Purest access to US equity

Purest access to US equity

US equity income-focused funds, like the North American Income Trust (NAIT), have not had to deal with the suspension of dividends in the way that their UK peers have. Though share buybacks have ceased, regulators in the US have not banned bank distributions in the way that they have elsewhere, while healthcare, NAIT’s other major exposure, is holding up very well.

NAIT provides the purest access to North American income – its closest peer, BlackRock North American Income, allocates over 20% to Europe. NAIT’s manager, Fran Radano, has taken advantage of recent market volatility; exiting some small-cap names with low earnings visibility in favour of what he considers to be better-quality names while they have been trading at cheap valuations. Meanwhile, NAIT has revenue reserves nearing 90% of last year’s total dividend and the ability to supplement portfolio income through option writing, both of which provide investors with additional comfort over the dividend.

Above average income and long-term growth

Above average income and long-term growth

NAIT’s objective is to invest for above-average dividend income and long-term capital growth, mainly from a concentrated portfolio of S&P 500 US equities.

Tunnel-vision markets shift focus to next business cycle

Tunnel-vision markets shift focus to next business cycle

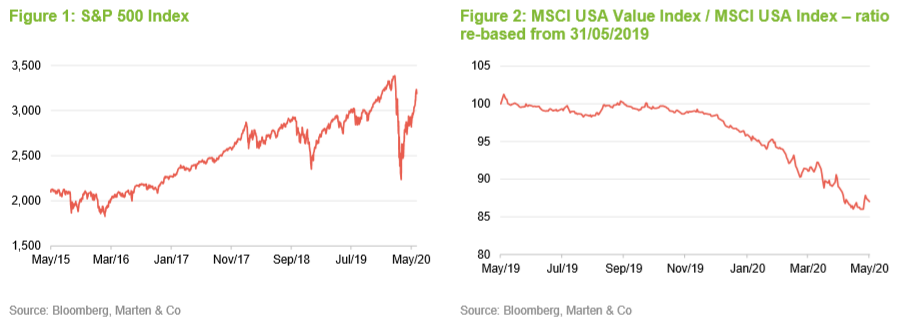

Over the first quarter of 2020, the US economy contracted at an annualised rate of 5%, while the Federal Reserve’s median projection is for a 6.5% fall in gross domestic product (GDP) for 2020 compared to 2019. Unemployment, at 13.3% in May, is just below its highest level since the great depression. Yet, based on the reaction of markets, one might be forgiven for wondering what all the fuss has been about; the S&P 500 is up by around 30% from its March nadir.

Nowhere has the disconnect between the pandemic’s impact on the real economy and the stock market been starker than the US. Fuelled initially by the mega-cap technology companies, which are much less affected by, and in some cases are benefiting from, the pandemic; and then by ample support from the Federal Reserve, the outperformance of growth over value stocks has gathered pace (as illustrated by Figure 2). On a forward price earnings (P/E) basis, the S&P 500 is at its most expensive in over 15 years.

Banks are better positioned than in 2008 though

Banks are better positioned than in 2008 though

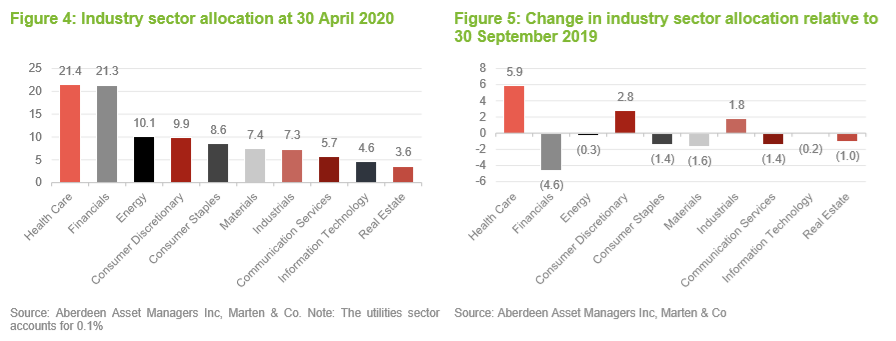

Over May, the rally deepened with greater participation by cyclical sectors, led by financials, energy, and real estate. The improvement in the performance of financial services is important to NAIT, as it is one of its dominant exposures (the other being healthcare); as at 30 April 2020, financial services accounted for 21.3% of NAIT’s portfolio. Previously, both the large and regional banks had been lagging the rally, having increased their loan-loss reserves. Weaker margins, as a result of the return to near-zero interest rates, has also weighed on investors’ minds.

