Polar Capital Global Financials Trust

Investment companies | Update | 7 June 2023

Avoiding mishap

After years of squeezed margins thanks to ultra-low interest rates, banks’ profitability is increasing (in part, as the spread between the interest rates that they pay on deposits and the rates that they charge borrowers widens). However, higher rates have brought increased recession risk and, as we discuss from page 4 onwards, have exposed inept risk management within some US regional banks, with some high-profile bank failures.

The managers of Polar Capital Global Financials Trust (PCFT) were quick to cut exposure to more exposed areas of the sector, while increasing PCFT’s weighting towards areas such as insurance and reinsurance, where the picture looks brighter.

Sentiment has turned against the financials sector once more, but as investors find assurance that the problems are stock specific rather than sector-wide, this could swing back in PCFT’s favour.

Growing income and capital from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

Troubled banks

The past few months have been eventful within the financials sector. The collapse of Silicon Valley Bank (SVB) in March, was preceded by that of Silvergate, which had exposure to the cryptocurrency market. Two days after SVB failed, Signature Bank followed. The next big hit came from Credit Suisse and that was followed by First Republic.

US banks that failed had a high proportion of uninsured deposits.

Before writing this note, we talked to one of PCFT’s managers – Nick Brind – about the situation. He pointed out that the three big US bank failures had one significant factor in common, a high proportion of uninsured deposits (those not covered by state guaranteed deposit insurance) as a percentage of total deposits. Understandably this led to customers with deposits above the insured limit moving their deposits elsewhere.

$250,000 limit on deposit insurance.

Nick feels that, while the outflow of deposits has stabilised, one way for the US authorities to reduce the risk that further runs are seen for whatever reason would be for Congress to approve an increase in state guaranteed deposit insurance (currently limited at $250,000 per depositor, as compared to the £85,000 covered by the Financial Services Compensation Scheme in the UK). However, there is political resistance to this, with Republicans in particular claiming that this would create a moral hazard whereby banks could take excessive risks, comforted that customers would be bailed out in the event of failure.

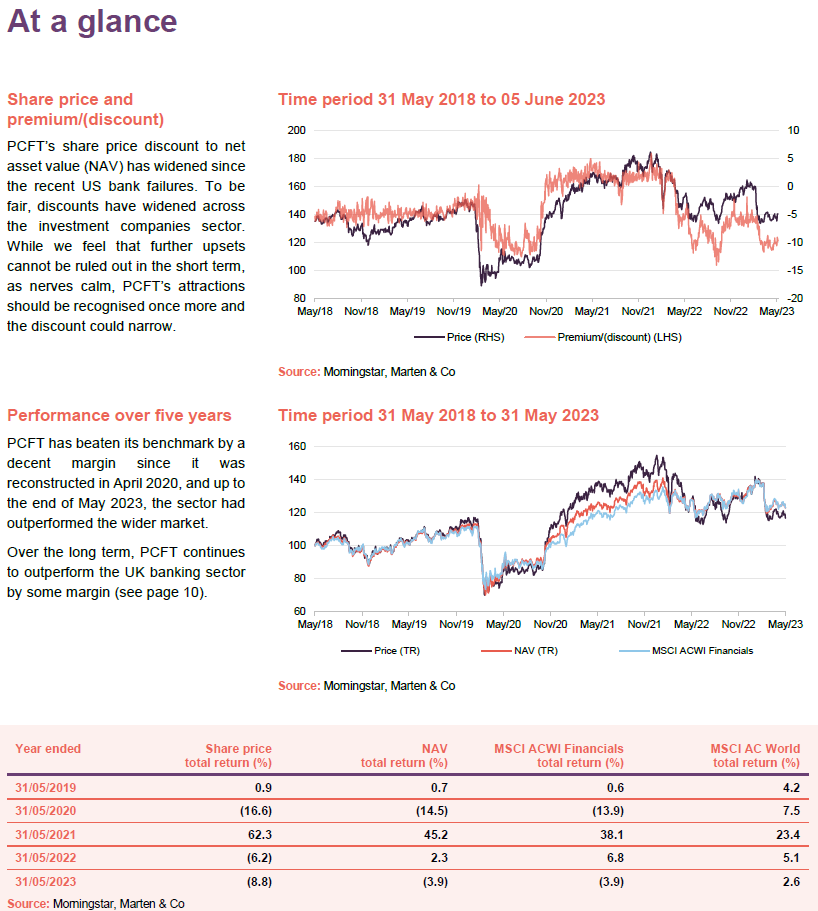

Figure 1 plots the percentage of uninsured deposits for a selection of US banks on the vertical axis against the notional losses on their bond portfolios as a percentage of their total capital employed on the horizontal axis.

