North American Income Trust

Investment companies | Update | 28 November 2023

The port in the storm

America is still showing signs of the ‘exceptionalism’ it covets, by being in better economic health than its developed peers, yet it is not all plain sailing for US equity investors, as Fran Radano, the manager of North American Income Trust (NAIT), points out. He believes that cracks are starting to show, but the market is yet to reflect this. Given that this is coupled with what Fran believes are exuberantly-high valuations in segments of the US market, he has rotated NAIT into more defensive stocks. In addition, NAIT’s value-bias is better suited to the Fed’s ‘higher for longer’ attitude towards interest rates.

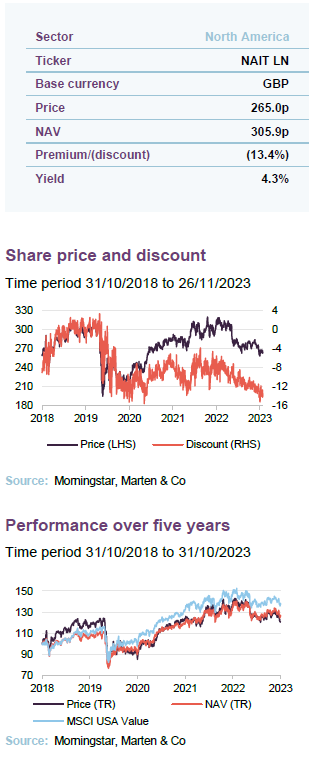

Irrespective of NAIT’s current positioning, its discount and value bias do offer a compelling opportunity for investors looking to capitalise on these trends. NAIT continues to offer the attractive dividend profile that has long characterised it, with a 4.3% yield, 12 years of progressive dividend increases and is supported by a robust revenue reserve.

Above-average income and long-term growth

NAIT’s objective is to invest for above-average dividend income and long-term capital growth, mainly from a concentrated portfolio of dividend-paying S&P 500 US equities. It may also invest in Canadian stocks and US small- and mid-cap companies to provide for diversified sources of income as well as fixed income investments, which may include non-investment grade debt.

Fund profile

NAIT’s objective is to provide investors with above-average dividend income and long-term capital growth through active management of a portfolio consisting predominantly of S&P 500 US equities. NAIT may also invest in Canadian stocks and US mid- and small-cap companies as a way of accessing diversified sources of income. Up to 20% of NAIT’s gross assets may be invested in fixed-income investments, which may include non-investment grade debt.

For more information, visit: www.northamericanincome.co.uk

The company maintains a diversified portfolio of investments, typically comprising of between 35-40 equity holdings and no more than 10 fixed interest investments

(which tend to be much smaller positions), but without restricting the company from holding a more- or less-concentrated portfolio from time to time.

NAIT’s primary reference index is the Russell 1000 Value Index but we have used the MSCI USA Value and S&P 500 indices as comparators for the purposes of this report.

abrdn Fund Managers Limited acts as NAIT’s AIFM. The day-to-day management of the portfolio is delegated to abrdn Inc. The lead manager is Fran Radano, who sits on the equities team based in Philadelphia and Boston.

Market outlook

Over the last 18 months, the US has experienced one of the most extreme periods of monetary tightening on record in response to its first bout of real inflation for almost half a century. Market conviction has bounced from one extreme to the other. While the EU and UK flounder in what looks increasingly like a stagflationary mire, the US economy has held up remarkably well, thanks in part to the huge fiscal stimulus fuelled by ever increasing government deficits, which has helped sustain corporate profits, labour market strength, and domestic consumption.

The US labour market remains robust, though the average analyst is expecting a recession in the next year

The rate of inflation is trending downward, giving policymakers some breathing room, and the odds that the economy may avoid a recession all together have increased dramatically. While the market consensus still gives odds of around 55% for a recession within the next 12 months, some commentators including Goldman Sachs are much more optimistic. There are signs that such optimism may be vindicated, as only recently the US announced that it achieved a 4.9% (annualised) GDP growth for the third quarter of 2023, the highest in nearly two years.

Nevertheless, the Fed’s broadly defined target of 2% price growth may still be incompatible with current unemployment rates of under 4%. Only recently, US employment figures surprised on the upside, with 336,000 jobs added in September, nearly double the consensus estimate.

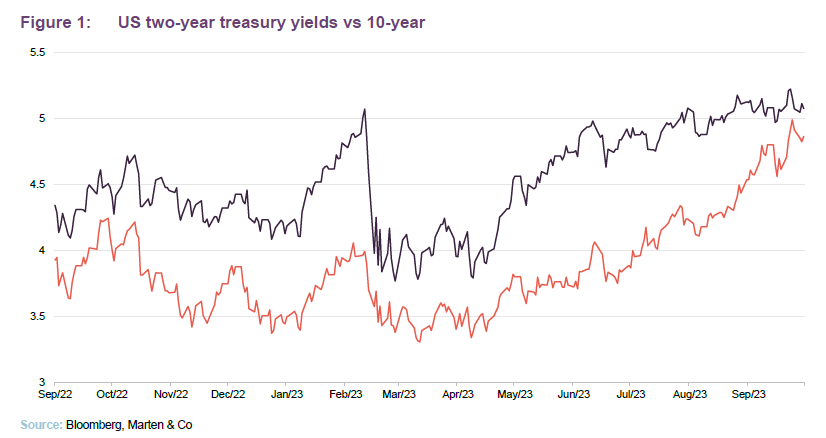

The Fed has remained hawkish over stubborn inflation

Fed chair Jerome Powell has signalled that the fight against inflation is not over, expressing a ‘higher for longer’ narrative around interest rates, with interest rates remaining unchanged at 5.25% after the most recent November Fed meeting. US two-year treasury yields still broke 5% for the first time in over a decade in October, and the US yield curve remains inverted, traditionally a sign the market is pricing in a near-term economic slowdown. On the plus side, the most recent inflation data has shown a fall in annualised inflation to 3.2% in October, a greater fall than pundits had forecasted. This could create pressure on the Fed to cut rates, or at least temper its ‘higher for longer’ rhetoric, given that it is quickly approaching its 2% inflation target.

