and

• Balance sheet/cash flow.

In Dan’s view, the most important factor in driving value creation or destruction is the quality of the management team. Its ability to have a vision, execute on strategy and adapt to a changing environment is crucial. Dan and the team make a point of meeting not only the top layer of management, but also other key people within a business. He believes that a common reason for growing companies experiencing “growing pains” is if they fail to build the infrastructure and depth of team beneath the top management layer.

Meeting management is a core part of the BlackRock Emerging Companies team’s approach, and between them they probably have around 750 meetings a year. Usually, they try to have as many of the team in a meeting as possible, to get a diversity of viewpoint.

Dan looks for companies whose products are not purely competing on price but instead offer solutions to customers’ problems – this gives the company pricing power and persistent demand for its products. It is also important that a company maintains its product’s relevance through investing in research and development.

The industry that a desirable company operates in should have structural growth drivers. It should not be capital-intensive, nor heavily influenced by the economic cycle. It should be free from regulatory interference and should not be facing competitors with strong financial support.

Dan avoids heavily indebted companies. He points out that the CFO often ends up managing the company for the benefit of the bank rather than investors in these situations. Dan focuses on cash-flow measures of value as these are less easy to manipulate than profits. He looks for indicators of quality such as the conversion of sales into cash – such companies can establish a virtuous circle whereby excess cash can be recycled into sales efforts. A company trading on 25x cash earnings is preferable in his eyes to one on 10x earnings but with no cash flow. The latter are the types of companies that he tends to short.

On average, THRG’s long investments trade on higher multiples than the short investments. This reflects a focus on quality and a desire to avoid value traps (stocks that look cheap but never fulfil their potential).

Industry change

Industry change

Industry change can provide both long and short ideas. Previously in his career, Dan was a strategy consultant. The experience highlighted the impact of disruptive change on industries and has influenced his thinking since. Small and medium-sized companies can be a good source of industry disruptors, as they need to do something special, or otherwise innovate, if they are to compete effectively.

There are many ways that disruptive change can manifest itself. These include new products, changes to manufacturing that allow products to be sourced more cheaply, vertical integration to improve and extract cost from supply chains, and changes in distribution.

Portfolio construction

Portfolio construction

Position sizes are driven by liquidity, risk considerations and conviction. Liquidity is important; Dan wants to be able to trade out of a position in the event that something is going against it. He also says that he is ruthless about selling positions when the investment thesis is not working. As an aside, he says that historical average daily volume is a misleading indicator of future liquidity for small-cap stocks.

Dan does not consider the benchmark when constructing the portfolio; consequently, the portfolio will tend to have a high active share.

Dan is targeting a portfolio with 120 positions – about 80 long positions and 40 shorts. The number of shorts may seem large, but it is important that the short book is diversified. Dan points out that it is perfectly possible to accurately predict that an industry will suffer long-term decline, then select a stock to represent this, which is then subject to a bid, quite possibly from a competitor. This is because companies in declining industries frequently see consolidation as a remedy, although this may not work as a strategy in the long term. Nevertheless, being short a stock that becomes subject to a bid can be costly. It is therefore better to own a spread of stocks to represent a theme.

The largest position size that Dan would be comfortable with is 5% – there is nothing in the portfolio that is as big as that now. At the low-end, he wants to avoid having a long tail of small positions in the portfolio.

Essentially, Dan is a growth investor. He therefore believes that the portfolio may underperform in an environment where investors are favouring value stocks. Valuation is secondary to the investment thesis, in Dan’s opinion, but part of the assessment of the merits of a stock is an attempt to identify whether the market appreciates, and is therefore pricing in, the story.

Dan does not believe that mean reversion applies to the types of stocks he is focused on; winners win big and losers go bust. Therefore, he does not trade stocks based on valuation differentials.

Shorting

Shorting

About half of short positions represent themes – for example, industries under pressure. Dan cites the examples of pubs and restaurants, and out-of-town retail. These themes are expressed through several stocks in accordance with the approach outlined above. It is not as simple as shorting a basket of stocks in any given industry, however. Even within a struggling sector, there may be companies whose strategy allows them to survive or even thrive.

