Macro driven market is creating opportunities

Macro driven market is creating opportunities

Fran Radano, the manager of North American Income Trust (NAIT), comments that the US market has been very macro-driven this year, frequently outweighing company fundamentals. Whilst it can be challenging to trade through such environments, increased market volatility creates opportunities for investors who are able to look through the noise.

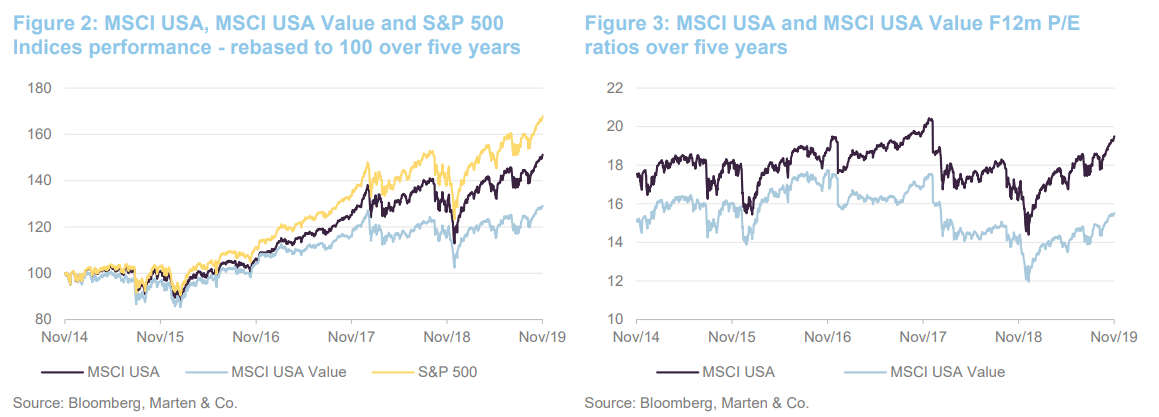

Valuations have increased during the last 12 months and the broader equity market, as represented by the MSCI United States, is trading at a F12m p/e of 19.3x. This is close to its five-year high (20.4x) and above its five-year average of 18.0x. However, valuations for US value stocks, as represented by the MSCI USA Value Index, are much less demanding. On a F12m p/e basis, this index is trading in line with its five-year average of 15.5x, which is markedly below its five-year high (17.8x).

Above average income and long-term growth

Above average income and long-term growth

NAIT’s objective is to invest for above-average dividend income and long-term capital growth, mainly from a concentrated portfolio of S&P 500 US equities.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | MSCI USA value TR (%) | MSCI United States TR (%) | S&P 500 Value TR (%) |

|---|---|---|---|---|---|---|

| 1 | 31 Oct 2015 | -0.80 | 2.90 | 4.60 | 8.90 | 4.40 |

| 2 | 31 Oct 2016 | 42.20 | 40.50 | 35.40 | 32.00 | 34.60 |

| 3 | 31 Oct 2017 | 13.80 | 12.80 | 9.60 | 13.60 | 10.00 |

| 4 | 31 Oct 2018 | 7.60 | 8.50 | 7.60 | 11.40 | 7.10 |

| 5 | 31 Oct 2019 | 15.80 | 5.20 | 9.70 | 12.90 | 13.00 |

US markets valuation summary

US markets valuation summary

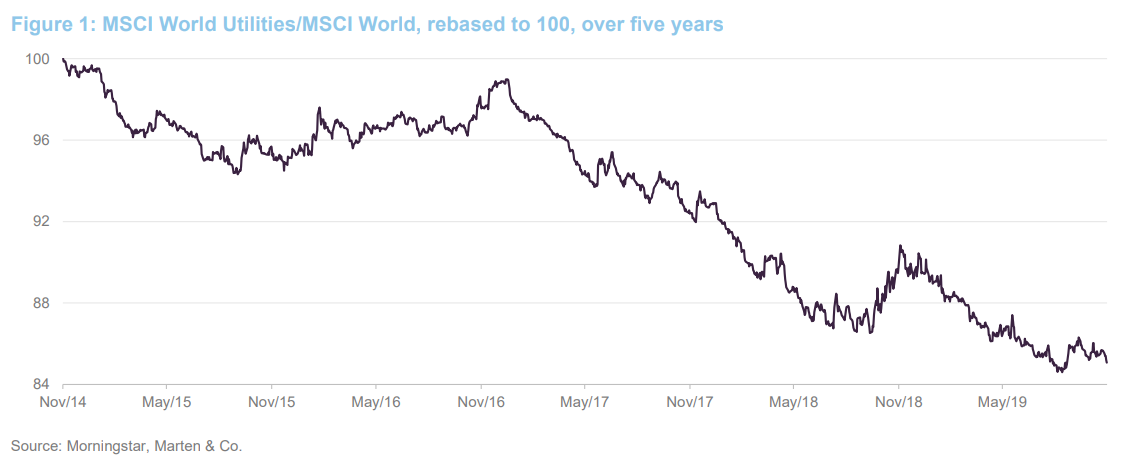

As illustrated in Figures 1 and 2, US value stocks have broadly underperformed wider US equity markets during the last five years, most of which have occurred during the last three years, albeit with distinct periods of volatility. This is a period where markets and the performance of growth versus value stocks have been largely driven by top-down macroeconomic considerations. These have frequently outweighed company fundamentals, at least in the short-to-medium term.

As illustrated in Figure 3, US value stocks have tended to trade at a discount to the broader US equity during the last five years (arguably reflecting the markets general bias towards growth stocks during this period).

As also illustrated in Figure 3, valuations have increased for both US value stocks and US equities in general. However, whilst the broader equity market at a F12m p/e of 19.5x is close to its five-year high (20.4x) and above its five-year average of 18.0x, US value stocks are trading in line with their five-year average (15.5x) and markedly below their five-year high (17.8x).

Fund profile

Fund profile

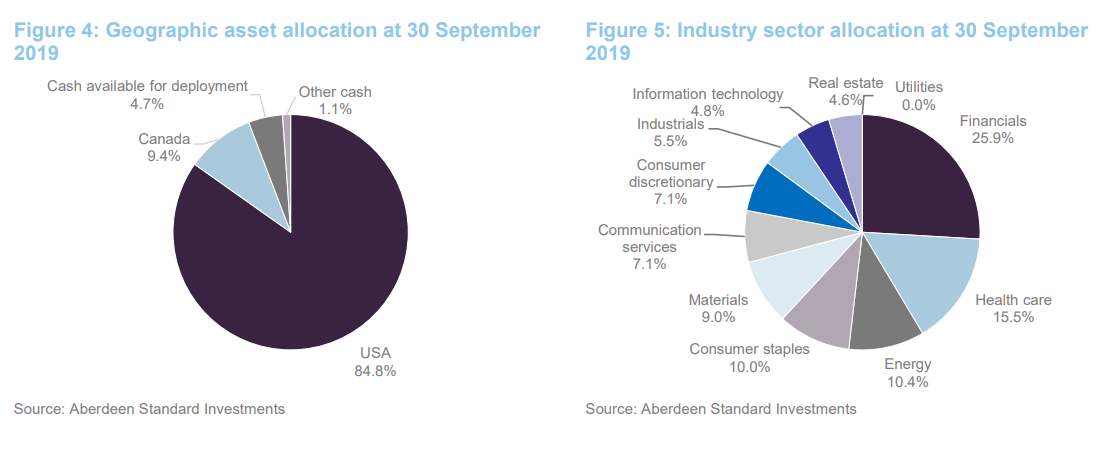

NAIT’s objective is to provide investors with above average dividend income and long-term capital growth through active management of a portfolio consisting predominantly of S&P 500 US equities. NAIT may also invest in Canadian stocks and US mid- and small-cap companies as a way of accessing diversified sources of income. Up to 20% of NAIT’s gross assets may be invested in fixed income investments, which may include non-investment grade debt.

