India Capital Growth

Investment companies | Update | 15 March 2023

Don’t Stop Believin’

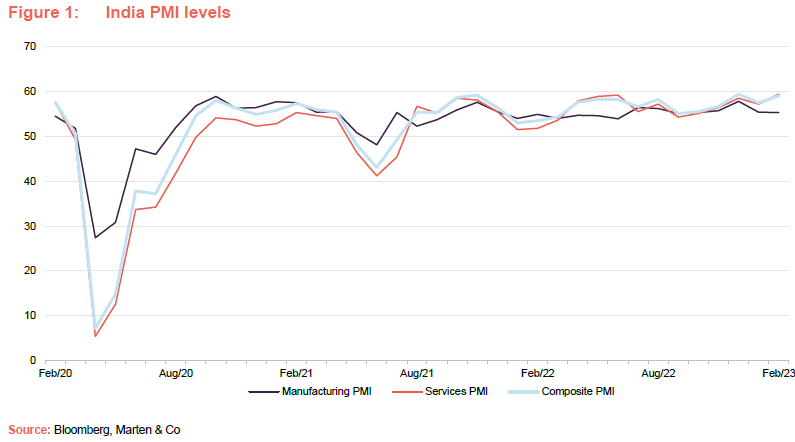

India Capital Growth’s (IGC’s) adviser, Gaurav Narain, says that at a time when many economies and equity markets are struggling, there are many reasons to be optimistic about the outlook for the Indian economy. Although down in sterling absolute terms during the last 12 months, the Indian market made progress in local currency terms and has performed well relative to its emerging market peers, benefitting from a good run in the second half of 2022 from which IGC also benefitted.

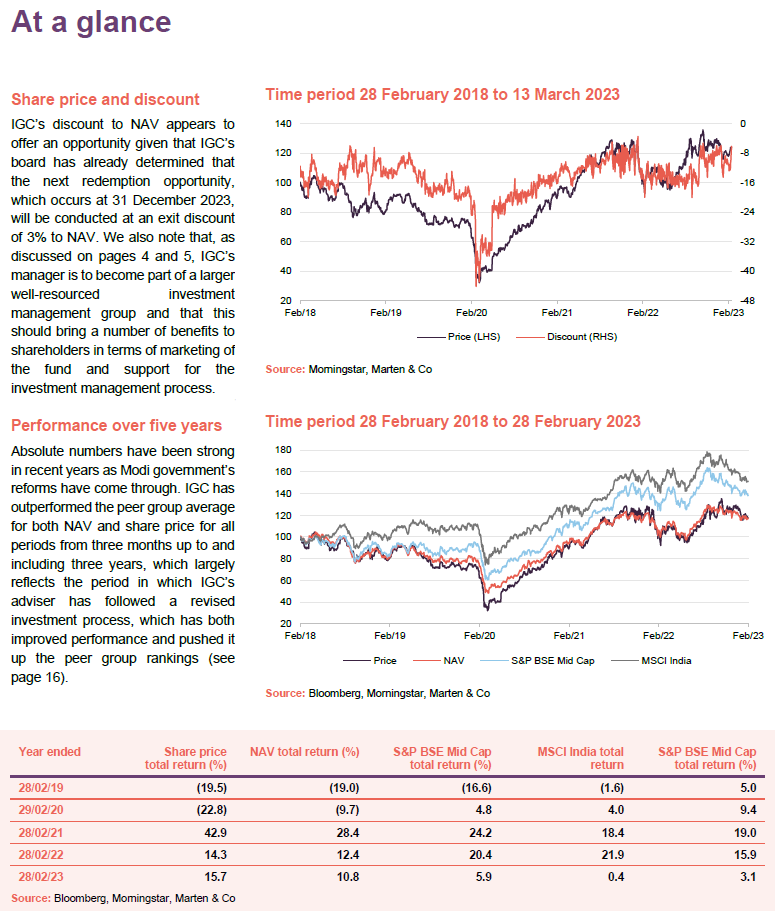

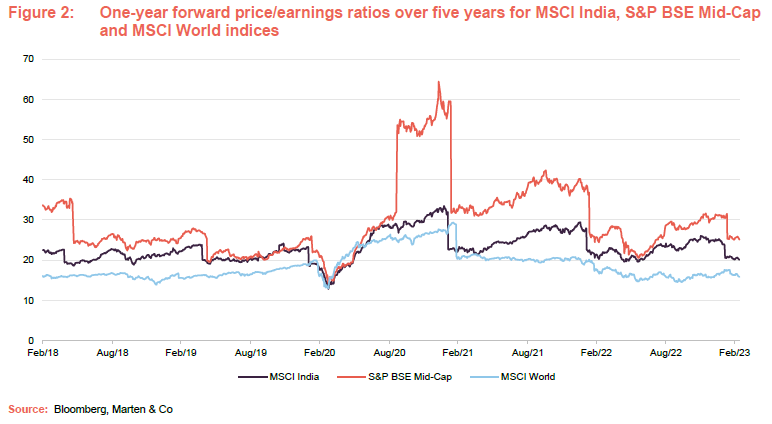

Despite the recent market setback so far this year, Gaurav thinks there is more upside to come, noting that business confidence is high (both the services and manufacturing purchasing managers indexes (PMIs) were over 55 at the end of February and have been around this level for some time – see page 6). Gaurav notes that valuations remain elevated even after the recent setback, but recent market volatility has thrown up opportunities and IGC’s own discount to net asset value (NAV) offers value, particularly with a redemption opportunity where the exit discount is set at a maximum 3% of NAV and the additional resource that the manager’s absorption into AssetCo Plc should bring (see pages 4 and 5).