California-based SVB, which had a strong specialism in lending to early-stage technology companies and private equity funds, was the 16th-largest bank in the US. In the face of a significant influx of cash, it mismatched its assets and liabilities, acquiring a portfolio of bonds which it then did not mark to market (adjust the value of assets of assets to reflect current market prices), on the grounds that it was going to hold these to maturity.

As bond yields rose and the value of the bonds fell, creating a big mark-to-market loss, nervous depositors began withdrawing funds. Soon SVB was forced to sell assets to raise cash, crystallising losses on its bond portfolio, as the run on deposits spiralled out of control. By 10 March, having failed to raise fresh equity, the Federal Deposit Insurance Corporation (FDIC) called time on the business, precipitating what was then the second-largest bank failure in US history (after Washington Mutual in 2008). SVB’s US operations were sold to First Citizens BancShares and its UK business to HSBC. First Citizens BancShares later sued HSBC for poaching US staff.

On 12 March, SVB’s customers’ deposits were guaranteed in full. However, depositors were already pulling money out of other lenders perceived as risky. New York-based Signature Bank, which had significant exposure to real estate lending as well as to cryptocurrencies, was shut down on the same day.

Credit Suisse also saw significant outflows of deposits.

Long seen as accident-prone, Credit Suisse also saw significant outflows of deposits. Saudi National Bank, Credit Suisse’s third-largest shareholder, ruled out a further injection of equity capital, unsettling Credit Suisse’s customers. A SFR50bn credit line from the Swiss National Bank failed to calm nerves. Finally on 19 March, UBS agreed to buy Credit Suisse in a deal thrashed out by regulators that deliberately bypassed shareholders of both banks, but controversially wiped out its AT1 bondholders while giving some minimal value to equity investors which should have ranked below them in this sort of situation (the equity holders should have been wiped out first). Unsurprisingly, holders of the AT1 bonds have filed a lawsuit against the Swiss financial regulator.

In the US, attention had turned to First Republic, which had significant exposure to mortgages. The bank’s shares were falling sharply and, on 16 March, a group of 11 US banks agreed to deposit $30bn with the bank to bolster its capital and help prop it up. Superficially, that seemed to do the trick, but on 25 April, First Republic revealed that $100bn of deposits were pulled from the bank during March, and the share price began to slide again. Over the weekend at the end of April, JPMorgan agreed to buy most of First Republic’s assets as the FDIC shut the bank, with First Republic taking SVB’s slot as the second-biggest-ever US bank failure.

PCFT had a 0.3% position in SVB ahead of its collapse, but the managers sold the entire stake before the news emerged of customer withdrawals. PCFT had no exposure to any of the other banks that collapsed.

The big banks are getting bigger.

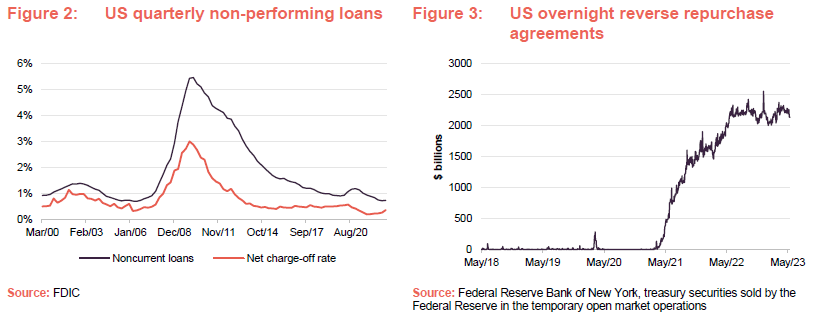

Nick notes that money has been flowing not only into banks that are perceived to be stable, such as JPMorgan Chase, but also into money market funds, which are said to have seen inflows of about $370bn over March and now hold about $5.3trn. As Figure 3 shows, a substantial proportion of that (about $2.2trn) has been parked with the Federal Reserve using its reverse repo facility. Effectively, this is taking money out circulation, which should be disinflationary.

It is too early to quantify the impact on smaller regional banks which have seen sharp falls in their share prices, such as PacWest, Western Alliance, Zion Bancorp and Comerica. PacWest cut its dividend aggressively and has sold off some of its loan book.

