Chrysalis Investments

Investment companies | Update | 26 July 2023

Putting growing pains behind it

There is no denying that the last 18 months have been a challenge for Chrysalis Investments (CHRY). However, under the hood, the majority of the portfolio assets have actually performed reasonably well given the circumstances, especially when you consider that one company, Klarna, contributed more than half of CHRY’s total NAV adjustment during FY2022. Its other private investments, which make up the majority of the portfolio, fell just 5.6% during the same period.

The long-term prospects for the fund remain unchanged, with the company investing in a range of disruptive assets that continue to benefit from the rapidly accelerating digital transition. The performance of these companies relies on their ability to disrupt their respective industries over years, not months.

While short-term fluctuations in macroeconomic conditions creates challenges, including the ability to finance growth (as investors pull money out of sectors of the market considered to be higher risk), the business plan execution we have seen across the majority of the portfolio over the past 12 months leaves us optimistic going forward.

Supporting growing businesses

CHRY aims to provide access to returns available from investing in later-stage private companies with long-term growth potential, an investment class that has traditionally been difficult to access for individual investors. CHRY also benefits from the flexibility to continue to support these businesses after they IPO.

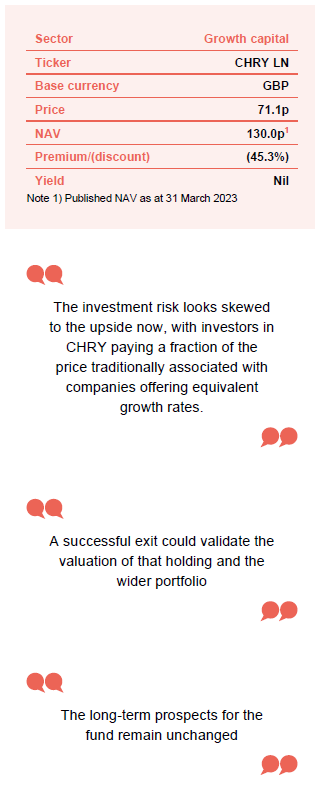

At a glance

Balance sheet resilience

Despite a rebound in growth stocks over the last few months, investor sentiment has remained bearish towards companies generating negative cash flows that require additional funding for growth, in marked contrast to the position when the cost of debt capital was close to zero when these sorts of companies went parabolic. Hence the importance of the adviser’s efforts to increase the proportion of the portfolio that is funded through to profitability (becoming self-funding).

CHRY’s adviser believes that it has significantly increased the portfolio’s resilience and its ability to optimise growth going forward.

With the actions that they have taken over recent months (discussed in some detail on pages 6 and 7), CHRY’s adviser believes that it has significantly increased the portfolio’s resilience and its ability to optimise growth going forward.

To provide an impression of the scale of the evolution of the portfolio over the 12 months ended 31 March 2023, the total portfolio weighting of those companies that were either profitable or funded to profitability increased from 42% to 74%. That figure rose to 84% with a £12.5m follow-on investment in Smart Pension announced on 15 May 2023 (see page 11).

For the remaining 16% of assets that the adviser believes may need additional financing, funding options include:

- a follow-on with funding from CHRY;

- a follow-on where CHRY does not participate; and

- a strategic exit/ merger.

As of 31 March, CHRY had net cash of approximately £43m and a position in LSE-main-market-listed Wise Plc worth about £12m (Wise has a market cap of £6.8bn), to give a total liquidity position of approximately £55m. That will have been reduced by the recent £12.5m investment into Smart Pension.

The investment adviser believes that its guidance published in November 2022, of a likely primary follow-on capital requirement of approximately £20m is still appropriate, of which circa €4m has been invested into wefox and £12.5m in Smart Pension. The £20m additional investment in Starling (see page 7) was a separate matter. As a result, the investment adviser believes the company remains in a strong liquidity position.

This should leave investors satisfied that the adviser has significant financial flexibility should funding markets remain tight for the foreseeable future.

Attractive valuations

Aggregate revenue growth for CHRY’s portfolio has more than tripled since the fund’s inception.

Aggregate revenue growth for CHRY’s portfolio has more than tripled since the fund’s inception which, along with multiple compression (where the valuation multiple applied to a company results in a change in its share price but does not necessarily reflect changes in its earnings), has led to a range of very attractive valuations across the portfolio. Based on figures as at end-2022, CHRY’s aggregate one-year forward EV/sales ratio stood at 4.2x and, given CHRY’s current discount, the implied valuation at a company level is more than halved.

For comparison, the NASDAQ 100 index currently trades at around 5.0x and the MSCI World growth index 3.7x. Although this is useful for illustrative purposes, the indices do not truly provide a like-for-like comparison to the company’s assets, nor a true representation of the value provided by the portfolio.

Aggregate sales growth within CHRY’s portfolio is expected to be in the vicinity of 50% over 2023.

