Economic and Political Monthly Roundup

Investment companies | Monthly | July 2023

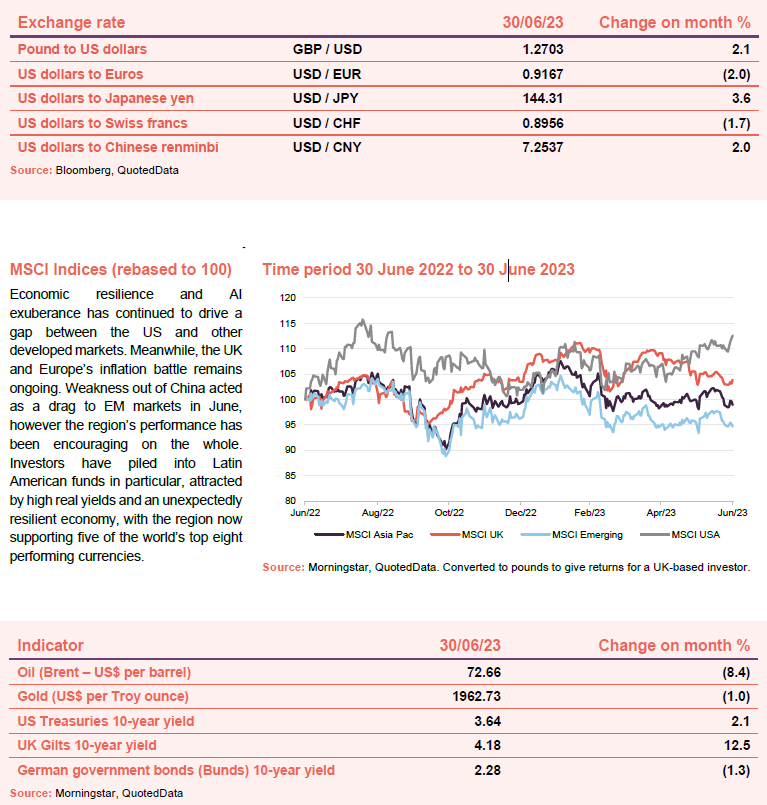

Picking up from where they left off in May, US markets continued to surge ahead in June, comfortably outperforming their global peers. The return to US dominance has been well documented, particularly regarding index concentration, with the top seven companies on the NASDAQ 100 adding one entire Germany worth of market cap over the first six months of the year.

Along with the AI binge, large cap tech has benefited from the relative safety provided by established, secular cashflows and unparalleled balance sheet strength which appears to have insulated the sector from continually rising discount rates. Still, with earnings steadily turning over, it’s difficult to see how such rich multiples, which have returned to the highs reached during the peak of the post pandemic rally, can be maintained.

“When we have free money people do stupid things. When we have free money for a decade people do very stupid things” – Stanley Druckenmiller

Outside of the US, markets have struggled. Inflation continues to torment policy makers in the UK, while the Eurozone is faced with a diverging landscape where pricing pressures have receded in some locales while remaining red hot in others. It remains unclear how the ECB plans to manage such a scenario with one overarching monetary policy regime.

In China, things have gone from bad to worse as optimism around the reopening gave way to a raft of geopolitical and economic concerns. The economy continues to battle tepid domestic demand, credit growth, and a global slowdown in trade while efforts to stimulate risk exacerbating a deeply complex and already overleveraged property sector.

Somewhat surprisingly, emerging markets provided a silver lining for the month, with Latin America and India leading the way, providing a bastion of strength relative to their more established peers.

At a glance

Global

(compare global and flexible investment funds here, here, here and here)

John Scott, chairman, JPMorgan Global Core Real Assets – 29 June 2023

The current environment is both at the political and macro level one of the most uncertain in the last decade, if not since the global financial crisis of 2008/09. The public capital markets have adjusted rapidly to the increase in central bank rates and monetary tightening; the private markets have begun this process, but the market has been and will continue to go through a process of price discovery as views on the trajectory of inflation and rate movements become clearer and therefore allow both buyers and sellers to focus on what is an acceptable range of pricing.

There remains a significant appetite for new capital, not least in the area of decarbonising our energy cycle, notably the substitution of wind, solar and nuclear electricity for fossil fuelled generation. Global, secular trends such as the drive to net zero and increasing digitisation of industry and consumer experience, will be long term asset growth drivers.

. . . . . . . . . . .

Alex Crooke, fund manager, Bankers Investment Trust – 12 June 2023

Tighter monetary conditions, driven by increasing interest rates and bond sales from central banks, have a dampening effect on economic activity. However, the real economy is actually weathering these conditions well, with many companies having low levels of debt and possessing pricing power, while consumers are benefitting from wage growth or using savings to bolster spending. However, the rate of inflation needs to fall. The alternative is that interest rates will continue to rise or be maintained at a high level for longer and their impact will be felt more deeply by many. There is good evidence that prices are starting to moderate and, in the case of energy, starting to fall. We expect markets in Asia to lead the recovery and are positioned for better news in that region. However, we remain more cautious in other regions.

. . . . . . . . . . .

Sebastian Lyon, investment manager, Personal Assets Trust – 12 June 2023

The past two years have seen us exit a hall of mirrors. We are now emerging from a prolonged period of distortion, born of zero (and even negative) interest rates, combined with quantitative easing. Economies and financial markets are slowly absorbing the effects of much tighter monetary conditions. While the dominos have been falling since early 2021, with the peaking-out of cryptocurrencies and retail investor speculation, the process of unwinding excess will take time and requires patience. The consequences are the unravelling of the ‘Everything Bubble’, which has inflated all assets and is likely to end with prices falling back down to earth. Despite the market declines in 2022 in equities and bonds, valuations remain high as investors are anchored on multiples of the last decade.

We are no longer in a buy-and-hold market, in which valuations expand as lower yields support higher prices. We expect that inflation has become embedded. This is the product of several factors, but of particular importance is the increased bargaining power of labour in the aftermath of the pandemic. Wage inflation is the most important component in driving higher prices on a more sustained basis. This is coinciding with slowing globalisation and increased intervention from governments, often in pursuit of more nationalist agendas. These factors are inflationary, and they come at a time when central banks have less room to manoeuvre. We expect that interest rates can only rise so far without severely injuring indebted economies. This unfamiliar backdrop has called time on a 40-year bull market in bonds, with all the implications that brings for investors.

The beneficiaries of four decades of falling yields are less likely to perform in this new regime. We are looking for companies that will learn to thrive in the new environment. As Edward Chancellor’s excellent book The Price of Time informs us, the 2010s may look like an aberration, a product of highly unusual conditions where ultra-low interest rates prevailed. The past environment rewarded insensitivity to valuation and the purchase of growth at any price. Such a strategy is less likely to succeed in the 2020s. Higher costs of debt are only just beginning to be felt. In any normal cycle, there is usually a lag before Federal Reserve rate rises take effect and the lag may be longer this time around. This is largely on account of consumer resilience, a product of transfer payments and consumer savings that were built up during the pandemic and are still being run down. Those will not last forever, but they might provide a stay of execution until 2024. In addition to this, much of today’s finance is in the shadows in the form of private equity and leveraged loans, which have ballooned in a post-financial crisis economy. Private equity investors find themselves in a Faustian pact with their managers, resisting the need to mark down their investments. Write-downs may be delayed but not avoided. In the world of private equity, price discovery is inevitably more opaque for both the managers and the owners but its effects will ultimately be felt.

