Healthy dividend increases

Unlike its AIC North America peers, North American Income Trust (NAIT) combines an income focus with having at least 90% of its assets invested in the US. After more than a year of uncertainty around dividends, things finally seem to be normalising, with some companies even increasing their dividends. Over the past year NAIT’s manager, Fran Radano, has found good value in stocks with slightly lower yields than would previously have been expected for a NAIT holding, but these companies offer greater opportunities for capital appreciation and often-times double digit dividend growth. These are complemented by high yielders with more modest dividend or earnings growth.

Above-average income and long-term growth

NAIT’s objective is to invest for above-average dividend income and long-term capital growth, mainly from a concentrated portfolio of dividend-paying S&P 500 US equities. It may also invest in Canadian stocks and US small- and mid-cap companies to provide for diversified sources of income as well as fixed income investments, which may include non-investment grade debt.

Market outlook

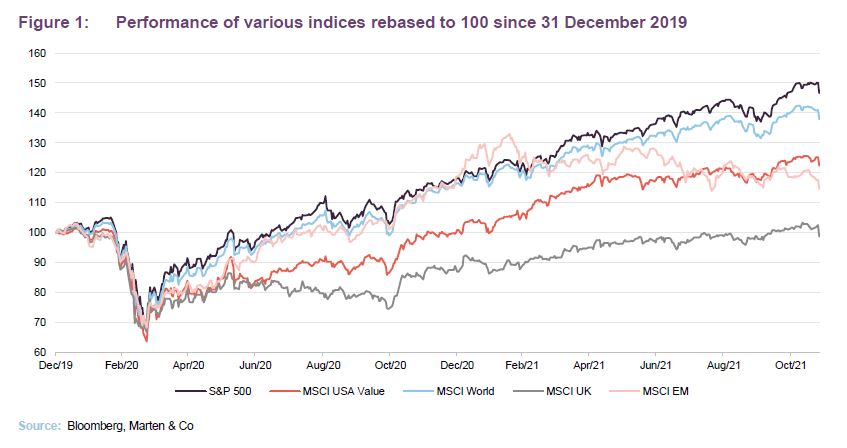

This time last year, 13 months after the COVID-19 virus was first identified, the first vaccine was given the green light for manufacturing and distribution. After one of the worst market meltdowns seen in recent history, disruptive lockdowns and slashed distributions by many companies, there was finally light at the end of the tunnel. While new variants of COVID have caused occasional setbacks, this light appears to have grown bigger and brighter for most developed markets.

The US economy has been no exception and its stock market has been ahead of most others, with the S&P 500 ending 2020 with a stunning 68% return. This was largely down to many of its leading blue-chip companies – including big tech names such as Amazon, Microsoft and Netflix – outperforming as they and their customers adapted to a new way of life. As lockdowns and restrictions have mostly been lifted and more than half the country has been vaccinated, the US market has continued to outperform over 2021.

Over the past 12 months to 30 November 2021, the S&P 500 has returned 29% and the MSCI USA Value is up 23%. This compares with 23% for the MSCI World and 18% for the MSCI United Kingdom. The MSCI Emerging Markets has delivered only 4% during the same period.

Inflation the biggest risk

The US economy is likely to sustain above-trend growth into 2022, with strong fundamentals helping to power the stock market to new highs. There is hope and even some evidence that another COVID-19 wave may not be as harsh as previous waves as greater vaccine access is supportive of a more complete recovery in the quarters ahead.

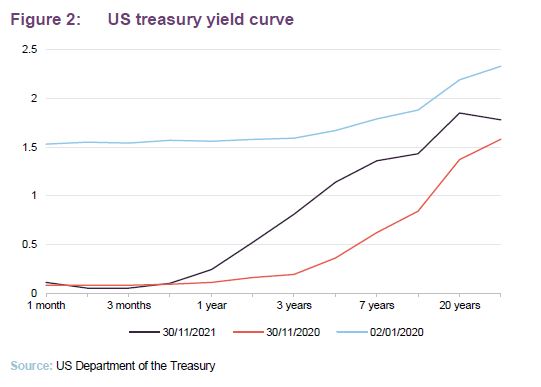

The Federal Reserve looks set to reduce its asset purchases around the end of the year and its first rate hike may follow, depending on the direction of inflation going into 2022. A report from Russell Investments suggests that inflation is likely to drop back below the Fed’s 2% target in 2022, but other commentators fear that inflation is becoming more entrenched. 10-year Treasury yields could rise moderately in the coming months, further steepening the yield curve.

