April 2023

Monthly roundup | Investment companies

Kindly sponsored by abrdn

Winners and losers in March 2023

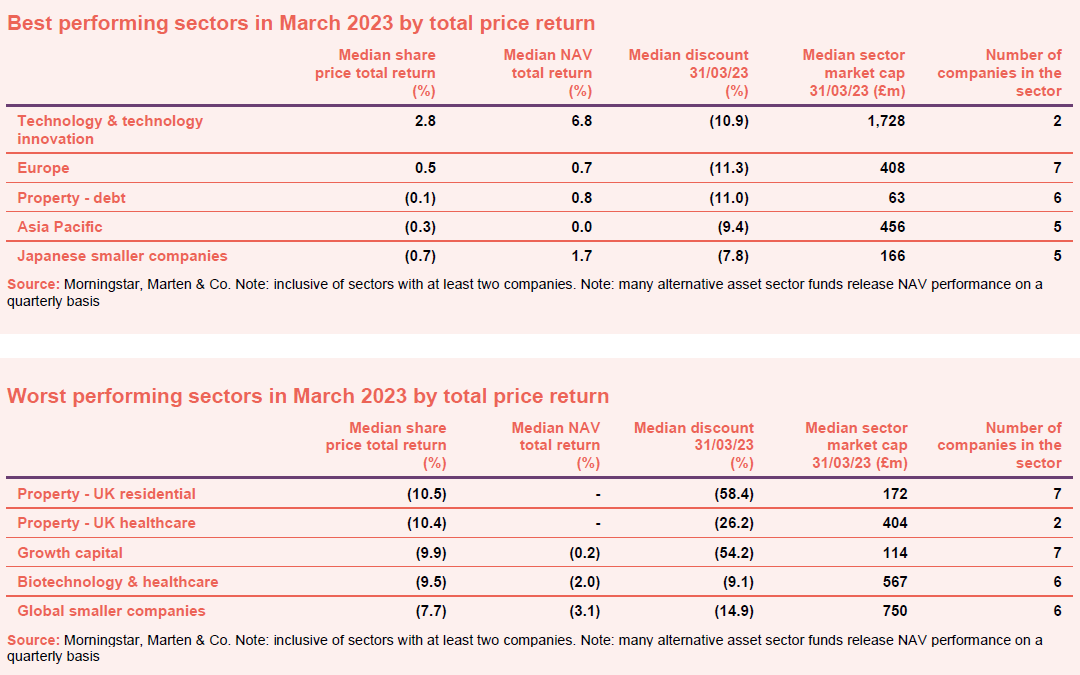

Technology & technology innovation (renamed this month from technology & media) was one of only two sectors with positive returns for the month thanks to a considerable overweight to mega cap tech. Their outperformance appears to be a symptom of a dramatic fall in global bond yields precipitated by the collapse of SBV. Falling yields are driving investors back into longer duration stocks. However, flows out of cyclicals and more risky areas of the market suggest that they are also seeking the relative safety of highly liquid, cash printing companies like Apple, Microsoft, and Google. Europe was the other sector with positive returns with Fidelity European Trust contributing the lion’s share of the outperformance. The trust was a beneficiary of defensive positioning across staples and luxury assets as well as a falling USD, which also contributed to the returns of Asia Pacific and Japan. It was a surprise to see property – debt show up. However, this was more a function of some idiosyncrasies within the sector, namely the continued wind down of Starwood European Real Estate Finance.

UK residential property was the worst performing sector for the month as the two social housing specialists, Civitas Social Housing and Triple Point Social Housing REIT, saw their share prices fall by double-digits. This is despite Triple Point reporting a valuation uplift in 2022. The ongoing debacle at Home REIT, which is currently under investigation for bribery, among other things, may be (unfairly) impacting sentiment towards the social housing players. The UK property healthcare sector was next on the list and is made up of two aged care REITs which tend to be relatively uncorrelated to wider macro volatility, so it was somewhat of a surprise to see these feature. However, it is clear that the entire sector is under pressure as rising interest rates weigh on profitability while the regional banking crisis has also raised concerns around solvency given the amount of leverage in the industry. A bid in the sector (for Industrials REIT) could bolster sentiment in April.

