Strength to strength

Our initiation note on JPMorgan Japanese Investment Trust (JFJ), published in September this year, focused on the trust’s impressive performance record relative to its benchmark and competing trusts. Over the past few months, it has extended this record. In addition, JFJ’s discount to NAV has narrowed significantly, further boosting returns to shareholders.

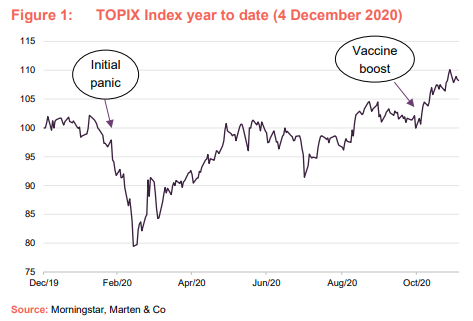

JFJ’s managers are optimistic about the future for Japan and the trust. A new Prime Minister is pushing the digitalisation of Japan’s economy. The response to the COVID-19 outbreak has accelerated much structural change in Japan, to the benefit of JFJ’s portfolio, which is focused on areas of growth such as the internet, automation and healthcare.

We believe that JFJ is positioned to go from strength to strength.

Capital growth from Japanese equities

JFJ aims to produce capital growth from a portfolio of Japanese equities and can use borrowing to gear the portfolio within the range of 5% net cash to 20% geared in normal market conditions.

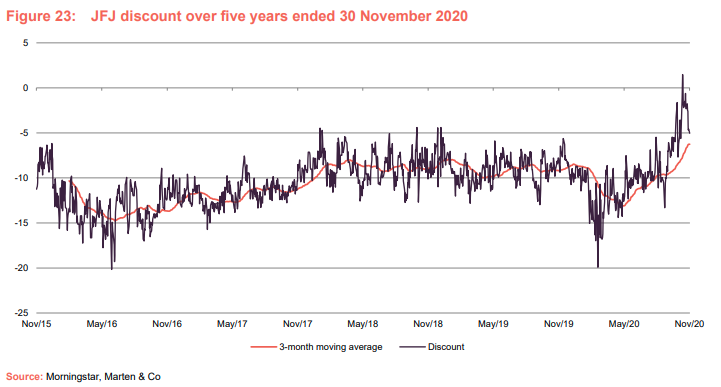

Over the year to the end of November 2020, JFJ’s discount moved within a range of 19.9% (as investors’ concern about the severity of the pandemic peaked) to a 1.5% premium and averaged 9.6%. At

8 December 2020, the discount was 0.9%.

The shares are now trading close to asset value, having traded at a premium for the first time since 2006.

JFJ has had a particularly strong 2020, both relative to its benchmark and its peer group.

The managers’ focus on companies benefiting from structural change in Japan positioned the trust well when COVID-19 hit.

| wdt_ID | 12 months ended | Share price total return (%) | NAV total return (%) | TOPIX total return (%) | MSCI ACWI total return (%) |

|---|---|---|---|---|---|

| 1 | 30 Nov 2016 | 17.50 | 17.70 | 23.90 | 24.90 |

| 2 | 30 Nov 2017 | 30.80 | 26.30 | 17.00 | 15.00 |

| 3 | 30 Nov 2018 | -1.10 | -0.60 | -0.60 | 5.10 |

| 4 | 30 Nov 2019 | 13.70 | 12.10 | 6.90 | 12.10 |

| 5 | 30 Nov 2020 | 51.20 | 46.60 | 7.70 | 11.40 |

Results for year ended 30 September 2020

JFJ has just published its results for the 12 months ended 30 September 2020; over its financial year, JFJ generated a return on NAV of 35.0% and a return to shareholders of 41.8%. This contrasts with a return of just 2.0% for the trust’s benchmark – the Tokyo Stock Exchange First Section Index (TOPIX) (all in total return terms). JFJ’s returns have been helped by its gearing (borrowing), which stood at 14.7% at the end of October 2020. We believe that the ability to gear is one of the attractions of the closed-end structure and JFJ’s board has embraced this.

The discount narrowed from 11.4% at the end of September 2019 to 7.0% at the end of September 2020. A modest level of share buybacks helped calm nerves when other trusts’ discounts widened.