For example, aggregate sales growth within the portfolio is expected to be in the vicinity of 50% over 2023, compared to average rates in the mid-single digits for the indices mentioned above. It is also true that the growth of the broader market indices is more closely tied to GDP which is expected to slow considerably over the next few years. Given its relatively targeted nature, the Chrysalis portfolio is less bound by these constraints, with the adviser focusing on a number of secular (non-cyclical) themes that should compound at rates significantly faster than GDP over the next few years.

The CHRY portfolio companies are also significantly smaller, both in terms of market cap and revenue, than the aggregate company in the NASDAQ and MSCI World Growth indices and therefore base effects provide an additional advantage – it is much easier to grow revenues at 50% when they are £100m compared to £100bn.

Investors in CHRY are paying a fraction of the price traditionally associated with companies offering equivalent growth rates.

With funding issues addressed and the success of CHRY’s investments less tied to the economic cycle, the investment risk looks skewed to the upside now, with investors in CHRY paying a fraction of the price traditionally associated with companies offering equivalent growth rates.

Opportunity

Whilst a relatively concentrated asset base (the fund is currently made up of 13 investments) and challenging track record since IPO leaves some cause for concern, volatility is part and parcel of investment in the fast growing, innovative businesses that make up the majority of this portfolio. Obviously, the size of the recent sell-off is unfortunate for investors, but the opportunity for outsized returns (well ahead of market comparables) has only been increased with valuations at historic lows.

Starling, which we discuss on page 11, provides the perfect example of the upside that can come from successful disruption with top-line growth more than quadrupling to £415m over the past three years, and each company in CHRY’s portfolio has the potential to achieve similar results.

The reality is, however, that the path to achieving this sort of growth is never in a straight line. Perhaps the best example is Amazon, long considered one of the most disruptive companies of its generation. Since 1997, its shares have advanced more than 100,000%, but over that period it has suffered multiple drawdowns of well over 50%, the largest of which hit 94% during the dotcom bust.

Expecting gains of that magnitude may be unrealistic. However, the opportunity remains substantial as we enter what is being dubbed the fourth industrial revolution, or ‘globalisation 4.0’. This race towards the new, digital era was turbocharged during the pandemic, with numerous executives highlighting adoption curve acceleration stemming from global lockdowns and supply chain upheaval. Trends such as digital payments jumped forward as much as five years, while entire new industries tied to cloud technology and high-performance computing were spawned.

In hindsight, investor exuberance and interest rates close to zero created an environment where price discovery disappeared, and all manner of dislocations occurred as investors piled into this digital goldrush (when the cost of credit is low investors tend to take on more risk). However, the backlash as interest rates have risen has created massive discounts applied to almost anything associated with growth or innovation. Despite this, the bottom line remains that consumption habits have been permanently changed and technological innovation is charging ahead with companies like The Brandtech Group and Starling at the forefront. With markets swinging from exceptional optimism to outright pessimism, there exists a massive opportunity to invest in tomorrow’s Amazon at incredibly attractive valuations.

This is the relatively unique opportunity provided by CHRY which is able to capitalise on its advisers’ extensive expertise to identify potential innovators early in their life cycles, while also allowing investors to take a share in private assets that would otherwise be difficult/or impossible to gain access to.