The rest of the book represents idiosyncratic shorts selected for stock-specific reasons. Companies with questionable accounting are a fertile hunting ground for shorts, although Dan says that sometimes these can take a while to come to fruition.

BlackRock has a blanket ban on disclosing short positions and so it is not possible to identify which stocks have been shorted, even if they have a significant impact on performance (positive or negative). We appreciate that some investors will find this frustrating.

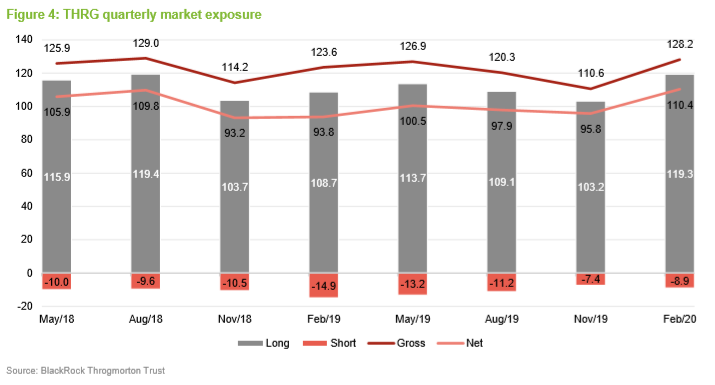

The board has set a maximum limit of net gearing of 20% and, in practice, gearing is provided by the CFD portfolio. The fund operates with an upper limit of 130% gross exposure to equities. Typically, this might comprise 100% in equities, 20% in long positions and 10% in short positions, i.e. a net exposure of 110%.

Cash balances are generally kept low and gearing is flexed by adjusting the size of the CFD book; Dan expects to operate within a range of 100% to 110% net long. The manager has the flexibility to reduce net exposure to a minimum of 70%. This is more likely to be achieved by using shorts rather than holding cash (as illustrated by minimum net (1) rather than minimum net (2) in Figure 3).

Up to 15% of the portfolio may be invested in overseas stocks. Dan does not want to have exposure to unquoted investments within the portfolio (for liquidity reasons).

Asset allocation

Asset allocation

Dan cut THRG’s gross and net exposure in the run up to the December 2019 election, not wanting to make a call on the outcome either way. He rebuilt exposure over the remainder of the year and into January. Dan has said that he feels that the gross and net were too high going into the pandemic. He has cut them since. At the end of April, he said that gross exposure was about 113 and net exposure around 105.

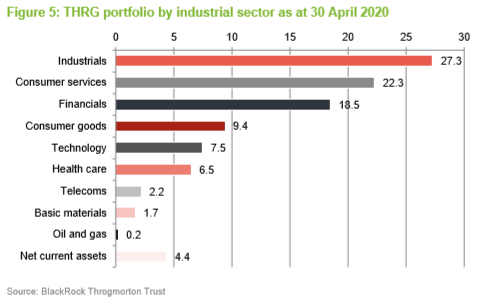

Consumer services accounted for around 30% of the portfolio at the start of the year. By the end of April, this had reduced to about 23% as a result of both falling share prices and disposals. These companies have diverse business models and, in most situations, they would not have all been hit at the same time – but the lockdowns shuttered many of these businesses.

New investments and increased positions reflect a few themes that Dan has identified in the wake of the crisis.

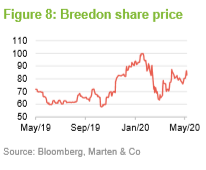

The UK government is expected to increase spending on infrastructure in an attempt to stimulate the recovery. Given this, Dan has been building positions in housebuilders and companies that supply materials to the construction industry. One of these is Breedon.

Video gaming is an area that is booming as a consequence of the lockdowns. Consumers are demanding new games and customer numbers have soared. There is a shortage of technical expertise, which constrains the supply of new product to this market and underpins margins. Programmers can work from home, however, so companies should not see any interruption to planned release schedules.

Digital payments is an area that is benefitting from the disruption – to support the boom in ecommerce, but also because physical cash is being seen as a potential vector for spreading the virus. There is considerable potential for growth – in Europe, 75% of retail transactions still rely on cash. Dan has bought a company focused on this area.

