Riding out the storm

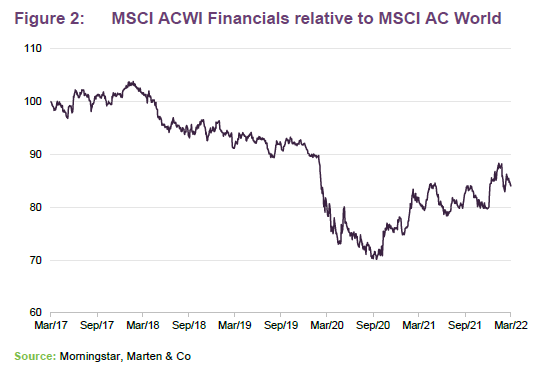

Polar Capital Global Financials Trust (PCFT) has been a beneficiary of renewed interest in the financials sector, as economies reopen and interest rates begin to edge up (higher rates should feed into higher margins for banks). Incredibly, the sector is yet to make up the ground it lost relative to the wider market in early 2020, as COVID-19 hit.

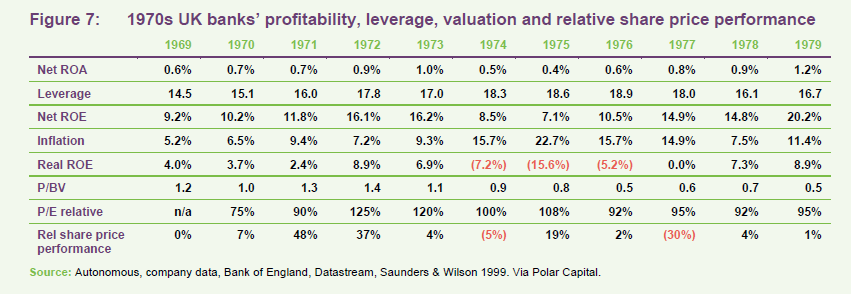

Many of the companies in PCFT’s portfolio are reporting strong earnings growth already. However, the sector’s rerating has stalled on fears of a recession. PCFT’s managers point to the strength of banks’ balance sheets and their conservative lending policies. They also cite the evidence of 1970s UK – when barring brief periods of very high inflation – banks did relatively well (see page 5).

Growing income and capital from financials stocks

PCFT aims to generate a growing dividend income, together with capital appreciation. It invests primarily in a global portfolio, consisting of listed or quoted securities issued by companies in the financial sector. This includes banks, life and non-life insurance companies, asset managers, stock exchanges, speciality lenders and fintech companies, as well as property and other related sub-sectors.

PCFT’s managers believe the financials recovery incomplete

Our November 2021 annual overview note was titled More to go for, and we could have used the same headline again, as the managers believe that many of the themes that we highlighted in that note persist today. That note includes details of PCFT’s investment philosophy and approach, so interested readers might want to refer back to it.

Economic recovery from the effects of the pandemic and an environment of rising interest rates may have been driving better relative performance from the financials sector. The managers say that loan growth is recovering but slowly, and that small/mid-sized banks are growing their loan books faster than larger banks. The managers continue to see opportunities for PCFT as the many small/mid-sized banks in the US continue the process of consolidation.

The managers note that PCFT is not just a cyclical recovery or a banks story, however. The portfolio also has exposure to structural growth themes in emerging markets and fintech.

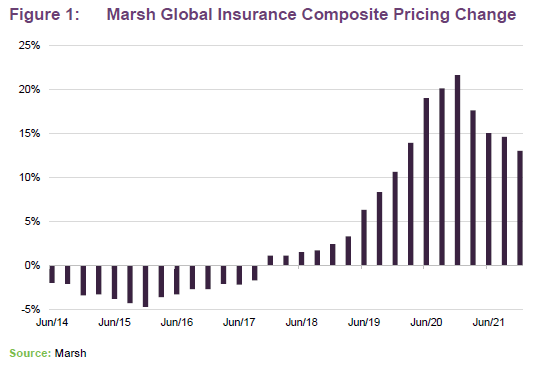

In the non-life market, the managers say that the insurance underwriting environment is the best that it has been in a decade, as premiums have been rising faster than claims.