Sentiment towards banking shares in particular is seen as a key test for the validity of this rally. A legacy of the 2008 crisis is that the banking sector, from the global majors to regional and super-regional players, are considerably better capitalised today than they were during the global financial crisis (GFC). Furthermore, much of the riskier lending activity has shifted away from banks into the shadow banking sector (witness, for example, the expansion of the peer-to-peer lending sector in recent years) and so a banking crisis is considered unlikely by most market commentators. However, an even deeper and prolonged recession than expected would obviously challenge current assumptions.

Buybacks stopped but no restriction on dividends

Buybacks stopped but no restriction on dividends

Share buybacks, rather than dividends, account for the majority of capital distributions by US companies. Fran says that, in general terms, pre-pandemic total income returns are similar in the UK and the US. Whilst the UK market has seen a swathe of dividend cuts, dividends have largely been untouched in the US, with many companies instead opting to suspend share repurchases. As a result of paying out proportionally less of their earnings as dividends, payout ratios are much lower and US companies have greater capacity to maintain their dividends.

Also, unlike in the UK and Europe, regulators have not banned the payment of dividends by US banks. The enormous capital buffers put in place by US regulators in the aftermath of the GFC have allowed them to satisfy the surge in demand for cashflow by businesses, so far.

The ability of the US banking sector to pay out dividends is controlled by the Federal Reserve, which monitors the industry through an annual stress test. Based on the KBW Bank Index, US banks are at their cheapest since 2012, on a price-to-book (P/B) basis.

Asset allocation

Asset allocation

As at 30 April 2020, NAIT’s portfolio consisted of 38 equity and 12 fixed-income investments, with an active share of 89.1%. The North American mandate means the manager can allocate to Canada too – this represents 10% of the portfolio (the US is 81%, with the balance held in cash). These figures are all in line with when QuotedData published its last note on NAIT.

Comparing the most recent sectoral makeup with the position as at 30 September 2019, the most recently available portfolio data when QuotedData last published, the main differences are the change in exposure to financials (down 4.8%) and healthcare (up 5.9%). In the case of healthcare, the change reflects the addition of the biotech company, AbbVie (discussed below), as well as a wider defensiveness displayed by pharmaceutical companies (note: defensive companies tend to be less sensitive to the economic cycle than cyclical companies). The move in financials has been largely performance driven, with sentiment towards the banking sector shaped negatively by the return of ultra-loose monetary policy (low interest rates and quantitative easing) and the threat of a considerable increase in loan defaults. However, the regulatory overhaul banks were put through after 2008 means they are far better capitalised today (that is they have much stronger balance sheets) – a lot of the riskier debt is now held by nonbanking entities.

Elsewhere, the increase in industrials exposure was mainly the result of Fran topping up the Lockheed Martin holding. Exposures to Texas Instruments and Cisco were reduced, bringing down NAIT’s exposure to technology. Within consumer staples, Fran trimmed exposure to The Coca-Cola Company (Coca-Cola) and has significantly reduced exposure to the beer company, Molson Coors.

Fran can augment the portfolio’s income by writing options. At the end of April, there were nine open option positions, with a total exposure of around 12% (2.8% puts and 9.3% calls). Page 7 of QuotedData’s initiation note explains the manager’s approach to option writing.

Additional income can be generated from earning option premiums while being able to buy something a little cheaper or sell something a bit higher than current prices. The manager does not write in-the-money options as a means to convert capital into income.