Mid- and small-cap listed investments in India

IGC’s investment objective is to provide long-term capital appreciation by investing (directly or indirectly) in companies based in India. The investment policy permits the company to make investments in a range of Indian equity securities and Indian equity-linked securities. The company’s investments are predominantly in listed mid- and-small-cap Indian companies.

Fund profile

IGC is an investment company listed on the Main Market of the London Stock Exchange. It invests in India, predominantly in listed mid- and small-cap Indian companies. The fund is aiming to generate capital growth for shareholders. IGC has not paid dividends in the past and the fund adviser says it is unlikely to do so in the near future.

Further information is available at www.indiacapitalgrowth.com.

While IGC’s main focus is on Indian mid- and small-cap companies, the fund can and does hold large-cap stocks as well. The board and the manager use the S&P BSE Mid Cap Index (total return) for performance evaluation purposes, although the portfolio is not constructed with reference to this index. The other funds in IGC’s peer group benchmark themselves against the MSCI Index and therefore we have included this index within the report as well.

Management arrangements

IGC has been advised by Gaurav Narain of Ocean Dial Asset Management India Private Limited, a company owned by Avendus Capital Private Limited, which in turn is backed by KKR. Since Gaurav’s start as an adviser to the fund in November 2011, the underlying portfolio has grown at a compound annual growth rate of 12.9%.

Gaurav has over 30 years of experience in Indian capital markets, having started his career as vice president of research for SG Asia. The seven-strong investment team is split between London and Mumbai. Each of the analysts is assigned responsibility for several industry sectors. The manager is responsible for monitoring portfolio risk, and all dealing is done from London.

Long-standing, experienced investment team of six, split between London and Mumbai.

Ocean Dial runs two strategies focused on India: IGC and an onshore portfolio management services offering. Ocean Dial had assets under management of £128m in its listed mid- and small-cap Indian strategy as at the end of February 2023.

Sale of Ocean dial of AssetCo Plc

On 6 March 2023, it was announced that AssetCo Plc, the asset manager founded and chaired by Martin Gilbert (co-founder & chief executive officer of Aberdeen Asset Management until 2017), had agreed to acquire Ocean Dial Asset Management Limited. The deal is subject to regulatory approvals from the Financial Conduct Authority in the UK, the Securities Exchange Board of India and the Reserve Bank of India.

The intention is that Ocean Dial will be combined with AssetCo’s other active equity asset management businesses, coming under the River and Mercantile brand and operating from a shared, central infrastructure. We think that this is good news for IGC as it will strengthen the breadth and depth of resources available to the company. In particular, once the deal has been completed, IGC will have access to River & Mercantile’s distribution and investment support capabilities, which should bring a number of benefits for IGC shareholders.

From a marketing perspective, the transaction should not only help to increase its reach to investors significantly, but should address any concerns investors might have regarding the viability of a relatively small investment management platform, albeit one backed by KKR. The increase in marketing resource comes at a good time given the redemption opportunity at the end of this year.

From an investment management perspective, the additional resources available to support the investment management process should put IGC’s advisers in a good position to build on the gains made following the improvements that were made to the investment management process in 2020 (discussed in detail in our May 2020 note – see page 20 of this note). The existing team at AssetCo has significant resources devoted to environmental, social and governance (ESG), which can be important in a market such as India, and this is seen as a key focal point for co-operation.

Investors may be pleased to know that it will be business as usual for the investment advisory team in India, who are critical to IGC’s process, and so investors should not expect to see any style drift or fundamental changes to the way that IGC is managed.

The UK directors of Ocean Dial – David Cornell and Robin Sellers – will stand down after facilitating a transition to the on-going management structure. This will include Swati Jain, Ocean Dial’s global head of sales & distribution, and the management team of AssetCo.

Alignment of interest

Employees of Ocean Dial and members of IGC’s board collectively hold 359,797 shares in the company, which represents 0.34% of its issued share capital.

Indian capital gains tax provisioning

As we have discussed in our previous notes, IGC is liable for capital gains tax (CGT) in India. Although CGT is only payable at the point at which the underlying investments are sold, and capital gains are crystallised, IGC must provide for this additional cost. However, it should be noted that the actual capital gains tax paid may differ significantly from IGC’s provision and, depending on performance, it may not actually be crystallised.

Since 30 July 2021, a deferred tax provision for Indian CGT has been reflected in IGC’s daily NAV estimate. IGC now discloses its NAV both before and after the CGT provision, which it says is to facilitate a meaningful comparison of investment performance.

Fund adviser’s view

IGC’s adviser, Gaurav Narain, says that the second half of 2022 was particularly good for the Indian economy and its equity markets. At a time when other global economies struggled, India’s domestic economy did very well. Inevitably, exports slowed, but the domestic economy, which was exhibiting a sustained recovery, was able to take up the slack. Since the start of 2023, the market has experienced a correction. The catalyst for this appears to have been emerging concerns over corporate governance at the Adani Group (a major infrastructure investor in India whose interests span airports, roads, water management, power transmission data centres, solar manufacturing and much more). Some investors were already nervous of India’s higher valuations versus peers as well as growing pressures on exports which have continued to fall as the global economy slows under the weight of rising interest rates. However, perhaps this is less of an issue given that developed market inflation has shown some signs of moderating.

