August 2023

Monthly roundup | Investment companies

Kindly sponsored by abrdn

Winners and losers in July 2023

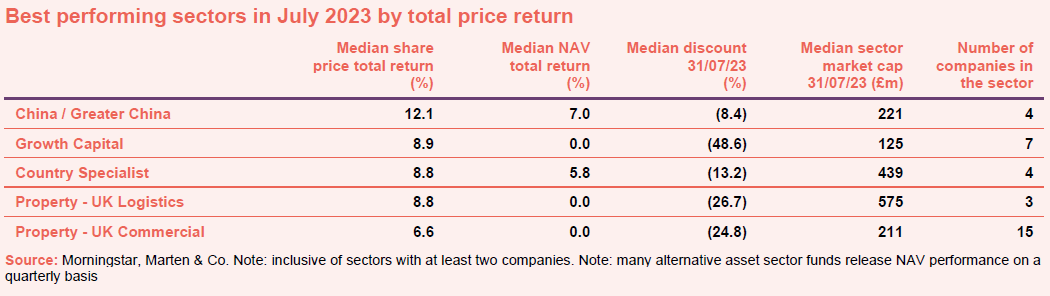

The China / Greater China sector led markets higher over the course of July following a Politburo meeting that outlined a range of measures designed to support the beleaguered economy. While the meeting provided some optimism for investors in the region, critics have noted that the focus was more on high level sentiment rather than any concrete policy interventions. Data across the region also continues to trend lower, with the latest numbers showing that the economy is in deflation, while exports also fell 14.5% year-on-year in July, marking the steepest fall since the outset of the pandemic.

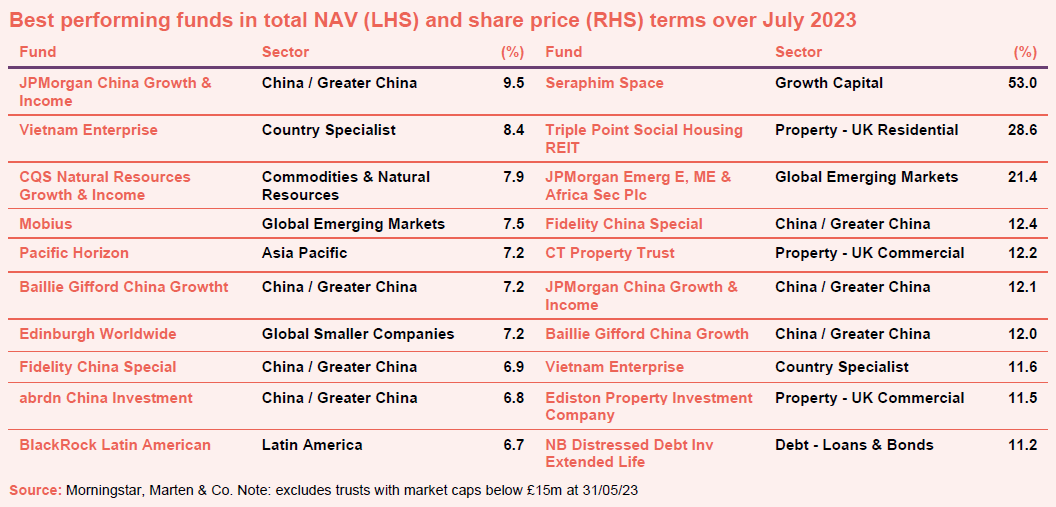

Growth Capital was also up strongly, with shares in the Schroder Capital Global Innovation, Chrysalis, and Schiehallion funds all up close to double digits, however the clear winner was Seraphim Space, which jumped 53% following a trading update which showed that 11 companies in the trust’s investment portfolio had closed investment rounds during the first half of 2023. Of these, six were made at higher valuations than previous rounds with only one being a ‘down round’. The company also announced a new buyback programme which would allow up to 14.99% of its share capital to be repurchased.

The Country Specialist fund, made up predominantly of funds from Vietnam, was also up strongly, continuing its good run having also featured in the best performers list in June. This has been boosted by relatively low inflation in the region, improved consumer spending, and increasing tourist activity.