Outside of property, a number of cyclically exposed companies also underperformed as markets began to price an increasing risk of recession following the banking crisis earlier in the month. SVB’s collapse and rising interest rates have also affected the ability for more risky sectors of the market to access capital. Healthcare is generally considered more defensive, and as such should have benefited from these flows, however biotech tends to fall outside of this characterisation, with companies generally requiring significant amounts of cash to maintain their R&D pipelines.

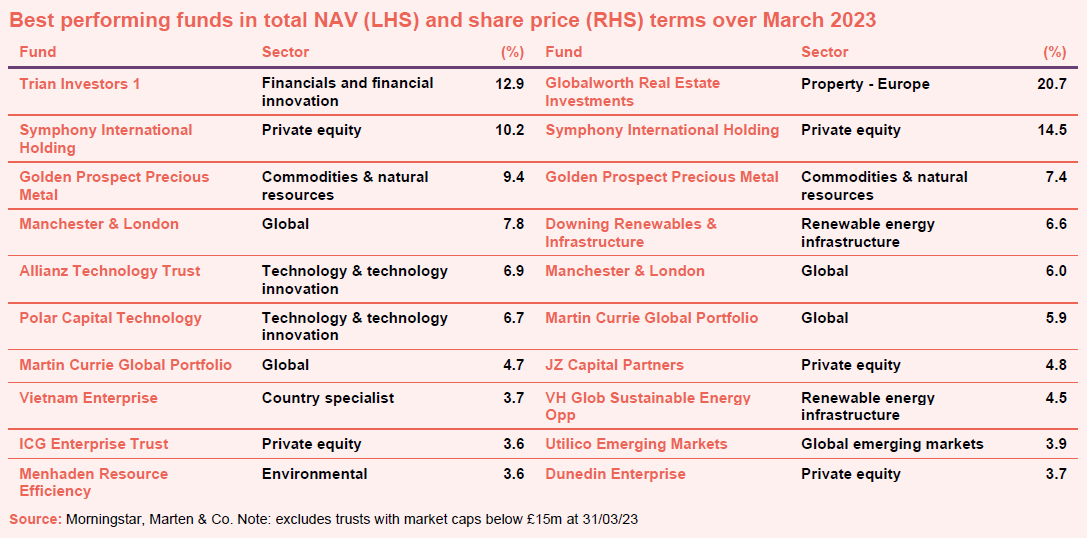

The performance of Globalworth Real Estate stands in contrast to the wider moves in the property sector discussed above, however, its share price gain needs to be put in the context of a 45% drop over the past year. Trian Investors 1 rose as it distributed more of its assets to shareholders. It will likely wind up later this month. A number of private equity funds continue to outperform despite wider public market volatility, although Symphony is relatively unique in that it targets high growth sectors in Asia. The company’s investments have benefited from the stability of equity markets in places such as India and Singapore which have been less impacted by broader market volatility. Global funds, including Manchester & London, Martin Currie Global Portfolio and Menhaden Resource Efficiency have benefited from their exposure to large cap US tech, for reasons discussed above. Commodities have had a relatively rough time of late, although they managed to gain some respite as the USD retreated. Gold, on the other hand, has vaulted higher – up over 20% over the past month – as central bankers are no longer able to fight inflation as hard as they might have liked due to concerns around financial stability, driving Golden Prospect Precious Metal’s outperformance.

Worst-performing

It’s not surprising to see a wide representation of REITs making up the worst performing list of funds, particularly in commercial property, which is facing a multitude of headwinds. As we briefly touched on above, the sector is highly leveraged while valuations look stretched at the same time as demand for rent falters. Add to this concerns around lender solvency and you get the rapid derating of the sector which we are seeing below. Phoenix Spree has a stock-specific problem in that weak sales of condominiums in Berlin are restricting its ability to pay a dividend. Outside of real estate, the overwhelming theme of the worst performers is the rotation away from risk; small caps, biotech growth, nascent renewable infrastructure, all of which have large capital requirements and relatively weak balance sheets reliant on external funding for growth. The fall in HydrogenOne’s share price seemed overdone to us – government money is pouring into the hydrogen sector, globally. Interestingly, Polar Capital Global Financials is the only pure play financial that shows up on any of our worst performer lists (despite having no exposure to the banks that ran into trouble), which is perhaps a reflection of how well policy makers have managed the SBV collapse and resulting collateral damage. The relative underperformance of companies that rely on funding from banks like SBV also highlights the risks associated with sectors leveraged to cheap capital. UK small cap seems to have taken another tumble in March. Some of that may relate to the SVB issue.