With that as a backdrop, it may be surprising that year to date, the S&P500 has returned over 9% to end October. Almost all of this return is due to multiple expansion. By some measures, such as Shiller’s cyclically adjusted P/E ratio, US markets are now as rich as they have been in the last 100 years and are at valuations comparable to the peak of the 1929 crash and the eve of the GFC. The manager’s views on the interaction between valuations and interest rates are discussed in more detail on pages 5 and 6.

NAIT’s valuations remain well below the market’s, so should avoid a possible selloff

Although much of this margin expansion has been driven by tech exuberance, especially around AI, benchmark indices remain historically expensive even when these are excluded. Fran is finding it hard to reconcile the broad market valuation. Nevertheless, he feels that there are compelling opportunities for long term investors to pick up companies benefiting from secular tailwinds that are trading on increasingly appealing valuations. NAIT’s portfolio trades on a median P/E ratio of about 12.5 times, well below the S&P 500 current P/E ratio of about 22 times, with NAIT’s portfolio also having a beta of about 0.82 to the S&P 500.

Manager’s view

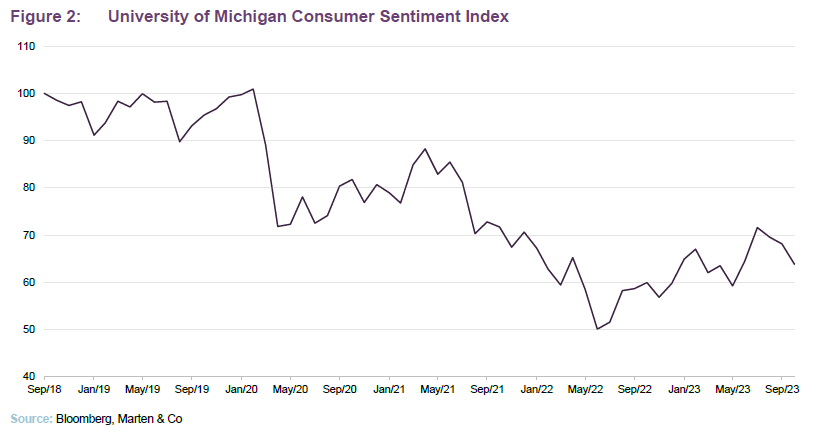

When we caught up with Fran recently, he highlighted some of the elements of the US economy that have been driving his investment rationale. He says that US employment figures are indicating that we have entered the part of the cycle that is commensurate with a tight labour market. While this is helpful for consumer-facing stocks in the immediate term, Fran believes that investors are over-extrapolating the long-term strength of the consumer, and that investors are not awake to the chance of future weakness.

There are tentative signs of weakening consumer confidence evident in Figure 2 and while it is still up from the start of the year, it remains firmly below its long-term levels, even lower than its COVID-19 level.

NAIT’s manager is seeing signs of weakness in the US consumer and businesses

Fran is already seeing signs of pullback in some US sectors. In his analyst meetings with US industrials, he is starting to see signs of slower growth, with the post-COVID boom having finally run its course. Bank lending has also become more restrictive in the US, a sign of the heightened cost of capital and a general cautiousness in the face of economic uncertainty. Given all of this, he believes that balance sheet concerns will be key going forward. The most pertinent issue will be the debt structures of US companies, and their ability to refinance in the current environment. Given that US treasuries yield 5%, how will companies deal with having to refinance debt that was previously financed at 2%?

NAIT is positioned in defensive and high quality companies that can withstand the forthcoming slowdown

While the team is generally constructive on the outlook for the US economy, the ‘house’ view remains that a mild recession is still likely. However, given current economic resilience from low unemployment, it now expects this to begin in the first quarter of 2024, and to last just three quarters. NAIT is positioned accordingly, and it believes that the portfolio offers compelling value, while also providing insulation from the worst of market volatility.

Fran thinks that valuation is also likely to become a much more important factor in investment decisions and investors will shift their focus towards profitability and long-term viability of cash flows (part of the ‘quality factor’ that has long permeated NAIT’s investment process). He notes that over the long-term, starting valuation has proven to be the best predictor of investment returns over time. This stands in contrast to the experience that a decade of central bank induced financial repression following the GFC created.

A more pronounced rotation into value stocks may be on the cards, especially for high-quality, well-capitalised value companies able to navigate the wall of debt refinancing over coming years. Fran is avoiding the more cyclical stocks within his remit, reducing NAIT’s exposure to consumer discretionary and cyclical industrials.

Investment process

Increased individual sector research responsibilities but emphasis on building consensus retained

Buy and sell ideas are presented to the team and each analyst’s goal is to build consensus around their investment theses. Individual portfolio managers have responsibility for the content of their portfolios, but all investment decisions are peer-reviewed and any stance that differs from the consensus view must be justified. An ESG analyst is embedded within the team and ESG factors are incorporated into the research process (see more detail on pages 9-10)

NAIT’s portfolio comprises 35 equity positions as at 30 September 2023, drawn largely but not exclusively from the constituents of the S&P 500 Index. It also has 11 fixed income positions, which help to increase the diversification of NAIT’s portfolio as well as providing a useful source of income.

The company may invest in Canadian stocks and smaller US companies to provide diversified sources of income as well as up to 20% of gross assets in fixed income investments, which may include non-investment grade debt.

The contribution of fixed income to portfolio income has declined over recent years

The dividend overlay is NAIT’s only positive factor bet. The portfolio holds some quality bias and there are some negative factor overlays, such as momentum. The negative momentum overlay can be explained by the need to trim positions when prices go up on occasion, as yields decrease.

The fixed income portion of the fund is managed by the fixed income team based in Boston.

The equities are selected on a ‘best ideas’ basis. Candidates for the portfolio must satisfy both quality and valuation criteria. Aspects of quality include the strength of a company’s business model, where it compares with its competitors, and the quality and experience of its management. Meeting management and visiting companies is a core part of the investment process, and the manager will not invest in a stock if the team has not met with management. The manager believes that the emphasis on quality should help NAIT avoid ‘value traps’. He looks for stocks that are on an improving trend in terms of revenues and profits but does not invest in ‘recovery’ situations. The portfolio is usually close to fully invested, but the manager has the option to increase the exposure to cash (or other liquid securities) if he believes it is warranted.