Gaurav says that on almost all metrics, the outlook for the Indian economy is positive. He observes that economic growth forecasts for 2023 and 2024 remain strong although he acknowledges there is still risk around the degree to which export levels slow and what further impact this might have.

Gaurav comments that government investment in infrastructure is really helping, with private sector investment following suit. As illustrated in Figure 1 above, confidence is strong and, reflecting this and the fact that the banking sector has been cleaned up, credit growth is also running at a clip (circa 16%), all of which is translating into decent gross domestic product (GDP) growth. Gaurav says that investors questioned how sustainable India’s post-COVID recovery would be, because the economy had been consolidating following the government’s reforms and there had been problems in the banking sector, too. However, growth is now coming through and Gaurav says that momentum is strong, aided by a good festival season. Small and medium-sized enterprises (SMEs) that were at the sharper end of the slow-down are now turning around and real estate is also doing very well (in terms of sales volumes, Mumbai had the best year of sales in the last decade in 2022).

Government focused on the jobs market

Gaurav says that a key positive for the economy has been the government’s focus on getting the job market moving again. It is estimated that India needs to create around 10-12m jobs a year, for which it needs to boost the manufacturing sector and has been making investments (such as in the infrastructure programme, which Gaurav says is really helping to sort out bottlenecks). It also needs to put in place policies to get manufacturing going (think the “made in India” programme, discussed in our previous notes, which includes incentives such as lower taxes for domestic manufacturing and subsidies for capital expenditure). As we noted in our December 2021 note, the government’s budget set the tone for restoring growth in India, which has come to pass.

Gaurav says that these measures are leading to incremental business growth and, at the same time, India is capturing business from China as companies attempt to broaden and strengthen their supply chains (an over-reliance on China was highlighted as a key weakness when the Chinese government implemented extensive lockdowns as part of its zero-COVID policy). Gaurav comments that these incremental gains have helped offset export losses elsewhere, although these gains have been more sector-specific, but he thinks that this trend still has a long way to run, arguing that India is a competitive place to do business with a typical labour cost around one-third of that of China’s.

Valuations are the big challenge

With the supportive domestic economic backdrop, Gaurav thinks that the biggest challenge facing investors is valuations. He comments that the Indian market has performed well versus global peers recently and so relative valuations are not as attractive as they have been previously (India previously traded at around a 30-40% premium to its emerging market peers, but today this is more like 70-80%), which could make the market vulnerable to a correction. However, Gaurav says that the drivers underpinning India’s growth look robust – according to the International Monetary Fund’s (IMF’s) latest forecasts (re-affirmed at the beginning of February) Indian GDP is predicted to grow at 6.1% during the 2023 financial year and 6.8% in the 2024 financial year– and the feedback he is getting from management teams is very positive (once again, export levels being the key risk).

Export exposure

Gaurav comments that around 35% of the portfolio has some export exposure. For example, IGC has around 10-11% in the information technology (IT) space, of which 8% is in IT services. Indian IT services performed strongly during 2020 and 2021 as COVID fuelled demand for IT services (both changing working patterns as well as the adoption of cost optimisation strategies). Gaurav says that, with the global economy slowing, there is an expectation that demand for these services will slow down as well, but IGC’s portfolio companies are not yet seeing any significant impact. However, these companies have de-rated (their share prices have fallen) in anticipation of a slowdown in IT spend. Gaurav comments that, while this may happen, many of the services provided are core to their clients and some, which help with managing costs, are even more important in a downturn. The evidence so far is that companies are not compromising on the expenditure and order books remain intact.

IGC’s portfolio also has around 10% allocated to healthcare and specialty chemicals. Gaurav says that specialty chemicals has been doing well and continues to benefit from the movement of suppliers out of China.

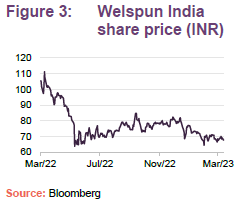

Gaurav says that only one company in IGC’s portfolio has seen a moderate impact – Welspun India, which is the largest home textile company in the world. Its exports have suffered as consumers have curtailed their discretionary spending. Welspun supplies the likes of Costco and Walmart in the US, both of which have been destocking. However, Gaurav says that the impact has not been so acute, as Welspun has seen a significant element of this business replaced by business that has been moved out of China.

In addition to its ‘Christy’ brand, which is targeted primarily at international buyers, Welspun launched its own brand, ‘Spaces’, which targets the domestic Indian market, which – as we have discussed above – is a segment that is doing well. Welspun has also established a co-licensing deal with Martha Stewart, which Gaurav expects to be a source of growth, and its flooring business is also benefitting from as companies seek to broaden their supply chains beyond China.