Moves in discounts and premiums

The narrowing of the discounts for the two REITs is a result of a significant negative adjustment to NAV for both companies. It’s not clear what drove Chelverton’s higher premium however the company has taken it as an opportunity to issue more shares. Downing Renewables is riding the positive news from its annual results, reporting a NAV total return for 2022 of almost 20%. It probably also helped that a frustrated board authorised share buybacks on the trust. Even after its impressive share price rise over March, Globalworth remains on a very wide discount. This may reflect investors’ concerns over the prospects for eastern Europe’s economy as the was in Ukraine rumbles on.

At the other end of the scale, Digital 9 and HydrogenOne saw their discounts widen further, with both trading roughly 50% below NAV at the end of March. Despite this, the companies saw NAV uplifts through 2022 and both have released trading updates over the past month to reassure investors of the underlying health of their assets. Unfortunately, the weakness appears to be driven by wider macroeconomic conditions (chiefly rising interest rates) with the renewable infrastructure and growth capital sectors particularly weak over the last few months. Phoenix Spree Deutschland was discussed above.

https://quoteddata.com/wp-content/uploads/2023/04/5-3.png

Money raised and returned

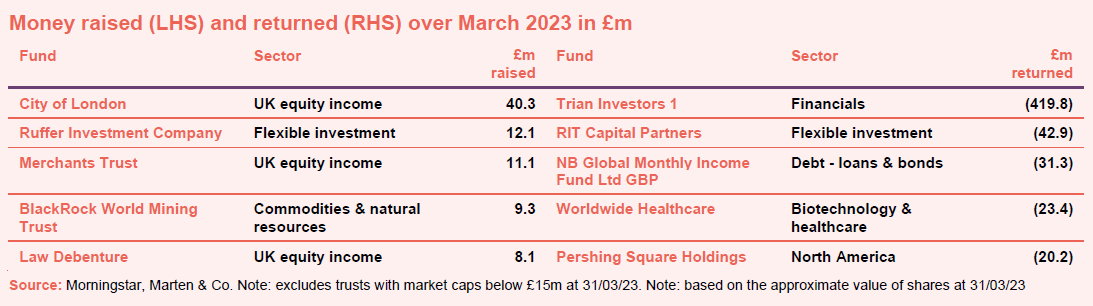

Money raised for the month was mostly a case of the usual suspects with City of London, Ruffer, and Merchants taking advantage of their respective premiums to raise capital. CTY in particular has picked up where it left off, having raised £65.5m at the back end of last year. BlackRock World Mining also features, capitalising on its impressive 2022 performance. The lack of new faces reflects what has been a relatively challenging environment for the trust universe over the last few months

For those companies returning cash, Trian headlines the list as it distributed its Unilever shares and goes through the process of winding up. RIT Capital Partners has also been aggressively buying back shares, after its shares fell to a discount almost on par with its pandemic nadir.

SLF Realisation left the sector during March and JPMorgan Global Growth & Income converted its C shares, which saw a total of 58,605,746 ordinary shares enter circulation.

Major news stories and QuotedData views over March 2023

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news and we usually have a special guest or two answering questions about a particular investment company.

| Friday | The news show | Special Guest | Topic |

| 13 January | DGI9, AT85 | Thao Ngo | Vietnam Enterprise |

| 20 January | RICA, ORIT | Stephanie Sirota | RTW Venture Fund |

| 27 January | JLEN, HGEN, USF, HNE | Eileen Fargis | Ecofin US Renewables |

| 3 February | SOHO, AERI | Will Fulton | UK Commercial Property REIT |

| 10 February | 3IN, CCJI, CHRI | Colm Walsh | ICG Enterprise |

| 17 February | IBT, ASCI | James Dow | The Scottish American Investment Company |

| 24 February | HEIT, NESF | Jean Hugues de Lamaze | Ecofin Global Utilities and Infrastructure |