However, as Figure 2 shows, there is still further to go before the sector even gets back to pre-pandemic levels, and even then, it has a lot of ground to make up relative to the wider market.

In recent weeks, the sector has given up some of its relative outperformance.

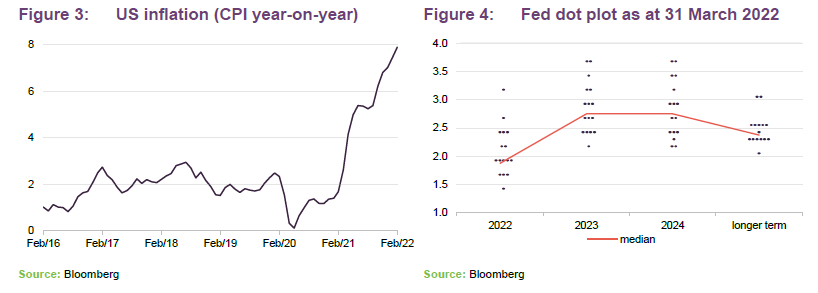

In our last note, we noted a shift in the narrative from inflation being a transitory problem to something more entrenched. Russia’s invasion of Ukraine and the knock-on effects on energy, metals and food prices have most likely prolonged the period of high inflation. Central banks have begun to raise rates in a bid to tackle the problem.

How far rates will rise remains open to debate. As Figure 4 shows, the median forecast from Fed bank governors is that US rates will be 2.75% in 2023 and 2024 before falling back. In November 2021, the expectation was that they would peak at 2.5% but not until beyond 2024.

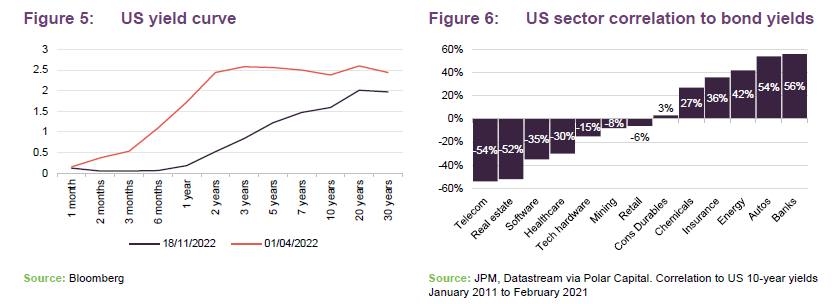

Figure 5 shows the shift in the US yield curve since we last published on PCFT. The managers say that rising bond yields are good news for banks, as is illustrated in Figure 6. Rising short-term rates are, PCFT’s managers believe, particularly good news for banks in the current environment. Whilst short-term rates are higher, deposit rates are negligible and the impetus for customers to switch accounts looking for the best rate is not really there. Their thesis is that banks’ margins can expand, therefore.

Generally, PCFT’s managers think that central bankers are behind the curve in tackling inflation. There is low visibility on the direction of economies, but central bankers feel obliged to show that they are on top of things.

As Figure 7 shows, historical data – from the UK in the 1970s – suggests that banks can prosper in a higher inflation environment, but periods of double-digit inflation and negative real returns in equity tend to be more difficult. In such environments all equities are likely to suffer.

Looking again at Figure 5, from two years onwards, the curve as at 1 April 2022 is fairly flat; in fact between 2 years and 10 years it is inverted. That has often been seen as a precursor to a recession and it may be that this is weighing on the financials sector currently. The sector has underperformed recently as commodities and energy stocks in particular have driven markets.