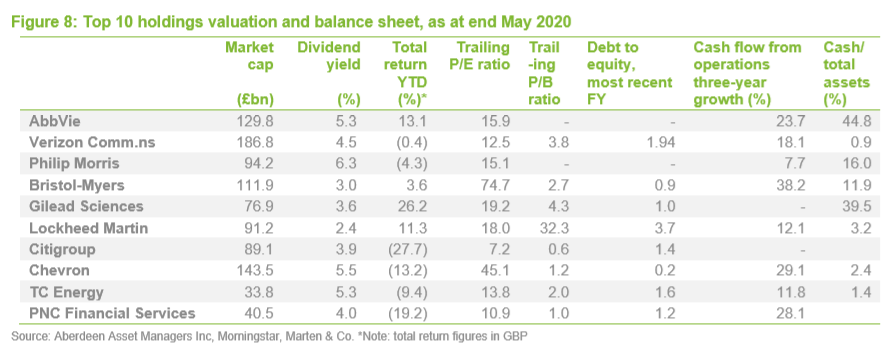

Top 10 holdings – new entrant AbbVie takes top-spot

Top 10 holdings – new entrant AbbVie takes top-spot

Many of the stocks in the list of the top 10 holdings have been discussed in earlier notes (see previous publications section for a list of these).

The main change to the top 10 has been the addition of biotech company AbbVie. Fran took advantage of what he saw as a major market mispricing, with the shares yielding around 7% at the time of the initial investment (the holding was topped up over April).

Like so many healthcare companies, AbbVie has been looking to acquisitions to cushion the impact of key drugs going off patent. It will lose exclusivity in 2023 on Humira, an anti-inflammatory drug used in arthritis care. AbbVie recently received regulatory clearance to complete the acquisition of Allergan for $63bn. Allergan is probably best-known for making Botox, but it also makes drugs used in eyecare and branded antidepressants.

Other new entrants to the top 10, since QuotedData’s most recent note, are TC Energy, PNC Financial Services (profiled below) and defence company Lockheed Martin. Lockheed Martin has been performing well of late, after delivering healthy revenue and earnings growth across its main business segments.

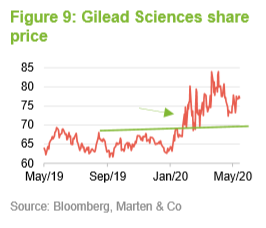

Gilead Sciences has been the best-performing holding within the top 10 so far this year. Gilead is the company behind the broad-spectrum antiviral drug Remdesivir, which is being shown to shorten the symptoms of coronavirus for severe cases. Biotech has been performing well going back to the latter part of 2019, particularly after it became clear that Bernie Sanders was not going to be the Democratic Candidate in the upcoming US Presidential election.

Stocks that have slipped out of the top 10 are Truist Financial (formerly BB&T), Johnson & Johnson, Cisco, and Coca-Cola. The collapse in on-premise soft drinks sales over recent months, key to Coca-Cola’s franchise-based model in the US, is a headwind for Coca-Cola currently. Johnson & Johnson has legacy legal exposure to cases involving both baby powder (talc) and opioids. While Fran thinks the issues there are manageable, they are not without risk (and management distraction). He decided to reallocate this capital to AbbVie and Bristol-Myers Squibb.

Nine additions to the portfolio since our last note

Nine additions to the portfolio since our last note

In addition to AbbVie, the following companies have been added to the portfolio, since our last note: Home Depot, PNC Financial Services (PNC), Restaurant Brands, Omega Healthcare, Maxim Integrated Products, Blackstone Group, UnitedHealth Group and United Parcel Service (UPS).

Home Depot (www.homedepot.com), the US’s largest home improvement retailer, was acquired at a price in the region of $150 per share. Fran funded this through outright sales or trims across three consumer and materials holdings, including Meredith Corporation, which had fallen to below 1% of the portfolio. With much more time being spent at home, home improvement spending has increased considerably – Home Depot reported a 7.5% increase in like-for-like sales over the first quarter of 2020.

PNC (www.pnc.com) was added at a price of around 1x book value. Regional banks have the attraction of being closer to the end-customer than the money center banks (Citigroup, JPMorgan and Bank of America) and having relatively straightforward business models (NAIT does have exposure to Citigroup and Fran says that its exposure to capital market risk is factored into his risk/reward assessment of that stock).

Shares in regional banks have been performing poorly of late, with many generally considered to be more vulnerable to the real economy impact of the pandemic. The collapse in oil prices will have repercussions, with many regional banks having large energy loan portfolios. PNC sees the current environment as a major opportunity to expand – it recently sold a $14bn stake in BlackRock and is expected to try and acquire one of the larger US regional banks. CEO William Demchak recently said that he was gearing up for “opportunities that history has shown can arise in disrupted markets”.