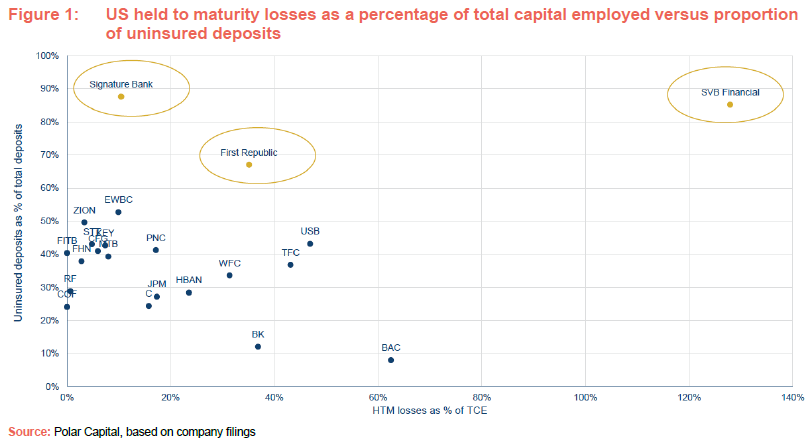

There are concerns about the impact on banks’ balance sheets of slower growth (perhaps even a recession) as higher interest rates bite. However, sentiment towards the sector appears to be being driven by news headlines rather than fundamentals. News that Berkshire Hathaway has been selling bank stocks has not helped, for example. It is notable that, as Figure 2 illustrates, as at the end of the fourth quarter of 2022, non-performing loan rates remain at historically low levels.

Concerns about commercial real estate exposure.

In the current environment of higher interest rates, it is thought that commercial real estate exposure may be the next problem area. Nick says that the biggest risk lies within smaller regional US banks and commercial real estate accounts for about 30% of their loan books. However, for the larger banks the exposure is more like low double-digit percentages of their books. These loans are secured against offices, retail, industrial and the like, but the majority relates to multi-family properties. Nick suggests that with typical loan to value ratios (LTVs) in the 50–60% range, falling property valuations should be manageable for most banks.

The underlying story remains the same

As we summarised in our last note, PCFT’s managers feel that investors’ concerns about the overall health of the financial sector are overblown. They acknowledge the problems within the US regional banking sector, but have eliminated exposure to this area within PCFT’s portfolio (from a low single-digit percentage of assets at the start of the year). Higher interest rates continue to be good news for banks’ margins, although the cost of servicing deposits is rising.

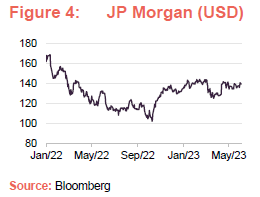

If anything, the events of the past few months have strengthened the investment case for the large-cap banks. For example, JPMorgan (PCFT’s largest holding and one that the managers have added to in recent months, alongside Wells Fargo) looks set to profit handsomely from the First Republic deal. It has upgraded its earnings forecasts for 2023. Nevertheless, the managers suggest that it is being overly conservative in its assumptions on the profitability of First Republic’s business, which could mean further upgrades to come. EU banks have also been seeing earnings upgrades, and here Credit Suisse seems to be perceived as a one-off problem.

Nick expects that loan losses will rise, but this should be manageable given the more conservative lending standards adopted by banks in the wake of 2008’s global financial crisis. Higher regulatory costs will likely have an impact at the margin.

EU banks have been hit by negative sentiment on the back of the US regional banks’ problems and have derated. The managers note that European regulators have approved share buyback plans for a number of European banks, suggesting that they retain confidence in the health of the sector (if they were worried, they would be ensuring that the banks conserved their capital). In the managers’ view, banks are very cheap. Concerns about commercial real estate exposure should be less of an issue in the EU as they have a lower exposure as a percentage of their loan books and European banks have also hedged their interest rate risk so are unaffected by the sharp rises in interest rates on the value of their securities and loan portfolios.

The picture for insurance and reinsurance in particular looks good.