The company maintains a diversified portfolio of investments, typically comprising around 40 equity holdings and around eight to 10 fixed interest investments (which tend to be much smaller positions) but without restricting the company from holding a more or less concentrated portfolio from time to time.

NAIT benchmarks itself against the Russell 1000 Value Index but we have used the MSCI USA Value, MSCI USA and S&P 500 indices as comparators for the purposes of this report.

The board has appointed Aberdeen Standard Fund Managers Limited to act as NAIT’s AIFM. The portfolio is managed on a day-to-day basis by Aberdeen Standard Investments (ASI), and the lead manager is Fran Radano (Fran or the manager). Fran is a senior investment manager within the ASI team, which is led by Ralph Bassett, who is a named co-manager of NAIT.

NAIT’s history goes back to 1902, but the trust has only been in its current form since 2012. Before then, its portfolio tracked the S&P 500 Index. Fran has been working on the trust since 2012 and took over as lead manager in 2015. The equities team is based in Philadelphia and Boston. More information on the manager and ASI is available on page 17 in the enclosed PDF version.

Manager’s view

Manager’s view

Fran says that the US market has been very macro-driven this year and, whilst equities for NAIT’s portfolio continue to be selected on a bottom-up ‘best ideas’ basis, you cannot afford to ignore the broader economy and politics and the swings in sentiment that these are bringing.

Fran considers that the US economy is doing reasonably well. He had expected that, with the US election due within less than 12 months, there would have been firmer signs of the trade spat with China reaching resolution. However, whilst the yield curve briefly inverted, this has since normalised, and the Fed has taken decisive action in cutting interest rates that has helped keep the economy on track. He now has greater confidence that a soft landing can be achieved. Overall, Fran is aware that there are headwinds and, although he says that it is difficult to trade around these, they are less threatening than they have been and are creating opportunities at the margin, particularly where there is increased volatility.

Market gains this year have not been universal. This has created the opportunity for Fran to rotate out of stronger performing names that have got ahead of themselves into better value opportunities (he says that there have been various instances where companies have improved in quality, but the market has failed to appreciate this adequately, creating buying opportunities).

US banks – maintaining a preference for the regional operators

US banks – maintaining a preference for the regional operators

NAIT did not have a holding in any of the four largest US banks. The manager is deliberately avoiding banks with significant investment bank earnings and foreign currency exposure. Instead, he strongly favours the smaller regional banks, noting that they are closer to the end customer, have relatively straightforward business models, and the regulation that they are subject to is much less-arduous than for the megabanks.

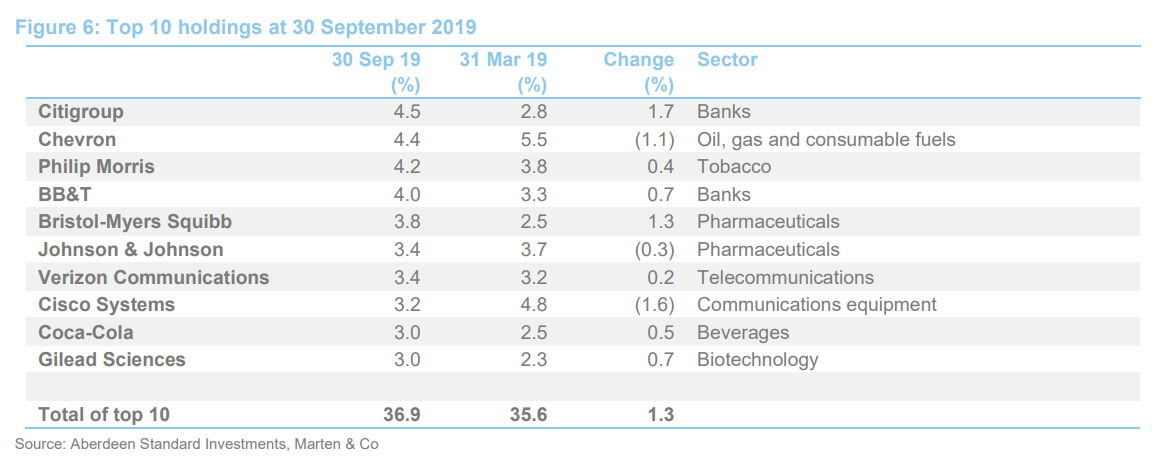

As noted in our May 2019 update note, Citigroup is an exception to this. At that time, Fran felt that Citigroup was starting to become attractive and he has since topped up NAIT’s holding. He feels that it has made significant progress in cleaning up its portfolio, but the market has not given it adequate credit for this and so it represented a good buying opportunity.

Other bank holdings include BB&T and Regions Financial. BB&T operates over 2,000 branches across 15 states and Washington, D.C. It offers consumer and commercial banking, securities brokerage, asset management, mortgage, and insurance products and services. Regions Financial is headquartered in Birmingham, Alabama and has branches across the south-eastern and midwestern states. It describes itself as one of the largest full-service providers of consumer and commercial banking, wealth management, and mortgage products and services in the US. It operates approximately 1,500 banking offices and 2,000 ATMs.

Utilities – sold down aggressively on valuation grounds

Utilities – sold down aggressively on valuation grounds

Driven by interest rate reductions and the expectation that rises are now further away, US utilities have performed strongly this year. When we last published, NAIT had two utilities holdings and, reflecting their strong performance, Fran has since liquidated both positions in their entirety. Neither have been replaced. Fran feels that, with the strong performance of the sector, it is difficult to find value and he is not prepared to move down the quality scale in search of stronger yields. He also feels that, should there be any normalization in the yield curve, utilities stocks, with their current high valuations, would be more vulnerable than the rest of the market. He has therefore reinvested the proceeds in other areas where he sees better value and has also reduced the trust’s gearing.

Investment process

Investment process

The merger between Aberdeen Asset Management and Standard Life required that the investment teams of the two businesses be amalgamated. This process was completed in April 2018 and the combined team is sharing research duties. In the wake of the merger, there is an increased emphasis on individual team members having responsibility for researching a specific sector. Buy and sell ideas are presented to the team and each analyst’s goal is to build consensus around their investment theses. Individual portfolio managers have responsibility for the content of their portfolios, but all investment decisions are peer reviewed and any stance that differs from the consensus view must be justified. An ESG analyst is embedded within the team and ESG factors are incorporated into the research process.