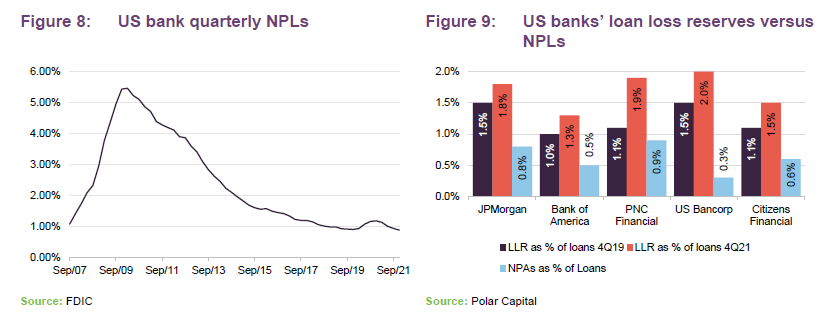

Against that, as Figure 8 shows, rates of non-performing loans (NPLs) are still low and falling. Having adopted a more conservative lending policy in the wake of the GFC, and having in many cases been forced to suspend dividends and share buybacks during the pandemic, banks’ balance sheets are stronger.

Capital returns are accelerating now that restrictions have been lifted, but US banks’ loan loss reserves are 30% higher than they were pre-COVID. In addition, the managers say that US households appear to have saved much of the stimulus money that fed through to them. When that is combined with historically low interest rates, US household debt service ratios are at record lows.

The managers think that the situation may be worse in Europe than in the US. Accordingly, they have been trimming PCFT’s European exposure, as we show in the next section.

PCFT’s portfolio has no Russian exposure. A position in Sberbank was sold in December, and a small position in TCS Group, owner of Tinkoff Bank, was sold in January, both well-ahead of the outbreak of war.

Asset allocation

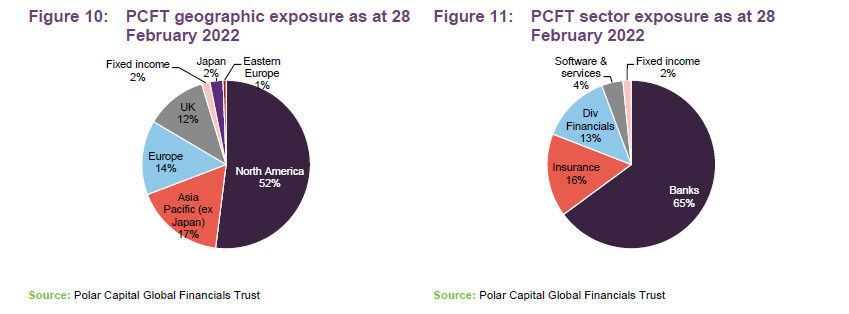

At the end of February 2022, there were 70 positions in PCFT’s portfolio, down from 81 at the end of September 2021 – the data we used in our last note. The portfolio had an active share of 69% at the end of February and 88% of the portfolio was in stocks with market caps above $5bn – a little more than when we last published.

The most significant change to PCFT’s asset allocation since the end of October 2021 has been a substantial (10 percentage point) increase in exposure to North America, funded largely from a reduction in European exposure and from cash. Within Europe, the managers added to exposure to the Nordic region, and exposure to the UK has been maintained. The managers are less positive on the rest of Europe. Whilst banks there have been reducing exposure to Russia, they often have more exposure to Eastern Europe than elsewhere. The portfolio’s direct exposure to Eastern Europe is now zero. KBC has some small exposure to the region, as does DnB.

The managers say that weak share prices for European banks did throw up some opportunities for PCFT. They say that they have made investments in FinecoBank, an Italian digital bank and wealth management company, and a Swiss insurer, Baloise Holdings.

Top 10 holdings

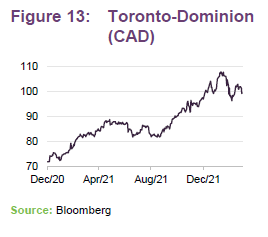

Since we last published on PCFT using data as at the end of October 2021, PNC Financial Services, Nordea Bank, UBS and BNP Paribas have dropped out of the list of the 10-largest holdings to be replaced by Toronto-Dominion, Berkshire Hathaway, Wells Fargo and Sumitomo Mitsui Financial. PNC and UBS lie just outside the top 10, and Nordea is still said to be a large position. In part, however, these changes reflect a reduction in exposure to European banks.