The trust’s dividend was upped from 5.0p to 5.1p and this was covered by earnings of 5.2p. Income is a by-product of the investment approach and stocks are not held for the dividend yield. The board aims to pay out the majority of the net revenue income available each year.

The ongoing charges ratio fell to 0.65% from 0.68%, aided by rising net assets, which surpassed £1bn for the first time in the trust’s history. The ratio falls as fixed costs are spread over a wider base.

The trust’s good performance has continued since the period end. The discount has narrowed further, with the shares trading briefly on a premium in November 2020.

Japan coped with COVID relatively well

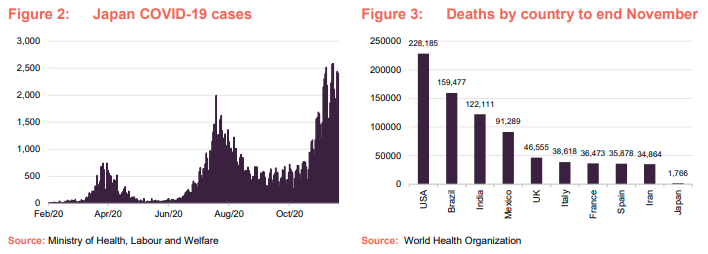

COVID-19 has had a significant influence on the global economy over 2020. In Japan, in common with many other countries, the number of cases appears to have picked up over the last few months. However, when compared against other countries, in terms of the infection, Japan’s experience of COVID-19 has been relatively benign. It ranks 49th in terms of attributable deaths according to statistics from the World Health Organization, and 132nd of 193 countries in terms of deaths as a percentage of its population.

The country’s relative success in tackling the outbreak was due in part to travel restrictions and lockdown measures imposed on the country. JFJ’s managers, Nicholas Weindling and Miyako Urabe, note that the pandemic pushed the country’s economy into a record slump in the second quarter of 2020 (an 8.2% fall in GDP) as these measures took effect.

Japanese companies are very well capitalised, with over half having net cash on the balance sheet at the end of March 2020, and this worked in their favour. As restrictions were eased, the economy recovered, helped by rising exports and increased private consumption (GDP rebounded by 5.0% over the third quarter of 2020).

COVID has accelerated structural trends

The managers note that, despite being perceived as a high-tech country, Japan lags many of its peers in surprising ways. They cite examples such as the relatively low percentage of online sales, low penetration rates for cloud-based software, the prevalence of cash within the economy, the use of fax machines and – particularly relevant to top-10 holding Bengo4.com – the use of physical ink stamps to certify documents.

COVID-19 is forcing change upon businesses, accelerating the adoption of new technologies. It may be helped in this by Japan’s new Prime Minister Yoshida Suga. He took on the role in August this year, following the resignation of Shinzo Abe. Suga was chief cabinet secretary under Abe and this gives the managers comfort that there will be no dramatic shift in economic policy. However, Suga is keen on streamlining government with increasing use of digital technologies. Another of his signature policies is to cut mobile phone bills, which are relatively high. Japan ranks well-below the UK and US in the penetration of smartphones. It is also lagging behind the UK, US and China in the rollout of 5G (an area where its neighbour Korea ranks as no.1, based on data from Omdia).

Investing in the new Japan

We highlighted in our initiation note that JFJ’s portfolio is focused on sectors that could be described as the ‘new Japan’. We have updated Figure 4 (which shows the spread of investments on that basis, as at 31 October 2020).

Examples of stocks that make up these themes include CyberAgent within internet, Nintendo within Japan Brand and Keyence within Automation, the trust’s largest holding, which was discussed in our previous note (see page 12 of that note).

CyberAgent has a media-streaming business and also offers online betting, blogging, online advertising and mobile phone gaming. It would be an obvious beneficiary if the cost of data was slashed for mobile phone users.

The need for automation

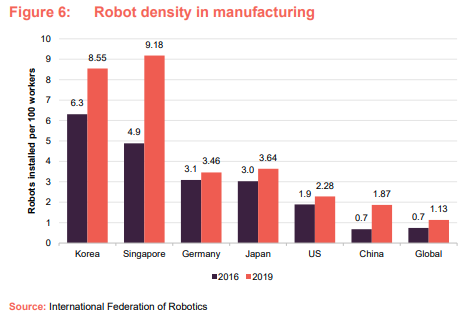

Japan’s demographics mean that its workforce is shrinking. One obvious solution is to increase automation. Japan has responded and emerged as a global leader in this area.

