Whilst the ongoing conflicts in Ukraine and the Middle East have intensified, economic recovery in the US continues, with a rise in the S&P Global US composite PMI output index, tracking improvements in the outlook for both manufacturing and services. With May’s reading of 54.4, the index reached its highest level since April 2022 (figures above 50 are said to signal economic growth). This is not helpful for those hoping for interest rate cuts. For example, David M. Soloman, CEO of Goldman Sachs, is assuming that the central bank will not cut rates this year. However, The Federal Reserve has resisted speculation about potential rate increases.

‘The behaviour of the economy over the last six months is reassuring’ – Ben Broadbent, BOE

Against the backdrop of the Prime Minister’s call for a general election in July, British inflation fell to 2.3% for the year to April 2024, below readings for the US and Europe. As a result, the Bank of England has indicated a possible cut to interest rates this summer, which BNP Paribas expects will come in three rounds, starting in August, followed by later reductions in September and November. Despite progress on inflation, the UK has experienced a drop in living standards, with middle income households said to be 20% worse off than their German counterparts and 9% worse off than those in France.

China’s Shanghai Composite Index made small gains in May, supposedly in response to policies that have eased restrictions in the property market, a welcome change amidst the country’s ongoing housing crisis. Nevertheless, the IMF forecast on 29 May that Chinese growth will reach 5% this year, bolstered by a strong GDP in Q1. However, the report also expects these gains to slow to around 3.3% before the decade ends, due to factors such as the difficulty of sustaining an ageing population.

Investors might point to the huge outperformance of US earnings both against the rest of the world and against their own history

CG Asset Management

There is also tangible evidence that certain stocks in the UK market are cheap

CT UK Capital and Income Investment Trust

China stock markets have stabilised since January , as concerns about the Chinese property market and the broader economy eased

JPMorgan China Growth and Income

At a glance

| Exchange rate | 31 May 2024 | Change on month % | |

| Pound to US dollars | GBP / USD | 1.2742 | 2.0 |

| Pound to Euros | GBP / EUR | 1.1744 | 0.3 |

| US dollars to Japanese yen | USD / JPY | 157.31 | (0.3) |

| US dollars to Swiss francs | USD / CHF | 0.9023 | (1.9) |

| US dollars to Chinese renminbi | USD / CNY | 7.2418 | 0.0 |

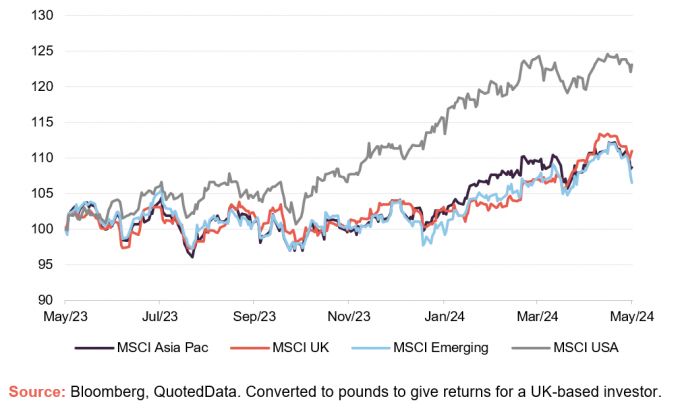

MSCI Indices (rebased to 100)

The US market led the way again over May, and once again Asian and emerging market indices were the laggards. The prospect of higher for longer rates in the US helped strengthen the US dollar relative to the pound but it is interesting that 10-year US treasury yields fell. The oil price retreated from its recent highs but gold continued to climb.

Time period 31 May 2023 to 31 May 2024

| Indicator | 31 May 2024 | Change on month % |

| Oil (Brent – US$ per barrel) | 81.62 | (7.1) |

| Gold (US$ per Troy ounce) | 2327.33 | 1.8 |

| US Treasuries 10-year yield | 4.50 | (3.9) |

| UK Gilts 10-year yield | 4.32 | (0.7) |

| German government bonds (Bunds) 10-year yield | 2.66 | 3.1 |

Global

James Harries, STS Global Income and Growth Trust, 21 May 2024

We continue to see equity markets as fully priced both in absolute terms and relative to their own history. While economic data, especially in the US, has been surprisingly resilient this has had the effect of making inflation more persistent and interest rate cuts, upon which recent exuberance partly rests, less likely. That this is happening following the largest and most rapid rise in interest rates in 40 years warrants a cautious approach.

We also question the longevity of the upward move in markets predicated on the rapid adoption of AI across the economy. Investors have a tendency, known as Amara’s Law, to over-estimate the effects of a new technology in the short term but underestimate it in the longer term. Consistent with this would be a lull between the rapid build out of the infrastructure currently being deployed, and productive AI usage in the real economy. The former may well be short-lived whereas the latter opportunity may well play out over years. If this turns out to be correct investors may face severe losses in the near term as valuations prove hard to justify. This happened to hardware manufacturers such as Alcatel and Lucent following the dot com boom in 2000.

. . . . . . . . . . .

Lawrench Burns, manager, Scottish Mortgage Investment Trust, 23 May 2024

Peeling Back the Layers of Artificial Intelligence:

In the summer of 2018, I was fortunate to spend two full days in Palo Alto talking with Professor Brian Arthur, one of the world’s most influential thinkers on technology and the economy. He told me he thought artificial intelligence (AI) would be the most significant invention since the Gutenberg printing press.

It was quite a statement, given that the printing press was invented over half a millennium ago. Before its invention, scribes painstakingly copied books by hand. Most were kept in monasteries chained to desks to prevent theft. Gutenberg’s invention made knowledge accessible, allowing ideas to spread like never before. It powered the Scientific Revolution, the Reformation, and countless political revolutions. Its impact was profound and immeasurable.

