Investment Companies News

Investment companies are companies set up to make investments on behalf of their shareholders (also called closed-end funds and, in specific circumstances, investment trusts).

Investment companies are companies set up to make investments on behalf of their shareholders (also called closed-end funds and, in specific circumstances, investment trusts).

Gresham House’s net asset value fell from 445.1p to 378.5p over the year ended 31 December 2013. most of the fall can be accounted for by write-downs in the valuation of the company’s investment properties and the fall in value of one of its equity investments – Memorial Holdings (a cemetery company which lost its […]

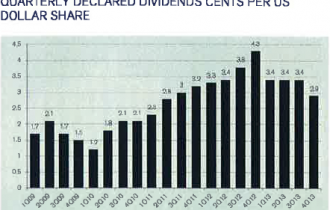

Carador has announced results for the year ended 31 December 2013. Over the year it generated a NAV return of 3.99% as an NAV fall of 7.75% was offset by dividend payments totalling 13.1 cents. The target dividend for 2014 is 10 cents (to be paid in quarterly chunks of 2.5 cents)

ICG Longbow has released its first set of results, for the period ended 31 January 2014. At that stage the company had made eight investments, was 85% invested and the NAV per share was 98.79p. The earnings for the period were 1.29p per share – lower than anticipated at the time of the IPO – this […]

Hg Capital has bought a stake in Visma (a software and business process outsourcing company centred on the Nordic region) – acquiring a 31% stake for £405m. £40m of this will come from the Hg Capital Trust and the rest from Hg’s limited partnership vehicle, Hg Capital VII. The net effect of the transaction will be that […]

Candover has sold Innovia (a manufacturer of films for packaging and the substrate for polymer banknotes – they are working on the new £5 and £10 notes) for €498m. this was the last asset in Candover’s 2001 fund. Candover Investments (the fund) will get €12.8m of proceeds and €7.6m of carried interest from the transaction. […]

Utilico Emerging Markets has consulted shareholders and decided not to proceed with its plan to issue long term debt and hold a continuation vote. It has instead extended a £50m bank borrowing facility it has with Scotiabank until April 2016.

Foresight Solar Fund has announced that its 16MW Pitworthy plant is now connected to the grid and operational. Also RWE Supply and Trading will finance construction of Foresight Solar Fund’s 37MW Kencot plant and Foresight no longer plans to buy a plant in Deptford that was highlighted as a potential acquisition in the fund’s prospectus. […]

Hansa Trust (which has two classes of shares – voting shares HAN and non-voting shares HANA) has announced that it is broadening its investment approach. Where, to date, it has mostly invested in UK equities and also has a stake in holding company, Ocean Wilsons, it will now also invest in other asset classes – […]

ICG Longbow has made its tenth loan – £8m to Quay Hotels, secured against the Ramada Encore Hotel in Gateshead. With the deal concluded ICG Longbow would have invested slightly more than all the proceeds of its original issue. It has today issued 3.6m shares at 102p per share to cover the shortfall. Following the […]

Standard Life Investment Property Income has announced its results for the year ended 31 December 2013. Over the year the fund generated a net asset value total return of 25.2%. The share price increased by 20.2%, equivalent to a total return of 29.2%. The dividend was unchanged on the previous year but the yield at the end […]

3i has announced that one of its larger holdings, animal health and nutrition specialist Phibro, has IPO’d in the US. 3i gets £67.6m in cash and still has a £25m stake in the business. Overall the deal adds £21.8m to 3i’s net asset value.

F&C Commercial Property Trust, managed by Richard Kirby, has announced results for the year ended 31 December 2013 that show the fund delivering a net asset value total return of 13.0% for the year – better than the 10.9% return generated by the IPD Quarterly Universe. The company has a sizeable cash pile to deploy which, […]

Utilico Emerging Markets is considering putting long-term finance in place with the aim of securing fixed rate funding at an attractive rate. Before it does so it wants to make sure that shareholders are happy with the idea and therefore is proposing to hold a continuation vote now and get shareholders to agree that the […]

El Oro has published its interim results for the six months ended 31 December 2013. The net asset value at the end of the period was 95.0p up from 92.0p at the end of June 2013.