Asset allocation

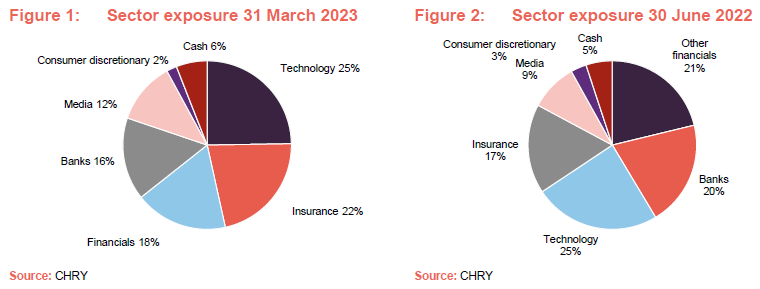

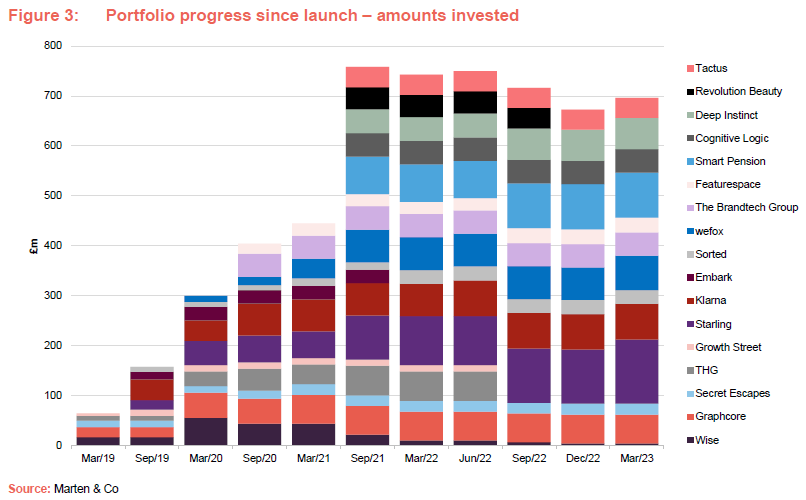

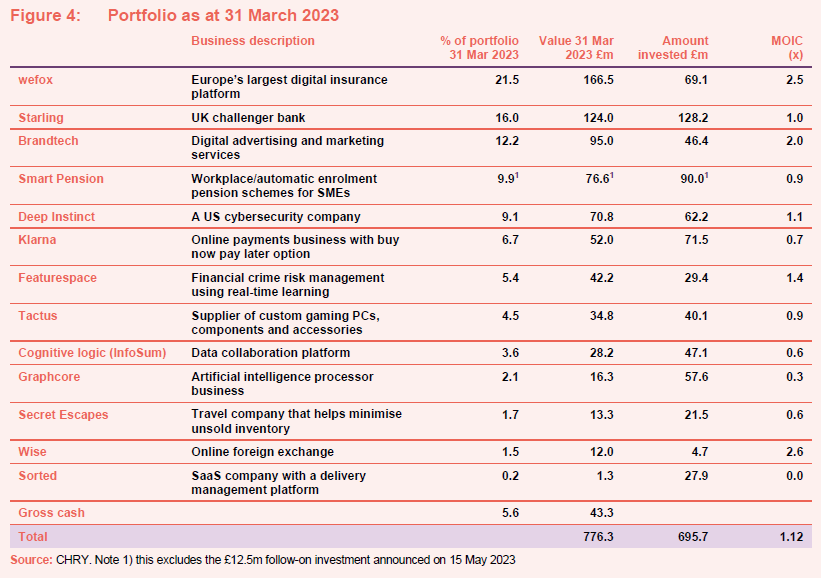

At the end of March 2023, CHRY’s portfolio was valued at £776m, including £43.3m of cash. Wise, valued at £12m, was the only listed position.

Changes to the sector exposure largely reflect the revaluation of existing positions. No new investments have been acquired since our last note was published. Purchases and sales of existing investments are described in the section below.

Portfolio Activity

CHRY’s focus is on ensuring that portfolio company development is fully supported.

As flagged in our last note, CHRY’s focus has shifted away from identifying new potential investment opportunities and towards ensuring that the development of its portfolio companies is fully supported (essentially ensuring they have enough cash to continue to grow). No investments into new holdings were made over CHRY’s last financial year, but £80.3m of capital was deployed to support existing positions. In November 2022, the adviser said that the maximum likely funding it would need to commit to support companies in the portfolio that were neither profitable nor funded through to profitability was £20m.

The adviser also made a tactical call early in the year to ensure its investee companies were fully prepared for tighter funding markets (where higher interest rates can lead to less willing lenders due to increased default risk), by encouraging operational efficiencies where possible, as well as pre-emptive capital raises.

In August 2022, CHRY invested an additional £5m into Featurespace’s Series G funding round.

Deep Instinct closed a $62.5m funding round in September 2022, with CHRY contributing $17m of this. The round was led by BlackRock with participation from Unbound and Millennium.

As discussed in our last note, wefox successfully closed a €400m Series D funding round in July 2022, which valued it at €4.5bn. In February 2023, CHRY invested a further €4m in wefox in an extension of this Series D funding round.

In February 2023, CHRY bought a £20m equity stake in Starling in a secondary market transaction (as Jupiter’s open-ended small-cap fund sold stock) at a price that was modestly higher than Starling’s end-2022 valuation in CHRY’s accounts. The announcement made it clear that this transaction did not form part of the £20m follow-on funding requirement identified by the advisers in November 2022.

In May 2023, CHRY announced a £12.5m follow-on investment in Smart Pension, forming part of a $95m Series E funding round and made at a valuation consistent with the current carrying value of £76.6m.

CHRY was also able to move on from several underperforming assets. Its position in THG was entirely disposed of after its share price suffered from inflation-induced downgrades to profit expectations. Following these developments, the investment adviser felt that it was value-enhancing to redeploy capital elsewhere.

The entire Revolution Beauty position was also sold following a raft of issues regarding its 2022 financial year (FY22) audit. As background, auditor BDO raised multiple concerns regarding the group’s ability to provide sufficient and accurate evidence in respect to a number of key audit areas, leading to a suspension of its shares on the London Stock Exchange. This resulted in CHRY offloading its stake for £5m in an off-market transaction. Whilst this was an improvement on the carrying value that had been marked down to zero, it is just a fraction of the £45m invested back in July 2021, although the adviser did note the possibility of a potential legal challenge stemming from the incident.

