A win-win scenario

India, the world’s fifth-largest economy, has rebounded very strongly as COVID-related restrictions have eased; a fact that Gaurav Narain, India Capital Growth’s (IGC’s) investment adviser, believes has caught many observers by surprise. The key indicators suggest further recovery from here. India’s purchasing managers index (PMI) was 56.3 for November – a number above 50 points to an expanding economy. Gaurav says that recent results have generally surprised positively.

As was discussed in QuotedData’s last note, IGC’s manager, has enhanced its investment process and recent performance shows a marked turnaround in its returns relative to its competitors (IGC’s NAV was up 48.2% during the half year to 30 November 2020, versus an average of 25.3% for its peers).

Gaurav has been rebalancing the portfolio towards long-term growth stocks that are yet to fully recover. Investors have the opportunity to benefit, both from this recovery and from a narrowing of IGC’s discount, as this outperformance comes through. Should this not materialise, there is a redemption opportunity at the end of 2021.

Mid- and small-cap listed investments in India

IGC’s investment objective is to provide long-term capital appreciation by investing (directly or indirectly) in companies based in India. The investment policy permits the company to make investments in a range of Indian equity securities and Indian equity-linked securities. The company’s investments are predominantly in listed mid- and-small-cap Indian companies.

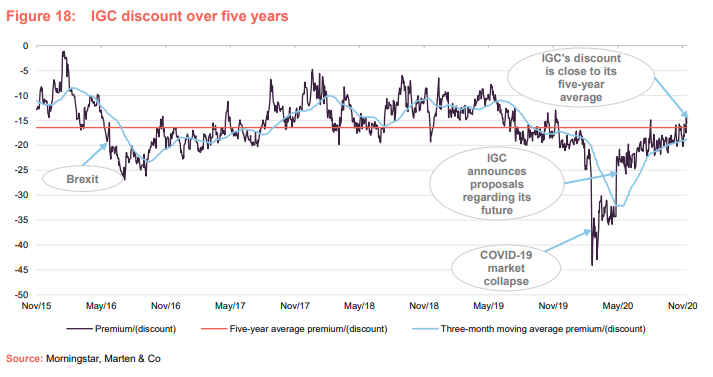

IGC’s discount widened sharply as markets collapsed in March, in the face of an accelerating COVID-19 infection rate. However, this began to reverse in April. The discount then narrowed dramatically on 26 May, when IGC published a series of proposals regarding its future which included a redemption opportunity.

Changes were put in place earlier this year to give more rigour to the investment process. The peer group analysis shows a significant improvement in IGC’s performance relative to its peers.

| wdt_ID | Year ended | Share price total return (%) | NAV total return (%) | Portfolio total return (%) | S&P BSE Mid Cap TR (%) | MSCI India total return (%) |

|---|---|---|---|---|---|---|

| 1 | 30 Nov 2016 | 22.80 | 25.60 | 35.20 | 34.40 | 21.20 |

| 2 | 30 Nov 2017 | 45.80 | 35.10 | 35.10 | 34.50 | 22.30 |

| 3 | 30 Nov 2018 | -17.10 | -20.60 | -20.60 | -12.00 | 3.20 |

| 4 | 30 Nov 2019 | -14.60 | -7.00 | -7.00 | -2.90 | 4.40 |

| 5 | 30 Nov 2020 | 2.30 | 4.90 | 4.90 | -24.10 | -20.20 |

Fund profile

IGC is an investment company listed on the Main Market of the London Stock Exchange. It invests in India, predominantly in listed mid- and small-cap Indian companies. The fund is aiming to generate capital growth for shareholders. IGC has not paid dividends in the past and the manager says it is unlikely to do so in the near future.

Management arrangements

IGC has been managed since 2010 by David Cornell of Ocean Dial, a company owned by Avendus Capital Private Limited, which in turn is backed by KKR (an American global investment company that manages multiple alternative asset classes, including private equity, energy, infrastructure, real estate, credit, and, through its strategic partners, hedge funds). He has been assisted in this since November 2011 by Gaurav Narain (Gaurav or the adviser) of Ocean Dial Asset Management India Private Limited, which is based in Mumbai. Gaurav has over 25 years of experience in Indian capital markets, having started his career as vice president of research for SG Asia. The seven-strong investment team is split between London and Mumbai. Each of the analysts is assigned responsibility for a number of industry sectors. The manager is responsible for monitoring portfolio risk and all dealing is done from London.

Ocean Dial manages two funds investing in India: IGC and an open-ended fund, Gateway to India fund. Ocean Dial had AUM of US$170m as at the end of November 2020.

Alignment of interest

Employees of Ocean Dial collectively hold 397,381 shares in IGC, while members of IGC’s board collectively own 112,500 shares between them. Combined, Ocean Dial employees and the three directors hold 0.5% of IGC’s issued share capital.

Taxation

IGC invests through both a Mauritian subsidiary (ICG Q Limited) and a Guernsey fund (IGC F Limited) in a portfolio of Indian securities. Changes to the Indian tax regime in 2018 mean that the portfolio is now liable to pay capital gains tax at 15% on short-term gains and 10% on its long-term (over 12 months) gains. IGC will accrue any potential capital gains tax liability in its NAV. Given the manager’s and adviser’s focus on holding companies for the long-term, it might be reasonable to expect that the bias will be to the realisation of long-term gains. No capital gains tax was accrued at 30 June 2020.

Index comparators

IGC’s main focus is on Indian mid- and small-cap companies, but the fund can and does hold large-cap stocks as well. The board and the manager use the S&P BSE Mid Cap Index (total return) for performance evaluation purposes, although the portfolio is not constructed with reference to this index. The other funds in IGC’s peer group benchmark themselves against the MSCI Index and therefore we have included this index within the report as well.

Manager’s view – the economy is rebounding strongly

IGC’s adviser, Gaurav Narain, observes that since we last published on 26 May 2020, the world’s fifth-largest economy recovered very strongly, which he says has caught almost all observers by surprise.

India’s Prime Minister, Narendra Modi, announced on 25 March 2020 that a full national lockdown was being imposed for 21 days, in an attempt to slow down the spread of the coronavirus. This lockdown was subsequently extended – there were four phases – but restrictions began to ease from the beginning of June.

