Moving up the league table

Moving up the league table

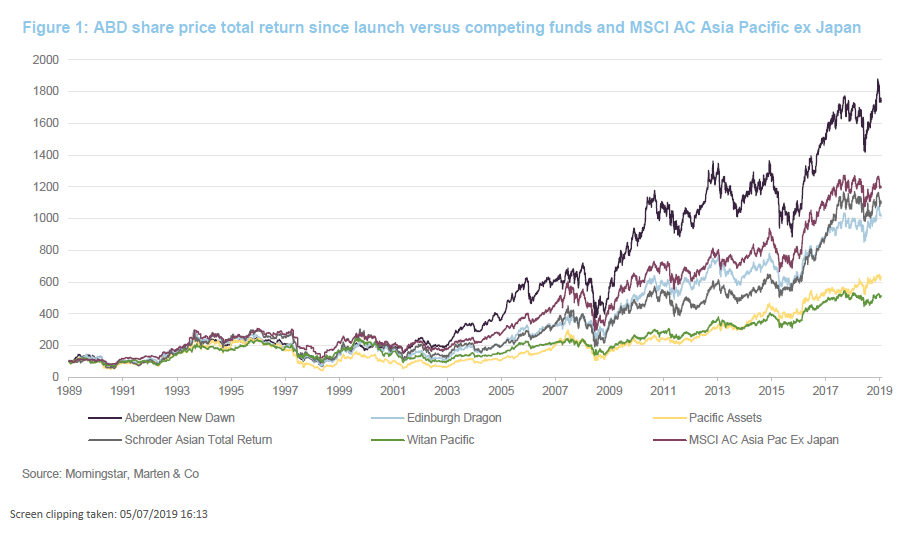

As it celebrates its 30th birthday, Aberdeen New Dawn (ABD) can look back on a tumultuous but ultimately rewarding period for investing in Asia. The rise of China and the broadening of economic growth across the region has created whole new areas for ABD to invest in. Countries such as India and Vietnam, which feature in the portfolio, offer the prospect of above-average growth rates for years to come. Whilst the ongoing trade dispute between the US and China creates a strong headwind for the region, this more challenging time is playing to ABD’s strengths. Its focus on high-quality companies is being rewarded and it is climbing the performance league table once again.