Wise was also used as a source of capital, with the partial realisation made at approximately 3x the original cost. Although the adviser believes it is still only scratching the surface of its potential, given its current market share, a balance needed to be made between running positions and ensuring adequate liquidity was available to support other holdings.

Current portfolio

We discussed each of CHRY’s holdings in our last note. The top five holdings, listed below, make up almost 70% of the fund.

wefox

wefox raised €400m in July 2022, despite private fundraising markets being effectively shut.

Leading the pack is wefox, Europe’s largest digital insurance platform which makes up 21.5% of the portfolio with a carrying value at 31 March 2023 of £166.5m. Despite private fundraising almost grinding to a halt over the past year, the company was able to close a Series D funding round in July 2022, raising €400m which valued it at €4.5bn, a more than 30% increase in its post-money valuation from the year prior. Then, on 17 May 2023, it announced that it had raised a further $110m in an extension of the Series D round. $55m of that came from JP Morgan and Barclays in the form of a revolving credit facility, and an additional $55m was raised from equity investors including CHRY (CHRY announced its €4m commitment in February 2023).

wefox has more than doubled its turnover every year since 2015.

wefox’s growth trajectory has been remarkable, with the company more than doubling its annual turnover every year since its inception in 2015. When CHRY first invested in 2019, the company generated less than €50m of revenue. This jumped to over €300m in 2021, and nearly €600m of revenue in FY22, making it one of the largest Insurtech assets globally.

wefox has achieved a CAGR in revenue of c 120% since CHRY invested in 2019.

wefox has achieved a CAGR in revenue of around 120% since CHRY first invested in 2019. Selective M&A has contributed to this, but organic growth has typically been 40–75% each year. The adviser believes that wefox’s organic growth can be maintained at a rate of around 30-40% in the medium term. Crucially, the adviser believes that the business is on track to generate run-rate profitability towards the end of 2023; a milestone that few listed peers have been able to achieve.

The company continues to expand internationally, recently adding Netherlands to its list of territories, and its runway appears considerable, with the insurance sector yet to undergo the full-scale digital disruption we have seen in industries such as digital payments. In May 2023, wefox launched a global affinity business, linking insurance companies and customers targeting markets worth $3trn.

The Brandtech Group

Similar positive sentiment exists for The Brandtech Group (formerly You & Mr Jones) which aims to address complexities arising from the rapid fragmentation of global media. In just six years, the company has grown to become the global market leader in content in-housing and is now delivering enterprise-level marketing technology solutions for some of the world’s biggest brands including Unilever, Google, Adidas, Microsoft, LVMH, and Danone.

CHRY’s adviser sees a clear path to Brandtech generating revenues of over $1bn in the near term.

As with any business, growth rates are expected to moderate as the company matures, however given its dominant market position and track record, which has maintained revenue growth at around 30% over the past four years, it would be reasonable to assume organic growth in excess of 20% is possible in the medium term.

This consistent top line growth also flows through to what management describe as market leading margins. While the company does not publish information on its profitability and the figures that CHRY has used in its literature are well out of date, the group has been profitable since CHRY first invested and margins have steadily improved as the company has scaled. EBITDA margins in this sector typically range from 15% to 25%. The adviser feels that the company is one of the most IPO-ready holdings in the portfolio, which could result in a significant NAV uplift, given that the investment accounts for 12.2% of the fund at a carrying value of £95m.

Jellyfish deal complete.

Last August, Brandtech began discussions to acquire Jellyfish, a performance and digital marketing agency with clients including Google, Netflix, and Uber. The deal was finally confirmed in June and CHRY says that it has created the number one digital-only marketing group in the world with over US$1bn in revenue, over 7,000 employees, working for eight out of 10 of the world’s largest advertisers, and 49 of the top 100. The acquisition provides Brandtech with scale in media, which is the largest part of the addressable market and also the most profitable segment to operate in.

Starling Bank

As noted above, Starling Bank offers a useful case study of the level of growth achievable by the sort of disruptors that CHRY invests in. Starling has already grabbed a considerable share of the digital banking market in the UK in its short lifetime.

Starling is growing its customer base at breakneck speed.

The company has been particularly successful in the SME space, growing its account base from just a 0.3% market share in November 2018 to 9.4% at the end of March 2023. The bank has essentially gone from nothing to owning more than half the equivalent market share of high street bank Barclays, which has been around since 1690. Its share of personal accounts stands at 2.4%, an equally impressive effort given the level of competition in that space. Despite an already exceptional rate of expansion, the company continues to grow its number of accounts at breakneck speed, adding 800,000 customers over the 12 months ended 31 March 2023.