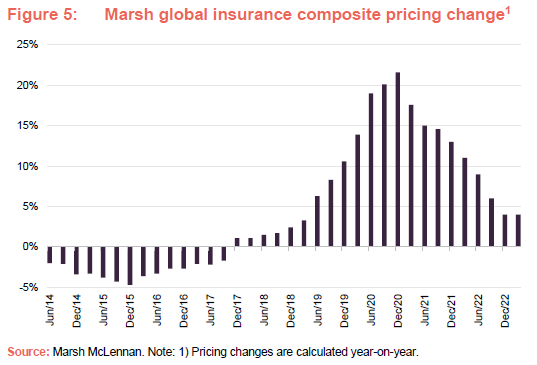

Elsewhere in the sector, Nick notes that commercial insurance rates are still rising across most lines, albeit more slowly than they were. The picture for reinsurance looks good as the pool of capital has shrunk on the back of large losses, in particular Hurricane Ian (second only to 2005’s Hurricane Katrina in terms of insured losses) and losses related to the invasion of Ukraine. Nick says that on average, reinsurance rates are up by 37.5% year on year.

Asset allocation

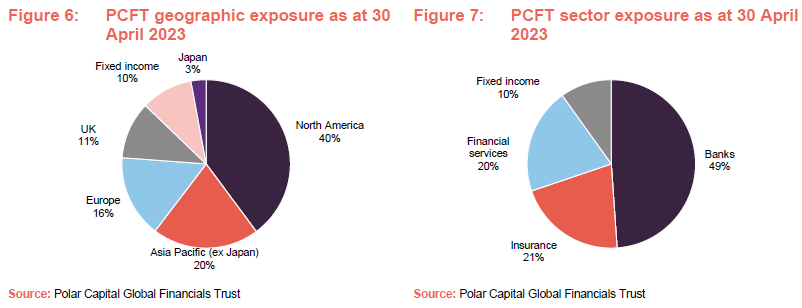

At the end of April 2023, there were 90 positions in PCFT’s portfolio and 94.9% of the portfolio was in stocks with market caps above $5bn (even more than was the case six months earlier). PCFT had an active share of 67.8% relative to the benchmark at end April 2023.

Since end October 2022 – the data that we used when we last published a note on PCFT – the trust’s exposure to fixed income has risen, funded largely by a reduction in its North American banks exposure. In addition, payments firms have been reclassified from software to financial services and the managers have added to this area as well as to PCFT’s insurance weighting. The managers have shifted the emphasis of the portfolio further towards larger-cap companies.

PCFT’s managers added to fixed income positions during the LDI-triggered selloff last September at the time of the Truss/Kwarteng budget and again more recently. PCFT’s exposures in this area include AT1 bonds and other bank capital, but it did not have exposure to Credit Suisse’s AT1s.

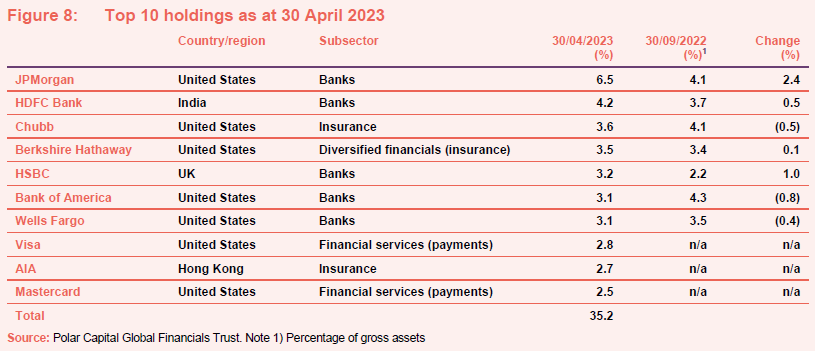

Top 10 holdings

Since 30 September 2022 (the data we used for the last note), DBS Group, Toronto Dominion, and PNC Financial Services have dropped out of the list of the 10 largest holdings (but are still sizeable holdings) and have been replaced by Visa, AIA, and Mastercard (all of which are longstanding positions within the portfolio).

We have discussed most of these companies in previous notes.

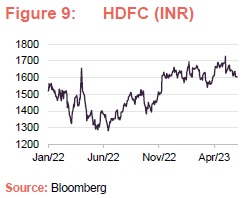

HDFC

HDFC is the leading private sector bank in India with a market share of about 10% of deposits and 83m customers. HDFC’s share price was hit when the Indian Finance Minister announced a new tax on insurance premiums in February 2023’s budget. However, good results published in April 2023 helped restore confidence. Revenue for the accounting year that ended 31 March 2023 was up 16% year-on-year and profit before tax was 21% higher.