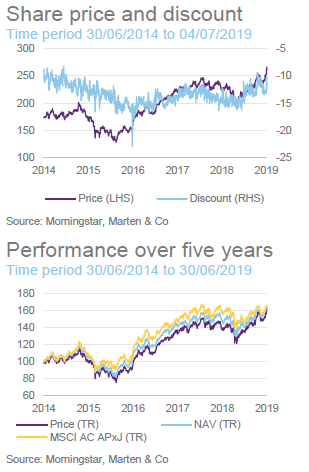

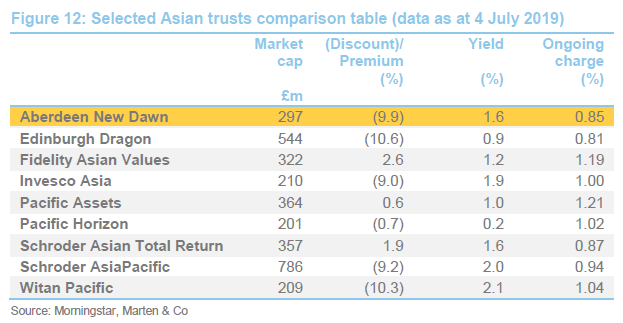

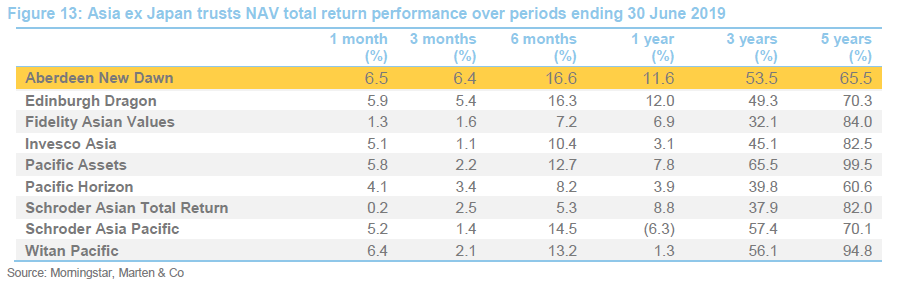

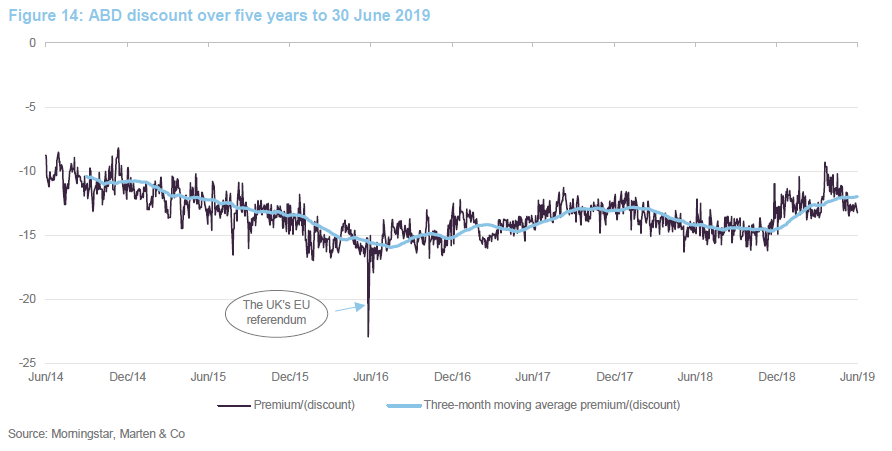

It is striking that, despite ABD’s improved relative performance and a low ongoing charge ratio (one of the lowest of its peers), ABD remains on one of the widest discounts versus its competitors (see page 7).

Capital growth from Asia Pacific ex Japan

Capital growth from Asia Pacific ex Japan

ABD aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries, excluding Japan. ABD holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies. ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms).

A tumultuous 30 years

A tumultuous 30 years

The 30-year period encompasses the Asian debt crisis (when a raft of Asian countries and companies that had borrowed cheaply in US dollars, often encouraged by countries pegging their currency to the dollar, were caught out as the Asian currencies collapsed); the Tech boom and bust (although Asia was much less affected than Western economies); the credit boom and bust; the rise of China; the recent Asian tech boom; and now the burgeoning trade war between Trump and Xi. Within this period, many individual countries had their own mini-crises.

ABD’s focus on high-quality companies paid off in this environment. Investors in ABD at launch have seen their money multiplied 17.4 times since launch. An investment in the next best Asia Pacific trust that was in existence then, now called Schroder Asian Total Return, would have made you 11.0 times your money.

Tariff dispute dominates sentiment

Tariff dispute dominates sentiment

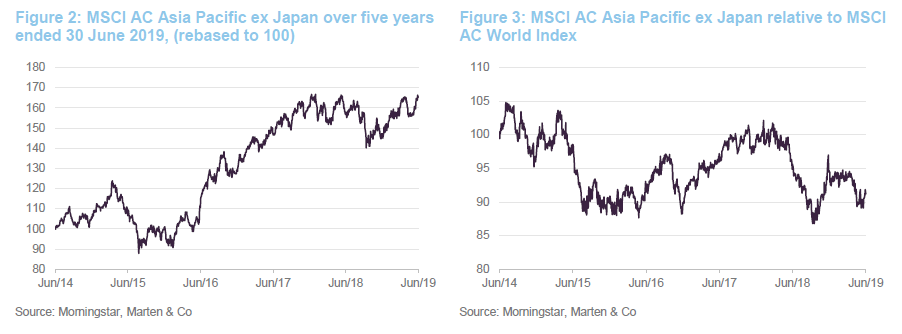

We published our initiation note on Aberdeen New Dawn (ABD) early in October 2018. Markets have been volatile since then. The dominant factor influencing sentiment has been the ongoing trade war between the US and China. The mood has swung from one of conciliation to renewed hostility. Tariffs now extend to more goods and at higher rates than was the case back in October. Trump’s seeming preparedness to use trade as a weapon, as evidenced by the recent threats made against Mexico, undermines hopes that he might step back from the dispute with China and makes it harder to achieve a lasting agreement. The issue of dominance in technology (ostensibly about national security), which has manifested itself most notably in the actions taken against Huawei, seems unlikely to dissipate.

The actions of the US Federal Reserve have also had an impact. From a position of hawkishness, the Fed pivoted to saying that rates would not rise in 2019 and the process of quantitative tightening would be placed on hold. The promise of an end to US rate increases, the market leaning towards a rate cut in July and a weaker US dollar are all positive for Asia and emerging markets.

Manufacturers seeking to avoid tariffs are relocating elsewhere in South East Asia, to the benefit of Vietnam and Thailand in particular. As Chinese companies route exports through third-party countries, we must run the risk of Trump broadening the tariff war further, and new 400% duties on Vietnamese steel are evidence of that.

