Heralding in the age of AI

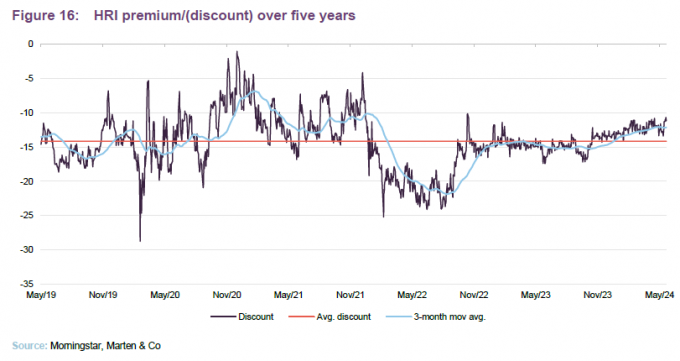

In a world where AI stocks have determined the fortunes of global equity markets, Herald Investment Trust (HRI) offers a way to capitalise on these potent tailwinds while still offering an arguably seldom-found discount opportunity within a universe known for its high valuations, coupled with the trust currently trading on an attractive 11.5% discount.

HRI’s war chest of liquid capital means that it is well primed to take advantage of opportunities as they arise, as well as to profit from the inefficiencies of the UK equity market.

Thanks to structural tailwinds supporting technology and successful stock-picking by the HRI team, HRI has been able to sustain its track record of outperformance, with its NAV performance surpassing that of the US small-cap technology sector, despite its substantial allocation to the UK.

Small-cap technology, telecommunications and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia and technology. Investments may be made across the world, although the portfolio has a strong position in UK stocks. The business activities of investee companies will include information technology, broadcasting, printing and publishing and the supply of equipment and services to these companies.

Fund intro

More information can be found at the trust’s website: www.heralduk.com.

Established in 1994, HRI invests globally in small technology, communications and multimedia companies with the aim of achieving capital growth. It is the only listed fund of its type. The trust invests globally, but has a strong bias towards the UK, which further distinguishes it from other global technology funds, which tend to be biased towards the US.

New investments in the fund will typically have a market capitalisation of $3bn or less, but are generally much smaller when the first investment is made. If successful, these can grow to be a multiple of their original valuation. This type of investing is longer-term in nature and so the trust’s portfolio tends to have low turnover. Reflecting the risks inherent in this type of investing, and the liquidity constraints of having a small-cap investment remit, the trust maintains a highly diverse portfolio of investments (typically in excess of 250) to help mitigate this risk.

Experience is important in markets such as these

HRI’s lead fund manager, Katie Potts, has managed HRI since its launch. Her track record shows how important experience is in markets such as these.

Whilst we outline numerous advantages of HRI in this note, one of the most consistent benefits the trust has offered has been the considerable experience offered by Katie, who was a highly-regarded technology analyst at SG Warburg (later UBS) prior to launching the fund. She owns a substantial stake in the company and a significant minority stake in the management company, and therefore is clearly motivated to ensure the success of the fund.

Under Katie’s stewardship, HRI has navigated several downturns and has benefitted from the team’s ability to select companies capable of weathering difficult conditions. HRI’s closed-ended structure has also been used to great effect. Whilst open-ended funds are often forced sellers, HRI can capitalise on its ability to gear and to pick up lines of stocks at attractive prices, though it has been keeping a net cash allocation more recently (we discuss this further on page 10).

HRI’s size, focus on smaller companies, and the depth of expertise within the management team all mean that it plays an important role as a provider of much-needed capital to listed technology companies looking for expansion capital. This is particularly valuable in a downturn and has offered HRI further opportunities to generate alpha when others may not have been able to.

HRI offers a liquid subcontract for any investor looking to gain access to this part of the market, and we believe that an investment in HRI complements an investment in one of the large-cap technology funds.

Management arrangements

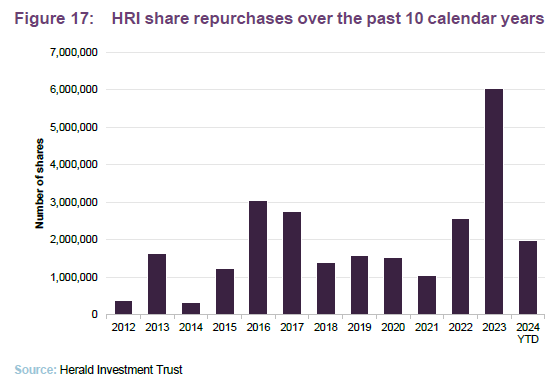

HRI owns a 15.5% stake in its management company, Herald Investment Management Limited (HIML), which was valued at £5.6m as at 31 December 2023. HIML also manages an OEIC, the Herald Worldwide Technology Fund (which has more exposure to large-cap companies than the trust).

Katie leads a team of eight analysts, three of whom have regional responsibility for overseas investments. The team is based in London, except one member who is based in New York to help support corporate access. US companies do not come to the UK as much as they used to, and HRI feels it necessary to have a US presence to enable frequent contact with companies. The HIML team can also draw on the knowledge of three consultants. We have included some biographical details on the team at the end of this note. Research responsibilities are organised along sector lines, but Katie has also delegated responsibility for managing the Asian portfolio to Fraser Elms (the deputy manager) and Hao Luo; the continental European portfolio to Taymour Ezzat; and more recently the North American portfolio to Peter Jenkin.

Market backdrop

HRI’s recent performance reflects a tale of two cities, capturing both the recent fervour around the technology sector and the woes of the UK market. This places HRI in an interesting, if not arguably unique, position, with its performance capturing some of the extremes of both market dynamics, having achieved outsized gains on the back of the rally in AI-linked companies, while also trying to capitalise on the opportunities presented by the declining liquidity in the UK small-cap market.

