Return to form

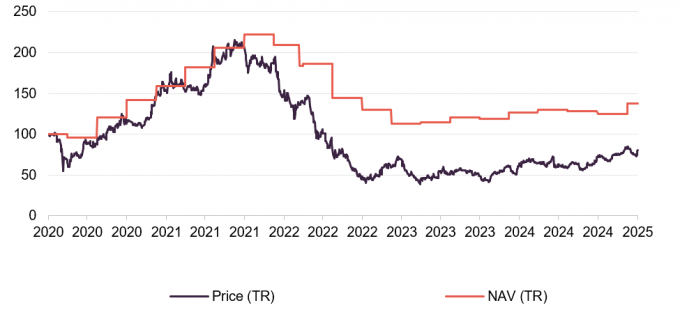

Chrysalis Investments Limited (CHRY) has experienced decent net asset value (NAV) and share price growth recently. With the bulk of the proceeds from the disposals of Graphcore and Featurespace received, and the term loan facility drawn down, CHRY is making good progress with its share buyback programme (see page 4). As of publication, 46,183,261 shares had been bought back, around 7.8% of CHRY’s issued share capital, and this is boosting its NAV. CHRY has now returned about £45m of its £100m target and is well placed to press ahead with this, as it had a total liquidity position (available cash and credit) of approximately £144m at end December 2024.

The bulk of the portfolio is performing well – in its recent results, CHRY said that all portfolio companies have seen profits rise or losses narrow – and Klarna’s IPO still looks likely at some point this year. While there is a good case that it might soon be time to make new investments, the focus for 2025 will remain on narrowing the discount to NAV, which is in much better shape than it was a year ago, but still has room for improvement.

Supporting growing businesses

CHRY aims to provide access to returns available from investing in later-stage private companies with long-term growth potential, an investment class that has traditionally been difficult to access for individual investors. CHRY also benefits from the flexibility to continue to support these businesses after they IPO.

At a glance

Share price and discount

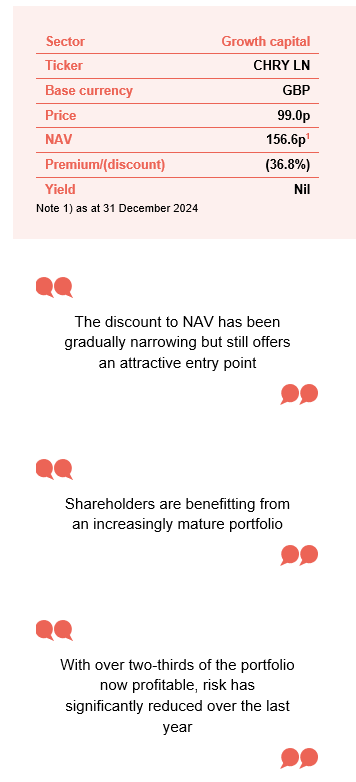

Over the 12 months ended 31 January 2025, CHRY’s shares traded between a discount as wide as 50.6% and as narrow as 23.7%; the average discount over that period was 40.6%. As of publishing, CHRY’s discount was 36.8%.

The discount has been on a narrowing trend for a while now, which we believe reflects the overall good news that is emerging on CHRY’s portfolio, as well as the effects of buybacks.

Time period 31 January 2020 to 25 February 2025

Source: Morningstar, Marten & Co

Share price and discount

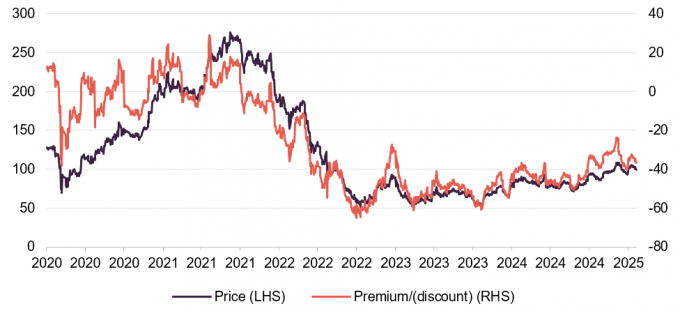

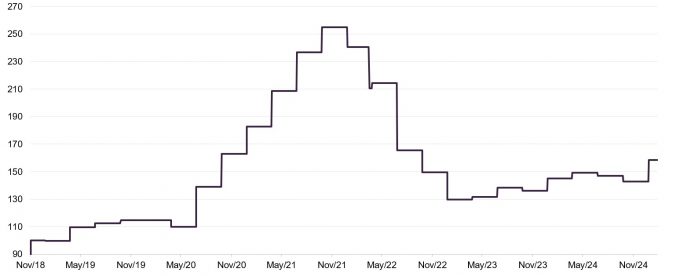

At the end of December 2024, CHRY’s NAV was 156.62p, up 10.9% over the quarter and 9.2% over 2024 as a whole.