AI has the potential to impact the world similarly, but instead of externalising information, it is externalising intelligence. Making it available at rapidly decreasing cost anywhere in the world, instantly and on demand. That could be to write a high school student’s essay on the reign of Queen Victoria or to help a radiologist identify a cancerous tumour. Given that you can do even more with intelligence than you can with information, Brian Arthur concluded that, logically, AI’s impact should be even more significant than the printing press.

Fast-forward nearly six years, and his views look increasingly prescient. The latest AI models now very nearly match or exceed human performance in a growing number of tasks, including image classification, reading comprehension, visual reasoning and competition-level mathematics. The progress in surpassing human performance benchmarks has been so fast that the editor-in-chief of the AI Index recently commented that a decade ago, benchmarks would serve the AI community for five-to-ten years, but now they often become irrelevant in just a few years.

This pace of progress has been made possible by the continued exponential improvement of the three inputs that drive AI performance: compute, data and algorithms. A way of measuring these improvements is the number of parameters a model has. Each parameter is a variable that the model can adjust during the training to better predict outcomes. In 2018, when talking to Professor Arthur, GPT-1 had just been released, and it had 100 million parameters. Earlier this year, OpenAI released GPT-4, which is believed to have 1.7 trillion parameters, demonstrating the rapid change in model size and complexity in just a few years.

. . . . . . . . . . .

Kate Fox and Lee Qian, portfolio managers, Kesytone Positive Change, 2 May 2024

‘It’s not what you look at that matters, it’s what you see‘ – Henry David Thoreau

We can all look at inflation figures and the US Federal Reserve’s most recent meeting minutes; or at the horrendous footage of the conflicts in Ukraine and the Middle East; anyone can look at charts illustrating the rise in global temperatures or the exponential spread of viruses.

Looking around us we see a world facing significant environmental and social challenges; we see individuals and businesses innovating and developing new products and services or new business models that have the potential to address these global challenges. We see investment opportunities in businesses that are challenging the status quo. What we see is encapsulated in our dual objectives: to contribute towards a more sustainable, inclusive and healthier world while generating attractive investment returns for shareholders. To do this we endeavour to see what matters most, rather than being distracted by trying to predict short-term sentiment on interest rates or geopolitics.

It could be said that society is at a watershed moment in time, faced with the choice of continuing along the path we are on, or having the bravery, ambition and determined optimism needed to help steer us onto a more sustainable and inclusive trajectory.

This watershed moment is rich with investment opportunities for the brave and ambitious. Some interesting areas we are exploring include the electrification of mining equipment, new treatments for obesity, and companies helping improve access to medication.

. . . . . . . . . . .

UK

Ian Pyle and Charles Luke, Shires Income. 22 May 2024

Making forecasts for the next 12 months is always difficult, and especially at the moment. In the last three months we have seen interest rate expectations move back and forward, with global markets pushed to new highs before retreating again. At this time, it seems that interest rates will need to stay higher for longer to counteract inflation and continued strong growth from the US economy – but which direction we will be heading a year from now is hard to guess. Economic policy and market sentiment is very data dependent, and the data can change quickly. The added complication of a record year for democratic elections globally, including the US and the UK, makes the outlook even cloudier.

Stretching our time horizon perhaps makes the task easier. Interest rates are higher than they have been for some time and although they are not going back to the extreme lows we have seen in the last decade, the likelihood is that the direction of travel is back towards an equilibrium rate of 3-3.5% within our investment timeframe. Rates at that level should allow for a more normal market, with equity performance broadening out, something we have started to see in March and April 2024. Market performance in the past year has been unusually concentrated – history would indicate that is unlikely to remain the case forever. Similarly, the discount on UK equities is historically high, providing a margin of safety. Without a re-rating of the benchmark index we will continue to see UK companies acquired by international peers.

. . . . . . . . . . .

Sarika Patel, chair, abrdn Equity Income Trust, 13 May 2024

The geopolitical and macroeconomic backdrop has led to a period of volatile performance for UK equities. Although expectations are growing for an interest rate cut in June, we expect any decreases to be slower than analysts originally forecast. Against this backdrop, the Investment Manager remains focused on companies that have the ability to generate growth and strong cash flows which can then be used to pay sustainable dividends.

Since the beginning of 2024 there has been significant press commentary highlighting how undervalued the UK is relative to other markets and, within the UK, how mid- and small-cap companies are undervalued relative to large-caps. The Company’s index-agnostic investment approach, coupled with the manager’s focus on valuation, means that the portfolio is well positioned to benefit from any resurgent interest in the UK equity market, either via increased investor allocations or merger activity. Since February, three of our holdings have received bid approaches at substantial premiums to the then existing share prices, underlining the fact that the UK’s low valuations are being noticed overseas.

Over time, dividends have tended to represent a high proportion of total return from UK equities. Income stocks have been out of favour in recent years as investors have favoured growth. This remained true during the period as a whole, although the Investment Manager observed a pronounced shift towards value stocks towards the end of the period, which coincided with a recovery in our relative performance.

Having weathered recent crises, our Investment Manager believes that our holdings have demonstrated a level of resilience not reflected in their valuations. This implies low expectations, which provides the potential for share prices to respond favourably to further evidence of solid cash flows and dividends in the months ahead.

. . . . . . . . . . .

Jane Lewis, CT UK Capital and Income Investment Trust, 28 May 2024

The UK stock market has made reasonable gains since the start of our financial year. Nevertheless, UK equities have performed less well and are valued at a lower level than many other international markets. This certainly provides scope for additional progress.

There is also tangible evidence that certain stocks in the UK market are cheap. The increasing number of corporate bids and acquisitions within the UK stock market gives first-hand evidence that acquirors, whether they be industry peers or financial buyers, recognise the value available and are prepared to pay up for it, with take-over premiums being at levels substantially above pre-bid share prices.