Is the US too expensive?

After recovering from its drop in March 2020, and heading straight into a rally, US stocks had already started to look expensive late last year. The S&P 500’s price-to-earnings ratio has stood above 30 times since the beginning of 2021, and in September it rose above 33. This kind of level – last seen before the burst of the dot-com bubble in 2000 and before that, during the lead up to the stock market crash of 1929 – has rarely been sustained.

However, to some extent, valuations reflect the drop in interest rates and bond yields since the pandemic hit. With inflation where it is, real returns on cash and good quality bonds are negative.

Manager’s view

NAIT’s manager, Fran Radano, says that viewed top-down the US market feels expensive, and that he currently has a hard time spending more than 20 times peak earnings for a company within his dividend paying remit. That being said, he says he has been able to find a good selection of companies that fit his requirements and at reasonable prices, and while some are now on higher valuations, such as Citigroup, he is not willing to sell such high-quality names just yet. We talk more about these holdings among others later.

Dividends back on track

After more than a year of uncertainty around dividends, with companies all over the world suspending, cutting or even scrapping theirs altogether, Fran is feeling positive about the comeback. He says dividend cuts are no longer a detractor from returns as they were in the fourth quarter of 2020. He says dividend growth has been extremely strong in recent months and that it is above long-term trends. However, he caveats this by highlighting that many companies haven’t increased their dividends for six or seven quarters. He says that many did not want to raise their dividends during the pandemic or around the turn of the year when things were still uncertain. Banks have only been allowed to raise their dividends since the summer of 2021. This has had an impact on dividend growth for NAIT, as financials account for more than 20% of the portfolio.

He says the team feels very good about NAIT’s holdings and the portfolio’s underlying long-term dividend growth. Out of NAIT’s circa 40 holdings, only one cut its dividend. Gaming and Leisure Properties, a landlord to regional casinos, cut its dividend from 70 cents to 60 cents, though this has since climbed back up to 67 cents. Fran says this was understandable considering casino doors were closed for the best part of six months. While the company received all its rent payments, revenues for the underlying businesses were essentially zero. Fran adds most of the portfolio’s companies kept their dividend payments flat, with some even turning off their share repurchase programmes.

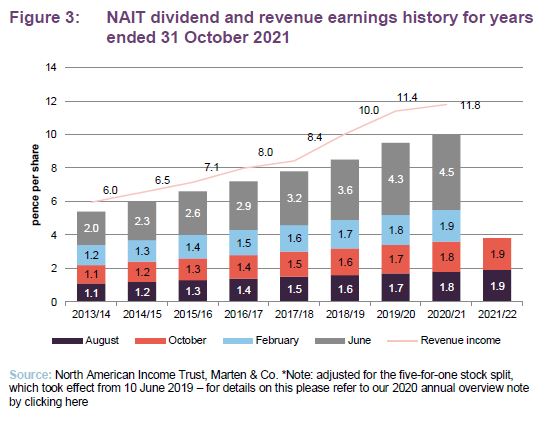

Rising dividend for NAIT

Meanwhile, NAIT managed to increase its own dividend, which it has done every year since adopting its income mandate in 2012. The company has managed to build up a years’ worth of revenue reserves while also providing a progressive dividend to its shareholders.

Asset allocation

As at 31 October 2021, NAIT’s portfolio consisted of 41 equity and 2 fixed-income investments, with an active share of 89.7%. This compares with 39 equity and 7 fixed-income holdings in January 2021, when the active share was 87.8%.

NAIT can also invest in Canada – as at 31 October, this represents 8% of the portfolio while the US accounts for 89% and the balance is held in cash. While the Canadian portion has decreased by 0.1 percentage points since our last note, the US exposure has decreased by 0.9 percentage points.