In retrospect, the NAV turned a corner in March 2023, but the recovery in the share price began in the autumn of that year, and as we discuss on page 11, has a lot further to go.

Time period 31 January 2020 to 31 January 2025

Source: Morningstar, Marten & Co

| Year ended | Share price TR (%) | NAV total return (%) | MSCI UK TR (%) | NASDAQ TR (%) | S&P 500 TR (%) |

|---|---|---|---|---|---|

| 31/01/2021 | 53.1 | 59.3 | (10.9) | 38.8 | 12.6 |

| 31/01/2022 | (1.3) | 31.6 | 23.7 | 18.7 | 26.2 |

| 31/01/2023 | (55.2) | (46.1) | 8.5 | (11.1) | 0.0 |

| 31/01/2024 | (6.7) | 11.8 | 2.2 | 37.7 | 16.8 |

| 31/01/2025 | 27.1 | 9.2 | 17.5 | 29.2 | 29.5 |

The buy case in brief

In its full-year results presentation in January 2025, CHRY’s investment advisers set out six reasons why they are increasingly optimistic about the company’s prospects.

1.) The core portfolio has significant opportunities – the advisers believe that CHRY offers exposure to a high-quality collection of assets that are generally growing strongly.

2.) Ongoing progress towards profitability – the advisers say that over two-thirds of the portfolio is now profitable and suggest that risk has significantly reduced over the last year, or two as key assets have moved into profitability, implying a reduction in expected capital intensity.

3.) An improved backdrop – levels of M&A (mergers and acquisitions) and secondary market liquidity in unquoted assets are picking up.

4.) A focus on realisations – the two substantial exits achieved in 2024 (Graphcore and Featurespace) could be eclipsed if Klarna achieves its IPO as expected in the first half of 2025. This position was valued at £144m as of December 2024.

5.) Capital discipline – the advisers have managed liquidity carefully, supporting existing holdings and making meaningful progress with the capital allocation programme. The company is committed to return up to £100m to shareholders. With only c£45m bought back to date, there remains substantial firepower which should lead to NAV accretion and support the share price.

6.) Growth is scarce – in an environment where economic growth is anaemic or absent, CHRY has a number of assets that have great potential.

We would add a seventh reason to this list:

7.) Even after the discount narrowing that we saw last year, the current 36.8% discount to NAV provides an attractive entry point.

Significant progress on capital allocation policy

Since we last published, the disposals of Graphcore and Featurespace and securing and drawing down the term facility (see page 12) have transformed CHRY’s balance sheet. The substantial liquidity that this has freed up has allowed CHRY to make significant progress with the second stage of its capital allocation policy – the return of up to £100m to shareholders, which is being carried out through share buybacks – with around £45m returned to date.

Shareholders are benefitting from an increasingly mature portfolio. They were happy to support the continuation of the company in 2024, and some have been asking when the advisers intend to make new investments. We would also like to see the advisers sowing the seeds of future returns. In addition, as the number of positions in the portfolio falls, the board is mindful of the desirability of maintaining a diversified portfolio.

Nevertheless, the immediate priority remains to fulfil the promises made when the capital allocation policy was set out. Even when £100m of capital has been returned to shareholders, the policy says that CHRY will return at least 25% of any net realised gains. The board says it would want to see a sustained improvement in the discount before committing capital to new investments. It suggests that CHRY is unlikely to consider using its liquidity to make new investments before 2026.