After a horrid run to start the year, the property sector saw some burgeoning signs of life thanks predominantly to a positive read on inflation in the UK during July.

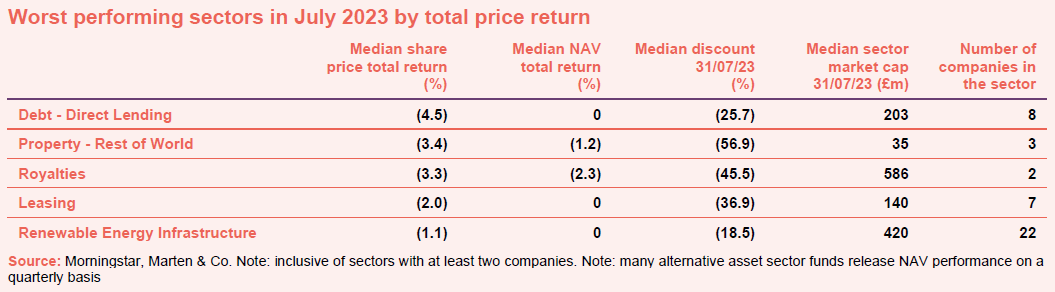

With median returns positive in July, the worst performances list was relatively limited. Debt – Direct Lending continues to suffer from higher risk premiums, which have also dragged on the Renewable Energy Infrastructure and Leasing sectors. The Rest of World Property, which is predominantly invested in developing and emerging market economies, has seen outflows linked to the general risk off mood and malaise around global growth.

With median returns positive in July, the worst performances list was relatively limited. Debt – Direct Lending continues to suffer from higher risk premiums, which have also dragged on the Renewable Energy Infrastructure and Leasing sectors. The Rest of World Property, which is predominantly invested in developing and emerging market economies, has seen outflows linked to the general risk off mood and malaise around global growth.

The best performers list was almost entirely made up of funds exposed to China and its economy. While the Vietnamese economy has been strong in its own right, it remains China’s largest trading partner so any recovery here is certainly beneficial. CQS Natural Resources benefits from similar tailwinds, with China the largest consumer of commodities and natural resources globally. Mobius and Pacific Horizon also have significant exposure to the region.

Edinburgh Worldwide has benefited from stock specific factors with several of its top ten holdings, which include Zillow Group and Exact Sciences outperforming the market. BlackRock Latin American has maintained its momentum from the previous month, with investors attracted by the region’s relative macro resilience and high real yields.

As noted on page one, shares in Seraphim Space were up strongly, although this should be taken in context with its recent performance with the fund still down 34% over the past year. Outside of the sectors not already discussed, the JP Morgan Emerging Europe, Middle East and Africa trust bounced off its lows although it remains a long way back given its previous exposure to Russia.