India’s GDP (gross domestic product) fell by 23.9% in Q1, year-on-year, and Gaurav thinks that the fall would have been more severe had rural India been locked down to the same extent as the cities. However, following this contraction, the year-on-year fall for the second quarter of 2020 was much lower, at just 7.5%. Gaurav believes that this trend of improvement has continued into the third quarter of 2020, with demand continuing to pick up strongly. He observes that the key macroeconomic barometers are suggesting that the economy is growing. For example, auto sales are up around 30%, power sales were up 13.2% in the third quarter of 2020 versus the second quarter of 2020 (according to the Indian Energy Exchange) and the purchasing managers’ index was 56.3 in November, having hit an eight-year high in October of 58.9 (it was last at this level in 2012).

India has moved into the festival season and there had been concerns that this could lead to a surge in cases, with increased restrictions imposed after this. However, following Diwali in mid-November, the infection rate continues to edge down (India was seeing 98 thousand new cases per day in mid-September, but this was down to 36 thousand at the beginning of December) and Gaurav says that the recovery rates are now significantly higher than they were at the beginning of the pandemic (initially the mortality rate was around 4% and is now around 1.6%, which compares well against other countries – the global average is around 2.3% according to data from the World Health Organisation). Gaurav says that we are now mid-earnings season and results have generally surprised on the positive side, with a lot of margin improvements coming through.

Government is keeping its powder dry and will focus on its infrastructure programme

Gaurav considers that the government’s efforts to prop up the economy in the face of the pandemic have been relatively limited. He thinks that there has been a concern that, rather than providing support for business, much of the stimulus would flow into savings and so the government has preferred to keep its powder dry for its big infrastructure development plans.

On 5 November, Prime Minister Modi held a meeting with the top 20 global investment funds to attract investment into the infrastructure space. India’s government is offering tax-free status to the long-term infrastructure projects that these funds invest in (no capital gains tax, income tax or dividend related tax liabilities). Gaurav says that the government has already identified the projects, and roads and airports are seeing the biggest infrastructure development plans (some US$1 trillion over the next five years).

For example, the government has plans for around US$15bn of infrastructure projects around Mumbai. This includes a bullet train linking it to Ahmedabad, which has just had its contract awarded to Larsen & Turbo; a new airport (Navi Mumbai International) being built at Ulwe Kopar-Panvel in Maharashtra; two express ways (one to Delhi and the other to the heart of the country); and seven Metro lines being built simultaneously (with 300-400km of new track, with two lines expected to be open by the end of the year). Similarly ambitious plans are being rolled out across other states. With the planning consultations already completed, these projects now require funding.

Moving to a digital economy

In lockstep with global trends, the onset of the pandemic saw a rapid acceleration of India’s digital economy, as the country has had to adapt to the situation. India now has 650m smart phone users and 99% of all digital transactions take place over the phone, as most citizens have sidestepped the laptop/desktop journey. The smartphone caters for every need, and since India has the lowest data costs globally (13 US cents per GB per month), IGC’s adviser expects usage to continue to grow from a low base.

Reflecting strong mobile penetration the government launched its United Payments Interface (UPI) which acts as a gateway through which all digital transactions pass, catching both Mastercard and Visa off guard and enabling enterprises and individuals to transact with each other through a single portal. Currently UPI processes $2bn transactions daily, but this is expected to grow significantly as digital transactions increasingly gain market share.

As a reflection of the way that India is changing, there are now approximately 450m bank accounts in India, which is more than one per family. It is through these bank accounts that all subsidy payments are now delivered and internet banking is rapidly replacing the need to form an orderly queue. The adviser expects that “soon there will be a bank branch in everyone’s pocket”, which can only speed up financial intermediation across the country. The exception to this is roll out of 5G, which is still someway away, due to the high costs of bidding for additional spectrum.

Bank’s performance exceeding expectations

The central bank’s moratorium on interest payments on loans ended in August, and whilst there were concerns about increasing non-performing loans (NPLs), the large banks have been reporting collection rates that have been higher than expected (around 95% of the pre-COVID level). Reflecting this better-than-expected progress, the large banks have already started to reduce their COVID provisions.

Credit growth showing signs of recovery

Credit growth has been modest. The Reserve Bank of India’s statement of the sectoral deployment of bank credit for October shows non-food bank credit growth of 5.6 year-on-year for October 2020 (October 2019: 8.3%), but Gaurav highlights that the banks are sitting on a lot of cash and expects credit growth to recover as economic activity picks up, people gain confidence and take advantage of current low interest rates (the festival season has also traditionally brought about a rise in the demand for credit). While personal loans for consumer durables and advances against fixed deposits are down markedly over six months (by 26.0% and 22.7% respectively), loans for housing, advances against share bonds, credit card debt, vehicle loans, and other personal loans are all up (by 2.6%, 18.0%, 2.0%, 1.5% and 5.2% respectively).

Foreign exchange reserves at an all-time high and the Indian rupee has been resilient

Gaurav says that, in addition to most-macroeconomic indicators being relatively healthy, India’s foreign exchange (forex) reserves are at an all-time high and the currency is healthy too. The central bank has been busy buying US dollars and selling rupees, quite aggressively, to bolster foreign exchange reserves (Gaurav says that the improvement in Forex reserves is a massive change – data from Bloomberg at the end of November suggested these are the fifth-highest globally – behind China, Japan, Switzerland, and Russia).

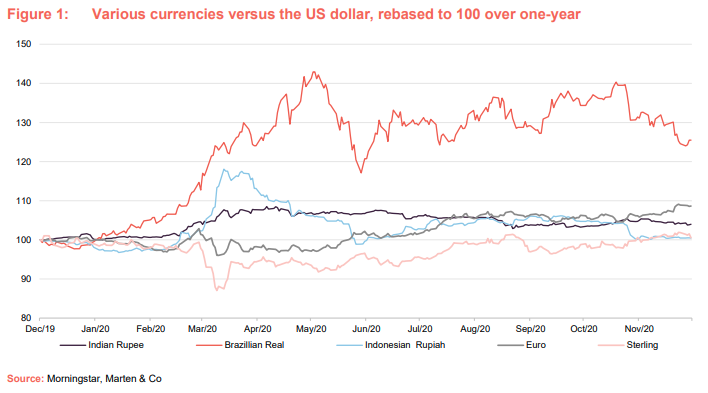

Against this backdrop, the Indian Rupee (INR) has been remarkably stable this year, as illustrated in Figure 1, which shows a number of currency, both developing market (the INR, the Brazilian Real and the Indonesian Rupiah) and developed market (the Euro and sterling) all against the US dollar (all rebased to 10 over one-year). Inspection of Figure 1 shows that the INR has exhibited the least volatility out of all of the currencies provided.