NAIT’s portfolio comprises approximately 40 equity positions, drawn largely but not exclusively from the constituents of the S&P 500 Index. It also has about 10 fixed income positions, which help to increase the diversification of NAIT’s portfolio as well as providing a useful source of income. The split of the portfolio was 85% equities and 15% bonds when the fund was repositioned in 2012, but since 2015 the bond weighting has been below 5% as higher prices and lower yields have made them far less compelling. There is no intention to reweight the bond sleeve above 5% anytime soon as it is simply a modest diversifier of income sources. The fixed income portion of the fund is managed by the Boston office. The portfolio is usually close to fully invested, but the manager has the option to increase the exposure to cash (or other liquid securities) if he believes it is warranted.

The equities are selected on a ‘best ideas’ basis. Candidates for the portfolio must satisfy both quality and valuation criteria. Aspects of quality include the strength of a company’s business model, where it compares with its competitors, and the quality and experience of its management. Meeting management and visiting companies is a core part of the investment process, and the manager will not invest in a stock if the management has not met the ASI team. The manager believes that the emphasis on quality should help NAIT avoid ‘value traps’. He looks for stocks that are on an improving trend in terms of revenues and profits, but does not invest in ‘recovery’ situations.

The approach is a long-term one and portfolio constituents change relatively rarely, but the manager top-slices and tops up positions in response to short-term valuation shifts.

Whilst there is no outright prohibition on buying stocks for NAIT’s portfolio that do not pay a dividend, the manager has never done so. NAIT’s portfolio is not a barbell one; instead, it has a concentration of stocks yielding between 2% and 4%. Predictability of income is a key consideration when selecting stocks, but the overall emphasis is on choosing stocks that look attractive on a total return basis, not just on yield alone. Their ability to generate dividend growth is an important factor.

Position sizes are determined by conviction, and the manager places no emphasis on the weightings of stock within the benchmark when building the portfolio. New positions typically enter the portfolio with a 1%–1.5% weighting. Fran chooses to operate with a soft cap on position sizes of 5%, and tends to trim positions when they exceed this level. Furthermore, he seeks to limit the number of positions that exceed the 4% level to a small number.

A range of metrics is used to analyse the portfolio in order to ensure that, wherever practical, there is no excessive bias towards or against any sector, geography or theme. Given the lack of income available, the portfolio has a natural underweight exposure to the technology sector (and, in recent years, this has weighed on the fund’s performance relative to the US market as a whole). At the same time, the portfolio does not have much exposure to some sectors that might typically be seen as the preserve of income fund managers such as telecoms, utilities and REITs. This is because the manager is looking for stocks with decent earnings and dividend growth potential. He is also avoiding companies that distribute capital.

Option writing augments income

Option writing augments income

The portfolio’s income is augmented by option writing activity. In recent times, Fran has been running with a ratio of about 50% calls to 50% puts. Writing puts to buy and calls to sell positions is a useful way of deriving income from an investment decision that would have been made anyway. Specifically, options are only utilised once a buy or sell decision have been reached. If the manager believes the option market provides the best risk reward in executing this decision, then put or call options may be sold.

The greatest opportunity to earn income comes from the stocks with the highest implied volatility. At any time, NAIT may have between zero and nine open positions; there is no requirement to write options if the manager believes it would not be a profitable activity. The manager stresses that he does not write options with the primary goal to generate income per se. Option writing is a tool to buy and sell positions where extra income can be generated while being able to buy something a little cheaper or sell something a bit higher than current prices. The manager does not write in-the-money options as a means to convert capital into income.

Investment restrictions

Investment restrictions

Certain restrictions have been imposed on the manager by the board:

- No single investment will exceed 10% of gross assets at the time of investment.

- The portfolio will have at least 35 holdings.

- Exposure to derivative instruments is limited to 20% of net assets at the time of the relevant acquisition, trade or borrowing.

- NAIT will not acquire unlisted or unquoted securities (it is permitted to hold securities which are about to be listed or traded on a stock exchange, but Fran says that, in reality he has not intention of utilising this permission). NAIT is also permitted to continue to hold securities that cease to be listed or quoted, if appropriate. However, once again, Fran says that is not something he envisages the trust doing.

There are no restrictions relating to the size of the companies that NAIT can hold (as measured by market capitalisation) and no limits to sector or country exposures. Although permitted to do so, NAIT does not generally hedge its exposure to foreign currency.

Asset allocation

Asset allocation

Portfolio activity

Portfolio activity

There were 49 holdings in the portfolio at the end of September 2019; 40 equity investments and nine fixed income investments (one equity investment fewer and one fixed income investment fewer when compared to the end of March 2019, this being the most recently available data when we last published).

Comparing NAIT’s exposures as at 30 September 2019 and 31 March 2019, it can be seen that financials (already the trust’s largest sectoral allocation) have increased by around 2.7 percentage points. This has been largely driven by the performance of holdings in this space, for example Citigroup, which he has also added to. Fran continues to have his preference for regional banks (see page 5 in the enclosed PDF version). Real estate has also increased by 2.7 percentage points, which reflects the addition of a new holding in Gaming and Leisure Properties Inc, the first gaming focused REIT. Health care has increased by 2.4 percentage points, which has mostly been performance-driven. The manager has been reallocating some of this exposure into better-value holdings.

The largest move down has been in information technology; a decrease of 4.7 percentage points. The reduction was primarily due to NAIT exiting Microsoft, one of its initial holdings in 2012. Fran says that the valuation had doubled to nearly 30x forward earnings and the dividend yield was only 1.5%. Therefore, despite strong fundamentals, Microsoft was simply deemed to no longer be a top 40 idea, given the combination of its valuation and dividend yield. In addition, NAIT reduced position sizes in holdings TXN and CSCO.

Top 10 holdings

Top 10 holdings

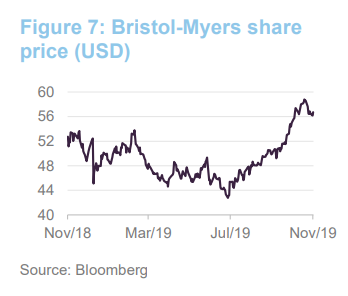

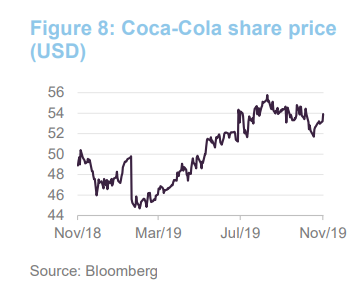

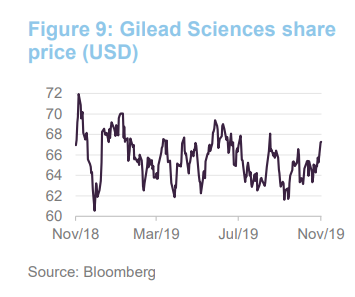

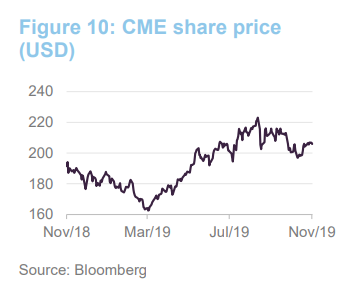

Figure 6 shows NAIT’s top 10 holdings as at 30 September 2019 and how these have changed since 31 March 2019 (the most recently-available data when we last published). New entrants to the top 10 are Bristol-Myers, Coca-Cola and Gilead Sciences (positions NAIT’s manager has added to on the back of market weakness in these stocks). Names that have slipped out of the top 10 are CME, Texas Instruments and Procter & Gamble (positions that the manager has been selling down following a strong price performance). We discuss some of the more interesting changes in the following pages. Readers interested in more information on other names within NAIT’s top 10 should see our previous notes, where many of these have been previously discussed (see page 19 of this note in the enclosed PDF version).