Helped by rising interest rates, for the year to 31 March 2023 Starling reported revenue of £453m (FY22 £216m) and pre-tax profits of £195m (FY22 £32m). Total lending was £4.9bn (FY22 £3.3bn) and customer deposits totalled £10.6bn.

Founder Anne Boden is stepping down from her role as CEO.

Founder Anne Boden has announced that she is stepping aside as CEO, but will remain on the board, so Starling will continue to benefit from her expertise.

Starling is the second-largest holding in the CHRY portfolio following an additional £20m purchase of equity announced in February 2023, and it has been noted that the carrying value is just 5x book. This appears to be highly conservative relative to some of its peers. The company’s recent performance provides a perfect example of the upside that exists for successful disruptors, and there remains a long runway for future growth as digital banks continue to take market share off main street incumbents.

Smart Pension

Smart Pension is the fourth largest holding in the CHRY portfolio following the recent £12.5m follow-on investment noted on page 4 and considering the current stress in private funding markets (as capital flows towards less risky investments like government debt), the successful fundraiser is a testament to the strength and attractiveness of Smart’s business model.

Impressive top line growth with revenues up 65% YOY.

The company is a leading workplace pensions provider in the UK (one of four major players). Since its inception in 2015, it has grown assets under management (AUM) at a remarkable rate, reaching £4.7bn at the end of 2022, up 123% from the previous year. This momentum is expected to continue with management forecasting AUM in excess of £10bn by the end of 1H23. They have been able to convert this growth into impressive top line performance with revenues up 65% year-on-year (YOY) to £67m and now serve over one million members and 70,000 employers.

As with the majority of CHRY’s investments, there are significant tailwinds driving the sector, notably an on-going regulatory convergence on a global scale towards mandatory direct contribution retirement savings plans, due to retirement savings gaps in most advanced countries. Smart can further capitalise on this opportunity, as it is one of the only cloud-based platforms that is able to serve the global retirement and savings market, with the company rapidly expanding its operations internationally. Early in 2022, Smart acquired US-based Stadion Money Management, which offers personalised digital retirement solutions to advisers, employers and members, while also announcing a partnership with Finhabits. Outside of the US, international expansion includes projects in Ireland, New Zealand, Dubai, and Australia.

Smart’s platform will prove very profitable at scale.

The adviser says that it expects Smart’s platform will prove very profitable at scale. Smart is said to already be profitable in the UK and expects that its international business will become profitable in coming years.

The proceeds of the funding round will be used to drive growth in key markets and finance a pipeline of acquisitions.

Deep Instinct

Deep Instinct can predict and prevent threats 750x faster than the fastest ransomware can encrypt.

Deep Instinct rounds out the list of CHRY’s five-largest investments with a carrying value of £70.8m. The company is the world’s first and only purpose-built, AI based, deep learning cybersecurity framework, used to predict and protect against threats before they emerge. Using this proprietary technology, Deep Instinct can predict and prevent known, unknown, and zero-day threats in less than 20 milliseconds, 750x faster than the fastest ransomware can encrypt. The investment adviser knows of no other cyber security solution which guarantees the same levels of efficacy as Deep Instinct, and this unique proposition was reflected by the company’s inclusion in the 2022 Gartner Magic Quadrant for Endpoint Protection Platforms (EPP); the only new vendor to be recognised for EPP (Magic Quadrants compare vendors based on Gartner’s standard criteria and methodology, influencing the buying decisions of companies of all sizes globally).

Financials for the company are not publicly disclosed. However, the adviser says that it has secured a number of very high-profile customer wins over the past 12 months.

PayPal Ventures joined the list of backers for the company in March 2023 (size of the investment and terms were not disclosed).

Other holdings

Klarna

S&P have recently assigned Klarna an investment grade credit rating.

Klarna is an eCommerce platform for merchants and shoppers which has turned itself into a leading global payments system providing smarter and more flexible shopping and purchase experiences to 147m active consumers across more than 400,000 merchants in 45 countries. The company thrived during the pandemic induced acceleration in online spending however there has been some consternation recently around the feasibility of its business model, stemming from a significant increase in operating losses as markets adjusted to tighter financial conditions and the impact of higher impairment charges. The company’s response has been impressive with adjusted operating losses (meaning the company’s core operations are not profitable) improving by over 80% since their nadir in 2Q22. This has been a function of both improving credit losses – driven by Klarna’s responsible decision to limit credit growth last year in the light of deteriorating economic conditions – and lower operating costs – driven by Klarna’s cost cutting programme that was largely enacted over 2Q22.

The success of the profitability drive is ongoing and contributed to a recent credit upgrade with the company now holding an investment grade (BBB-/A-3) credit rating by S&P Global.

Klarna now accounts for 6.7% of the portfolio.