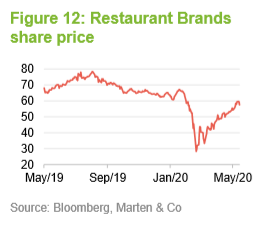

American-Canadian restaurant operator Restaurant Brands (www.rbi.com) accounted for 2.8% of the portfolio, as at end-April. The company owns three fast-food/coffee shop brands: Burger King, Tim Hortons and Popeyes. It was established in 2014, following a $14bn merger between Burger King and Tim Hortons, and is majority-owned by the Brazil-based private equity company 3G Capital, which has a long history of involvement in the food and beverage sectors.

Restaurant Brands is amongst the largest restaurant companies globally, with sales in excess of $40bn and a store count of around 26,000. Following the inevitable sharp slowdown over March, the company says that “substantially all” of its North American stores are now open. The company has thousands of drive-through outlets across North American, which are helping to bring customers back. Popeyes, the smallest of its three brands, is growing extremely quickly – same-store sales were up 40% yearon-year over May. Burger King’s sales contracted by a mid-single digit figure, while Tim Hortons saw a mid-20% decline.

The remaining new holdings are (with accompanying portfolio weights at 30 April):

• UnitedHealth Group (www.unitedhealthgroup.com) – 3.0%. UnitedHealth is the largest healthcare insurer in the US. Fran initiated the position in mid-2019 and increased it by 80%, following the March sell-off.

• Omega Healthcare (www.omegahealthcare.com) – 2.0%. Operating within a REIT structure, the company runs a few hundred assisted-living facilities across the UK and US. Based on historic dividends, the shares currently yield over 8.5%.

• Blackstone Group (www.blackstone.com) – 1.8%. An alternative asset manager operating in the private equity, real estate, hedge funds and credit spaces. Fran increased the holding by 50% over March – Blackstone’s quarterly dividends are variable, based on its fee revenues. January’s was a bumper 61 cents, while April was 39 cents, more in line with expectations. The shares have recovered their loses from March and are now up over the year-to-date.

• UPS (www.ups.com) – 1.4%. This position was recently reduced by around 45%. Surprisingly, the explosion in home delivery demand has not worked in UPS’s favour. Residential shipping volumes, which are less profitable than its commercial shipments, have soared to 70% of total shipment – the split between residential and commercial is typically 50:50, in normal conditions. An increase in the number of residential deliveries (particularly from Amazon – one of its main customers, and one with significant bargaining power, too) has strained profit margins. Carol Tomé (CFO at Home Depot for 24 years) took up the position of CEO on 1 June 2020. She has a difficult balance to strike: UPS needs to increase its margins, particularly on the business it does with Amazon, but this could increase Amazon’s incentive to ramp up its own delivery system.

• Maxim Integrated Products (www.maximintegrated.com) – 1.1%. The company manufactures integrated circuits and associated products that are used in a range of applications (automotive, consumer and industrial for example).

Performance

Performance

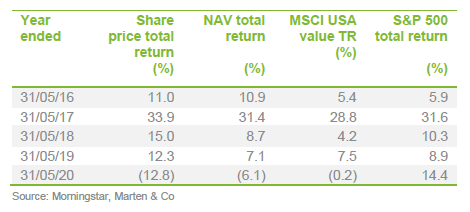

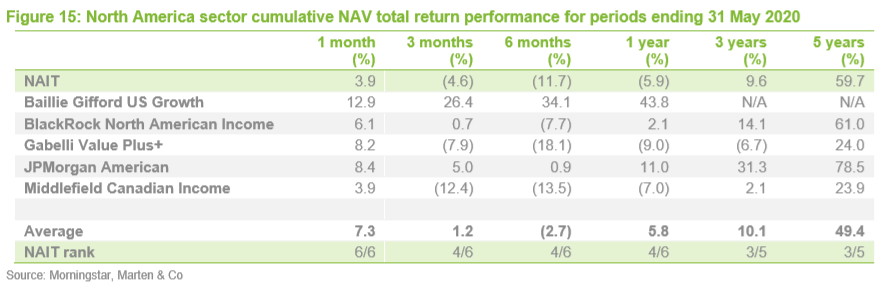

NAIT outperformed the MSCI USA Value Index and its peer-group (defined as the AIC North America sector) for the majority of the past five years. More recent performance has been weaker, in absolute and relative performance, for reasons that are addressed below.