. . . . . . . . . . .

Asia Pacific

Schorder Oriental Income Fund, 23 May 2024

Most of 2023 and the start of this year have been disappointing for Asian markets relative to global equities, with the region lagging developed markets. Much of this performance gap was driven by a divergence in valuation multiples through the year, with China and Hong Kong in particular experiencing significant de-rating for reasons outlined above.

Geopolitics has been another concern overhanging the region, with tensions around US-China relations, Taiwan, Ukraine and most recently the Middle East all contributing to investor caution. Positively, despite having the potential to escalate cross-strait tensions, the recent Taiwanese election passed off uneventfully with a result which was broadly in line with expectations. However, later in the year, we have the US elections and there remains the potential for heightened market volatility as these approach, where rhetoric on China is likely to heat up once again after a more restrained period recently. This can already be seen by a number of bills and policies that are aimed at restricting Chinese growth and influence.

Nevertheless, there are some reasons to be a little more optimistic on the outlook for the Chinese market in 2024. Most obviously, consensus expectations are now very low, compared to the post-reopening euphoria seen in the market at the start of 2023, and this is reflected in lower valuations than a year ago. There is clearly therefore scope for better market performance, should growth surprise on the upside. Although sentiment around the property market remains very poor, activity in that industry is already subdued, and consumer confidence is again at extremely depressed levels. That is not to say that there can’t be further deterioration, of course, but a large degree of pessimism has already been priced in at this point. Given our underweight to China, we continue to look for higher-quality stocks that have sold off to levels which look attractive on a long-term view. However, the reality is that it has been hard for us to find new names that are attractive from an income perspective as many concerns remain when it comes to investing in the Chinese market – poor capital allocation, structurally lower nominal growth, unpredictable regulatory and policy shifts, high debt levels – and we remain significantly underweight the market.

We retain our preference for Hong Kong, where valuations are generally lower and shareholder returns are more of a focus for management teams. Although visitor numbers to Hong Kong have picked up significantly since the borders re-opened, the US dollar linked exchange rate system has meant that interest rates have followed the path of US rates which has depressed activity. If US rates do start to ease, the corollary for Hong Kong is expected to be that monetary conditions are likely to also improve which should be positive for the market.

Australia continues to be a market that has historically offered great long-term returns, in large part due to the reinvestment of dividends, but valuations are not obviously cheap versus the rest of the region, given its strong outperformance. Our principal exposure continues to be through the materials and financial sectors, but a de-rating of the health care sector and underperformance of consumer staples has seen us add to exposure there. More recently, the prospects of a soft landing have also seen banks perform strongly, which has led us to reduce our exposure to them. In the South-East Asian region, we are most exposed to Singapore, which is benefitting from its increasing status as a regional wealth management hub, as well as the growth of its ASEAN neighbours.

As noted above, the last 18 months or so have been tough for many Asian exporters, with excess inventories piling up in a variety of sectors whether in bicycles, textiles, power tools or semiconductors, to name a few. Of course, the demand outlook for Asian exports in 2024 remains uncertain, but the supply-side response of manufacturers, which is more under their control (i.e. cutting capital expenditure and production), has led to encouraging progress on destocking across many areas. Should expectations of a US “soft landing” come to pass, that would likely be positive for Asian goods exports, which historically has been supportive of Asian markets.

We remain overweight in IT, the best performing sector in 2023, as valuations moved higher on the back of normalising inventories, as well as the impact of AI on industry growth rates. Despite this, we view our holdings as still trading at relatively attractive valuations given the long-term growth outlook for the sector.

We also remain overweight to financials – a diverse sector spanning not only banks, but also insurers and exchange companies. The banks we own are generally well-capitalised, with strong deposit franchises. Many of our holdings are in more mature markets, such as Singapore, which in general trade at attractive valuations and decent dividend yields, but also have exposure to their faster growing hinterland. Direct exposure to faster growing markets, where credit penetration is relatively low, includes Indonesia. We also continue to be overweight Real Estate, albeit we have reduced the size of that overweight.

We have narrowed some of the underweights in those areas of the market typically perceived as more defensive, including consumer staples, health care and utilities. Given underperformance, relative valuations here are starting to look more interesting.

Korea has recently benefitted from an expectation that we might see an improvement in shareholder returns, similar to that which has been seen in Japan over the last few years. Korea has always looked cheap versus the region, and this in part has been due to perceived poor corporate governance and low shareholder returns. The government’s ‘Corporate Value-up’ programme is meant to improve that, and companies that could benefit from that have performed better.

Turning to the wider region, the dividend yield looks relatively attractive at the moment versus a global benchmark. In the medium to long term, dividends tend to follow earnings and earnings have recovered materially from the Covid lows. However, earnings growth during 2023 has faced some ongoing pressures, as has been seen in earnings revisions trends, particularly in some of the more cyclical areas (areas where earnings follow the cycles of the economy) such as amongst the energy and resource names. This year, if consensus earnings are anything to go by, earnings growth should recover which should be a positive, albeit we would caution that there is risk to these earnings numbers. Still, we believe overall payout ratios in Asia do not look extended in an absolute sense and corporates in Asia remain relatively lowly geared (a relatively low rate of debt) which should be supportive of dividends. The arguably more significant impact on dividends received comes from the performance of Sterling, which was quite strong over the past 12 months, thus impacting the progression of dividend growth.

Overall, aggregate valuations for the region are now trading at around long-term averages. However, this masks a large variation across individual markets where Singapore, China and Hong Kong, amongst others, look relatively cheap versus history. Historically, easing global interest rates and a weaker US dollar have been positive for Asia given the knock-on impact to domestic monetary conditions. Therefore, if rates do start to fall later this year, and it should be said that recent expectations have seen the timings for cuts shift further out, it could be a potential catalyst for the markets given where starting valuations are.