The approach is a long-term one and portfolio constituents have historically changed relatively rarely (portfolio turnover was higher in 2020 due to the pandemic and some of the opportunities it brought), but the manager top-slices and tops up positions in response to short-term valuation shifts.

Most stocks in the portfolio yield between 2% and 4%

Whilst there is no outright prohibition on buying stocks for NAIT’s portfolio that do not pay a dividend, the manager has never done so. NAIT’s portfolio follows a bell curve distribution, with a concentration of stocks yielding between 2% and 4%. Predictability of income is a key consideration when selecting stocks, but the overall emphasis is on choosing stocks that look attractive on a total return basis, not just on yield alone. Their ability to generate dividend growth is an important factor.

Position sizes determined by conviction, not primary reference index weights

Position sizes are determined by conviction, and the manager places no emphasis on the weightings of stocks within the primary reference index when building the portfolio. New positions typically enter the portfolio with a 1%–1.5% weighting. Fran chooses to operate with a soft cap on position sizes of 5% and tends to trim positions when they exceed this level. There is also a hard stop of 10% of gross assets at the time of investment (see below). Furthermore, he seeks to limit the number of positions that exceed the 5% level to a small number.

A range of metrics is used to analyse the portfolio to ensure that, wherever practical, there is no excessive bias towards or against any sector, geography or theme. Given the lack of income available, the portfolio has a natural underweight exposure to the technology sector (and, until the recent rotation towards value, this had weighed on the fund’s performance relative to the US market as a whole). At the same time, the portfolio does not have much exposure to some sectors that might typically be seen as the preserve of income fund managers such as telecoms and utilities. This is because the manager is looking for stocks with decent earnings and dividend growth potential.

Option writing augments income

Writing puts to buy and calls to sell positions is a useful way of deriving income from an investment decision that would have been made anyway

The portfolio’s income is augmented by option writing activity. Writing puts to buy and calls to sell positions is a useful way of deriving income from an investment decision that would have been made anyway. Specifically, options are only utilised once a buy or sell decision has been reached. If the manager believes the option market provides the best risk-reward in executing this decision, then put or call options may be sold. The options mix has been equally spread between puts and calls over recent years.

The greatest opportunity to earn income comes from the stocks with the highest implied volatility. At any time, NAIT may have between zero and nine open positions; there is no requirement to write options if the manager believes it would not be a profitable activity. Option writing is a tool to buy and sell positions where extra income can be generated while being able to buy something a little cheaper or sell something a bit higher than current prices. Fran stresses that he does not write options with the primary goal to generate income per se. He does not write in-the-money options as a means to convert capital into income. We note that at the end of August 2023, there were five open option positions.

Investment restrictions

Certain restrictions have been imposed on the manager, by the board, as part of the investment policy:

- No single investment will exceed 10% of gross assets at the time of investment.

- The portfolio will have at least 35 holdings.

- Exposure to derivative instruments is limited to 20% of net assets at the time of the relevant acquisition, trade or borrowing.

- NAIT will not acquire unlisted or unquoted securities (it is permitted to hold securities that are about to be listed or traded on a stock exchange, but Fran says that he has no intention of utilising this permission). NAIT is also permitted to continue to hold securities that cease to be listed or quoted, if appropriate. However, once again, Fran says that is not something he envisages the trust doing.

There are no restrictions relating to the size of the companies that NAIT can hold (as measured by market capitalisation) and no limits to sector or country exposures. Although permitted to do so, NAIT does not generally hedge its exposure to foreign currency.

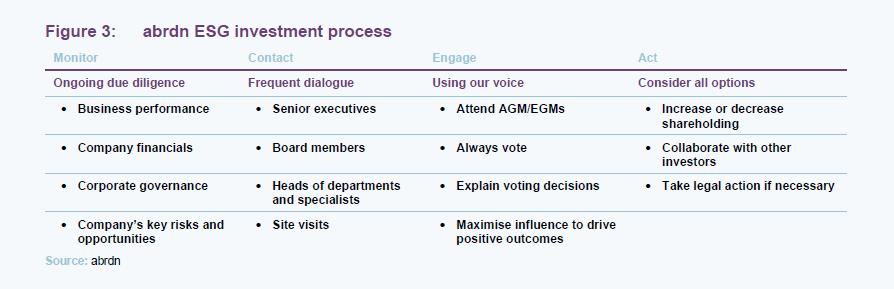

Active approach to ESG engagement

Whilst ESG factors alone are not the over-riding criteria in relation to investment decisions, ESG is fully integrated across NAIT’s investment process. The manager conducts extensive and high-quality fundamental and first-hand research to fully understand the investment case for every company in its global universe. A key part of the manager’s research involves focusing its extensive resources on analysis of key ESG issues. Stewardship and active engagement with every company are also fundamental to the investment process, helping to produce positive outcomes that lead to better risk-adjusted returns.

Once abrdn invests in a company, it is committed to helping that company maintain or raise its ESG standards further, using the manager’s position as a shareholder to press for action as needed. abrdn actively engages with the companies in which it invests to help them improve and become even better businesses.

The manager sees this programme of regular engagement as a necessary fulfilment of its duty as a responsible steward of clients’ assets. It is also an opportunity to share examples of best practice seen in other companies and to use the manager’s influence to effect positive change. The manager’s engagement is not limited to the company’s management team. It can include many other stakeholders such as non-government agencies, industry and regulatory bodies, as well as activists and the company’s clients. What gets measured gets managed – so the manager strongly encourages companies to set clear targets or key performance indicators on all material ESG risks where appropriate.

The manager’s engagement with any company is tailored as appropriate for each business. ESG matters are prioritised as applicable to the individual circumstances and are aligned to the company’s ‘ESG Q Score’.

Examples of areas that abrdn actively engages with companies on include but are not limited to:

- Environmental: deforestation, waste and water management, climate risks, carbon emissions, energy management, air quality;

- Social: employee safety, human rights, diversity issues, labour management, cyber-security, customer privacy; and

- Governance: succession planning, renumeration, capital allocation, corporate strategy, board diversity, ESG disclosures.

