North American Income Trust (NAIT) has published its annual results for the year ended 31 January 2024, a period in which US investors were focused on monetary policy developments, geopolitical tensions and the uncertainty surrounding the possibility of either a recession or a soft landing for the US economy. During the period, NAIT provided NAV and share price total returns of -1.6% and -0.9%, which NAIT says compares against a return of 2.6% from its primary reference index, the Russell 1000 Value Index (all figures in sterling terms).

Stock selection, mainly in the materials sector, weighed on relative performance. Sector allocation, especially in the industrials sector, was also negative. Sterling strength was also a headwind.

NAIT’s discount narrowed marginally from 9.3% to 9.1% during the year. More broadly, the investment trust sector experienced a widening of discounts over much of 2023 and NAIT used its share buyback authority to try and limit discount volatility during the period. The revenue account remained healthy, maintaining a level of cover established in prior years.

Market backdrop

Even with the volatility witnessed in financial markets, US equities recorded gains over the year, with growth stocks significantly outperforming value stocks. Over the year to 31 January 2024, growth-focused stocks performed relatively well. In particular, there was a strong performance from the technology sector, especially artificial intelligence-related companies, such as NVIDIA, Microsoft and Alphabet. During the year to 31 January 2024, the top seven (or Magnificent Seven) technology stocks contributed nearly 65% of the total return of the S&P 500 Index, driven by the market’s enthusiasm for AI. NAIT says that the communication services, technology and industrials sectors were the strongest performers within the Russell 1000 Value index, while the utilities, materials and energy sectors were the primary market laggards for the period.

The US Federal Reserve (the Fed) continued with its monetary tightening measures in the first half of the financial year, with the central bank increasing the target range for the federal funds rate to 5.25%-5.50%, a level unseen in over two decades. In the second half of the financial year, the Fed maintained interest rates and its messaging turned more dovish as inflationary pressures reduced, raising the prospect of monetary easing. However, annual core inflation remained above the Fed’s 2% target, while conflicts in the Middle East and Ukraine increased the risk of an uptick in inflation and, at the end of 2023, the Fed signalled that it would proceed cautiously.

On a positive note, the US economy remained strong and avoided the widely anticipated recession after the Fed’s prolonged period of monetary tightening, as well as the banking sector failures that occurred earlier in 2023. The US government reached an agreement in June 2023 to suspend its debt ceiling, thereby avoiding a government shutdown, which helped markets. As the financial year progressed, investors embraced the likelihood of a soft landing for the economy, as opposed to a recession. Nevertheless, macroeconomic uncertainty continues, especially with the ongoing conflicts in the Middle East and Ukraine and the upcoming US election.

Performance attribution

At a sector level, the main detractor from performance was the materials sector due to negative stock selection. The second-largest detractor was the industrials sector due to stock selection and, to a lesser extent, an underweight exposure.

The largest individual stock detractors from performance included:

- Agricultural sciences company, FMC Corporation, a producer of crop-protection chemicals, suffered from inventory destocking which forced management to materially reduce its guidance. The weakness was derived from farmers over-ordering crop inputs after being unable to procure supplies in 2022 due to supply-chain disruptions.

- Pharmaceutical firm, Bristol-Myers Squibb, underperformed due to a combination of new US government pricing measures affecting the pharmaceutical industry and a pipeline that has not yet received full approval for launching new drugs.

- Drugstore chain CVS Health was another weak performer as it contended with rising patient utilisation in its managed care segment and investors debated the cost of its acquisition of Oak Street Health, a provider of value-based care to the Medicare population.

- On the positive side, the two largest contributors to the Company’s performance at the sector level were energy and technology due to stock selection.

At a stock level, the largest individual contributors included:

- Semiconductor supplier Broadcom performed strongly, alongside other companies with artificial intelligence (AI) exposure, after reports indicated a significant increase in demand for AI solutions. Broadcom subsequently reported earnings that confirmed these improving demand trends.

- Phillips 66, the oil refiner, discussed options to improve operational performance, along with various strategic alternatives, with activist investor Elliot Management. Elliot established a $1 billion position in Phillips 66, will nominate two new board members, and publicly outlined a strategy to unlock shareholder value.

- Comcast, the telecommunications conglomerate, also fared well after reporting earnings that were better than expected. The company was able to offset the loss of broadband subscribers with higher pricing, while the theme parks division continues to experience robust growth.

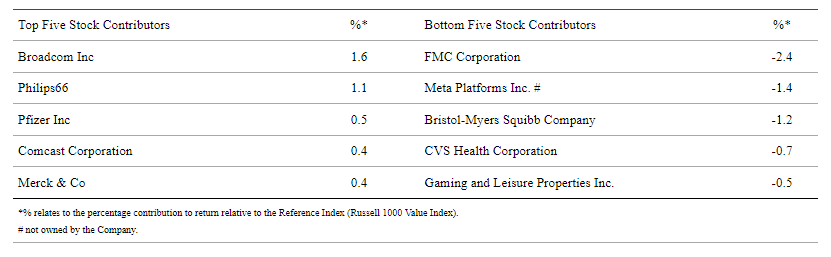

The top five contributors and bottom five contributors over the year ended 31 January 2024 are detailed below:

Portfolio activity

The manager initiated positions in five companies during the year:

- NextEra Energy – the renewable energy and utility company owns Florida Power & Light Company, the US’s largest regulated electric utility, serving more than 12 million people. NAIT’s manager says that the utility business is high quality due to the large backlog of growth projects combined with a constructive regulatory environment allowing for relatively high returns. The company also owns NextEra Energy Resources, which is the world’s largest generator of renewable energy from wind and solar assets as well as a leader in battery storage. Altogether, in the manager’s view, NextEra Energy combines two excellent businesses that support peer-leading earnings growth, along with a secure dividend.