Featurespace

Featurespace is a technological platform created to combat fraud and financial crime that accounts for 5.4% of the portfolio. The company demonstrated strong growth over the past 12 months while picking up a number of accolades as it looks to cement its position in the market. These include:

- winning the Next Generation Payments award in the 2021 FinTech Rankings;

- Best-in-Class among fraud and Anti Money Laundering (AML) machine learning platforms by Aite-Novarica Group;

- “Best Technology Initiative” via Worldpay’s Fraudsight (powered by Featurespace) at the 2022 Cards & Payments Awards; and

- finalist in the 2021-22 Cambridge Independent Science and Technology Awards for AI Company of the Year and Technology Company of the Year.

The company also announced the appointment of John Shipsey as CFO. John was CFO at Smiths Group from 2017 to 2022 and the CFO of global technology group Dyson, from 2005 to 2017.

Performance

Up-to-date information on CHRY and its peers is available on our website.

Following the move to self-managed status, the company established an independent valuation committee which decides what the appropriate valuation should be and submits that to the board for approval. Positions are revalued quarterly.

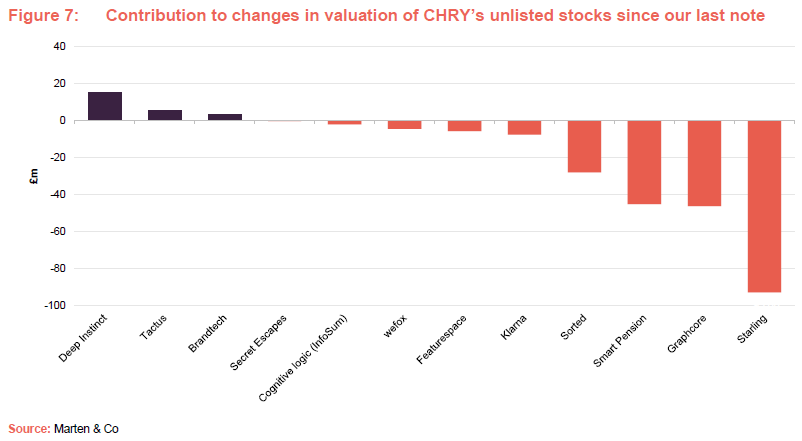

The graph below shows the changes in valuation for each of CHRY’s assets since our last note. The overall valuation of the fund fell from £980m to £776.3m over the period from 18 August 2022 to 31 March 2023. Mark-to-market moves accounted for the majority of this. Despite its strong results, Starling was the single largest detractor, followed by Graphcore and Smart Pension. The success of Deep Instinct provided the biggest positive contribution.