Toronto-Dominion

Toronto-Dominion Bank (td.com) has performed well. In its latest quarterly accounts, covering the three months ended 31 December 2021, it reported earnings up 14%, strong revenue and volume growth across all its businesses, and a common Tier 1 ratio of 15.2% even after buying back 7.5m shares. Toronto-Dominion operates across North America, but with a bias to Canada (the US loan book is about a third of the Canadian one). Assets under management or advisory surpassed CAD1trn for the first time. Adoption of its digital services is increasing.

Toronto-Dominion published some information on the sensitivity of its income to higher rates. It reckoned that a 0.25% increase in short-term rates would add CAD394m to its 12-month net interest income. A 1% increase in rates across the curve would add CAD2bn.

Berkshire Hathaway

The managers have added to the position in financial conglomerate Berkshire Hathaway (berkshirehathaway.com), using it as a way of increasing exposure to non-life insurance. Berkshire Hathaway recently announced plans to acquire Alleghany Corp for $11.6bn. The purchase price will be settled in cash, but that still leaves around $136bn of cash/short-term treasuries on Berkshire Hathaway’s balance sheet. These assets support Berkshire’s insurance and reinsurance activities.

Alleghany adds to Berkshire Hathaway’s exposure to property and casualty insurance and this area remains the largest segment of the business. However, in his latest letter to shareholders, Warren Buffet sought to characterise the company as an infrastructure investor. In addition to insurance, the group has an equity portfolio which includes a large position in Apple stock, owns a freight railroad company – BNSF – and has a substantial energy generation and transmission business that has a bias to wind and solar.

2021 was a better year for Berkshire in terms of share price performance. It has been buying back stock – around 9% of its share capital over the past couple of years.

Moneybox

PCFT participated in a fundraise for Moneybox (moneyboxapp.com), an unlisted online UK wealth platform. Users are encouraged to save small amounts and then add to their savings over time.

PCFT’s managers feel that the economics of the business are attractive. Moneybox has been building its customer base and is said to have reached over £2.5bn in assets under administration from more than 750,000 customers.

Others

Back on the non-life insurer theme, the managers bought back into Marsh McLennan (the world’s largest insurance broker), and with a view to exploiting the rising and increasingly volatile commodities markets, PCFT now has a position in The Intercontinental Exchange (ICE).

The managers have observed that the discount that Schroders non-voting ordinary shares trades on relative to the voting ordinary shares is the widest it has been since 1991 (about 40%, having widened from about 7% in 2018) and have been buying Schroder non-voting shares for PCFT.

In Asia, the managers feel that the outlook is uncertain as inflationary pressures build. Oil producer Indonesia may be relatively better placed. They added to positions in Bank Central Asia and Bank Rakyat Indonesia Persero. India has been recovering from the effects of COVID, but rising energy costs will likely have an effect there. COVID is becoming a problem again in China, and Hong Kong in particular. The portfolio is underweight Chinese banks. It does have a position in AIA, but the managers acknowledge that there are question marks over its pace of growth.

Another recent purchase was of Macquarie. The managers like its exposure to the buoyant commodities sector as well as the structural growth provided by its renewables/infrastructure exposure. The purchase helps reduce PCFT’s underweight exposure to Australia.