Reducing dependency on exports and boosting competitiveness

India is a net importer, but in the aftermath of the crisis, its imports are down around 20%, yet its exports are up around 5%, markedly improving its balance of payments deficit. The Modi government has been working to reduce India’s dependency on imports, particularly where the country has a large market (for example, consumer electronics is approximately a US$40bn market). (Note: the balance of payments for a country is the difference between all of the money flowing into and out of that country in a particular period of time.)

Gaurav says that Modi’s “Made in India” programme has been a big success. It not only provides incentives to purchase from domestic manufacturers, but is also making it easier to set up production plants in the country (which benefit from India’s relatively-low labour costs). Gaurav says that hundreds of plants have been set up and he sees this as a long-term structural change. For example, Apple iPhone 12 components are being made in India.

Healthcare is another key area being targeted. The government is providing tax benefits and support to help set up pharmaceutical plants. The government’s related measures have also seen India move from around 132 in 2013 to 63 in 2020, in the World Bank’s ease of doing business index, which has been a big focus of government reform. Interestingly, it has gone from 182 to 27 for dealing with construction permits, from 49 to 13 for protecting minority shareholders and from 116 to 52 for resolving insolvency.

Corporate tax rates have been cut in a bid to make India more competitive with other Southeast Asian countries and to encourage manufacturing. For new manufacturer units, the corporate tax rate is 15%, which the manager believes is the lowest in Asia. Two pillars of this have been the government’s labour reforms and its reforms of the agricultural sector. India has also been focusing on improving education. The aim of the measures is to get India’s economy growing at a faster rate. Corporate profits are also coming off a low base – corporate profits were 1.8% of GDP in 2019, having previously troughed in 2001 at 1.9% and having previously peaked at 7.3%, which suggests strong growth potential from here.

Investment process – The “House of Ocean Dial”

Recent innovations

In our May 2020 note, we explained how Ocean Dial IGC had both refined its investment process and strengthened the advisory team. Tridib Pathak joined Ocean Dial in October 2019 as co-head of equities, working alongside Gaurav Narain, whom regular followers of IGC and readers of our notes on the company will be very familiar with.

The analyst team was also expanded earlier this year with the addition of Saurabh Rathore and Ashutosh Garud, which took the number of team members to seven, and Ocean Dial are looking to make an additional hire. The new hire will focus on integrating ESG criteria into Ocean Dial’s investment process. Biographies of members of the investment advisory team are provided below.

Powered by AI

In addition to expanding the team, a series of innovations were introduced into the investment process, including the use of artificial intelligence (AI) tools to the screening and monitoring process. This is achieved through the use of a tool that pulls information on an investee company from multiple sources of unstructured data onto a single dashboard that is readily accessible for interrogation by the investment team.

Feet on the ground

Gaurav and the rest of the India-based team at Ocean Dial are bottom-up investors, operating in a market with historically strong and consistent earnings growth, where periods of elevated volatility have provided regular mispriced entry points.

Ocean Dial seeks out companies whose management practices are culturally aligned with theirs and whose business models are capable of creating long-term shareholder value in a sustainable manner. A focused universe of companies from which potential investments are scrutinised is referred to as the House of Ocean Dial. More specifically, companies with the following attributes are eliminated:

- Market capitalisation of below US$100m.

- Environmental, Social, and Corporate Governance concerns.

- Business models which are:

- incomprehensible

- not scalable

- driven by global commodity prices

- conglomerated; or

- unable to create sustainable economic value.

- Business-to-Consumer companies where the consumers are predominantly based outside of India.

- Insufficient knowledge to have an informed view on any of the above.

This has resulted in a current universe of approximately 140 companies in which the managers can invest. Each analyst covers roughly 35 names and coverage entails forensic accounting, detailed financial modelling, and one-to-one corporate interaction twice annually.

Portfolio construction – aiming for 30 holdings

The House of Ocean Dial is a universe of companies on which the team can build focus. The manager will allocate to approximately 30 holdings which are independent both of the IGC’s benchmark and the market capitalisation of the business.

The starting point is to examine the highest ranked companies in the universe in terms of expected return, and from this the manager has discretion to dive deeper. In addition to meeting regularly with senior management, the team meets with suppliers, customers, and business competitors where relevant. The portfolio looks to invest with a minimum position size of 2%. This could range to up to 8% depending on the liquidity of the traded volume and the strength of conviction.

Investment committee

The House of Ocean Dial is a continuously evolving universe of investible opportunities. An investment committee exists to ensure that existing names continue to pass filters set, and to provide a forum for members of the investment team to propose new names for inclusion into the universe.

The committee meets quarterly and acts as a gatekeeper for stocks under consideration, with any changes needing to be approved by the committee. The agenda also includes the following issues.

Mitigating behavioural risk

The team is cognisant of the challenge of distinguishing, without the benefit of hindsight, between temporary downward fluctuations caused by volatility, and a genuine loss of capital. To diminish the probability of the latter, the research process is structured to ensure that each investment thesis is constructed on a sound basis while allowing the decision-making framework to react effectively should a change in the thesis occur over the course of the holding period. All investments are documented on initiation to enable the manager to assess the effectiveness of decisions made without being clouded by viewing them through the lens of hindsight.

Cognisant of the potential pitfalls of behavioural biases

Direct management interaction is limited, where appropriate, to twice a year, with healthy scepticism accorded to guidance in order to ensure the team remains detached in its assessment of a given company. Moreover, the investment committee provides an open forum for discussion on price movements or changes in fundamentals to ensure a continuous and systematic re-assessment of each investment thesis. The universe-ranking tool provides a quantitative basis for guiding where the highest expected return opportunities exist, while triggering a re-assessment of holdings that are falling down the ranking.

Valuation risk

A broad range of valuation techniques are used to compare the advisers’ analysis of a company’s current worth against its own history and in relation to its peer group. This is completed using Ocean Dial’s internal assessment of the company’s outlook rather than relying on sell side research or management’s own estimates. Using data analysis tools, each company model is incorporated into a “ranking tool” which provides the investment team with multiple ways with which to measure the upside to fair value for each portfolio candidate.

The ranking tool acts as a strong signal to the portfolio adviser as to where the most profitable opportunities in the universe lie. Its strength is as a guide to enable better resource allocation and decision making, not as a systematic final output of what the portfolio should be. Deeper due diligence in the form of further management interaction, background checks, and broader scrutiny of the competitive landscape is conducted by the team depending on the portfolio adviser’s requirement to build a fully informed thesis as to whether an investment decision should be recommended.

Asset allocation

As QuotedData highlighted in its May 2020 note, Gaurav made a lot of adjustments to the portfolio between January and May as the crisis was unfolding, and volatility was particularly elevated. Since then, portfolio changes have been much more modest. Gaurav is happy with the shape of the portfolio, but has advised some rebalancing to take advantage of opportunities. For example, the manager has added to both Emami and Jyothy Labs, as both suffered from their exposures to the consumer.