Asset allocation

As at 30 September 2023, NAIT’s portfolio consisted of 35 equity and 11 fixed-income investments.

As at 30 September 2023, NAIT’s portfolio consisted of 35 equity and 11 fixed-income investments, with an active share of 87.4%. This compares with 36 equity and 7 fixed-income holdings at 31 December 2022 (the most recently available data when we last published), when the active share was 87.5%. We note that while the number of bonds in NAIT’s portfolio has increased, the actual bond exposure as a percentage of assets has only marginally increased since the last note, up 0.6 percentage points. The marginal increase in NAIT’s bond holdings likely reflects the increased yields available to bond holders, in light of rising US interest rates.

NAIT can also invest in Canada and, as at 30 September 2023, this represented 6.4% of the equity portfolio while the US accounted for 93.6%. The Canadian exposure has decreased by 1.9 percentage points since our last note (from 8.3%); the US exposure has increased by 11.4 percentage points (from 82.2%). At end September 2023, cash was 1.7% of net assets and net gearing as at 10 November 2023 was 6.9%.

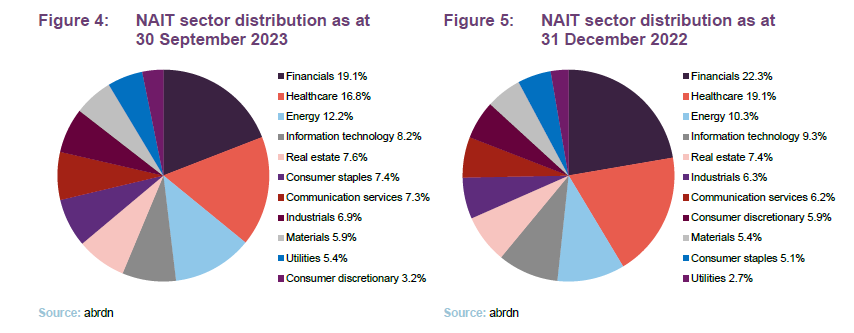

Sector breakdown

Comparing the most recent sectoral makeup with the position as at 31 December 2022, the main differences are the change in exposures to financials (down by 3.2 percentage points), healthcare (up by 2.3 percentage points), consumer staples (up by 2.3 percentage points) and consumer discretionary (down by 2.7 percentage points, reflecting the team’s desire to reduce exposure to consumer spending). While not obvious from figures 4 and 5, the team has also adjusted the nature of its industrial exposure, rotating into more ‘defensive’ industrials.

The portfolio remains overweight banks, reflecting the benefit to margins of a rising interest rate environment, but the weighting has been trimmed to reflect recession risk.

Portfolio activity

Recent portfolio activity reflects the manager’s views that we outlined from page 6 onwards.

Market volatility has offered the team several opportunities to duck in and out of names within its portfolio even on the larger side their market cap range. Two examples include Comcast and Phillip Morris, where the team has been able to trade c.50 bps around their fluctuating share prices.

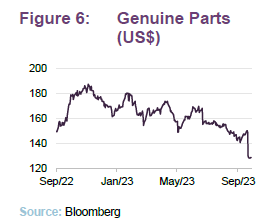

Genuine Parts Company is an automobile and industrial replacement parts service. Fran sold NAIT’s position once it began to trade around 20 times earnings, but in recent months its valuation fell back down to 15 times, making it too attractive an opportunity to pass up in Fran’s view. Genuine Parts’ downward share price trend reflects weak sales data, although it does still stand to exceed its earnings forecast.

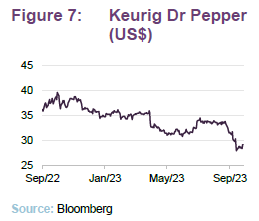

The team also purchased Keurig Dr Pepper, the beverage maker which also operates its own drink dispensing machines. The team views this as a ‘model consumer story’. Its strong brands should be less sensitive to changes in discretionary spending if we do see a weakening of overall US consumer demand

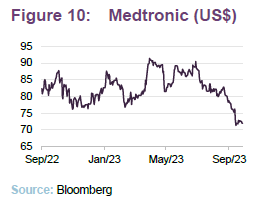

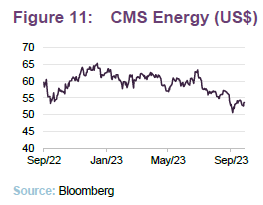

We discuss the largest recent purchases – Medtronic and CMS Energy – in our top ten section; Fran has also been trading CMS Energy, selling out of it at 25 times earnings and repurchasing at 17 times.

NAIT exited its position in Hannon Armstrong, the climate solution investment firm. The team became concerned over the risk/return profile of its investments in green energy projects, saying that the return profile of the company is below that which the NAIT team would consider to be acceptable. Another sale was of VF Corporation, the apparel company which own brands such as North Face, Supreme, and Vans. Fran had opted to give its new management team some leeway to see if they could improve the outlook for the company. However, after seeing the balance sheet of the company continue to deteriorate, he opted to sell.

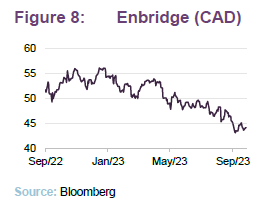

NAIT also exited TC Energy, the energy company which primarily operates mid-stream pipelines the US. The team became concerned after TC Energy announced delays in its Coastal GasLink project, which was also fined for failing to meet Canadian environmental regulations. The timing of this was particularly poor as the company has debt maturing soon, which the team was concerned about. Fran opted to recycle the capital into Enbridge, another mid-stream pipeline operator listed in Canda with a much stronger balance sheet. Unlike TC Energy, Enbridge has been far more successful in its expansion plans, having recently purchased a series of assets from Dominion Energy for $14bn. This gives it a plug-and-play approach to enter the regional gas utility market in select US states, offering less execution risk.