Bristol-Myers Squibb (3.8%) – market concerns were overdone and presented a buying opportunity

Bristol-Myers Squibb (3.8%) – market concerns were overdone and presented a buying opportunity

Bristol-Myers Squibb (www.bms.com) suffered earlier this year as investors’ concerns about patent expirations and its near-term development pipeline came to the fore. In this regard, the company’s proposed merger with Celgene (announced in January) has also created some headwinds. Specifically, Celgene faces a patent cliff of its own (reportedly one of the largest in the industry); to get regulatory approval for the deal, Bristol-Myers agreed to divest Otezla, Celgene’s blockbuster drug that is used to treat psoriasis; and there have also been investor concerns over whether Celgene’s blockbuster Revlimid (used to treat multiple myeloma and myelodysplastic syndromes) is able to stand up to patent challenges.

Despite these concerns, Fran felt that the market’s reaction was significantly overdone and that the de-rating during the first half of 2019 offered a buying opportunity. Fran thinks that the company offers excellent cash flow generation and that the additional cashflows provided by the merger with Celgene would give the company additional time to work through its issues. He also likes the new management team and believes that whilst there is inevitably some lawsuit risk in this field, share price risk was strongly skewed to the upside.

Coca-Cola (3.0%) – rotated from PepsiCo

Coca-Cola (3.0%) – rotated from PepsiCo

Following a strong share price performance, NAIT’s manager sold down the trust’s position in PepsiCo and rotated the proceeds into the Coca-Cola Company (www.coca-cola.com) instead. Fran considers that PepsiCo has a very strong portfolio of brands and is very cash generative, but he felt that it had become overvalued by the market, and that its share price was not justified by its growth outlook.

In contrast, Coca-Cola suffered heavily in February after it warned that sales growth was expected to slow this year (a combination of a more cautious outlook for a number of its overseas markets, a stronger US dollar weakening the value of its overseas earnings, and increased commodity costs). Fran acknowledges these issues, but felt that the market’s reaction has been overdone. He thinks that its core-asset-light approach (for example, Coca-Cola makes the syrup for its products, but tends to outsource bottling operations) means that its earnings should be more resilient as the global economy slows. He also believes that management’s strategy of diversifying the business (for example, the purchase of Costa Coffee) is correct and that they are executing this well. As Figure 8 illustrates, NAIT has benefitted as Coca-Cola’s share price has recovered this year.

Gilead Sciences (3.0%) – position expanded during periods of weakness

Gilead Sciences (3.0%) – position expanded during periods of weakness

Gilead Sciences (www.gilead.com) describes itself as a research-based biopharmaceutical company focused on the discovery, development, and commercialisation of innovative medicines. It has four primary therapeutic areas of focus: HIV, liver disease, oncology and inflammation, and its antiviral drugs are used in the treatment of HIV, hepatitis B, hepatitis C, and influenza.

The company had a difficult 2018 (its hepatitis C franchise has been seeing new competitive threats from the likes of AbbVie’s Mavyret) and there was a prolonged period of uncertainty following the announcement in July 2018 that John Milligan would be stepping down as CEO (Daniel O’Day was finally announced as his replacement in December 2018). As illustrated in Figure 9, Gilead has experienced a relatively volatile 2019. NAIT’s manager felt that the market was being overly bearish on Gilead and has used periods of weakness to top up NAIT’s holding, rotating out of other stocks that have performed strongly.

CME Group – trimmed on valuation grounds

CME Group – trimmed on valuation grounds

CME Group (www.cmegroup.com) was formed in 2007 from the merger of Chicago Mercantile Exchange & Chicago Board of Trade. It owns large derivatives, options and futures exchanges in Chicago and New York and describes itself as “the world’s leading and most diverse derivatives marketplace offering the widest range of futures and options products for risk management”.

CME Group is a company that NAIT’s manager really likes. He thinks that it has a very good management team and is well positioned to benefit from long-term structural growth. It is a position that Fran will top up during periods of weakness and then sell down again on strength. As illustrated in Figure 10, the stock has experienced a very strong run of share price performance, since reaching its 12-month low at the end of March. Fran acted decisively and cut the position aggressively when CME’s share price was close to its recent highs, which were partly driven by a strong set of results (its revenue increased by 20% to $1.3bn, driven by strong growth in its international markets – Latin America, Asia, and Europe specifically, where trading volumes increased by 81%, 28%, and 22%, respectively). However, Fran says that the company ‘over-earned’ last year due to higher interest rate volatility and that he would expect this to normalise this year. Nonetheless, he maintains a positive active weight in the stock.

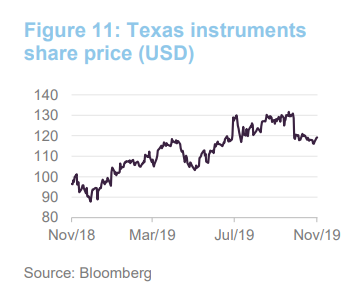

Texas Instruments – trimmed following strong performance

Texas Instruments – trimmed following strong performance

Texas Instruments (www.ti.com) is a technology company that designs and manufactures semiconductors and various integrated circuits. Headquartered in Dallas, Texas, it has a global footprint (it is a top-10 producer by sales volume), employing some 30,000 people in more than 30 countries. As partially illustrated in Figure 11, Texas Instruments has had a strong run of performance during the last three years. It has been steadily increasing its sales revenue, improving its margins and repurchasing stock, which it describes as an essential part of its capital management strategy.

Like CME, Texas Instruments is a company that the NAIT’s manager really likes and sees as a core long-term holding for the trust that he is happy to add to when it looks cheap and reduce when the market appears to have got ahead of itself. Fran added to the position aggressively when it was trading around the US$90 level and has cut this back as the share price has recovered (a quarter was sold around the US$110 mark and another quarter at around the US$130 mark). Whilst Fran continues to like the company, he felt that, given the state of the economic cycle, there is the potential for a more challenging consumer electronics environment going forward and, from a risk management perspective, it made sense to trim the position. However, as a counterweight, he believes that the company is well positioned to benefit from the rollout of 5G networks.

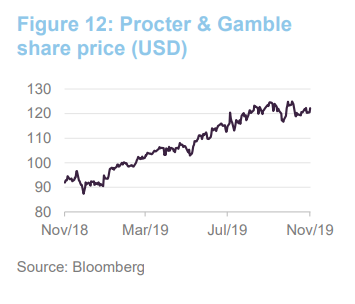

Procter & Gamble – trimmed following strong performance

Procter & Gamble – trimmed following strong performance

Procter & Gamble (us.pg.com) is multinational consumer goods company, headquartered in the US, with an extensive list of global brands. It sells its products (largely personal and household care-related) to over 5bn consumers in 180 countries.

Fran considers that Procter & Gamble is a high-quality company that has fantastic brands and is now well-managed. He topped up NAIT’s holding when the company was out of favour in 2018 (due to challenges with some of its brands and lacklustre price and sales growth) and the trust has benefitted as the share price has recovered strongly during the last 12 months. However, given the strength of the price increase (33.0% YTD as at 26 November 2019), Fran concluded that, despite its defensive characteristics, it was time to sell down the position and reallocate the proceeds to better value stocks.