- Genuine Parts Company – a leading global distributor of automotive and industrial replacement parts, has a track record of consistent execution and prudent capital allocation, which has driven its profitable growth. It has established itself as a premier supplier of automotive aftermarket parts, led by its flagship NAPA brand.

- Keurig Dr Pepper – the beverage firm has products in both the cold drinks segment (led by the flagship Dr Pepper brand) and, following the merger with Keurig, in coffee. Keurig is the dominant player in the single-serve coffee segment. Historically, the cold drinks business has grown in line with, or above, the market, benefiting from the company’s strength in (non-cola) flavours and its status as a preferred distributor and acquiror of niche brands.

- Essential Utilities – this is a diversified utility with two-thirds of its earnings from the water business and one-third from the gas business. NAIT’s manager says that, in the short run, the gas business should grow faster given the infrastructure upgrades required. However, the water business should grow at a comparable pace over the intermediate term due to several small acquisition opportunities given that around 85% of the country is served by small, privately-run municipal operations.

- Enbridge – this energy infrastructure company, which operates in the midstream segment, is one of the most advantaged oil pipeline networks in North America, in the manager’s view, with a strong collection of natural gas infrastructure and utility assets and a growing renewable energy platform. The company’s diversified asset portfolio generates predictable cash flows thanks to its regulated and long-term contracts with customers.

Five companies were sold out in their entirety during the year:

- Home Depot – NAIT’s manager believes higher interest rates, elevated inflation and the resumption of student loan payments will prove to be large headwinds for the consumer, pressuring earnings estimates over time.

- VF Corporation – despite having a portfolio of well-admired brands like Vans, The North Face, Timberland, Supreme, and Dickies, the company has faced multiple setbacks due to its poor execution.

- Hannon Armstrong Sustainable Infrastructure Capital – NAIT’s manager felt that the stock would remain under pressure in a higher-for-longer interest-rate environment, with investors becoming increasingly concerned that higher funding costs would negatively affect the company’s return profile.

- CI Financial – NAIT’s manager says that the company’s management has become more aggressive from a capital deployment perspective, with an acceleration in buybacks and the rapid acquisition of US wealth management businesses. While strategically sound, these actions are raising leverage at a time of higher interest rates.

- TC Energy – the holding in this energy infrastructure firm was sold and the proceeds used to fund the investment in competitor Enbridge. Factors primarily outside TC Energy’s control have created delays on new projects and put upward pressure on costs, negatively affecting project-level returns.

- Within the Company’s corporate bond portfolio, several new positions were initiated over the year to take advantage of more attractive valuations, as yields climbed higher due to further monetary tightening together with concerns over what an economic slowdown could mean for the instruments’ credit quality. Some bond positions were exited as the valuation of these bonds traded above what the manager deemed to be their fair value. Fran says that he continues to work closely with abrdn’s fixed income specialists to monitor credits and market conditions for new opportunities and to manage downside risk.

Dividend growth

NAIT’s manager says that its holdings continued to build upon an established track record of dividend growth during the review period, with several companies announcing double-digit increases. It highlights semiconductor suppliers Broadcom and Analog Devices, which boosted their payouts by 14% and 13%, respectively, as well as the insurance provider AIG Group, which increased its dividend by 13%. Derivatives exchange operator CME Group, renewable energy company NextEra Energy, and healthcare provider CVS each raised their quarterly dividend payouts by 10%.

Additionally, two holdings in the portfolio announced special dividend payments to shareholders during the review period. Derivatives exchange operator CME Group declared an annual variable dividend of US$5.25 per share in December 2023. The company uses this approach to facilitate paying out all cash that it generates over the year beyond a minimum threshold. Gaming-focused REIT Gaming and Leisure Properties Inc. declared a special earnings and profits cash dividend of $0.25 per share.

Revenue account

The Company’s equity portfolio generated £17.1 million in revenue during the financial year, close to the £17.8 million in the previous year. Options continue to be part of the portfolio and represented 17.2% of the Company’s total gross income, whilst corporate bonds accounted for only 2.6%. The Company’s revenue return per ordinary share dipped marginally to 12.0 pence compared to last year’s 12.2 pence.

Dividend

The board remains committed to the Company’s progressive dividend policy and extending the track record of thirteen consecutive years of dividend growth. The board declared, on 28 March 2024, a fourth interim dividend of 3.9 pence per share, resulting in total dividends for the year ended 31 January 2024 of 11.7 pence per share (2023 – 11.0p) and representing annual growth of 6.4%. The fourth interim dividend will be paid on 3 May 2024 to shareholders on the register on 12 April 2024 (ex-dividend date: 11 April 2024).

Discount management

The Company’s share price ended the year at 289.0 pence, a 9.1% discount to the total NAV of 317.8 pence. This compares to a 9.3% discount at the end of the 2023 financial year. Over the course of the year, the Company’s shares mainly traded at discounts ranging between 9.0% and 15.0%. During the year, 2,882,402 shares were bought back and cancelled at an average price of 275 pence and an average discount of 11.5%. The total cost was £8.0 million. Since 31 January 2024, the Company says that it has bought back an additional 1,187,253 ordinary shares at a cost of £3.3m.

Gearing

NAIT’s board believes that the sensible use of gearing should enhance returns over the longer term and NAIT has long-term financing agreements totalling US$50 million with MetLife which comprise two loans of US$25 million with terms of 10 and 15 years. These are fixed at 2.7% and 3.0% per annum expiring in December 2030 and 2035 respectively. Net gearing at 31 January 2024 stood at 4.1% (2023: 2.9%).