So in conclusion, although uncertainties remain around China’s outlook, the region’s inexpensive aggregate valuations, alongside potentially easing global interest rates, a weaker US dollar and a recovering goods export cycle does set up a more constructive backdrop for Asian markets in 2024, barring a global hard landing, or a more extreme geopolitical risk event.

. . . . . . . . . . .

Ayaz Ebrahim and Robert Lloyd, portfolio managers, JPMorgan Asia Growth and Income, 29 May 2024

This year began with much discussion about falling US inflation, and the prospect that this would allow the US Fed to ease policy, thereby increasing the likelihood of a soft landing, rather than the recession many feared. However, economic data released during the first three months of 2024 proved more resilient than expected. Corporate cash flows have been healthy, companies have insulated themselves from the worst effects of high interest rates, and real rates are lower than in previous cycles. As a result, the economic and corporate environment has been sufficiently robust to withstand the impact of higher nominal rates. Investors revised their forecasts for inflation and near-term rate cuts accordingly. Additionally, as Jamie Dimon (Chairman & CEO of JPMorgan Chase Bank) noted in his annual letter to shareholders, there is a growing need for spending to support the transition to a net zero economy, the restructuring of global supply chains and rising healthcare costs. All these factors could compound the stickiness of inflation. The trajectory of yields on ten-year US Treasuries has mapped the path of inflation expectations over recent months. Yields fell from 5% in October 2023, to a low of 3.8% in January of 2024, before rising to 4.5% at the time of writing.

In Asia, market attention has focused on the poor performance of Chinese equities, especially relative to developed markets. Chinese equities declined by 17% in the five years to the end of 2023, while US and European large cap stocks have risen by 107% and 60% respectively over this period. The major problem facing China is the enormous misallocation of capital into the residential property sector. Home ownership stands at 90%, and 20% of households own more than one home. However, the sector is now struggling with massive oversupply and declining sales, and several developers have been bankrupted by heavy debt burdens. The challenging outlook for residential property exacerbated by demographic trends has weighed on Chinese consumer sentiment, which is at an all-time low. On the positive side, poor equity market sentiment has resulted in attractive valuations. With lower Chinese interest rates likely to stimulate economic activity, there is considerable scope for a recovery in valuations, if stronger growth lifts corporate earnings.

In sharp contrast to the current malaise in the Chinese market, the backdrop for markets in India and Taiwan appears extremely positive. In these markets, high valuations are the stumbling block for many investors, especially in India, where the index is trading close to all-time high valuations, as measured on a price to book basis. As noted above, this market is being buoyed by India’s strong economic performance. Following a contraction in 2021, India’s GDP growth exceeded 9% in 2022 and 7% in 2023 in real terms, and is expected to have reached a similar level for the fiscal year ending March 2024, thanks to rising urban consumption, supported by wage growth, and a surge in capital expenditure. It is widely expected that Prime Minister Modi will win the current parliamentary elections.

The Taiwanese market has been led by the growing earnings of its largest company, TSMC, and broad swathes of the technology sector that are seen as beneficiaries of rising tech spending, especially in AI-related areas. With respect to TMSC, recent company meetings and industry analysis suggest that the company has consolidated its global leadership in the fabrication of the most advanced semiconductor chips. Within its high performance computing business, it is possible that revenues related to AI processing chips could rise to 20% of total revenues within the next three years, compared to below 10% today.

We are excited by the Korean authorities’ efforts to replicate Japan’s successful corporate governance reform agenda. Korea’s so-called ‘Corporate Value-Up Program’ encourages companies to take steps to improve their chronic low valuations, due to the risk of being ‘named and shamed’ if they fail to act. In addition, the authorities plan to make supportive regulatory changes aimed at protecting minority shareholders from poor governance practices. While questions remain regarding the authorities’ commitment to corporate governance reforms, the measures have the support of some 14 million individual investors, who together account for one third of eligible voters. This reform program is part of broader efforts by Korean regulators and various capital market leaders to help households create wealth through investment in financial assets. The plan also incorporates proposals for tax incentives, including the removal of capital gains tax, which will take effect from 2025.

Despite persistent uncertainties related to global and regional geo-political tensions, Asia’s powerful combination of strong growth, innovation, favourable structural trends, and attractive valuations in at least in some key markets, underpins our belief that Asian equity markets continue to provide many attractive investment opportunities.

. . . . . . . . . . .

China/Greater China

Alexandra Mackesy, chairman, JPMorgan China Growth and Income, 29 May 2024

China stock markets have stabilised since January, as concerns about the Chinese property market and the broader economy eased. Investors have also been encouraged by the Chinese government’s indications of a planned economic stimulus programme and continued evidence of companies raising dividend payouts and buying back shares.

As a Board, we are mindful that challenges remain. While the Chinese government has recently confirmed its GDP forecast of 5% for 2024, domestic consumer demand is still subdued. While recent talks between China and US have been encouraging, an escalation in anti-Chinese rhetoric ahead of this year’s US presidential election cannot be ruled out. Concerns also remain about shifting patterns in global supply chains and the ongoing conflicts in Ukraine and the Middle East, which may also dampen market sentiment in the short term. That said, our Portfolio Managers are increasingly optimistic about the prospects for Chinese equities over the coming year.

. . . . . . . . . . .

