Change is a coming

Change is a coming

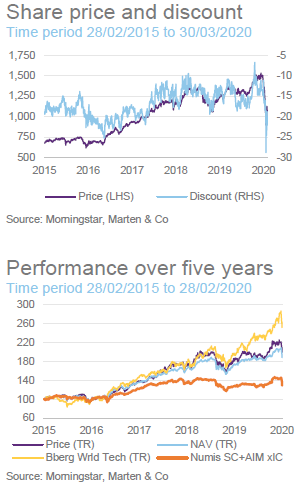

Following an excellent year of performance during 2019 (an nav total return of 27.5%), Herald Investment Trust (HRI) has seen its discount widen and the value of its portfolio companies fall since the outbreak of covid-19.

As authorities scramble to contain the virus, our lives are changing in significant ways. Inevitably, technology is enabling these upheavals and this will accelerate the demand for associated products VoIP phones, teleconferencing services, remote desktop access, VPNs, etc) and will likely offer other solutions to the challenges that society currently faces. With its discount elevated and holdings cheaper than they have been, the current environment may offer a good entry point for the patient investor.

Small-cap technology, telecommunications and multi-media

Small-cap technology, telecommunications and multi-media

HRI’s objective is to achieve capital appreciation through investments in smaller quoted companies in the areas of telecommunications, multimedia and technology. Investments may be made across the world, although the portfolio has a strong position in UK stocks. The business activities of investee companies will include information technology, broadcasting, printing and publishing and the supply of equipment and services to these companies.

Fund profile

Fund profile

Established in 1994, HRI invests globally in small technology, communications and multimedia companies with the aim of achieving capital growth. It is the only listed fund of its type. The trust invests globally, but has a strong bias towards the UK, which further distinguishes it from other global technology funds, which tend to be biased towards the US.

New investments in the fund will typically have a market capitalisation of $3bn or less, but are generally much smaller when the first investment is made. If successful, these can grow to be a multiple of their original valuation. This type of investing is longer-term in nature and so the trust tends to have low turnover. Reflecting the risks inherent in this type of investing, the trust maintains a highly diverse portfolio of investments (typically in excess of 250) to help mitigate this risk.

HRI has had the same lead fund manager since launch, Katie Potts. She was a highly regarded technology analyst at SG Warburg (later UBS) prior to launching the fund. Katie owns a substantial stake in the company and a significant minority stake in the management company and, clearly therefore, is motivated to ensure the success of the fund.

HRI’s size, focus on smaller companies and the depth of expertise within the management team mean that it plays an important role as a provider of much-needed capital to listed technology companies looking for expansion capital.

HRI offers a liquid subcontract for any investor looking to gain access to this part of the market, and we believe that an investment in HRI complements an investment in one of the large-cap technology funds.

Management arrangements

Management arrangements

HRI owns a 15.4% stake in its management company, Herald Investment Management Limited (HIML), which was valued at £4.4m as at 31 December 2019. HIML also manages an OEIC, The Herald Worldwide Technology Fund – which has more exposure to large-cap companies than the trust – and two venture capital funds, which have ceased to make new investments. One of these venture capital funds, Herald Ventures II, is held in HRI’s portfolio.

Katie leads a team of six analysts, five of whom are based in London and one in New York. US companies do not come to the UK as much as they used to, and HRI feels it necessary to have a US presence to enable frequent contact with companies. The HIML team can also draw on the knowledge of three consultants. We have included some biographical details on the team at the end of this note. Research responsibilities are organised along sector lines, but Katie has also delegated responsibility for managing the Asian portfolio to Fraser Elms (the deputy manager) and Hao Luo, and the continental European portfolio to Taymour Ezzat and Peter Jenkin.

Market valuations

Market valuations

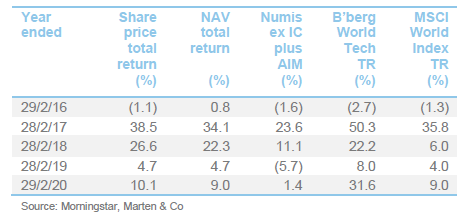

Figure 1 provides a useful illustration as to why investors may wish to consider having an allocation to the technology sector. As shown in Figure 1, the global technology sector – as represented by the large cap Bloomberg World Technology Index – has provided marked outperformance of global equities as measured by the MSCI World Index (all in sterling terms) during the last five years and particularly during the last four years (a similar pattern is seen if a 10-year horizon is taken with global technology providing a marked outperformance).

In light of the current market setback, it is noteworthy that global technology suffered more heavily during the more challenging markets in the second half of 2018, but more than recovered the loss in the subsequent rally. As illustrated in Figure 2, there was considerable multiple expansion for technology stocks in the second half of 2019 but, following recent market declines, valuations are noticeably less expensive than they have been.

Manager’s view

Manager’s view

The manager’s investment themes tend to be long-term in nature. In the team’s view, the TMT space has attractive growing end markets that are a source of growth in a low GDP-growth world. Furthermore, it believes that the sector has an unusual ability to earn super-normal margins that can be sustained (for example, software and semiconductors); business models that are scalable with high levels of recurring or predictable earnings; businesses that offer the opportunity for margin improvement, particularly in developing companies; a strong tendency towards entrepreneurial management; and strong cash flow generation. The manager sees a broad opportunity across the technology space and highlights the following themes:

- Internet of things; architecture and platforms;

- Wireless charging technology;

- Digital media;

- Graphene;

- ADAS – driver monitoring;

- 3D memory and 3D logic;

- NFV and SDN;

- Data replication and analysis;

- Machine learning and AI;

- Robotics;

- Adaptive security architecture;

- Mesh app and service architecture;

- User programmable software;

- Spin-torque memory (STT MRAM);

- Cloud computing advancement;

- Advanced cyber defence;

- SSD;

- Falling cost of storage;

- Big data;

- Telehealth;

- Energy storage; and

- Hydrogen fuel cells.

Note: some of these themes are explored in greater detail in our previous notes (see page 22 of this note).

Covid-19 – significant impact if Chinese production is disrupted for a prolonged period

Covid-19 – significant impact if Chinese production is disrupted for a prolonged period

Katie says that, while HRI’s direct exposure to Chinese companies is minimal, the impact on the technology sector will be significant if covid-19 continues to disrupt manufacturing in China. She says that a handful of HRI’s holdings in each region manufacture products in China (either directly through their own operations in China, or through subcontractors and suppliers). Furthermore, many companies use PCs and servers that, at the very least, have components that are manufactured in China. Whilst it is hard to pin-down the precise length of the current disruption, Katie says that the knock-on effects will be felt in many sectors if production is halted for a prolonged period.

On the flip side, the fast spread of the virus, and the authorities’ measures to try and contain this, are forcing changes in people’s working and living habits. Inevitably, technology is enabling these shifts (for example, a boom in home-working), which will accelerate these changes and the demand for associated products (VoIP phones, teleconferencing services, remote desktop access, VPNs, etc).

