Next generation dividend hero

After a few difficult years, the North American Income Trust (NAIT) has plenty to feel good about in 2022, according to its manager, Fran Radano. It has enjoyed a turnaround in relative performance as its value style of investing has come back in favour. Investors seem to have been rotating away from growth stocks on the back of inflation fears. Acknowledging these fears, Fran is confident that the trust can provide an income stream that should outpace US inflation.

Meanwhile, the trust, which has been run in its current form since 2012, achieved ‘next generation dividend hero’ status this year, as it has managed to increase its dividend every year for ten consecutive years. It has also built up sufficient reserves to cover more than a full year’s dividend at current rates.

Above-average income and long-term growth

NAIT’s objective is to invest for above-average dividend income and long-term capital growth, mainly from a concentrated portfolio of dividend-paying S&P 500 US equities. It may also invest in Canadian stocks and US small- and mid-cap companies to provide for diversified sources of income as well as fixed income investments, which may include non-investment grade debt.

Fund profile

NAIT’s objective is to provide investors with above-average dividend income and long-term capital growth through active management of a portfolio consisting predominantly of S&P 500 US equities. NAIT may also invest in Canadian stocks and US mid- and small-cap companies as a way of accessing diversified sources of income. Up to 20% of NAIT’s gross assets may be invested in fixed-income investments, which may include non-investment grade debt.

The company maintains a diversified portfolio of investments, typically comprising around 40 equity holdings and no more than ten fixed interest investments

(which tend to be much smaller positions) but without restricting the company from holding a more or less concentrated portfolio from time to time.

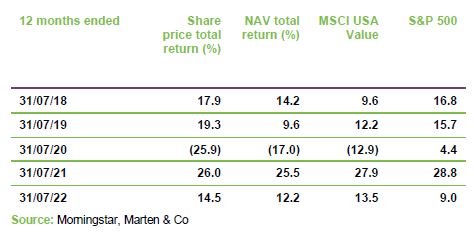

NAIT uses the Russell 1000 Value index as its reference index, but we have used the MSCI USA Value and S&P 500 indices as comparators for the purposes of this report.

abrdn Fund Managers Limited acts as NAIT’s AIFM. The day-to-day management of the portfolio is delegated to abrdn Inc. The lead manager is Fran Radano, who sits on the equities team based in Philadelphia and Boston, and he is supported by Ralph Bassett.

NAIT’s history goes back to 1902, but the trust has only been in its current form since 2012. Fran has been working on the trust since then and took over as lead manager in 2015.

Market overview

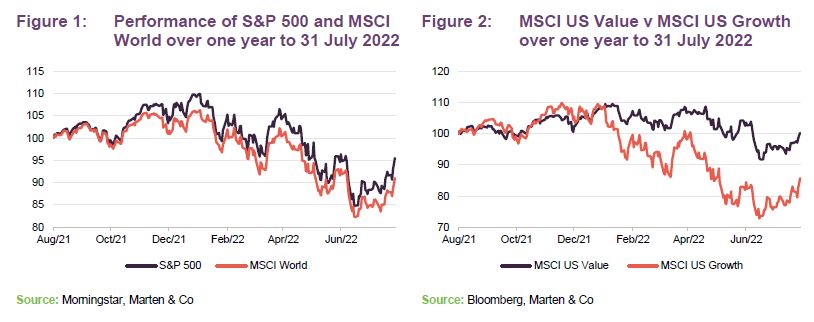

As highlighted in our most recent note on NAIT, published in December 2021, last year saw a strong start for US equity markets reportedly following the rollout of COVID-19 vaccines and optimism over additional US government stimulus spending under President Joe Biden. However, investors’ risk aversion appeared to resurface in the second half of the year as the emergence of further COVID-19 variants prompted renewed lockdowns and travel restrictions, with associated supply chain disruptions.

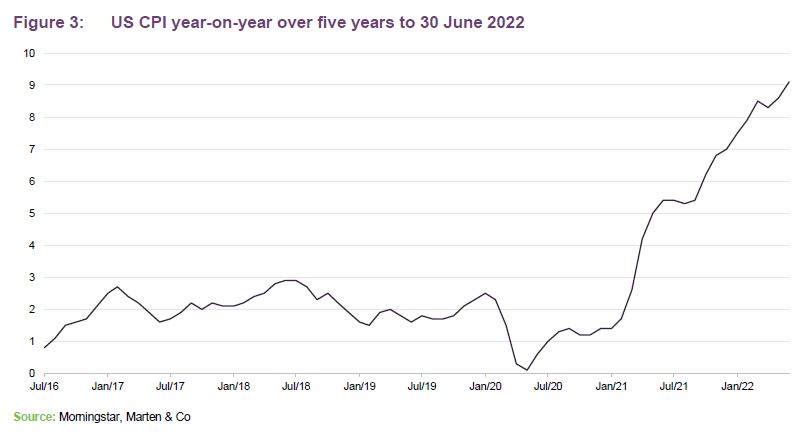

As the year went on, inflation began to climb, and this has continued into 2022. As a result, we have seen the Federal Reserve raise interest rates four times, with two 0.75 percentage point increases in quick succession in June and July, reported as “countering the fastest pace of inflation in over 40 years”. Markets have priced in further hikes for the remainder of the year.

Meanwhile, February saw the start of Russia’s horrific attack on Ukraine. Data has shown that the ongoing war has created greater uncertainty for global markets and has worsened the inflation problem, with a particular impact on areas such as energy and food prices.