American investor Stanley Druckenmiller said recently, “when we have free money people do stupid things. When we have free money for a decade people do very stupid things”. These are now being revealed. The collapse of Silicon Valley Bank in March, along with Credit Suisse, Signature Bank and more recently First Republic, exposes vulnerabilities to the fastest tightening of interest rates in 40 years. We are beginning to see the unfolding of a regional banking crisis in the United States. The environment for borrowing has become a lot tougher, and this will affect consumers and businesses alike. With inflation elevated, central banks cannot be seen to pivot too early. We expect that this necessitates a ‘hard landing’ when it comes to the real economy, something that is not currently being factored into equity valuations. Our low equity exposure at c.24%, which is a 10-year low, reflects this.

We have been hunkering down since 2021 in the knowledge that a prolonged bull market is likely to be followed by a painful bear market. Our liquidity remains high, yet sharp-eyed shareholders will notice a very low level of actual cash. We are at last paid to wait, with short dated UK gilts and US Treasuries yielding 4 to 5%. 2022 was the year we shifted from TINA (there is no alternative to equities) to TARA (there is a real alternative). A risk-free rate substantially above zero is back, for the first time since 2008. Most of our stocks have been defensive in the past year, with the share price of companies held in the portfolio appreciating +4% on average in sterling. We are delighted to see our staples such as Nestlé, Procter & Gamble and Unilever demonstrating excellent pricing power without sacrificing volumes. Portfolio activity was higher in the first half of the financial year but remained modest in the second half of the period.

Gold has performed well and is currently flirting with a new all-time high in US dollar terms. Performance from bullion, in an environment of weaker sterling, has been helpful to the Company. Gold, for us, remains essential portfolio insurance and a diversifier from risk assets. It also provides valuable protection against the ongoing debasement of fiat currencies. A recession is likely to unleash more money printing down the line. This will be positive for the currency that cannot be printed.

After a disappointing year in 2022, we believe that index-linked bonds are now poised for better returns. In the US, index-linked bonds are trading on positive real yields, and we believe that their (currently depressed) valuation offers two ways to win. The first will be if nominal bond yields fall, returning from whence they came. This will occur if interest rates are cut, as they were in 2008 or 2020, in response to a struggling economy. Alternatively, inflation expectations rising will lift ‘breakevens’ (the inflation rate priced into bond markets) as investors anticipate inflation to return on a more structural basis. As it stands, index-linked bonds are pricing in a world where interest rates remain higher than they have been in over a decade, but where inflation returns to the Federal Reserve’s 2% target. In such a world, real growth needs to be structurally stronger than it has been. For the reasons alluded to in this report, namely the continued indebtedness of Western economies and the recent rise in the cost of capital, we do not believe this to be consistent with the likely reality.

In light of all of this, investors are talking bearishly. But they are acting bullishly. It will take time for positioning to shift from the benign environment of the past decade. Investor focus seems to be on coincident indicators as opposed to looking forward to the effects of higher interest rates and tighter lending conditions. These are likely to lead to a recession. Bond markets, often a more reliable and rational indicator than more emotional and volatile stock markets, are indicating the most inverted yield curve since 1981. The lower yields in longer duration bonds are a clear warning of a hard landing. This is currently being ignored. Ayrton Senna said, “You cannot overtake 15 cars when it’s sunny…but you can when it’s raining“. We know the companies we want to own should attractive valuation opportunities present themselves and we are ready to increase our equity exposure, from currently prudent levels, as conditions become more treacherous.

. . . . . . . . . . .

John Evans, chairman, STS Global Income & Growth Trust – 8 June 2023

Much of the focus of financial markets is on the timing and scale of changes in short term interest rates. We may be near the peak of the current cycle – there are a myriad of views. However, whilst the cost of debt may change it is unlikely that Central Banks will relent on their liquidity policies as these have to address 14 years of largesse. Many of the well-publicised issues in the US and other banking systems recently owe more to the effects of the quantitative tightening than the higher cost of money.

The rate of inflation may be declining, or be forecast to do so, but prices are still rising at unfamiliar levels.

. . . . . . . . . . .

Managers, Edinburgh Worldwide – 8 June 2023

Some Reflections on Growth and Technology

We have frequently noted how innovation and the application of technology is a structural force that largely sits outside of conventional business cyclicality. But recent headlines on technology sector job losses and retrenchment indicate that many tech-led companies have not been immune from current pressures. In some cases, the reasons for this cyclicality directly relate to end product demand, but in many other areas we suspect it represents a period of adaption to a new normal that we would ultimately expect to see replicated more broadly across the economy.

That ‘new normal’ will likely favour efficiency in pursuing business growth. In an era of zero-cost money, a surplus of labour and an economic tailwind, the issue of productivity was primarily addressed indirectly through the expansionary pursuit of scale: grow bigger and operational leverage would ultimately drive productivity. Direct investments in productivity tools to drive unit economic efficiencies were generally less popular as they were less likely to yield near-term expansionary growth. Furthermore, they often carried a risk of disrupting an organisation as old processes and workflows are ripped and replaced.

We sense that the broad premise of technology adaptation sitting outside of conventional cyclicality still holds. But we would concede that the dynamics of growth and business scaling are adapting to the higher direct costs of expansion (e.g., higher borrowing costs and wage inflation). Technology companies are among the first to adjust to this, mainly because they were also the ones at the forefront of pursuing expansionary- based scale.

We should not confuse this as being the end of a technology cycle, far from it. As the focus shifts from the pursuit of scale towards tools of efficiency, we think companies that offer or exploit deep productivity- enhancing solutions will come to the fore. You might argue that this has long been the case (e.g. the rise of software tools since the 80s) but productivity growth in most major developed market economies has been lacklustre for several decades1. With looming huge improvements in intelligent automation as discussed below, the prospects for meaningful productivity gains look much brighter and we see the role of automation shifting from the current model of assisting humans with mundane tasks towards more value-added assistance or task displacement.

You will have likely heard about some of the recent advances in AI, particularly in the field of generative AI and local language models through tools such as ChatGPT. While AI and machine learning have been in their ascendency in recent years, their relevance has primarily centred upon narrow probabilistic prediction – with the accuracy of that prediction being most influenced by the intrinsic data quality and manual labelling of data used to train a specific algorithm.

Generative AI is focused on building novel content like art, an essay, or lines of code. When challenged, a sophisticated generative AI engine will draw upon the vast breadth of data it has been exposed to, generate an approximate answer and then seek to refine this through critical challenge. Such an iterative process distances generative AI from the narrower predictive AI on several fronts. Strikingly, it can make linkages between discrete observations and deal with areas of ambiguity in what it observes. Moreover, by mimicking mechanisms of natural conscious learning and seeking resolution not statistical perfection, generative AI outputs instinctively feel much more human-like, and it has proven itself to be especially adept at mastering language and dialogue.

At its core, generative AI advances are about delivering context-relevant, digestible outputs that seek to answer real-world queries. Its power can be pointed in many directions, whether creating novel digital content at a hitherto unimaginable scale or as a user-friendly distiller of complexity. The former could see it garner a role in the production of software code or in-silico screening of vast libraries of compounds for use in areas such as drug discovery or battery technology. The latter uniquely positions it to offer a scalable user interface that could ultimately perform various functions such as knowledge search or fully automated customer service. This is fundamentally different from most current technology interfaces which are about delivering blunt and narrow approximations.

What are the implications of all this? Our initial sense is that these impressive but still nascent advances will lay new foundations for how individuals and businesses engage with technology. Much like the arrival of the internet 30 years ago, we see generative AI as a horizontal technology tool that optically lowers the entry barriers within a range of verticals/industries. Traditionally, such a dynamic would be expected to favour nimble disruptors and disadvantage stale incumbents. Yet to borrow further from the experience of internet-based digitisation, while barriers to entry were initially lowered, we suspect that barriers to scale are likely to prove to be much harder to break down and will likely be better determinants when filtering winners from losers within this technology evolution.