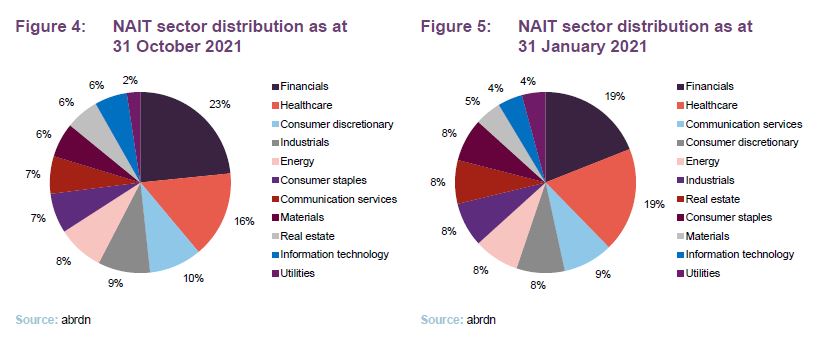

Sector breakdown

Comparing the most recent sectoral makeup with the position as at 31 January 2021, the main differences are the change in exposures to financials (up 4.4%), healthcare (down 3.2%) and communication services (down 2.2%). Though it remains the smallest sector weighting, utilities exposure has decreased from 4.2% to 2.4%.

Fran points out that some recent changes to the portfolio may make him appear averse to certain sectors, but that this is a result of the company’s index being restructured. The most recent restructure in 2020 led to NAIT being 200 basis points underweight the healthcare sector, which the manager says looked dramatic, but was simply the result of a stock specific change.

NAIT bought UnitedHealthcare during the peak of then Presidential candidate Bernie Sanders’ popularity within the Democratic Primary in 2019, when many believed healthcare would be nationalised. However just one year later, the stock was trading on high earnings multiples while its yield fell from more than 2% to just over 1%. Fran reiterates that he is not anti-healthcare, but the index happened to change as soon as he exited the stock last year.

Similarly, NAIT is underweight technology at 6%, which makes up such a huge part of the S&P 500 (10%). Again, he clarifies he is not anti-tech but rather a bottom-up stock picker. He also highlights that there are several companies in the benchmark that do not meet the income remit, such as the 1.1% position in Salesforce.com (CRM), which does not pay a dividend.

Top 10 holdings

Since we published our last note, which highlighted NAIT’s top ten holdings as at 31 January 2021, there have been few changes to the list. New additions include technology conglomerate Cisco Systems, telecommunications company Comcast and clothing company Hanesbrands. Verizon Communications, JPMorgan Chase & Co and CMS Energy have dropped out of the top ten, though they remain in the portfolio.

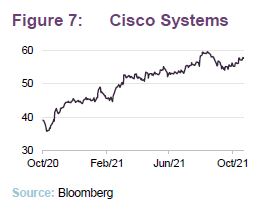

Cisco Systems

Cisco Systems (www.cisco.com) is a multinational technology conglomerate corporation and a worldwide leader in IT, networking and cybersecurity solutions. It currently represents 3.3% of NAIT’s portfolio and, despite being trimmed during the summer of this year, is an overweight position in the portfolio relative to the index. The current yield for Cisco is 2.6% while its dividend pay-out figure is $1.48. Fran says the outlook for the stock depends on spending trends for cloud computing infrastructure as well as corporate and telecom networks. Earlier this year, Cisco said it expects subscription revenue to account for 50% of total revenue in 2025, up from 44% in 2021.

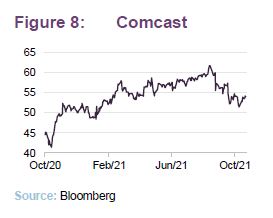

Comcast

Comcast (www.comcast.com) is a telecommunications conglomerate headquartered in Pennsylvania. It recently announced a joint venture partnership with ViacomCBS (which NAIT does not own) to launch “SkyShowtime,” a subscription video-on-demand service, in more than 20 European countries with the service expected to launch sometime in 2022. More recently, the company’s third-quarter earnings beat analyst expectations on the top and bottom lines while the stock is leaning into its sizable mobile opportunity. Fran says Comcast’s commercial growth remains healthy and though its average dividend yield over five years is low for the typical NAIT holding at 1.8%, he feels the prospect of multiple expansion as well as the company’s double digit dividend growth makes up for this.