This has contributed to a rotation towards value-centric areas of the market and growth is experiencing its biggest downturn for several years. This has included a sharp fall in technology stocks. NAIT has an underweight exposure to the technology sector, with just an 8.7% portfolio allocation as at the end of June 2022.

Manager’s view

Fran feels, given the macroeconomic events of recent months, that investors are finally focusing on value and the market has become more discerning. He says that this is working in NAIT’s favour. He believes that the prospects for dividend growth from the portfolio are good and this dividend growth is capable of outpacing inflation over the medium term.

Relative to the wider market, NAIT had a good start to the year, driven in part by the rotation to value, he adds. The energy, financials and real estate sectors (all of which NAIT has overweight exposures to) have been the strongest performers within the Russell 1000 Value Index, while the communication services, the information technology and utilities sectors (all underweight exposures) have been the primary market laggards since the start of the year.

In the energy sector, Fran took profits as oil prices soared, which was also true in other sectors where some stocks were trading at peak multiples on peak earnings. He likes oilfield service businesses which are benefiting as a higher oil price is leading to higher investment in the sector.

Given rising rates, Fran thinks that financials look interesting. Banks will have to raise deposit rates but are expected to be able to expand their margins. He says that, at present, there is a tension between the prospect of higher margins from higher rates and the possibility of higher defaults if the economy dips into recession. All in all, he foresees both profit growth and higher valuation multiples for the sector and it is a favoured area.

More recently, Fran observes that the US equity market has experienced a sharp downturn, as investors have become more risk averse – rising inflation has led to a growing concern that interest rate rises, designed to dent inflation, will trigger a recession. Although first-quarter corporate earnings in aggregate surpassed investors’ expectations, there was a notable slowdown in corporate profit growth as margins came under increased pressure from rising inflation and ongoing supply-chain constraints. Moreover, given the more uncertain macroeconomic outlook, Fran feels that companies were generally not well rewarded for ‘beating’ consensus forecasts, while their guidance for the current fiscal year was notably more cautious overall. Fran says that inflationary challenges are increasingly weighing on consumer confidence, and also feels that the upward trend in mortgage rates has caused a marked slowdown in the US housing market.

Inflation frustration but healthy outlook

Fran says that the Fed has become more hawkish since the end of 2021 and that its chairman, Jerome Powell, has signalled that its focus has shifted from supporting the economy to tackling inflation, particularly given the low US unemployment rate (3.6% at end June) and hourly earnings increases running at 5.1% year-over-year.

He also believes that Russia’s invasion of Ukraine introduced greater uncertainty to markets across the world and, while Fran is generally optimistic, he acknowledges that the conflict does present risks of higher global inflation and the potential for downside economic forecasts.

In Fran’s view, inflation is not transitory and is perhaps understated as it does not reflect what is happening within real estate. He feels that the Fed is behind the curve, but quite well aligned on the need to tackle inflation. Quantitative tightening only started around May 2022 (and monetarist commentators feel that may be a more effective way of tackling inflation than higher rates).

The pace of rate rises has been a bit faster than Fran was expecting when we spoke to him. At the time, he was wondering whether we would have to see bigger rate rises in September, in the event June and July’s 0.75% hikes brought that forward.

Fran says the trust provides an income stream that he thinks should outpace inflation. He expects dividend growth in the mid to high single digit range, which can already be seen in that a third of the portfolio has grown its dividend by 10% over the past year.

Investment process

Buy and sell ideas are presented to the team and each analyst’s goal is to build consensus around their investment theses. Individual portfolio managers have responsibility for the content of their portfolios, but all investment decisions are peer-reviewed and any stance that differs from the consensus view must be justified. An ESG analyst is embedded within the team and ESG factors are incorporated into the research process.

NAIT’s portfolio comprises 39 equity positions as at 30 June 2022, drawn largely but not exclusively from the constituents of the S&P 500 Index. It also has three fixed income positions, which help to increase the diversification of NAIT’s portfolio as well as providing a useful source of income.

The company may invest in Canadian stocks and smaller US companies to provide diversified sources of income as well as up to 20% of gross assets in fixed income investments, which may include non-investment grade debt. However, since 2015 the bond weighting has been below 5%, as higher prices and lower yields have made them less compelling.

The dividend overlay is NAIT’s only material positive factor bet. The portfolio holds some quality bias and there are some negative factor overlays, such as momentum. The negative momentum overlay can be explained by the need to trim positions when prices go up on occasion, as yields decrease.

The fixed income portion of the fund is managed by the fixed income team based in Boston. Between 21 January 2021 and 31 January 2022, the average credit rating for NAIT’s quoted bonds was BB.

The equities are selected on a ‘best ideas’ basis. Candidates for the portfolio must satisfy both quality and valuation criteria. Aspects of quality include the strength of a company’s business model, where it compares with its competitors, and the quality and experience of its management. Meeting management and visiting companies is a core part of the investment process, and the manager will not invest in a stock if the team has not met with management. The manager believes that the emphasis on quality should help NAIT avoid ‘value traps’. He looks for stocks that are on an improving trend in terms of revenues and profits but does not invest in ‘recovery’ situations. The portfolio is usually close to fully invested, but the manager has the option to increase the exposure to cash (or other liquid securities) if he believes it is warranted.

The approach is a long-term one and portfolio constituents have historically changed relatively rarely (portfolio turnover was higher in 2020 due to the pandemic and some of the opportunities it brought), but the manager top-slices and tops up positions in response to short-term valuation shifts.