While a clear advantage of generative AI is the ability to train it on vast broad data sources, real-world commercial use cases of this technology will likely have a requirement for domain-relevant digital data with which to hone the algorithms. This proprietary data likely exists within businesses that currently cater to their respective end markets. Furthermore, many incumbents (or at least those that remain/have emerged over the past few decades) are digital native businesses – they are unlikely to be refuseniks when experimenting with what AI offers. Taken together our initial view is that for digitally savvy, forward-thinking businesses we suspect that generative AI is more opportunity than a threat. For such companies, this opportunity should be about making deeper engagements with their customers and better leveraging the assets they already have with the prize being to better their offering, take share, and drive deep productivity savings. Given the importance of this topic, we expect it to be a recurring theme in our dialogue with holdings over the coming year.

. . . . . . . . . . .

Managers, abrdn Diversified Income and Growth – 5 June 2023

Global divergence is a key theme for the second half of the year. We continue to think a US recession is, in some sense, “necessary” to restore price stability and bring inflation in line with target. Well-documented banking stresses, as well as the broader evolution of the US data flow, increase our conviction that the Fed’s rate hiking cycle is providing the conditions for such a recession. While we have seen some headline making and non-trivial events, banking issues are not, at this time, believed to be a 2008 repeat.

In Europe, while economic data of late has been stronger, underlying inflation pressures remain worryingly strong, which will keep the ECB hawkish in the near term meaning European growth will move broadly sideways. In contrast, we expect China to be the fastest growing major economy in 2023. A strong re-opening rebound is underway, boosting domestic consumption with some knock-on benefits for Emerging Markets in the region and commodities.

With core inflation still ahead of target, central banks will raise interest rates further in the near term. However, the point of peak rates is close, and once the recession commences and core inflation has fallen, a pronounced cutting cycle will begin. The likelihood of recession and the impact on earnings means we are less favourable on corporate risk than earlier in the cycle. We have a preference for investment grade corporate bonds rather than high yield debt as a result.

In the higher yield space, we are maintaining our Emerging Market debt positions. Emerging Market central banks are ahead of developed peers in combatting inflation and will have more room to cut when a global recession hits. We remain mindful of shorter-term volatility in this space however.

We are currently negative on Global Property. Despite the linkage of rents to inflation, we expect the depressed economic environment to erode capital values. In addition, sectors such as offices, are facing severe headwinds from a reduction in demand due to hybrid working, and expensive refinancing rates, with recent headlines of landlords turning the keys over to their banks rather than refinance certain assets.

. . . . . . . . . . .

UK

(compare UK funds here, here, here and here)

Robert Talbut, portfolio manager, Schroder UK Mid Cap – 27 June 2023

Since the ill-fated mini budget in September 2022, we have experienced a period of relative calm, in addition to a welcome period of improved performance. However, there remains plenty to ponder, as ten-year UK interest rates have resumed their gentle curve upwards. We first wrote about “eye catching levels of inflation” in the 2021 Annual Report, and the fact is that although the UK economy has been more resilient than the vast majority of market commentators and forecasters expected, inflation remains stubbornly high. In the six-month period reviewed here, the 12-month rate of Consumer Price Inflation (“CPI”) remained above 10%, a level unseen since the early 1980s.

Against this inflationary backdrop, a majority of the companies in the portfolio have fared remarkably well, demonstrating the pricing power we seek. Economic consensus suggests inflation will continue to fall as the year progresses, given lower energy and petrol prices, and it could even be that the suggestions in the media of price limits on certain commodity foods are enough to rein in this particularly sticky element of the inflation cocktail.

Our response, in this environment, is to stick to our strategy of choosing resilient businesses which can deliver high risk-adjusted returns with rising cash flows and earnings. We have maintained our focus on two categories of investment. First, those unique assets with scarcity value and franchise power that allow management teams to raise prices without noticeably impacting demand. The other category is more cyclical businesses or in industries that are undergoing some sort of change, or that might be at some form of a strategic crossroads. This could be industry consolidation, management change or supply retreating out of the market. As a result of this change, we believe these companies will deliver better returns on capital in the future, rewarding shareholders. Additionally, portfolio companies tend to be net cash, or to have low levels of debt. This is important as refinancing costs have increased sharply, hurting profitability, and increasing risks for equity holders.

Despite the consistently negative view presented in the media, there are a myriad reasons to be optimistic about UK mid caps. Consumer confidence is rebounding, with the highest reading for 15 months recorded in May 2023. In April 2023, 20 million adults saw a 10% increase in their incomes. This included over 12 million pensioners receiving the state pension, nearly 6 million receiving universal credit and over 2 million receiving housing benefit. The labour market is strong, and the housing market appears to have recovered from its near-death experience in September 2022.

Furthermore, the lowly valuation of the UK market continues to attract attention from Private Equity and trade buyers. Recent bids for UK mid caps Wood Group, Dechra Pharmaceuticals and Network International attest to this, and, if these valuation levels persist, the trend seems likely to accelerate.

We would also like to remind readers that we are fishing in an attractive pond. In terms of the long-term potential of UK equities, we suggest that investors willing to look beyond the ongoing negative headlines will find the UK punches above its weight. This can be seen in terms of multi-baggers relative to the US, and this is why the Benchmark has beaten the S&P 500 return over the 25 years to 31 March 2023, when measured in local currency. In US dollar terms, it has very nearly matched the popular US index. This is despite the UK mid cap index suffering a substantial derating in the past 24 months. The Mid 250 is populated by multiple “unique” companies, with strong growth prospects, generating cash and delivering attractive returns on capital.

. . . . . . . . . . .

George Ensor, portfolio manager, River & Mercantile UK Micro Cap – 16 June 2023

Despite the recent bounce in equities, investor sentiment remains poor. The hit to consumer income from higher inflation now being realised is evident in consumer confidence which is close to the low of March 2020. The exceptional fiscal and monetary response of the last two years is being unwound through higher rates, excess liquidity withdrawal and higher taxes – measures that are likely to weigh on growth. We should therefore be prepared for ongoing volatility in equity returns, style leadership and investor sentiment.

However, given the underperformance of smaller companies over the last six months, we caution against becoming too bearish ‘after the event’ and note that current levels of consumer confidence have historically been coincident with troughs in its relative performance.

In the short term, we believe we are likely to avoid a recession owing to the strong consumer balance sheet coupled with the positive seasonal effect (i.e. lower prices) in the energy market. We are presumably somewhere near peak disruption to supply chains which means that businesses with reasonable pricing power should sooner or later be able to recover the hit to profitability that supply chain challenges have caused, and robust consumer businesses represent bargain basement – we are selectively finding cases of March 2020 valuation levels on through-cycle metrics, even if aggregate markets are perhaps surprisingly within 10% of all-time highs.

. . . . . . . . . . .

Wendy Colquhoun, chairman, Henderson Opportunities Trust – 21 June 2023

The valuation of UK equities is at a very low level. A coming together of different factors has been behind the fall in valuations. There has been a lack of capital spend in the economy driven by caution over Brexit and Covid-19. The pension fund industry and various other domestic investors have abstained from buying and have been large disinvestors in UK equities over the last ten years. Overseas buyers have been increasing holdings as domestic holders sell, but their focus is on large global companies, leaving a lack of capital to invest in small, domestic-facing businesses. However, the low valuations are leading to takeover activity picking up.

The UK economy is growing but at a very slow pace. The consumer, in spite of the cost of living crisis, has not shown the weakness in spending that some anticipated. Unemployment is low and companies overall are responding well to the demanding circumstances they face. At the same time, many good quality companies that have sound long term plans are trading on very undemanding valuations.

. . . . . . . . . . .