Scaling back bonds

Fran highlights that the portfolio is now largely equities with less than 1% representing exposure to bonds. He says he sold off most of the bond holdings when markets became depressed last year and people were clamouring for income, driving bond yields down.

This is an interesting development considering NAIT was launched in its current form in 2012 with a breakdown of 85% equities and 15% bonds. Fran says by 2015 this had fallen to 5% and since he became lead manager, this has been reduced even further. Fran says if he sees a good opportunity, he will take it but feels no obligation to hold bonds. Saying that, he does think BB+ rated high yield bonds are the ‘sweet spot’ as they have all the metrics of an investment grade bond but with a little premium.

Of the two bonds remaining in the portfolio, tyre manufacturer Goodyear was bought half-way through 2021, following a deal which saw it buy one of its major competitors, Cooper.This is an interesting development considering NAIT was launched in its current form in 2012 with a breakdown of 85% equities and 15% bonds. Fran says by 2015 this had fallen to 5% and since he became lead manager, this has been reduced even further. Fran says if he sees a good opportunity, he will take it but feels no obligation to hold bonds. Saying that, he does think BB+ rated high yield bonds are the ‘sweet spot’ as they have all the metrics of an investment grade bond but with a little premium.

Financials – a leading sector

Financials have traditionally been the largest weighting of NAIT’s portfolio by some margin, and currently represents more than 21% of the fund. Fran says the bank overweight has been ramped up recently as he is a little more interest rate sensitive than he was six months ago.

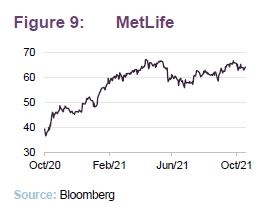

MetLife

MetLife (www.metlife.com) is a leading global provider of insurance, annuities and employee benefit programs and is a new addition to NAIT’s portfolio for 2021. Fran says he had been looking at the company for a while but was finally able to buy it at a good price earlier this year. He points out that over the summer it posted better-than expected results for the second quarter of its 2021 fiscal year and saw heathy year-over-year revenue and earnings growth, bolstered by notable strength in its Retirement and Income Solutions unit. The company currently offers a dividend yield of 3.0%.

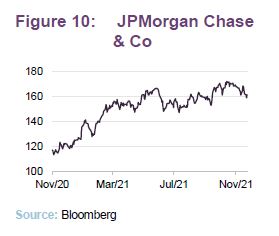

JPMorgan Chase &Co

JPMorgan Chase & Co (www.jpmorgan.com) is another of NAIT’s financials holdings and has been in the portfolio for much longer than MetLife. The current dividend yield for JPMorgan is 2.5%. The investment bank is one of the four companies in the fund where Fran feels that valuations are starting to look rich, but the company is of the highest quality and therefore he is not willing to sell just yet. The other names that fit this description are Texas Instruments, Home Depot and CME.