Long-term growth above the wider economy; sector more defensive than market appreciates

Long-term growth above the wider economy; sector more defensive than market appreciates

Despite near-term disruption from covid-19, the manager remains confident that the technology sector can provide growth over and above that available in the wider economy and that, with much of the sector now exposed to non-cyclical spending, it is perhaps more defensive than the market appreciates. In particular, the recurring revenues associated with IT infrastructure and applications – used by corporations, the consumer and governments alike – are effectively non-discretionary spending. However, in the face of geopolitical uncertainties, the constraints of smaller companies’ liquidity, and valuation levels that are potentially vulnerable to rising interest rates, the manager continues to maintain higher-than-normal cash levels to ensure that it can exploit buying opportunities when they occur.

Investment process

Investment process

Extensive fundamental research

Extensive fundamental research

HIML’s investment process is driven by bottom-up stock selection, based on extensive fundamental research of the universe of smaller companies that make up the telecommunications, multimedia, and technology sectors. The listed universe within this space includes more than 5,000 quoted companies, but in their respective markets, these companies also compete against many more unquoted companies and the HIML team believes it important to get to know as many of these as possible. This is not just because unquoted companies may eventually list, but because the information gleaned by the HIML team from competitors, customers and suppliers can be a useful source of ideas, valuable in evaluating how sustainable a company’s competitive position is and assessing the risks within a business, as well as providing a useful means of cross-referencing the information provided by another company’s management.

Idea-generation

Idea-generation

In terms of idea-generation, HIML benefits from being a major player in the UK and companies will routinely make the effort to present to the team. The US is a very important market, however, and as small-cap US technology companies are visiting London less frequently, HIML established a satellite office in New York. In addition, Katie visits the US for around five weeks a year to meet companies and the wider HIML team also travels extensively.

Searching for companies with sustainable advantages

Searching for companies with sustainable advantages

At heart, the members of HIML’s team are value investors. Rather than just looking to identify companies with the capacity to grow, they are looking for companies that are capable of making decent returns on capital or those with earnings growth which will propel them to a single-digit P/E within a reasonable period of time. This requires an analysis of a company’s products, markets and competitive position. In this regard, the HIML team is looking for companies where it can see clear markets for its products and where it has advantages over the competition that mean it is more likely to succeed. These come in a range of forms, but could include superior technology, network effects or barriers to entry such as specific intellectual property, patents and the like.

Reflecting the benefits that can be accrued from making early-stage investments in technology companies, loss-making companies are considered for the portfolio. However, the team needs to be able to see both a significant market opportunity and a clear path to profitability. The team tends to be wary of companies that are trading on large multiples of sales, and prefers not to own stocks trading on what it describes as ‘concept valuations’.

HIML says that it does not attempt to model companies’ cash flows in any great detail and that, for the types of companies in which it is investing, there is usually far too much uncertainty to make this a useful exercise. However, it does spend considerable time analysing companies’ accounts to gain an understanding of how a business works and the robustness or otherwise of its earnings.

The importance of diversification

The importance of diversification

The nature of smaller technology, multimedia and telecommunications (TMT) companies is that they are often dependent on a single product or service and, whilst success can propel share prices many times higher, failure can mean bankruptcy. New technologies can create value very quickly but they can also severely disrupt existing business models and product life-cycles can be quite short. The high degree of stock-specific risk that this entails is countered by having a high degree of diversification within the portfolio.

Liquidity considerations and profitability play a part. These small-cap positions tend to be less liquid and, from a risk management perspective, this inherently places a limit on the size of each position, as larger positions are harder to buy and sell and are more likely to move the market. Furthermore, stocks that are held in large size by other investors can make HIML nervous, in case these shareholders ever become forced sellers.

In general, HRI holds less than 5% of the share capital of the companies in its portfolio, if they are loss making businesses. This gives the manager room to support a company if it needs to undertake a fundraising. The manager also aims not to own more than 10% of the issued capital of its holdings, even if they are profitable businesses.

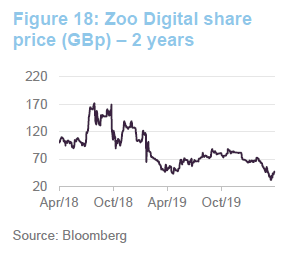

Reflecting this, the handful of companies where HRI holds a larger percentage of ownership are often those that needed to raise cash, but found insufficient large investors willing or able to invest other than HRI. Katie has said previously that you can damage your own property by failing to support a fundraise. A good example is Zoo Digital where, as we reported in our December 2017 note (Who wants to be a billionaire? – see page 10 of that note) HRI cornerstoned a £2.6m fundraise for a company that turned out to be the best-performing stock in its portfolio that year (up 550%), or are positions that were close to HIML’s 10% limit, that repurchased stock, thereby pushing the holding over this threshold.

At the end of February 2020, HRI had 301 holdings. The HIML team is conscious that, in some investors’ eyes, this is a large number of companies to follow, but it counters that the small companies in which it is investing have far simpler business models than most large-cap companies, and that this makes them much easier to follow in detail. Cross-referencing between suppliers, customers and competitors is an important part of the investment process.

An alternative strategy could be to move up the market-cap scale to find greater liquidity, which would allow the team to increase the average position size and, in the manager’s view, necessitate a migration to a much heavier US weighting. However, the team believes that it is crucial that HRI maintains exposure to micro caps. Katie says that this is where HRI’s best returns have originated, with many stocks rising by more than 10 times. Katie also believes that smaller-cap stocks are generally better value as these companies are not well covered by analysts. MiFID II has contributed to a reduction in the amount and quality of research available.

Portfolio construction

Portfolio construction

HIML’s investment process is driven entirely by stock selection and without reference to any benchmark index. The portfolio has long had a bias to the UK. This reflects Katie’s belief that the UK technology sector is more vibrant than Europe’s; UK stocks are, generally, more reasonably valued than US ones; and Asian stocks generally have inferior business models (frequently they are providing outsourced manufacturing services to larger tech companies and often have little pricing power).

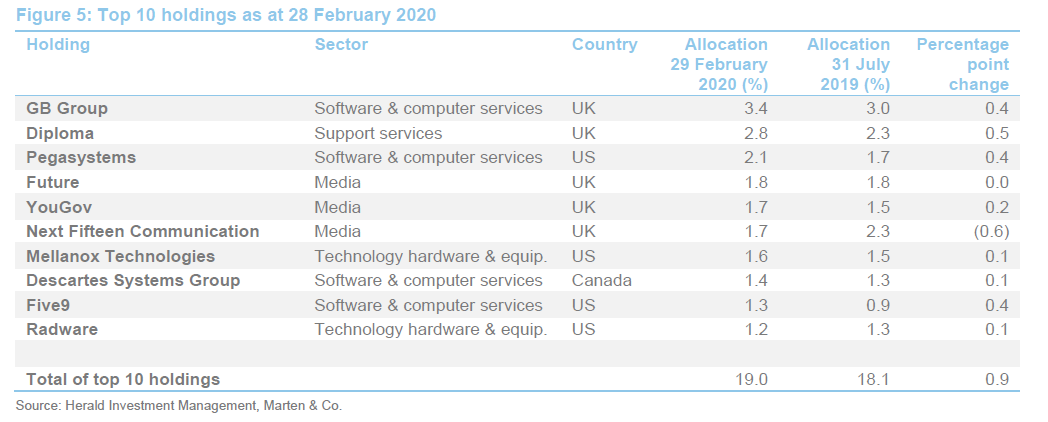

Long-term winners tend to form the core of the portfolio (the top 10 holdings were 19.0% of the fund at the end of February 2020). HRI’s larger positions usually started as much smaller positions and then grew as they outperformed their brethren.

