April 2024

Monthly | Investment companies

Kindly sponsored by abrdn

Winners and losers in March 2024

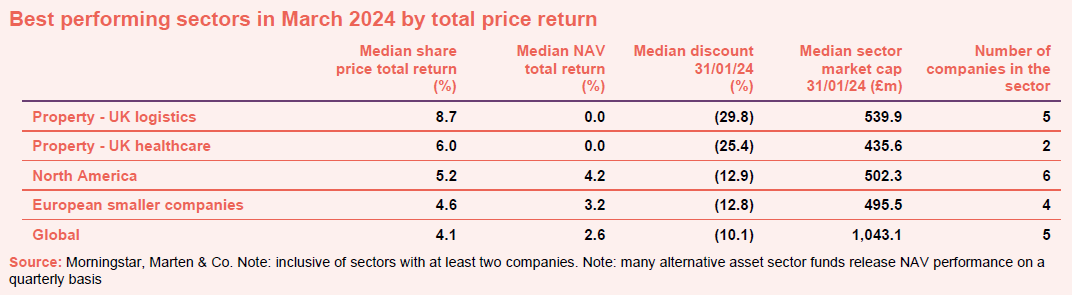

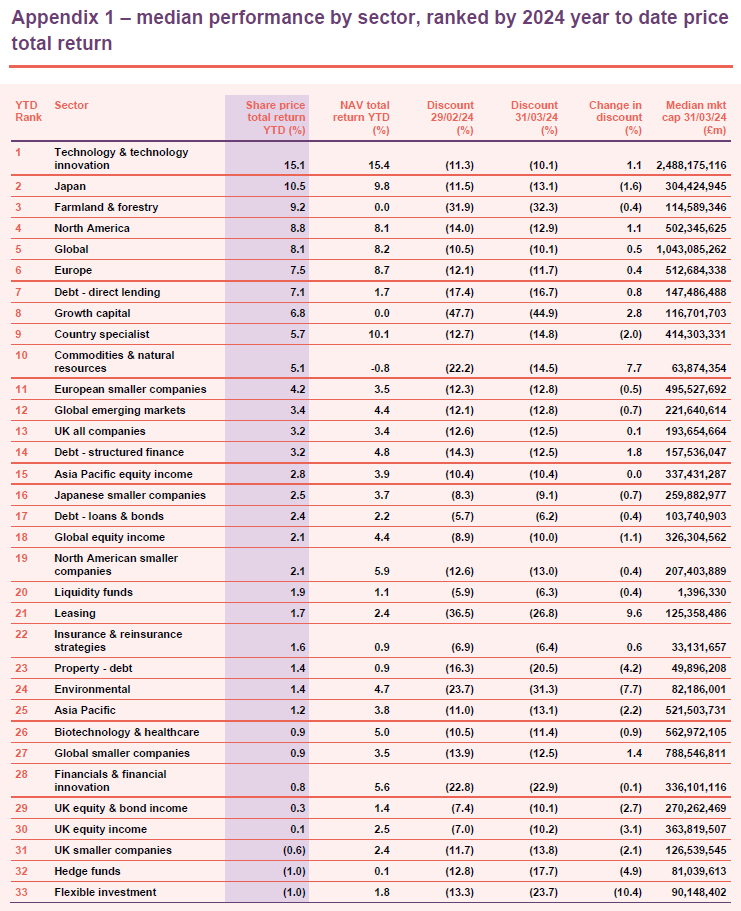

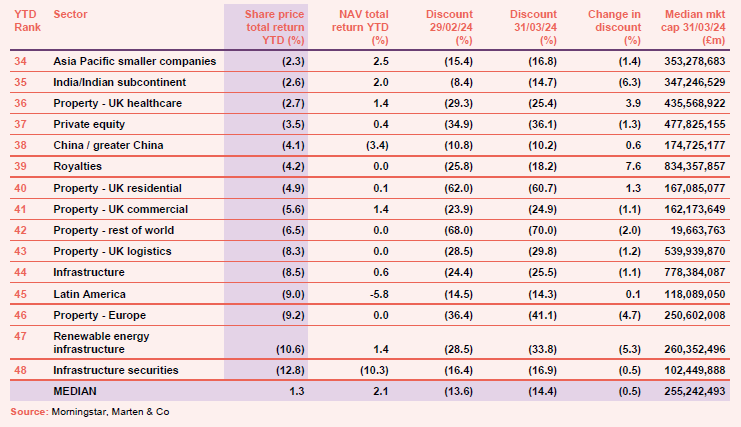

Green shoots have finally started to emerge in the UK property market with logistics and healthcare the two best performing subsectors in March, up 8.7% and 6.0% respectively. Returns were boosted by February’s inflation data which, while still well above the Bank of England’s target of 2%, was down sharply, falling to 3.4% from 4.2% the month prior, marking the slowest annual rate since September 2021. Falling inflation has driven down bond yields with the two-year gilt yield falling almost 30 basis points (0.3%) this month.

The North America sector maintained its recent momentum in March, although on this occasion the outperformance was driven by broad based gains across the economy rather than the concentrated bunch of tech stocks we have become accustomed to. Within the sector, the BlackRock Sustainable American Income trust was the best performer thanks in particular to solid growth in the financial sector.

The European smaller companies sector was also up strongly, with the move likely reflecting a more dovish tone from the European Central Bank following February’s inflation data which came in at just 2.4%. Traditionally, smaller companies are more rate sensitive than their mid and large cap peers as they tend to hold higher levels of debt, meaning any fall in interest rates is well received.

Global returns continue to be driven predominantly by the outperformance of the US which now makes up almost 60% of global benchmarks. That being said, the best performing trust within the sector was Scottish Mortgage which, after a challenging couple of years has seen some interesting developments. During the month, the company announced a decision to make at least £1bn available for buybacks over the next two years, which, once completed will amount to roughly 7.8% of its net assets. The company also announced that Elliott Associates, the US activist hedge fund, had acquired a 5% stake in the trust.