HRI offers a compelling opportunity to tap into the tech sector at a discount

It is the combination of the ever-expanding opportunities presented by AI (which is still at a nascent stage), the undervaluation and inefficiencies of the UK equity market, as well as HRI’s own discount, that make HRI attractive at the current time.

AI – no longer science fiction

Artificial intelligence has been a major driver of the performance of global equity markets throughout 2023 and so far in 2024. The predicted efficiency gains from this transformative technology have propelled the share prices of companies heavily involved in AI to new heights, offsetting the challenges posed by higher interest rates. Nvidia, the US semiconductor giant, stands out as the poster child of AI. Its processors are the preferred choice for AI software, leading to a nine-fold increase in its share price since the start of 2023.

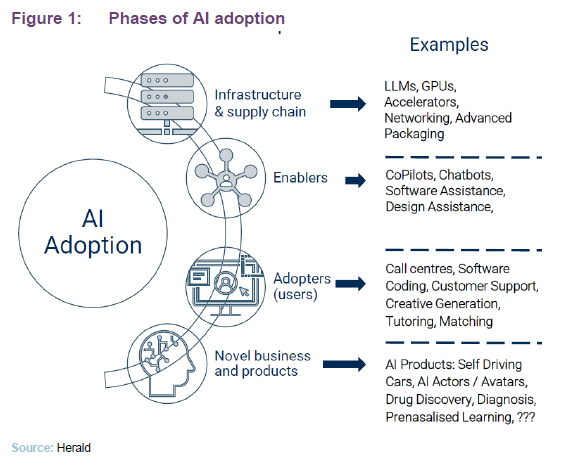

AI has been a major driver of global equity returns, and is still in its infancy

However, the enthusiasm for AI (and the resulting investor demand) has been mainly concentrated in companies associated with what the HRI team refers to as ‘infrastructure and supply’, the first level of AI development and adoption. In practical terms, this has meant that the biggest winners of the AI tailwinds have been a small group of semiconductor firms, their suppliers, and select software companies. These companies have been critical in enabling companies to develop and integrate AI software, the flagship of which has been the semiconductor giant Nvidia, which has reported gains of c.150% so far this year.

This limited group of winners has skewed the performance of managed funds. For instance, 64% of UK active equity funds outperformed the MSCI ACWI in the 30 days leading up to Nvidia’s latest earnings call, but only 14% did so in the following 30 days.

Despite the excitement in public markets, there seems to be a delay in recognising the AI opportunity compared to the activity seen within private capital, which has been more proactive. Notable investments in UK-based private AI firms include $1bn for Wayve Technologies and $50m for Poly AI in April.

Although AI is the most talked-about trend in technology, it is not the only one driving the sector. The HRI team identifies other significant trends, such as the push towards carbon neutrality, onshoring of production, and the increasing demands on cybersecurity systems. The team also emphasises that in any major software trend, long-term winners are often the ‘picks and shovels’ companies. HRI quotes the dot-com bubble as a clear example, with survivors like Cisco – which provided essential networking hardware and software – being the biggest winners.

The HRI team has mapped out the AI-value chain, as seen in Figure 1, identifying potential future winners. The team sees four broad phases of adoption, with the ‘infrastructure & supply chain’ and ‘enablers’ being the market’s current focus. However, as we mentioned earlier, the ‘infrastructure & supply chain’ companies (the picks and shovels of AI) have seen the most investor attention, which may mean that there is significant potential for gains in other areas.

UK-centric issues

The UK market has faced numerous challenges, compounding year-on-year, leading to a growing disconnect between the share price performance of UK companies and their fundamentals. Since our last report in November 2023, UK equities have experienced consistent outflows, continuing a nearly-decade-long trend. In 2023, outflows from UK open-ended funds reached a record £13.6bn, with billions more withdrawn so far in 2024.

Investors have been pulling money out of the UK

This aversion to UK equities stems partly from persistent political risks, which have eroded investor confidence since the 2016 Brexit referendum. Additionally, investors perceive the UK market as regionally biased and dominated by cyclical stocks in the FTSE 100, and sectors that have fallen out of favour compared to the US tech sector.

The exodus of market participants has reduced liquidity and complicated financing efforts for UK companies. Raising capital through IPOs has become particularly challenging due to the scarcity of domestic capital relative to overseas markets. The HRI team comments on the difficulty that UK tech entrepreneurs are facing in growing their early-stage businesses, less they relinquish large ownership stakes to entice investors.

The team has also commented that the lack of liquidity in the smallest segments of the UK market has complicated the investment thesis in some promising UK smaller companies, less HRI find itself in a position where it cannot readily exit their holdings.

As a result of the decline in market participants, private buyers of UK companies continue to remain active in the region, with private-equity deal-making in the UK still above its pre-COVID levels, especially from international buyers; a reflection of the valuation opportunity within the UK.

Rates

Whilst the technology sector benefits from strong secular tailwinds, as demonstrated by the outsized returns of the ‘AI winners’, growth companies remain vulnerable to global interest rate expectations. This vulnerability is heightened because technology stocks typically trade at high valuations, reflecting their growth potential, making them more sensitive to interest rate changes.

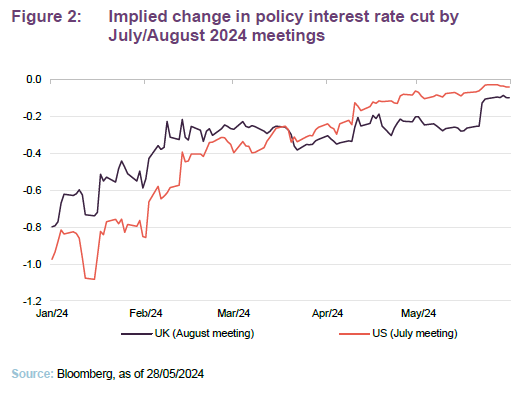

Since our last report on HRI, there have been significant developments in rate expectations, particularly a potential divergence between the US and the UK/Europe. Higher GDP expectations, a tight labour market, and fiscally supportive policies have led the US Federal Reserve (Fed) to adopt a more hawkish stance compared to the Bank of England (BoE).