| 03 March | AEET/AEEE, PEY/PEYS, SOHO | David Bird | Octopus Renewables Infrastructure Trust |

| 10 March | ATST, FCIT, HOT, OCI | Anthony Catachanas | VH Global Sustainable Energy Opportunities |

| 17 March | BGLF / BGLP, EPIC, SMT, ALAI | James Hart | Witan Investment Trust |

| 24 March | SMT | Richard Staveley | Rockwood Strategic |

| 31 March | GOT, PSDL, TFG, MNTN | Alex O’Cinneide | Gore Street Energy Storage Fund |

| Coming up | |||

| 14 April | Stephen Inglis | Regional REIT | |

| 21 April | Jean Roche | UK Mid Cap Fund | |

| 28 April | Craig Baker | Alliance Trust | |

| 12 May | Kamal Warraich | Canaccord Genuity Wealth | |

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

Research

AVI Global Trust (AGT) offers investors a unique opportunity to access a distinctive portfolio of good-quality investments that are selected because the managers believe that they are trading at a discount to their intrinsic value. Thanks to recent market movements, AGT’s ‘double discount’ – its own share price discount to NAV plus the discount on the underlying portfolio – now sits on an abnormally wide level. The management team has been tactically increasing AGT’s market exposure to tap into these discount-opportunities. This gives AGT’s shareholders the potential to benefit from a powerful combination of NAV gains and discount closing. AGT has demonstrated the success of its approach, which has been the main driver of the trust’s highly-competitive near-to-mid-term performance. AGT’s NAV returns rank first in its peer group over three years to end February 2023 (see page 15).

JLEN Environmental Assets (JLEN) experienced an eventful but fruitful 2022. Volatile power prices, rampant inflation, rising interest rates and new taxes buffeted the renewables sector but generally acted as a tailwind for net asset value (NAV) growth. Some of these issues will continue to affect the sector in 2023. We explore all of these from page 4 onwards. JLEN’s managers can have little influence on these big macroeconomic factors but they can, through their investment activity, lay the foundations for future NAV uplifts.

Pantheon Infrastructure (PINT) has been busy assembling a diverse portfolio of 11 investments in infrastructure projects, located in developed markets. The majority of these have explicit inflation-linkage built into their structure or implicit protection through regulation or market position. In addition, the company is substantially hedged against foreign exchange movements. Whilst it is still early days for the trust, the NAV has made positive progress.PINT’s ambition is to generate NAV total returns of between 8% and 10% per annum over the long term. This is intended to come in the form of both capital and income growth. For this financial year, the trust is targeting a dividend of 4p per share.PINT still has about £72m of funds available to deploy into new investments (see page 16). The manager says that the tailwinds that support the demand for new infrastructure, and the growth opportunities that accompany it, remain strong across all the sub-sectors the company is active in. Once PINT’s discount is eliminated, we would expect to see the company grow through share issuance.

Oakley Capital Investments (OCI) invests in private equity funds managed by Oakley Capital Limited (Oakley). OCI is, as we show on page 22, the best-performing fund in its peer group over five years. As evidenced by its latest full-year results, this has been achieved in spite of a difficult macroeconomic backdrop. OCI believes that this can be attributed to three core factors:•the expertise that its adviser has built in a focused group of sectors (technology, consumer, education) over 20 years of private equity investing;•a unique investment origination strategy, which continues to unearth opportunities that others cannot access (seven new investments were made last year); •and a set of proven value-creation strategies that help accelerate the earnings growth of the companies that OCI backs (22% EBITDA growth on average over 2022, accounting for around two-thirds of OCI’s NAV growth over 2022). The success of the approach is evidenced by OCI’s 23% compound annual growth rate of its net asset value (NAV) over five years.

India Capital Growth’s (IGC’s) adviser, Gaurav Narain, says that at a time when many economies and equity markets are struggling, there are many reasons to be optimistic about the outlook for the Indian economy. Although down in sterling absolute terms during the last 12 months, the Indian market made progress in local currency terms and has performed well relative to its emerging market peers, benefitting from a good run in the second half of 2022 from which IGC also benefitted. Despite the recent market setback so far this year, Gaurav thinks there is more upside to come, noting that business confidence is high (both the services and manufacturing purchasing managers indexes (PMIs) were over 55 at the end of February and have been around this level for some time – see page 6). Gaurav notes that valuations remain elevated even after the recent setback, but recent market volatility has thrown up opportunities and IGC’s own discount to net asset value (NAV) offers value, particularly with a redemption opportunity where the exit discount is set at a maximum 3% of NAV and the additional resource that the manager’s absorption into AssetCo Plc should bring (see pages 4 and 5).