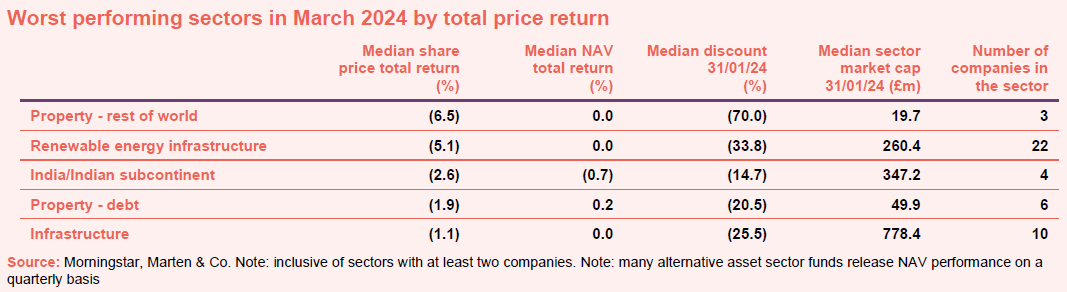

While China managed to avoid the worst performers list this month, the fall in the Property – rest of the world sector was headlined by the Macau Property Opportunities trust. The trust released its interim results in March, citing the sluggish Chinese economy as one of the key reasons for its ongoing struggles.

Despite the positive inflation developments discussed above, the Renewable energy infrastructure sector remained under pressure in March, continuing a long running trend of underperformance. This remains particularly frustrating for investors and management alike as despite the share price performance, many trusts within the sector boast positive NAV growth so far this year. The sector was one of the worst affected by the rapid rise in interest rates, and it was expected that once this pressure eased, returns would begin to improve, however this has not been the case so far.

Much like their renewable energy peers, the Infrastructure sector is yet to see any real positive inflection from falling inflation, despite some companies within the sector managing to maintain reasonable solid fundamental performance.

Strong economic growth continues to drive returns in the Indian market, with benchmark indices up almost 30% over the past 12 months. More recently however, concerns have arisen over valuations and market liquidity, particularly within small and mid-cap sectors. This prompted The Securities and Exchange Board of India to requested Indian mutual funds find ways to slow the flow of funds into smaller stocks. Upcoming Indian elections add another layer of complexity, and markets took a breather in March. However, momentum remains strong, and markets have resumed their climb since the end of the month.

Despite some signs of improvement, the property sector remains under immense pressure from higher interest rates, particularly within areas such as lending, and commercial property. The Alpha Real Trust was the worst performer, releasing its interim results during the month with shares down 12%. Among other issues, the company cited four loans in the portfolio which have borrowers in receivership.