Performance

Performance

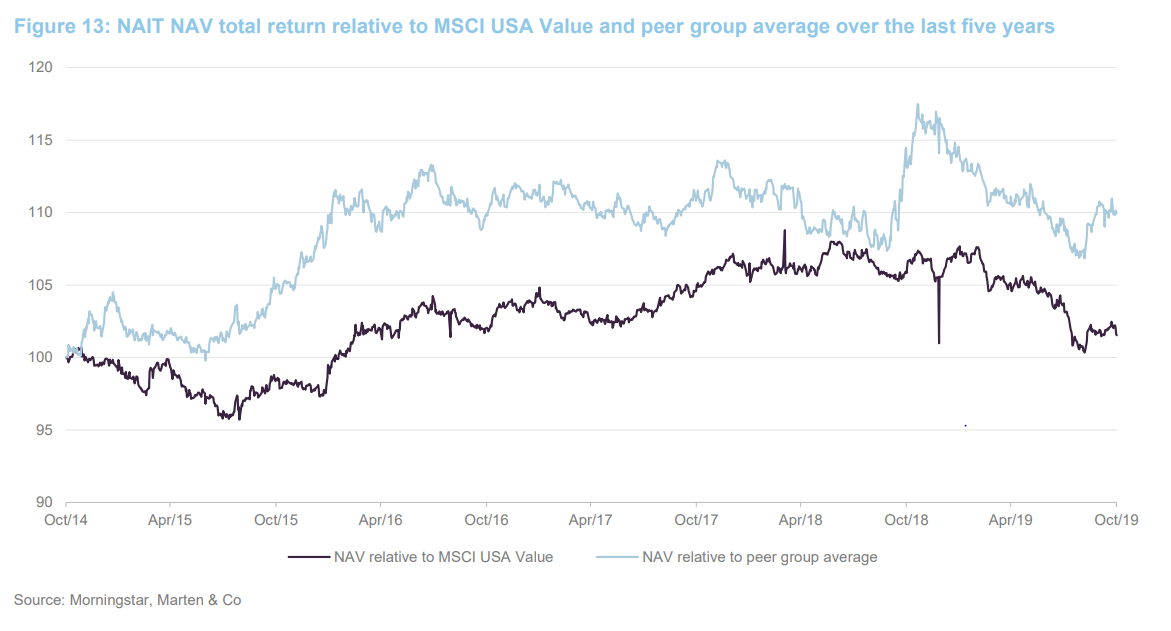

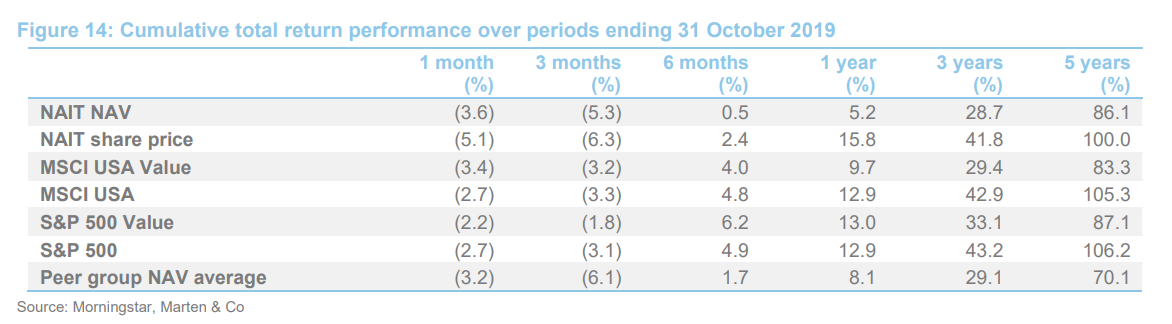

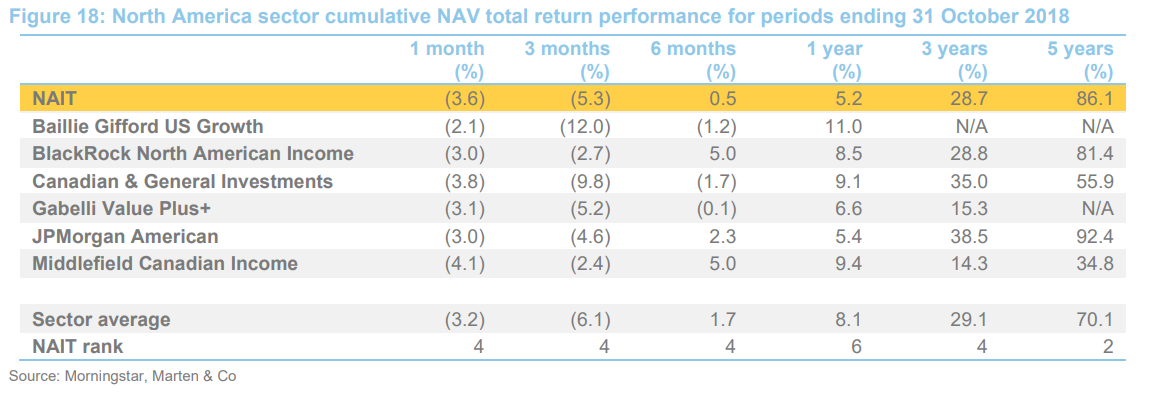

Figures 13 and 14 illustrate that over the last five years, NAIT’s NAV total return performance has exceeded that of the MSCI USA Value Index and the average of its peer group (it has exceeded the peer group average by a significant margin). Whilst NAIT’S absolute returns have been negative during the last three months, NAIT’s longer-term absolute returns are very strong and we think that a strategy such as NAIT’s is better assessed over longer-term horizons. NAIT’s NAV has underperformed both the MSCI UK and S&P 500 indices during the last five years. However, this reflects the strength of growth stocks during the last five years. NAIT’s NAV has also underperformed the S&P 500 Value Index during the last five years, but the underperformance is minor.

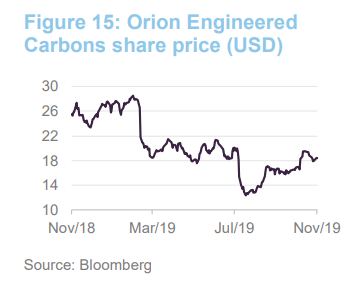

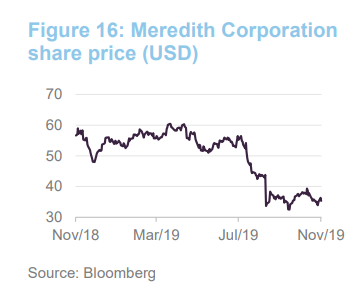

On pages 9 to 11 (in the enclosed PDF version), we discuss a number of positions that have performed strongly for NAIT (for example CME, Texas Instruments and Procter & Gamble). At the other end of the spectrum, two companies that have detracted from performance are Orion Engineered Carbons and Meredith Corporation.