HRI has some minor exposure to unquoted companies, including its stake in HIML. This is not an area that the trust is focused on, and no more unquoted investments are currently planned. The HIML team believes that it is useful that HRI retains the flexibility to hold unquoted investments, however, as this gives it the opportunity to retain attractive companies that choose to delist.

Sell discipline

Sell discipline

Stocks are sold when valuations no longer reflect the growth prospects of the company, their margins start to normalise relative to the wider market (an indication that the company’s intellectual property is no longer capable of supporting superior returns) or when there is a clear deterioration in the business model. Companies that have grown larger are typically top-sliced to fund new investments and provide further capital to the earlier-stage smaller companies.

Asset Allocation

Asset Allocation

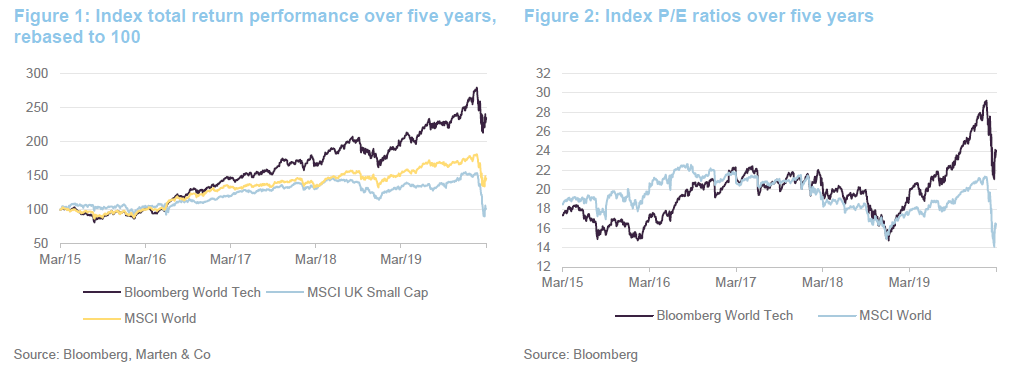

The changes to HRI’s asset allocation since we last published, using data at the end of August 2019, have been relatively small. The trend has been one of taking money out of the UK and US at the margin, and redeploying this in Europe and Asia. HRI has continued to benefit from takeover activity, particularly in the US, and whilst Katie redeployed some of the proceeds, cash levels have risen. Ahead of covid-19, pricing was quite strong in the US, reflecting demand from private equity investors. The number of holdings has increased from 288 to 301.

The top 50 companies represent around 48.7% of the HRI’s portfolio, which illustrates that it has a long tail of smaller positions. However, successful companies tend to become larger positions as they grow. This is both due to valuation increases and because HIML will add to a position as the company delivers and the team gains confidence in the company.

Top 10 holdings

Top 10 holdings

Figure 5 shows HRI’s top 10 holdings as at 28 February 2020 and how these have changed since 31 July 2019 (the most recently available data when we last published). Reflecting the manager’s long-term, low-turnover approach, most of the top 10 portfolio holdings will be familiar to regular readers of our notes on HRI.

Since we last published in October 2019, M&C Saatchi has dropped out of HRI’s top 10 holdings following a profits warning in December. Five9 has moved up the ranks to take its place. We discuss these developments in more detail on the following pages. However, readers interested in more detail on HRI’s top 10 holdings, or other names in HRI’s portfolio, should see our earlier notes, where many of these have been discussed previously (see page 22 of this note).

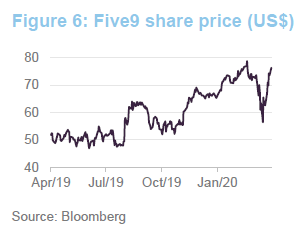

Five9 (1.3%) – reduced following a strong performance, prior to covid-19 outbreak

Five9 (1.3%) – reduced following a strong performance, prior to covid-19 outbreak

Five9 (www.five9.com) provides cloud-based software for contact/call centres; its software facilitates more than five billion call minutes annually. Five9 has a purpose-built virtual contact centre (VCC) cloud platform that is both secure and highly scalable. The VCC platform has a comprehensive suite of applications that allows Five9’s clients to manage and optimise optimisation their customer interactions across voice, chat, email, web, social media and mobile channels simultaneously. The platform can respond to demand, allowing clients to quickly deploy agents, in any geographic location, with only a computer, headset and broadband internet connection.

HRI first invested in March 2015, at a price around US$5 per share. As illustrated in Figure 6, the share price hit a high of US$76.59 on 14 February 2020. Katie was taking profits then, halving the position size. After a covid-19 related slide, the shares have recovered strongly over the last couple of weeks as investors recognised the attractions of the business model in this environment.

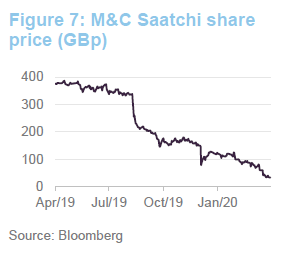

M&C Saatchi – profits warning in December

M&C Saatchi – profits warning in December

M&C Saatchi (mcsaatchi.com) is a marketing services business, with an international network of advertising agencies, that services clients across a wide variety of industry sectors. It has long been a constituent of HRI’s portfolio and has featured in its top 10 holdings for a number of years.

As illustrated in Figure 7, the company’s share price has come under significant pressure during the last 12 months. The share price fell sharply on 12 August (24.5% on the day) after the company disclosed that it would be taking a £6.4m one-off charge in its annual results for the year ending 31 December 2019. This was due to “misapplication of accounting policies”, which had been unearthed during an internal accounting review of several of the company’s UK subsidiaries. The company said that these mostly relating to the timing of revenue recognition and incorrect accounting of some assets and liabilities. The £6.4m comprised £4.9m in relation to issues identified, with a further £1.5m to provide for any potential further items arising (the company said that it thought it had uncovered the full extent of the issues).

However, in tandem with its Q3 trading update, the company issued a profit warning on 4 December 2019 saying that its underlying profit (before tax and exceptional items) was expected to be significantly below the levels expected at the time of its interim results. This was due to weaker than expected trading in the final quarter of the year and higher than expected central costs. It also said that it would be making adjustments of £11.6 million to its results, to be apportioned between its 2018 and 2019 financial results, in relation to the issues highlighted in the accounting review. Its shares were down 46.2% on the day.