The theme is represented within the portfolio by stocks such as Keyence, Misumi and SMC.

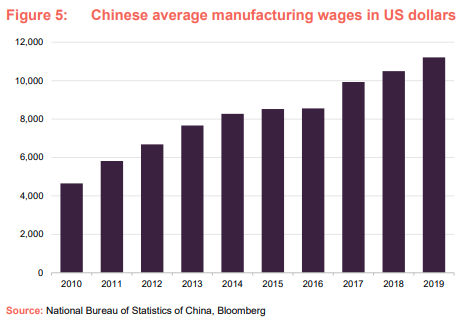

Japan is far from unique in having an ageing workforce – much of Europe is affected by this problem. Even China’s working-age population is already shrinking. Chinese manufacturers also have to contend with rising wage costs, as is illustrated in

Figure 5, which shows the average manufacturing wage in China expressed in US dollars.

Consequently, China is one of the fastest-growing end markets for Japan’s automation companies. Figure 6 shows the number of robots per 100 workers in a selection of countries, comparing 2016 with 2019.

Potential new theme? – Renewable energy

In a recent interview that we did with Nicholas Weindling, he highlighted Japan’s energy generation problems. Where there is a problem, there is an opportunity, and he is looking at the potential for renewable energy in Japan.

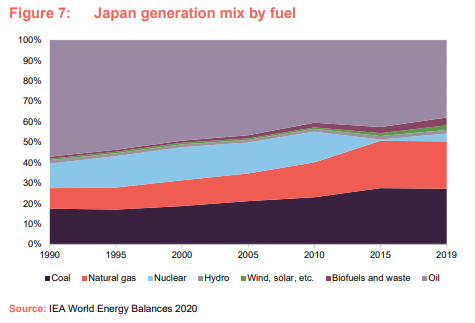

Japan has few natural resources and imports most of its fossil fuels. The generation mix was highly dependent on nuclear (about 30% of supply in 2011, from 54 reactors) but, after the Fukushima disaster, sentiment turned against the industry. Just nine reactors at five plants are currently in operation, out of a possible 39 that are operable. Nicholas does not believe many, if any, of the remaining reactors will be switched back on.

As is clear in Figure 7, when nuclear generation was curtailed, the slack was taken up largely by coal and gas. Japan is likely to fail to meet its own objectives on curbing greenhouse gas emissions.

However, the managers point out that Japan has immense renewable energy potential in terms of onshore and offshore wind, solar and geothermal. There are hopes that a policy review currently underway will find ways of boosting renewable energy production.

Asset allocation

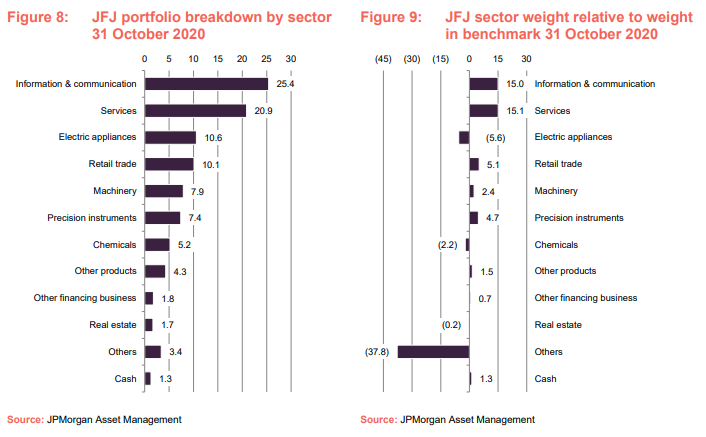

At the end of October 2020, there were 66 holdings in the portfolio, four more than when we last wrote.

Sector weights are driven by stock selection, but they reflect the portfolio’s bias to the ‘new’ Japan and the absence of exposure to sectors such as pharmaceuticals, transportation equipment and banks.