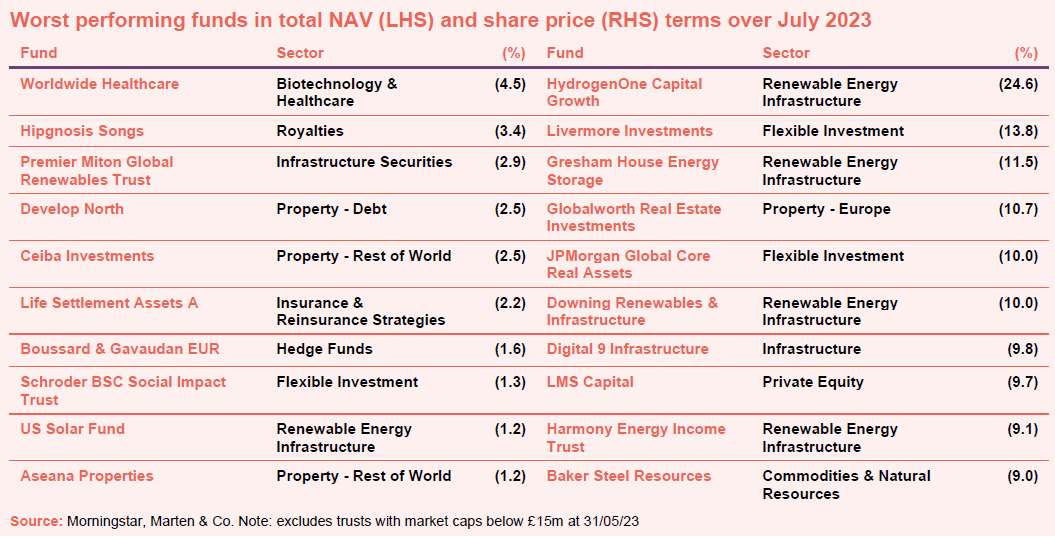

Worst-performing

In terms of NAVs, the worst performers list was dominated by income funds dragged down by higher risk premiums and the general ‘risk-off’ attitude of investors, which has seen capital flow out of some sectors of the market. This has been particularly acute for those companies investing in Renewable Energy Infrastructure and Infrastructure, including Gresham House Energy Storage and Digital 9 Infrastructure. With risk free government debt now yielding close to previous sector averages, there is less incentive to invest purely on an income basis in the short term.

HydrogenOne has also suffered from its exposure to fast growing but as of yet unprofitable small caps as the market continues to place a premium on companies able to generate sustainable cashflows. It’s possible too that a lack of appreciation of the hydrogen sector’s prospects (addressed in the recently published Bluffer’s guide to hydrogen) has also contributed.

Worldwide Healthcare suffered from weakness in several of its larger holdings, including Intuitive Surgical which fell 5% over the course of the month. It is not clear what drove down the shares of LMS Capital (although it is thinly traded), while the fall in Baker Steel Resources is a surprise considering the general outperformance of commodities during the month.

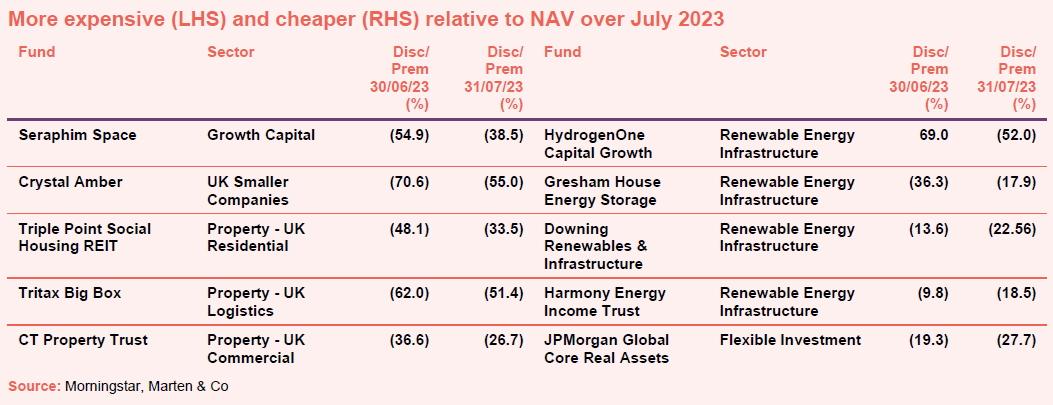

Moves in discounts and premiums

For those companies getting more expensive, Crystal Amber maintained its momentum following the sale of British oil producer Hurricane Energy the month prior, as did Triple Point Social Housing following the bid for Civitas Social Housing, which helped re-rate the entire sector. The fund also benefited from July’s positive inflation data, as did the Tritax and CT Property trusts.

As outlined in the worst performers sectors, Renewable Energy Infrastructure continues to suffer both from rising bond yields and concerns around funding. This is despite the underlying assets in the sector remaining relatively resilient, thanks, in many cases, to inflation linked revenues and elevated electricity prices. So, while median NAV returns have been positive over the past few months, falling shares prices have led to a considerable widening of discounts.