Whilst there is no outright prohibition on buying stocks for NAIT’s portfolio that do not pay a dividend, the manager has never done so. NAIT’s portfolio follows a bell curve distribution, with a concentration of stocks largely yielding between just below 2% to just above 5%. Predictability of income is a key consideration when selecting stocks, but the overall emphasis is on choosing stocks that look attractive on a total return basis, not just on yield alone. Their ability to generate dividend growth is an important factor.

Position sizes are determined by conviction, and the manager places no emphasis on the weightings of stocks within the benchmark when building the portfolio.

New positions typically enter the portfolio with a 1%–1.5% weighting. Fran chooses to operate with a soft cap on position sizes of 5% and tends to trim positions when they exceed this level. There is also a hard stop of 10% of gross assets at the time of investment (see below). Furthermore, he seeks to limit the number of positions that exceed the 5% level to a small number.

A range of metrics is used to analyse the portfolio to ensure that, wherever practical, there is no excessive bias towards or against any sector, geography or theme. Given the lack of income available, the portfolio has a natural underweight exposure to the technology sector (and, until the recent rotation towards value, this had weighed on the fund’s performance relative to the US market as a whole). At the same time, the portfolio does not have much exposure to some sectors that might typically be seen as the preserve of income fund managers such as telecoms and utilities. This is because the manager is looking for stocks with decent earnings and dividend growth potential.

Option writing augments income

The portfolio’s income is augmented by option writing activity. Writing puts to buy and calls to sell positions is a useful way of deriving income from an investment decision that would have been made anyway. Specifically, options are only utilised once a buy or sell decision has been reached. If the manager believes the option market provides the best risk-reward in executing this decision, then put or call options may be sold. The options mix has been equally spread between puts and calls over recent years.

The greatest opportunity to earn income comes from the stocks with the highest implied volatility. At any time, NAIT may have between zero and nine open positions; there is no requirement to write options if the manager believes it would not be a profitable activity. Option writing is a tool to buy and sell positions where extra income can be generated while being able to buy something a little cheaper or sell something a bit higher than current prices. Fran stresses that he does not write options with the primary goal to generate income per se. He does not write in-the-money options as a means to convert capital into income. We note that at the end of June 2022, there were three open option positions.

Investment restrictions

Certain restrictions have been imposed on the manager, by the board, as part of the investment policy:

- No single investment will exceed 10% of gross assets at the time of investment.

- The portfolio will have at least 35 holdings.

- Exposure to derivative instruments is limited to 20% of net assets at the time of the relevant acquisition, trade or borrowing.

- NAIT will not acquire unlisted or unquoted securities (it is permitted to hold securities that are about to be listed or traded on a stock exchange, but Fran says that he has no intention of utilising this permission). NAIT is also permitted to continue to hold securities that cease to be listed or quoted, if appropriate. However, once again, Fran says that is not something he envisages the trust doing.

There are no restrictions relating to the size of the companies that NAIT can hold (as measured by market capitalisation) and no limits to sector or country exposures. Although permitted to do so, NAIT does not generally hedge its exposure to foreign currency.

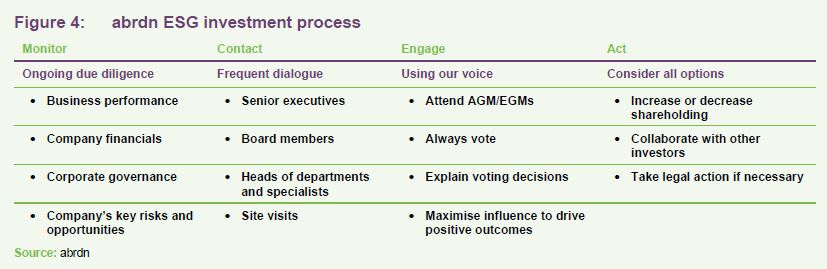

Active approach to ESG engagement

Whilst ESG factors alone are not the over-riding criteria in relation to investment decisions, ESG is fully integrated across NAIT’s investment process. The manager conducts extensive and high-quality fundamental and first-hand research to fully understand the investment case for every company in its global universe. A key part of the manager’s research involves focusing its extensive resources on analysis of key ESG issues. Stewardship and active engagement with every company are also fundamental to the investment process, helping to produce positive outcomes that lead to better risk-adjusted returns.

Once abrdn invests in a company, it is committed to helping that company maintain or raise its ESG standards further, using the manager’s position as a shareholder to press for action as needed. abrdn actively engages with the companies in which it invests to help them improve and become even better businesses.

The manager sees this programme of regular engagement as a necessary fulfilment of its duty as a responsible steward of clients’ assets. It is also an opportunity to share examples of best practice seen in other companies and to use the Manager’s influence to effect positive change. The manager’s engagement is not limited to the company’s management team. It can include many other stakeholders such as non-government agencies, industry and regulatory bodies, as well as activists and the company’s clients. What gets measured gets managed – so the manager strongly encourages companies to set clear targets or key performance indicators on all material ESG risks where appropriate.

The investment process consists of four interconnected and equally important stages:

The manager’s engagement with any company is tailored as appropriate for each business. ESG matters are prioritised as applicable to the individual circumstances and are aligned to the company’s ‘ESG Q Score’.