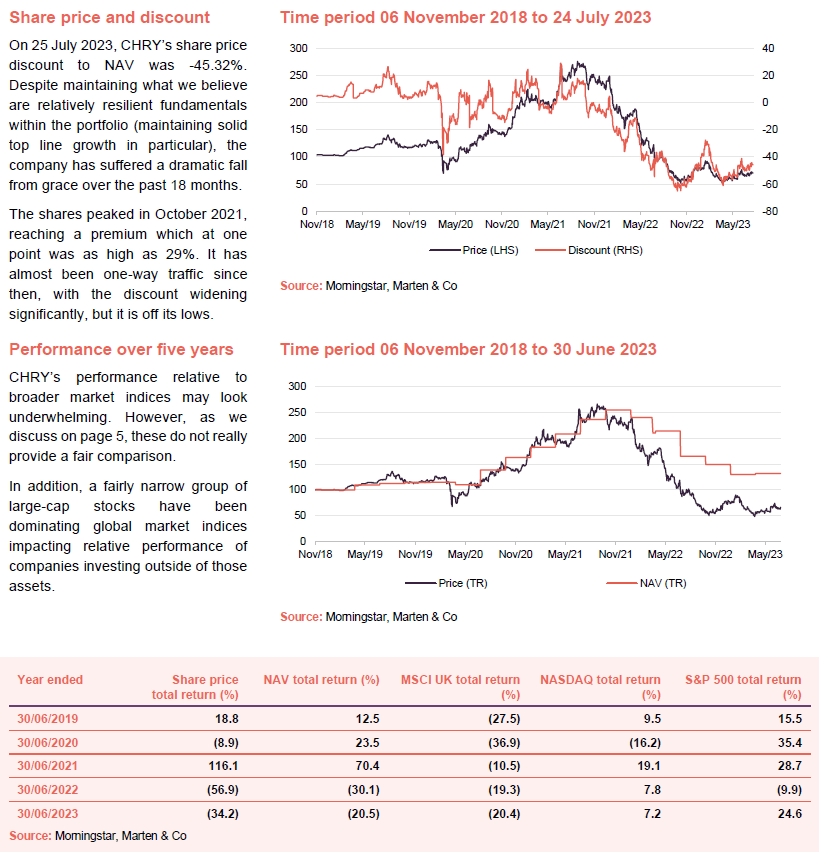

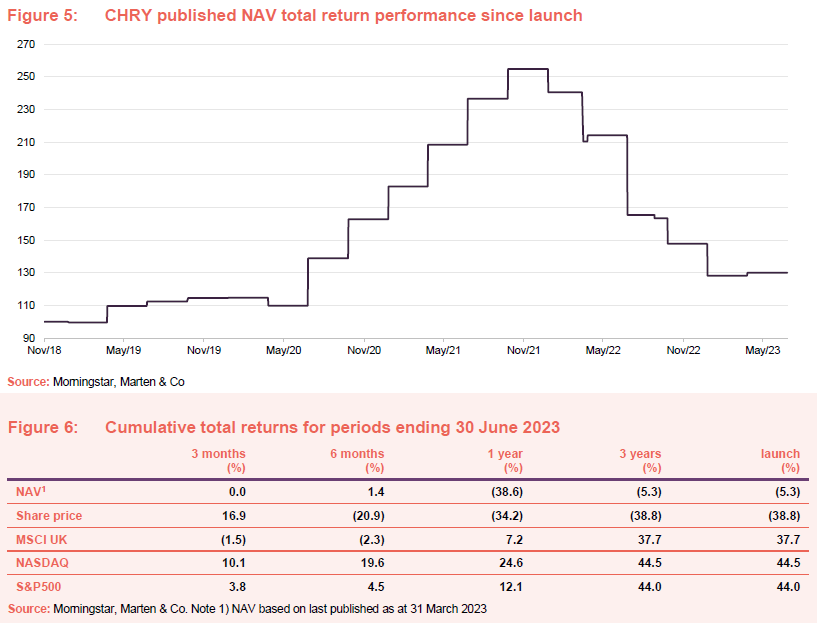

CHRY’s performance relative to broader market indices may look underwhelming. However, as we discussed on page 5, these do not really provide a fair comparison. In addition, a fairly narrow group of large-cap stocks have been dominating global market indices.

Most of the NAV fall is the mark to market effects of the extreme adverse shift in sentiment towards growth.

As the graph above highlights, CHRY’s NAV has followed a pattern familiar to many investors, peaking around the end of 2021 before de-rating as interest/discount rates rose. The fall in NAV from peak to trough is dramatic, but – as discussed in our last note – the majority of this can be attributed to Klarna. Whilst there have been some failures within the portfolio (Revolution Beauty and THG), this is to be expected with a portfolio of growth capital investments. However, for the most part the fall in NAV reflects the mark-to-market effect of the extreme adverse shift in sentiment towards growth stocks, particularly unprofitable growth stocks following a period of investor exuberance, rather than a reflection of any structural weakness in the majority of portfolio.

Promisingly, the most recent NAV update showed a small but positive improvement of 1.4%, which would have been closer to 3% absent foreign exchange impacts.

A successful exit could validate the valuation of that holding and the wider portfolio.

The IPO market in the UK remains very subdued, with the lack of activity almost on par with the hiatus following the global financial crisis in 2008, despite economic conditions which are considerably more stable. CHRY has several later-stage assets which could be floated, and a successful exit – whether through an IPO or trade sale – could materially enhance the company’s liquidity while validating the valuation of that holding, and by extension, that of the wider portfolio.

In addition, the manager has noted the possibility of several investments moving from a “price of last round” valuation to a “peer group” valuation, which would likely result in a positive impact on the NAV. Post period end, they have also seen increasingly positive market activity, particularly in the company’s larger holdings.

When viewed amongst its growth capital peers, CHRY’s price return has performed more or less in line with the sector median over the past year.

Premium/(discount)

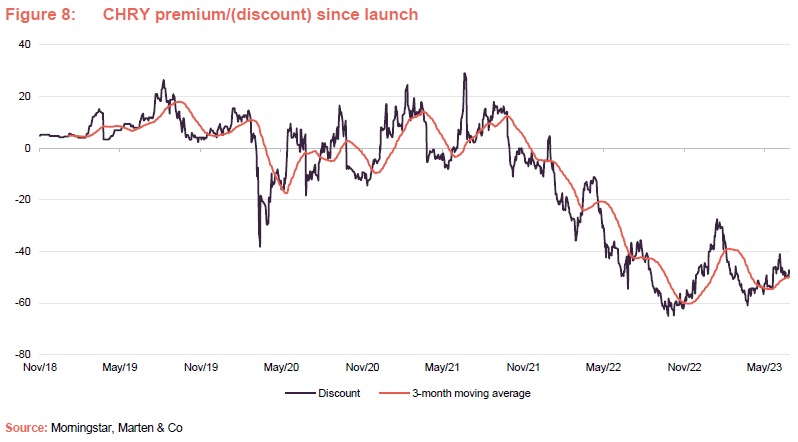

Over the 12 months ended 30 April 2023, CHRY’s shares traded between a discount as wide as 65.1% and as narrow as 27.5%, the average discount over that period was 48.2%. On 25 June 2023, CHRY’s discount was -45.32%.