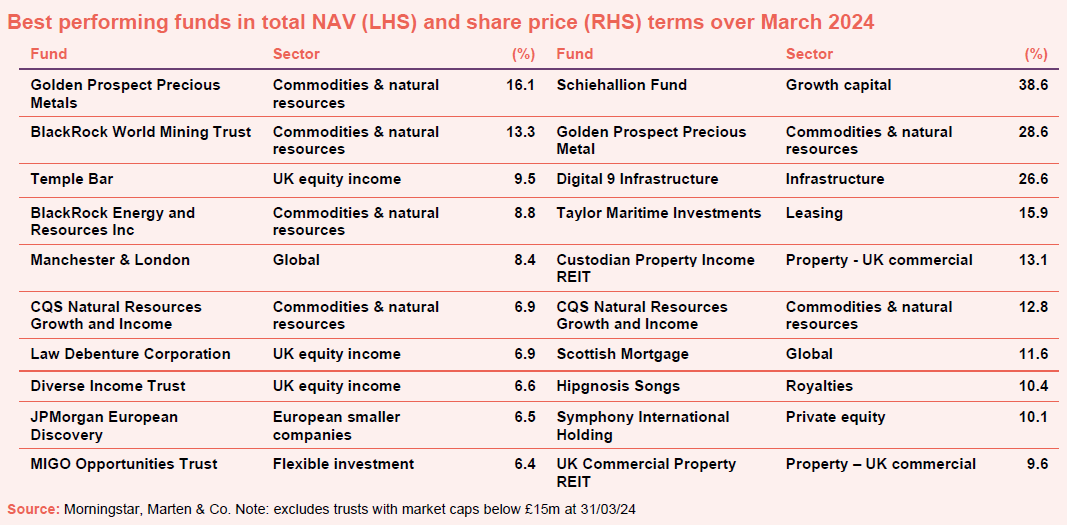

Looking now at the best performing companies in terms of NAV growth, the list is dominated by the Commodities & natural resources sector after a barnstorming run across the asset class. Golden Prospect Precious Metal led the way, representing a high beta play on the price of gold, with the rally coming as miners have been trading at a multi-decade low relative to the gold price. The precious metal has had a remarkable run over the past six weeks, with spot prices up almost 20% since the middle of February. Fears that the Federal Reserve’s control of inflation is lacking seems the most likely explanation.

Oil prices have also rallied strongly over the last couple of months due to escalating geopolitical tensions, an improving growth outlook, and ongoing supply cuts. The energy sector also boasts compelling fundamental upside with recent analysis from the Bank of America suggesting that energy is the second most undervalued industry group for a potential higher growth regime.

Base metals have also risen thanks to the improving global growth outlook and hopes of the long-awaited recovery in Chinese demand. Supply disruptions have added to the momentum, while longer-term production imbalances for key electrification metals such as copper remain a strong tailwind.

Strong commodity returns have also boosted the UK equity income sector, with companies such Temple Bar, Law Debenture, and Diverse Income all holding relatively large positions, particularly in the energy sector. These companies have also benefited from exposure to the Financials sector, which was up strongly in March as the UK economy shows signs that the worst is now behind it.

Outside of these sectors, JPMorgan European Discovery which invests in a broad range of European smaller companies benefited from the softer inflation data discussed earlier, while the MIGO Opportunities Trust saw strong performance from some of its larger investments, including VinaCapital Vietnam and Georgia Capital.