Performance

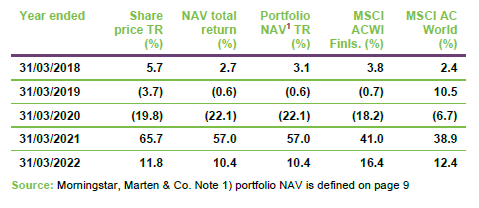

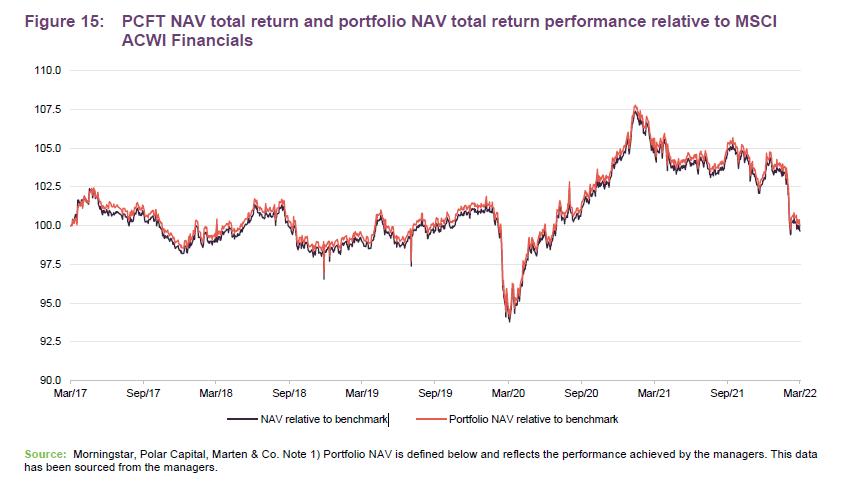

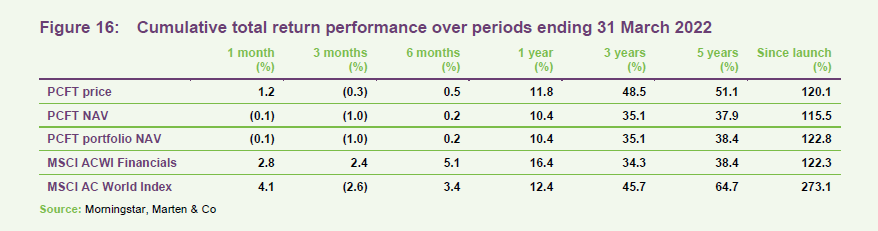

In the chart in Figure 15 and the table in Figure 16, we show returns both for PCFT’s IFRS NAV and also a ‘portfolio NAV’ which strips out the effects of the dilution attributable to PCFT’s subscription shares (which were exercised in July 2017). The portfolio NAV gives a better indication of the returns achieved by the managers.

Looking at the five-year chart, PCFT matches the MSCI ACWI Financials ahead of the pandemic panic in March 2020. A short period of underperformance is swiftly reversed and PCFT has a period of strong relative performance over the following year. In turbulent markets since February 2021, it has given up a little of its earlier outperformance, but as Figure 16 shows, has made gains on an absolute basis.

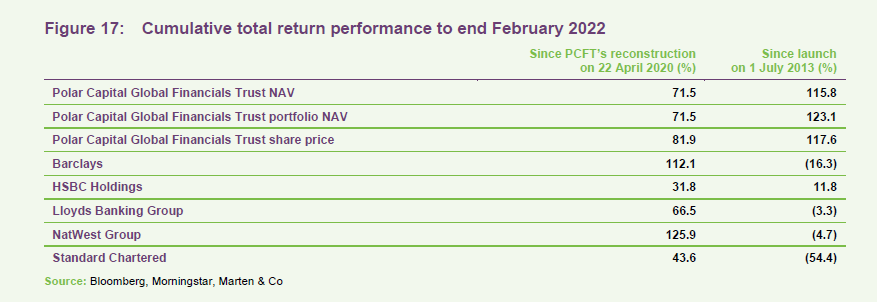

One of the drivers behind the launch of PCFT in 2013 was that it would provide UK-based investors with a relatively lower-risk exposure to the financial sector. Since then, PCFT has delivered returns well ahead of the major UK banks as is evidenced in Figure 17.

The period since PCFT’s reconstruction in April 2020 has been characterised by much improved sentiment towards financials – as we have observed elsewhere in this note – but also by a modest uptick in interest in UK stocks from international investors. This has helped spark a bounce in the share prices of Barclays and NatWest. Nevertheless, they remain pretty poor investments relative to PCFT over longer time periods.