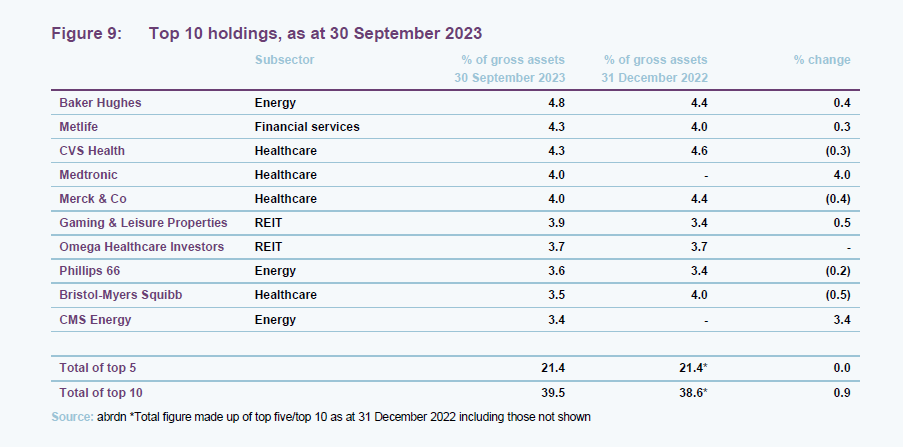

Top 10 holdings

Since we published our last note, which highlighted NAIT’s top 10 holdings as at 31 December 2022, there have been few changes to the list. Medtronic, Cogent Communications and CMS Energy have replaced Omega Healthcare, Comcast and Philip Morris. We discuss some of the more interesting changes and developments in the following pages. Readers interested in more information on other names within NAIT’s top 10 should see our previous notes, where many of these have been previously discussed (see page 27 of this note).

Medtronic

Medtronic is one of the leading medical device companies in the US. The sector has seen several dramatic swings in sentiment over the last few years, particularly around the pandemic due to long term disruptions to elective surgeries. More recently, supply constraints and rising rates have weighed on returns. While disruptive in the short term, the bulk of these headwinds should have little impact on the long-term upside present in medical technology, and Medtronic in particular.

Broader macro impacts aside, it would be a fair assessment to say that the company has underperformed expectations over the last few years, with modest top line growth dragging down share price performance well below both peer group and global benchmarks. This has been particularly disappointing given the company’s dominant positioning in an industry which maintains strong competitive moats, and traditionally offers high margins for incumbents.

While frustrating for existing shareholders, cash flow and earnings multiples are now well below their historic ranges while the company is undertaking a comprehensive transformation of its operations designed to get at the root of what has held back growth. With a strong balance sheet, the company is executing large-scale functional improvements to global operations and supply chains, and has begun to allocate capital to secular growth markets as well as focusing R&D investments on technology megatrends like robotics and artificial intelligence that will drive growth in its industry over the next decade.

CMS Energy

CMS is a pure-play regulated gas and electric utility company in Michigan, a state with one of the most attractive regulatory regimes in the country, with above-average permitted returns and favourable cost recovery mechanisms. In combination with the company’s effective use of its cost base and capital spending, these factors have allowed CMS to consistently deliver impressive earnings growth, above peer group averages, despite continually changing demand conditions.

In addition to ongoing fundamental performance, the team has gained an increasingly favourable view of the company since management released its 10-year capital spending plan, which set out industry leading net-zero targets for both its gas and electrical systems, and designs to improve the reliability of service, which include investments such as the new Covert generating plant, which allows the company to maintain low cost, reliable energy supply. These actions should place CMS on track to meet its net zero carbon emissions goal by 2040, and net zero methane emissions by 2030, both of which compare favourably to peers in speed of transition. In recognition of these efforts, CMS is now included in the MSCI ESG Leaders Index, the only vertically integrated utility to feature.

Given its historic record of outperformance, the company has traditionally traded at a relatively elevated multiple in relation to its peers, and the advisors of NAIT sold its position in 2022 due to valuation concerns. Since then, however, a pullback in its shares provided an opportunity to re-establish a holding in a company that is regarded as a best-in-class operator in its sector.

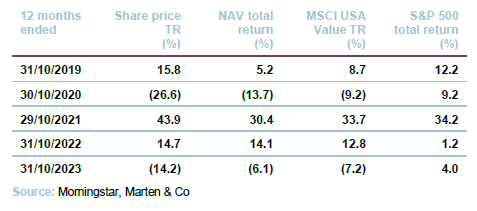

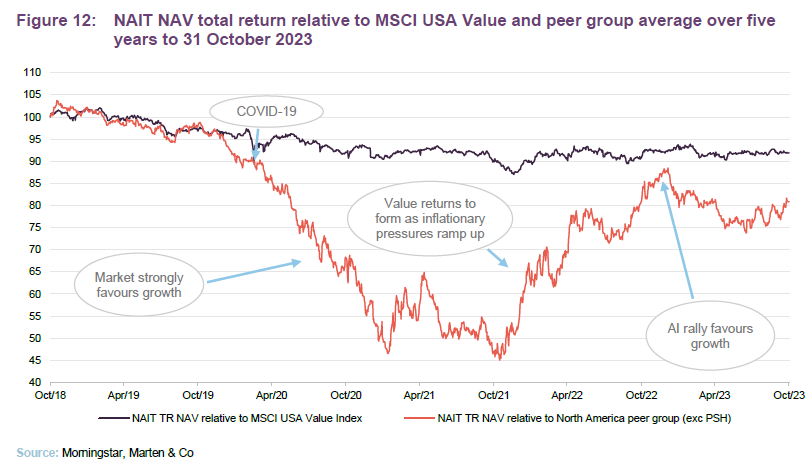

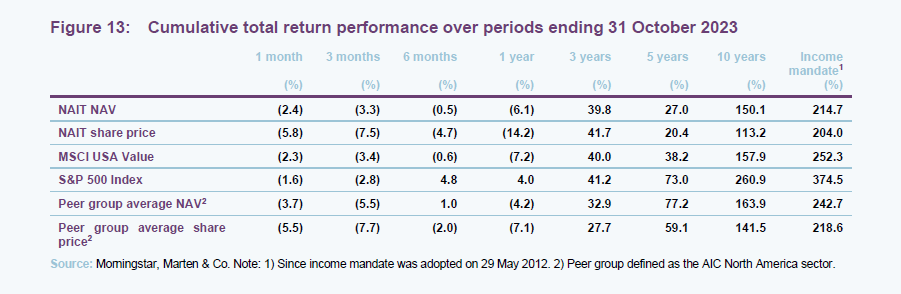

Performance

When we published our last note at the start of the year, we commented on how the tailwinds behind value stocks were persisting to the benefit of NAIT relative to its peers. However, the return to form of US technology stocks, thanks to their exposure to AI, explains the fall in NAIT’s performance relative to peers over 2023.