Rebecca Jiang, Howard Wang, and Li Tan, managers JPMorgan China Growth and Income

We believe the worst is probably behind us both in terms of the slowdown of China’s economic growth, and the derating of Chinese equities. There are good reasons to view the outlook more positively. For a start, we see some signs of a domestic economic recovery. At the same time, exports have remained resilient throughout the economic downturn. Several domestically focused internet and consumer companies have become even more cash generative, thanks to improved operating efficiencies and reductions of non-core investments. Like the SOEs, they are returning more cash to shareholders. The property sector is also showing some signs of stabilising. After declining for two years, we believe sales of new homes are now close to a level justified by long-term trends in population growth and new family formation. The sector’s drag on GDP is also diminishing, although it will still detract from growth this year. We expect 2024 to bring more local stimulus policies to support housing demand, and perhaps even a comprehensive clean-up of developers’ bad loans. Contagion risks to the financial sector are contained at the moment, helped by provisions made in the past and decline in deposit rates. In the solar and electric vehicle sectors, oversupply should ease gradually as some weaker, poorly-funded suppliers struggle to compete and eventually exit the market.

Valuations are now at very attractive levels. Using the conservative valuation metrics of price to book, the ratio of the MSCI China Index is 1.22x, a level only seen during SARS in 2003 and China’s 2016 slowdown. Chinese stock markets are now priced more cheaply than they were during the 2008-2009 Global Financial Crisis. Geopolitics are partially to blame, but we believe this dampener on sentiment and risk appetite is abating. In the wake of several recent high level meetings between US and Chinese leaders and officials, it is now widely accepted that China and US will continue to compete in various areas, irrespective of which candidate wins the US Presidency. Direct confrontation and war is highly unlikely, as both parties agree that this would be counter to their best interests. Concerns regarding tensions across the Taiwan Strait also seem to have eased after Taiwan’s presidential election proceeded peacefully. The victor, William Lai of the pro-independence Democratic Progressive Party, favours preserving Taiwan’s current political status. As the election did not deliver a majority to any one party, it is highly unlikely that Taiwan’s legislature will pass any radical resolution imposing pressure on the cross-strait relationship.

Valuations may be boosted over the medium term by official pressure to improve shareholder returns. Our portfolio should benefit accordingly. While many of our cash rich holdings are already increasing payout ratios and conducting buybacks, there is scope for some to do even more. While challenges undoubtedly remain, given the amount of risk, disappointment and possible pessimism priced into the market at current levels, we see potential for upside surprises to results and valuations in the next twelve months, possibly encouraged by ongoing market support from government financial institutions.

For all these reasons, we are becoming more optimistic about the prospects for Chinese equities over the coming financial year. We are determined to grasp the opportunities created by an economic and market recovery to claw back lost performance, and we look forward to reporting on the company’s progress as our portfolio companies realise their true worth.

. . . . . . . . . . .

Country specialist

Weiss Korea Opportunity Fund, 2 May 2024

There is increasing concern that North Korea could carry out some form of destabilising provocation against South Korea in 2024, and, as a result, WKOF has increased its exposure to Korean sovereign bond credit default swap protection. While it seems highly unlikely that an attack would occur that could trigger a large-scale military conflict, we consider that there is an increased likelihood of some form of action intended to sow political division in Korea and increase national security distractions in China and the US. In recent months, political and military tension in the Korean Peninsula have continued to escalate, as North Korea has exhibited signs of increased aggression. In January, North Korea fired artillery shells towards the border islands of South Korea, tested more ballistic missiles and followed such provocations with a declaration that “South Korea [is] its principal enemy”. In February 2024, North Korea’s parliament announced it had abolished laws that allow for economic cooperation with South Korea, further signalling an ongoing deterioration of the relationship between the Koreas. This announcement followed the discovery that North Korea demolished The Monument to the Three Charts, a 30-meter monument that had stood as a symbol of unification between the Koreas since 2001. With upcoming legislative elections and presidential elections in South Korea and in the United States, respectively, North Korea is expected to intensify their provocations throughout the year.

South Korea’s economy, the fourth largest in Asia, expanded 1.4% in 2023. While this year’s growth was the country’s lowest since 2020, the growth during the fourth quarter suggests that the domestic economy remains on the road to recovery. In 2023, South Korea’s annual exports declined by 7.4% while annual imports decreased by 12.1%. The decline in exports has partially been attributed to decreased demand from China, to which exports fell by 2.9% year over year. After stagnating for sixteen months, chip exports began to rise in November 2023 with exports jumping by 21.8% on a year on year basis during December.

South Korea’s 3.5% policy interest rate or bank base rate, which has been unchanged since January 2023, remains at its 15-year high. Following the Bank of Korea’s (“BOK”) November 2023 meeting, it raised its inflation target from 2.4% to 2.6% and, once again decided to leave its policy interest rate unchanged following its most recent meeting in January. In the 2023 Half-Yearly Report, we discussed the Bank of Korea’s concern about levels of household debt, which stood at 103% of GDP as of 30 June 2023. At 30 September 2023, South Korea’s household debt hit a new record, despite the restrictive interest rate policy described above, so will most likely remain an area of focus for the BOK. Governor Rhee has previously suggested that, should household debt levels continue to rise, the BOK might consider subsequent rate hikes.

. . . . . . . . . . .

Europe

Stefan Gries and Alexandra Dangoor, BlackRock Greater Europe Investment Trust, 2 May 2024

The outlook for Europe is mixed in 2024 but European equities surprised positively last year and this could be repeated. Stock markets will continue to be dominated by interest rates and European stocks have been boosted by expectations of interest rate cuts but the ECB is likely to be cautious and will presumably take its time in adjusting policy despite Eurozone inflation falling at a brisk pace. There are additional risks, aside from the prospect of recession: operating margins for European stocks hit record highs in 2023 which may not be replicated this year, continued weak growth in China and less exposure to artificial intelligence, a key driver for US stocks.

However, our portfolio managers are cautiously optimistic as the ECB should be able to start cutting interest rates later in the year as inflationary pressures continue to ease. The surge in commodity prices driven by the war in Ukraine and rise in goods prices driven by the supply-chain disruptions during the COVID-19 pandemic are largely in the past. Additionally, the earnings situation of most companies in Europe has significantly improved compared to 2022 and the region’s stocks remain lowly valued versus history and on an international basis, suggesting there could still be scope for share price gains in 2024.