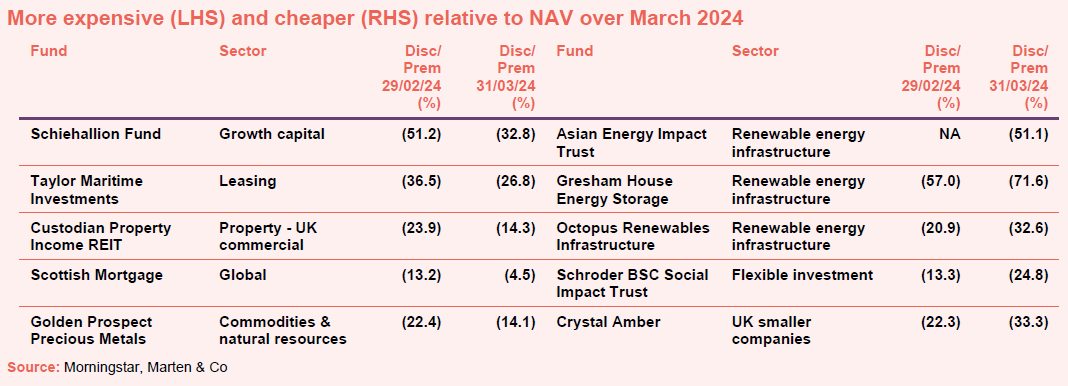

The best performers by share price list also reflects the improvement in the Commodities sector, but we did see some large moves in several individual trusts. Baillie Gifford’s fund of unquoted companies Schiehallion Fund saw a significant shift, which began at the start of March following two large trades which were well above the trust’s average daily volume. The share price momentum continued over the course of the month, although the trust remains on a 35% discount. Shares in Taylor Maritime Investments also rallied strongly off the back of a large purchase by shipping magnate Christian Oldendorff. Digital 9 Infrastructure bounced following the announcement that the Icelandic regulator had given approval for the sale of its holding in Verne Global group, which was then completed later in the month.

Custodian Property Income REIT’s shares jumped following the announcement that its planned merger with the abrdn Property Income Trust was off after not receiving enough support from the target’s shareholders. It seems likely that this reflects the unwinding of merger arbitrage trades, which also had the effect of depressing abrdn Property Income’s share price. Custodian’s share price is still down 7.1% from the pre-deal announcement. Shares of Hipgnosis Songs bounced off their lows in March following a series of issues which have seen the trust lose almost 40% of its value. The latest of these was an announcement that the company’s NAV was calculated incorrectly. The positive return for the month perhaps reflects the hope that the worst is now behind the trust and that a bidder may finally emerge for its assets. It is unclear what drove the returns for Symphony International, with the company currently undertaking an asset realisation strategy.

Terms on the merger of UK Commercial Property REIT with Tritax Big Box REIT have been agreed, boosting the former’s share price.

Worst performing

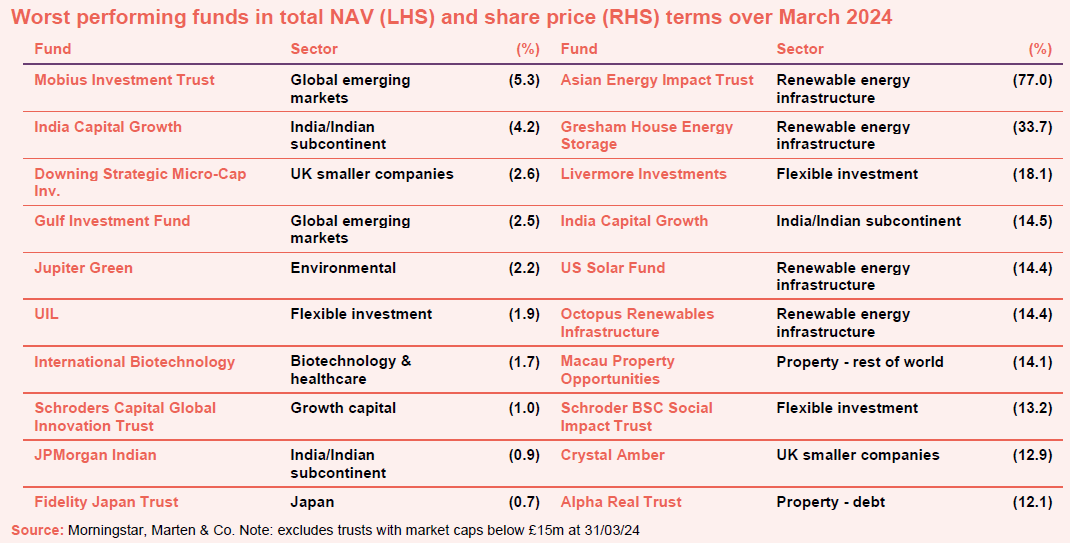

Returns across the investment trust sector were generally positive over March, reflected in the relatively modest falls in the worst performers list. The Mobius Investment Trust saw several of its larger investments decline by more than 10% including EPAM Systems and Elite Material. The two Indian funds suffered from the issues discussed on page 2.