NAIT’s relative performance has been hit by the outperformance of non-dividend-paying stocks

We note that the MSCI USA Value index did have some exposure to mega cap technology until its most recent rebalancing in June this year.

Another headwind which has faced NAIT has been the strength of Berkshire Hathaway, which was up 13% in 2023 and is the second largest position in the MSCI USA Value index. However, given its lack of a dividend it falls outside of Fran’s investment approach.

We observe that beyond the value vs growth narrative which permeates much of the US equity market discussion, we believe that NAIT’s performance could also be characterised by the performance of dividend versus non dividend paying stocks.

Non-dividend payers were amongst the top performers during 2019 and 2020, which is reflected in NAIT’s relative performance over five and three years. This, in turn, was a reflection of both the ultra-accommodative monetary policy of the time, which favoured investment and share buybacks over dividends. Now, dividend payers are more highly prized, as they are a symptom of more cash-generative and disciplined business models which may be better able to navigate a high interest rate environment.

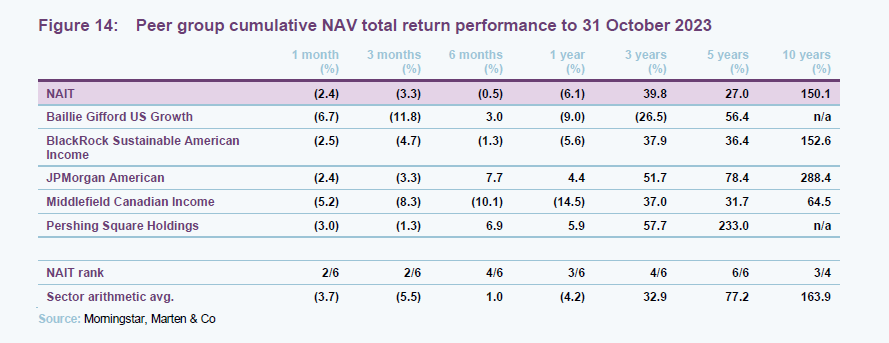

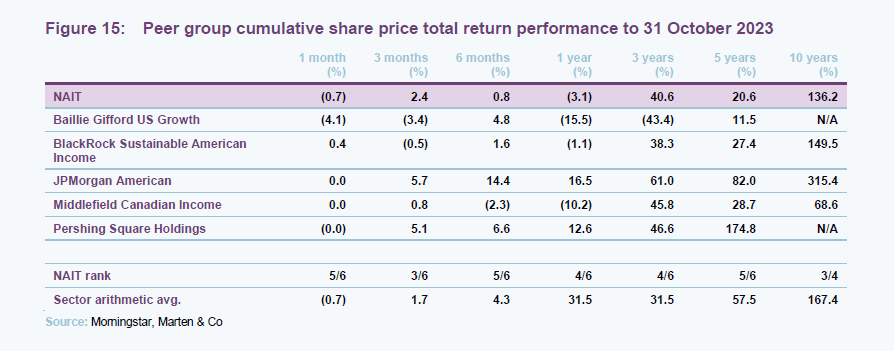

Peer group

Up to date information on NAIT and its peer group is available on the QuotedData website

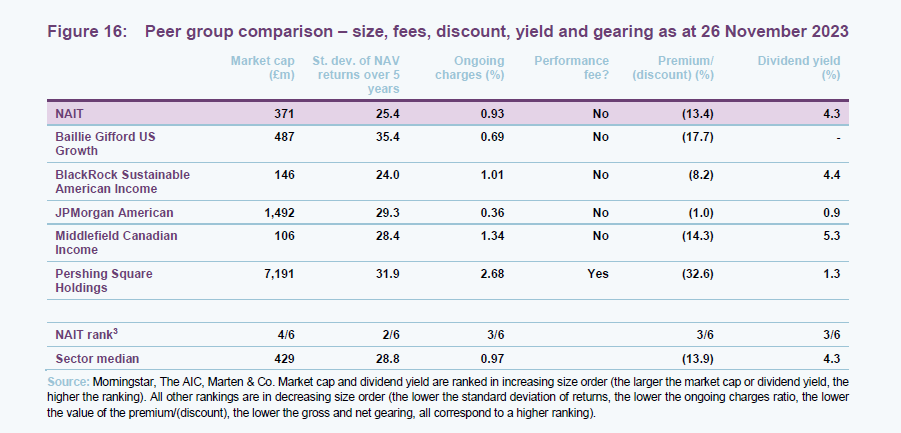

NAIT is a member of the AIC’s North America sector, which comprises seven members. All of these were members of the peer group when we last wrote about NAIT, although Pershing Square Holdings was a relatively new addition and so we excluded it from our analysis at that time, but we have included it in full in this peer group analysis. Canadian General Investments has been excluded from our comparison, as Morningstar has ceased to provide coverage.

NAIT’s peer group is a diverse blend of strategies, which can make direct comparisons problematic. The closest comparator to NAIT within the peer group is BlackRock Sustainable American Income (BRSA), which also has an income mandate. However, its mandate also includes a commitment to sustainable investing which arguably limits its ability to be compared to NAIT, and also makes NAIT the only ‘pure’ US income trust.

Given the diverse range of strategies, we believe that the relative performance within the peer group shown in Figure 15 is as much a reflection of the varying market tailwinds over the last five years as it is the relative skill of the managers.

Figure 15 illustrates a similar story, whereby the share price returns of NAIT have followed a similar trajectory to that of its NAV. However, there are differences that reflect movements in discounts over the various periods. As we note elsewhere, NAIT and its peers’ discounts have been pretty volatile during the last few years.