Managers, BlackRock Income and Growth – 21 June 2023

Inflation has consistently surprised in its depth and breadth, driven by resilient demand, supply chain constraints, and most importantly by rising wages in more recent data. Central banks across the developed world continue to unwind ten years of excess liquidity by tightening monetary policy, desperate to prevent the entrenchment of higher inflation expectations. Meanwhile, March saw the first signs of financial stress with the bankruptcy of Silicon Valley Bank and Signature Bank in the US serving to highlight the potential issues of the aggressive retrenchment of liquidity. Whilst the ramifications of this crisis remain unclear, it is likely that credit conditions and the availability of credit will continue to recede. This strengthens our belief that companies with robust balance sheets capable of funding their own growth will outperform. We are mindful of this and feel it is incredibly important to focus on companies with strong, competitive positions, at attractive valuations that can deliver in this environment.

The political and economic impact of the war in Ukraine has been significant in uniting Europe and its allies, whilst exacerbating the demand/supply imbalance in the oil and soft commodity markets. We are conscious of the impact this has on the cost of energy, and we continue to expect divergent regional monetary approaches with the US being somewhat more insulated from the impact of the conflict, than for example, Europe. We also see the potential for longer-term inflationary pressures from decarbonisation and deglobalisation, the latter as geopolitical tensions rise more broadly across the world.

We would expect broader demand weakness although the ‘scars’ of supply chain disruption are likely to support parts of industrial capital expenditure demand as companies seek to enhance the resilience of their supply chains. A notable feature of our conversations with a wide range of corporates has been the ease with which they have been able to pass on cost increases and protect or even expand margins during 2022 as evidenced by US corporate margins reaching 70-year highs. As we look ahead into the second half of 2023, we believe demand will weaken as the transitory inflationary pressures start to fade. This will mean that pricing conversations will become more challenging despite continued pressure from wage inflation which may prove more persistent. While this does not bode well for margins in aggregate, we believe we will continue to see greater differentiation as corporates’ pricing power will come under intense scrutiny.

The UK’s fiscal policy has somewhat diverged from the G7 as the present government attempts to create stability after the severe reaction from the “mini-budget”. The early signs of stability are welcome as financial market liquidity has increased and the outlook, whilst challenging, has improved. Although the UK stock market retains a majority of internationally weighted revenues, the domestic facing companies have continued to be impacted by this backdrop, notably financials, housebuilders and property companies. The valuation of the UK market remains highly supportive as Sterling weakness supports earnings of international companies, whilst UK companies are in many cases at COVID-19 or Brexit lows in share price or valuation terms. Although we anticipate further volatility ahead as earnings estimates moderate, we know that in the course of time, risk appetites will return, and opportunities emerge.

. . . . . . . . . . .

Charles Montanaro, manager, Montanaro UK Smaller Companies Investment Trust – 19 June 2023

The IMF is forecasting that interest rates will return to “rock bottom” due to chronic low growth in the developed world, linked to low productivity and ageing populations. Such forecasts are interesting insofar as they highlight just how unusual 2022 was. Interest rates soared as a result of the economic dislocation of COVID and the war in Ukraine, rather than underlying structural trends.

Unusually, the Quality and Growth styles significantly lagged the market last year. As Quality Growth, SmallCap investors, it will always be challenging when Quality, Growth and SmallCap all underperform – especially at such extreme levels. UK SmallCap posted its worst performance relative to Large Cap (21%) in 2022. However, it is unwise to become too down-hearted by one year. We have long argued that UK SmallCap is an attractive asset for long-term investors. It is important to give companies time to grow over time and different cycles. Taking a longer perspective, since January 1955, UK SmallCap has outperformed in 78% of the 70 ten-year rolling periods since then and in 99% of the 30-year rolling periods (see chart below):

As time ticks by, the impact of the black swan events described above appears to be fading. Global inflation has largely stabilised and investors are now pricing in the first interest rate cut as early as September 2023 in the US and March 2024 in the UK. The headwinds of the past 18 months might soon turn into tailwinds. However, we claim no expertise in forecasting macro-economic developments and waste little time in trying to do so. Instead, we talk to our companies. We continue to be reassured by their performance.

Although SmallCap remains out of favour as we write these lines, we cannot help but feel increasingly positive about what it holds in store for the coming years. At 31 March 2023, the Numis Smaller Companies (ex-IC) index was trading on 9.8x 12 months-forward earnings, 22% below its long-term average. To put things into perspective, since 2006 the index has only traded on a P/E of below 10x in 23 of the 198 months, i.e. 11% of the time. Every single time this has happened, it was followed by a year where SmallCap outperformed significantly (averaging a remarkable 23%).

More importantly, as someone brought up to recognise that you cannot eat relative performance, when UK SmallCap has fallen then the following three years have seen strong absolute returns. Last year saw the sixth worst year of absolute returns as the chart below shows (we will have to wait to add the figures for the next three years).

It is hard to recall such indifference to the asset class. As someone with more grey hair than most who has lived through seven Bear markets, it is hard not to be excited about investment opportunities especially for long-term investors. To borrow the words of Andrew Jones, the highly regarded Chief Executive of LondonMetric Property PLC: “when you invest in quality, time will help you to create wealth”.

Since UK SmallCap appears to be cheap, you would expect take-over activity to pick up. Already there are signs that M&A activity is indeed rearing its head again.

. . . . . . . . . . .

Andrew Watkins, chairman, CT UK High Income Trust – 1 June 2023

After two years of COVID and dealing with its aftermath, the world was plunged into further uncertainty by Russia. The effects on shareholder returns have been magnified in both directions over that three-year period, first fuelled by a total change in working practices amid massive (and expensive) Government support packages and then through rising energy prices and supply chain shortages leading to yet more (expensive) support, especially for the vulnerable and elderly. Added to this, in the UK came the advent of three Prime Ministers in a matter of weeks; the haphazard policy announcements that ensued caused serious disquiet in the gilt market which has only recently subsided.

A long period of near-zero interest rates probably led many to believe that borrowing money at such levels was the norm and unlikely to change anytime soon. The slowly dawning realisation that interest rates had to rise to defeat inflation has had the anticipated effect on the country but, miraculously, has not collapsed the economy, regardless of the inevitable squeeze on household budgets, or affected employment numbers as businesses still find it difficult to fill vacancies. Nor has it led to recession or to a stock market rout.

However, uncertainty is always the enemy and whilst the resilience of all the above is commendable, a period of calm in the wider world and stock markets in particular would be welcome and possibly key to making positive headway. Given war is on Europe’s doorstep and the rhetoric more alarming by the day, it is all the more remarkable that the UK’s FTSE 100 index recently hit an all-time high.

I sound all doom and gloom and I really don’t mean to be. It is likely that interest rates and inflation have peaked with the latter forecast to be nearer 5% by the end of 2023. This should help resolve many of the difficulties currently being experienced brought about by the likes of soaring energy prices, now thankfully abating, and wage demands, with more realistic settlements likely to be achieved.

. . . . . . . . . . .

Jonathan Cartwright, representative of the board, CT UK Capital and Income Trust – 1 June 2023

It might be tempting to think that the opportunities for UK equities are lacklustre as the stock market has already shown some signs of recovery since the start of the financial year, yet the economy is apparently struggling to produce any meaningful growth. Furthermore, inflation is proving more persistent than expected and interest rates are probably staying at higher levels for longer, which would normally be considered a headwind for businesses and share prices. We are also very aware of the emerging risk of instability in the US financial sector but, as yet there appears very limited read across to the UK.

All these points of caution, however, ignore the actual experience of many of the companies in our portfolio where sales, profits, earnings and dividends are increasing and where valuations appear undemanding. As has already been stated, share prices can be impacted by macro-economic events but, across a longer-term timeframe, fundamental value should be reflected in improving individual share prices as companies deliver superior performance.