As discussed on pages 14 and 15, M&C Saatchi was HRI’s largest single detractor from performance during the year ended 31 December 2019. Katie says that, whilst it has been their biggest disappointment, none of the directors have sold stock (thereby taking the full pain with fellow shareholders) and the situation reflects a lack of financial controls. This is being addressed (the CFO was replaced and the company now has a group treasurer) and, although the incident has been damaging for morale, the CEO has shareholder support, which is key.

Performance

Performance

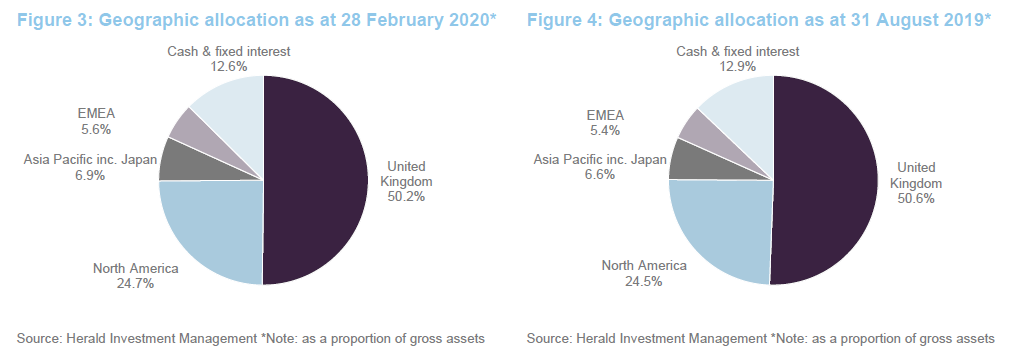

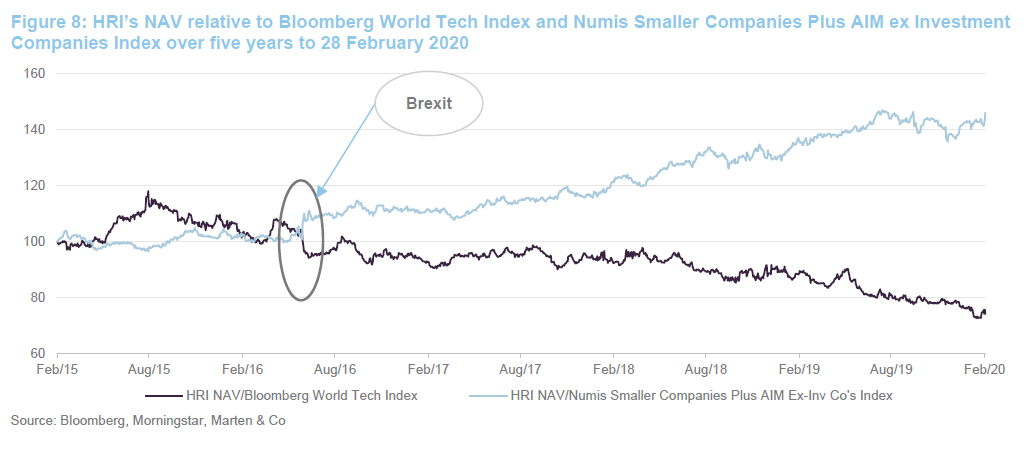

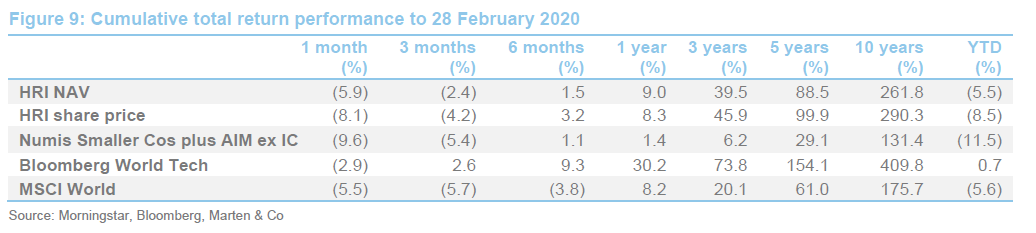

Between 30 September 2019 (the cut-off date we used to measure HRI’s performance when we last published) and 28 February 2020, HRI has continued to outperform the Numis Smaller Companies plus Aim ex Investment Companies Index (see Figure 8), while underperforming the Bloomberg World Tech Index. Over this period, HRI has provided share price and NAV total returns of 1.9% and 4.5% respectively, while the Numis index has a negative return of 0.4% and the Bloomberg index has returned 7.9% (all in sterling total return terms).

As is discussed below, HRI provided very strong returns during 2019. Whilst it has lost value, in absolute terms, during the first two months of 2020, the falls were relatively modest (for example, HRIs NAV fell by 5.5%, while the Bloomberg World Index lost 5.6%). However, as the outbreak of covid-19 has accelerated, markets have retrenched significantly. Month to date (to 30 March – the most recently available data before the publication of this note), HRI’s NAV is down 13.4%, its share price is down 21.4%, the Bloomberg Tech Index is down 5.5%, the Numis index is down 25.7% and the MSCI World is down 9.9% (all in sterling adjusted total return terms). Clearly, there is the potential for further market retrenchment as uncertainty increases and economic activity recedes as measures to counteract the virus bite. However, these are relatively short-term phenomena and, for investors prepared to look beyond this, there is strong recovery potential over the medium term.

Results for the year ended 31 December 2019 – an exceptional year of performance

Results for the year ended 31 December 2019 – an exceptional year of performance

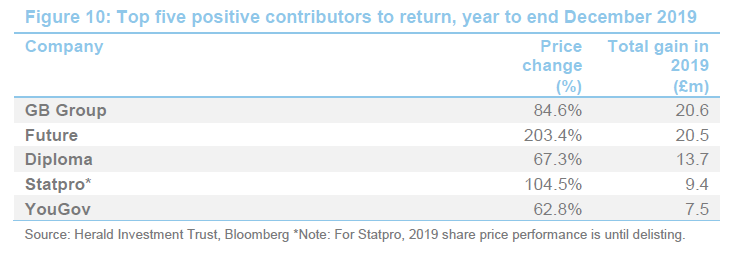

Following a more challenging year in 2018, when HRI’s nav provided a total return of -4.8%, 2019 was an exceptional year of performance. HRI provided an NAV total return of 27.5% (in sterling terms), although there was a sharp divide in returns from the underlying portfolios – both by size and region. Typically, HRI’s larger positions provided the best performance.

HRI’s UK portfolio returned 30.2%, outperforming the Numis by 8%. However, the return from stocks with a market capitalisation exceeding $1bn was 77.3%, which has driven the outperformance, while the return for stocks less than $1bn was 16.6% (this pattern was repeated for Asia, Europe and North America). The UK portfolio benefitted from eight takeovers (Statpro was the largest – see below), with an aggregate value of £38.1m. These stocks collectively accounted for 8.1% of the UK portfolio at the start of 2019.