Lower inflation and a stronger-than-expected UK could be the catalyst for a market re-rating

In its most recent meeting, the BoE maintained rates at 5.25% but did not rule out a possible rate cut in its upcoming June meeting. As shown in Figure 2, the market anticipates a higher likelihood of an interest rate cut in the UK in the near term compared to the US, based on the outcomes of the BoE’s 1 August meeting and the Fed’s 31 July meeting.

Whilst further interest rate cuts should be beneficial for a high-growth strategy, the fact that HRI retains a high allocation to UK growth stocks means it may be better primed to take advantage of rate cuts than other technology strategies, which often have higher allocations to the US.

Process

Extensive fundamental research

Bottom-up stock selection based on fundamental analysis. HRI’s universe is vast with over 5,000 listed companies

HRI’s investment process is driven by bottom-up stock selection, based on extensive fundamental research of the universe of smaller companies that make up the telecommunications, multimedia, and technology sectors. The listed universe within this space includes more than 5,000 quoted companies, but in their respective markets, these companies also compete against many more unquoted companies and the HRI team believes it is important to get to know as many of these as possible. This is not just because unquoted companies may eventually list, but because the information gleaned by the HIML team from competitors, customers and suppliers can be a useful source of ideas, valuable in evaluating how sustainable a company’s competitive position is and assessing the risks within a business, as well as providing a useful means of cross-referencing the information provided by another company’s management.

Idea-generation

In terms of idea-generation, HIML benefits from being a major player in the UK and companies will routinely make the effort to present to the team. The US is a very important market, however, and as small-cap US technology companies are visiting London less frequently, HIML established a satellite office in New York. In addition, Katie visits the US for around five weeks a year to meet companies, and the wider HIML team also travels extensively.

Searching for companies with sustainable advantages

At heart, the members of HIML’s team are investors. Rather than just looking to identify companies with the capacity to grow, they are looking for companies that are capable of making decent returns on capital or those with extraordinary earnings growth. This requires an analysis of a company’s products, markets and competitive position. In this regard, the HIML team is looking for companies where it can see clear markets for its products and where it has advantages over the competition that mean it is more likely to succeed. These come in a range of forms, but could include superior technology, network effects or barriers to entry such as specific intellectual property, patents and the like.

Reflecting the benefits that can be accrued from making early-stage investments in technology companies, loss-making companies are considered for the portfolio. However, the team needs to be able to see both a significant market opportunity and a clear path to profitability. The team tends to be wary of companies that are trading on large multiples of sales, and prefers not to own stocks trading on what it describes as ‘concept valuations’.

The team says that it does not attempt to model companies’ cash flows in any great detail and that, for the types of companies in which it is investing, there is usually far too much uncertainty to make this a useful exercise. However, the team does spend considerable time analysing companies’ accounts to gain an understanding of how a business works and the robustness or otherwise of its earnings.

The importance of diversification

The nature of smaller technology, multimedia and telecommunications (TMT) companies is that they are often dependent on a single product or service and, whilst success can propel share prices many times higher, failure can mean bankruptcy. New technologies can create value very quickly, but they can also severely disrupt existing business models, and product life-cycles can be quite short. The high degree of stock-specific risk that this entails is countered by having a high degree of diversification within the portfolio.

A high degree of stock-specific risk necessitates that HRI’s portfolio is diversified

Liquidity considerations and profitability play a part. These small-cap positions tend to be less liquid and, from a risk management perspective, this inherently places a limit on the size of each position, as larger positions are harder to buy and sell and are more likely to move the market. Furthermore, stocks that are held in large size by other investors can make the team nervous, in case these shareholders ever become forced sellers.

In general, HRI holds less than 5% of the share capital of the companies in its portfolio, if they are loss making businesses. This gives the manager room to support a company if it needs to undertake a fundraising. The manager also aims not to own more than 10% of the issued capital of its holdings, even if they are profitable businesses.

Reflecting this, the handful of companies where HRI holds a larger percentage of ownership are often those that needed to raise cash, but found insufficient large investors willing or able to invest other than HRI. Katie has said previously that you can damage your own property by failing to support a fundraise.

The HIML team is conscious that, in some investors’ eyes, their 326-stock portfolio is a large number of companies to follow, but it counters that the small companies in which it is investing have far simpler business models than most large-cap companies, and that this makes them much easier to follow in detail. Cross-referencing between suppliers, customers and competitors is an important part of the investment process.

Portfolio construction is driven by stock selection

An alternative strategy could be to move up the market-cap scale to find greater liquidity, which would allow the team to increase the average position size and, in the manager’s view, necessitate a migration to a much heavier US weighting. However, the team believes that it is crucial that HRI maintains exposure to micro-caps. Katie says that this is where HRI’s best returns have originated, with many stocks rising by more than 10 times. Katie also believes that smaller-cap stocks are generally better value as these companies are not well covered by analysts. MiFID II has contributed to a reduction in the amount and quality of research available.

Portfolio construction

Liquidity is an important driver of position size

HIML’s investment process is driven entirely by stock selection and without reference to any benchmark index. The portfolio has long had a bias to the UK. This reflects Katie’s belief that the UK technology sector is more vibrant than Europe’s; UK stocks are, generally, more reasonably valued than US ones, and Asian stocks generally have inferior business models (frequently they are providing outsourced manufacturing services to larger tech companies and often have little pricing power).