. . . . . . . . . . .

Europe

(compare European funds here and here)

Francesco Conte, manager, JPMorgan European Discovery Trust – 15 June

We began 2022 believing that inflation would prove to be transient. However, the tragic events in the Ukraine followed by Covid-19 lockdowns in China resulted in the risk of more persistent inflation.

More recently there have been signs that we have passed peak inflation, although inflation could stay elevated above Central Bank targets for some time. Markets feel much more optimistic than at any time since inflation began increasing mid-way through 2021. Sentiment is supported by falling energy prices and China reopening paving the way for a boost to European manufacturing exporters.

Nevertheless, the economic outlook is uncertain. Some leading economic indicators are under pressure and the US yield curve remains inverted which has historically led recessions, albeit with an unpredictable delay. There is a risk that earnings downgrades are coming for more cyclically exposed companies although there are no signs of this yet in order books. As a result, active management and thorough fundamental research will be paramount, and quality – of both management and balance sheets – will be imperative in a more uncertain environment.

2022 was a difficult year in absolute and relative performance. However, 2023 looks much more encouraging. While the last decade has been all about the US and technology, Europe looks extremely attractive in this new cycle as it starts with compelling valuations and, unlike China which also looks cheap, seems to be in a period of relatively harmonious internal politics, although Russia remains a wildcard.

Another uncertainty is how Artificial Intelligence (“AI”) will impact companies and sectors in the future. Just like the internet, AI will have a profound impact. But, like the internet it is difficult to predict the exact consequences. Nevertheless, it is likely that AI will have an overall positive impact on economies and equity markets due to efficiency gains. Companies will need to adapt; those that do not, risk being fatally disrupted. However, companies that take advantage of AI will reap the rewards. Understanding these consequences will be an important focus for the Investment Managers.

In relative terms, 2022 was very macro driven – such periods do not last forever and eventually bottom-up fundamentals reassert themselves. We expect this to be the case in 2023.

. . . . . . . . . . .

Mangers, JPMorgan European Growth & Income – 6 June 2023

The market is facing ongoing uncertainty about the inflation outlook and whether Central Banks can engineer a soft landing in which inflation is reduced without tipping economies into recession. While we continue to believe that the European banking sector is much more robust than it was during previous financial crises, we remain alert to the speed with which things can change and will act accordingly if required. On a more positive note, the concerns mentioned above are well known to the market and may already be priced in. On a longer term view the Company’s Managers continue to believe that the investment universe of European companies contains many high quality enterprises across different sectors and often with global reach. Moreover, the valuation of European markets continues to look attractive, particularly in comparison with the US, but importantly within the market too. Valuation spreads remain wide which suggests that there will be opportunities for stock selection to continue to add value.

. . . . . . . . . . .

Japan

(compare Japanese funds here)

Managers, JPMorgan Japan Small Cap Growth and Income – 23 June 2023

The external environment is uncertain, pervaded by geopolitical tensions, the risk of a global recession, and persistent concerns about inflation and interest rate hikes. Japan is also seeing signs of inflation, as rising commodity prices and a weaker yen have imported inflationary pressures although inflation levels are lower than in other major markets. However, as one response to Japan’s tight labour market conditions, some large corporates have started to announce generous wage increases, to attract and retain workers. These increases follow decades of stagnant wages, so this is very encouraging for the Japanese economy. On the monetary policy front, following the BoJ’s monetary policy tweak in December 2022, financial markets are awaiting further policy guidance from the BoJ’s new governor.

Regardless of these external and domestic events, we remain optimistic about the long-term outlook for Japanese small cap companies, and your Company, for several reasons. The average valuations of Japanese companies remain reasonable, and lower than both historical averages and valuations in most other major markets. Furthermore, Japanese equity markets will draw near-term support from Japan’s belated lifting of COVID-19 restrictions. Japan reopened its borders in October 2022, much later than most other developed nations, and just before China’s surprise decision to abandon its zero COVID-19 policies. So inbound tourism and a general reopening of the Japanese economy have only just gained traction in recent months. China’s reopening is also supportive for many Japanese companies.

However, in our view, the most important structural support for Japan’s equity market over the medium to longer term will be the ongoing improvement in corporate governance. The past few years have seen clear progress on this front, in large part thanks to the Corporate Governance Code introduced in 2015. We have seen notable improvement in areas such as board independence, and we expect more positive developments ahead, especially increased shareholder returns. Half of Japan’s listed non-financial companies still have net cash positions, so there is significant scope for this cash to be returned to shareholders over the longer term.

The pandemic has given added impetus to some other positive structural changes underway in Japan, especially the application of technology and digitalisation in many areas of economic activity. These trends will underpin growth, productivity and corporate earnings for years to come. In sharp contrast to other developed economies, Japan’s smaller companies are at the forefront of this innovation and change making them ideally positioned to prosper over the long term. However, the sell side coverage for such exciting mid- and small-cap companies tends to be thin, so many investors overlook the compelling opportunities available in this sector of the market.

. . . . . . . . . . .

Harry Wells, chairman, CC Japan Income & Growth Trust – 20 June 2023

While inflation is not so rampant in Japan compared to many other countries, it continues to broaden and climb with core inflation running at over 3.4%. This should encourage domestic flows back to the stock market which offers higher yields compared to the zero return on bank deposits. Surprisingly, local investors are still selling into strength with the TOPIX hitting a 33 year high up 10.1% in sterling terms in the calendar year to the end of April 2023. However, foreign investors are returning, attracted by economic trends, policy developments, attractive stock valuations and not least extensive media and press coverage hailing that the long bear market in Japan is finally over. Certainly, Warren Buffet has recently highlighted the growing attractions of Japan and has increased the stakes in the five trading companies that Berkshire Hathaway first acquired in 2020. The trend of returning cash to shareholders through share buy backs and dividends has been further stimulated by recent announcements by the Tokyo Stock Exchange (“TSE”) and Japan’s Financial Services Agency (“FSA”). Their measures are designed to accelerate the restructuring of the many companies that trade below book value, while encouraging greater balance sheet efficiencies and radical overhaul of capital allocation. This is all evidence of a continuing and refreshing commitment to corporate governance reform.

The economy is increasingly gaining traction post the pandemic and with China’s reopening in January 2023. We are seeing increased confidence in corporate earnings and consistent improvement in the level of dividend distributions across our holdings in the portfolio. Against this, the growing disparity of interest rates between sterling and the yen continues to put pressure on the currency cross rate, reducing Japanese income on translation to sterling if the yen continues to weaken.

Continued geopolitical tension especially between China and the USA in addition to the unpredictability of the North Korean regime, also remains a risk. Providing that these tensions do not worsen, the outlook for Japan is increasingly rosy, particularly for investors who recognise that income is a critical component of total return.

. . . . . . . . . . .

Kwok Chern-Yeh, managers, abrdn Japan Investment Trust – 5 June 2023

One of the most significant developments domestically over the year to 31 March 2023 was regarding the Bank of Japan (BoJ) and monetary policy. Despite inflation creeping up to its highest level in more than 30 years (albeit much lower than elsewhere), BoJ Governor Haruhiko Kuroda stuck to his no-intervention policy for much of the year, even in the face of an increasingly weak currency; the yen fell to its lowest point against the US dollar in more than 20 years. At the same time, the BoJ remained committed to its policy of yield-curve control and restricting sales of 10-year Japanese Government Bonds to ensure that yields stayed around zero.

Towards the end of 2022, the BoJ relaxed its rules. And, with Kuroda’s retirement in April 2023, there are expectations that new governor Kazuo Ueda will start to unpick some of the policies that have been pushed through in previous years. If this happens, the banking sector could start to become more profitable. Notably, despite some profit-taking and news from the US regarding the failure and subsequent buyout of Silicon Valley Bank, financials were the best performing sector over the review period.