To some extent, HDFC is riding the wave of a stronger Indian economy (loss provisions fell by 21%), but it is also taking market share. HDFC has a strong balance sheet, with a Tier 1 Capital ratio of 17.1%.

The managers are also encouraged that the planned merger of HDFC and Housing Development Finance will proceed in July.

AIA

PCFT has no direct exposure to China, but the managers are exploiting the recovery in China’s economy linked to the abandonment of previous COVID-related restrictions through positions in stocks such as Hong Kong-based life insurer AIA.

AIA’s business growth figures for the first quarter of 2023 were very strong, with a 28% uplift in the value of its new business, including double-digit growth from its Chinese operations. This should receive a boost in future periods as AIA has secured permission to operate in Henan (China’s third-most-populous province) for the first time.

Performance

Up to date information on PCFT is available on the QuotedData website.

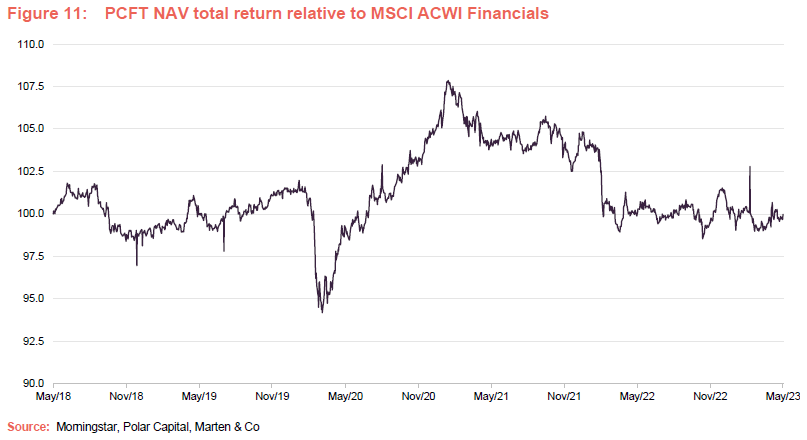

The drivers of PCFT’s long-term performance have been discussed in earlier notes. These include the impact of the pandemic panic in March 2020 and the subsequent recovery. The sell-off in highly-rated growth stocks hit returns early in 2022; PayPal was a notable contributor to the fall in PCFT’s relative performance over that period, for example. More recently, the trust’s returns have matched those of the MSCI ACWI Financials Index more closely.

SVB’s collapse occurred around the time of the brief spike on 9 March 2023, but this is likely a timing issue. As mentioned above, PCFT only had minimal exposure to SVB ahead of its problems becoming apparent, and the position had been sold before the stock ceased to trade.

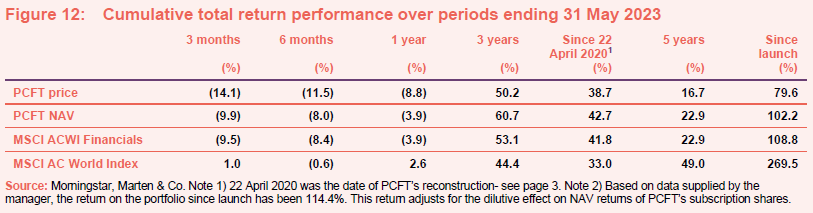

As Figure 12 shows, PCFT has beaten its benchmark by a decent margin since it was reconstructed in April 2020, and up to the end of April 2023, the sector had outperformed the wider market. As we discuss in the next section, the setback in the banking sector over the past few months has contributed to some modest discount widening for PCFT.

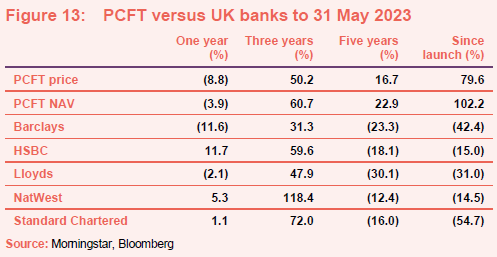

We have made the point in past notes that PCFT was established in part to provide UK-based investors with an alternative to a narrow group of relatively unexciting domestic financial stocks. UK banks have been re-rated somewhat over the past year or so as value-style investing has returned to favour. The longer-term picture of considerable outperformance by PCFT remains compelling, however.