Lots of flows into domestic mutual funds

Managers are seeing considerable flows into domestic mutual funds (some US$17bn of foreign money flowed out in 2022, but this was more than replaced by domestic inflows of around US$35bn). Gaurav comments that these net inflows have been very positive and helped reduce volatility in Indian markets. He says that over US$1bn a month of net inflows have flowed into mutual funds over the last four years, with half of this coming from systematic investment plans (mainly small savings from retail investors in tier 2/3 towns in India), and cautions that, with elevated valuations, some high-net-worth individuals might sell but he does not expect this to tip the balance, observing that most mutual fund managers are expecting the trend of decent net inflows to continue.

Positive tailwinds behind the banking sector

Gaurav highlights that all banks are doing very well. He remarks that, following the banking crisis, the sector, under the scrutiny of the Reserve Bank of India (RBI) has cleaned up its act dramatically. Previously, he says, corporate lenders could readily play one bank off against another, but following a regulatory shake up, this is no longer the case. If a corporate defaults on one bank, they can no longer just move on to the next lender, as all banks will treat them as a defaulter. New regulations have also made the banks much more aggressive on their provisioning. Reflecting this, strong COVID-related provisions were put in place during the pandemic, and these are now being unwound.

The RBI audited every bank and forced them to take write downs on non-performing loans (NPLs) and clean up their balance sheets. Reflecting this, Gaurav says that asset quality has probably never been better. Margins have also been increasing as asset values have expanded faster than the banks’ liabilities and there has also been considerable credit growth. This growth, combined with decreased provisioning, has led to profit growth across the sector – for both private and state-owned banks. Gaurav thinks that investors can look forward to a significant phase of growth with limited concerns over asset quality. He notes that the biggest rally has been in the public sector banks, which IGC avoids (these used to trade at price-to-book ratios of around 0.5x book and are now trading closer to 1.0x), while privately-owned banks are tending to trade in the 1.0-1.5x range (although the most expensive can be a lot higher), but Gaurav thinks that, generally, this valuation premium of the private sector banks is justified. He also comments that the banks’ strong performance has been driven by improving returns on assets.

Asset allocation

As at 28 February 2023, IGC’s portfolio comprised 33 holdings, which is an increase of one over the previous 12 months.

Gaurav says that portfolio sales and purchases have largely been the result of rebalancing the portfolio – taking profits and trimming strongly performing positions and rotating the proceeds into better opportunities. One new position has been added – Ashok Leyland – and they have also exited Divi’s Laboratories, an IGC holding for over 10 years (see below for a discussion of both).

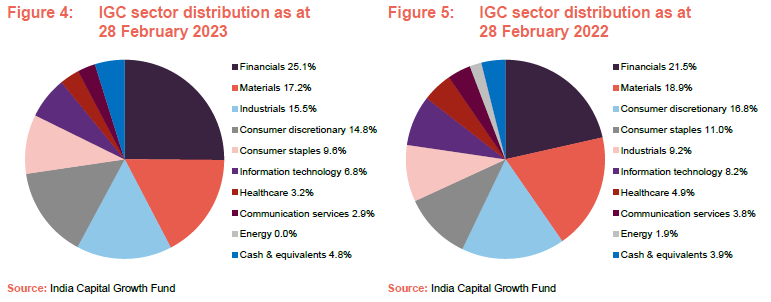

The key sectoral changes include a significant increase in the allocation to financials – 3.6 percentage points – reflecting the strong relative performance of the banking sector and industrials – 6.3 percentage points – which have also performed well. Otherwise, all other sectors have seen a decline of between 0.9 and two percentage points.

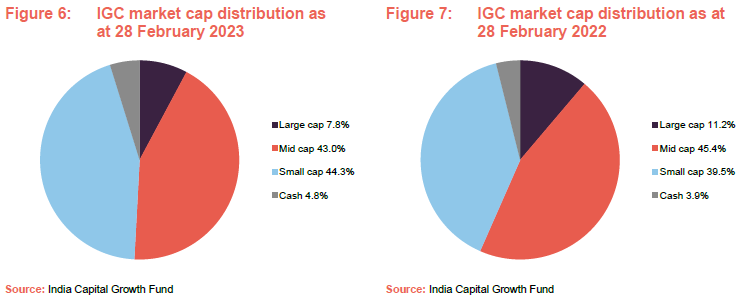

IGC’s net cash weighting (IGC is unleveraged) at the end of January 2023 was 4.7%, which is slightly above average. A comparison of Figures 6 and 7 below, which show the distribution of IGC’s portfolio by market cap as at 28 February 2023 and 28 February 2022, indicate that cash has increased at the margin with the big increase being to small caps, at the expense of the large caps and mid-caps. Gaurav comments that it has been a very volatile period, but that this throws up lots of opportunities.

Ashok Leyland – new position initiated

Headquartered in Chennai in Southern India, Ashok Leyland (www.ashokleyland.com) is the second-largest commercial vehicle manufacturer in India and the fourth-largest manufacturer of buses in the world. Gaurav describes it as a pure play commercial vehicle manufacturer, which he says is seeing a very big uptake driven by strong demand from the domestic economy. The company, which launched India’s first electric bus, operates nine manufacturing plants globally (seven in India, one in the UAE and one in Leeds in the UK).

Its product range includes trucks, buses, light commercial vehicles, defence vehicles, diesel engines, power solutions (agricultural and industrial engines, diesel generators, marine engines and gas gensets). The company has the largest fleet of logistics vehicles deployed with the Indian army as well as significant partnerships with other armed forces around the world. The company is part of the Hinduja Group, describing itself as the group’s flagship.