Prevailing global concerns – the ongoing Ukraine war, rising inflation and disruption to supply chains – combined with domestic worries, not least the weaker yen, weighed on the market. While companies considered to be more sensitive to rising interest rates, and the more ‘defensive’ sectors fared well, most other sectors lost ground. The weaker yen was particularly damaging for the margins of the better quality companies favoured by the Investment Manager.

There are already signs of improving macroeconomic conditions. The yen has bounced back from its October lows, there is general consensus that interest rate rises that have hurt the global economy should slow from here, while soaring inflation should slowly start to moderate. Meanwhile, China’s reopening is proving to be a positive for the supply-chain issues that have beset many Japanese businesses, where shortages of essential components, such as semiconductors, have delayed production.

Looking ahead, there is cause for optimism. The macroeconomic conditions that have hurt some of our holdings in the recent past appear to be reversing: the yen has strengthened, inflationary pressures are easing, and interest rate rises are moderating. While there are still concerns that the market may be underestimating the persistence of inflation, and that geopolitics could still lead to sudden changes in the economic outlook, we believe that the prospects for better run businesses in Japan should improve and, over time, see them outperform.

. . . . . . . . . . .

Nicholas Weindling, investment manager, JPMorgan Japanese Investment Trust – 2 June 2023

We are heartened by some recent improvements in Japan’s near-term economic prospects, and on balance we expect activity to continue to expand, supported by the re-opening of both the Japanese and Chinese economies. We are also encouraged by early signs of upward pressures on wages and by rising inflation, as this provides hope that Japan may be pulling out of its long period of damaging and seemingly intractable deflation. This would be a welcome development from the BoJ’s perspective, so, unlike the case in other major economies, we do not expect the central bank to try to quash nascent inflation pressures by implementing aggressive rate hikes.

The outlook for Japanese corporates is also positive. Company balance sheets are very strong compared to the rest of the world, and the focus on corporate governance and shareholder returns is increasing. For example, in February 2023 the Tokyo Stock Exchange announced that it will require companies trading below book value to devise and implement capital improvement plans. We expect progress in corporate governance and shareholder returns to continue apace, and in our view, this remains the single most compelling reason to invest in Japanese equities on a multi-year view. Half of Japan’s listed companies still have net cash positions, so there is significant scope for this cash to be returned to shareholders over the longer term, while in the short term, cash-rich businesses have greater scope to weather global recession and other unforeseen events.

Another key factor supporting our favourable view on Japanese equities is that the country is undergoing major technological transformation. Businesses and government are increasing their efforts to digitalise and automate their processes and administrative procedures, creating the potential for significant growth and productivity gains over the medium term. This should prove a very supportive environment for the dynamic, quality growth businesses in which we invest.

The Japanese market continues to offer many opportunities to invest in innovative, interesting companies at the heart of Japan’s new growth, at attractive valuations.

. . . . . . . . . . .

North America

(compare North American funds here and here )

Managers, BlackRock Sustainable American Income Trust – 28 June 2023

The start of 2023 finally showed the effects of the fastest Fed tightening cycle since 1980. The bank closures of Silicon Valley Bank, Signature Bank and First Republic Bank illustrated the increased challenges of operating in a high inflation, high interest rate economy and the fallout in our view is unlikely to change that. With regional banks remaining under pressure, we see consumer lending continuing to slow, which may further tighten financial conditions. Investors should remain mindful that we are only just over a year removed from the first Fed rate hike, meaning financial conditions were already set to tighten before March’s banking events. From a market perspective, this may create additional volatility if we see more negative outcomes related to a sluggish US economy. Despite a more challenging macro environment, we do not see the Fed cutting rates this year as core inflation proves to be resilient. We feel the Fed should prioritise curbing inflation as a premature interest rate cut could create additional economic challenges. Looking ahead, we continue to focus on resiliency by investing in high-quality businesses with strong fundamentals as we look for the economy to stabilise. While we see short-term choppiness ahead, we remain constructive of US equities in the long term.

. . . . . . . . . . .

Emerging Markets

(compare emerging market funds here)

Managers, JPMorgan Emerging EMEA Securities – 19 June 2023

Firstly, in 2022, GCC countries received US$1 trillion in revenues from energy exports. This represents a massive injection of capital into the region, which will manifest itself via higher consumption spending and infrastructure investments. In addition, as we discussed above, we expect oil and gas prices to rise in the second half of 2023, which will provide further support for energy companies, while earnings per share more broadly are likely to be 10-20% higher than initial estimates for 2022. Furthermore, just like their UK, European and Asian counterparts, some emerging market banks are benefiting from the rise in global interest rates. This should provide a significant additional boost to the market, as banks comprise almost 40% of the index. The portfolio’s exposure to financials will benefit accordingly.

In terms of overall GDP growth, activity in 2023 will not be as robust as in 2022, but it will still be strong, with regional growth running at a respectable pace just shy of 4%. The UAE, Qatar, Saudi Arabia and Greece will be positive outliers. The laggards will include Turkey and South Africa. In addition, inflation will be lower across the region thanks to interest rate tightening already in place.

Emerging markets in the Middle East and Africa are growing and evolving very rapidly and the opportunities created by this evolution will escalate over time. For example, last calendar year, 20 new companies entered the Company’s investment universe via initial public offerings (IPOs).

. . . . . . . . . . .

Chetan Sehgal, lead portfolio manager, Templeton Emerging Markets – 12 June 2023

Heading into 2023, while we remain watchful for developments that could change our overall outlook, including China’s relationship with Taiwan and the United States, we find many reasons to be positive about EMs. Many countries are towards the end of the rate tightening cycle. Most markets in Latin America have traditionally had a significant real interest rate and their economic potential has been curtailed because of the need for macroeconomic stability.

We expect any policy pivot in EMs to revive consumption and spur economic growth as inflation slows. In addition, after a slowdown in earnings in 2022, there is the prospect of a recovery in earnings growth in 2023, with China being the last major country to emerge from the pandemic. However, in the short-term, earnings are likely to remain weak with subdued consumption and inventory digestion and a recovery is expected more towards the second half of 2023. A pickup in earnings revisions in EMs would signify better times ahead for equity markets.

Although the current global outlook remains weak, economies with a greater focus on domestic demand are better placed to weather this in the near term. Many emerging markets such as China, India, Indonesia and Brazil have huge domestic consumption bases and are well-positioned to remain resilient from external demand shortfalls. In addition, policy makers in several markets are providing incentives to manufacturing companies to expand operations in order to remain self-sufficient and competitive. For example, India is driving investments through its Production Linked Incentive program. South Korea plans to offer tax breaks to semiconductor and other technology companies investing within the country whilst reforming stock market regulations. Thailand has also approved a budget to boost tourism in the country, one of its biggest growth drivers.

The long-term structural tailwind of consumption growth in EMs via expansion of the middle class and premiumisation of buying patterns is now more significant than ever. Some US$2.6 trillion in Chinese bank deposits were amassed in 2022(a) and middle-class households are looking to spend on experiences, products and services. In our view, China’s reopening could benefit many markets as the country has strong trade links with many EMs. Chinese tourism has also been a vital source of revenue for many countries.

After the removal of most COVID-related constraints, we have seen economic activity in China starting to recover in the first quarter of 2023, where retail sales, industrial production and investment in fixed assets increased. More importantly, companies are now able to operate their businesses without COVID protocols which removes the pressure of unplanned outages and improves overall efficiency.

Markets in Eastern Europe will benefit from the normalisation of energy dislocations, although the conflict in Ukraine will continue to be an overhang. Markets in the Middle East continue to see a boom in initial public offering activity which bodes well for future capital market developments in the region.