Premium/discount

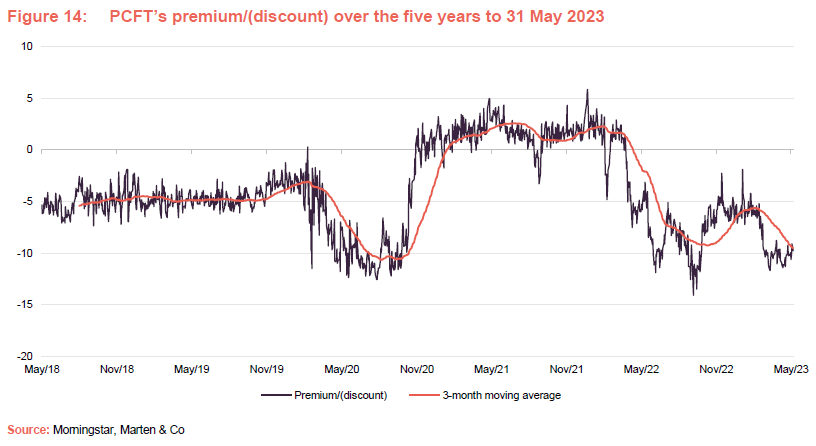

Over the 12 months to the end of May 2023, PCFT’s share price moved within a range of a discount to NAV of 14.1% to a discount to NAV of 1.9% and has traded at an average discount to NAV of 8.0%. On 5 June 2023, the discount was 10.1%.

Looking at the long-term picture, the change in sentiment toward the financials sector following the vaccine news in November 2020 is evident in Figure 13. The shares traded at a modest premium to NAV for some time after that, but in April 2022, as investors became increasingly nervous about the health of the global economy, the shares moved to trade at a discount once again.

PCFT’s discount has widened since the events described on pages 4 to 5. To be fair, discounts have widened across the investment companies sector. While we feel that further upsets cannot be ruled out in the short term, as nerves calm, PCFT’s attractions should be recognised once more and the discount could narrow.

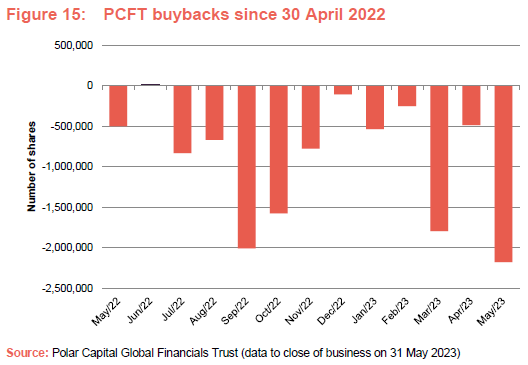

The board seeks to moderate fluctuations in the discount and premium through buybacks and issues of shares. On 1 February 2022, PCFT raised gross proceeds of £29.4m through the issue of 16,869,893 new ordinary shares at 174.31p per share, then a 1.5% premium to the NAV as at 31 January 2022. On 25 February 2022, PCFT raised gross proceeds of £16.6m through the issue of 9,905,427 new ordinary shares at 167.75p, again equivalent to a 1.5% premium to the prevailing NAV.

More recently, the board has stepped up and bought back stock, repurchasing over 11m shares net over the past 12 months.

Fund profile

PCFT looks to grow investors’ income and their capital.

More information on the trust is available on its website www.polarcapitalglobalfinancialstrust.com.

Polar Capital Global Financials Trust (PCFT) has twin objectives of growing both investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

PCFT launched on 1 July 2013 with a fixed life. In April 2020, in conjunction with a vote on prolonging the life of the trust, shareholders were offered a cash exit. Holders of 39.1% of PCFT’s then-issued share capital opted to sell their shares. The portfolio was reconstructed to facilitate this. Shareholders overwhelmingly approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life, but with five-yearly tender offers, the first of which is scheduled for 2025.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

Benchmarked against MSCI ACWI Financials.

Since April 2020, the trust’s performance benchmark has been the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials). A history of earlier benchmarks is given in previous notes (see below). We have used MSCI ACWI Financials for comparison purposes in this note.

PCFT’s AIFM is Polar Capital LLP, which had AUM of £18.8bn at 30 September 2022 and employs 15 investment teams, spread across offices in Europe, the US and Asia.

PCFT’s lead managers are Nick Brind, John Yakas and George Barrow.

Previous publications

QuotedData has published a number of notes on PCFT. You can read these by clicking the links in the table below or by visiting the QuotedData.com website.

Figure 16: QuotedData’s previously published notes on PCFT

Source: Marten & Co

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Financials Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.