Initially Gaurav advised that IGC’s bank exposure be reduced, but he has reversed this position recently as he thinks that the sector offers one of the most favourable risk-reward ratios in the Indian equities space today.

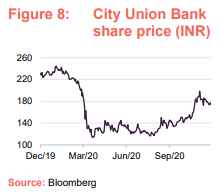

To recap, City Union Bank, previously one of IGC’s largest holdings, was reduced, while positions in DCB Bank, Indian Bank, Yes Bank and Jammu & Kashmir Bank were sold in their entirety. Then, reflecting concerns about the impact on international trade, the exposure to overseas businesses was also reduced. This provided cash, which the manager was able to deploy following the market sell off.

New additions included: Gujarat Gas (this was profiled in more detail in our May 2020 note – see pages 12 and 13 of that note); Aegis Logistics (logistics provider to the oil, gas, and chemicals sectors); ICICI Lombard (general insurance) and CCL Products (an instant coffee manufacturer).

Gaurav observes that the market has been highly focused on household, large cap names. Consequently, it has been overlooking the small- and mid-caps which will also benefit from increased economic activity as the economy recovers, and from falling costs. Gaurav observes that there has been a lot of value compression, creating a lot of opportunities in the space.

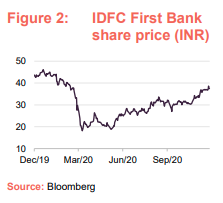

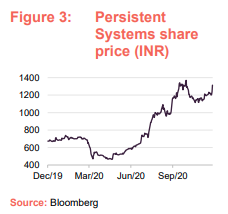

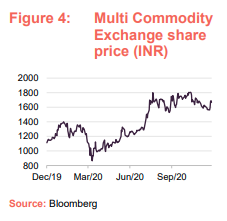

IDFC First Bank, Persistent Systems and Multi Commodity Exchange are new names that have been added to the portfolio. These are discussed in more detail below. We have also provided an update on Welspun India, a long-term IGC holding that has performed strongly this year.

IDFC First Bank – transitioning to a new age bank

IDFC First Bank (www.idfcfirstbank.com) is one of the youngest private sector banks in India. It was formed in 2018 with the merger of Capital First (a retail lending non-banking finance company) and IDFC Bank (an infrastructure lender which received its banking license in 2015). According to Gaurav, the merger kicked off a transition process that has seen the combined company move towards becoming “a new age retail bank”, driven by the management team that came in from Capital First.

Post-merger, the bank is in the midst of rolling out its five-year strategy of being a technology and digitally focused retail bank (70% of book), with low cost CASA deposits of 40% (CASA or current account savings account deposits are the cheapest and major source of funds for banks), net interest margins of 5-5.5%, and return on assets of 1.4-1.6%. Gaurav says that building a strong and diversified retail liabilities profile will be key to achieving this, along with shedding its wholesale book on the asset side. However, after up front stress in its legacy corporate and infrastructure book, through aggressive provisioning, the bank is now on a high growth trajectory.

Retail assets are already 63% of its loan book, net interest margins have jumped from 2.9% to 4.6% and most importantly the CASA ratio has reached its target following a surge in retail savings deposits aided by COVID. The bank is well capitalised with net non-performing assets of 0.4% and a provision coverage ratio of 74%. Gaurav believes that the bank is poised for a period of strong sustainable growth and, as the improving operating metrics play out, a rerating.

Persistent Systems – exposed to growth in digital services and positioned to benefit from corporate reorganisation

Persistent Systems (www.persistent.com) is an IT services company that launched in 1990 as an outsourced product development company. It has helped large software product companies such as IBM, Microsoft and Samsung, as well as small independent software vendors, to accelerate product development in a cost-efficient manner. An early adopter of digital technology, its projects span the key areas of today: cloud, analytics and mobility.

Persistent went through a difficult period from 2012 that ultimately saw the company’s founder step down as managing director & CEO in 2019. Gaurav says that his successor, has reformed the organisation, revamped the sales department and focused on digital services along with large annuity deals.

These changes have filtered into strong growth in deal wins and it remains the only company to post sequential growth in both the first and second quarters of the financial year ending 31 March 2021 (in spite of COVID-related disruptions). Profitability has therefore improved, but Gaurav believes this has room to expand via an improving revenue mix, operating leverage and cost efficiency measures. The pandemic has sparked an acceleration in digital spending by companies and Gaurav thinks that Persistent is well placed to capture this. It trades at a forward price earnings ratio, based on estimated earnings for the financial year ending 31 March 2022, of 16x with an estimated compound annual growth rate for earnings of 27% for the financial years 31 March 2020 to 31 March 2023.

Multi Commodity Exchange (3.5%) – a highly defensible position in a long-term structural growth area

Multi Commodity Exchange, or MCX (www.mcxindia.com) is the leading commodity exchange in India. Established in November 2003, MCX operates under the regulatory framework of Securities and Exchange Board of India (SEBI). MCX is also India’s first listed exchange and has close to 100% of the global commodities trade in India. Reflecting this, Gaurav says that MCX is very cash-generative, which has allowed it to re-invest in its business so that it now offers a state-of-the-art commodity derivatives exchange that is the go-to platform in India for price discovery and risk management in commodities derivatives transactions.

As is illustrated in Figure 4, MCX suffered as markets collapsed in March, losing around 40% of its value when compared to its peak immediately preceding COVID. However, while there were some initial concerns that depressed economic activity could lead to a decrease in commodities derivatives transaction volumes, such fears appear to have been short-lived. Gaurav saw this as a strong buying opportunity for what he thinks is a very well-managed company, with a highly defensible position in a long-term structural growth area that also benefits from the government’s infrastructure development plans. This appears to have been a good call for IGC, as MCX was up 93.0% on 11 December 2020 from its trough valuation in March.

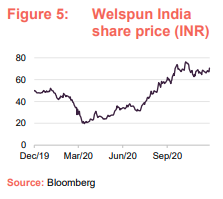

Welspun India (3.3%) – cotton issues well behind its textiles business, pipes business bolstered by major new contract

Based in Mumbai, Welspun India (www.welspunindia.com) is one of the largest home textile manufacturers in the world, and a company that has been a constituent of IGC’s portfolio for around four and a half years. It exports to over 50 countries, and its textiles business has a strong presence in the US (approximately 30% market share). We last discussed Welspun in detail in our October 2016 note (see page 6 of that note) where we explained that Gaurav’s initial purchase of the stock had been unfortunately timed.