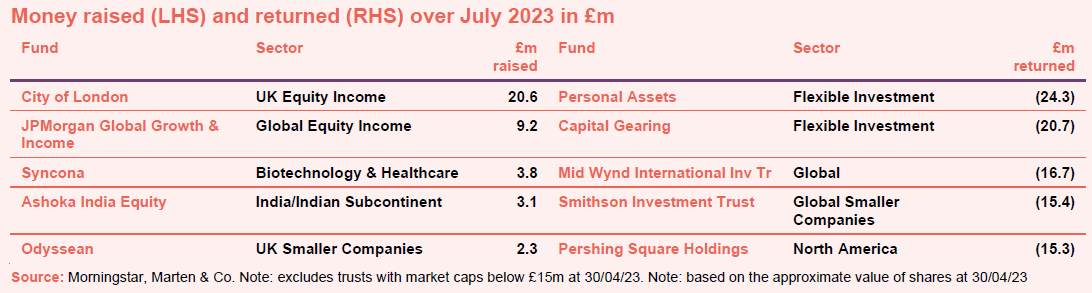

Money raised and returned

July proved to be a quiet period for fund raising (outside of City of London which issued over 5m shares during the course of the month). JPMorgan Global Growth & Income has also continued to raise capital, and is a regular on this list, while Syncona features thanks to a share issue related to its incentive scheme. Thanks to buoyant domestic markets, Ashoka India Equity now trades at a premium to NAV allowing it to slowly ramp up its capital raising programme while Odyssean has also taken advantage of impressive execution over the past year and is one of only a handful of UK smaller companies trading at a premium.

For those companies returning cash, it was a case of several larger trusts leveraging their respective balance sheets to manage discounts. Mid Wynd International was particularly aggressive as its discount, currently around 2%, approaches par.

Major news stories and QuotedData views over July 2023

Visit www.quoteddata.com for more on these and other stories plus in-depth analysis on some funds, the tools to compare similar funds and basic information, key documents and regulatory news announcements on every investment company quoted in London

Upcoming events

Here is a selection of what is coming up. Please refer to the Events section of our website for updates between now and when they are scheduled:

| · Closed End Funds: Summer Series – Global Income – 16 August

· abrdn European Logistics Income presentation – 22 August · Triple Point Energy Transition AGM 2023 – 31 August · abrdn New India online presentation – 14 September · STS Global Income & Growth AGM – 20 September · Schroder British Opportunities AGM – 27 September |

· abrdn New India AGM – 27 September

· Henderson Smaller Companies AGM 2023 – 5 October

|

Interviews

Have you been listening to our weekly news round-up shows? Every Friday at 11 am, we run through the more interesting bits of the week’s news, and we usually have a special guest or two answering questions about a particular investment company.

|

Research

From an operational standpoint, NextEnergy Solar Fund (NESF) is doing well. As we discuss on page 5 of this note, the board, encouraged by a high proportion of predictable revenue, has felt comfortable in declaring an inflation-matching 11% increase in NESF’s dividend per share, and is confident that this will be well-covered by earnings.

The rapid readjustment of valuations in the European logistics sector has encouraged investors seeking quality assets to return to the market, bringing optimism to Tritax EuroBox’s (EBOX’s) manager that values are stabilising. The company’s portfolio yield moved out 70 basis points (bps – equivalent of 0.7%) in the six months to 31 March 2023, but the worst of the declines seem to be over

The team behind AVI Japan Opportunity (AJOT) continues to champion the tenets of good corporate governance and shareholder alignment. On this front, it recently made some positive progress with one of its investments – NC Holdings – where it put forward some resolutions at that company’s annual general meeting (AGM).

There is no denying that the last 18 months have been a challenge for Chrysalis Investments (CHRY). However, under the hood, the majority of the portfolio assets have actually performed reasonably well given the circumstances, especially when you consider that one company, Klarna, contributed more than half of CHRY’s total NAV adjustment during FY2022. Its other private investments, which make up the majority of the portfolio, fell just 5.6% during the same period.

Despite the headwinds it has faced – chief among them higher interest rates – Montanaro European Smaller Companies (MTE) remains committed to investing in high-quality, high-growth companies. MTE’s manager, George Cooke, has been unflinching in his approach, making little change to MTE’s portfolio other than increasing its concentration by trimming lower-conviction holdings.