JPMorgan Japanese Investment Trust (JFJ) has a large exposure to good quality companies that are at the forefront of the modernisation of the Japanese economy. The portfolio embraces businesses in robotics, ecommerce, digitalisation, healthcare, and renewables. It also backs some great Japanese brands and businesses that are helping the economy adapt to an ageing population. These are ‘growth’ stocks and, as we discussed in our last note, even though Japan has not, as yet, experienced the interest rate rises that triggered the selloff in growth stocks in other markets, their share prices have plunged, and this has impacted on JFJ’s performance.The trust’s managers, Nicholas Weindling and Miyako Urabe, highlight the valuation opportunity that this has created; Japan was out of favour before this fall, the stocks in the portfolio are cheaper yet still boast superior earnings growth prospects than the average Japanese company, and the yen is undervalued (a stronger yen relative to the pound would boost JFJ’s returns). This could be a good chance to back a former sector-leading trust, while underlying valuations look cheap.

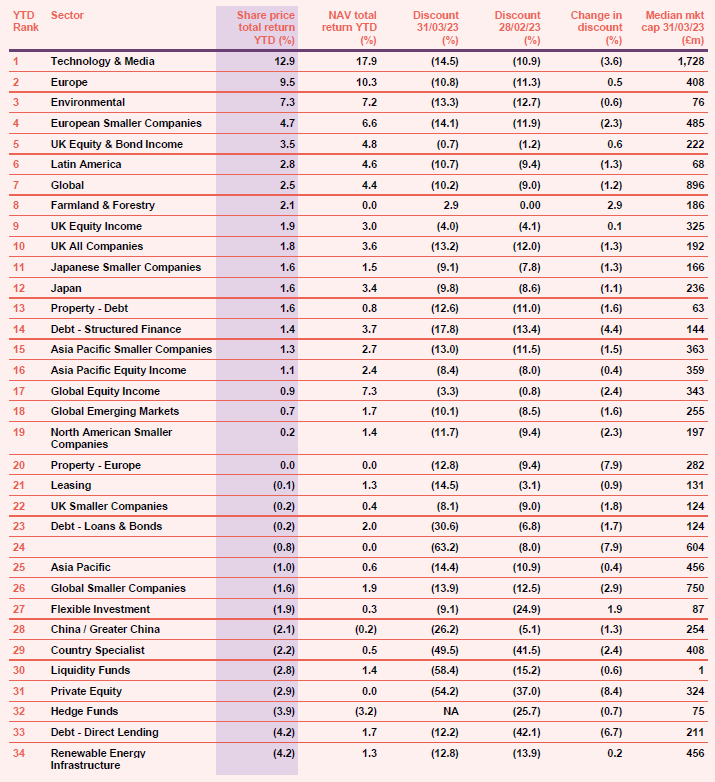

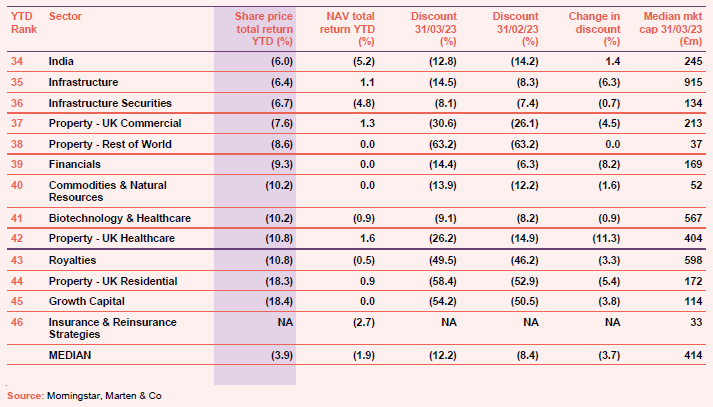

Appendix 1 – median performance by sector, ranked by 2022 year to date price total return

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.