Lower returns versus the S&P 500 index over the last five years reflect the strength of growth stocks over this period.

Performance attribution – new holdings adding active value

Performance attribution – new holdings adding active value

Going into March 2020, Fran, like many managers, felt that COVID-19 would play out similarly to SARS in 2002. Whilst it had a high mortality rate, SARS was contained to South-East Asia, with little impact on the rest of the world. Fran kept the portfolio generally defensive, though not overly so. More recently, the focus has been on raising cash selectively and targeting companies that offer better sales visibility.

Over the financial year to January 2020, NAIT’s underperformance of its benchmark was mainly the result of stock selection in the materials, communication services and consumer discretionary sectors. The diversified media company, Meredith, was the biggest detractor, following materially lower earnings guidance. The holding has since been sold.

The strongest stock selection came in the energy, industrials, and healthcare sectors. Defence company Lockheed Martin performed well, as did the healthcare company Bristol-Myers Squibb.

We note that based on Morningstar-compiled data, NAIT’s underperformance of BlackRock North American Income (BRNA), its closest peer (discussed below), in NAV terms over the one-year period to 31 May 2020, was largely attributable to stock selection within financials and a lower allocation to technology. Compared to BRNA, NAIT’s holding in Citigroup, AIG and Nutrien, have been the main detractors. Positive performance, relative to BRNA, has been led by some of the more recent additions to NAIT’s portfolio, namely AbbVie, UnitedHealth, and PNC.

Peer group

Peer group

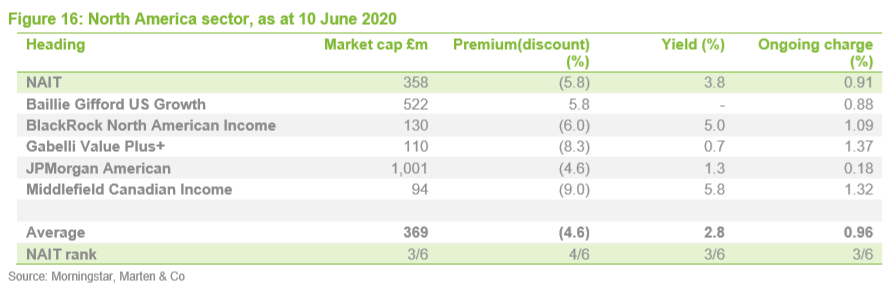

NAIT sits within the AIC North America sector, which is used as its peer group. We caution, however, that it is not an ideal comparison, on the basis that out of the six funds, only BRNA follows a similar strategy to NAIT. Baillie Gifford US Growth, JPMorgan American and Gabelli Value Plus+ are growth-focused and Middlefield Canadian Income allocates predominantly to Canada.

BRNA has been outperforming NAIT on a total return basis in recent months. The outperformance stretches to three- and five-year periods, though the difference over the latter is marginal. We think that a strategy such as NAIT’s is better assessed over longer-term horizons, providing an opportunity for the portfolio holdings to compound and for perceived mispricing to correct, which may not be captured during shorter periods.

NAIT’s shares currently carry a lower yield than BRNA’s, though its ongoing charges are lower and the difference between the two funds’ premium/(discount) is wider than when QuotedData’s two previous notes were published.

Also of note, BRNA’s mandate allows it to invest outside of North America – as at 30 April, the US accounted for 69.8% of its portfolio while Europe contributed 22.1%. In ordinary times, the greater geographical diversification might be considered an advantage; however, there has been more incidence across Europe of companies suspending distributions, compared to the US.