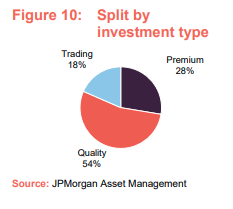

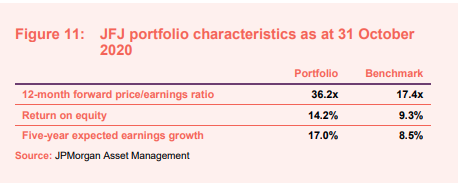

The bias to growth and quality results in a portfolio that trades on a higher-than-average price/earnings multiple than the benchmark, but offers higher returns on equity and faster earnings growth rates.

Top 10 holdings

Over the few months between end June (the data available when we last published) and end October, the composition of JFJ’s list of its 10-largest holdings has not changed much, as might be expected given the managers’ long-term approach. Chemical company Kao and electrical appliance company Tokyo Electron both fell out of the list in October but were still held within the portfolio. The manager has been taking profits on the trust’s positions in Kao and Fast Retailing (the owner of Uniqlo). Nintendo and Bengo4.com, which were just outside this list when we last published, have moved up to replace them on the back of strong performance.

We covered many of these companies in our last note (see pages 12 and 13 of that note). Looking at the two new entries:

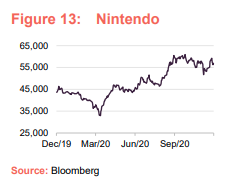

Nintendo

Nintendo is one of the world’s largest computer games companies, with strong and longstanding character brands such as Mario, Pokémon and Zelda, as well as newer products such as Animal Crossing.

The managers believe that the company is becoming more profitable as the emphasis for consumers switches from buying physical cartridges and discs to downloading games. Nintendo is exploiting the value within its brands by moving into areas such as theme parks.

Nintendo has a strong balance sheet with over $10bn in net cash. The managers think that some of this could be returned to shareholders.

Nintendo’s half-year results, covering the six months ended 30 September 2020, show net sales rising by an impressive 73.3% year-on-year, translating into an almost 250% increase in net profit. Sales of Nintendo Switch consoles were a significant contributor to these results, but digital sales are rising as a percentage of the whole.

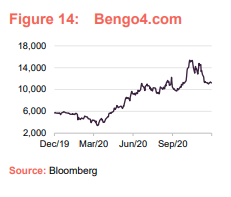

Bengo4.com

Bengo4.com offers online legal services and helps put customers in touch with lawyers. It also offers Cloud Sign Store DX (a service similar to Adobe’s DocuSign), which has seen a huge take-up in its service as COVID-19 restrictions have put barriers in the way of physical contracts.

Traditionally, Japanese contracts have been authenticated using hanko – physical ink stamps. CloudSign replaces this and has taken an 80% market share of the digital signature market, but this represents just 1% of contracts. There is room for significant growth.

Investment activity

Recent new holdings for the trust include: Z Holdings, HENNGE, AS ONE Corporation, Medley, and Yamashin Filter.

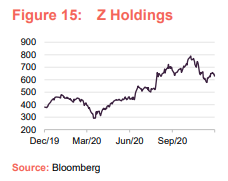

Z Holdings

Z Holdings, formerly Yahoo Japan, began as a joint venture between Yahoo and SoftBank. It has a search engine operation (Yahoo Japan), online marketplaces PayPay Mall (said to be the world’s second-largest, behind Amazon) and PayPay Flea Market (for the sale of second-hand items), an associated e-payments business, and an online media business. It also recently acquired a messaging app, Line, to boost its position in m-commerce (transactions done using mobile phones).

HENNGE

HENNGE is a cloud security business. The growth of home-working in the face of the pandemic has turbo-charged its sales growth. Total sales grew by over 21% year-on-year for the three months ended 30 September 2020 and profits for its 2020 financial year are forecast to be over 125% higher than the previous year.

AS ONE Corporation

AS ONE supplies laboratory equipment from a catalogue of over 75,000 items. It is shifting its business from physical catalogues to its own ecommerce platform as well as selling through third-party platforms such as Amazon and MonotaRO (a JFJ holding, discussed in our last note).