HRI’s North American portfolios returned was 39.5% (in sterling terms), some 10% ahead of the local index. However, stocks less than $1bn were up 35.9%, while stocks greater than $1bn were up 40.9%. The US portfolio also benefited from significant takeover activity. The largest were: Attunity (£17.3m), Mellanox (£16.8m), Amber Road (£9.4m), Hydrogenics (£6.7m) and Quantenna (£5.4m).

HRI’s European portfolio has benefitted from a good recovery in the semiconductor space during 2019 (this was a headwind during 2018, which affected BE Semiconductor Industries, a major The European portfolio returned 38.9% but returns varied significantly by size (up 23.1% for stocks less than $1bn, and up 89.8% for stocks greater than $1bn). Interestingly, the European portfolio is 181% over five years (in sterling terms), which makes it the best-performing region. The portfolio benefitted from the takeover of Data Respons during 2019.

HRI’s Asian portfolio returned 29.3% in sterling terms but returns were similarly dispersed (up 12.7% for stocks less than $1bn, and up 43.7% for stocks greater than $1bn). This was led by Taiwan (up 51.5%), although performance across Asian markets between countries and between the first and second half of the year was quite varied. China and Hong Kong were volatile (trade war and protests respectively). Australia had a meteoric start (up around 50% in sterling terms by mid July 2019) before giving a significant proportion of this back.

Key contributors and detractors during 2019

Key contributors and detractors during 2019

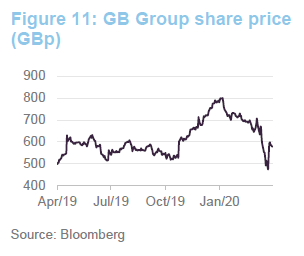

GB Group (identity data intelligence) has been a strong long-term-performing holding for HRI that performed strongly during 2019. The market reacted very positively to the announcement of its pre-close trading statement on 17 April (up from 550p to 630p per share; an increase of 14.5%), which showed an increase in total revenue of 19.7%, with 11.3% from organic growth; and a 20.6% increase in adjusted operating profit.

Although GB Group’s share price drifted down between April and October, its pre-close trading statement, for the six months ended 30 September 2019, released on 24 October, was also well received by the market. The share price increased by 14.2% on the day (from 527p to 602p per share). On a constant currency basis, organic revenues increased by 18%. However, total revenue increased by 64% to £93.7m, reflecting both recent acquisitions (Vix Verify and IDology) as well as positive trading across its location, identity and fraud segments.

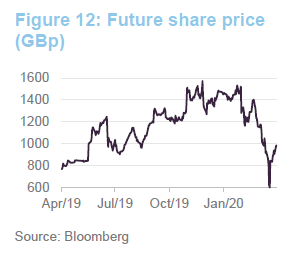

Like GB Group, Future has been a strong long-term performing holding for HRI that performed strongly during 2019. In our October 2019 update note (see page 8 of that note), we commented that Katie had described Future as “the market’s current hot media favourite” in the media space (it publishes a range of special interest consumer magazines and websites). We also explained that its operational performance had been strong (on the back of a positive performance from Amazon Prime Day related activity, strong ongoing trading in the US, as well as some additional benefits from foreign currency translations) and that full year EBITDA is now expected to be materially ahead of current Board expectations. Future continued to perform well through well into January 2020, although it has come under significant pressure as markets have retreated.

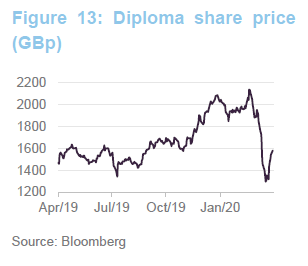

Diploma is a group of specialised distribution businesses that services industries with long term growth potential. It operates in three main business segments – life sciences, seals and controls. These offer opportunities for strong margins, that are sustainable, by delivering quality customer service, deep technical support and providing associated value-adding activities. Reflecting this, Diploma has a good track record of growing its sales, around three-quarters of which are outside the UK (it has performed particularly well during periods of sterling weakness post Brexit).

A focus on supplying essential products, which are typically funded by its customers’ as operating expenses, rather than capital items, provides for recurring income streams that tend to provide stable revenue growth. There were no big surprises in Diploma’s result announcements during 2019, which were broadly in line with expectations.

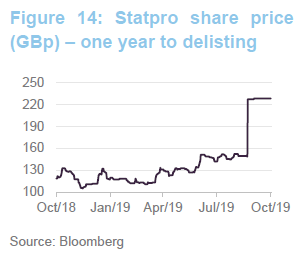

Statpro’s cloud-based platform provides portfolio analytics and data solutions to the global asset management industry. It is a long-time holding of HRI’s that exited the portfolio in November 2019 when it was taken over by Confluence Technologies. HRI first invested in the company in its IPO in May 2000. HRI usually limits its individual stakes in companies to 10% of their issued share capital. However, in the aftermath of the financial crisis, HRI took its stake up to over 11% when the Icelandic bank Kaupthing went bankrupt and Statpro was no longer able to draw on its overdraft facility. This was done in conjunction with Statpro’s directors, who also provided emergency funding.

Katie says that the return over the life of HRI’s holding is 1,018.5% and that, of the cumulative £13.8m total return over the history of the holding, £9.2m came in 2019 with the takeover premium.

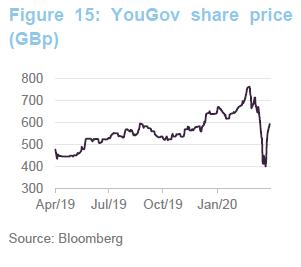

We discussed YouGov, the international data and analytics group, in our October 2019 note (see page 5 of that note). At that time, we commented that YouGov had experienced a strong price performance that had pushed it back up HRI’s rankings into its top 10 holdings. As illustrated in Figure 15, YouGov’s share price initially proved resilient in the face of the covid-19 outbreak (it performed strongly all the way through to end of February 2020) but has both fallen very sharply since and then recovered (overall it is down 7.6% between 28 February and 30 March). YouGov’s trading update for the six months ended 31 January 2020 showed that revenue growth was primarily driven by data products (with the US and UK performing particularly well), while good margins were maintained within its custom research division.

M&C Saatchi’s share price suffered heavily during 2019, both from the revelation that poor financial controls had led to profit being overstated in prior years (which would be addressed with a one-off charge) and that underlying profit for the 2019 year was below expectations due to weaker than expected trading in the final quarter and higher than expected central costs (see page 11).