Dividend

Dividend

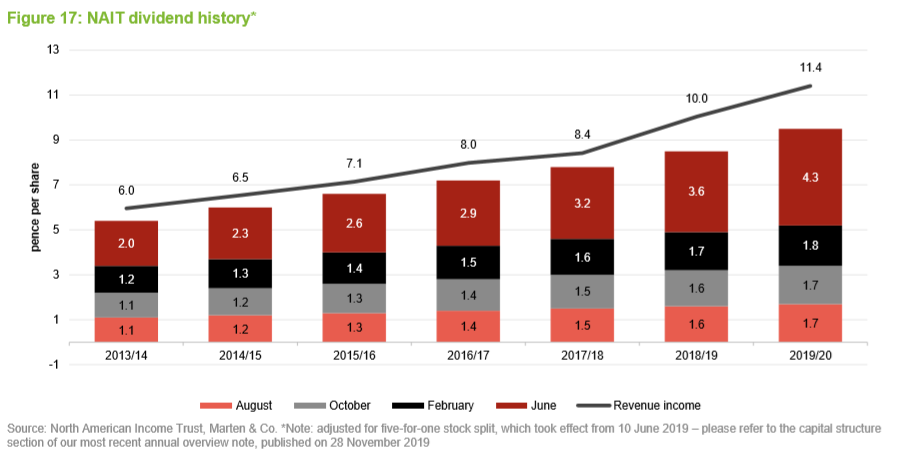

NAIT pays dividends on a quarterly basis, with the first interim dividend paid out in August. The second, third and fourth interim distributions are paid in October, February, and June. Between the year-ending periods to 31 January 2015 and 31 January 2020, NAIT grew its total dividend from 6p to 9.5p – equivalent to a compound annual growth rate of 9.6%.

Although not a formal aspect of NAIT’s dividend policy, the total annual has increased every year since NAIT adopted its income mandate in 2012. The impact of the pandemic will clearly challenge the ability of many companies to maintain distributions, through buybacks and dividend payments, over the next year or two.

Revenue reserve covers nearly 90% of the dividend

Revenue reserve covers nearly 90% of the dividend

As at 31 January 2020, NAIT had revenue reserves totalling £20.6m, equivalent to 8.3p (after payment of the third and fourth interim dividends), covering close to 90% of the dividend.

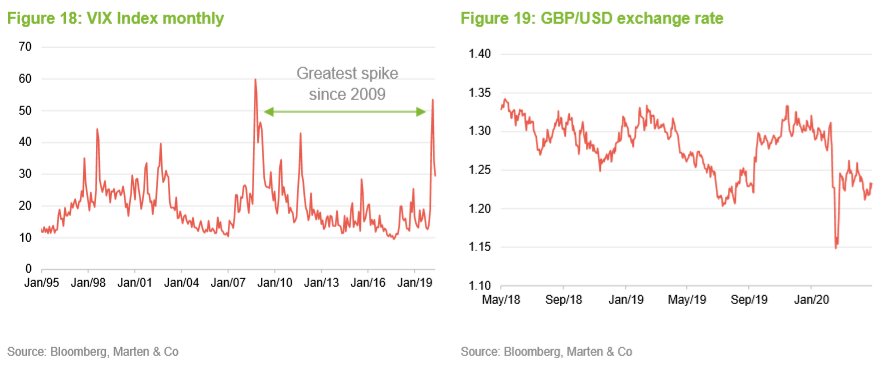

Greater volatility, as illustrated by the sharp spike in the VIX Index (see Figure 18), amplifies the return potential from writing options. Though derivative income is a byproduct of the portfolio process, there is the potential for it to compensate, to an extent, for lower distributions by portfolio companies. Over the most recent financial year to31 January 2020, NAIT generated option-related income of £4.0m (2019 – £3.9m). This represented 19.1% of total income (2019 – 20.5%).

Also, the dollar’s position as the global reserve currency and ‘safe haven status’ when sentiment turns provide a useful currency hedge. Sterling has fallen back to its preOctober 2019 level against the dollar.