Performance

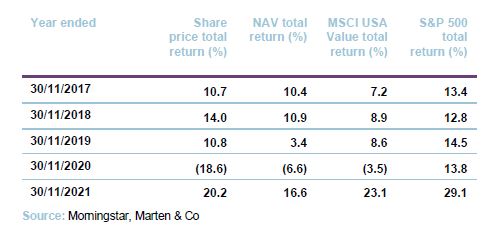

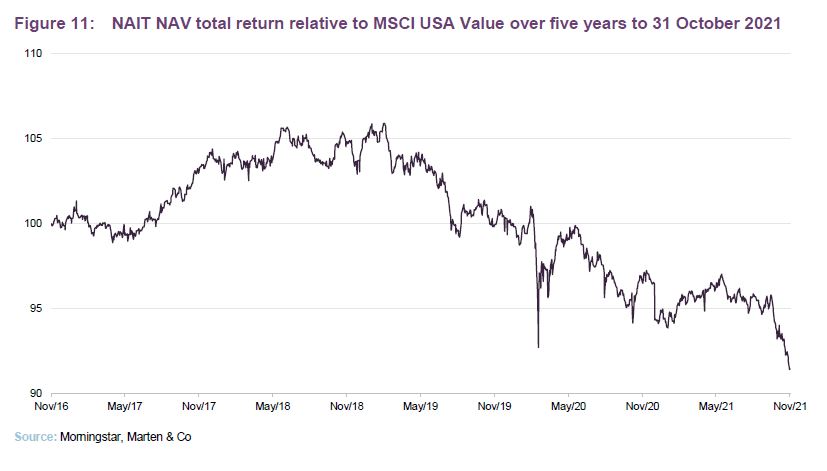

NAIT’s short-term performance has been disappointing recently compared to its benchmarks and peer group average. However, it was the underperformance suffered during 2019 (see Figure 11) which drags down the trust’s longer-term numbers. As explained in our previous notes, this was partly the result of stock selection in the materials, communication services and consumer discretionary sectors. However, this time around, a larger factor was the overwhelming outperformance of Growth against Value, and to add insult to injury, Fran adds that dividend-paying stocks in the Value universe were particularly to blame.

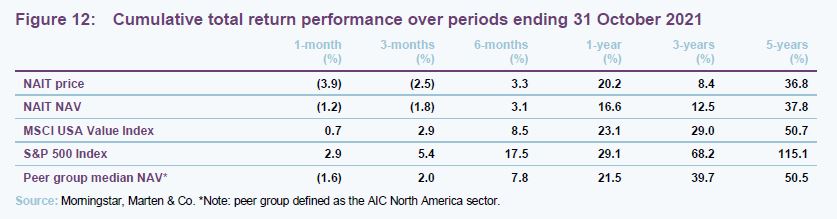

While the absolute numbers have always been positive and are strong over five years with an NAV return of 38%, they have failed to keep up with the peer group median return of 51% and the S&P 500 return of a staggering 115% over the same period, as highlighted in Figure 12.

The S&P 500 Index’s strength over the past five years (as illustrated in Figure 12) reflects the strength of growth stocks, which has worked against income-focused strategies such as NAIT’s, with core sectors such as financials having been out of favour with investors for several years.

However, for the first time in a while, value stocks had some momentum behind them towards the end of 2020 with both NAIT’s NAV and the MSCI USA Value Index outperforming the S&P 500, albeit temporarily.

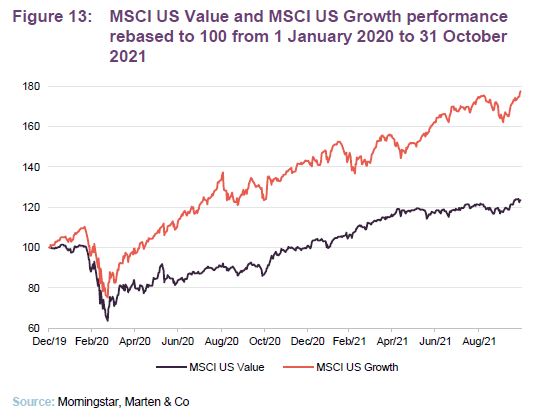

Fran says before that however, the MSCI US Growth Index had increased by around 40% since the start of 2020 while value had risen by only 1-2%, as shown in Figure 13. This was a ‘worst-case scenario’ situation for NAIT, the manager adds. He says dividend stocks may have appeared a nice safe haven but clearly the market wanted no part of that. While there has been some bounce back this year, US growth indices still outpace value.

Attribution

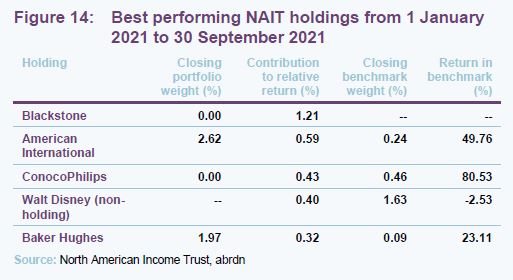

Though performance has fallen a little behind expectations year-to-date, there have been some key winners in NAIT’s portfolio. The top driver of performance for 2021 to 30 September 2021 was Blackstone (www.blackstone.com), contributing 1.21% to relative return. Despite the good performance, Fran has since sold his holding in the alternative investment management company as he felt he couldn’t justify the high multiples any longer while dividend payments were down year-on-year.