Performance attribution

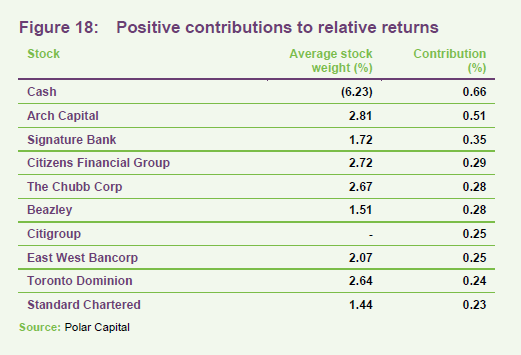

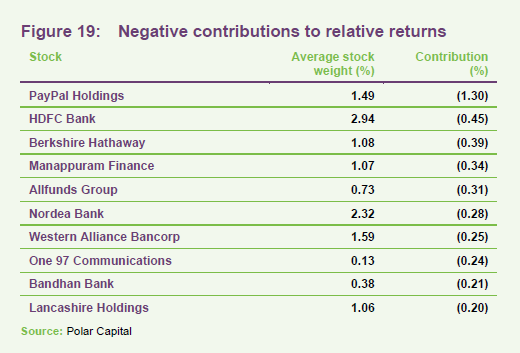

Our last note had performance attribution data up to 30 September 2021. The data below covers the period from end September 2021 to end February 2022. Over that period, the trust gave back some of its relative outperformance, returning 0.5% to the benchmark index’s 2.2%.

Arch Capital

Speciality insurer Arch Capital (archgroup.com) leads the list of positive contributions to PCFT’s returns over this period. Arch has achieved an impressive 15% compound growth rate in its book value per share over the past 20 years. It says that good results in 2021 were driven by improved underwriting conditions. It delivered 31% growth in insurance premiums over 2021 and 32% in reinsurance premiums. Delinquencies in the book of mortgages that it has insured continue their post-COVID fall.

PayPal

On the negative side of things, PayPal (pypl.com) was hit by the general growth sell-off. In its Q4 figures, PayPal noted that total payment volumes had grown by 33% year-on-year to $1.25trn. The number of active accounts grew strongly too, hitting 426m. However, the company guided towards lower earnings for 2022. The managers have added to the position following the recent weakness.

Peer group

PCFT’s listed peer group is eclectic and provides a poor comparison. PCFT’s reports tend to compare the trust with the average of the Lipper Financial sector. From the inception of the fund in 2013 to end February 2022, the trust returned 123.1% (on a portfolio NAV basis) while the Lipper Financial sector average return was 86.7%. From the date of the reconstruction of the trust in April 2020 to end February 2022, the returns were 70.8% and 53.4%, respectively.

Premium/(discount)