These uncorrelated drivers of returns in EM economies present an investment opportunity which our team’s deep experience, local expertise and a bottom-up investment approach can uncover.

EMs also continue to make strides towards climate goals and with the cost of renewable energy expected to fall in 2023, we might well see EMs make further climate commitments.

It is an interesting time to be looking at the emerging world today. We believe that the breadth of opportunity, growth, innovation, sustainability of business models and the much stronger institutional resilience compared to decades past when considered together create an attractive future for EMs.

. . . . . . . . . . .

Managers, Barings Emerging EMEA Opportunities – 9 June 2023

In the short term equity markets are likely to remain volatile as investors monitor developments in Ukraine, as well as the outlook for inflation and global economic growth. However, there is evidence that monetary tightening may have moderated inflation which is supportive. While the region will not be immune to these global trends, we believe there are a number of compelling opportunities across EMEA.

The Middle East continues to invest large sums of capital to further diversify their economies. This, combined with robust consumer demand, lower inflation and higher labour participation rate should continue to support earnings growth across multiple sectors. The representation of the Middle East in major indices has risen recently, whilst a burgeoning IPO market is broadening the investment opportunity. Interestingly, Middle Eastern markets remain underrepresented within investor portfolios, which – in combination with the region’s economic and structural tailwinds mentioned above – should help increase demand across the region’s equity markets.

South Africa presents another interesting investment opportunity, primarily because of its access to a broad range of metals, many of which have a role to play in the energy transition. High commodity prices have helped improve the country’s fiscal position, whilst increased demand from China reopening its economy will also be supportive. Political risk has increased recently and we remain vigilant to the potential for social unrest, whilst the country struggles to resolve the problem of electricity supply outages.

Markets across Central and Eastern Europe look set to have a softer economic landing than originally feared, helped by the significant fall in energy prices. Opportunities will exist as the region pivots away from Russian gas, particularly via the support of large EU infrastructure projects, such as the European Green Deal and NextGen EU funds. The region is also well placed to take advantage of nearshoring trends via the provision of lower cost skilled labour, strong regulatory protection, and crucially, a lower delivery time for the end consumer.

While Emerging European, Middle East and African markets have experienced challenges, the recent market volatility has also resulted in a potential opportunity, particularly for long term investments in high quality businesses with the potential for earnings growth that have seen their share prices weighed down by broader market moves. Markets continue to digest near term challenges to economic growth, alongside shifts from disruptive technological innovation and geopolitical tensions, all of which may cause mispricings from which the portfolio can benefit. This, however, creates an environment in which divergence in company performance is likely to increase as companies adjust and winners emerge stronger This environment offers improving opportunities for active management to secure outperformance.

. . . . . . . . . . .

Managers, BlackRock Frontiers Investment Trust – 5 June 2023

We still believe global markets are in the process of adjusting to a world of higher inflation and higher interest rates. The banking sector fragility we saw over the course of March is one indicator that this level of interest rates is starting to bite. Equally, we believe we are near a peak in the US Dollar and that provides a favourable setup for frontier markets that posit supportive economic fundamentals and policy making.

We retain an overweight exposure in Indonesia and Chile as both fit our macro-economic framework. In particular, the Indonesian economy is positioned to sustain high single digits nominal GDP growth given policy-making remains favourable to attract foreign direct investment and continue to grow its exports base. We have an optimistic view on Indonesia’s ability to grow its value-added nickel exports that the global EV battery supply chain will increasingly rely on. Indonesia holds one of the largest nickel reserves in the world and is quickly developing these into higher density battery grade nickel for NCM batteries. This will support Indonesian balance of payments and allow for more sustainable economic growth given Indonesia remains under invested in most sectors by relative emerging market standards. Our favourable view on Chile is predicated on the country implementing an orthodox monetary and fiscal policy which has enabled inflation to roll over and we believe there is value in stocks there as the interest rate cycle normalises.

GEOPOLITICAL FACTORS

From a geopolitical standpoint, the world looks increasingly split into three blocks: the ‘Western’ block such as Europe, US, South Korea, Japan, Australasia, the ‘Eastern’ block such as China, Russia, North Korea, and some Chinese aligned African nations, and then the ‘Neutrals’ such as India, Brazil, Saudi Arabia and much of the rest of South America and the Middle East. Most of the countries within our Frontier Markets universe are considered ‘neutrals’, and should benefit as the global geopolitical alliances recalibrate.

It is clear to us that these geopolitical concerns have already prompted a supply chain recalibration away from China and countries such as Vietnam and Malaysia will continue to see the benefit of re-shoring of supply chains.

Finally, we observe a marked contrast in the monetary and fiscal policy decisions taken in the small emerging and frontier markets versus developed markets in the post-pandemic years, and we find significant value in currencies and equity markets across our investment opportunity set. We are optimistic over the long-term in our under-frontiers investment universe which should enable compelling investment opportunities.

. . . . . . . . . . .

China

Helen Green, chairman, abrdn China Investment Company – 28 June 2023

The Chinese economy appears to be moving in the right direction. After a lengthy period of social and travel restrictions, we believe there is pent-up consumer demand in China. The reopening that is already underway should lead to a multi-stage recovery, with a gradual revival of domestic consumption. In turn, this should boost sectors ranging from tourism to healthcare, and property to banks.

China’s economic recovery appears to be underway, albeit at a slower and more gradual pace than elsewhere in Asia. This recovery is aided by supportive financial conditions. China’s inflation is lower than surrounding countries, meaning authorities have been more able to introduce accommodative monetary and fiscal policies to support economic growth. Projections from the International Monetary Fund (“IMF”) earlier this year forecast that China’s economy will grow 5.2% in 2023 (compared with 3% in 2022). China’s economy is also expected to contribute one third of overall global growth. Although the IMF also points out that “comprehensive macroeconomic policies and structural reforms” are still required.

At the heart of China’s economic growth is its rising middle class, providing opportunities to invest in companies that are set to deliver long-term capital growth. These companies are benefiting from rising affluence leading to growth in consumption, growing digital integration and more widespread technology adoption, the move to a greener, lower-carbon world, greater demand for healthcare products, and structural growth in consumer finance.

Mike Balfour, chairman, Fidelity China Special Situations – 7 June 2023

While the mood of investors in Chinese equities has swung between extreme bearishness and euphoria over the past year, the current backdrop reflects a more measured outlook. The Board continues to believe that a direct exposure to China – the world’s second-largest economy – is an important constituent of a diversified portfolio. Although economic growth was lacklustre in 2022, the International Monetary Fund expects China’s GDP to advance by 5.3% in 2023, ahead of the 3.9% average for emerging markets and developing economies and well in excess of the 1.3% forecast for advanced economies.

China is at a different point in the economic cycle to the rest of the world; rising interest rates and inflation in the West have meant very constraining central bank policies aimed at slowing economies down, whereas the opposite is the case in China. Inflation is not and has not been a problem and the authorities are taking a more stimulative approach to boost growth. This is being done at a measured pace to reduce unemployment, particularly amongst the young, but at a level which doesn’t fan speculation in the property sector which remains an issue.

ESG standards continue to improve, and as Western governments experiment with increasingly protectionist policies and try to tame inflation, opportunities increase for China to move up the value chain in manufacturing and services.

Against this improving backdrop, valuations in the stock market, and in particular those of small and mid-cap companies in China, remain relatively modest, with arguably the best opportunities to be found among the less well-known companies that may be overlooked by funds that lack a solid on-the-ground research presence.

While the Chinese stockmarkets are always likely to be volatile, we are encouraged that all the building blocks remain in place for continued healthy returns. There will be slips along the way and we remain mindful of geopolitical issues such as the relationship with the US and the status of Taiwan, however structural trends such as the growing middle class and on-going innovation support our positive medium to long-term view.