Gaurav says that the company has done very well since it was added to the portfolio. He comments that, during 2022, Ashok Leyland launched a new range of vehicles along with alternate fuel options, which has filled the obvious gaps within its product portfolio, leaving it in a very strong position. With the investment to achieve this complete, Gaurav now sees significant operating leverage in the business (it should be able to expand output without the need to expand its costs as fast), which should be able to benefit from the strong demand backdrop, giving the company a long growth runway.

Divi’s Laboratories – long-term holding exited on back of strong performance

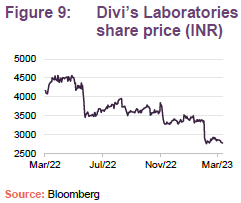

Divi’s Laboratories (www.divislabs.com) is a long-term IGC holding that has been in the portfolio for over a decade and a position that we have discussed in length in our previous notes (see page 20 of this note). The company makes active pharmaceutical ingredients (APIs) and is a global leader in providing research and development services to the global pharma industry. Despite holding it for a long time, Gaurav is not wedded to the stock and felt that the time had come to exit in full. This is despite continuing to like the company, with Gaurav noting that it is a very strong business with circa 40% operating margins.

Divi’s Laboratories’ share price had performed very strongly, reflecting a strong operational performance. For example, it was the sole supplier for the API for Merck’s COVID drug, from which it made massive profits and has been getting lots of incremental business. Gaurav says that its earnings base has moved up significantly, but with the world shifting away from COVID, he sees little in the way of earnings growth over the next two years. Given that the stock was trading at around a price/earnings ratio of 40x, Gaurav felt it was time to exit.

Updates on other holdings

Tech Mahindra has moved out of IGC’s top 10 (see below) but Gaurav comments that this former number one holding has been doing very well on the back of the 5G telecoms roll out.

Gaurav describes Affle India as a new age tech company that provides digital advertising solutions. However, rather than its revenues being impression-based, it is performance-driven (for example, it is able to track users’ actions and gets paid if its advertising generates a purchase). As the global economy cools, global advertising revenues are slowing down, but Affle India’s results-driven system is proving very popular with advertisers (particularly with digital start-ups) and so it is attracting more business (Gaurav says that it is growing revenues at over 30% per annum). At present, its offering – which is app-based – is very strong on Android and growing on Apple’s platform. It is also strong in India and Asia and growing in Latin America. Gaurav says it is a unique and different company that is very cash-generative and profitable.

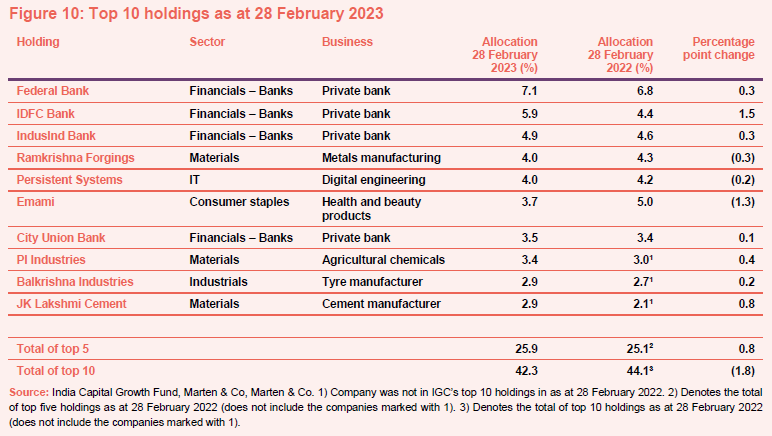

Top 10 holdings

Figure 10 shows IGC’s top 10 holdings as at 28 February 2023 and how these have changed over the previous 12 months. Reflecting its relatively low turnover approach, the names will likely be familiar to regular followers of IGC and our research on the company. Holdings that have since moved up into the top 10 are PI Industries, Balkrishna Industries and JK Lakshmi Cement (all discussed in our previous notes). Names that have moved out of the top 10 are Welspun India (discussed on page 8), Tech Mahindra (discussed above) and Affle India (discussed above).

We discuss some of the more interesting changes in the following pages. Readers interested in other names in the top 10 should see our previous notes, where many of these have been discussed previously (see page 20 of this note).

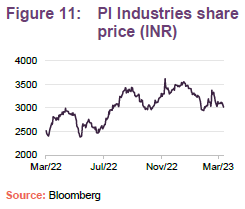

PI Industries (3.4%) – benefiting from market leading position

PI Industries (www.piindustries.com) is one of the market leaders in the agrochemical segment. We have previously discussed how, with its strong market position, it is well-placed to benefit as companies seek to shift their supply chains away from China, particularly given the strong relationships it enjoys with Japanese and European agrochemical businesses. Gaurav comments that this is coming to pass (it saw strong earnings growth during 2022 driven from custom synthesis exports) and he also observes that it continues to make progress in building out its pharmaceutical supply business, with both businesses benefitting as their customers seek to increase their supply chain resilience. As Figure 11 shows, the company has experienced decent share price recovery in the second half of 2022 reflecting its strong operational performance. Nonetheless, it remains a high-conviction holding.