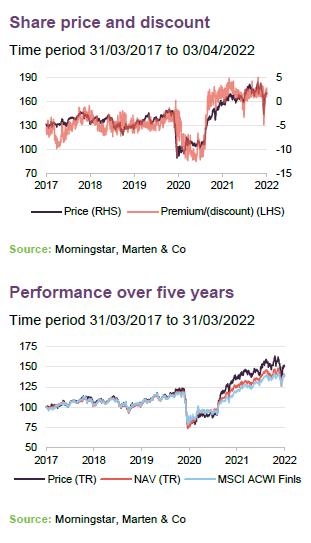

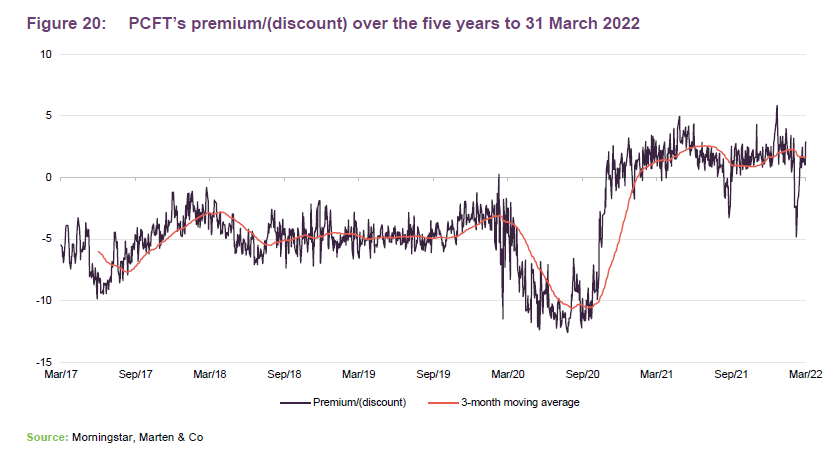

Over the 12 months to the end of March 2022, PCFT’s share price has moved within a range of a 4.8% discount to a premium of 5.9% and has traded at an average premium of 2.9%. At 3 April 2022, the premium was 2.2%.

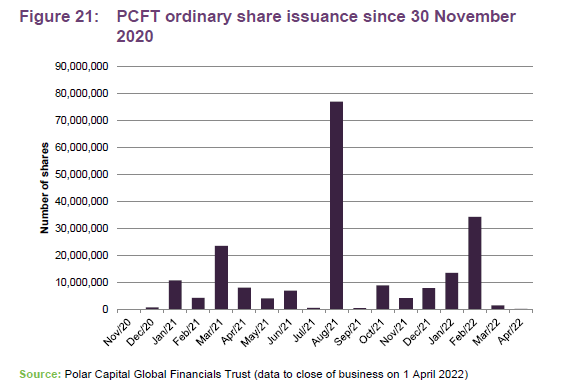

PCFT’s discount was trending towards zero ahead of the outbreak of COVID-19, but the panic in markets appeared to derail that. The change in sentiment toward the sector around the time of the vaccine news in November 2020 is clear from Figure 22. Since then, barring brief wobbles in September 2021 and March 2022, the shares have been trading at a modest premium to NAV and the trust has been able to issue stock on a regular basis.

In April 2021, the board decided to expand the trust by way of a placing, open offer, offer for subscription and intermediaries offer of C shares. This process raised gross proceeds of £122m for the company. In August 2021, the C shares were converted into ordinary shares on the basis of 0.6275 new ordinary shares for each C share held.

In total, PCFT has issued 207.6m ordinary shares since 30 November 2020.

Fund profile

Polar Capital Global Financials Trust (PCFT) has twin objectives of growing both investors’ income and their capital. Its global mandate makes it a useful alternative for UK-based investors looking to diversify their financials exposure.

PCFT launched on 1 July 2013 with a fixed life. In April 2020, in conjunction with a vote on prolonging the life of the trust, shareholders were offered a cash exit. Holders of 39.1% of PCFT’s then-issued share capital opted to sell their shares. The portfolio was reconstructed to facilitate this. Shareholders overwhelmingly approved an extension of the trust’s life beyond May 2020 and the trust now has an unlimited life, but with five-yearly tender offers, the first of which is scheduled for 2025.

Predominantly, the portfolio is invested in listed/quoted securities. The trust may have some exposure to unlisted/unquoted securities, but this is not expected to exceed 10% of total assets at the time of investment.

Since April 2020, the trust’s performance benchmark has been the MSCI All-Countries World Financials Net Total Return Index in sterling (MSCI ACWI Financials). A history of earlier benchmarks is given in previous notes. We have used MSCI ACWI Financials for comparison purposes in this note.

PCFT’s AIFM is Polar Capital LLP, which had AUM of £24.3bn at 31 December 2021 and employs 69 investment professionals, spread across offices in Europe, the US and Asia.

PCFT’s lead managers are Nick Brind, John Yakas and George Barrow.

Previous publications

QuotedData has published a number of notes on PCFT. Readers interested in further information about PCFT, such as investment process, fees, capital structure, trust life and the board, may wish to read our most recent annual overview note More to go for. You can read these by clicking the links in the table below or by visiting the QuotedData.com website.

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on Polar Capital Global Financials Trust Plc.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.