Downing Strategic Micro-Cap, which is in wind-down mode, saw one of its largest holdings, Fireangel Safety Technology, fall 47% overnight, although positive returns from a number of its other holdings at the beginning of April have recovered much of the fall. The negative returns of the other trusts mostly reflect market timing, rather than any company specific events.

In terms of the share price performance, shares in the Asian Energy Impact Trust (formerly ThomasLloyd Energy Impact) collapsed after its listing restoration, following the drawn-out debacle surrounding its investment in the Rewa Ultra Mega Solar Park in India. The company has since announced that it will ask shareholders to approve an orderly realisation of its assets. Several other renewable energy infrastructure companies also feature in the list. There are some company specific factors (such as Gresham House Energy Storage’s dividend cut) at work here, but the general selloff is hard to rationalise. Shares in the Gresham House Energy Storage trust have fallen almost 60% so far this year after the company was forced to cut its dividend due to a range of issues including grid connection delays and under-utilisation of battery balancing mechanisms. The US Solar Fund has also struggled over a long period due to a combination of factors which included uncertainty created by the company’s strategic review and the departure of its investment manager.

The attractions of Schroder BSC Social Impact Trust have faded somewhat with the higher attractive returns now available from “risk free” government debt, while returns of Crystal Amber fluctuate on the fortunes of holding De La Rue which now makes up 95% of the value of its quoted portfolio after several years of realisations. Alpha Real Trust reported the sale of its largest property asset at a substantial discount to book value.

Moves in discounts and premiums

We have talked about these moves already. Asia Energy Impact’s shares have fallen so far in April despite news of its planned wind-down. We would also note that retail investors are unlikely to ride to the rescue of Gresham House Energy Storage given that, unlike its peers, its shares are restricted to trading on the Specialist Funds Segment of the London Stock Exchange.

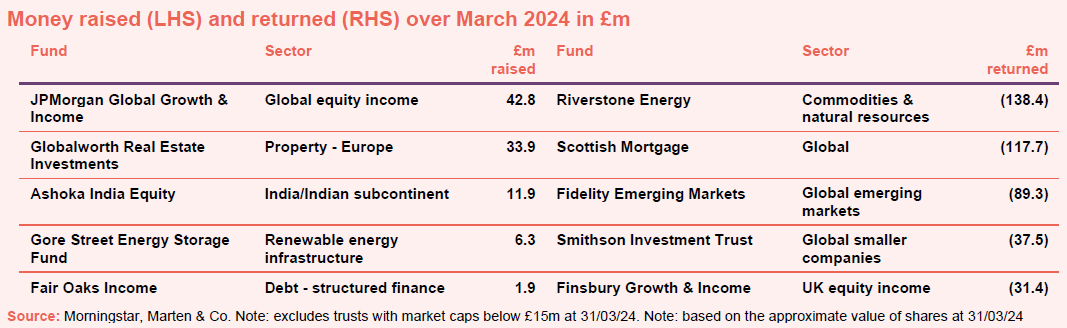

Money raised and returned

JPMorgan Global Growth & Income, which regularly features in the list of top issuers, led the charge in raising new capital during March. In addition to its regular tap issuance, that the company also announced that it will acquire the assets of JPMorgan Multi-Asset Growth & Income in exchange for the issue of 13,546,292 new shares. There were several other combinations during the month with Fidelity China Special Situations acquiring abrdn China, STS Global Income & Growth absorbing Troy Income & Growth Trust, and Henderson European Focus Trust merging with Henderson EuroTrust. Ashoka India Equity remains in demand as its shares continue to hit new highs. The Globalworth Real Estate trust issued shares to satisfy its stock-based compensation plan despite trading at a significant discount. Gore Street Energy Storage issued shares at asset value as part of a deal with Low Carbon to expand its portfolio with an additional 75MW of storage assets. Fair Oaks Income issued new shares to satisfy market demand.

Riverstone Energy closed its fully subscribed tender offer in March which resulted in the company repurchasing shares representing approximately 35.66% of its issued share capital. As discussed above, Scottish Mortgage has begun significant repurchases following the announcement of a £1bn buyback allocation over the next two years. Fidelity Emerging Markets announced the completion of a tender offer equal to 14.99% of its outstanding shares. Smithson Investment Trust has continued to repurchase shares as it trades on a stubborn discount which remains over 10%.