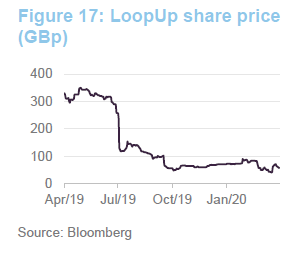

LoopUp, the conference call service provider, saw its share price suffer heavily following the release of its Q2 trading update on 3 July 2019 (down 44.3% on the day). The company said that, while it was seeing strong demand for its product, revenue from its existing customer base was “subdued”. It attributed this to general macro-economic factors and a need to divert more senior staff than expected into management and training activities to facilitate growth.

However, it said that expected revenue and EBITDA for the full year to 31 December 2019 to be approximately 7% and 20%, respectively, below market consensus at that time.

Zoo Digital, which we discussed on page 8 in conjunction with the fundraise that HRI supported in 2017, provides cloud software-based subtitling, dubbing and media localisation services. It saw its share price suffer heavily during January 2019, following the publication of its third quarter trading update (down 43.8% on the day). The company said that, while trading in the second half had begun “encouragingly”, its performance was affected by the loss of a single, material localisation project in the period. In addition to this, revenue from the processing of legacy DVD and blu-ray titles was also “significantly” lower than had been expected.

Brady, which provides commodity and energy trading software, saw its share price suffer heavily on 21 August 2019 (down 40.7% on the day) after it warned that it expected its full-year revenue to be in the region of £19m (an 18% decline), as the pipeline of revenue it had expected from new customers would not materialise during 2019. The company then announced in September that it would require additional working capital to support its existing operations, prior to the end of November 2019, and that it was exploring a number of options.

Support ultimately came from Hanover Investors. The private equity firm initially offered 10p a share (valuing Brady at £8.3m), to take the company private, but this was increased to 18p per share (valuing Brady at £15m), and the company’s shares were delisted from AIM on 8 January 2020. While the 18p was an improvement on the original offer, it is markedly below the 64.5p per share that Brady opened 2019 on, and consequently HRI booked a loss on the position during 2019.

Having previously been a very successful investment, compound semiconductor wafer company IQE has been a drag on HRI’s returns during the last couple of years, reflecting difficulties in this market. IQE supplies the wafers that enable the iPhone’s facial recognition technology, but it struggled when iPhone sales began to disappoint, and has suffered as some short-term investors have shorted the stock.

Dividend

Dividend

HRI is focused primarily on generating capital growth, and dividend income makes up only a small part of returns. The consequence of this is that HRI only declares a dividend where this is necessary to retain investment trust status, and in practice, no dividend has been declared since 2012. HRI had revenue reserves of 1.86p per share as at 31 December 2019 (2018: 1.77p per share). During 2019, HRI made a revenue return of 0.05p (2018: 0.08p).

Discount

Discount

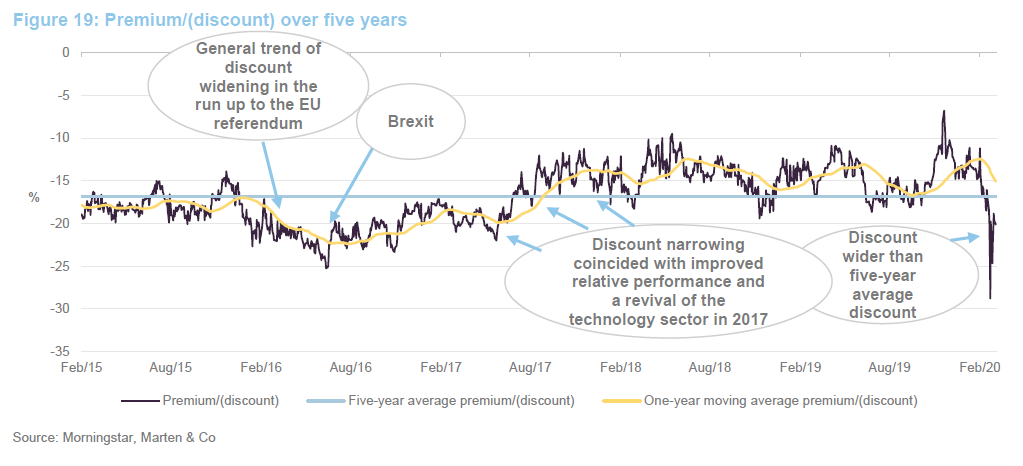

As Figure 19 shows, HRI has tended to trade within a discount range of 10% to 20% during the last two and a half years. As we have discussed in our previous notes, HRI’s discount has tended to narrow during periods were performance is strong or when the technology sector has been in favour. For example, between mid-2016 and early 2018, which coincided both with an improvement in HRI’s relative performance and a marked revival in the performance of the global technology sector, particularly during 2017; then again during the first half of 2019; and then during the final quarter of 2019. More recently, the discount widened dramatically, reaching a five-year high (28.8% as at 19 March 2020) as markets were scythed back by the outbreak of covid-19. However, it has quickly narrowed again (20.1% as at 30 March 2020). This is wider than its five-year average of 16.8%, but comfortably within its longer-term trading range.

Clearly, there is considerable uncertainty in financial markets at present. However, with the value of portfolio companies marked down and HRI trading about its longer-term average, now may represent a good entry point for the long-term investor who can afford to be patient. 2020 will be a volatile year for markets but Katie considers that tech stocks are less sensitive to the business cycle, and therefore more defensive, than most investors believe. If this proves to be the case, the discount could continue on its path of tightening from here, although the reverse is also true.

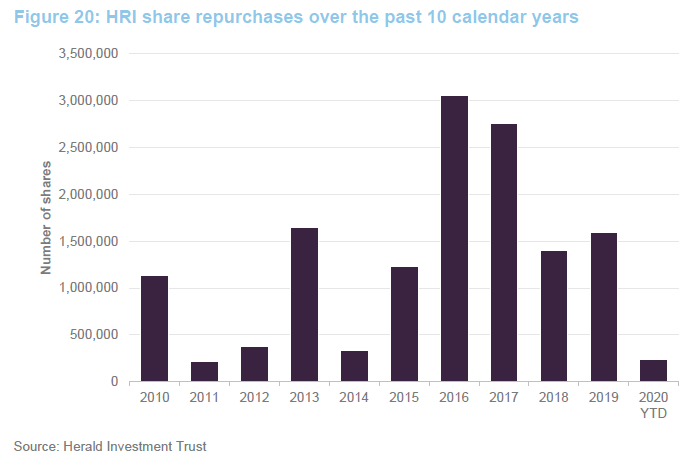

HRI has continued to benefit from strong cash inflows from portfolio realisations. In the past, some of these proceeds have been used to repurchase shares. Over the year to 31 December 2019 HRI repurchased 1.59m shares or 2.3% of its used share capital as at 31 December 2018 (during 2018, 1.41m shares were repurchased, this being equivalent to 2.0% of HRI’s issued share capital at the start of the year). During the last 12 months, HRI’s discount has moved within a range of 6.8% to 28.8% with an average of 14.8%.

Fees and costs

Fees and costs

Simple fee structure with no performance fee element

Simple fee structure with no performance fee element

HIML is entitled to an annual management fee of 1% of net assets (in a change to the previous arrangement, this now includes HRI’s holding in Herald Ventures II LP, but fees are no longer charged at the partnership level, so HIML has ensured that there has been no double-counting of fees on this investment).