Tariffs are a contributory factor in slower Chinese growth, as companies are being cautious about investment. Industrial production growth has slowed to 5.0%, the lowest figure in 17 years, and fixed asset investment growth is running at 5.6% for the first five months of 2019, below forecast levels. Further evidence is provided by a sharp drop in new orders for Japanese manufacturers, who export much of their output to China. The government has tried to stimulate the economy with tax cuts and measures to help small businesses but there are still concerns around the extent of debt in the economy.

Events in Venezuela and renewed Iranian sanctions have contributed to higher oil prices. A high oil price is bad news for most countries in Asia. This is particularly true of India, where economic growth has been disappointing of late. The decisive election win by the coalition led by the BJP gives Prime Minister Modi the freedom to continue to reform the economy. Many of the steps he has taken to date have proved disruptive, but the hope is that he is laying the foundations for faster growth in the future. Elections in Indonesia also went in favour of the incumbent, but led to violence on the streets.

The MSCI resolved to accelerate the inclusion of a proportion of the market cap of the China A share market within the MSCI China Index. This is attracting inflows into this market and has helped support valuations of domestic Chinese stocks.

Asset allocation

Asset allocation

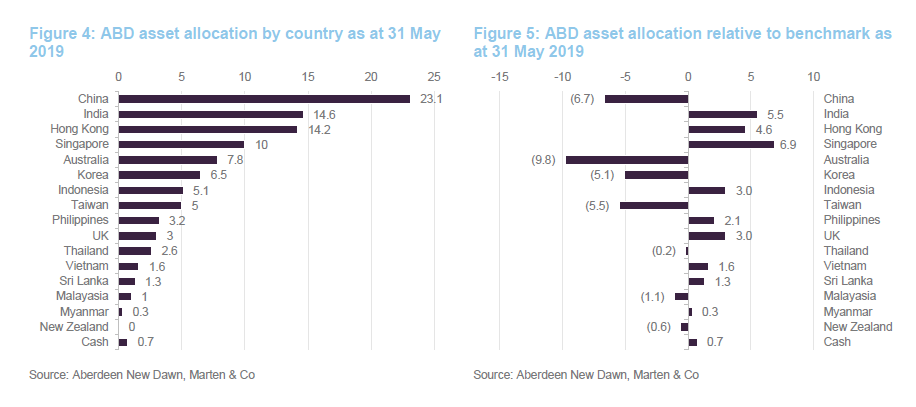

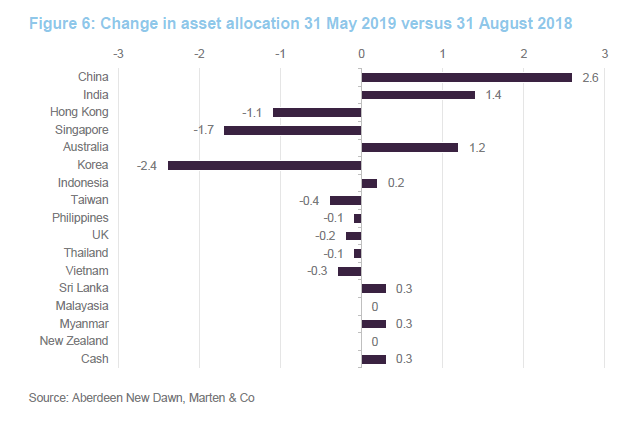

ABD’s portfolio retains its underweight exposures to the Australian, Chinese and Taiwanese markets but in recent months the managers have added to positions in China and Australia. They have also reduced exposure to Korea

Top 10 holdings

Top 10 holdings

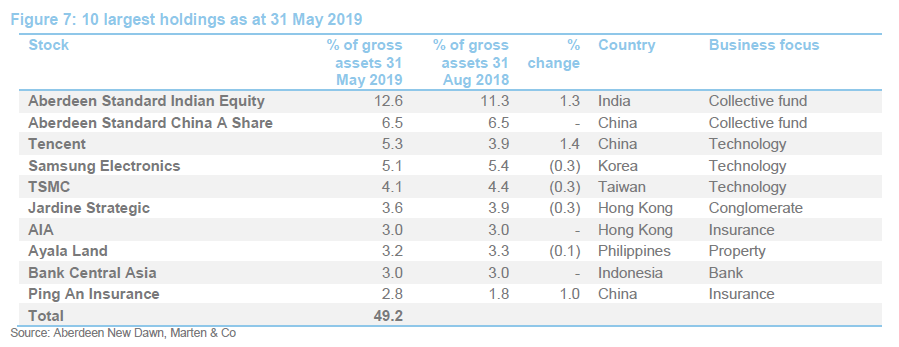

The composition of the list of ABD’s 10 largest holdings is unchanged from when we published our initiation note. The two Aberdeen Standard open-ended funds used to gain exposure to Indian and domestic Chinese stocks remain the largest holdings. Their names have been changed to reflect the merger of Aberdeen and Standard Life. The most notable change to the top 10 holdings is the increase in the percentage of the portfolio accounted for by Tencent (the largest stock in the benchmark). ABD’s active share has increased since we last wrote. At the end of April 2019, it was 71.1%, versus 70.7% at the end of August 2018.