Another strong driver of performance for the first nine months of the year was ConocoPhilips (www.conocophillips.com), which was sold in 2018 as Fran felt the yield was too low to justify retaining it given its low dividend growth prospects and in order to reinvest into other existing positions. However, he bought the company back this year. The oil and gas company has since performed exceptionally well, returning a huge 80% between January and September of this year. The stock contributed 0.43% to NAIT’s relative return during the same period.

Meanwhile, not holding certain companies within the comparative benchmark has also helped boost NAIT’s performance. For example, Walt Disney, which represents 1.63% of the benchmark has seen a reversal of fortunes following last year, when the stock was one of the best performers in the index despite suspending its already low dividend. Its negative returns have contributed 0.4% towards the trust’s relative return to the end of September.

On the negative side, NAIT’s relative performance was hit by disappointing numbers from top ten holdings Bristol-Myers Squibb and AbbVie. The former fell by 1% during the year to September-end, causing a -0.7% contribution to the trust’s relative return over the period while AbbVie, which is NAIT’s largest holding contributed -0.6% to the relative return. Other detractors included Omega Health Care Investors (down 11.8% and hitting the portfolio by -0.9%), FMC Corp (down 18.1% and hitting the portfolio by -0.68%) and CMS Energy (down 1.4% and hitting the portfolio by -0.54%).

Peer group

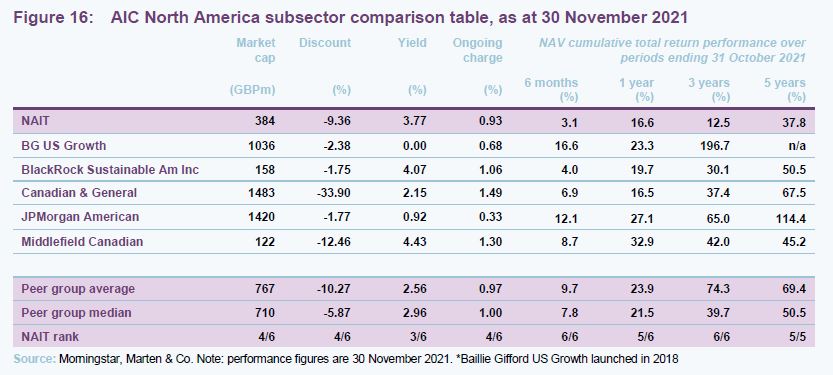

NAIT sits within the AIC North America sector, which is used as its peer group. We caution, however, that it is not an ideal comparison, on the basis that out of the six funds, only BlackRock Sustainable American Income follows a similar strategy to NAIT. Baillie Gifford US Growth and JPMorgan American are growth-focused and Canadian & General and Middlefield Canadian Income allocate predominantly to Canada. The growth-focused funds led the peer group over 2020 and 2021, as illustrated in Figure 16.

The table also shows that NAIT’s yield is currently lower than BlackRock Sustainable American Income and Middlefield Canadian and that its ongoing charge is in the mid-range versus its peers. Combined with its discount, which currently sits at 5.8%, NAIT is a reasonably priced solution for investors looking for income in the US stock market and where value can be found should the discount narrow or turn to a premium.

We also note that some of the other trusts have mandates which allow them to invest outside of North America. For example, as at 30 September 2021, the US accounted for 75.8% of BlackRock Sustainable American Income’s portfolio, with the remainder exposed to other countries such as the UK, Japan and France. Meanwhile, in addition to the US and Canada, JPMorgan American also has exposure towards Switzerland.

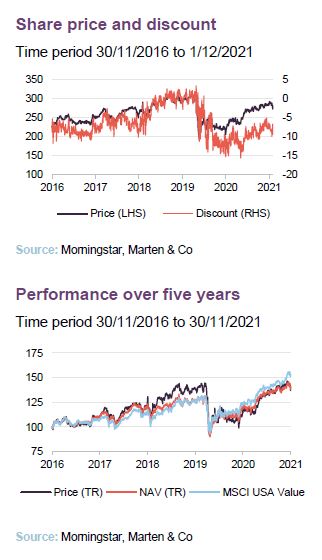

Premium/(discount)