Examples of areas that abrdn actively engages with companies on include but are not limited to:

- Environmental: deforestation, waste and water management, climate risks, carbon emissions, energy management, air quality

- Social: Employee safety, human rights, diversity issues, labour management, cyber-security, customer privacy

- Governance: Succession planning, renumeration, capital allocation, corporate strategy, board diversity, ESG disclosures

Asset allocation

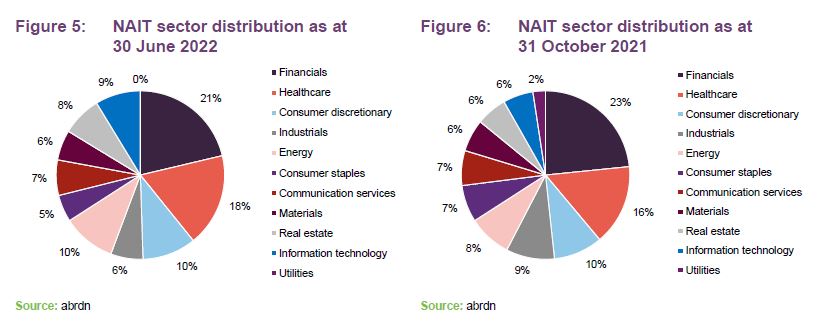

As at 30 June 2022, NAIT’s portfolio consisted of 39 equity and 3 fixed-income investments, with an active share of 89.1%. This compares with 41 equity and 2 fixed-income holdings in October 2021 – the figures reviewed in our last note – when the active share was 89.7%.

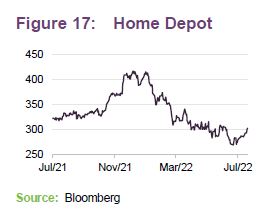

Turnover has picked up as stocks have re-rated. Fran cites the example of Home Depot, which he would normally have expected to hold for at least five years, but the holding was sold after just two years as it exceeded target valuation multiples.

NAIT can also invest in Canada – as at 30 June 2022, this represents 8.2% of the portfolio while the US accounts for 88.6% and the balance is held in cash. While the Canadian portion has increased by 0.2 percentage points since our last note, the US exposure has decreased by 0.4 percentage points.

Sector allocation has remained largely similar to how it looked in our last note apart from the fact that NAIT no longer has any exposure to utilities after selling its last holding in the sector, CMS Energy, earlier this year. Otherwise, financials remains the trust’s largest exposure at 21% (down from 23%), followed by healthcare at 18% (up from 16%) and consumer discretionary at 10% (no change).

While allocation to consumer staples has only changed by 0.2% percentage points from 5% to 7% over the period, it has fallen from being the sixth largest sector exposure (out of 11) to the smallest (out of 10), not including cash. This is reflected in the recent sales of Home Depot and Procter & Gamble.

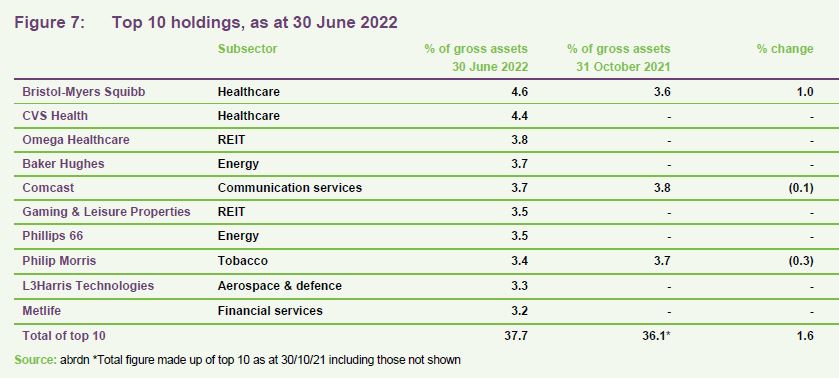

Top 10 holdings

Since we published our last note in December last year, which highlighted NAIT’s 10-largest holdings as at 31 October 2021, there have been a number of changes to the list. New additions include CVS Health, Omega Healthcare, Baker Hughes, Gaming & Leisure Properties, Phillips 66, L3Harris Technologies and Metlife. They have replaced AbbVie, Citigroup, TC Energy, Medtronic, Hanesbrands, Cisco Systems and Gilead Sciences though all remain in the portfolio.

Phillips 66

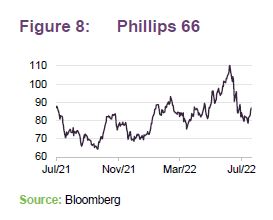

Phillips 66 (www.phillips66.com) is a downstream energy company with operations in oil refining, marketing, and transportation. Unlike its pure play oil refining peers, Fran says the company has a more diversified offering which is what appeals most to him. He says it is a transparent company with good capital allocation. In May 2022, Phillips 66 made a final investment decision to move forward with its Rodeo Renewed project, which will convert a traditional refinery into one of the world’s largest renewable fuel facilities. It also raised its quarterly dividend by 5.1%, equivalent to an annualised yield of 3.8%.

Baker Hughes

Baker Hughes (www.bakerhughes.com) is one of the world’s largest oil field service companies which the manager bought at the end of 2021 to replace ConocoPhillips. The price was attractive, he says, as the market perceived that there was an overhang of stock owned by GE. He sees the company as a long-term play and likes that it is more levered to natural gas and less so to oil. He adds that the company is in a unique position within the energy complex because beyond its exposure to traditional oil field services markets, it has a near monopolistic position (around a 90% market share) within liquefied natural gas equipment, and a diverse set of solutions that will help to accelerate the energy transition. Fran notes that the company makes attractive margins on its aftersales service business.

Fran says that this combination of an attractive fundamental backdrop, healthy financial profile, and strong dividend yield creates an opportunity which he believes the market still isn’t fully appreciating.