HRI has some minor exposure to unquoted companies, including its stake in HIML. This is not an area that the trust is focused on, and no more unquoted investments are currently planned. The HIML team believes that it is useful that HRI retains the flexibility to hold unquoted investments, however, as this gives it the opportunity to retain attractive companies that choose to delist.

Sell discipline

Sell discipline is driven by valuation and the viability/maturity of the business model

Stocks are sold when valuations no longer reflect the growth prospects of the company, their margins start to normalise relative to the wider market (an indication that the company’s intellectual property is no longer capable of supporting superior returns) or when there is a clear deterioration in the business model. Companies that have grown larger are typically top-sliced to fund new investments and provide further capital to the earlier-stage smaller companies.

Portfolio

HRI has a highly diversified portfolio of global small-cap technology stocks, with the trust currently invested in 326 companies. HRI tends to hold positions for the long term, with the manager topping and tailing positions where it feels these have run ahead of themselves or represent good value. Portfolio turnover is typically in the region of 15% per annum, suggesting an average holding period of around six to seven years, but HRI’s larger holdings tend to have been held for much longer.

HRI’s allocation not only sets it apart from its investment trust peers – as none offer the same style of exposure – but also its open-ended peers as well. HRI invests into smallest end of the market, gaining exposure to companies to which open-ended funds likely cannot risk taking the same levels of exposure. In a market that is being driven by a narrow band of companies, HRI’s idiosyncratic approach to technology investing offers an attractive diversification opportunity.

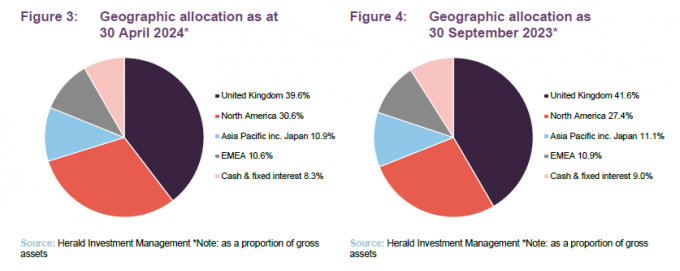

HRI’s US allocation has increased on the back of strong performance

HRI’s asset allocation has remained largely consistent since our last note, although there has been a noteworthy increase in its US exposure. This has come about due to the outperformance of HRI’s US holdings, rather than an intentional allocation by the team. This has led to the team trimming its US allocation on strength, with 2024 being the highest period of turnover within its US allocation.

We remind readers that HRI does not hedge its currency exposure, which can lead to deviations in its regional exposure for reasons not associated with the performance of individual companies. Since our last note, the dollar has depreciated against the pound, offsetting some of the US’s outperformance.

Cash levels – keeping the war chest primed and ready

HRI continues its trend of keeping a material portion of its assets in cash (or liquid equivalents), something which we reported on in our last three notes. Although sustaining a material amount of cash (i.e. more than required for managing trading or liquidity needs) can be viewed as a negative for most strategies, the HRI team believes that the opportunities presented by the inherent illiquidity of their smallest companies, and the general lack of market participants, continues to justify running a high level of cash, as they are in a position to support investee companies at times where not doing so could harm an investment.

HRI retains a substantial cash position, to quickly capitalise on price inefficiencies

A high cash level also leaves HRI well placed to benefit from opportunities such as when forced sellers of UK assets emerge; for example, open-ended funds meeting their daily liquidity needs, or wealth managers making strategic decisions to reduce their UK exposure. Regardless of the nature of the sale, there are increasingly fewer counter parties to those seeking to sell UK assets. This increases the spread required to generate sufficient liquidity and therefore improves the entry price for HRI. The other opportunity comes from entrepreneurs needing to offer increasingly attractive terms when attempting to raise capital.

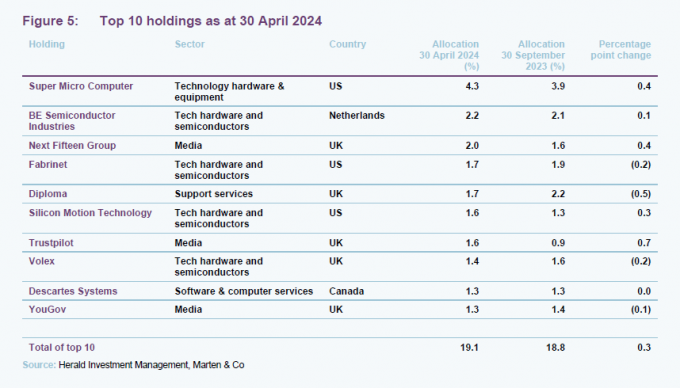

Top 10 holdings

Figure 5 shows HRI’s top 10 holdings as at 30 April 2024 and how these have changed since the end of September 2023 (the most recently available data when published our last note). There has only been one new entrant into the top 10 – Trustpilot, as a result of both top-ups by the team and strong performance by the company. Other noteworthy increases include Varonis Systems, Pason systems, and Franklin Covey, with the latter two being new entrants into HRI’s portfolio.

Generally speaking, we do not expect to see major shifts in HRI’s top 10 between notes. The team prefers to initiate new positions through small holdings (c.0.3%), and either let them grow in weighting via their share price or top up the position as the investment case is increasingly realised.

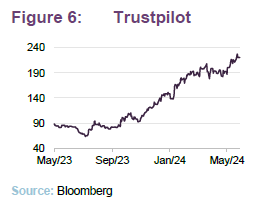

Trustpilot

Trustpilot (uk.trustpilot.com) is the UK-listed and Danish-headquartered online review provider. Trustpilot IPO’d in 2021; however, the HRI team delayed investing until 2023, believing it was mispriced when it entered the market. Recent results for its financial year ending 31 December 2023 were strong. Trustpilot crossed a key milestone in 2023, reporting its first profitable year, with an after-tax profit of $7.1m, a positive EBITDA of $15.5m (compared to a loss of $4.4m in the previous year) and an 18% YoY increase in revenues.