European equities delivered very strong returns over the last six months despite a backdrop of cautious sentiment given concerns over a potential recession, weaker China macro data and geopolitical risks. The asset class remains under-owned by investors and we observe a generally defensive positioning.

Our optimism entering the period – reflected in a pro-cyclical portfolio positioning – was rewarded as inflation fell closer to central bank targets and wages began growing in real terms, while corporate earnings came through better than the market had expected. Technology, industrials, financials and consumer discretionary sectors led the strong market rally, while defensive sectors including consumer staples and utilities underperformed.

. . . . . . . . . . .

Biotechnology & Healthcare

Ailsa Craig and Marek Poszepczynski, fund managers, International Biotechnology Trust, 7 May 2024

Overall, the biotechnology sector experienced a mixed performance during the period under review, declining during the first couple of months before staging a strong recovery through the last few weeks of 2023 and into the start of this year. Underlying this have been some encouraging and potentially significant developments.

Consolidation in the sector has continued, with many companies undergoing restructuring or M&A. This has been driven by a desire among large pharmaceutical companies to fill the revenue gap that stems from their impending patent expiries and the impact of implementation of the US Inflation Reduction Act. 2023 saw a record value of M&A transactions in the industry. This has presented opportunities for active investors to add value by capitalising on potential efficiencies, the gradual reshaping of the industry landscape and raises the prospect of improved productivity going forward.

Meanwhile, innovation in the biotechnology industry has continued at a rapid pace. This is reflected in the record number of new clinical trials being initiated and in the number of novel drug approvals, which rose to 55 in 2023, the highest level since 2018.

The accelerating pace of innovation is gradually being acknowledged by the stock market, which is starting to reward smaller, earlier-stage biotechnology companies with higher valuations. This is a sign of renewed investor appetite for the sector after a period in which “safer haven”, large established biotechnology companies with slower growth but stable cash flows, had been more in favour. With smaller cap biotechnology valuations closely correlated to US interest rates, this may also reflect the anticipated change in direction of US monetary policy signalled by the Federal Reserve.

Additionally, after a long period of subdued equity fundraising, we are seeing evidence of a recovery in financing activity in the biotechnology sector, particularly in the first months of 2024. There has been a nascent recovery in IPOs, as companies take advantage of the increasingly favourable market conditions to access public capital. Investors have also backed companies that have delivered positive clinical data, providing equity through successful secondary fundraising, which provides the funding these businesses need to take their drugs to the next stage of development. Access to capital underpins more investment in research going forward, fuelling innovation over the year ahead.

. . . . . . . . . . .

James Douglas and Gareth Powell, co-managers, Polar Capital Global Healthcare Trust, 15 May 2024

Near-term considerations: Recession risks dissipating?

What a difference a year makes, with the market now adopting a more optimistic stance on global growth while heavily discounting fears of a full-blown recession. That, coupled with expectations that interest rates will decline in the next 12 months, has driven a greater appetite for risk among equity investors. Thankfully, the healthcare sector is composed of a broad and diversified universe of businesses with many different end-markets and operating models across the market-capitalisation spectrum. Within that, the sector is heavily populated with high-growth, high terminal value companies that can flourish in a risk-on environment. Further, there are pockets of healthcare, for example dental and ophthalmology, that are sensitive to economic cyclicality. Conversely, if the market pivots to a more defensive stance, the more mature mega-capitalisation companies, with high gross and operating margins, will become more attractive on a relative basis.

Key themes: Innovation, emerging markets and artificial intelligence

In last year’s half-year report, we outlined three key investment themes which offered the potential for significant returns. As a reminder, those themes were utilisation, delivery disruption and consolidation and were influential in driving the Company’s positioning.

With regards to utilisation, calendar 2023 witnessed a marked pickup in patient activity which was a material positive for not only medical device and supplies companies, but also for healthcare providers and facilities. In contrast, rising levels of utilisation and consumption of products and services was a challenge for the healthcare insurance companies paying medical bills. A long-term, durable growth driver, the delivery of healthcare continues to be disrupted as healthcare systems globally look to generate efficiencies by treating patients in lower-cost settings such as surgery day centres and Ambulatory Surgery Centres. A trend that accelerated during the pandemic, this direction of travel is expected to continue for many years to come. Last but not least, the healthcare sector has seen an increase in M&A activity, mostly in the area of biopharmaceuticals as well as in the medical device arena.

The aforementioned themes will continue to be very relevant in the medium and long term, but as we highlighted in last year’s annual report for the year ended 30 September 2023, it is the three additional themes of innovation, emerging markets and artificial intelligence that are offering exciting, near-term investment opportunities and are influencing the Company’s current positioning.

Innovation: Driving new product cycles

Innovation is the lifeblood of many industries, none more so than healthcare and it appears to be flourishing. Superior understanding of human biology and the drivers of disease are allowing the biopharmaceutical industry to produce novel, targeted strategies to address significant unmet medical needs. Underpinning that view is the fact that in 2023 the US FDA approved 55 New Molecular Entities, which represents the second-best approval rate in 30 years. More importantly, perhaps, is the breadth of innovation that spans areas such as infectious disease, neurological conditions, opioid abuse, cardiovascular disorders and respiratory diseases. 2023 also saw important breakthroughs for patients with rare diseases and cancers.

While it is important to recognise and applaud the terrific pace of innovation, it is also essential to focus on the commercial landscape. Clearly not an exhaustive list, but the images below highlight recent breakthroughs in areas where there is not only a high unmet need but also large, addressable markets. Obesity, atrial fibrillation (an irregular, often abnormally high, heart rate) and Alzheimer’s disease are all huge markets but the medical breakthroughs in respiratory diseases are also significant. This is not just for a disease like Chronic Obstructive Pulmonary Disease (COPD, or smoker’s cough) but also for Respiratory Syncytial Virus (often referred to as simply RSV) which can impact both the elderly and new-born babies.