Gaming & Leisure Properties

Gaming-focused REIT Gaming and Leisure Properties (www.glppropinc.com) is a real estate investment trust that specialises in casino properties based in Pennsylvania. The manager says the company performed well in the aftermath of the pandemic (in contrast to Vegas-based gaming) and has benefited from the growth in online and app gaming. Last year, the company declared a special earnings and profits cash dividend of $0.24 per share and, more recently, has announced plans to acquire two Rhode Island casino properties from Bally’s Corp for $1bn. Fran says the recent addition of GLPI’s competitor, VICI Properties, into the S&P 500 is a validation of the gaming industry as a subset within REITs

MetLife

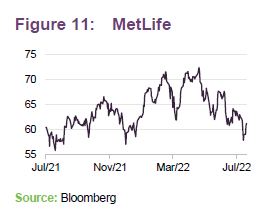

NAIT’s purchase of MetLife (www.metlife.com), which provides individual insurance, employee benefits and other financial services, in 2021 is what Fran calls a ‘structural play’. He says that the company currently has a collection of businesses (International Life, Group Insurance, and Institutional) that generate higher growth and superior returns relative to most of its US peers following the divestiture of some of its lower-value segments and its retail spin-off, Brighthouse Financial. As at

4 August 2022, MetLife has a dividend yield of 3.14%.

CVS Health

Retail drugstore operator and pharmacy benefit manager (having bought Aetna which is now a third-leg insurance and the highest-valued one) CVS Health (www.cvshealth.com) was only added to the portfolio earlier this year but the manager has been topping it up ever since, making it the trust’s second-largest position as at the end of June 2022. Fran says that the company ‘over-earned’ during the pandemic as its drugstores were pivotal in providing COVID-19 testing kits and vaccines but there is still more growth to be found going forward. The manager notes that healthcare companies can be a ‘tricky’ investment as they are heavily dependent on government rules which could ‘change everything’ but considers that the downside for CVS is low.

Initiations in the wider portfolio

Over the past 12 months, NAIT has made a number of new investments consistent with its high-quality, cash-generative stock selection process while market volatility created opportunities to add quality companies into the portfolio at attractive prices.

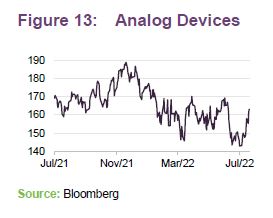

Analog Devices

NAIT initiated a new position in Analog Devices (www.analog.com) during the tech sell-off earlier this year. It is an analogue semiconductor vendor that sells into a wide range of global end-markets, most notably industrial, automotive and communications. Fran says that the company has gained significant scale through organic growth and acquisitions and is now the second-largest analogue semiconductor supplier globally. Its management team has a strong execution track record and company financials have improved significantly. He adds that Analog generates high margins and strong free cash flow, and a 100% return policy supports ongoing dividend growth making it an attractive growth and income story.

CI Financial

CI Financial (www.cifinancial.com) is a Canadian wealth management firm that has an investment management arm and a registered investment advisor (RIA) business. Fran points out that the company has experienced continued organic and inorganic growth as it expands into the US, and the launch of new products has driven revenue growth and improved profitability. He believes the market is not currently pricing in this future growth and improved mix to the RIA business, and that further multiple expansion is warranted as the quality of the earnings stream improves.

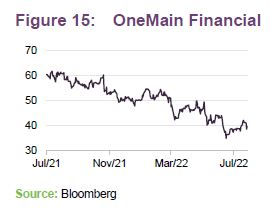

OneMain Financial

OneMain Financial (www.onemainfinancial.com) was also added to the portfolio during the past year. It provides credit to near-prime consumers and according to the manager, recently made improvements to its balance sheet, cost of funding, and risk profile by focusing more on secured lending and optimised pricing. Fran says these changes have resulted in a much higher-quality company with the scope for both earnings growth and sizable return of capital in the coming years via dividends (it already boasts a yield in excess of 5%), special dividends, and share buybacks.

VF Corp

Another new position over the past year was apparel and footwear company VF Corp (www.vfc.com) which focuses on outdoor and lifestyle activities. Fran highlights the repositioning and reshaping of the company’s portfolio of brands, which he believes will yield faster and more profitable growth coming out of the global pandemic. He says he is confident in the management’s ability to execute on this improving growth strategy, while the market appears more sceptical.

Exits

Meanwhile, there have been a number of sales within NAIT’s portfolio over the past 12 months including natural gas company ConocoPhillips, which was sold when the oil price went through $75. He also sold healthcare company UnitedHealth Group and telecommunications brand Verizon.

NAIT’s holding in the Michigan-based utility CMS Energy, was recently sold on valuation grounds. This is a stock which Fran says he has now bought and sold twice over the past ten years and will probably buy again when the valuation looks right.

NAIT’s shares in Procter & Gamble were sold after the strong run-up in the stock price. The company benefited as consumers increasingly relied on its products during the COVID-19 pandemic, however, many of these tailwinds have since faded, says Fran. He thinks P&G’s management has done well investing to extend the company’s earnings growth, while also remaining committed to returning cash to shareholders; however, these factors are already appropriately priced into the stock.

Similarly, Fran says forward earnings expectations for Home Depot, which he bought at the height of the pandemic in March 2020 as consumers stuck at home took on renovation projects, have been captured in the share price and so the company was sold at the end of 2021. The manager says the company’s fundamentals still look attractive but that the risk/reward in late 2021 made it far less compelling and no longer a best idea.