Figure 1: CHRY share buy backs

Source: Marten & Co (NB data to 25 February 2025)

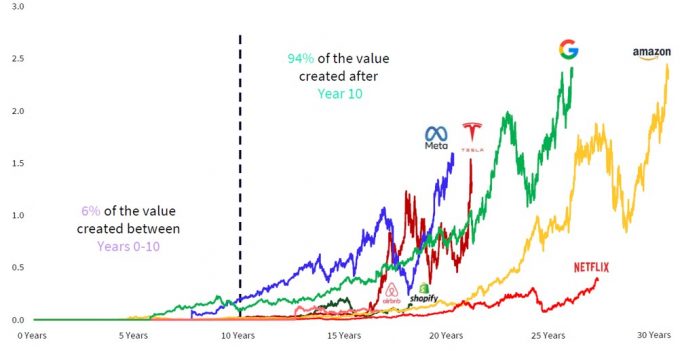

Beyond the need to address the discount to NAV, the advisers say that they are keen to maximise the value of CHRY’s most promising investments. They observe that many leading businesses created the majority of value for investors in the period following their first decade.

Figure 2: Value progression of representative tech companies started in the last 30 years ($ trillion)

Source: Chrysalis Investment Partners LLP, Bloomberg, Pitchbook

For example, as illustrated in Figure 2 (which was taken from CHRY’s full-year results presentation in January), looking at the value created by a basket of Netflix, Amazon, Google, Tesla, Meta, Shopify, and Airbnb since their foundation, just 6% of value was created in the first 10 years, with the other 94% coming afterwards.

Portfolio activity

Over the course of 2024, CHRY continued to reduce its exposure to Wise, made full sales of Sorted, Graphcore, and Featurespace, and invested additional sums in wefox and Klarna. In addition, Tactus went into administration on 1 June 2024.

Exits over 2024

Sorted – January 2024

CHRY had written down (reduced the carrying value) its position in Sorted over 2023. In January 2024, it announced that the company had been acquired by Location Sciences Group in a reverse takeover (a transaction where a private company merges with a public company to become publicly listed). The newly renamed Sorted Group Holdings Plc started trading on AIM in February 2024. CHRY still had a very small residual exposure to the business at the end of 2024.

The Graphcore exit kickstarted the recovery in CHRY’s share price and provided the firepower for buybacks to begin

Graphcore – July 2024

In December 2023, CHRY flagged the possibility of a disposal of a portfolio company. Details of the deal were finally announced on 12 July, when CHRY revealed that Graphcore had been acquired by Softbank. The expected proceeds were $56m, a 25% premium to the carrying value of the position in CHRY’s end March 2024 NAV.

This deal was significant as the original announcement kickstarted the recovery in CHRY’s share price and it freed up sufficient cash for CHRY to begin returns of capital to shareholders through buybacks.

Featurespace – September 2024

In September 2024, CHRY announced that it had sold Featurespace to Visa in a deal that was expected to result in cash proceeds to CHRY of about £89m. About £10m of that was in the form of deferred proceeds which were still outstanding at the end of 2024.

The sale price was at a 20% premium to the carrying value of the investment and crystallised a money multiple return of 3.0x (assuming the deferred proceeds are received in full). The advisers say that the disposal came earlier than they had anticipated.

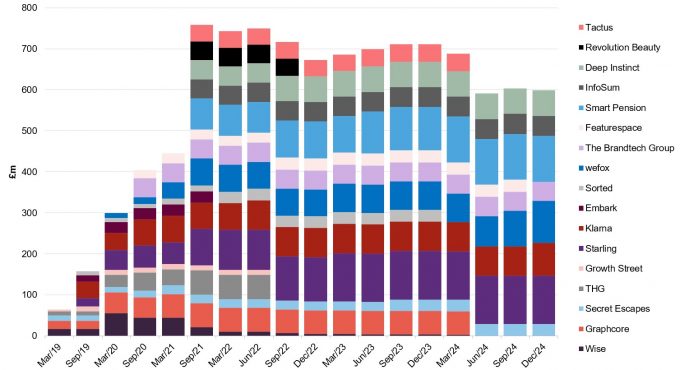

Figure 3 shows the history of the investments that the advisers have made in the portfolio, and reflects the realisations that have been made to date.

Figure 3: Portfolio progress since launch – amounts invested

Source: Marten & Co

Additional investments

wefox

CHRY backed fundraises for wefox (wefox.com) in each of the last three quarters, investing the equivalent of about £33m in total to help stabilise the business and improve its prospects.