Having started to build the position in the stock in July 2016, Target, the second-largest discount retailer in the US, severed ties with Welspun in August 2016, accusing the company of labelling cheaper bedsheets as being made of Egyptian cotton. This led to other retailers, such as Walmart and Ikea, suspending the sale of Welspun’s Egyptian cotton items, although continuing to sell its other products, as well as two class-action law suits in the US (a settlement was eventually agreed in relation to these in July 2019).

Following the emergence of the scandal, Welspun sold off dramatically, but Gaurav felt that the market had overreacted. He met management and concluded that this was a short-term issue and that the management team were handling it well. This led him to add to the position at depressed valuations, which initially proved to be a good call for IGC as the stock recovered strongly over the following six months.

However, while from February 2017 to the peak of the COVID-19 market collapse, Wellspun’s share price was broadly on a declining trend, the COVID-19 market collapse appears to have been a turning point. The scandal is now well behind it; it is a financially strong company that has seen an improvement in its competitive environment as the pandemic has forced weaker players to exit the market. In addition, in March 2020, it also won a major contract to supply offshore pipes for the Barossa offshore development project from Allseas Marine Contractors Australia.

The project, which is owned by a joint venture made up of ConocoPhillips Australia, SK E&S Australia and Santos Offshore, is a first for Welspun in the Australian offshore industry. It is also a hallmark of quality for the company as the 270 km (87 kilotonnes) of pipes it is to supply are for a critical application in a quality-conscious area. It also underlines Welspun’s strategic position in this area and the potential it has to supply pipes for other challenging offshore projects globally.

Consequently, Welspun is now trading well above its pre-COVID levels, even after the recent pause in November.

Top 10 holdings

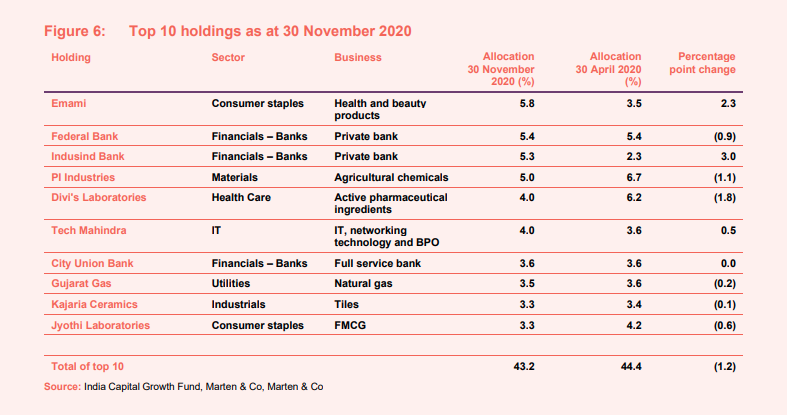

Figure 6 shows IGC’s top 10 holdings as at 30 November 2020 and how these have changed since 30 April 2020 (the most recently-available data when QuotedData last published on IGC). New entrants to the top 10 are IndusInd Bank and Kajaria Ceramics. Names that have moved out of the top 10 are Bajaj Consumer Care and, Berger Paints India. We discuss some of the more interesting changes below. Readers interested in other names in the top 10 should see QuotedData’s previous notes, where many of these have been discussed previously.

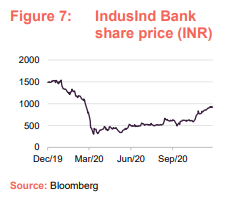

Induslnd Bank (4.1%) – banking sector offers one of the most favourable risk-reward ratios in the Indian market

IndusInd Bank (www.indusind.com) has been a constituent of IGC’s portfolio for some time. We last discussed it in our June 2018 note, where we commented that it was one of a number of private sector banks that were continuing to take share from the public sector banks, as they have traditionally been more discerning in their underwriting and were not weighed down by NPLs. At that time, IndusInd has just secured approval for its merger with leading microfinance company, Bharat Financial Inclusion.

As previously discussed, Gaurav was quick to reduce IGC’s exposure to the banks, early in the year, in advance of the market collapse (economic problems in the country have frequently turned into liquidity problems, in the banking sector, historically), and so IGC avoided the worst of the falls in the banking sector. However, Gaurav says that the government has been learning from its past mistakes and particularly following the collapse of IL&FS in September 2018 (a subject we have covered in our previous notes), which brought the banking sector to its knees.

Following the IL&FS crisis, government policy has driven an increase in liquidity in the banking system, so much so that Gaurav says that the banks are much better capitalised and are now flush with cash. He says that with the COVID-19 pandemic, it is the first time that India has faced an economic problem without simultaneously facing a liquidity problem. However, if you look at Figure 7, prior to the November ‘vaccine-rally’, IndusInd Bank, in common with other banks, had not properly participated in the market recovery.

This poorer relative performance affected other IGC holdings – Federal Bank and City Union bank (discussed above). In the case of the latter, it initially pushed it out of IGC’s top 10 holdings although, as illustrated in Figure 8, it has made a reappearance both because the position was topped up the position at depressed prices and the stock responded well to the positive news on vaccine development in November. By way of illustration, IGC’s allocation to banks was around 22% at the end of 2019, which was reduced by 3–4%, but has increased again and stood at 16.9% at the end of November. However, there has recently been increasing exposure to the banking sector, including IGC’s holding in IndusInd Bank, as Gaurav believes it offers one of the most favourable risk-reward ratios in India today.

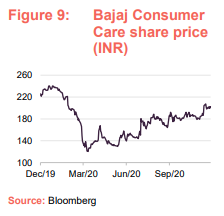

Bajaj Consumer Care – taking some profits following a strong performance

Bajaj Consumer Care (www.bajajconsumercare.com) is an Indian consumer goods company with significant brands in Indian hair care space, particularly in the hair oil industry, which has grown 11% in value over the last decade. Bajaj Consumer care is part of the wider Bajaj Group, which has interests in a variety of sectors, including sugar, consumer goods, power generation and infrastructure development.

We last talked about Bajaj Consumer Care in our May 2020 note, where we highlighted it as a stock that had the advantage of predominantly taking payment in cash (this applies to a lot of fast-moving consumer goods companies in India), as this gives them a cash cushion. The lack of receivables, while being able to pay their creditors in 60 days or so, allows them to stretch out their cash conversion cycle and makes them resilient during the downturn. Bajaj Consumer Care was discussed as an example.