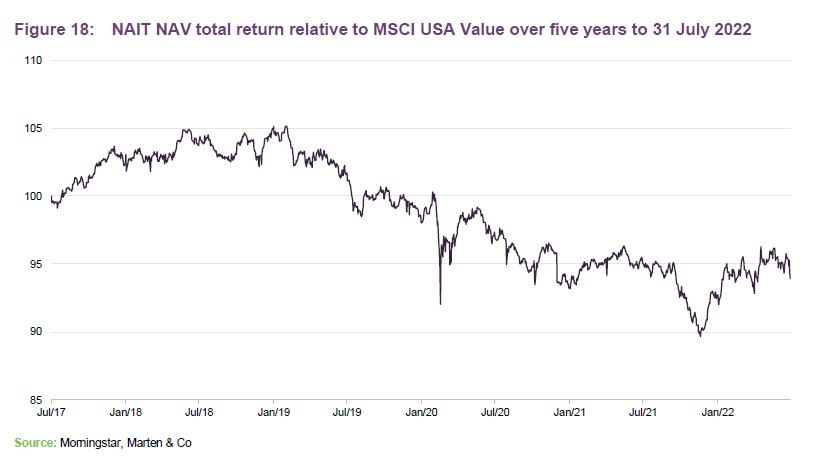

Performance

After a few years, where NAIT’s relative performance was perhaps held back by the overwhelming outperformance of growth against value and the impact of the pandemic, there has been a positive turnaround. Since the start of 2022, investors appear to have moved away from growth stocks, on the back of inflation fears, and have re-embraced value stocks. This has been positive for NAIT, which has started bringing its long-term figures closer to being in line with its index and peers.

The S&P 500 Index’s strength over the past five years (as illustrated in Figure 19) reflects the strength of growth stocks, will likely have worked against income-focused strategies such as NAIT’s, with core sectors such as financials having been out of favour with investors for several years.

The team takes great pride in being able to say that NAIT has increased its dividend yield every year since the current strategy was adopted, while simultaneously building up its revenue reserves.

Attribution

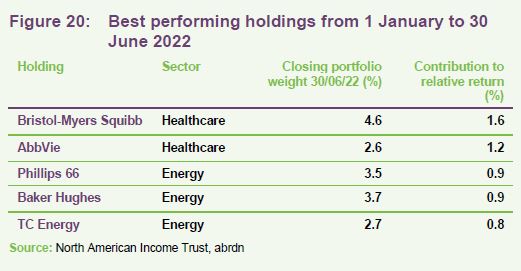

Though performance has fallen a little behind expectations year-to-date, there have been some key winners in NAIT’s portfolio. The top driver of performance during the first half of 2022 was the trust’s top holding Bristol-Myers Squibb. The strong performance comes after the pharmaceutical firm raised its quarterly dividend by 10.2% last year, which is equivalent to an annualised yield of 3.3%. Meanwhile, Abbvie has seen healthy year-over-year revenue and EPS growth as it has benefited from healthy revenue growth in its Global Botox Therapeutic business.

Energy names and top ten constituents Phillips 66 and Baker Hughes and Aerospace as well as TC Energy were also among the best performers, reflecting the overall strong performance of the energy sector in global markets.

On the negative side, NAIT’s relative performance was hit by disappointing numbers from CI Financial and retail brands Hanesbrands and VF Corp. Retail has struggled to keep up with the post-pandemic recovery and is likely to be hit further in the midst of the growing cost-of-living crisis. Other detractors included Cisco Systems and Citigroup.

Peer group

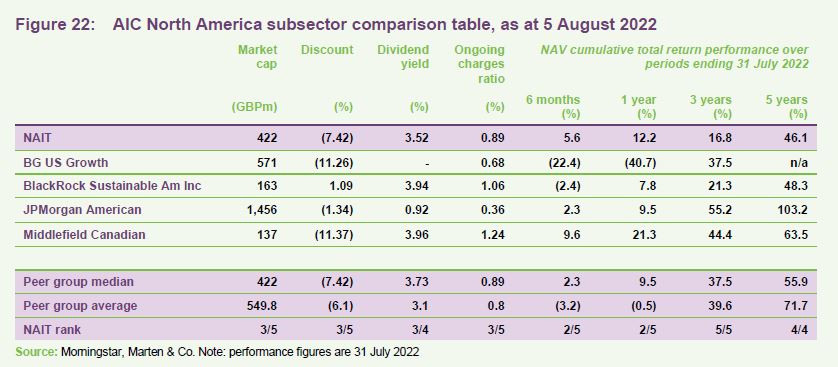

NAIT sits within the AIC North America sector, which is used as its peer group. Our data excludes Canadian General Investments (no longer covered by Morningstar) and Pershing Square Holdings, which was only recently added to the sector. Of the remaining peers, only BlackRock Sustainable American Income follows a similar strategy to NAIT.

Baillie Gifford US Growth and JPMorgan American have growth-focused portfolios, while Middlefield Canadian Income allocates predominantly to Canada. The growth-focused funds have led the peer group over the longer term, as illustrated in Figure 22, however they appear to have suffered more recently as markets have rotated towards value in the face of rising interest rates.

Over six months and one year, NAIT has been the second-best performing fund out of those listed in the table. NAIT sits mid-table in terms of market cap, discount, dividend yield and ongoing charges.