Orion Engineered Carbons

Orion Engineered Carbons

Whilst it has benefitted from a significant share price bounce, since hitting a 12-month low in August, Orion Engineered Carbons’s (www.orioncarbons.com) share price has fallen 27.1% YTD (as at 26 November 2019). The company describes itself as a leading producer of Carbon Black; a chemical, manufactured in highly controlled processes, that contains more than 95% pure carbon, which is used in a variety of industries. This year’s fall follows a very difficult share price performance during the second half of 2018.

NAIT’s manager added the position during a period of share price weakness. Amongst other things, the company’s compounds are used in tyre manufacture, and stocks with auto-exposure were under significant pressure as new car sales slowed. Fran felt that the market’s focus on new cars was misplaced, as the tyre replacement cycle is driven by miles driven, which remains roughly constant. However, he says that the market did not like the conservative guidance given by the company’s new CEO and the stock moved down sharply. The share price has since seen a partial recovery and, whilst Fran considers that the long-term prospects for the company are very promising, he has reduced NAIT’s exposure, as he thinks that the issues will take some time to work out.

Meredith Corporation

Meredith Corporation

Meredith Corporation (www.meredith.com) is a media and marketing services company which owns national and local media groups in the US. Its interests include magazines, television stations, websites, and radio stations. It describes its businesses as serving well-defined audiences that deliver the messages of national and local advertisers.

Meredith’s share price has fallen 31.9% YTD as at 26 November 2019. It suffered a 23.1% fall on 5 September 2019 when it announced its fourth quarter and annual results for the year ended 30 June 2019. These revealed that its US$1.8bn acquisition of Time Inc, which turned Meredith into the biggest magazine publisher in the US, was taking longer to implement and that the legacy Time brands were less profitable than expected. Fran thinks that Meredith is fundamentally a good business and that management will turn it around. However, he is watching the situation closely and may dispose of the position opportunistically if he feels that the company’s magazine segment will be under continued near-term pressure without visibility as to when the execution issues will be corrected.

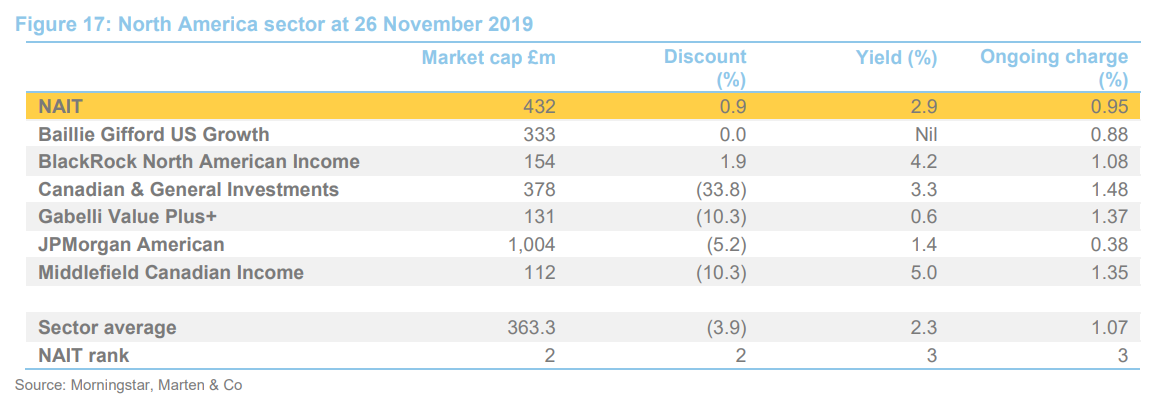

Peer group

Peer group

We have also compared NAIT’s performance to that of its AIC North American sector peer group, the constituents of which are listed in Figures 17 and 18. We caution, however, that this is not a perfect comparison, given that it includes two trusts focused largely on Canadian stocks and only one other trust, BlackRock North American Income, with a similar remit to NAIT.

NAIT offers a lower dividend yield than the BlackRock fund, but its ongoing charges are lower and whilst there is some recent underperformance of its closest peer, its three-year returns are almost equal and NAIT is ahead over five years.

Quarterly dividend payments

Quarterly dividend payments

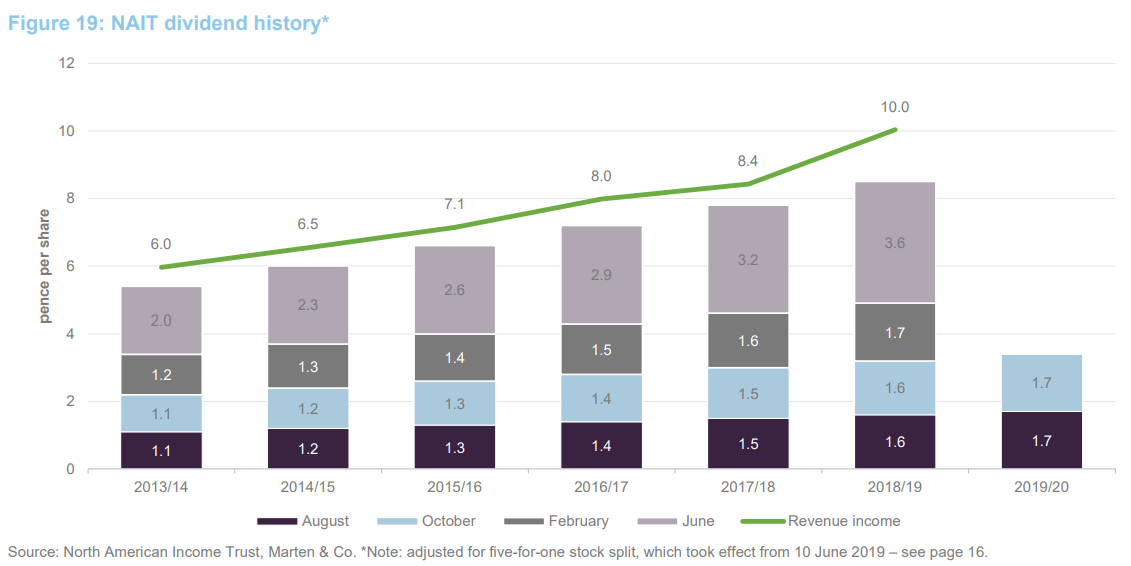

NAIT pays quarterly dividends. For a given financial year, the first interim dividend is paid in August (2019: 1.7p) with the second, third and fourth interims paid in October, February and June. As illustrated in Figure 19 below, the quarterly dividend rate paid for the first quarter has tended to be been maintained for the second interim in October. The third interim, paid in February, tends to see a modest increase. This is followed by a larger ‘balloon payment’ for the fourth quarter in June. Although not a formal aspect of NAIT’s dividend policy, the total annual has increased every year since NAIT adopted its income mandate in 2012.

Figure 19 shows NAIT’s dividend payment and revenue history, over the last six years, adjusted for the five-for-one share split that took effect on 10 June 2019 (see page 16 in the enclosed PDF version). Between the years ended 31 January 2014 and 31 January 2019, NAIT grew its total annual dividend from 5.4p per share to 8.5p per share. This is equivalent to a compound rate of 9.5% per annum.