At that time, Gaurav highlighted that the company has gross margins of 67%, a return on capital employed of 40% and cash in its books equivalent to 25% of its then market capitalisation. Gaurav was expecting the shares to re-rate and, as illustrated in Figure 9, this has come to pass. He has therefore been reducing IGC’s exposure and taking profits on the position, which has moved it out of IGC’s top 10 holdings.

Berger Paints India – exited following a stellar performance

Berger Paints (www.bergerpaints.com) is a long-time holding in IGC’s portfolio and one that we have discussed in our previous notes. The company has a strong and defensible market position – the four main paint manufacturers in India form an oligopoly (just a handful of competing companies) and have been disciplined in the past for their pricing. We last discussed Berger Paints in detail in our October 2019 note, where we commented that all of the Indian market had been performing relatively well during the then-prevailing period of market weakness, which had helped to propel Berger Paints into IGC’s list of 10 largest holdings.

As illustrated in Figure 10, a similar phenomenon has been seen in current challenging markets, with Berger Paints’s share priced having increased by 67.6% from the market nadir as at 11 December 2020. This share price appreciation reflects the fact that, in more economically-straitened times, people are less likely to move properties and are more likely to re-invest in maintaining and improving their existing assets, which – combined with its oligopoly pricing power – makes Berger Paints’s cash flow and earnings resilient when times are difficult. Reflecting this strong share price performance, Gaurav has been taking profits, reducing the size of the position, and has now exited the position in its entirety.

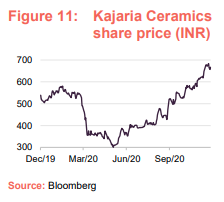

Kajaria Ceramics – strong recovery in the third quarter with

asset utilisation greater than 90%

Kajaria Ceramics (www.kajariaceramics.com) describes itself as India’s number one tile company. It is another long-time holding of IGC’s that we have discussed in our previous notes. In our March 2016 initiation note, we explained how the company transformed its business when it shifted its focus to higher added value vitrified tiles, which allowed it to expand its margins from 11% to 17%. The company also used to struggle with high working capital requirements and high capex requirements, which held back free cash flow generation and led to a sub-optimal ROCE. However, Kajaria was able to reduce its capital expenditure requirements by embarking on a series of joint ventures with a number of independent small manufacturers in Gujarat (its joint venture partners are responsible for the capital expenditure but Kajaria markets the finished product) and credit terms were cut drastically (from 60 days down to 78 days), which greatly improved its cash flow.

Initially, COVID had a significant impact on the company as it was forced to shutter its operations in March which, when combined with supply chain restrictions and partially shut dealer showrooms resulting, saw sales volume and revenue decline by 61% and 60% respectively for the second quarter of 2020 compared to corresponding quarter of the previous year. However, the third quarter saw a marked turnaround in the company’s fortunes with its asset utilisation in excess of 90% and its sales volumes and revenue in line with the corresponding quarter the previous year. The company said that subdued gas prices and a reduction in some of overheads had led to an improvement in profit margins.

Performance

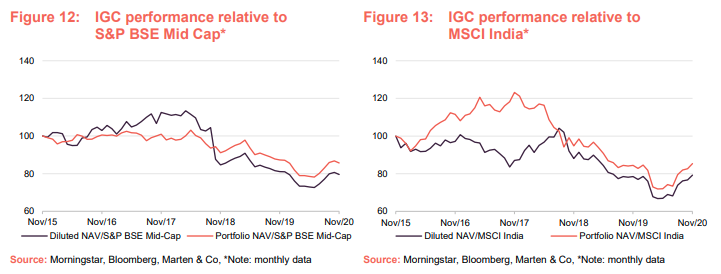

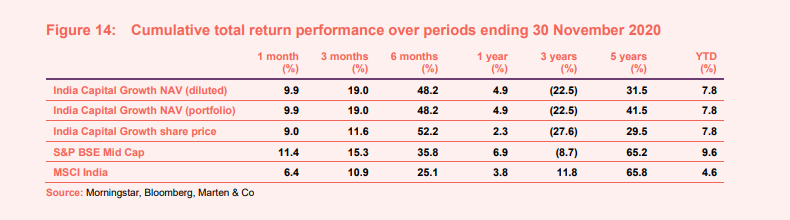

The data in Figures 12, 13 and 14 show returns for both IGC’s published NAV and for an adjusted, ‘portfolio’ NAV. The portfolio NAV removes the dilutive effects of IGC’s subscription shares (which were exercised in full in August 2016) and represents the performance generated by the manager and adviser.

As we have previously discussed, small- and medium-sized Indian companies have generally been underperforming larger ones, for much of the last two-and-a-half years, and this has impacted on IGC’s performance relative to the MSCI India Index. Stock selection decisions have also weighed on IGC’s performance relative to the S&P BSE Mid Cap Index during the last couple of years. However, as we discussed in our May 2020 note, the changes put in place to give more rigour to the investment process were showing early signs of improving the stock selection performance, and this has continued (the peer group analysis in the following section shows a significant improvement in IGC’s performance relative to its peers). The improvement is particularly evident in the three- and six-month periods. To recap, the universe ranking tool, discussed in the investment process section, is seen as adding more quantitative rigour to the investment process, as part of processes installed to mitigate behavioural risk.