. . . . . . . . . . .

India

Michael Hughes, chairman, abrdn New India Investment Trust – 28 June 2023

India remains one of the world’s fastest-growing economies, sustained by a stable macroeconomic environment. Supportive government spending, a revival in consumption and an easing of supply chain bottlenecks are likely to provide a buffer against rising interest rates and a likely global slowdown.

With a pro-growth budget for the 2024 fiscal year, there is increasing focus on India’s industrial policy, as the country seeks to entrench its position as a global manufacturing hub. The domestic economy is in the early stages of a cyclical upswing. Inflation is easing, and there is good momentum in real estate, infrastructure development and consumer spending.

That said, we must remain cognisant of the risks. Stockmarkets remain volatile and the external pressures on India have not eased. The next 12 months remains uncertain, with no end in sight to the Russia-Ukraine conflict, an expected rearrangement in global supply chains and a looming recession in the United States. However, India’s swelling economy and domestic demand, robust macroeconomic management and proactive policy measures mean that the country is well-placed to tackle such external headwinds.

. . . . . . . . . . .

Managers, JP Morgan Indian Investment Trust – 9 June 2023

In our view the short-term weakness of Indian markets relative to other equity markets is just that – short term. Markets, like stocks, rarely move in one direction. There are some natural bumps along the way, but we believe the long-term outlook continues to remain attractive. As an economy, India continues to tick the key top-down factors most investors care about – namely a strong democracy; fair and independent institutions; strong banking system; low leverage and economic growth expectations materially above any other global economy.

For these reasons, we believe India is on the cusp of being able to deliver a high rate of economic growth over multiple decades driven by strong local demand, an increase in in investment not only domestically but also from overseas as it is becoming a globally attractive investment destination. The advantage of land and labour is on the cusp of meeting demand both domestically and globally.

As most developed and emerging countries globally continue to struggle to expand their economies, our expectations are for India to remain one of the fastest growing. We estimate real GDP growth at around 7% for 2023 coming down to around 6% in 2025 but, encouragingly, being able to sustain this level of growth for many years beyond this. It’s difficult to find any other economy around the world that comes close to that. India has already overtaken the UK to become the fifth largest economy and based on estimates will likely become the third largest economy in the next decade.

Demographic Dividend

Many readers will be aware that India’s population has recently overtaken China’s to become the most populous country in the world. The fact that the age distribution in India is more weighted to economically active age groups underpins the structural opportunities in many sectors of the Indian economy. This, combined with the increase in income for lower-earning households, will, in our opinion, continue to drive higher demand from consumers. The combination of rapid urbanisation, a growing population, rising household affluence and improving accessibility of goods and services will drive the twin engines of consumer demand in India – staple goods and discretionary products – where we can find attractive investment opportunities.

Capital Expenditure meets demand

Post the global financial crisis, it’s fair to say that India missed a significant capex cycle. We have previously described this as the lost decade. However, that is only one part of the story. Over that period the government has made significant strides in terms of getting the foundation laid to allow for a new cycle which can be a much longer and more sustainable period of investment-led growth. This all comes at the same time as growing demand from international companies looking to have a balanced and diversified manufacturing base to ensure long term security. India offers an abundance of natural resources and a growing labour pool, which is highly skilled and low-cost. Many readers will have already read about Apple’s plans to switch manufacturing of iPhones to India. This, in our view, is just the beginning. In addition, we are starting to see a material pick-up in investment in areas like railways and road transportation, as well as in the manufacturing side. The combination of all these factors, gives us confidence about the outlook for growth. The banking system, that will be so important to be able to support this growth, remains in a sound position to be able to provide lines of credit as required.

IT Services

While this area, undoubtedly, is more connected to global growth expectations than other areas of the Indian economy, we still believe the long-term opportunity here remains extremely attractive. The talent pool mentioned above means that there is really no alternative for global corporates thinking about digital or cloud. Moreover the low cost of this talent pool means the opportunity here remains robust though with some level of cyclicality. We are less concerned with the noise around the short term. If anything, this is where investors like us, that can take longer-term views, will see the biggest opportunities present themselves.

Valuations

We are often asked about market valuations and whether we think the India equity market is expensive. Part of the answer to this question lies with investors’ time horizon. But also, more fundamentally according to a theoretical framework which we use to analyse and value individual stocks, the key components that drive the value of any business are its growth rate and the return on equity (ROE). Using the same lens for the market, we have long argued about the much longer and higher duration for the India equity universe. However, on top of that the Indian equity market has consistently delivered the attractive combination of a much higher average ROE and a lower variation around that coupled with the higher long-term growth. This provides ample justification for higher long-term multiples. We don’t view market valuations to be out of sync with the long-term opportunity.

In addition to the above, the long-term opportunity for any market is a function of two main drivers: 1) Dispersion – the difference between the best and worst performing stocks i.e., the ability to add value in stock selection and 2) Opportunity set. The India equity universe combines a high dispersion within the opportunity set with a large universe in which to invest. Hence the best backdrop for return generation.

So, all in all, there are many reasons to be optimistic about the long-term prospects of the Indian equity markets. Volatility such as the market experienced over the past six months is to be expected at times, although it is never comfortable. But we view investing as a marathon, not a sprint, and we remain confident that the Indian market offers just reward for patient investors willing to stay in the race.

. . . . . . . . . . .

Biotech and healthcare

(compare biotech and healthcare funds here)

Managers, The Biotech Growth Trust – 15 June 2023

Macroeconomic factors rather than industry fundamentals continued to dominate portfolio performance during the fiscal year. The fiscal year began with weakness in the biotech sector in April and May 2022, driven by continued investor concerns about rising interest rates. Continued rate hikes by the U.S. Federal Reserve (the Fed) to combat inflation drove down share prices for unprofitable technology stocks broadly, including emerging biotech. Valuations for emerging biotech, which had reached 20-year lows, appeared to bottom out in May and June. In August, drug pricing legislation in the U.S. was passed as part of the Democrats’ “Inflation Reduction Act”. While the bill allows for limited drug price negotiation by Medicare starting in 2026, the provisions appear manageable for the industry and passage of the bill cleared a longstanding political overhang for the sector. By the end of September, the biotech sector had begun staging a recovery from depressed levels. In October, a disappointing round of earnings from large capitalization (cap) technology stocks like Amazon and Meta and growing recession concerns appeared to draw generalist inflows into the defensive pharmaceutical sector and large cap biotech. Large cap biotech outperformance continued in November, but small cap biotech began outperforming in December, and January 2023. Unfortunately, interest rate expectations became more hawkish in February when the U.S. announced a lower-than-expected unemployment rate and higher-than-expected inflation, sending small cap shares back down. In March, the unexpected failure of Silicon Valley Bank (SVB) had a particularly negative impact on small cap biotech, many of which were SVB clients. Even though absolute cash exposure to SVB for most biotech companies was minimal, renewed risk aversion due to the concerns over the banking system caused large cap biotech to significantly outperform small cap biotech.

Our positioning at the beginning of the fiscal year was premised on overweighting smaller cap emerging biotech names for three reasons:

1) Emerging biotech was trading at 20-year valuation lows, with almost 20% of the industry at the start of the fiscal year trading at negative enterprise values (market capitalisation below the net cash on the companies’ balance sheets). Small and mid cap biotech companies had significantly underperformed large cap biotech and the S&P 500 since early 2021 and a reversion in performance based on historical patterns seemed likely.

2) We expected an increase in M&A activity due to the compelling valuations of smaller biotech targets.

3) Emerging biotech, rather than large cap biotech, was still contributing about two-thirds of the total biopharmaceutical industry pipeline. Fundamental innovation was strong.