The shift to home working (some of which may persist beyond the end of lockdowns) is encouraging the growth of companies delivering software as a service, communication as a service, online learning and ecommerce.

Top 10 holdings

Top 10 holdings

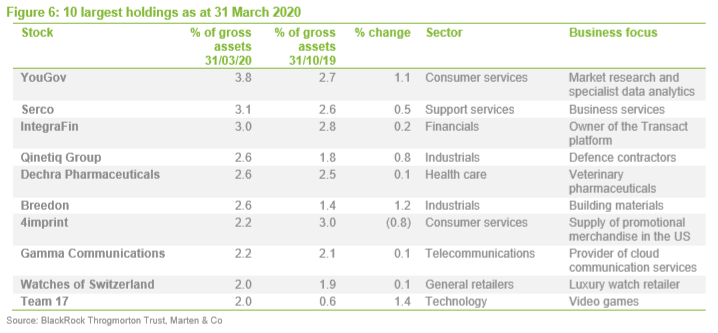

Figure 5 shows the top 10 holdings in the portfolio as at the end of March 2020. Comparing the list of the 10 largest holdings at the end of March 2020 to that at the end of October (the data we used in our last note): Workspace, WH Smith, SSP and Aveva have dropped out of the list and Qinetiq Group, Breedon, Watches of Switzerland and Team 17 have replaced them. Further profits have been taken from the position in 4Imprint. Watches of Switzerland has been discussed in earlier notes. It has been impacted in the short term by the closure of its retail outlets, but Dan is sticking with the position.

Qinetiq Group

Qinetiq Group

Qinetiq Group (www.qinetiq.com) is a technology business that was privatised from the Ministry of Defence early in the 2000s. It operates in the defence, security and aerospace markets (but not commercial aviation) and its customers are predominantly government organisations.

Results for the year ended 31 March 2020 showed strong growth in its order book and 10% organic revenue growth. Headline earnings per share fell but underlying earnings were marginally higher. The company has taken action to cut costs and conserve cash (including deferring the decision whether to pay a dividend), in the face of COVID-19.

Breedon

Breedon

Breedon (www.breedongroup.com) is a major building materials company with two cement plants, 80 quarries, 40 asphalt plants, 170 ready-mixed concrete and mortar plants, nine concrete and clay products plants, four contract surfacing businesses, six import/export terminals and two slate production facilities. Breedon should benefit strongly from any uptick in government-backed infrastructure spending.

Ahead of the pandemic, Breedon’s trading was in line with expectations. However, it closed most of its plants in Great Britain and Ireland as lockdowns began. Over 80% of staff were furloughed. Now, the business is opening up again as construction sites across the British Isles return to work.

Team17

Team17

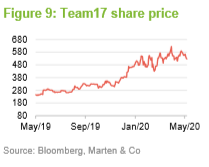

Team17 (www.team17group.com) is a British video games developer that was established in 1990 and focuses on paid-for games on home computers, video games consoles and the mobile and tablet gaming market.

2019 revenues grew by 43% and earnings per share by 68% over 2018. Seven new titles were launched, adding to a considerable back catalogue of over 300 digital revenue lines. Tellingly, perhaps, the chairman made no mention of COVID-19 in the March 2020 results announcement and no trading update has been necessary since.