The NAV is calculated monthly using mid-market prices, which is somewhat unusual, as most NAVs are calculated at bid prices. However, given that many of HRI’s underlying holdings trade on wide spreads, the mid-market valuation gives a better indication of the true value of the portfolio. There is no performance fee. The management fee also covers the cost of company secretarial services, which HIML has delegated to Law Debenture Corporate Services.

In the year to the end of December 2019, HRI’s ongoing charges ratio was 1.09%, up modestly from 1.07% the year before. The asset management contract is subject to 12 months’ notice.

Capital structure and life

Capital structure and life

Simple capital structure

Simple capital structure

HRI has a simple capital structure with one class of ordinary shares in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 30 March 2020, there were 67,066,777 in issue with no shares held in treasury.

The trust is permitted to borrow up to 50% of net assets and it had a £25m multi-currency revolving loan facility with RBS that matured on 31 December 2019. The facility was undrawn prior to its maturity, as HRI has been running with net cash for some time. The decision was therefore made not to renew the facility. As at 28 February 2020, HRI had net cash of 8.1% of its total net assets.

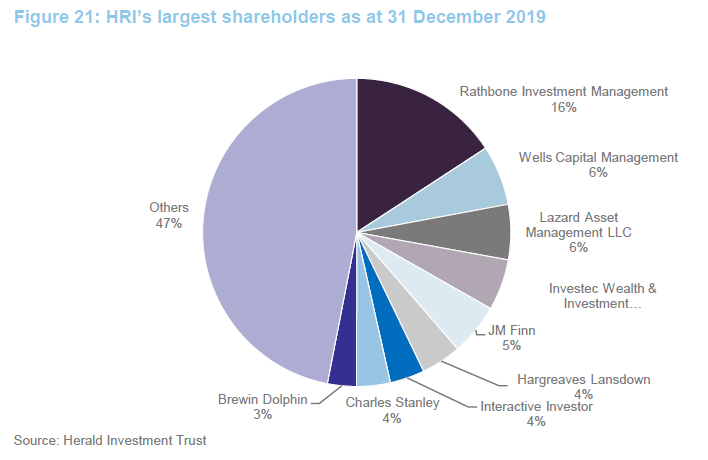

Major shareholders

Major shareholders

Unlimited life with three-yearly continuation votes

Unlimited life with three-yearly continuation votes

HRI does not have a fixed life, but shareholders are offered a continuation vote every three years. The next continuation vote is scheduled for the trust’s AGM in 2022.

Financial calendar

Financial calendar

The company’s year-end is 31 December. The annual results are usually released in March (interims in July) and its AGMs are usually held in April of each year.

Board

Board

HRI’s board is composed of six directors, all of whom are non-executive and considered to be independent of the investment manager. The board has undergone a modest refresh during the last couple of years and its size has expanded (previously HRI’s board comprised four directors, which helped to keep a rein on costs, but a trust of this size can comfortably support a larger board with shareholders benefitting from the additional oversight that thus greater resource allows). Short biographies of all board members are provided below. Other than HRI’s board, its directors do not have any other shared directorships.

Julian Cazalet retired in April 2019 (after 11 years of service) and Henrietta Marsh joined the board in September 2019. Ian Russell became chairman upon Julian Cazalet’s retirement. Stephanie Eastment has taken over from James Will as chairman of the audit committee.

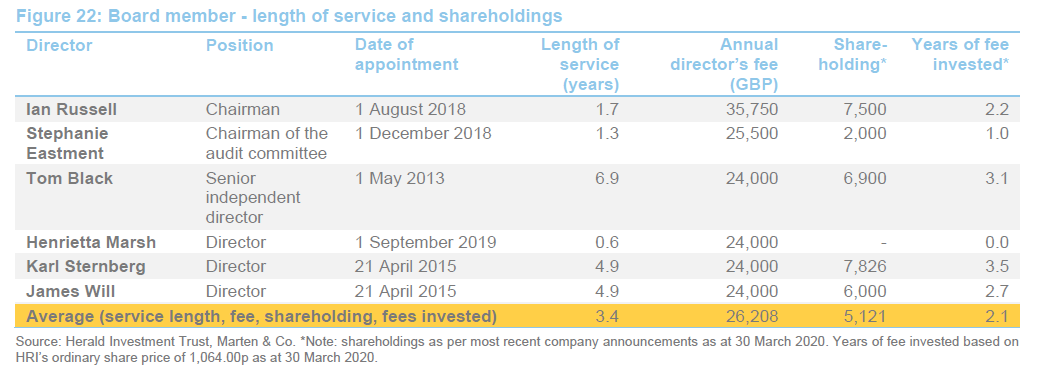

Total fees for the directors are capped at £200,000. Figure 22 shows the current composition of the board and provides some information on members’ length of service and shareholdings in the company. It is board policy that all serving directors retire and offer themselves for re-election annually.

As illustrated in Figure 22, with the exception of Henrietta Marsh, who has only recently joined the board, all of the directors have made significant personal investments in HRI’s ordinary shares. Stephanie Eastment and Karl Stenberg have both increased their shareholdings since we last discussed these in our February 2019 note (by 1,000 and 2,000 shares respectively).

Ian Russell (chairman)

Ian Russell (chairman)

Ian Russell is a chartered accountant who has held a number of finance roles in industry and banking. He also has considerable experience as an investment trust board member. Ian qualified as a chartered accountant with Thomson McLintock, and subsequently joined Scottish Power plc in 1994, initially as Finance Director. He then became CEO in 2001, a role he held until 2006. Since 2006, Ian has concentrated on non-executive roles. He is currently the chairman of HICL Infrastructure Company Limited, a non-executive director of Aberdeen Diversified Income and Growth Trust Plc, and a non-executive director of Mercantile Investment Trust Plc. He is also chairman of the Scottish Futures Trust Limited, an independent company established by the Scottish Government with a responsibility for delivering value for money across public sector infrastructure investment. Ian was previously a non-executive director of British Polyethene Plc and Johnston Press Plc.

Stephanie Eastment (chairman of the audit committee)

Stephanie Eastment (chairman of the audit committee)

Stephanie Eastment is a chartered accountant and company secretary with over 30 years’ experience in the financial services industry. She has considerable experience in the investment trust sector and is a member of the AIC’s Technical Committee. Stephanie qualified with KPMG and held various accounting and compliance roles at Wardley and UBS before joining Invesco Asset Management in 1996 as Manager, Investment Trust Accounts. When she left Invesco in July 2018, she was Head of Specialist Funds Company Secretariat and Accounts. Stephanie is a non-executive director and audit chair of Murray Income Trust Plc.