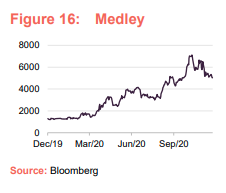

Medley

Medley is an internet company operating in the health care sector in the fields of telemedicine and online pharmacy, as well as medical recruitment (competing in some areas with M3). The company is growing rapidly – sales for the nine months ended 30 September 2020 were 42% ahead of those for the equivalent period in 2019. In April, in response to the COVID-19 crisis, the Ministry of Health, Labour and Welfare issued a guidance statement temporarily allowing the use of telemedicine for patients receiving initial medical examinations. The new administration under Prime Minister Suga is considering making these temporary measures permanent, as a part of its measures to promote Japan’s digital transformation.

Yamashin Filter

Yamashin Filter makes filters for a range of end markets, including for use in the construction machinery industry (where it is making inroads into the Chinese market), industrial filters and process filters. In response to COVID-19, it also now makes air filters for masks, which are sold into the domestic Japanese market.

Sales

The manager has sold the trust’s positions in cosmetics company Shiseido and SoftBank Group.

Performance

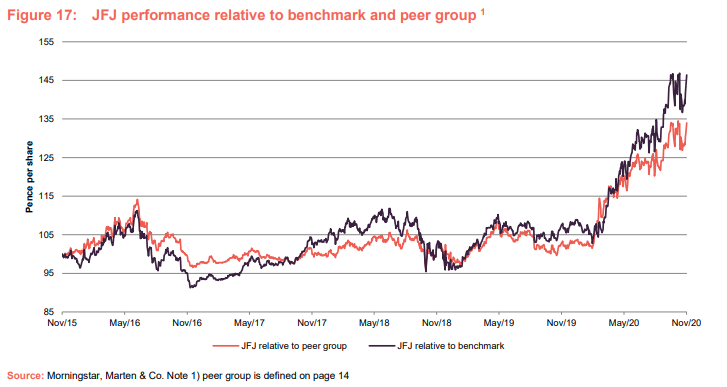

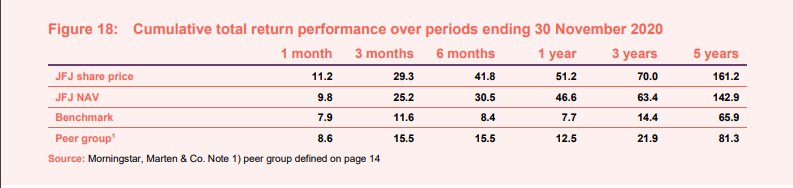

JFJ has had a particularly strong 2020 both relative to its benchmark and its peer group, as is evident in Figures 17 and 18.

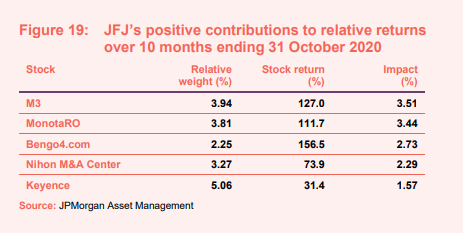

As was the case when we last published, relative to the trust’s benchmark over the 10 months of 2020, stock selection continues to drive returns.

M3, the operator of the Ask Doctors website, continues to be the largest positive contributor to JFJ’s performance this year (as it was when we last published). Bengo4.com had a particularly strong October and this pushed it up into this table.

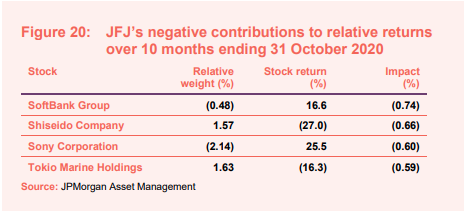

The managers have sold JFJ’s positions in both SoftBank and Shiseido since we last published. Softbank has been beset by problems with WeWork (the flexible workspace company whose IPO failed last year), the hit that its stake in Chinese tech company Alibaba took from the cancellation of the Ant Financial IPO, and volatility with respect to the valuation of its stake in the Vision Fund (a vast venture capital fund). The managers felt uncomfortable with the company’s valuation and sold JFJ’s holding, but the share price continued to climb.

Shiseido (a Japanese multinational personal care company that is one of the oldest cosmetics companies in the world) has been hurt by the loss of sales at airports. However, the managers say that it also faces increased competition from Chinese companies and this was the trigger for the disposal of JFJ’s stake.