Performance

Performance

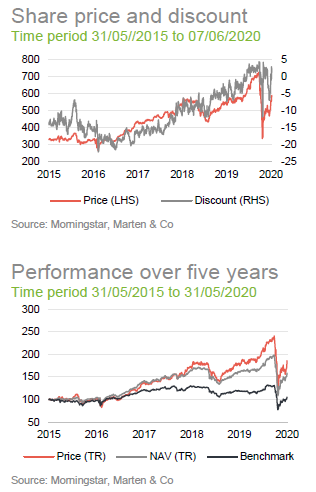

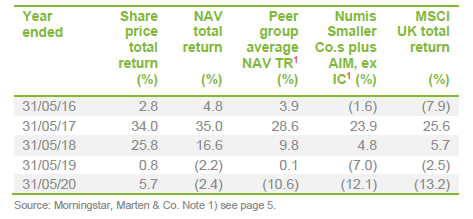

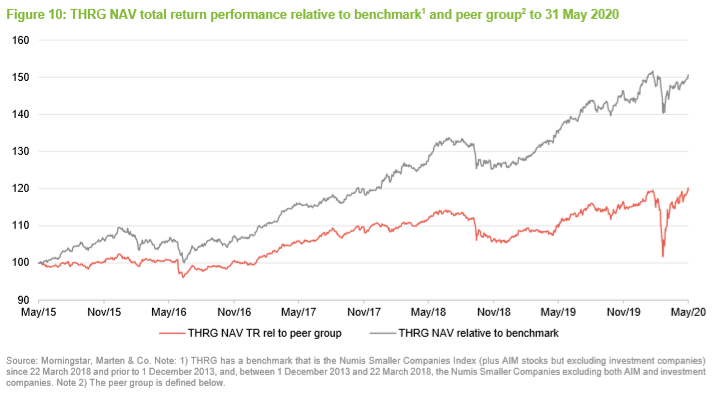

THRG has outperformed both its benchmark and the average of the peer group over both the long-term and the short-term, as illustrated in Figure 11.

THRG has regained the ground it lost in its relative performance during the panic in March. On an absolute basis, THRG’s share price is up over the year ended 31 May 2020 and it has almost recouped its losses in NAV terms as well.

THRG’s five-year performance numbers are particularly impressive. Dan became comanager in March 2015 and has therefore been involved with the management of the portfolio over all of that period.

Peer group

Peer group

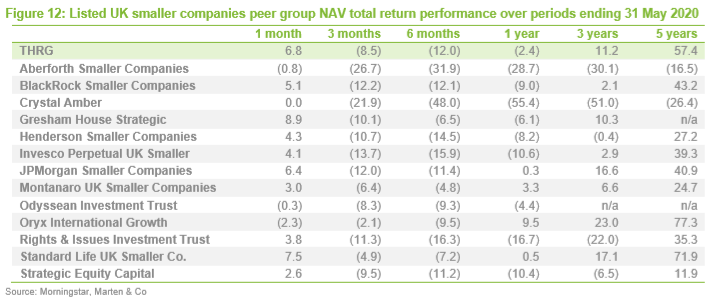

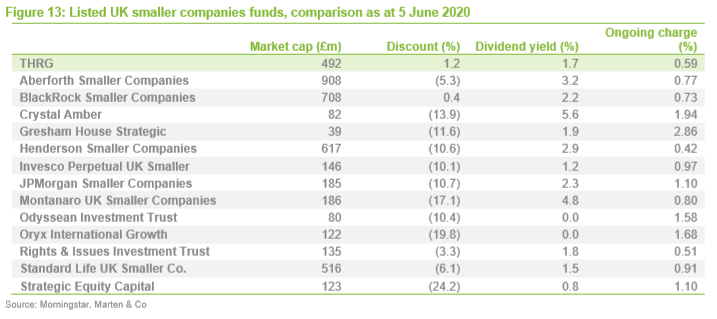

For comparison purposes, we have used a subset of funds in the AIC’s UK smaller companies sector. We have excluded split-capital companies, trusts with a small market capitalisation, and those that focus exclusively on micro-cap companies. A complete list is provided in Figures 12 and 13.

THRG ranks third of 12 within the peer group over five years, and fourth of 13 over three years.

THRG and its stablemate, BlackRock Smaller Companies, are the only two funds in this peer group that are trading at a premium, reflecting their strong long-term track records. THRG’s ongoing charges ratio is one of the lowest of this group of funds.

Performance drivers

Performance drivers

THRG has not published any breakdown of its performance over April or May, which was well-ahead of both the peer group and the benchmark. In March the trust’s short positions contributed 2.4% to returns. However, this was more than offset by falls in the value of its long positions.

THRG’s exposure to consumer services businesses detracted from its returns. As we discuss below, companies reliant on passenger traffic at airports and major train stations, such a Watches of Switzerland and WH Smith, were particularly badly hit.

Dan feared that THRG would suffer disproportionately in the selloff as investors have a tendency to cash in stocks that have done well, and THRG had many of those. In practice, this did not happen but THRG did underperform a little. Sectors that THRG has a persistent underweight exposure to, such as oil and banks, overleveraged companies and companies that were overdistributing – paying dividends at the expense of investing in the long-term future of their business – all suffered.