Peer group – marked improvement in IGC’s near term relative performance

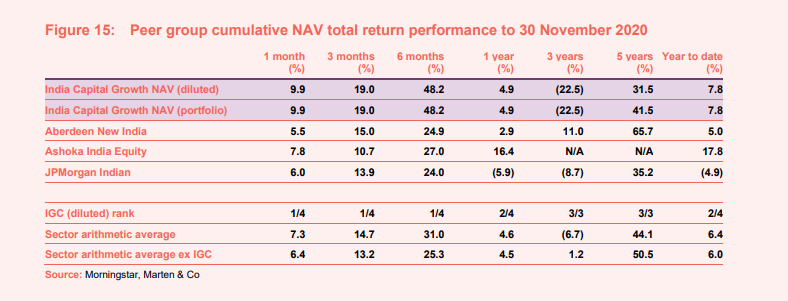

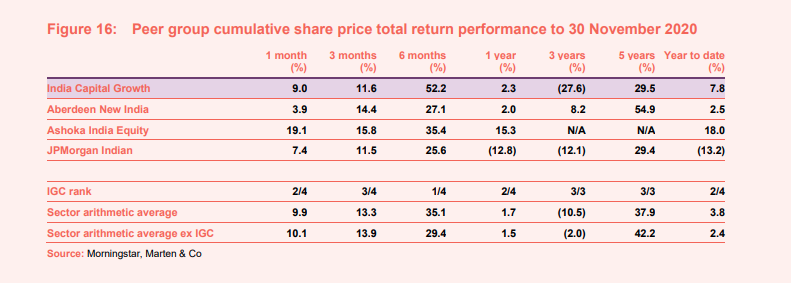

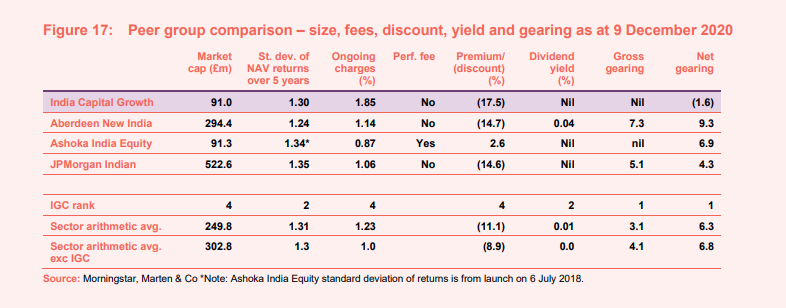

IGC is a member of the AIC’s Country Specialist: Asia Pacific-ex Japan sector, which comprises 12 members with a variety of different focuses with the region. For the purpose of this analysis, we are focusing on the four pure Indian equity funds, which are listed in in Figures 15, 16 and 17.

As illustrated in Figure 15, there has been a marked improvement in IGC’s cumulative NAV total return performance relative to peers during the last six months (IG ranks first over the one-, three- and six-month periods), which broadly coincides with the changes to the investment process which the manager tells us is bearing significant fruit, according to its own internal analysis. This strong performance is starting to lift IGC’s performance over the medium-term horizons – it ranks second year to date and over one-year. IGC ranks third over the three- and five-year periods but, if the adviser’s changes continue to drive outperformance, IGC will move up the rankings over these longer periods as well.

Looking at Figure 16, a similar picture can be seen for IGC’s share price performance (for example, it ranks first over six months, second over one-year and year to date, and third over three and five-years). However, in the very short periods of three and six months, IGC share price has not kept pace with the growth of its NAV, allowing the discount to widen. Similarly, if IGC continues to outperform it peers, this should lead to additional interest from investor both closing the discount and pushing IGC’s share price performance up the peer group rankings for both the short term and longer term periods. It is worth noting that, for a strategy such as this, longer -term time frames are generally considered to be more relevant to assessing performance, and we believe that the market is waiting to see if the recent strong performance is maintained.

As illustrated in Figure 17, IGC is the smallest of the four funds focused on India and listed in London and this is a significant reason why it has the highest ongoing charges ratio of this peer group. Ashoka India Equity’s ongoing charges ratio is particularly low, because it does not charge a base management fee, but unlike the rest of the peers charges a performance fee of 30% of outperformance (capped), measured over three years, to compensate. Consequently, in years where the performance fee falls due, its ongoing charges ratio will increase accordingly, pushing it up the rankings.

IGC is operating with a net cash position, unlike its peers. Volatility of NAV returns, as measured by the standard deviation of daily NAV returns over five years, are broadly comparable across the four peers, although IGC ranks sector with volatility that is marginally below the sector average.

Discount

As illustrated in Figure 18, IGC’s discount widened sharply as markets collapsed in March, in the face of an accelerating COVID-19 infection rate. However, as also illustrated in Figure 18, this showed some clear reversion in April and then in May, but this saw a dramatic narrowing on 26 May when IGC published a series of proposals regarding its future. Readers interested in more details of the proposals should see QuotedData’s previous note, also published on 26 May 2020, which covered the proposals in more detail. However, to recap, a summary is provided as follows:

- The introduction of a redemption facility, giving shareholders the right to request the redemption of part or all of their shareholding on 31 December 2021 and every second year thereafter at an exit discount equal to a maximum of a 6% discount to NAV per redemption share;

- A change to the investment manager’s fee from 1.25% of total assets per annum to the lower of 1.25% of average market capitalisation (calculated on a daily basis) per annum or 1.25% of total assets per annum with effect from

1 July 2020 with a further review to the investment manager’s fee in 2022; and - IGC may seek to satisfy redemption requests by matching such requests with demand for new ordinary shares from incoming investors.

Following the announcement of these proposals, shareholders voted to approve IGC’s continuation on 12 June. It now has until December 2021 to prove itself. However, it is noteworthy that reflecting both better than expected economic data, and welcome news on the development of a vaccine, IGC’s discount has continued to narrow as markets have advanced. As at 11 December 2020, IGC was trading at a discount of 15.6%, which is fractionally narrower than five-year average of 16.4%. During the last 12 months, it has traded within a range of 44.1% (at the height of the market collapse) to 13.0%, with a one-year average of 22.9%.

The most likely catalysts for a further narrowing of IGC’s discount would be an improvement in its relative performance and an improvement in sentiment towards mid-cap Indian stocks. The adviser comments that the companies in the portfolio are still, on average, very cheap and with signs that India is getting a better handle on controlling the virus, this might suggest that the trust would respond well to any improvement in India’s economy. For IGC’s shareholders, that might be compounded by a narrowing of the discount. We think that, should portfolio companies start to see a marked uplift in performance, this is likely to provide momentum for the discount to narrow, as more focus turns towards attractive valuations and India’s long-term opportunity to widen its manufacturing base.

Fees and costs

The investment manager is entitled to receive a management fee payable jointly by IGC and ICG Q Limited, equivalent to 1.25% per annum (pre 1 July 2019 1.5%) of gross assets less current liabilities. Either side must give 12 months’ notice to end the contract. There is no performance fee.

The administrator is Apex Fund Services (Guernsey) Limited. The custodian of IGC’s assets is Mumbai-based, Kotak Mahindra Bank Limited. Cash is held in both Mauritius and India.

The ongoing charges ratio for the year ended 31 December 2019 was 1.85%, slightly lower than the equivalent figure for 2018 (1.91%). The decrease reflects the reduction in management fee (noted above), which occurred halfway through the year. All things being equal, the ongoing charges ratio would have been lower still for 2019. However, IGC also saw a reduction in its asset base for 2019 versus 2018 (for example, total net assets at the end of 2019 were £99.6m, versus £114.4m at the end of 2018), which will have served to elevate the ongoing charges ratio as IGC’s fixed costs were spread over a smaller base.

Looking to the year ended 31 December 2020, IGC’s ongoing charges ratio should benefit from having a full year of the management fee being charged at the new lower rate.