Premium/(discount)

Premium/(discount)

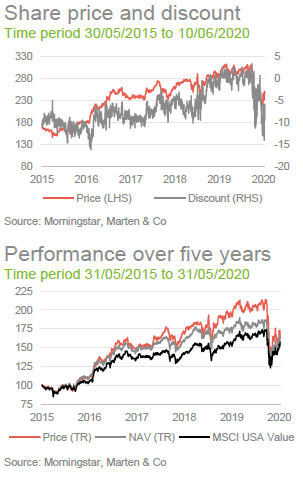

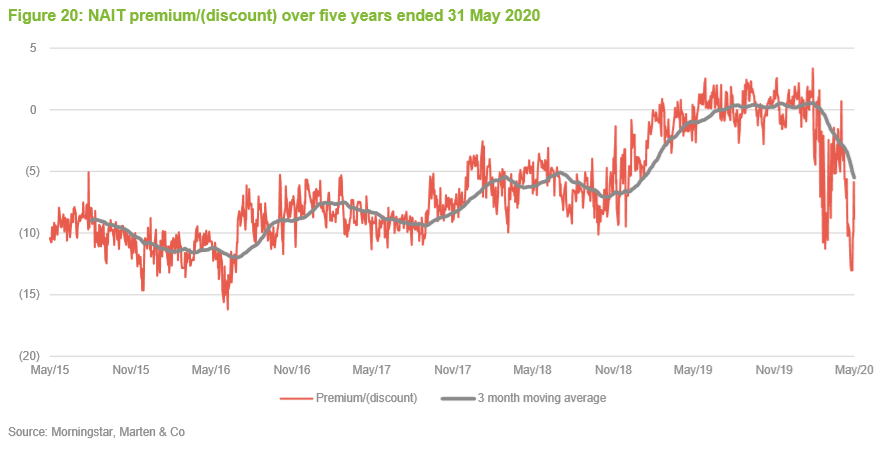

While most trust’s discounts widened significantly towards the end of March as the COVID-19 infection rate accelerated, and have been on a narrowing trend since, NAIT’s has been unusual in that it has experienced a double peak. That is, having traded at a premium until late February, NAIT moved to trading at a discount that initially peaked at 11.3% on 24 March. Thereafter, NAIT’s discount narrowed so that it was actually trading at a 0.7% premium on 30 April, before widening again and peaking at 13.0% on 25 May. As at 10 June 2020, NAIT was trading at a discount of 5.8%.

It would appear that the second peak was share price rather than NAV-led. In comparison, BRNA’s premium/(discount) has followed a more typical course since March – its shares are now back trading at a premium. Since the market’s low in March, we note that the movements in NAIT and BRNA’s NAV’s have followed similar trajectories.

NAIT is authorised to repurchase up to 14.99% and allot up to 10% of its issued share capital, which gives the board a mechanism with which it can influence the premium/discount. For more detail, please refer to page 15 of QuotedData’s most recent annual overview note.

Fund profile

Fund profile

NAIT’s objective is to provide investors with above average dividend income and longterm capital growth through active management of a portfolio consisting predominantly of S&P 500 US equities. NAIT may also invest in Canadian stocks and US mid- and small-cap companies as a way of accessing diversified sources of income. Up to 20% of NAIT’s gross assets may be invested in fixed income investments, which may include non-investment grade debt.

The company maintains a diversified portfolio of investments, typically comprising around 40 equity holdings and around eight to 10 fixed interest investments (which tend to be much smaller positions) but without restricting the company from holding a more or less concentrated portfolio from time to time.

NAIT benchmarks itself against the Russell 1000 Value Index but we have used the MSCI USA Value and S&P 500 indices as comparators for the purposes of this report.

The board has appointed Aberdeen Standard Fund Managers Limited to act as NAIT’s AIFM. The portfolio is managed on a day-to-day basis by Aberdeen Standard Investments (ASI), and the lead manager is Fran Radano. Fran is a senior investment manager within the ASI team, which is led by Ralph Bassett, who is also a named comanager of NAIT.

NAIT’s history goes back to 1902, but the trust has only been in its current form since 2012. Fran has been working on the trust since then and took over as lead manager in 2015. The equities team is based in Philadelphia and Boston. More information on the manager and ASI is available on page 17 of QuotedData’s most recent annual overview note.

Previous publications

Previous publications

Readers interested in further information about NAIT may wish to read QuotedData’s previous notes:

Reasons to be cheeful, initiation note, published October 2018

Time to grow?, update note, published May 2019

Macro driven market is creating opportunities, annual overview, published November 2019.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on The North American Income Trust plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.