NAIT’s has announced the first two interim dividend payments for the current financial year at 1.7 p per share. In aggregate, this is 6.3% higher than for the prior year. As Figure 19 shows, NAIT’s dividends have been covered by earnings, allowing it to build up substantial revenue reserves. At the 31 July 2019, NAIT had revenue reserves of £16.8m, equivalent to 11.8p per share (31 July 2018: £14.2m or 10.0p per share) before deducting the first and second interim dividend payments (paid in August and October). After adjusting for the first and second interim dividends, NAIT had a revenue reserve equivalent to 8.4p as at 31 July 2019 (2018: 6.8p). This is 0.99x the total dividend payment for the 2018/19 financial year (2018: 0.8x).

2018/19 year was a bumper year for revenue income

2018/19 year was a bumper year for revenue income

As discussed in our October 2018 initiation note, the manager was expecting that the year ended 31 January 2019 could be a bumper year for NAIT’s revenue account. As illustrated in Figure 19, this proved to be the case. There were two key factors. First of all, NAIT income from writing options was higher than in the prior year (20.5% of total income versus 14.9%), which partly reflected a timing issue around the mark-to-market of the option portfolio at the end of NAIT’s accounting year. Second, NAIT’s managers also indicated that companies in its portfolio were delivering a positive step change in their dividend payments. In terms of income generation for the year ending 31 January 2020, NAIT’s interims report option premia totalling £1.9m during the first half, down from £2.5m in the prior year, which represented 19.2% of total income at the halfway stage (down from 26.5% for the prior year).

Premium/(discount)

Premium/(discount)

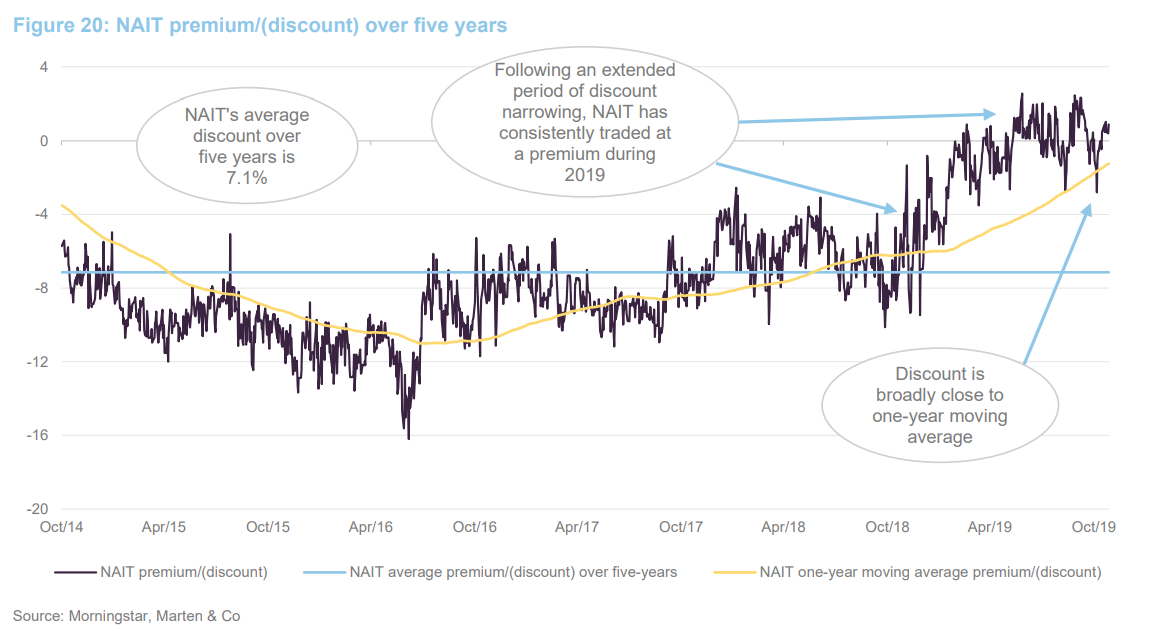

Whilst NAIT’s premium is modestly narrower than that of BlackRock North American Income (see Figure 17), its discount has been broadly on a narrowing trend since mid-2016, albeit with some volatility in the premium/discount. As at 26 November 2019, NAIT was trading at a premium of 0.9%. This is in marked contrast to the broader North America sector, which was trading at an average discount of 3.9%. Over the past 12 months, NAIT has traded within a range of a 9.5% discount to a 2.5% premium and an average discount of 1.2%.

NAIT is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. The board says that it continues to work with the manager to promote NAIT’s benefits to a wider audience and, although this has not been necessary since September 2017, the board is also prepared to use of selective share buybacks to provide liquidity and will attempt to limit share price volatility. However, with NAIT trading at a premium, the trust has been able to issue shares into the market to satisfy demand. We would welcome this issuance, as it should not only improve liquidity in NAIT’s shares but, all things being equal, should reduce its ongoing charges ratio by spreading its fixed costs over a larger asset base.

We also note that, whilst to date all shares repurchased have been cancelled, repurchased shares may be held in treasury for reissue at a later date. However, shares would only be reissued from treasury at a premium to asset value and so NAIT’s repurchase and issuance activity should be NAV-accretive to remaining and existing holders respectively.

Fees and costs

Fees and costs

NAIT has appointed Aberdeen Fund Managers Limited, a wholly-owned subsidiary of Standard Life Aberdeen Plc, as its AIFM. This management agreement may be terminated by either party on three months’ notice.

NAIT’s management fee is calculated at 0.75% of net assets up to £350m, 0.6% between £350m and £500m and 0.5% over £500m. For accounting purposes, the management fees are charged 70% against the capital account and 30% against the income account, as is the interest cost associated with NAIT’s gearing (see below).

Secretarial and administration services provided by Aberdeen Fund Managers Limited are provided for an index-linked annual payment that amounted to £112k in FY 2019 (2018: £108k). NAIT also makes a contribution to the marketing cost for the trust that amounted to £211k in FY 2019 (2018: £213k).

NAIT has appointed Computershare Investor Services Plc as its registrar and BNP Paribas Securities Services as its depositary. The fees for these services in FY 2019 were £60k and £50k respectively (2018: £60k and £48k).

NAIT’s ongoing charges ratio for the year ended 31 January 2019 was 0.95% (2018: 0.98%). At the interim stage (31 July 2019) the board said that the ongoing charges ratio was on track to be 0.91% for the year ended 31 January 2020.

Capital structure and life

Capital structure and life

NAIT has a simple capital structure with one class of ordinary share in issue. As at 26 November 2019, NAIT had 143,002,520 ordinary shares in issue with no shares held in treasury. At the company’s AGM on 4 June 2019, shareholders approved a five-for-one share split of the company’s shares. This took effect from 10 June 2019. The board proposed this sub-division to increase the marketability of the trust’s shares. The rationale is that a small regular saver is now able to purchase more shares for a given monthly subscription, meaning that capital can be deployed more quickly.

NAIT may borrow up to an amount equal to 20% of its net assets. It has a $75m three-year unsecured multi-currency revolving credit loan facility with Scotiabank (Ireland) Designated Activity Company. $40m of this was drawn down at the end of July 2019, down from $50m as at 31 January 2019, at an interest rate of 0.975% over LIBOR.