Dan believes that the reason for this was that he did not act fast enough to cut the trust’s exposure to consumer services, stocks reliant on air travel especially. He also thinks that he was too slow to cut the trust’s gross and net exposure to markets, saying that he was caught out by the speed of the change.

At the same time, he points out that he sees his forte as being picking stocks, not calling macroeconomic changes or market forecasting. Whilst he adjusted THRG’s market exposure to reduce risk, he was not panic selling at the bottom of the market and so was able to benefit as the market bounced off the lows.

WHSmith

WHSmith

Dan says that, in retrospect, he was too slow to reduce THRG’s exposure to WHSmith (www.whsmithplc.co.uk). The company has been hit hard by the collapse in air and rail passenger volumes in the wake of COVID-19. WHSmith’s revenues were down 85% in April 2020.

Ahead of the outbreak, WHSmith was reporting higher revenues (up 7% year on year over the six months to the end of February 2020). All of this growth was coming from its travel-related outlets, however. As high street revenues fell, profitability was impacted.

Dividend

Dividend

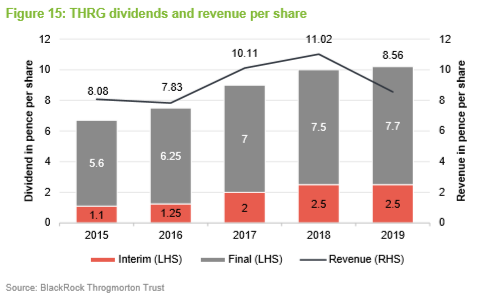

Dividends are a by-product of the investment process and THRG’s portfolio is not managed with any income generation objective in mind. Nevertheless, the portfolio may generate reasonable levels of income. The base management fee is charged 25% and 75% to the revenue and capital accounts respectively, while 100% of any performance fee is charged to capital.

Net revenue per share fell to 8.56p for the year ended 30 November 2019, from 11.02p for the prior year. The board decided to use some of THRG’s revenue reserves to fund a small increase in the final dividend.

THRG has a substantial revenue reserve (£11.7m as at 30 November 2019, equivalent to 14.0p per share) and this is available to supplement current year revenue if the board feels that would be desirable once again.

Discount

Discount

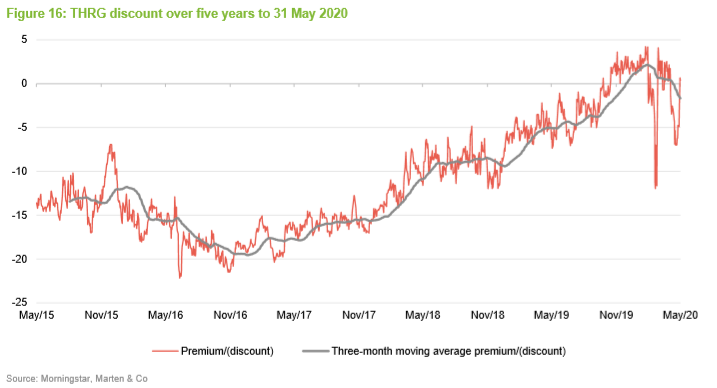

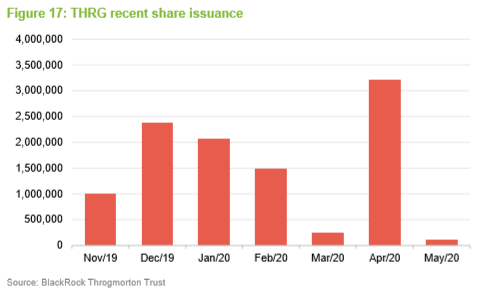

THRG’s discount has been eliminated and, in recent months, it has been able to issue shares at a premium to asset value. This share issuance has the twin benefits of enhancing asset value for existing shareholders and, in time, reducing ongoing charges as fixed expenses are spread over wider base. Over the year to the end of May 2020, the discount moved within a range of 12.0% to a 4.2% premium, averaging a 1.3% discount over this period. As at 9 June 2020, the premium was 2.8%.

We were pleased to see THRG issuing shares. All the shares that were held in treasury have now been reissued and the company is expanding for the first time in many decades.