While there are some very large funds in the sector, NAIT is still a decent size. NAIT’s ongoing charges ratio is below the sector median. We note that JAM’s ultra-low OCF is the result of not only the size of the trust but also the fact that its strategy is closely aligned with that of a very large equity strategy run by JPMorgan, allowing it to further reduce the trust’s fees.

NAIT has the second lowest volatility of its peers, and likely reflects the inherent defensiveness of high quality, high dividend paying stocks.

The table also shows that NAIT’s trailing 12-month yield is above the sector average, although currently lower than either BRSA or Middlefield Canadian Income. However, BRSA has been paying a substantial portion of its dividends out of capital.

NAIT’s discount is below the median of the peer group. We feel that, given the market backdrop, a double-digit discount on a value-oriented trust such as NAIT looks attractive.

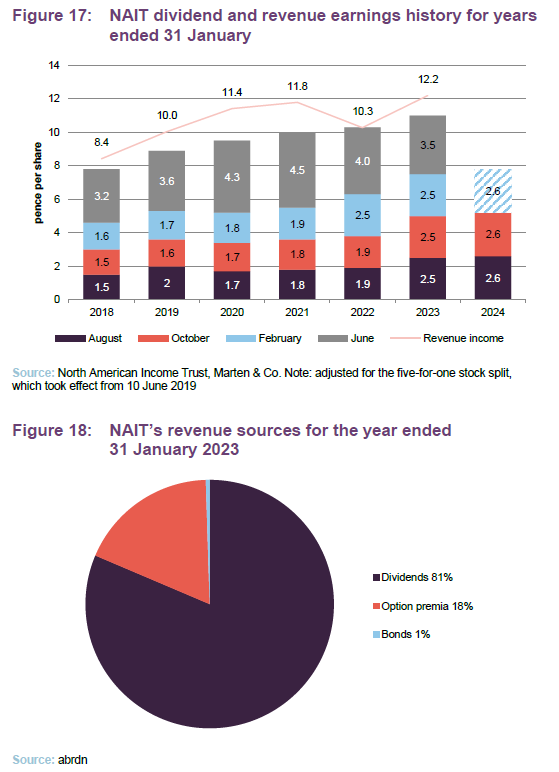

Quarterly dividend payments

NAIT pays dividends quarterly, with the first interim dividend paid out in August. The second, third and fourth interim distributions have previously been paid in October, February and June. However, the board has recently proposed that the payment date be moved to August, October, January, and May, as to better space out the payments.

For the full year to 31 January 2023, NAIT paid a dividend of 11.0p per share, a 7% increase from the previous year’s 10.3p per share, equivalent to a yield of 4.3%. NAIT’s dividend was fully covered by its revenues, with an 11% surplus being generated. NAIT has paid 11 years of progressive dividends, solidifying its place as an AIC next generation dividend hero (funds with at least 10 years of consecutive dividend increases). NAIT’s board has been judicious in building up its revenue reserve, which will help to defend its dividend. NAIT has a revenue reserve coverage ratio of 1.6 times, based on its last full year dividend.

NAIT is counted as ‘next generation dividend hero’, with more than 10 years of dividend growth

For the current financial year, NAIT’s board has declared the first two interim dividends at 2.6p per share, in line with the level indicated in their recent annual report. While it will wait to see how the final revenue stream looks before declaring the final dividend, it has indicated an intention to retain NAIT’s progressive dividend pay-out.

Figure 18 illustrates the sources of NAIT’s revenue income for the last financial year (ended 31 January 2023). The bulk of NAIT’s income is derived from dividends, with option premium providing a significant element and bonds a very minor contribution, with the latter two a slightly smaller component of revenues since we last published.

Premium/(discount)

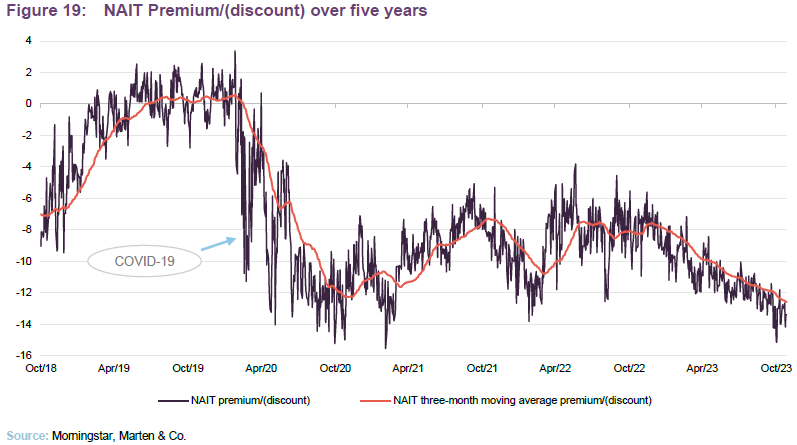

Over the 12 months to 31 October 2023, NAIT’s shares have traded within a discount range of 5.5% to 15.0%, with an average discount of 10.3%. This represents a wider range than its peer group, which has traded at discounts between 4.8% and 10.3%, with an average discount of 9.8%. As at 26 November 2023, NAIT was trading at a discount of 13.4%.

As can be seen in Figure 19, NAIT traded at a premium during much of 2019, reflecting a belief that, pre COVID-19, the US was facing a possible unwinding of the Fed’s accommodative policy. The onset of COVID-19 derated the entire peer group, though NAIT was hit much harder given its lack of growth stock exposure. In September 2020 with the rollout of the COVID-19 vaccine, that changed and NAIT’s discount began to close the gap on its peer group average.

The entire investment companies sector has derated over the past year or so for a variety of reasons including a switch into bonds and cash, as higher yields have become available, misleading charges disclosure and wealth manager consolidation. NAIT has not been immune to this.

However, as we have discussed in this note, NAIT seems well-positioned relative to peers in the current economic environment.

Selective repurchases

NAIT is authorised to repurchase up to 14.99% and issue up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. This authority was renewed at the most recently-held AGM in June 2023. The board uses this discount control mechanism as a tool to reduce volatility in the premium or discount to underlying NAV, while also making a small positive contribution to the NAV.