Peer group

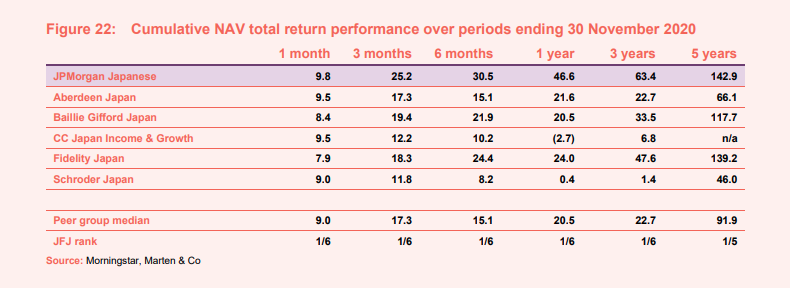

For the purposes of this note we have used the constituents of the AIC Japan sector as a peer group. The trusts listed here have roughly similar objectives except for CC Japan Income & Growth, which – as its name implies – places more emphasis on income generation and consequently has the highest dividend yield. By contrast, JFJ’s growth focus puts its yield towards the bottom end of the peer group.

JFJ’s ongoing charges ratio has fallen again this year (to 0.65% from 0.68%), putting it first in its peer group on this measure. The discount has tightened since we last published (see next section).

JFJ is the best-performing trust in its sector over all time periods in Figure 22. This is a remarkable achievement.

Discount

Over the year to the end of November 2020, JFJ’s discount moved within a range of 19.9% (as investors’ concern about the severity of the pandemic peaked) to a 1.5% premium and averaged 9.6%. At 8 December 2020, the discount was 0.9%.

The board monitors the discount closely and has stepped up efforts to market the trust and authorised share buy backs – 649,000 shares have been repurchased into treasury since we published our initiation note on 9 September 2020. This appears to be working as the shares are now trading close to asset value, having traded at a premium for the first time since 2006.

Each year at the AGM, the board puts forward resolutions that permit the company to issue new shares, reissue shares from treasury and repurchase shares for cancellation or to be held in treasury. The board has stated that shares held in treasury would only be reissued at a premium to NAV. We hope that the trust’s strong performance and the board’s efforts are rewarded with a re-expansion of the trust from here.

Fund profile

JPMorgan Japanese Investment Trust (JFJ or the trust) aims to achieve capital growth from investments in Japanese companies. For performance monitoring purposes, the trust is benchmarked against the returns of the Tokyo Stock Exchange First Section Index (commonly known as TOPIX) in sterling.

The trust makes use of both long- and short-term borrowings with the aim of increasing returns.

Day-to-day investment management activity is the responsibility of JPMorgan Asset Management (Japan) Limited in Tokyo. The co-investment managers are Nicholas Weindling, who has had responsibility for JFJ’s portfolio for more than a decade, and Miyako Urabe, who was appointed co-manager in May 2019. They are supported by a well-resourced team.

The investment emphasis is on identifying high-quality companies that are capable of compounding their earnings sustainably over the long term. That means investing in companies in growing industries that have strong balance sheets and are resilient in the face of macro-economic issues.

The managers recognise that JFJ’s performance may lag its benchmark in periods of market exuberance, triggered by an uptick in growth prospects, for example. The final quarter of 2018 and the first half of 2016 were periods of underperformance for this reason. However, the managers prefer to focus on identifying attractive stocks rather than attempting to time markets. Similarly, the trust’s gearing level is driven by availability of attractively priced stocks, not by macroeconomic considerations.

Benefitting from local knowledge

The investment team is based in Tokyo, where JPMorgan has had an office since 1969. Nicholas says that it is now relatively unusual for non-domestic asset managers to have a physical presence in Japan. Visiting companies is an integral part of the team’s investment process.

The team is 25-strong and is a mix of fund managers and analysts – roughly half and half. In addition, one of the strengths of the business is that the managers can also draw on the expertise of JPMorgan’s analytical teams around the world. This helps with competitive analysis, for example – it can also help identify trends on which Japan is behind the curve.

Previous publications

Readers may wish to read our initiation note – Number one for a good reason – published in September 2020.

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on JP Morgan Japanese Investment Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.