Trustpilot also reported positive user growth, with total cumulative reviews reaching 267m, a 25% increase YoY. The number of reviewed domains rose to 1.1m, and active domains exceeded 116,000 for the first time. Trustpilot continued to invest in protecting the integrity of its platform, implementing new models to predict fake reviews and prioritising genuine reviews. Trustpilot also appointed a new CEO in September 2023, Adrian Blair. A veteran of the ‘digital disruption’ industry, having run accounting and healthcare software firms prior to joining Trustpilot, Adrian’s tenure marked the start of a substantial rally in Trustpilot’s share price, which is up c.170% since the start of September.

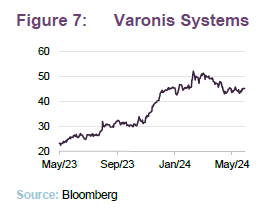

Varonis Systems

Varonis Systems (www.Varonis.com) is a US data security company and sits just outside HRI’s top 10 holdings. Varonis is a cyber security provider, focusing specifically on securing its clients’ data, doing so using cloud-based software rather than having it installed on its client’s local devices. As per its most recent results, released for the financial year ending 31 December 2023, Varonis continues to transition to a software-as-a-service (SaaS) business model, which will improve its recurring revenues and is expected to be the primary driver of the company’s near-term growth. To that end, Varonis’s management offers its SaaS customers easier deployment, faster time-to-value, and powerful automation capabilities when compared to non-SaaS. The company has also made strides in the utilisation of AI, via the launch of Athena AI.

Whilst the company is loss-making, its reported loss for 2023 of $100m was 20% lower than the prior year. The company also reported a 5% growth in YoY revenues as well as a c.90% renewal rate in its clients and a 17% increase in annual recurring revenue. Varonis’s management remains confident in the structural opportunities within the sector, and it highlights remote working, increasing cloud adoption, and the rise of generative AI tools as all increasing the amount of data which will require security.

Pason Systems

Pason Systems (www.pason.com) is a Canadian-listed leading global provider of specialised data management systems for drilling rigs. Pason’s recent earnings (for the financial year ending 31 December 2023) showed that the company was able to buck the trend of the wider drilling sector, generating a 10% increase in YoY revenues despite a 5% decrease in the average number of active US land drilling rigs. This revenue growth was driven by increased revenues generated per drill site and by its International Business Unit and Energy Toolbase. Though down slightly on the year, Pason still reported a high, near-50% EBITDA margin.

The company also purchased the remaining outstanding shares of Intelligent Wellhead Systems, a developer of valve management solutions for drilling rigs, which Pason’s management believes will help diversify its future revenues. Management is also confident that the structural drivers surrounding the oil industry will continue to support future revenue growth, such as consolidation within the oil industry likely to increase demand for consistent automation and analytics technologies.

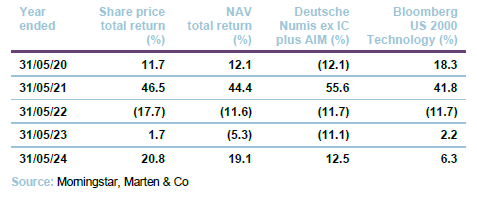

Performance

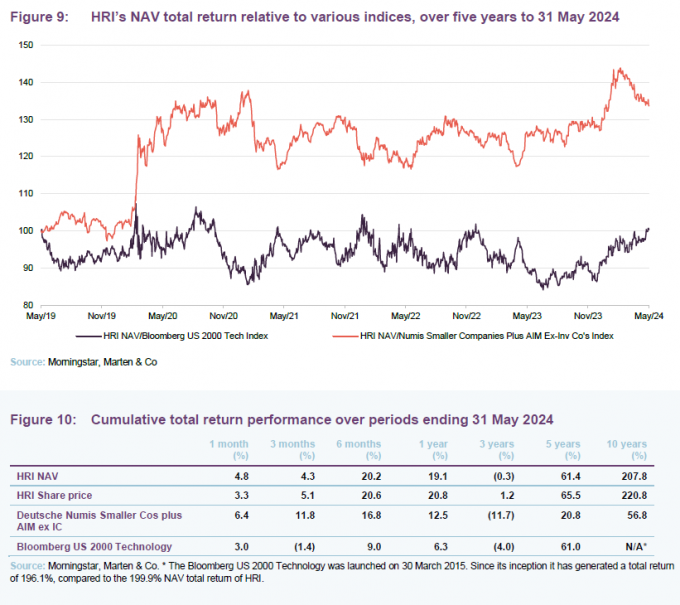

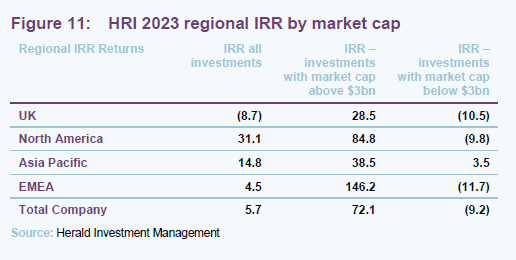

As can be seen in Figures 10 and 11, HRI has been able to generate returns which exceed both the Deutsche Numis Smaller Cos plus AIM ex IC (which captures the performance of the wider UK small-cap market) and the Bloomberg US 2000 Technology Index (a proxy for the US small-cap technology space that is also a close proxy for the Russell 2000 Index) for all periods of three months and above.

HRI has outperformed both the UK and US markets over the long term

Interestingly, HRI’s NAV has still been able to edge ahead of the US small-cap sector while still having a near-50% allocation to the UK, a region which has structurally underperformed the US due to reasons we highlighted earlier. Beyond its ability to generate outperformance, the allocation-return profile of HRI makes it attractive from a diversification standpoint as well.