Additions to the portfolio

Additions to the portfolio

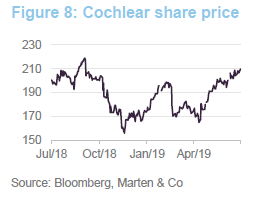

Cochlear is an Australian company tackling hearing loss. It is the world’s largest manufacturer of cochlear implants, and sells them globally. It is making inroads into the Chinese market and the managers see growth there helping to underpin the company’s sales growth. They also say that the company has a strong balance sheet. The managers were able to initiate a position in the stock as the share price fell in the general market weakness experienced in Q4 2018.

Another Australian company added to the portfolio since we last wrote on ABD is Woodside Petroleum. ABD has little exposure to the energy/oil sectors, Woodside Petroleum offers exposure to LNG, which, because it burns more cleanly than coal, is benefiting from growing demand for power generation.

The stock market sell-off in Q4 2018 provided an opportunity for the managers to add to existing holdings in China. The emphasis was on stocks that are not directly exposed to the ongoing trade dispute but have more of a domestic focus. One example is Ping An, the Chinese insurance company that also offers banking and other financial services products. The managers also added to the holding in the Aberdeen Standard China A Share fund.

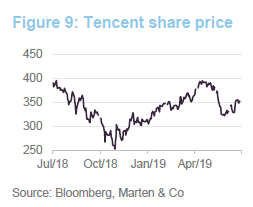

Possibly the most significant addition was to ABD’s holding in Tencent, moving from an underweight exposure relative to the benchmark to an overweight position. The technology sector was one of the worst-affected by falling markets in Q4. Tencent had a difficult 2018 as the authorities prevented it from launching new games in the Chinese market. Part of the rhetoric focused on the health impacts of excessive gaming on Chinese youth. The managers think that Tencent’s regulatory problems have peaked.

Exits from the portfolio

Exits from the portfolio

Three holdings have been sold in their entirety. Aitken Spence, a Sri Lankan conglomerate whose business has been under pressure; MTR Corporation (the Hong Kong mass transit company), where the manager believed that the valuation looked full following the payment of a large special dividend; and Malaysian bank, CIMB, which had outperformed rivals but the manager felt it was failing to deliver on its original investment thesis.

They also took some money off the table in India on the back of perceived high valuations.