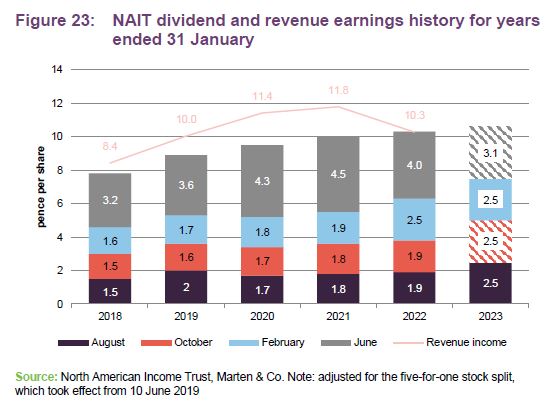

Dividend

NAIT pays dividends quarterly, with the first interim dividend paid out in August. The second, third and fourth interim distributions are paid in October, February and June. For the full year to 31 January 2022, NAIT paid a dividend of 10.30p per share, a 3% increase from the previous year’s 10.00p per share.

Fran says that companies that were forced to suspend or cut their dividends during the pandemic have reinstated them and, in many cases, increased them by some margin. This is feeding through into NAIT’s revenue account. The manager suggests that it is perhaps worth noting that the number of companies that cut their dividend was much smaller than in the UK.

Although not a formal aspect of NAIT’s dividend policy, the total annual dividend has increased every year since NAIT adopted its income mandate in 2012. This means that NAIT now qualifies as an AIC next generation dividend hero (funds with 10 years of consecutive dividend increases).

In July 2022, the board declared a first interim dividend of 2.5p per share in respect of the year to 31 January 2023, which is payable on 5 August 2022 to shareholders on the register at close of business on 22 July 2022. The ex-dividend date was 21 July 2022. The board currently expects to pay two further quarterly dividends each of 2.5p and a fourth quarterly interim dividend of at least 3.1p, making a total dividend of at least 10.6p for the year to 31 January 2023.

The amount of the fourth quarterly dividend will be determined once the results for the financial year are known, but the board is looking to continue to build on the track record of ten consecutive years of dividend growth and to pay dividends more evenly over the year.

As Figure 23 illustrates, NAIT has a track record of growing its annual dividend and this has been supported by the build-out of its revenue reserves, with dividends having been consistently covered by earnings. As at 31 January 2022, NAIT had revenue reserves totalling £23.653m.

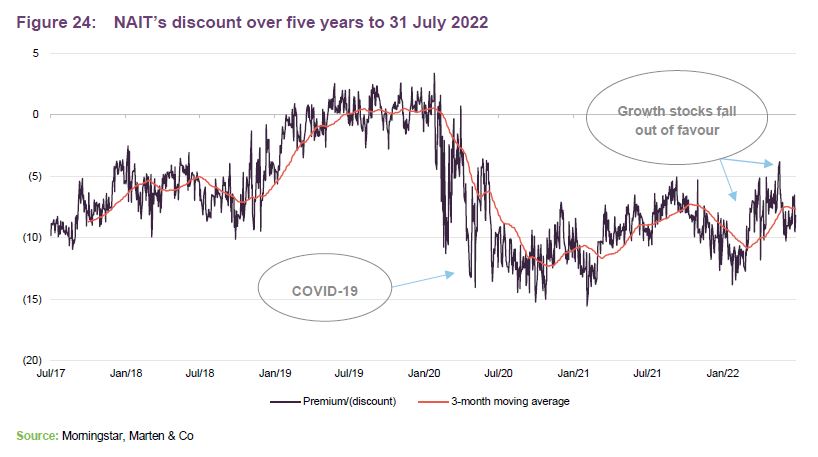

Premium/(discount)

Over the 12 months to the end of June 2022, NAIT’s share price has traded on a discount, ranging from 13.8% to 3.8%. The average discount for the 12 months was 8.6%.

As at 5 August 2022, NAIT’s shares were trading on a discount of 7.4%.

NAIT is authorised to repurchase up to 14.99% and issue up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. The board uses this discount control mechanism as a tool to reduce volatility in the premium or discount to underlying NAV, whilst also making a small positive contribution to the NAV.

Fees and costs

NAIT’s management fee is calculated at 0.75% of net assets up to £250m, 0.6% between £250m and £500m and 0.5% over £500m and is payable quarterly. For accounting purposes, the management fees are charged 70% against the capital account and 30% against the income account, as is the interest cost associated with NAIT’s gearing.

Secretarial and administration services provided by abrdn Fund Managers Limited are provided for an index-linked annual payment that amounted to £120k for the year to 31 January 2022 (2021: £118k). NAIT also makes a contribution to the marketing cost for the trust – or ‘promotional activities’ – which amounted to £177k for the last full financial year (2021: £212k).

NAIT has appointed Computershare Investor Services Plc as its registrar and BNP Paribas Securities Services as its depositary. The fees for these services for the year to 31 March 2022 were £51k and £43k respectively (2021: £46k and £45k).

NAIT’s ongoing charges ratio for the year to 31 January 2022 excluding look-through costs was 0.88%. This figure was 0.95% including look-through costs.

Capital structure and life

NAIT has a simple capital structure with one class of ordinary share in issue. At 30 June 2022, the company’s capital structure consisted of 140,234,749 ordinary shares of 5p each. During the year to 31 January 2022, NAIT bought back 2,353,212 ordinary shares for cancellation. Between then and 30 June 2022, 441,185 shares have been repurchased. This represents 0.3% of the opening issued share capital.

Gearing

In December 2020, NAIT issued a $25m 10-year senior unsecured loan note at an annualised interest rate of 2.70% and a $25m 15-year senior unsecured loan note at an annualised interest rate of 2.96%. The loan notes are unsecured and unlisted and interest is payable in half yearly instalments in June and December. They are due to be redeemed at par on 21 December 2030 and 21 December 2035.

The total fair value of the loan notes at 31 January 2022 was £41,348,000 comprising £20,065,000 in respect of the 10-year loan and £21,283,000 in respect of the 15-year loan. The proceeds of the loan note were used to repay and cancel in full the $75m revolving credit facility (RCF).