Balkrishna Industries (2.9%) – small volume high margin niche tyre manufacturer

Balkrishna Industries (www.bkt-tires.com) is an Indian multinational specialist tyre company based in Mumbai that specialises in tyres for the agricultural, industrial or OTR (off-the-road) segments. Gaurav observes that the company’s earnings will be down for the year ending 31 March 2023, due to higher raw material and freight costs. However, he thinks should reverse for the year ending 31 March 2024 as price increases take effect and freight costs normalise, which should drive over 30% earnings growth in 2024. While it can be a little cyclical, the company’s tyre business is a very solid earner.

Balkrishna Industries has invested in flexible production that allows it to produce multiple ranges of tyres and in small volumes. If a company launches a new tractor or piece of mining equipment, the size of the tyre frequently differs and Balkrishna’s production system allows it to cater to the needs of these more-specialist customers. Reflecting this, it has over 3,000 stock keeping units (SKUs), which it can price very keenly (it has an operating margin in the region of 26-28%, while a typical tyre company’s might be 7-8%).

Previously, there has been margin pressure from Chinese suppliers in particular, but their operations are geared to high-volume low-margin orders and cannot compete with Balkrishna’s offering. Gaurav notes that there are lots of barriers to entry and thinks it would be very difficult for a competitor to replicate its process. It has been doing very well with European orders, driven by the situation in Ukraine.

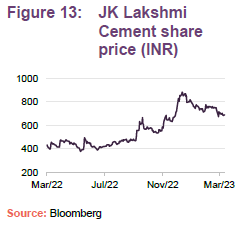

JK Lakshmi Cement (2.9%) – benefitting from strong domestic demand

JK Lakshmi Cement (www.jklakshmicement.com) has been a regular constituent of IGC’s top 10. It is a part of the 135-year-old JK group and has a 3% market share in India with 13.9m tonnes per annum (MTPA) cement capacity. Its primary operations are based out of northern and western India, and it has three cement plants and four grinding units.

We last discussed the company in our June 2021 note, where we wrote that the company had plans to undertake a brownfield capacity expansion of 2.5MTPA in the north-western state of Rajasthan once the pandemic wanes, further strengthening its position in this region. This has since come to pass, aided by a booming economy and housing market. The company continues to benefit from the change in management which has helped to bring a fresh perspective.

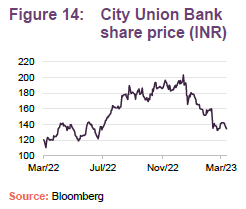

City Union Bank (3.5%) – well run regional bank

City Union Bank (www.cityunionbank.com) is another long-time IGC holding, which we have discussed in our previous notes (see page 20 of this note). It has regularly made an appearance within IGC’s top 10 holdings, often being trimmed on the back of strong performance and then re-allocated to when its valuation has been depressed – for example, Gaurav reduced IGC’s financials exposure during the first wave of the pandemic, but started to rebuild this at the end of 2020/early 2021 as positive news on vaccine development came through.

Gaurav describes City Union Bank as a regional bank with a very strong presence in South India. It is focused on SMEs and all of its lending is collateral based, giving it strong levels of protection. Typically, it is the sole banker to the corporates that it lends to, which Gaurav says gives it a strong influence with its customers, allowing it to gain high visibility over its lenders, and which allows it to achieve strong returns (a return on equity of approximately 16-18%). Gaurav notes that it is a very niche bank but is very well-run.

Performance

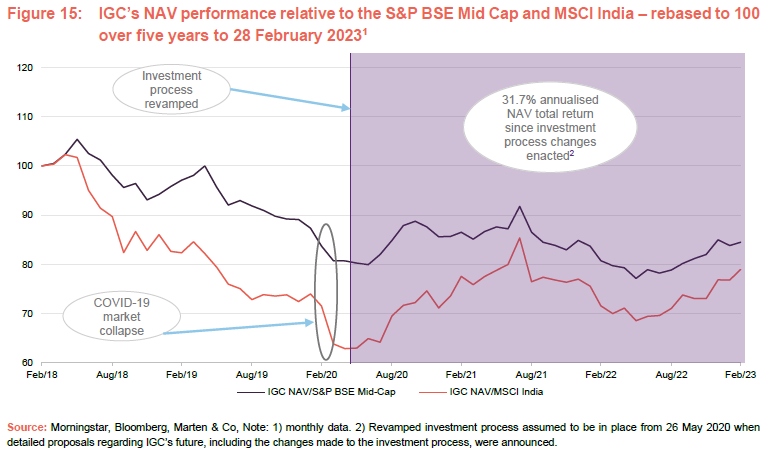

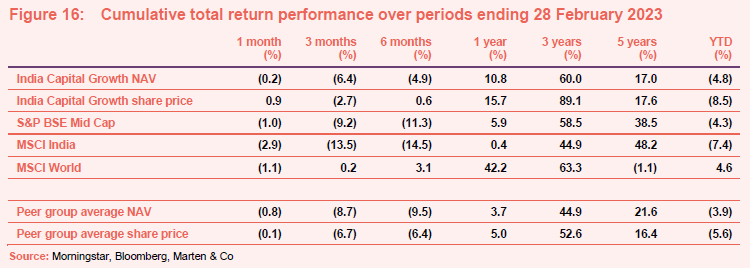

As is illustrated in Figures 15 and 16, while the longer-term trend has been one of underperformance of IGC’s NAV over both the S&P BSE Mid-Cap and MSCI India indices, it has been on a recovering trend since the COVID-related market collapse of March 2020. Absolute numbers have been strong in recent years as Modi government’s reforms have come through.