. . . . . . . . . . .

Private Equity

Richard Hickman, managing director, HarbourVest Global Private Equity, 30 May 2024

We expect 2024 to be a better year for private markets than last year. The improvements in the investment environment seen during Q4 of 2023 have continued in the early months of this year. Equity indices, including the Nasdaq, have reached new highs, and confidence in the AI revolution is growing. Crucially for private markets, IPOs are re-starting. The expected listing of Klarna, one of Europe’s largest fintech companies, could provide a significant boost to both sentiment and activity. Shein, an online fashion retailer, has filed for IPO this year, with management evaluating a number of potential listing venues. M&A activity is also picking up, as a stabilising macro environment facilitates agreement on pricing, and scepticism over NAVs appears to be abating. This paves the way for a pick-up in exits in H2, which, if realised, will provide further, much-needed validation of NAVs. Venture and growth could also generate some real surprises in AI-related areas such as machine learning and synthetic biology.

Listed private equity investment companies are still under pressure from several quarters: outflows from open-ended UK equity funds and ETFs continue, asset managers are striving to reduce reported look-through costs; while discount volatility and a reduced appetite for risk are still limiting demand for investment companies more broadly.

. . . . . . . . . . .

Flexible investment

Peter Spiller, Alastair Laing and Christopher Clothier, CG Asset Management Limited, 24 May 2024

If we are right that the world is in a structurally more inflationary environment, then the outlook for nominal bonds remains poor. This is exacerbated by the fiscal situation in developed countries. The average budget deficit across the G8 is forecast to be 4.6% in 2025, so the supply of bonds will increase while central banks continue to reduce their balance sheets. Added to which there is no imminent sign of recession, nor any discernible term premium in longer dated bonds.

The outlook for index-linked bonds is more nuanced. Real yields in the US are above 2% across the length of the treasury curve. It appears that the sustainable growth rate of the US economy has risen materially which suggests that these real interest rates are close to fair value. However, the fiscal position is poor and looks set to deteriorate. Real interest rates at these levels will not be sustainable if there is no prospect of bringing fiscal deficits under control. Left unchecked, financial repression – characterised by negative real interest rates – will be necessary. What is less certain is the path. Index-linked bonds trade in sympathy with nominal bonds. If nominal bonds are weak, as seems plausible, index-linked will most likely suffer with them. Yet the long-term prospects look fair or, should financial repression be enacted, excellent.

Risk assets present a similar conundrum. US equities have rarely been so expensive. The cyclically adjusted PE ratio stands at 34x today, it reached 38x during the “everything bubble” of 2021 and otherwise was only higher during the technology bubble. Market breadth has fallen dramatically as returns are increasingly concentrated in the so-called Magnificent Seven. Microsoft trades on a free cash flow yield of 1.7%. To deliver acceptable returns, from this starting valuation, it needs to be able to grow its free cashflow between 8-10% per annum in perpetuity.

In attempting to justify these high prices, investors might point to the huge outperformance of US earnings both against the rest of the world and against their own history. While tempting to attribute this to American exceptionalism, that is only part of the story. More significant in recent years has been the contribution from collapsing interest expenses and corporation tax rates. Having termed out their debt, it may be some years before interest expenses rise meaningfully, but it seems unlikely they can fall. With the US running ever larger fiscal deficits, we would not expect corporation tax to continue to fall. But with the possibility of a Trump presidency, nothing should be ruled out. In any event, it seems that this large tailwind to earnings will become a headwind.

While the prospect for US equities looks poor, the outlook for investment trusts is the most attractive that it has been for years. Discounts on investment trusts are the widest they have been since the global financial crisis. Furthermore, these discounts are broad based and include the larger, more liquid high quality trusts. In response we have added to our investment trust holdings, partly financed by sales of ETFs and partly from cash. We are optimistic that these holdings will provide better returns than broader equity markets.

. . . . . . . . . . .

Dan Higgins, Marylebone Partners, 29 May 2024

We can see reasons why markets could rise further over the rest of 2024. Inflation is seemingly under control, the global economy is in reasonable shape, and corporate earnings are fairly robust. Moreover, financial conditions are broadly supportive, and allocators are more sanguine about the economy even as they adjust to a more realistic outlook for interest rates.

However, this is no time for complacency. Potential risks on the horizon include a record number of political elections, signs of stress in Commercial Real Estate, and the troubling geopolitical situation in the Middle East.

Although valuation alone is rarely the trigger for a new bear market, headline multiples for equity markets are full once again. This leaves some ‘long-duration’ growth stocks susceptible to a de-rating if inflation proves stickier than expected.

. . . . . . . . . . .

Property

Mark Allan, chief executive, Land Securities

For much of the decade leading up to 2022, creating value in real estate was often about leveraging up a spread between rental yields and ultra-low borrowing costs or picking high-level sector themes. The significant rise in cost of capital across the globe has not only changed the former but also the latter, as shown by the challenges faced by low-margin online retail models and the shift back to physical retail. As such, irrespective of sector, quality has become a much more important driver of future performance, which means it can be misleading to look at market averages. Indeed, even though market-wide vacancy is elevated, with London offices at 8.8%, retail at 12% and even logistics at 7.8% now, the best assets in each of these sectors have little vacancy and so continue to show good rental growth.

This provides a critical underpin for capital values. The outlook for interest rates is more balanced now than it has been for a couple of years, but we remain of the view that it is unlikely that rates will come down sharply from current levels. In what will therefore likely remain a higher nominal rate environment, we think yields for assets which have inherent income growth and therefore provide a real income stream look attractive, yet for most assets which lack this growth, we think the risk to values remains down.