Performance

Performance

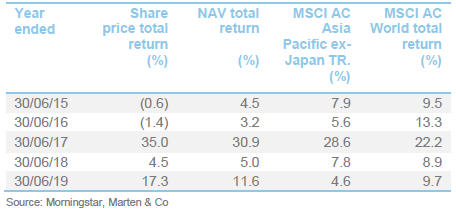

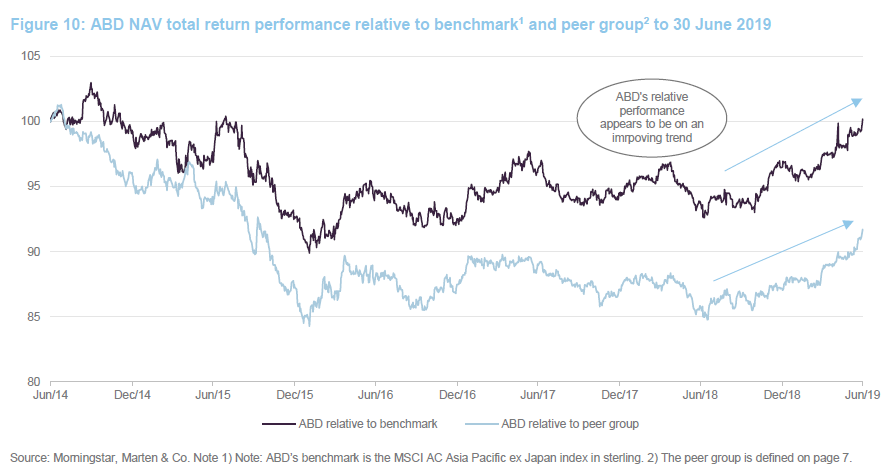

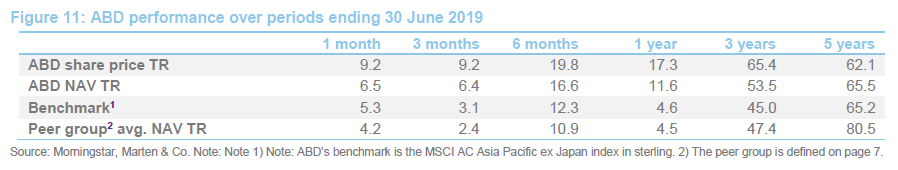

Whilst the portfolio’s underweight exposure to technology and China held ABD back in 2014/2015, ABD’s NAV returns have been ahead of both its benchmark and the average of its peer group over the past three years. ABD held up relatively well during the period of market weakness in the second half of 2018 but, importantly, it has continued to outperform in 2019 when the market has been recovering.

While an underweight exposure to China proved beneficial for the trust’s relative performance in 2018, topping up some positions in China (notably the holding in the Aberdeen Standard China A share fund) and good stock selection has helped ABD hold its own in the subsequent recovery.

The manager cites good contributions from stocks such as Ping An, China Resource Land (a shopping mall operator and residential property developer), bucking problems elsewhere in that sector, and Bank Central Asia in Indonesia, which benefits from a low-cost funding base and the ability to pick and choose who it lends to.

In Australia, the trusts positions in the miners, Rio and BHP, were positive for performance. The trust does not hold Australian banks, which have been facing uncertainty in the face of a royal commission review of the banking, superannuation and financial services industry.

Peer group

Peer group

The AIC has made some changes to its Asian sectors, creating new Asia Pacific Income and Asia Pacific Smaller Companies sectors and merging the Asia ex Japan and Asia including Japan sectors to a new sector entitled Asia Pacific. We will use the constituents of this sector as ABD’s peer group going forward. However, we will exclude All Asia Asset Capital on size grounds.

Edinburgh Dragon has shrunk since we last wrote, having held a tender offer, leaving Schroder AsiaPacific as the largest fund in the sector. ABD is about middle of the pack in market cap terms. Notably, ABD trades on one of the widest discounts, which sits at odds with its improving performance track record. None of these funds offers much of a yield, as the high-yielding trusts moved to the new sector. Finally, but importantly given the increased emphasis that investors place on fees, ABD sits on the second-lowest ongoing charges ratio after its stablemate, Edinburgh Dragon.

While its five-year NAV returns are still the lowest of the peer group, ABD’s performance turnaround is evident over shorter time periods.

Discount

Discount

ABD’s discount has moved within a range of 9.3% to 16.2% over the year ending 30 June 2019 and averaged 13.4% over that period. The chart suggests that the discount is on a narrowing trend, possibly reflecting ABD’s improved performance ranking within its peer group. However, as we discussed above, ABD’s discount remains the widest of the peer group.

In normal market conditions, ABD repurchases shares when the discount is wider than the board would like. The board has no specific discount target in mind. Its aim is to provide a degree of liquidity for shareholders. The authority to repurchase shares is renewed at each AGM (and more frequently, if necessary).

Fund profile

Fund profile

Aberdeen New Dawn (ABD) aims to provide shareholders with a high level of capital growth through equity investment in the Asia Pacific countries excluding Japan. ABD holds a diversified portfolio of securities in quoted companies spread across a range of industries and economies. Investments may also be made through collective investment schemes and in companies traded on stock markets outside the Asia Pacific region, provided that over 75% of their consolidated revenue is earned from trading in the Asia Pacific region, or they hold more than 75% of their consolidated net assets in the Asia Pacific region.

ABD is benchmarked against the MSCI All Countries Asia Pacific ex Japan Index (in sterling terms).

The manager is Aberdeen Fund Managers Limited, which has delegated the investment management of the company to Aberdeen Asset Management Asia Limited (Aberdeen or the manager). Both companies are wholly-owned subsidiaries of Standard Life Aberdeen Plc. At the end of June 2019, Standard Life Aberdeen’s Asia Pacific equities business had AUM of £27.7bn, of which the large cap, Asia Pacific ex Japan strategy (that ABD forms a part of) accounted for £11.6bn.

As we explain later, Aberdeen’s approach is to manage money using a team approach. We met James Thom, a senior investment manager in the team, for the purposes of preparing this note.

Previous publications

Previous publications

Investors may be interested to read our initiation note, Market setback creates opportunities, which can be accessed by clicking the link or by visiting our website.

The legal bit

The legal bit

This marketing communication has been prepared for Aberdeen New Dawn Investment Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.

ABD : Aberdeen New Dawn – Moving up the league table