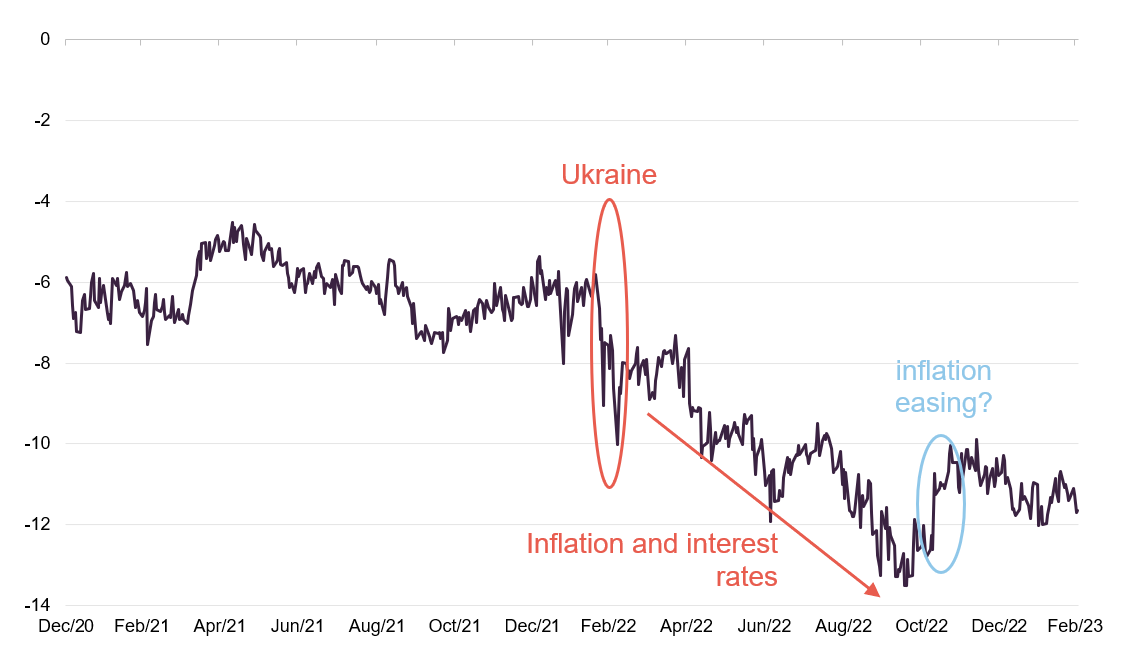

The chart below shows how the median discount of share price to net asset value (NAV) across the whole London-listed investment companies market has moved since the start of 2021. What we see is a big lurch downwards around the outbreak of the war in Ukraine. Then a steady widening over the next few months while inflation ballooned and interest rates were climbing, followed by a sharp rally in autumn 2022 as it seemed that US inflation had peaked. More recently, it feels as though discounts are widening again, perhaps as investors fret that higher interest rates might be with us for longer than they had anticipated.

There have been some big moves: 59 funds experienced a discount widening of more than 20 percentage points over that period. Within that group are some of the industry’s largest and most visible funds – Scottish Mortgage, 3i Infrastructure, International Public Partnerships, Tritax Big Box REIT, LXI REIT, HarbourVest Private Equity, Pantheon International, Hipgnosis Songs, and Supermarket Income REIT, for example. That is a serious problem for the investment companies sector. These (all of which still have market caps over £1bn) are the funds that many first-time investors will have picked. They are probably the funds that were recommended by friends and family, they include some of the funds that have seen the biggest inflows of capital in recent years. That all adds up to a lot of disappointed people.

If the sector is to regain investors’ trust, action is needed, and soon.

Be wary of big premiums

However, quite a few of these de-ratings represent a shift from trading at a substantial premium to trading on a modest discount. 3i Infrastructure, for instance, began 2021 trading on a 21% premium and today trades on about a 3% discount. Here the issue is one of education. As we caution investors in our guide (see page 26), big premiums can be problematic. It is wise to be wary of buying funds trading on big premiums to asset value as these can evaporate when sentiment shifts. There isn’t much that 3i Infrastructure can or even should do to get the fund trading back at a 21% premium – unfortunately, that loss may be permanent.

Illiquidity is an issue

We feel that when a discount starts to hit double digit territory, boards should be thinking about what they can do to tackle that. Most of the funds mentioned above are investing in relatively illiquid assets. It is harder for them to sell investments to fund share buy backs. One fund where that is not true is Scottish Mortgage. However, it does have an illiquid asset problem in that almost 30% of the fund is invested in private equity (the figure at the end of January 2023 was 28.1%). That is an issue as shareholders have imposed a limit of 30% on the trust’s unlisted exposure, if it breaches that level, the trust cannot make any new unlisted investments. Scottish Mortgage has been repurchasing its shares but not fast enough to make a real difference to its discount. Its buybacks, which are generally funded from liquid assets, push it closer to having 30% in unlisteds. We have called for that limit to be raised to 50% and we would then like to see the trust step up its share buyback activity with the aim of achieving a meaningful narrowing of the discount.

Other big global funds already have policies in place to do just that. For example, the £2.9bn market cap Alliance Trust aims to keep its discount not far off 5% in normal market conditions, and it does a reasonable job of that. Today, it is trading on a discount of just 6.7%, having bought back over 16m shares since the start of 2022.

Doubts about true NAV figures

Some funds have seen their discounts widen as investors feel that their NAVs may be overstated. That seems to be true in the private equity sector, for example. However, there has been quite a bit of evidence to suggest otherwise. These funds are regularly selling businesses, and when they do, they tend to record big valuation uplifts, suggesting that if anything the NAVs are understated. There could be danger here for some of these funds. A few years ago, one of the flagship funds in the private equity sector and one of its best-performers was targeted by an asset stripper. The fund was dismembered, realising significant profits. It is not inconceivable that this could happen again.

Decisive action

This week, we have seen a couple of funds decide to take action to demonstrate the accuracy of their NAV valuations. On 2 March, Tritax Big Box REIT announced that it was selling three assets for a combined total of £125m. This was in line with the value that had been attributed to these assets at the end of December, and reflected a combined net initial yield of 4.6%. The money raised is being used to reduce debt. The chairman also indicated that some of the money would be recycled into other investment opportunities, but we think shareholders should be demanding that at least a portion of it should be used to fund share buy backs at this level (the current discount is about 23%).

Triple Point Social Housing REIT, which is trading on a hefty 54% discount (down from a 6% premium at the start of 2021), is being more proactive. Its latest results statement said that “The board and the manager are focused on delivering value to shareholders, and are exploring making accretive share buybacks and the potential sale of a portfolio of the group’s properties”. We think that could make a real difference to its rating.

More corporate activity?

In this week’s show, both Andrew McHattie and I highlighted the discount opportunity that exists currently within the renewable energy sector. The subject came up because shareholders in Aquila Energy Efficiency voted against the continuation of that fund this week, and its discount narrowed – a bit anyway, yet there is still some distance to go if the NAV is correct. Andrew noted the possibility of more corporate action activity across the investment companies sector, as brokers starved of revenue from sponsoring share issues look to generate corporate fees instead. That seems quite likely to me. We have already seen quite a few funds decide to throw in the towel, launching strategic reviews, in recent months, and there could be more to come.