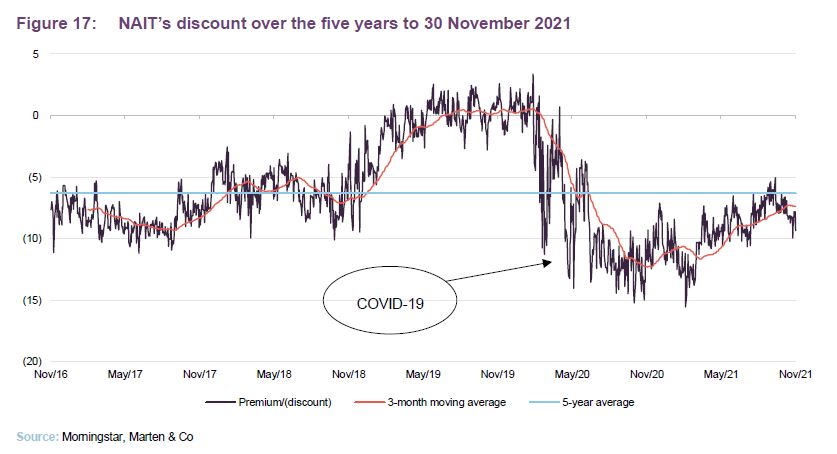

Over the year to the end of November 2021, NAIT’s share price has traded on a discount, ranging from 15.6% to 5.1%. The average discount for the 12 months is 9.3%.

Curiously, having initially narrowed from November 2020 to the end of last year, in the aftermath of the vaccine-led bounce in value-focused sectors, NAIT’s discount has widened since the turn of the year back towards the pre-November 2020 level, with increases in the NAV not matched by the share price. As we highlighted in our last note, this appears to be at odds with the direction financial markets have taken, when the rally in banking shares, signalling from the bond market and rotation back into many of the value sectors NAIT focuses on, is factored in.

As at 2 December 2021, NAIT’s shares were trading on a discount of 5.8%.

NAIT is authorised to repurchase up to 14.99% and issue up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. This authority was renewed at the most recently-held AGM in June 2020. The board uses this discount control mechanism as a tool to reduce volatility in the premium or discount to underlying NAV, whilst also making a small positive contribution to the NAV. With 2021 having brought greater visibility, as vaccination programmes continue apace, NAIT has resumed share repurchases to control its discount.

Fund profile

NAIT’s objective is to provide investors with above-average dividend income and long-term capital growth through active management of a portfolio consisting predominantly of S&P 500 US equities. NAIT may also invest in Canadian stocks and US mid-and small-cap companies as a way of accessing diversified sources of income. Up to 20% of NAIT’s gross assets may be invested in fixed-income investments, which may include non-investment grade debt.

The company maintains a diversified portfolio of investments, typically comprising around 40 equity holdings and no more than ten fixed interest investments

(which tend to be much smaller positions) but without restricting the company from holding a more or less concentrated portfolio from time to time.

NAIT uses the Russell 1000 Value index as its reference index but we have used the MSCI USA Value and S&P 500 indices as comparators for the purposes of this report.

Aberdeen Standard Fund Managers Limited acts as NAIT’s AIFM. The day-to-day management of the portfolio is delegated to Aberdeen Asset Management Inc. The lead manager is Fran Radano, who sits on the equities team based in Philadelphia and Boston. The team is led by Ralph Bassett, who is also a named co-manager of NAIT.

Board changes

In its half-year report dated 28 September 2021, NAIT’s chairman, James Ferguson, announced he would be retiring and therefore stepping down from his role at NAIT at the end of the year. He will be replaced by Dame Susan Rice, who currently sits on the board as a senior independent director.

Susan is a chartered banker with extensive experience in financial services, retail, utilities, leadership and sustainability. Her previous roles include managing director of Lloyds Banking Group Scotland, chairman and chief executive of Lloyds TSB Scotland, President of the Scottish Council of Development and Industry and a member of the Scottish First Minister’s Council of Economic Advisors.

James said: “I have been very grateful over the years for the support of my colleagues on the board and the investment management and secretarial services provided by our manager. A search is underway for a new independent non-executive director.”

Previous Publications

QuotedData has published five notes on NAIT. You can read these by clicking the links in the table below.

The legal bit

This marketing communication has been prepared for The North American Income Trust Plc by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.