When we last published on CHRY, wefox was its largest position (valued at £188.8m at end December 2023). CHRY wrote down the value by £62.3m as at the end of March 2024, citing a strategic repositioning within the business, amongst other factors. On 6 March 2024, wefox announced that founder Julian Teicke would become non-executive president (a leadership role without day-to-day management responsibilities) of the company and that Mark Hartigan had been appointed as CEO and executive chairman.

CHRY reduced the valuation materially again at the end of June, and Richard Watts joined wefox’s board. A new CEO, Joachim Mueller, was appointed in September 2024.

With CHRY’s support, wefox has restructured its business to focus on its core markets – notably Netherlands, Austria, Switzerland, and Italy – selling some non-core assets, and withdrawing from the German market. It will no longer seek to write insurance, and its insurance carrier has been sold. Instead, the focus is on its insurance distribution and managing general agent (MGA) operations. Under the MGA business model, wefox will earn commissions by underwriting insurance on behalf of an insurer but will not take on the risk itself.

In its most recent update, CHRY’s advisers said that wefox’s streamlined, asset-light business model enables efficient growth, while allowing wefox to capture distribution margin and some of the underwriting margin through its MGA strategy.

Klarna

In its latest quarterly report, CHRY announced that it had invested £8.2m in a secondary investment (purchasing a stake from another investor rather than injecting fresh capital into the company) in Klarna (klarna.com) at a discount to the position’s latest valuation, which we believe implies a valuation for the whole business of about $15bn.

Klarna has flagged that it hopes to IPO in 2025 and filed a draft Registration Statement on Form F-1 (a precursor to an IPO) to the Securities and Exchange Commission (the US financial regulator) in November 2024.

The business more or less broke even over the first nine months of 2024, reporting a loss before tax of SEK2m on revenue of SEK20.3bn (up 23% year-on-year). However, the trend was one of improving profitability over 2024, driven largely through cost-cutting helped by the adoption of AI. The Klarna Checkout division has been sold as the company focuses on building out strategic partnerships in the payments sector.

Klarna now serves 85m consumers and 600k partners, processing 2.5m daily purchases across 26 countries. Revenue growth has been supported by increasing use of its services in the US. Klarna also cites Worldpay’s decision to make Klarna a default payment option, as well as collaborations with Adyen, Apple Pay, Google Pay, Xero, and UATP as drivers of future revenue growth.

In January, Klarna announced that businesses in 25 countries using Stripe could offer Klarna’s payment options, which could be another valuable source of revenue growth.

The news of the IPO filing was a factor in CHRY’s share price rise over the latter half of the fourth quarter of 2024. The additional liquidity that an exit would create would transform CHRY’s balance and should help contribute to further discount narrowing.

Current portfolio

The portfolio is in good health. Over the 12 months ended 30 September 2024, the underlying profit before tax of the portfolio rose by 45% in aggregate and revenue rose by 22%.

Figure 4: Portfolio as at 31 December 2024

| Business description | % of portfolio 31 Dec 2024 | Value 31 Dec 2024 £m | Amount invested £m | MOIC(x) | |

|---|---|---|---|---|---|

| Starling | UK challenger bank | 29.1 | 278.9 | 118.3 | 2.4 |

| Klarna | Online payments business with buy now pay later option | 15.0 | 143.6 | 79.5 | 1.8 |

| Smart Pension | Workplace/automatic enrolment pension schemes for small and medium-sized enterprises | 12.9 | 123.4 | 111.6 | 1.1 |

| Brandtech | Digital advertising and marketing services | 9.1 | 87.4 | 46.4 | 1.9 |

| wefox | Europe’s largest digital insurance platform | 6.9 | 65.8 | 103.1 | 0.6 |

| InfoSum | Data collaboration platform | 4.3 | 41.4 | 48.5 | 0.9 |

| Deep Instinct | A US cybersecurity company | 4.3 | 41.1 | 62.2 | 0.7 |

| Secret Escapes | Travel company that helps minimise unsold inventory | 2.1 | 20.0 | 28.0 | 0.7 |

| Featurespace | Financial crime risk management using real-time learning | 1.1 | 10.5 | n/a | n/a1 |

| Wise | Online foreign exchange | 0.3 | 3.2 | 0.7 | 4.6 |

| Graphcore | Artificial intelligence processor business | 0.1 | 1.0 | n/a | n/a2 |

| Sorted | Software-as-a-service company with a delivery management platform | – | 0.3 | n/a | n/a3 |

| Gross cash | 14.8 | 141.5 | |||

| Total portfolio | 100.0 | 958.3 | |||

| Debt | (70.0) | ||||

| Net assets | 888.3 |

Looking at a couple of these in more detail:

Starling

Starling (starlingbank.com) has been one of CHRY’s most successful investment to date, providing the most significant positive contribution to returns over 2024, as we show on page 12. The bank has been strengthening its management team, with new hires taking on the roles of chief banking officer, chief operating officer, chief marketing officer, and managing director of SME (small and medium-sized enterprise) banking.