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

Major news stories and QuotedData views over March 2024

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

Research

abrdn Private Equity Opportunities – On the way to greener pastures

Despite navigating through challenging conditions in 2023, abrdn Private Equity Opportunities (APEO) achieved remarkable success with recently published annual results reporting both positive net asset value (NAV) growth and double-digit share price returns. APEO’s discount to NAV has narrowed by more than 10 percentage points in recent months, so that it is shares are trading on a 28.9% discount currently, narrowing from about 45% last October. This resilience came in spite of a slowdown in activity in European private equity markets in 2023, dampened by a residual fear of rising interest rates and geopolitical tensions.

In spite of an uncertain macroeconomic environment, Oakley Capital Investments’ (OCI) underlying portfolio continued to generate robust earnings growth in 2023 (average 14% EBITDA growth), which in turn drove 4% net asset value (NAV) growth. More importantly, OCI achieved an 18% total shareholder return during the period, extending the long run of strong share price performance delivered by the company (an average compound annual growth rate of 24% per year).

We are now more than three years into the tenure of Ian Lance and Nick Purves as managers of the Temple Bar Investment Trust. In that time, the Redwheel team has established a well-diversified portfolio of value-orientated holdings, positioned for what they believe is a long-overdue reversion to more normal market conditions, after a decade of exceptional economic policy and quantitative easing. Slowing growth and stubborn inflation in the UK have weighed on returns over the past 12 months. However, the trust remains well ahead of both benchmark and peer group averages since the change in management, and the current negative sentiment surrounding UK markets has allowed Ian and Nick to pick up a number of market-leading companies at historically low multiples.

In yesterday’s BlackRock Throgmorton (THRG) annual general meeting, manager Dan Whitestone outlined the significant potential for a surge in UK equities, with small and mid-caps outperforming large caps by a sizeable margin, as the macroeconomic outlook in the UK improves. Dan highlighted that UK companies’ share prices have become increasingly detached from their earnings potential. A combination of political uncertainty thanks to the forthcoming elections, sticky interest rates, strength in overseas stock markets (in particular in a handful of big AI-related US tech names), and consistent outflows of investments in UK-focused funds has weighed on valuations.

A number of factors have combined to have a small negative effect on Aquila European Renewables’s (AERI’s) net asset value (NAV) and the share price discount to NAV in recent weeks, including nerves about when interest rates will be cut, lower power prices, and the imposition of new taxes on renewables in Norway and Spain. These have added to the broader economic pressures that have weighed on the share price over the past year, but the adviser observes that these are now mostly de-risked. The entire renewable energy infrastructure sector has been affected by widening share price discounts to NAV and, for the most part, we believe this is entirely unjustified, having gone well past the mechanical impact of rising interest rates on the sector.

NextEnergy Solar Fund – High- and growing-income opportunity

NextEnergy Solar Fund (NESF) is almost 10 years old. Since launch, it has built a £1.2bn, 933MW portfolio of 100 operating solar assets, powering the equivalent of over 330,000 homes, declared dividends totalling £333m, and avoided the emission of about 2.2 Mt CO2e. NESF is on track to pay 8.35p in dividends, with forecast dividend cover of about 1.3x. Share price weakness that has afflicted the whole sector means that dividend translates to a dividend yield of 11.1%, one of the highest in its sector, and the share price’s near 30% discount to net asset value (NAV) provides the prospect of attractive capital appreciation when sentiment towards the sector recovers.

At just over two years old, the Pantheon Infrastructure Trust (PINT) can claim to have seen a lot in its short life. Its positive net asset value (NAV) return over this period, despite increasingly challenging economic conditions, is a testament to the execution of the fund’s advisers, and the stability of its assets. Whilst the company’s share price has fallen, this is more a reflection of negative market sentiment towards the broader infrastructure sector than any fundamental weakness on the part of PINT. Promisingly, as the rate of inflation began to trend lower, sentiment towards the listed infrastructure sector improved steadily, particularly for companies such as PINT which maintained financial discipline as funding costs rose. Over the last few weeks, discounts to NAV have widened once more due to the rebound in inflation. However, despite these short-term fluctuations, we believe the PINT portfolio remains well positioned for significant growth.

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

IMPORTANT INFORMATION

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.