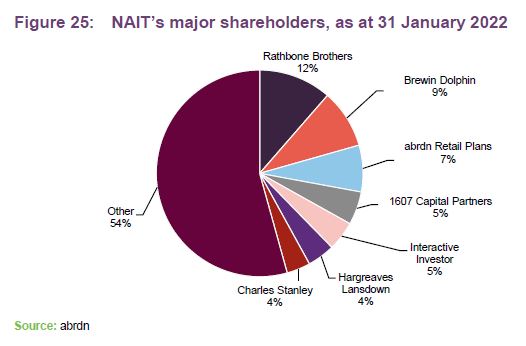

Major shareholders

Financial calendar

NAIT’s financial year-end is 31 January. Its annual results are usually published in April (interims in September) and its AGMs are usually held in June of each year.

The most recent AGM was held on 8 June 2022 in Edinburgh and saw all resolutions, including the re-election of its board (see Board section of this note) passed.

Three-yearly continuation vote

NAIT does not have a fixed life, but every three years shareholders are offered the chance to vote on the continuation of the company. The last continuation vote, held in June 2021, was passed with 98.6% of votes in favour and the next continuation vote is scheduled for the AGM in June 2024.

Management

The investment team has 18 members (nine in Philadelphia and nine in Boston). Ralph Bassett, head of North American equities, joined the manager in 2006 from Navigant Consulting. He graduated with a BS in Finance from Villanova University. Ralph is a CFA charterholder.

Fran joined the manager in 2007 following the acquisition of Nationwide Financial Services. Previously, he worked at Salomon Smith Barney and SEI Investments. He graduated with a BA in Economics from Dickinson College and an MBA in Finance from Villanova University. Fran is also a CFA charterholder.

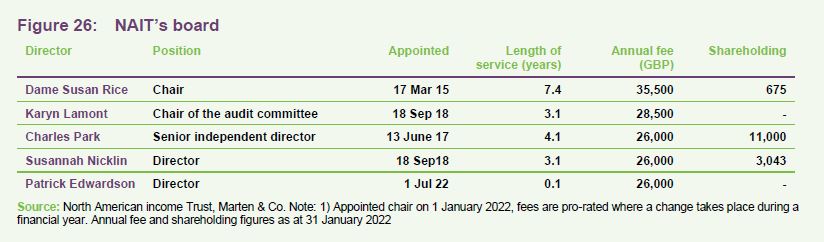

Board

The board consists of five non-executive directors, all of whom are considered to be independent of the manager and do not sit together on other boards. All directors stand for re-election annually. James Ferguson, who had been chair of the board for almost 20 years, retired at the end of 2021 and was succeeded by Dame Susan Rice, formerly the senior independent director. As a result, her role was taken on by Charles Park. As part of its succession planning, NAIT appointed Patrick Edwardson as an independent non-executive director at the start of July 2022.

Dame Susan Rice (chair)

Susan is a chartered banker with extensive experience as a non-executive director, as well as in financial services, retail, utilities, leadership and sustainability. Her previous roles include managing director of Lloyds Banking Group Scotland, chairman and chief executive of Lloyds TSB Scotland, President of the Scottish Council of Development and Industry and a member of the Scottish First Minister’s Council of Economic Advisors. She has also held a range of non-executive directorships, including at the Bank of England and SSE. She was appointed as chair of NAIT on 1 January 2022, taking over from James Ferguson who retired on 31 December 2021.

Karyn Lamont (chair of the audit committee)

Karyn is a chartered accountant. She was previously an audit partner at PwC, specialising in the UK financial services sector. Karyn has provided audit and other services to a range of clients, including several investment trusts, a broad range of management companies and outsourced service providers. Her specialist knowledge includes financial reporting, audit and controls, risk management, regulatory compliance and governance. She is the audit committee chairman of The Scottish Investment Trust, Scottish Building Society, iomart Group and Scottish American Investment Company. Karyn is also a non-executive director of Ediston Property Investment Company.

Charles Park (director)

Charles has over 25 years of investment management experience. He was a co-founder of Findlay Park Investment Management, a US boutique asset management house established in 1997, and deputy chief investment officer with joint responsibility for managing Findlay Park American Fund until his retirement from the firm in 2016. Prior to co-founding Findlay Park, Charles was an investment manager at Hill Samuel Asset Management and an analyst at Framlington Investment Management. He is a non-executive director of Polar Capital Technology Trust plc.

Susannah Nicklin (director)

Susannah is an investment and financial services professional with over 20 years of international experience in executive roles at Goldman Sachs and Alliance Bernstein in the US, Australia and the UK. She has also worked in the social impact private equity sector with Bridges Ventures, the Global Impact Investing Network and Impact Ventures UK. She is the chairman of Schroder BSC Social Impact Trust, senior independent director of Pantheon International and a non-executive director of Amati AIM VCT, Baronsmead Venture Trust and Ecofin Global Utilities and Infrastructure Trust. She is a CFA charterholder.

Patrick Edwardson (director)

Patrick is the board’s most recent addition. He joined Baillie Gifford in 1993, becoming a partner in 2005, and managed bond, equity and multi-asset portfolios, managed the Scottish American Investment Company and led Baillie Gifford’s multi-asset team until his retirement in 2020. He is a non-executive director on the boards of JPMorgan Multi Asset Growth and Income and Edinburgh Investment Trust. Patrick is also managing director of Atheian, a family investment office.

Previous publications

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on The North American Income Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.