2023, large and in charge

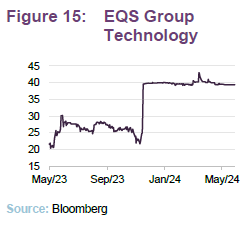

The dominance of larger companies and US-listed stocks in 2023’s global returns, as we described in our market update section, is apparent within Figure 11. Of HRI’s smaller, sub $3bn allocations, only its Asia Pacific investments were able to generate a positive return. We note that the outsized returns of HRI’s EMEA large-cap allocation was a result of the takeover of EQS group, described in the next section.

US equity gains have offset HRI losses in the UK market

The standout trend in Figure 11 has been the influence of the AI rally on stock returns, with investors favouring the larger technology stocks, particularly those in the US, over the smaller. At the other end of the scale, rising interest rates have also weighed on the relative performance of smaller companies. In the case of the latter, this partly reflects that they tend to have a higher portion of their value discounted from some point in the future, but in some instances, risk has increased as debt will be both more expensive and harder to come by at the margin.

Key contributors

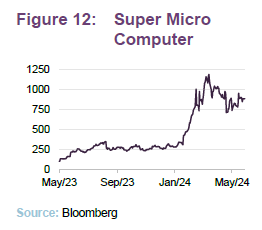

There are four particularly noteworthy companies within HRI’s portfolio which have been major contributors to its 12-month return: Super Micro Computer, Celestica, Silicone Motion Technology, and EQS Group. We also note that Trustpilot, which we described on page 11, was also a major contributor to HRI’s returns.

Super Micro Computer

Super Micro Computer (www.supermicro.com) is one of the largest producers of high-performance and high-efficiency servers. Based in Silicon Valley, it provides servers and platforms for a variety of markets, including enterprise data centres, cloud computing, artificial intelligence, fifth generation (5G) and edge computing. The demand for its AI solutions led to a three-fold YoY increase in sales for Q1 2024 to $3.9bn. 2024 is on track to be a record year for the company, with a projected maximum revenue target of $15bn for the financial year.

Its management credits the performance to “Strong demand for AI rack scale plug-and-play solutions, along with our team’s ability to develop innovative direct liquid cooling (DLC) designs, enabled us to expand our market leadership in AI infrastructure”.

HRI reported share price gains of c.327% over 2024, with Super Micro Computer contributing 4% to HRI’s total return over the period. The team has been trimming its holding for the purposes of good portfolio management.

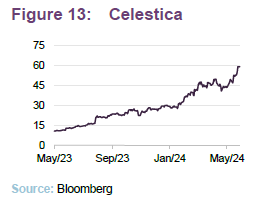

Celestica

Celestica (www.celestica.com) is a Canadian firm that provides solutions to optimise supply chains, ranging from design and engineering to logistics and fulfilment. Connectivity and cloud solutions account for c.60% of its revenues.

Celestica has started 2024 on a strong footing, with the company reporting a 20% YoY increase in its Q1 2024 earnings (compared to Q1 2023), as well as improving its margins and significantly increasing its earnings per share and free cash flow. The start of the year has been so strong that Celestica’s management has already raised its outlook for its 2024 financial year, increasing its revenue target from $8.5bn to $9.1bn. This comes on the back of a strong 2023, where Celestica reported 10% growth in revenues and its highest-ever profit margin of 5.6%.

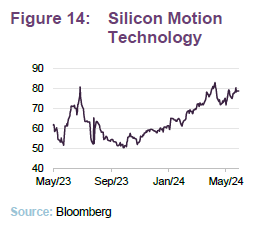

Silicon Motion Technology

Silicon Motion Technology (www.siliconmotion.com) is an American-Taiwanese company that develops NAND flash controller integrated circuits for solid-state storage devices. The company saw its shares rally over the fourth quarter of 2024 after announcing positive Q4 2023 and Q1 2024 results, which reversed a downward trend that had seen the share price fall c.40% from its 2022 peak. The results suggest a stabilising of demand in end markets and that the benefits of ongoing structural tailwinds, such as the rollout of 5G networks, are coming through. The company is also benefitting from management initiatives, such as greater use of outsourcing and successful expansion into the Enterprise SSD market. The full-year outlook has been revised upwards, with revenues expected to reach c.$815m by year end, which would be a 30% increase YoY, and an expected margin of c.45%.

EQS Group

EQS group (www.eqs.com) is a Germany-based international cloud provider in the fields of corporate compliance, investor relations and sustainability reporting. EQS was subject to a takeover by US private equity firm Thoma Bravo in November 2023, which valued the company at c. €400m (the purchase price of €40 per share was a 53% premium to the undisturbed price). EQS’s founder-CEO Achim Weick highlighted that Thoma Bravo’s historical track record with “transformative technologies” made it the right partner for the expansion of EQS. The takeover of EQS highlights that even in the more challenging environment, the prospect of M&A activity is a powerful tailwind within small-cap investing, especially given the relative cheapness of UK and European technology companies compared to their US peers.

Dividend

HRI is focused primarily on generating capital growth, and dividend income makes up only a small part of returns. The consequence of this is that HRI only declares a dividend where this is necessary to retain investment trust status, and in practice, no dividend has been declared since 2012.

Structure

Simple capital structure

HRI has one class of ordinary share in issue. It can gear up to 50% of net assets

HRI has a simple capital structure with one class of ordinary shares in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 18 June 2024, there were 54,235,252 in issue with no shares held in treasury.

The trust is permitted to borrow up to 50% of net assets; however, it currently has no form of credit. It previously had a £25m multi-currency revolving loan facility with RBS that matured on 31 December 2019 and was not replaced. As at 30 April 2024, HRI had net liquid assets of 8.3% of its total net assets, held in a combination of cash and government bonds.