Capital structure and life

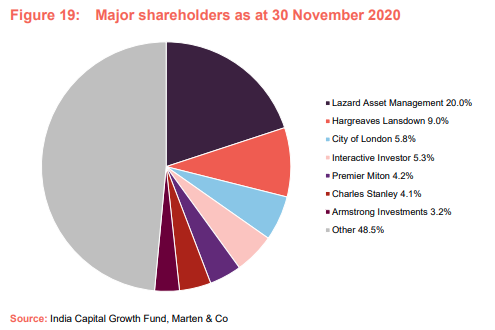

IGC has a simple capital structure with one class of ordinary shares in issue. Its ordinary shares have a premium main market listing on the London Stock Exchange and, as at 11 December 2020, there were 112,502,173 of these in issue with nil held in treasury. IGC has the authority to buy back up to 14.99% of its issued share capital, a power that it renews at each annual general meeting (AGM). Figure 19 shows the major shareholders in IGC at the 30 November 2020.

IGC maintains an ungeared portfolio

Although permitted to, the manager does not employ gearing (borrowing) in the management of the fund. This reflects the relative volatility of the Indian stock market. The manager will normally keep cash of 3–4% on hand to take advantage of attractive investment opportunities as they arise.

Unlimited life with a full redemption opportunity every two years

The introduction of a redemption facility gave shareholders the right to request the redemption of part or all of their shareholding on 31 December 2021 and every second year thereafter at an exit discount equal to a maximum of a 6% discount to NAV per redemption share.

Financial calendar

IGC’s financial year end is 31 December. The annual results are usually released in March (interims in September) and its AGMs are usually held in June of each year. IGC does not pay a dividend.

Investment advisory team

Gaurav Nariain – co-head of equities

Gaurav Narain joined Ocean Dial in November 2011 and has been involved with the Indian markets for the past 25 years. He has held senior positions as both a Fund Manager and an equities analyst for New Horizon Investments, ING Investment Management India and SG (Asia) Securities India. Gaurav holds a Master’s degree in Finance and Control and a Bachelor of Economics from Delhi University, and is based in Mumbai.

Tridib Pathak – co-head of equities

Tridib Pathak has had a career in the Indian financial markets that spans over 30 years, with stints in project finance, credit analysis and latterly pan-Asia equity research for UBS Securities. His buy-side career began in 1999, since which he has been investing in Indian equities for both domestic and international investors at firms including Lotus Asset Management and DBS Cholamandalam, where he served as CIO. Tridib joined Ocean Dial in 2019 from the Enam Group, where he was Senior Portfolio Manager for four years. He is a Chartered Accountant from the Institute of Chartered Accountants of India.

Shahil Shah – assistant fund manager

Shahil Shah was part of the original investment team which was set up in 2005 and specialises in Telecommunications, Consumer, Healthcare, and Media sectors. He holds a Master’s degree in Commerce and Finance from Mumbai University and is based in London. Shahil supports the Co-Heads of Equities in the day-to-day maintenance of the funds.

Saurabh Chugh – analyst

Saurabh Chugh was the part of the original investment team and joined in 2006. He specialises in Information Technology, Energy, Transport, Infrastructure and Soft Commodities. He holds an MBA in Finance from Nirma Institute of Management, Ahmedabad, and is based in Mumbai.

Ankush Kedia – analyst

Ankush Kedia joined Ocean Dial team in April 2018 and is based in Mumbai. He has 12 years of investment experience in public markets and private equity. He previously worked for Avezo Advisors (a division of Avendus Capital) as Principal and Co-fund Manager focusing on private equity style investments in small- and mid-cap listed companies in India. Prior to Avezo, Ankush worked with Mayfield Fund and Axis Bank. Ankush holds an MBA in Finance and Economics from XLRI, Jamshedpur and a BTech in Mechanical Engineering from IIT Roorkee.

Ashutosh Garud

Ashutosh Garud joined Ocean Dial in 2020 after working as Associate Portfolio Manager in the Avendus Wealth Management Team. Prior to joining Avendus, he worked with Reliance Wealth Management. Ashutosh holds an MBA in Finance from Chetana Institute of Management Studies, a Bachelor of Commerce & Economics from Mumbai University, and is a CFA charterholder.

Saurabh Rathore – analyst

Saurabh Rathore joined the Ocean Dial team in January 2020 and is based out of Mumbai. He has three years of experience in financial services across global markets, investment analysis and due diligence, business strategy and risk management. Prior to Ocean Dial, Saurabh has been associated with Avendus, Credit Suisse and J.P. Morgan. He holds a B.E(Hons) in Electrical and Electronics Engineering from BITS-Pilani and an FRM Charter, and has cleared CFA Level-III examination.

Board

The board consists of three non-executive directors, all of whom are independent of the manager and who do not sit together on other boards. Any director who has served for more than nine years stands for re-election annually, and one third of the remaining directors retire by rotation at each AGM and seek re-election. The maximum total payable to the directors is set in the articles of association as £200,000. Patrick Firth joined is the newest member of IGC’s board. He was appointed with effect from 25 September 2020, taking over the role of chairman of the audit committee from John Whittle, who retired at IGC’s AGM that same day.

Elisabeth Scott (chairman)

Elisabeth Scott has 34 years’ experience in the asset management industry, having started as a US equity fund manager in Edinburgh in 1985. She went to Hong Kong in 1992, where she remained until 2008, most recently in the role of managing director and country head of Schroder Investment Management (Hong Kong) Limited and chairman of the Hong Kong Investment Funds Association.

Patrick Firth (chairman of the audit committee)

Patrick Firth is a chartered accountant. He qualified with KPMG and has worked in the investment and funds industry in operations and management in Guernsey for nearly 30 years. Patrick Firth is also a non-executive Director of ICG Longbow Senior Secured UK Property Debt Investments Limited, Riverstone Energy Limited and NextEnergy Solar Fund Limited and chairman of AIM-traded GLI Finance Limited.

Peter Niven (director)

Peter Niven has over 40 years’ experience in the financial services industry, both in the UK and offshore. He was a senior executive in the Lloyds TSB Group until his retirement in 2004, and until July 2012 was the chief executive of Guernsey Finance LBG, promoting the island as a financial services destination. He is a Fellow of the Chartered Institute of Bankers and a chartered director.

Previous publications

Readers interested in further information about IGC may wish to read our previous notes.

Compounding machine, initiation, March 2016

Indian powerhouse, update, July 2016

India at a significant discount, update, October 2016

Full steam ahead, annual overview, March 2017

Moving to the main board, update, January 2018

A return to earnings growth, annual overview, June 2018

Shakeout uncovers value, update, November 2018

Discounted value, annual overview, October 2019

Needs more time, update, May 2020

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on India Capital Growth Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained in this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained in this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.