A new Easy Saver instant access deposit account, paying an initial 4% interest rate, was launched in November 2024. CHRY says that it has already taken significant deposits. In February 2025, Starling stopped paying interest on current accounts.

An FCA investigation (Financial Conduct Authority – the UK financial regulator) into Starling Bank’s onboarding of certain high-risk customers and sanctions screening processes resulted in a £29m fine in November 2024. The bank has taken action to address the failings identified. CHRY points out that the fine was affordable in the context of Starling’s headroom over its regulatory capital requirements – the minimum financial reserves required by regulators – of about £284m as at March 2024.

Starling’s last results were published in June 2024 and covered the 12 months ended 31 March 2024. Over that period, revenue had grown by 50.6% to reach £682.2m, pre-tax profits were 54.7% higher at £301.1m (marking a third year of profitability), and total deposits were up 4% to £11bn.

Smart Pension

Smart Pension (smart.co) has been building its leadership team with a number of hires, including former UK pensions minister Guy Opperman, who will be helping it to scale its software sales internationally. The total value of assets managed on Smart Pension’s Keystone software platform is about £15bn, and CHRY believes this division can provide significant organic growth.

The Smart Pension Master Trust now serves over 1.4m members in the UK and has assets under management (AUM) of about £6.4bn. The UK government is considering setting a minimum size of £25bn for multi-employer pension schemes by 2030. That would provide an impetus to further consolidation of this sector and CHRY believes that Smart Pension would take a leading role in this. To date, Smart Pension has made 10 acquisitions since it was launched just over 10 years ago, most recently acquiring the assets of the Options Master Trust in June 2024.

Whilst the focus has been on revenue growth, in the first quarter of 2024 Smart Pension undertook a cost-cutting exercise, reducing its headcount by 150 to 427 by end June 2024. CHRY’s manager believes that this will put it on the road to profitability in 2025.

Performance

Up-to-date information on CHRY and its peers is available on our website

At the end of December 2024, CHRY’s NAV was 156.62p per share, up 10.9% over the quarter and 9.2% over 2024 as a whole.

In retrospect, the NAV turned a corner in March 2023, but the recovery in the share price began in the autumn of that year, and as we discuss on page 12, has a lot further to go.

Figure 5: Cumulative total returns for periods ending 31 December 2024

| 3 months(%) | 6 months(%) | 1 year(%) | 3 years(%) | 5 years(%) | launch(%) | |

|---|---|---|---|---|---|---|

| NAV1 | 10.9 | 7.8 | 9.2 | (34.2) | 38.1 | 58.4 |

| Share price | 20.5 | 28.7 | 27.1 | (46.9) | (19.7) | (0.7) |

| MSCI UK | 7.3 | 4.0 | 17.5 | 30.3 | 43.7 | 55.3 |

| NASDAQ | 11.9 | 16.3 | 29.2 | 58.2 | 160.7 | 235.9 |

| S&P500 | 9.9 | 13.7 | 29.5 | 51.3 | 114.9 | 156.0 |

As in previous reports, we have included the MSCI UK, NASDAQ and S&P500 as comparators. However, none of these would make an ideal benchmark – S&P 500’s returns are distorted by the Magnificent Seven, for example.

Figure 6: CHRY published NAV total return performance since launch

Source: Morningstar, Marten & Co

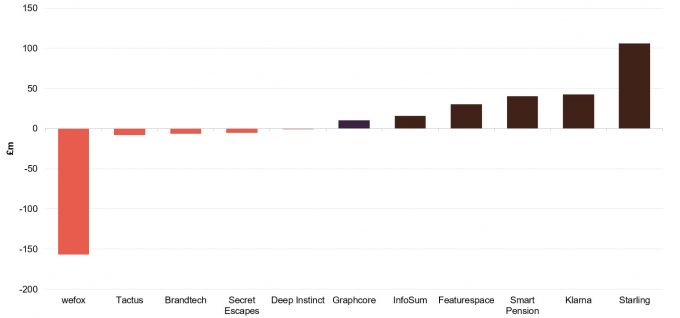

Figure 7 below shows the changes in valuation for each of CHRY’s assets since our last note, which used valuations as at 31 December 2023.