Fees and costs – Tiered management fee structure with no performance fee element

1% annual management fee up to assets of £1.25bn and 0.8% thereafter; no performance fee

HIML is entitled to an annual management fee of 1% of HRI’s net assets up to £1.25bn and 0.8% of HRI’s net assets above this level.

The NAV is calculated monthly using mid-market prices, which is somewhat unusual, as most NAVs are calculated at bid prices. However, given that many of HRI’s underlying holdings trade on wide spreads, the mid-market valuation gives a better indication of the true value of the portfolio. There is no performance fee. The management fee also covers the cost of company secretarial services, which HIML has delegated to Law Debenture Corporate Services.

In the year to the end of December 2023, HRI’s ongoing charges ratio was 1.07%, slightly higher than the 1.05% of the year before. The asset management contract is subject to 12 months’ notice.

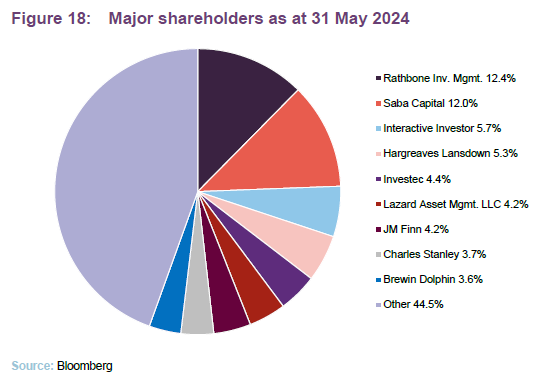

Major shareholders

Unlimited life with three-yearly continuation votes

HRI does not have a fixed life, but shareholders are offered a continuation vote every three years. The next continuation vote is scheduled for the trust’s AGM in April 2025.

Board

HRI now has a new chairman, Andrew Joy

HRI’s board is composed of six directors, all of whom are non-executive and considered to be independent of the investment manager. The current chairman, Andrew Joy, was appointed to the role in April 2023. He replaced Tom Black, who had indicated his intention to retire from HRI’s board at its AGM in April 2023. Karl Sternberg has also retired, following nine years on the board as a non-executive director.

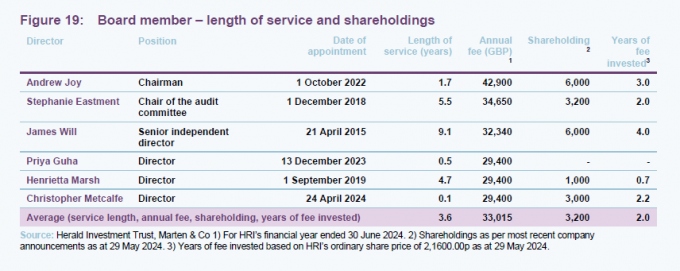

Figure 19 shows the current composition of the board and provides some information on members’ length of service and shareholdings in the company. It is board policy that all serving directors retire and offer themselves for re-election annually.

Recent share purchase and disposal activity by directors

Christopher Metcalfe has made his inaugural purchase of HRI shares

As is illustrated in Figure 19, with the exception of Priya Guha who only joined the board in December, all directors have personal investments in the trust, which we consider to be favourable as it helps align directors’ interests with those of shareholders. One director has purchased HRI shares during the last 12 months. This was Christopher Metcalfe, who made his inaugural share purchase acquiring 3,000 shares on 25 April 2024 for 2,076.84p per share. None of the directors has disposed of any shares during the last year.

Board diversity

One out of the three most-senior board positions is held by a woman

At the time of writing, the board has a 50/50 split in terms of gender identity (men/women), with one of the most-senior positions (chair of the audit committee) held by a woman, and two (chairman and senior independent director) held by a man.

At present, the board is composed of five individuals who are classified as White British or other White (including minority-White groups) and one that is minority ethnic. Appointments to the board are made on merit. However, the board will ensure that a diverse group of candidates is considered, and these will be evaluated against objective criteria having regards to the benefits of diversity – including gender, social and ethnic background and personal strengths, experience and knowledge.

Andrew Joy (chairman)

Andrew is highly regarded for his extensive knowledge of the financial sector and of the high-growth part of the smaller company sector. He was one of the founding partners of Cinven, a leading private equity firm investing in Europe and US, and has been chairman or director of numerous growth companies over the past 30 years. He is also a senior advisor of Stonehage Fleming, chairman of the investment committee of FPE Capital, and a trustee of several charities. He was previously chairman of The Biotech Growth Trust Plc.

Stephanie Eastment (chair of the audit committee)

Stephanie is a chartered accountant and company secretary with over 30 years’ experience in the financial services industry. She has considerable experience in the investment trust sector and is a member of the AIC’s Technical Committee. Stephanie qualified with KPMG and held various accounting and compliance roles at Wardley and UBS before joining Invesco Asset Management in 1996 as Manager, Investment Trust Accounts. When she left Invesco in July 2018, she was Head of Specialist Funds Company Secretariat and Accounts. Stephanie is a non-executive director and audit chair of Murray Income Trust Plc.

James Will (senior independent director)

James joined HRI’s board in April 2015 and became the senior independent director on 20 April 2021 following Tom Black’s appointment as chairman at the conclusion of the trust’s AGM that day. James was until 2014 chairman and a senior corporate finance partner of law firm Shepherd and Wedderburn LLP, where he also headed the law firm’s financial sector practice. During his career as a lawyer, James was involved in advising smaller quoted technology companies for over 20 years on a range of corporate transactions, including flotations, secondary fundraisings and mergers and acquisitions. He is chairman of both The Scottish Investment Trust Plc and Asia Dragon Trust Plc.