. . . . . . . . . . .

Simon Carter, chief executive, British Land

In the past 12 months macroeconomic and geopolitical uncertainty has remained high. However, inflation has declined, and markets are now anticipating interest rate cuts. Consequently, yield expansion in the portfolio slowed significantly in the second half and strong rental growth meant values were broadly flat.

Our base case is that we will be operating in a more supportive economic environment over the next 12 months than we have seen in the last two years. With inflation lower, the next move in the base rate is likely to be down rather than up and although UK GDP growth is expected to be modest at best, most forecasts are for it to be positive. Unemployment is expected to remain low which should be supportive of demand for best-in-class workspace at our campuses as businesses continue to focus on attracting and retaining talent in a competitive jobs market. The return of real wage growth should provide valuable breathing space for consumers, supporting our retail parks business.

. . . . . . . . . . .

Michael Morris, chief executive, Picton Property

During the year there has been lacklustre transactional activity, due to the increased cost of debt and falling capital values. MSCI recorded £40.1bn of investment transactions for the year to March 2024, which is 27% down on the £55.4bn recorded for the year to March 2023 and 51% lower than the £82.1bn transacted in the year to March 2022. Transactions in the industrial sector had the highest weighting, comprising 24% of the total.

With interest rates anticipated to reduce from the second half of 2024 and increased liquidity in the lending market, it is expected that trading activity will begin to pick up as we head towards the end of the year.

The UK economy appears to be improving, with inflation falling and the Bank of England widely anticipated to commence base rate cuts in the second half of 2024. This expected reduction in interest rates should continue the positive momentum in terms of improving business, investor and consumer confidence, as the cost of debt and cost of living pressures continue to ease.

Despite increases in long-term UK Government bond yields over the year, paralleled by similar rises in property yields, there are signs of stabilisation emerging. The short to medium-term economic outlook offers signs of cautious optimism. Downside risks remain, particularly in relation to geopolitical instability in the Middle East and eastern Europe, which could potentially fuel inflationary pressures. The timing of and scale of the Bank of England’s interest rate cuts are highly dependent on the trajectory of inflation and strength of the labour market in the coming months.

. . . . . . . . . . .

Jonathan Murphy, chief executive, Assura

The UK is facing a healthcare crisis, and the nation’s ageing population combined with unrelenting hospital waiting lists continues to drive significant demand for investment in healthcare infrastructure.

This demand for investment in improved and more diverse health facilities has received cross-party political support, with countless reports highlighting the need to move services out of hospital and tackle health inequalities within communities in a cost-effective way. 2024 is set to be an election year and the NHS will undoubtedly be a key election topic, already having been granted considerable air time by all the major political parties in recent months. Whichever party is in Government post-election, our expectation is that there will continue be a desire to demonstrate improvements in health services during the next parliamentary term. Investment in community healthcare is an obvious way to achieve this – easing pressure on the NHS, benefiting patients, focusing on prevention rather than treatment, and ultimately making the health system more efficient over the long-term. The primary care market remains a challenging environment in which to achieve external growth, with delays in agreeing the rents required for new build developments to be commercially viable. The underlying demand for new buildings remains high, so we are confident that this position will unlock in due course, and pockets of opportunity have started to emerge in some regions

. . . . . . . . . . .

Toby Courtauld, chief executive, Great Portland Estates

Whilst macro-economic volatility persists, our confidence and belief in London remains. Unrivalled as one of the world’s most attractive and diverse mixed-use locations, London is a true global city. Central London is busy and office workers have returned, with hybrid working now the norm. 74% of our portfolio is in the West End and 93% located close to Elizabeth line stations. Looking forward, we anticipate supportive rental conditions for the best spaces and are optimistic for further rental growth.

With customers increasingly demanding the very best, sustainable spaces, they are competing in a market increasingly starved of new, Grade A supply, putting further upward pressure on prime rents.

Despite a weak macro-economic backdrop, we anticipate that current occupational trends will continue. We expect that the demand for the best spaces will outstrip supply and the trend for smaller spaces to be provided on a flexible basis to increasingly become the norm. Buildings that are unable to meet this evolving demand, particularly in the face of competition from elevated secondary supply, will underperform. The gap between the best and the rest is likely to widen further.

. . . . . . . . . . .

Phil Redding, chief executive, Tritax EuroBox

Market sentiment has continued to be influenced by macro-economic factors, with the continuation of restrictive monetary conditions and uncertainty on the timing of interest rate cuts, leading many investors to adopt a “wait-and-see” approach. This environment has led to valuations across some of our markets to drift lower during the period. However, with inflation in Continental Europe on a downward trajectory and expectations that interest rates will also turn lower, this should provide a more supportive backdrop for our markets over the remainder of the year.

While investment volumes have remained subdued, more recently we have seen evidence of activity picking up, particularly from those investors with high conviction on the sector’s long-term structural drivers and strong market fundamentals. The reported up-tick in investment volumes during the period reflects this trend and is also an encouraging sign that activity should gain momentum through the year and into 2025. However, stability and valuation improvement will likely remain dependent on the extent and timing of Central Bank actions in the near term.

Occupier markets in Continental Europe have also not been immune to the more challenging economic outlook, with take-up declining, albeit off the back of three very strong years through the pandemic. Demand remains broad-based but some occupiers are becoming more cautious, and decision-making is taking longer.

The significant decline in development pipelines towards the end of last year has mitigated to a degree this fall in demand, with average vacancy levels only increasing moderately in most markets. Increases in country averages also mask a divergence between core markets, that remain very tight, and peripheral markets, where speculative development is taking longer to lease up. Overall, occupier market fundamentals remain robust and continue to support positive rental growth.

. . . . . . . . . . .

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it. Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.