The board resumed buybacks in July this year, in light of the wider sell off of NAIT and the sector. Since 25th July, the date from whence the board restarted in dividend buybacks, it has repurchased 1.7m shares, equal to 1.1% of the current circulation.

Capital structure and life

NAIT has a simple capital structure with one class of ordinary share in issue. At 26 November 2023, the company’s capital structure consisted of 138,358,689 ordinary shares of 5p each.

Gearing

In December 2020, NAIT issued a new long-term financing arrangement to replace its RCF

In December 2020, NAIT issued a $25m 10-year senior unsecured loan note at an annualised interest rate of 2.70% and a $25m 15-year senior unsecured loan note at an annualised interest rate of 2.96%. The loan notes are unsecured and unlisted and interest is payable in half yearly instalments in June and December. They are due to be redeemed at par on 21 December 2030 and 21 December 2035.

The total fair value of the loan notes at 31 January 2023 was £38,579,000 comprising £19,278,000 in respect of the 10-year loan and £19,301,000 in respect of the 15-year loan. The proceeds of the loan note were used to repay and cancel in full the $75m revolving credit facility (RCF). NAIT has a net gearing of 7.5% currently.

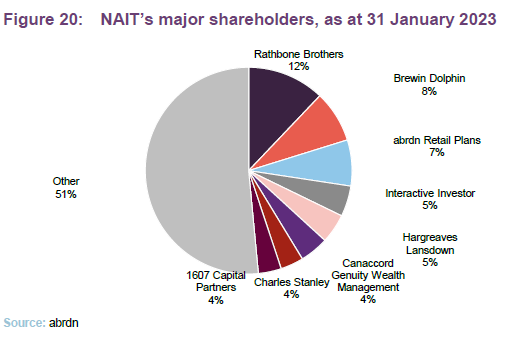

Major shareholders

Financial calendar

NAIT’s financial year-end is 31 January. Its annual results are usually published in April (interims in September) and its AGMs are usually held in June of each year.

The most recent AGM was held on 8 June 2023 in Edinburgh and saw all resolutions, including the re-election of its board (see Board section of this note), passed.

Three-yearly continuation votes

NAIT’s next continuation vote is due at the 2024 AGM

NAIT does not have a fixed life, but every three years shareholders are offered the chance to vote on the continuation of the company. The last continuation vote, held in June 2021, was passed with 98.6% of votes in favour and the next continuation vote is scheduled for the AGM in June 2024.

Management

The investment team has 18 members (nine in Philadelphia and nine in Boston). Fran joined the manager in 2007 following the acquisition of Nationwide Financial Services. Previously, he worked at Salomon Smith Barney and SEI Investments. He graduated with a BA in Economics from Dickinson College and an MBA in Finance from Villanova University. Fran is also a CFA charterholder.

Board

The board consists of five non-executive directors, all of whom are considered to be independent of the manager and do not sit together on other boards. All directors stand for re-election annually. The chair, Dame Susan Rice, has announced her intention to retire as director at the end of the AGM in 2024, having served for nine years, and the board announced its succession plan, that it will appoint Charles Park, current senior independent director, as chair at that time. Charles joined the board in June 2017 and has extensive experience investing in the US.

Dame Susan Rice (chair)

Susan is a chartered banker with extensive experience as a non-executive director, as well as in financial services, retail, utilities, leadership and sustainability. She is chair of Forth Green Freeport and her previous roles include managing director of Lloyds Banking Group Scotland, chairman and chief executive of Lloyds TSB Scotland, President of the Scottish Council of Development and Industry and a member of the Scottish First Minister’s Council of Economic Advisors. She has also held a range of non-executive directorships, including at the Bank of England and SSE.

Karyn Lamont (chair of the audit committee)

Karyn is a chartered accountant. She was previously an audit partner at PwC, specialising in the UK financial services sector. Karyn has provided audit and other services to a range of clients, including several investment trusts, a broad range of management companies and outsourced service providers. Her specialist knowledge includes financial reporting, audit and controls, risk management, regulatory compliance and governance. She is the audit committee chairman of Scottish Building Society, iomart Group and Scottish American Investment Company, and Ediston Property Investment Company.

Charles Park (senior independent director)

Charles has over 25 years of investment management experience. He is a co-founder of Findlay Park Investment Management, a US boutique asset management company that was established in 1997. He was deputy chief investment officer with joint responsibility for managing Findlay Park American Fund until his retirement from the firm in 2016. Before co-founding Findlay Park, Charles was an investment manager at Hill Samuel Asset Management and an analyst at Framlington Investment Management. He is a non-executive director of Polar Capital Technology Trust, Evenlode Investment Management, Findlay Park Investment Management and Spring Park Investments and a member of Salters’ Management Company Limited.

Susannah Nicklin (director)

Susannah is an investment and financial services professional with over 20 years of international experience in executive roles at Goldman Sachs and Alliance Bernstein in the US, Australia and the UK. She has also worked in the social impact private equity sector with Bridges Ventures, the Global Impact Investing Network and Impact Ventures UK. She is the chairman of Schroders BSC Social Impact Trust, senior independent director of Pantheon International and a non-executive director of Amati AIM VCT, Baronsmead Venture Trust, Ecofin Global Utilities and Infrastructure Trust, and Frog Capital LLC. She is a CFA charterholder.

Patrick Edwardson (director)

Patrick joined Baillie Gifford in 1993, becoming a partner in 2005, and managed bond, equity and multi-asset portfolios, managed the Scottish American Investment Company and led Baillie Gifford’s multi-asset team until his retirement in 2020. He is a non-executive director on the boards of JPMorgan Multi Asset Growth and Income and Edinburgh Investment Trust. Patrick is also managing director of Atheian, a family investment office.

Previous publications

Readers interested in further information about NAIT, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note As headwind turns Tailwind, published on 10 February 2023, as well as our previous update notes and our initiation note (details are provided in Figure 23 below). You can read the notes by clicking on them in Figure 22 or by visiting our website.

| Figure 22: QuotedData’s previously published notes on NAIT

Source: Marten & Co |

Legal

This marketing communication has been prepared for The North American Income Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this not.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.