Henrietta Marsh (director)

Henrietta has a background in fund management, having worked in UK small-cap and private equity investment over several decades. From 2005 until 2011, she was AIM fund manager at Living Bridge Equity Partners and, prior to that, she spent 14 years at 3i in several roles, including as fund manager of 3i Smaller Quoted Companies Trust Plc (1997–2002). Henrietta spent her early career with Morgan Stanley and Shell. She is currently a non-executive director of Gamma Communications Plc (AIM listed), a trustee of 3i Group Plc’s pension fund, and a member of the London Stock Exchange’s AIM Advisory Group.

Priya Guha MBE (director)

Priya has significant knowledge of the global technology sector and experience in both public and private sectors. She currently has a portfolio of roles across the global and UK technology and innovation landscape including as a non-executive director at UK Research & Innovation and Digital Catapult, a venture partner at Merian Ventures (a San Francisco based venture capital fund), and as an advisor to various start-up companies including Kheiron Medical Technologies and Gallos Technologies. She is also a non-executive director at Reach Plc.

Christopher Metcalfe (director)

Christopher has considerable investment management experience, having worked previously at Newton Investment Management (2006-2017), Schroder Investment Management (1995-2006) and Henderson Administration Group plc (1985-1994). He is currently chairman of the Martin Currie Global Portfolio Trust, senior independent non-executive director at JP Morgan US Smaller Companies Investment Trust Plc, and a non-executive director of Columbia Threadneedle UK Capital and Income Investment Trust Plc. He was previously a non-executive director of abrdn Smaller Companies Income Trust Plc until its merger with Shires Income in December 2023.

Management team

Katie Potts

Katie is the managing director and also the lead fund manager for HIML. She established HIML in December 1993 to manage HRI, which was launched in February 1994. Katie read Engineering Science on a GKN Group scholarship at Lady Margaret Hall, University of Oxford. She worked for five years in investment management at Baring Investment Management Limited before joining S.G. Warburg Securities’s UK electronics research team in 1988. The team was consistently voted top team in the Extel survey of analysts in the sector, and she was voted top analyst by finance directors of electronics companies canvassed by The Treasurer magazine. In addition, Katie had responsibility within S.G. Warburg’s UK research department for commenting on accounting issues.

Katie is supported in managing the funds by a team of eight other investment professionals and three consultants.

Fraser Elms

Fraser Elms joined HIML in May 2000. He is the deputy manager of HRI and has lead responsibility for managing HIML’s Asian portfolios. Prior to joining HIML, Fraser was a technology analyst with Dresdner Kleinwort Benson, where he covered the European technology sector. Before this he worked at Prudential for three years as member of a team of three UK unit trust fund managers that managed £5bn in equities, with Fraser having lead responsibility for three funds collectively worth £400m. He graduated from Lancaster University with a degree in Economics and initially joined Prudential as a product manager for their unit trusts, before completing an MSc in Investment Analysis at the University of Stirling and re-joining Prudential in an investment role. Fraser covers the semiconductor sector.

Taymour Ezzat

Taymour joined HIML in November 2004. He is a portfolio manager on the venture funds, sitting on the venture committee and taking lead responsibility for a number of the investments in the venture portfolios. He also has analytical responsibility for the media sector across all HIML’s quoted and unquoted portfolios, as well as for the European portfolio. Previously he spent a year appraising a number of venture capital opportunities for E.D. Capital Partners. Prior to that, Taymour spent six years at Northcliffe Newspapers, the regional newspapers division of Daily Mail and General Trust (DMGT), latterly as finance director of its electronics publishing arm. Prior to this, he worked for Reuters in London and Eastern Europe for four years. Taymour qualified as an accountant with Price Waterhouse, and studied Economic History at the London School of Economics and Political Science.

Hao Luo

Hao joined HIML in 2004 and works with Fraser Elms on managing the Far East portfolios. He also has analytical responsibility for the manufacturing sector globally. Hao obtained a BA in Economics from Hunan University in China and a Masters degree in Finance from Manchester University, and worked for J&A Securities in Shanghai from 2000-2002. He is a CFA charterholder.

Peter Jenkin

Peter joined HIML as an analyst in 2015. He covers the software sector and contributes to the overall investment selection. Previously, Peter worked jointly on the European portfolio, but now has responsibility for HRI’s North American portfolio. Before joining HIML, he studied Construction Engineering Management at Loughborough University.

Bob Johnston

Bob was recruited in 2016 to establish a US office for HIML. He has more than 20 years’ experience in the technology sector on the sell-side, and has worked with the HIML team for roughly 15 years. Most recently, Bob was with the technology specialist Pacific Crest. He previously also worked for Hambrecht & Quist and SoundView Technology Group. Bob has taken on responsibility for telecommunications, networking and security analysis.

Danny Malach

Danny joined HIML in June 2016 and since April 2017 has acted as the funds dealer. He obtained First Class Honours in his undergraduate degree in Accounting at Northumbria University, and subsequently achieved a Merit in his MSc in International Economics and Finance.

Fati Naraghi

Fati joined HIML towards the end of 2019 to focus on the Herald Worldwide Technology Fund and to cover some of the larger technology companies. Prior to joining HIML, she spent 20 years at Newton Investment Management, where she was responsible for the global tech sector. Fati has a PhD in Communications Systems and is qualified as an AWS Cloud Practitioner.

Previous publications

Readers interested in further information about HRI may wish to read our previous notes (details are provided in Figure 20 below). You can read the notes by clicking on them in Figure 20 or by visiting our website.

| IMPORTANT INFORMATION | ||

|---|---|---|

| This marketing communication has been prepared for Herald Investment Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from | receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the | period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note. This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited. |

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

| Authorised and regulated by the Financial Conduct Authority.50 Gresham Street, London EC2V 7AY0203 691 9430www.QuotedData.comwww.martenandco.comRegistered in England & Wales number 07981621, 2nd Floor Heathmans House, 19 Heathmans Road, London SW6 4TJ |

|---|