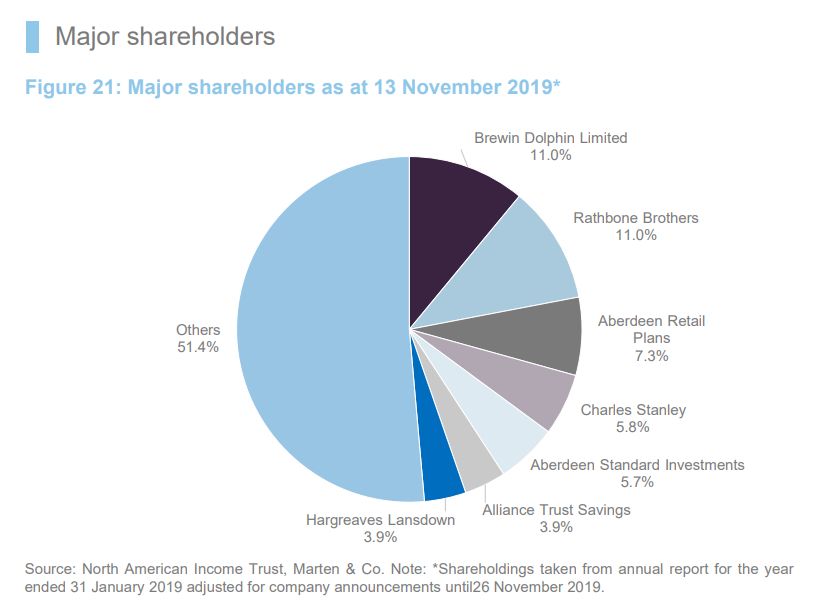

Major shareholders

Major shareholders

Financial calendar

Financial calendar

NAIT’s financial year end is 31 January. Its annual results are usually published in April (interims in September) and its AGMs are usually held in June of each year. As discussed on page 13 in the enclosed PDF version, NAIT pays quarterly dividends in August, October, February and June.

Three-yearly continuation votes

Three-yearly continuation votes

NAIT does not have a fixed life, but every three years shareholders are offered the chance to vote on the continuation of the company. The last such vote was at the AGM in 2018 and was carried with 99.98% of votes being cast for continuation.

Manager

Manager

The investment team has 19 members (nine in Philadelphia and 10 in Boston). Head of the team is Ralph Bassett who joined the manager in 2006 from Navigant Consulting. He graduated with a BS in Finance, from Villanova University. Ralph is a CFA charterholder.

Fran Radano joined the manager in 2007 following the acquisition of Nationwide Financial Services. Previously, Fran worked at Salomon Smith Barney and SEI Investments. He graduated with a BA in Economics from Dickinson College and an MBA in Finance from Villanova University. He is also a CFA charterholder.

Board

Board

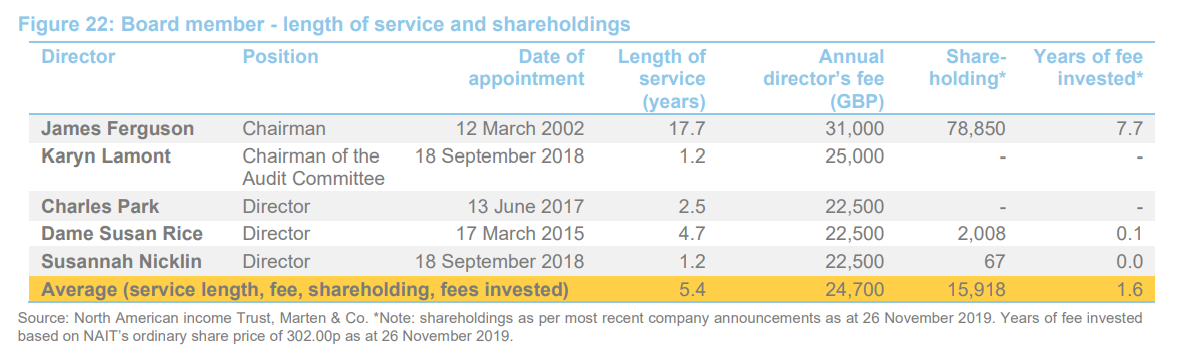

The board consists of five non-executive directors, all of whom are considered to be independent of the manager and do not sit together on other boards. All directors stand for re-election annually. At the last two AGMs, some shareholders voted against the re-election of the chairman, James Ferguson, who has now been a director of NAIT for nearly 18 years. With a tenure of this length, some investors will start to question a director’s independence from the investment manager. However, James has a significant personal investment in the trust that is equivalent to 7.7 years of his annual fee. This should give shareholders comfort of his personal alignment with their interests.

One concern previously raised was that the board had not been refreshed in some time. However, with the exception of the chairman, the board has been completely refreshed since 2015, as illustrated in Figure 22. At the company’s AGM on 4 June 2019, shareholders approved an increase in the aggregate limit placed on the directors’ fees from £150k to £175k.

James Ferguson (chairman)

James Ferguson (chairman)

James Ferguson was a former chairman and director of Stewart Ivory and a former deputy chairman of the AIC. He is chairman of Monks Investment Trust, Value and Income Trust, Northern 3 VCT and The Scottish Oriental Smaller Companies Investment Trust. He is also a director of The Independent Investment Trust.

Karyn Lamont (chairman of the Audit Committee)

Karyn Lamont (chairman of the Audit Committee)

Karyn Lamont is a chartered accountant. She was previously an audit partner at PwC, specialising in the UK financial services sector. Karyn has provided audit and other services to a range of clients, including a number of investment trusts, a broad range of management companies and outsourced service providers. Her specialist knowledge includes financial reporting, audit and controls, risk management, regulatory compliance and governance. Karyn is the audit committee chairman of The Scottish Investment Trust and a non-executive director at the Scottish Building Society.

Charles Park (director)

Charles Park (director)

Charles Park has over 25 years of investment management experience. He is a co-founder of Findlay Park Investment Management, a US boutique asset management company which was established in 1997. He was deputy chief investment officer with joint responsibility for managing Findlay Park American Fund until his retirement from the firm in 2016. Prior to co-founding Findlay Park, Charles was an investment manager at Hill Samuel Asset Management and an analyst at Framlington Investment Management. He is a director of Polar Capital Technology Trust.

Dame Susan Rice (director)

Dame Susan Rice (director)

Dame Susan Rice is a chartered banker and currently chairman of Scottish Water, Business Stream, President of the Scottish Council of Development and Industry, chairman of The Scottish Fiscal Commission and Scotland’s 2020 Climate Group and a non-executive director of J Sainsbury, C Hoare & Co, Big Society Capital and the Banking Standards Board. Her previous roles include managing director of Lloyds Banking Group Scotland, chairman and chief executive of Lloyds TSB Scotland, a director of the Bank of England and a non-executive director of SSE plc. Originally from the United States, her early career was at Yale and Colgate universities and then at NatWest Bancorp.

Susannah Nicklin (director)

Susannah Nicklin (director)

Susannah Nicklin is an investment and financial services professional with over 20 years of international experience in executive roles at Goldman Sachs and Alliance Bernstein in the US, Australia and the UK. She has also worked in the social impact private equity sector with Bridges Ventures, the Global Impact Investing Network and Impact Ventures UK. Susannah is the senior independent director of Pantheon International and a non-executive director of Amati AIM VCT, City of London Investment Group and Baronsmead Venture Trust. She is a CFA charterholder.

Previous publications

Previous publications

Readers interested in further information about NAIT may wish to read our previous notes:

The legal bit

The legal bit

This marketing communication has been prepared for The North American Income Trust plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.