Crucially, IGC has outperformed the peer group average for both NAV and share price for all periods from one month up to and including three years, which largely reflects the period in which IGC’s adviser has followed a revised investment process, which has both improved performance and pushed it up the peer group rankings (something that is explored in greater detail in the peer group section below). In terms of its share price, the three-year period also captures the implementation of new policies which had a positive impact on its discount.

Small- and medium-sized Indian companies have generally outperformed larger ones during the last three years, reversing a previous trend of strong outperformance of the large caps, which has arguably contributed to IGC’s outperformance of the MSCI India Index in recent years.

Reflecting both the broader challenges in equity markets during the last 12 months for example, rising interest rates as central banks have sought to turn the tide on rising inflation, negative sentiment as energy and other commodity costs have driven up as a consequence of the war in Ukraine (despite India’s sanctions-busting activities) and supply chain issues as lockdowns prevailed China, plus home-grown issues such as the collapse in the value of the Adani group of companies (which IGC had no exposure to), absolute returns have been much lower during the last 12 months than the previous couple of years.

For many foreign investors, India – like its Asian peers – is seen as a growth market and this has weighed on capital flows as interest rates have risen. In addition, rising US interest rates are traditionally a headwind for Asia more generally. However, IGC has provided a positive return over both six months and one year and, over both periods, is the only fund in its peer group to do so.

Peer group

Up- to-date information on IGC and its peers is available on the QuotedData website.

IGC is a member of the AIC’s India sector, which comprises four members. All of these were members of the peer group when we last wrote about IGC. Within this peer group, IGC is the most-focused on small and medium-sized companies. Members of India sector will typically have:

- over 80% invested in Indian shares;

- an investment objective/policy to invest in Indian shares; and

- an Indian benchmark.

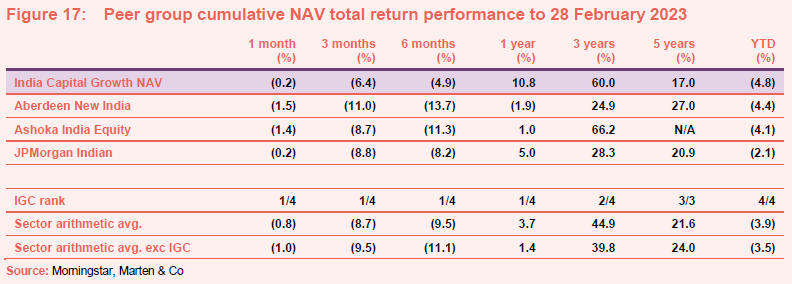

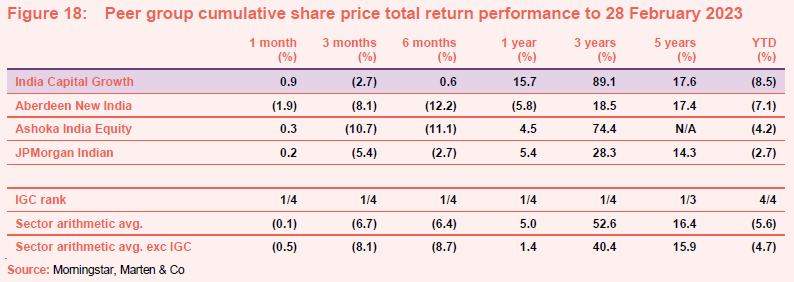

As highlighted in our previous notes, there has been a marked improvement in IGC’s cumulative NAV total return performance relative to peers following the change in investment process in May 2020, which is illustrated in Figure 17. The only fund to have beaten IGC in NAV total return terms over the last three years is Ashoka India Equity, but IGC has beaten it by a significant margin over the last 12 months (IGC ranks first over one, three and six months, and first over one year).

As discussed above, IGC and its peers have all posted negative returns over the last six months but IGC’s outperformance of its peers during this period is particularly stark.

A comparison of Figures 17 and 18 shows that while discount narrowing has provided superior share price performance relative to the NAV over the six-month period, the broader trend has been one of discount widening so that IGC’s NAV performance has not been fully reflected in its share price. It is a similar story for the rest of the peer group.