Tom Black (senior independent director)

Tom Black (senior independent director)

Tom was previously chief executive of Detica Group Plc, a leading company in the field of large-scale information collection and analysis for intelligence and counter fraud applications. As such, he understands HRI’s smaller companies remit, having grown an early stage technology company and listed it on the London Stock Exchange. He also has advisory roles with a number of smaller unlisted businesses. Tom is chairman of Thruvision Group plc (formerly Digital Barriers Plc), and is a non-executive director of CloudCoCo Group Plc. He is also chairman and trustee of the Black Family Charitable Trust, which is focused on supporting disadvantaged young people with their educational needs.

Henrietta Marsh (director)

Henrietta Marsh (director)

Henrietta has a background in fund management, having worked in UK small cap and private equity investment over several decades. From 2005 until 2011, she was AIM fund manager at Living Bridge Equity Partners and, prior to that, she spent 14 years at 3i in several roles, including as fund manager of 3i Smaller Quoted Companies Trust plc (1997–2002). Henrietta spent her early career with Morgan Stanley and Shell. She is currently a non-executive director of Gamma Communications Plc (AIM listed), a trustee of 3i Group Plc’s pension fund and a member of London Stock Exchange’s AIM Advisory Group.

Karl Sternberg (director)

Karl Sternberg (director)

Karl spent much of his earlier career at Morgan Grenfell (which became Deutsche Asset Management), where he rose to become chief investment officer, Europe & Asia Pacific. Subsequently, he was a founding partner of Oxford Investment Partners Limited, where he worked from 2006 until 2013, when it was acquired by Towers Watson. Karl is a non-executive director of Clipstone Logistics REIT Plc, Monks Investment Trust Plc, Lowland Investment Company Plc, Alliance Trust Plc, JP Morgan Elect Plc, Island House Investment LLP and Jupiter Fund Management Plc.

James Will (director)

James Will (director)

James was, until 2014, chairman and a senior corporate finance partner of law firm Shepherd and Wedderburn LLP, where he also headed the law firm’s financial sector practice. During his career as a lawyer, James was involved in advising smaller quoted technology companies, for over 20 years, on a range of corporate transactions, including flotations, secondary fundraisings and mergers and acquisitions. James is chairman of both The Scottish Investment Trust Plc and Asia Dragon Trust Plc.

Management team

Katie Potts is the managing director and also the lead fund manager for HIML. She established HIML in December 1993 to manage HRI, which was launched in February 1994. Katie read Engineering Science on a GKN Group scholarship at Lady Margaret Hall, University of Oxford. She worked for five years in investment management at Baring Investment Management Limited, before joining S.G. Warburg Securities’s UK electronics research team in 1988. The team was consistently voted top team in the Extel survey of analysts in the sector, and she was voted top analyst by finance directors of electronics companies canvassed by The Treasurer magazine. In addition, Katie had responsibility within S.G. Warburg’s UK research department for commenting on accounting issues.

Katie is supported in managing the funds by a team of six other investment professionals and three consultants.

Fraser Elms joined HIML in May 2000. He is the deputy manager of HRI and has lead responsibility for managing HIML’s Asian portfolios. Prior to joining HIML, Fraser was a technology analyst with Dresdner Kleinwort Benson, where he covered the European technology sector. Before this he worked at Prudential for three years as member of a team of three UK unit trust fund managers that managed £5bn in equities, with Fraser having lead responsibility for three funds collectively worth £400m. He graduated from Lancaster University with a degree in Economics and initially joined Prudential as a product manager for their unit trusts, before completing an MSc in Investment Analysis at the University of Stirling and re-joining Prudential in an investment role. Fraser covers the semiconductor sector.

Taymour Ezzat joined HIML in November 2004. He is a portfolio manager on the venture funds, sitting on the venture committee, and taking lead responsibility for a number of the investments in the venture portfolios. He also has analytical responsibility for the media sector across all HIML’s quoted and unquoted portfolios. Previously he spent a year appraising a number of venture capital opportunities for E.D. Capital Partners. Prior to that, Taymour spent six years at Northcliffe Newspapers, the regional newspapers division of Daily Mail and General Trust (DMGT), latterly as finance director of its electronics publishing arm. Prior to this, he worked for Reuters in London and Eastern Europe for four years. Taymour qualified as an accountant with Price Waterhouse, and studied Economic History at the London School of Economics and Political Science.

Hao Luo joined HIML in 2004 and works with Fraser Elms on managing the Far East portfolios. He also has analytical responsibility for the manufacturing sector globally. Hao obtained a BA in Economics from Hunan University in China and a Masters degree in Finance from Manchester University. He worked for J&A Securities in Shanghai from 2000-2002. Hao is a CFA charterholder.

Peter Jenkin joined HIML as an analyst in 2015. Peter covers the software sector and contributes to the overall investment selection. Before joining HIML he studied Construction Engineering Management at Loughborough University.

Bob Johnston was recruited to establish a US office. He has more than 20 years’ experience in the technology sector on the sell-side, and he has worked with the HIML team for roughly 15 years. Most recently, Bob was with the technology specialist Pacific Crest. He previously also worked for Hambrecht & Quist and SoundView Technology Group. Bob has taken responsibility for telecommunications, networking and security analysis.

Danny Malach joined HIML in June 2016. At Newcastle University Danny obtained First Class Honours in his undergraduate degree in Accounting and a Merit in (MSc) International Economics and Finance.

Fati Naraghi joined HIML towards the end of 2019 to focus on the Herald Worldwide Technology Fund and to cover some of the larger technology companies. Prior to joining HIML, Fati spent 20 years at Newton Investment Management where she was responsible for the global tech sector. Fati has a Ph.D. in Communications Systems and is qualified as an AWS Cloud Practitioner.

Previous publications

Previous publications

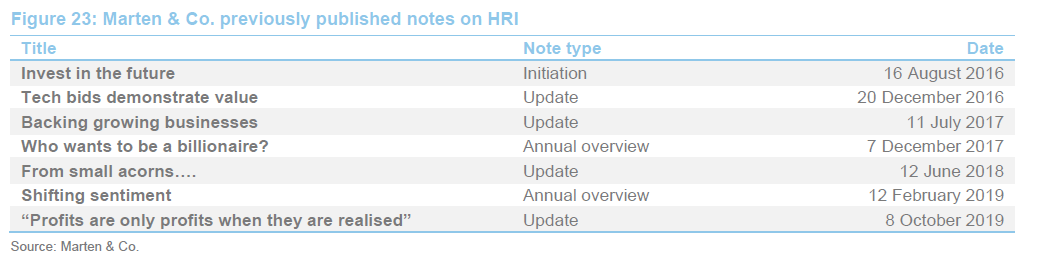

Readers interested in further information about HRI may wish to read our previous notes (details are provided in Figure 23 below). You can read the notes by clicking on them in Figure 23 or by visiting our website, www.martenandco.com.

The legal bit

This marketing communication has been prepared for Herald Investment Trust by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice and in accordance with our internal code of good conduct, will refrain from doing so. Nevertheless, they may have an interest in any of the securities mentioned in this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.