Fees and costs

Fees and costs

BlackRock Investment Management (UK) Limited provides THRG with portfolio and risk management services under a contract that THRG has with BlackRock Fund Managers Limited. That contract is terminable on six months’ notice by either side. BlackRock Fund Managers’ base fee is calculated as 0.35% of gross assets (calculated monthly and paid in arrears). In addition, it can earn a performance fee of 15% of the outperformance of the benchmark index over a two-year rolling period with an effective cap of 0.9% of average gross assets, resulting from a cap on total management fees of 1.25% over a two-year period.

The ongoing charges ratio for the year ended 30 November 2019 was 0.59%, marginally higher than the equivalent period for the prior year (0.57%), reflecting increased expenditure on marketing (some of which relates to an under-accrual of marketing expenditure in 2018). Were performance fees included in the calculation, the ongoing charges ratio would have been 1.75% (2018: 1.29%).

Capital structure and life

Capital structure and life

THRG has 83,643,462 ordinary shares in issue and no other classes of share capital. THRG’s board takes powers each year to repurchase up to 14.99% of the trust’s issued share capital (excluding treasury shares) and to issue up to 10%. Shares repurchased may be held in treasury or cancelled, at the discretion of the board. No treasury shares will be reissued other than at prices that represent a premium to the prevailing NAV, thereby ensuring that this action does not have any adverse effect on ongoing shareholders.

The board has set a maximum limit of net gearing of 20%. In practice, gearing is provided by the CFD portfolio.

The company’s year end is 30 November and AGMs are normally held in March.

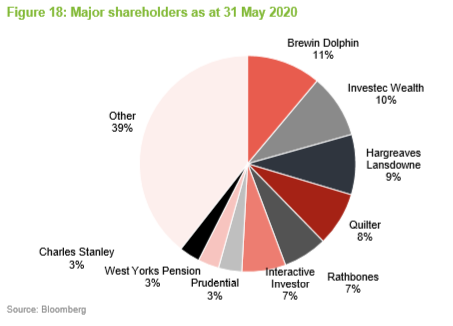

Major shareholders

Major shareholders

Board

Board

THRG has four non-executive directors, all of whom are independent of the manager and none of whom sit together on other boards.

Chris Samuel was chief executive of Ignis Asset Management from 2009 until its sale to Standard Life Investments in 2014. He was previously chief operating officer at Gartmore and Hill Samuel Asset Management and was a partner at Cambridge Place Investment Management. He is also chairman of JPMorgan Japanese Trust and is a non-executive director of the Alliance Trust Plc, UIL Limited and its subsidiary UIL Finance Limited, Sarasin Partners LLP and Quilter Financial Planning. He graduated from Oxford with an MA in Philosophy, Politics and Economics and qualified as a chartered accountant with KPMG.

Loudon Greenlees was chief financial officer and chief operating officer of Thames River Capital from 1999 until 2007 and then commercial director until May 2013. Prior to this, he had been group finance director and chief operating officer of Rothschild Asset Management and group finance director of Baring Asset Management. He is a chartered accountant.

Jean Matterson was appointed to the Board in July 2012. She recently retired as a partner of Rossie House Investment Management which specialises in private client portfolio management with particular emphasis on investment trusts. She was previously with Stewart Ivory & Co for 20 years, as an investment manager and a director. She is a director of Capital Gearing Trust Plc, Herald Investment Management Limited and HIML Holdings and is a former chairman of Pacific Horizon Investment Trust Plc.

Louise Nash was a UK small and mid-cap fund manager, firstly at Cazenove Capital and latterly at M&G Investments, which she left in 2015. She now works for family wine business Höpler. She also acts as a consultant to JLC Investor Relations. Louise holds an MA in German and Politics from the University of Edinburgh and the IMRO Investment Management Certificate.

Previous publications

Previous publications

Readers may be interested in our previous publications on THRG, which are listed below:

Vision, execution and adaptability, initiation note, published September 2018

Throg’s shorts shine, update note, published January 2019

Impressive run continues, annual overview, published July 2019

Look past the short-term noise, update note, published December 2019

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on BlackRock Throgmorton Trust plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.