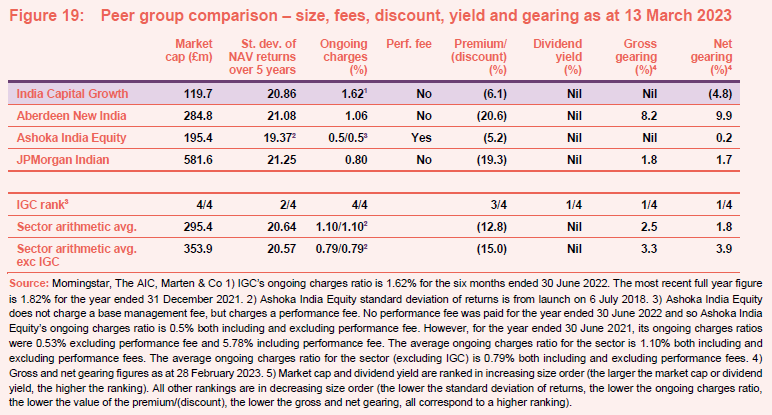

As illustrated in Figure 19, IGC is the smallest of the four funds focused on India and listed in London and this is a significant reason why it has the highest ongoing charges ratio of this peer group. Ashoka India Equity (the next-smallest fund) has a particularly low ongoing charges ratio, because it does not charge a base management fee, but unlike the rest of the peers, charges a performance fee of 30% of outperformance (capped), measured over three years, to compensate. Consequently, in years where the performance fee falls due, its ongoing charges ratio will increase accordingly, pushing it up the rankings. For its most recent financial year ended 30 June 2022, Ashoka India Equity did not incur a performance fee and so its ongoing charges ratio (both including and excluding performance fee) is low at 0.5%. However, for the prior year ending 30 June 2021, Ashoka India Equity incurred a performance fee, which made it the most expensive fund by some margin with an ongoing charges ratio of 5.78%.

IGC is operating with the largest net cash position (unlike its peers, it does not utilise gearing). Volatility of NAV returns, as measured by the annualised standard deviation of daily NAV returns over five years, are broadly comparable across the four peers, although IGC’s volatility is very close to the sector average.

Premium/(discount)

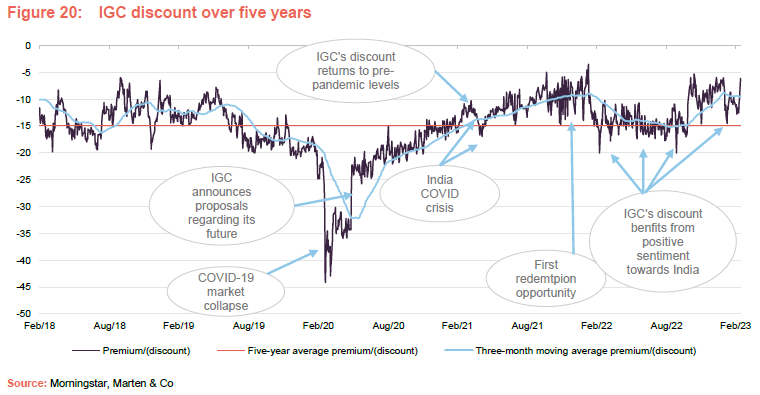

As is illustrated in Figure 20, IGC’s shares have traded consistently on a discount to NAV during the last five years, with marked periods of widening and narrowing driven both by shifting sentiment towards India and positive developments for IGC (for example, the introduction of the bi-annual redemption opportunity – discussed below – and a rejig of the investment process that subsequently gave rise to superior performance). Many of these have been discussed in our previous notes and we would recommend for readers who would like more colour to review these – see page 20 of this note.

During the last 12 months, IGC has traded in a discount range of between 5.3% and 20.0%, with an average discount 12.6%. At 13 March 2023, IGC was trading at a discount of 6.1%, which is in line than its one-year average and around nine percentage points narrower than its five-year average of 14.9%, which arguably reflects the improvements made during the intervening period as well as a general improvement in sentiment towards India as the benefits of the government’s reform agenda have finally started to filter through.

The board and the manager would like to see the discount eliminated altogether. We continue to think that this may be possible, especially as valuations are now less demanding, which could lay the foundation for a new period of strong performance, particularly given the long-term structural tailwinds that India is benefitting from. The small and mid-cap segment in which IGC invests has headwinds versus the wider India market during the last 12 months, but this should not continue indefinitely and could give a boost to IGC if this reverses.

Current discount could offer value

Figure 20 also illustrates that not only did IGC’s discount narrow following the announcement of the proposals for the redemption opportunity (and other associated improvements such as reduced management fee) in May 2020, but the discount also narrowed in the run-up to the first redemption opportunity at the end of December 2021, which was conducted at an exit discount of 6% to NAV. In this regard, the current discount appears to offer an opportunity given that IGC’s board has already determined that the next redemption opportunity, which occurs at 31 December 2023, will be conducted at an exit discount of 3% to NAV. We also note that, as discussed on pages 4 and 5, IGC’s manager is to become part of a larger well-resourced investment management group and that this should bring a number of benefits to shareholders in terms of marketing of the fund and support for the investment management process. If these bring the benefits that IGC’s manager envisages, this could also help to narrow IGC’s discount.

Redemption opportunity

IGC has a redemption facility that gives shareholders the right to request the redemption of part or all of their shareholding on 31 December every second year. The next such redemption opportunity is due to take place on 31 December 2023 and IGC’s board has determined that the exit discount for the December 2023 redemption point will be a maximum of 3%.

Whilst shareholders can use the next redemption opportunity to exit the fund should they wish, investors have previously been given the chance to buy stock at the exiting discount level. Although this is a tighter discount than it has previously been, it still may look attractive if IGC’s discount narrows and India continues to deliver on its strong growth prospects.

Previous publications

Readers interested in further information about IGC, such as investment process, fees, capital structure, trust life and the board, may wish to read our annual overview note The show must go on, published on 8 December 2022, as well as our previous notes (details are provided in Figure 21 below). You can read the notes by clicking on them in Figure 21 or by visiting our website.

Figure 21: QuotedData’s previously published notes on IGC

Source: Marten & Co |

Legal

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on India Capital Growth Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it, but in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.