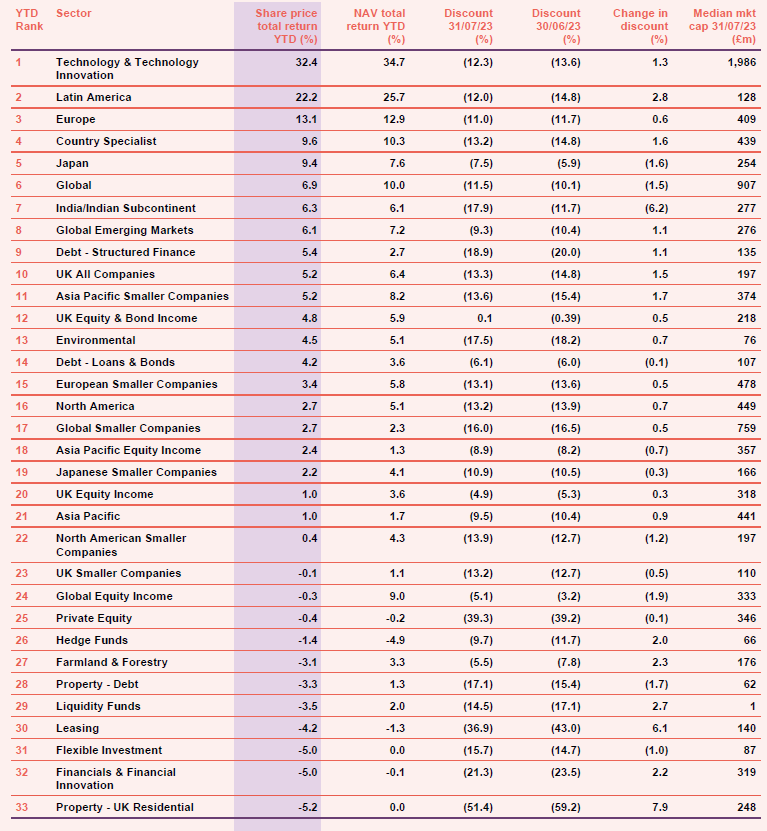

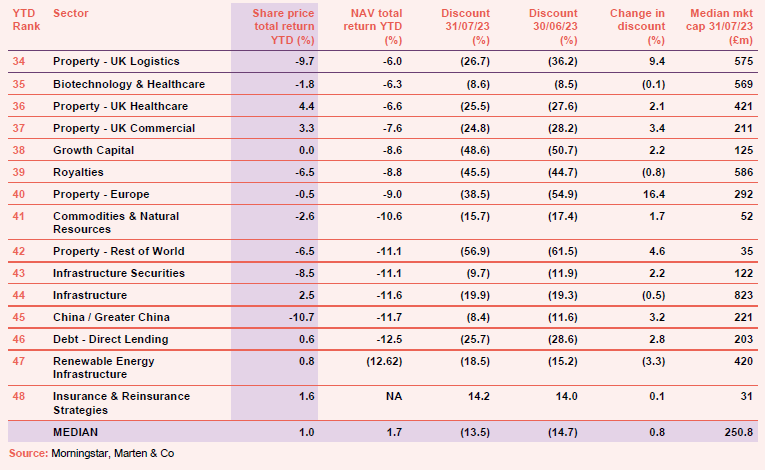

Appendix 1 – median performance by sector, ranked by 2023 year to date price total return

Guide

Our independent guide to quoted investment companies is an invaluable tool for anyone who wants to brush up on their knowledge of the investment companies’ sector. Please register on www.quoteddata.com if you would like it emailed to you directly.

The Legal Bit

This note was prepared by Marten & Co (which is authorised and regulated by the Financial Conduct Authority).

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

Marten & Co may have or may be seeking a contractual relationship with any of the securities mentioned within the note for activities including the provision of sponsored research, investor access or fundraising services.

The analysts who prepared this note may have an interest in any of the securities mentioned within it.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.