Figure 7: Contribution to changes in valuation of CHRY’s unlisted stocks since our last note

Source: Marten & Co

The overall valuation of the fund rose from about £854m to £888m over the course of 2024. The fall in the valuation of wefox for the reasons discussed on page 7 was more than offset by uplifts in the value of Starling, Klarna, and Smart Pension.

The uplifts in the valuations of Graphcore and Featurespace reflect the terms of the sales of those stakes during the period.

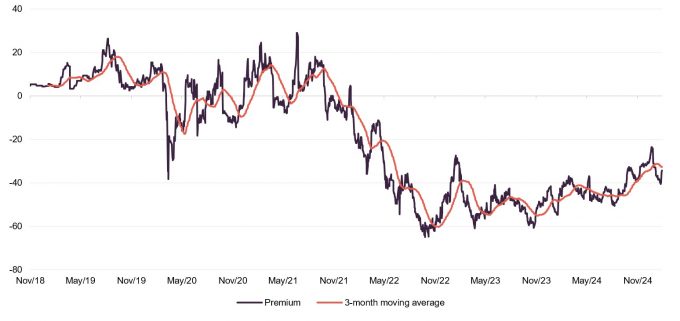

Premium/(discount)

Over the 12 months ended 31 January 2025, CHRY’s shares traded between a discount to NAV as wide as 50.6% and as narrow as 23.7%; the average discount over that period was 40.6%. As of publishing, CHRY’s discount was 36.8%.

The discount to NAV has been on a narrowing trend for a while now, which we believe reflects the overall good news that is emerging on CHRY’s portfolio, as well as the effects of buybacks.

The macroeconomic backdrop is a bit more supportive too. The Bank of England has now cut rates three times from the peak. Longer-term gilt yields remain elevated, but are off their recent peaks.

Figure 8: CHRY premium/(discount) since launch

Source: Morningstar, Marten & Co

Fund profile and management arrangements

Investors may wish to consult the fund’s website at chrysalisinvestments.co.uk

CHRY’s investment objective is to generate long-term capital growth through investing in a portfolio consisting primarily of equity or equity-related investments in unquoted (private companies) and listed companies. Having the ability to back fast-growing companies, regardless of whether or not they are listed, is core to CHRY’s investment strategy.

At launch, the company’s name was Merian Chrysalis Investment Company Limited (ticker MERI). That changed in December 2020, following Jupiter’s acquisition of Merian Global Investors Limited. The advisory team of Nick Williamson and Richard Watts moved across from Merian. Then, with effect from 1 April 2024, Nick and Richard formed a new investment adviser – Chrysalis Investment Partners LLP – which entered into a tripartite contract (a three-party agreement) with CHRY’s board, under which it took over investment advisory services from Jupiter and G10 Capital Limited took over as AIFM. As a result, Richard and Nick are solely focused on CHRY’s portfolio. They are supported by research analyst Mike Stewart, investment specialist Carmen Azad, legal counsel James Simpson, and finance director Bekki Whiting.

The board noted that some shareholders have advocated for an expansion of the adviser’s resources. The board and the adviser are exploring ways in which to achieve this, and will update shareholders as appropriate.

The debt facility

In September 2024, CHRY announced it had secured a two-year, £70m debt facility with Barclays Bank. It comes with an uncommitted accordion facility (an option to increase the size of the facility) of £15m. Interest is charged at a margin over SONIA. The loan was immediately drawn down and can be repaid after one year with no penalty to CHRY.

Previous publications

Readers interested in further information about CHRY may wish to read our previous notes listed below. You can read them by clicking on the links in Figure 9 or by visiting our website.

Figure 9: QuotedData’s previously published notes on CHRY

| Title | Note type | Date |

|---|---|---|

| Shepherding its portfolio through the storm | Initiation | 9 September 2022 |

| Putting growing pains behind it | Update | 26 July 2023 |

| Turned a corner | Update | 7 February 2024 |

IMPORTANT INFORMATION

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Chrysalis Investments Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.