Despite maintaining what we believe are relatively resilient fundamentals, the company has suffered a dramatic fall from grace over the past 18 months. The shares peaked in October 2021, reaching a premium which at one point was as high as 29%. It has almost been one-way traffic since then, with the discount widening significantly, as is illustrated in Figure 8.

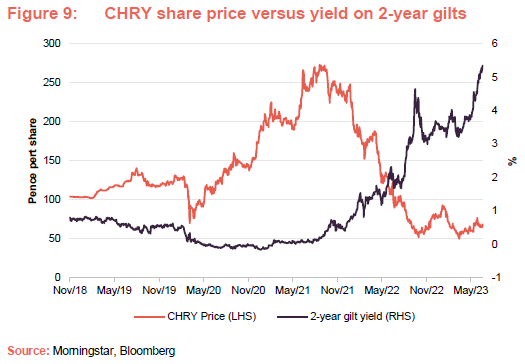

We discussed the reasons for CHRY’s discount widening in our last note. As illustrated in Figure 9, the chief underlying factor has been the market’s response to rising interest rates and the associated possibility of a recession. Within CHRY’s portfolio, stock-specific issues (Revolution Beauty, THG and the Klarna write down) have also had an impact on sentiment, as is inevitable in what is a relatively concentrated portfolio. So, too, did the reaction to the performance fee, the terms of which have now been amended (see page 17).

It feels to us as though we are much closer to the peak in rates than we were at the time of the publication of our last note, and this is especially true in the US. However, inflation is proving stubborn (especially here in the UK) and, barring a dramatic plunge in economic activity, rates may remain elevated for a while yet.

Extreme pessimism towards growth coupled with a wide discount offers investors a potentially attractive entry point.

The extreme pessimism towards growth companies that has depressed CHRY’s NAV, coupled with the wide discount, provides new investors with a potentially attractive entry point, provided they are conscious of the volatility inherent to the sector. As more of CHRY’s holdings become self-sustaining and then profitable, a less-risky portfolio should command a better rating. If, as discussed above, CHRY is able to demonstrate the accuracy of its NAV and free up substantial liquidity through an IPO or a trade sale of one of its assets, the shares could be re-rated quickly.

Performance fee update

Following a review of its performance fees with the board and investment adviser, the company announced a number of revisions to the previous arrangements designed to ensure long-term alignment between the advisory team and CHRY’s shareholders’ interests.

- The overall performance fee level was reduced from 20% to 12.5% of the amount by which the adjusted net asset value exceeds the higher of the high-water mark and the hurdle rate.

- The performance fee is to be satisfied in shares (excluding tax and other liabilities attributable to receipt of the performance fee which will be satisfied in cash), with a deemed issue price set at the higher of NAV and share price as at the year-end in respect of which the fee accrues.

- The shares allotted under the performance fee will be allocated by Jupiter solely to the members of the advisory team, to ensure alignment of the team with CHRY’s shareholders.

- The “high-water mark” set in September 2021 is maintained at the same level.

- Introduction of a deferred settlement structure; 25% of the shares due in any performance fee payment will be immediately issued with the remaining 75% of payment deferred by CHRY for between three and five years, subject to share price tests.

- A cap on the performance fee payable in any one year is based on the performance fee payment not resulting in the company’s total expense ratio (TER) exceeding 3.75% in that year.

Fund profile

Investors may wish to consult the fund’s website at chrysalisinvestments.co.uk.

CHRY’s investment objective is to generate long-term capital growth through investing in a portfolio consisting primarily of equity or equity-related investments in unquoted and listed companies. Having the ability to back growing companies, regardless of whether they are listed or not, is core to CHRY’s investment rationale.

At launch, the company’s name was Merian Chrysalis (ticker MERI). That changed in December 2020, following Jupiter’s acquisition of Merian Global Investors Limited.

Jupiter has a team of 13 investment professionals working on the fund.

The advisory team of Nick Williamson and Richard Watts (the advisers) moved across from Merian and remain focused on the fund. They are supported by research analyst Mike Stewart (who is described as integral to the fund’s due diligence process, as well as sourcing deals), legal counsel James Simpson, ESG director Andrew Mortimer, and finance director Bekki Whiting. In addition, they can tap into the expertise of Jupiter’s seven-strong UK small- and mid-cap team.

CHRY is a self-managed AIF, to which Jupiter Investment Management Limited provides portfolio management.

For comparative purposes, we have used the MSCI UK, NASDAQ 100 and S&P 500 indices in this note, as CHRY does in its annual report.

Previous publications

Readers interested in further information about CHRY may wish to read our initiation note – Shepherding its portfolio through the storm, published in September 2022.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Chrysalis Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.