John Laing Environmental has announced that it has completed on its deals to acquire Amber Solar, Castle Pill & Ferndale Wind and Bilsthorpe Wind projects from the John Laing Group. They already tied up the acquisitions of the Dumfries & Galloway Waste, Hall Farm Wind and Tay Wastewater Projects and so John Laing Environmental has now […]

Henderson Far East Income, managed by Michael Kerley (pictured), underperformed its benchmark by a little over the six months to the end of February 2014; its net asset value total return was -2.6% vs. -0.8% for the FTSE All World Asia Pacific ex Japan Index. The first two quarterly dividends have been maintained at 4.4p per […]

Invesco Perpetual UK Smaller Companies has released its annual results for the year ended 31 January 2014. Over that period Invesco Perpetual UK Smaller Companies achieved a net asset value total return of 31.4% – marginally behind that of the benchmark (the Numis Smaller Companies ex Investment Companies Index returned 31.8%). The discount widened slightly from 13.7% to […]

Dexion Trading has announced that today’s EGM approved the winding up of the company and liquidators have been appointed. The Directors were persuaded to go down this route after a recent tender offer was significantly oversubscribed.

Summit Germany has announced two deals. For the largest of these they are paying €45.5m to acquire a loan facility with a face value of €74m secured against 11 properties that Summit Germany used to own. Effectively Summit will now control these properties. The portfolio consists of nine office buildings and two retail properties with a total lettable area […]

Picton Property has announced that it is buying a 335,000 square feet distribution warehouse in Grantham, Lincolnshire for £11.48m. The property produces a rent of c£3 per square foot (£1m per annum) and it is secured against The Random House Group (the publisher).

Duet Real Estate Finance has announced results for the year ended 31 December 2013. The net asset value fell from 98.5p to 93.5p but Duet real Estate finance paid dividends totalling 10p for the year so the total return on the net asset value was 5.1%. The share price fell from 90.5p to 86.5p and […]

Martin Currie Global Portfolio underperformed its benchmark over the year to the end of January 2014 as the net asset value total return was 8.1% and the FTSE World Index return was 10.5%. The discount narrowed however so the share price total return was 9.8%. Dividends, now paid quarterly, totalled 4p for the year, 2.6% […]

Aberdeen Latin American Income has published its interim results for the six months ended 28 February 2014. Its net asset value fell by 9.1% in total return terms, underperforming its benchmark which fell by 7.2%. (The benchmark is a composite of the MSCI Emerging Markets Latin American 10/40 Index and the JP Morgan Global Bond Index – […]

Merchants Trust has released its results for the year ended 31 January 2014. The fund is 125 years old this year so the annual report (which you can access from the Merchants Trust page by clicking the link) dwells quite a bit on the fund’s progress since 1889. 2013/14 was not a bad year for […]

Chelverton Growth Trust has released its results for the six months ended 28 February 2014. Over that period the net asset value per share increased from 44.87p to 49.98p, an increase of 11.4%. In the same period the Company’s benchmark index, the MSCI Small Cap UK index increased by some 17.2%. The Chairman attributes the underperformance to the volatility of […]

Bluefield Solar has announced that most of its solar plants are now operational – only Cefn Betingau in Glamorgan and Sheppey in Kent are yet to be connected and Bluefield Solar believes this will happen this month. The upshot of this is that Bluefield Solar’s directors feel confident that it will meet its objective of […]

Foresight Solar is acquiring a 12MW solar plant at Spriggs Farm close to Stansted airport. This was not one of the deals projected to occur in Foresight Solar’s prospectus. The Company says it is now 80% invested and this will shortly rise to 93% with the acquisition of Holsworthy (which was in the prospectus). Foresight Solar […]

Schroder Japan Growth has released its interim results covering the six months to the end of January 2014. Over that period the net asset value fell by 3.0%, slightly less than the 3.2% fall in the TSE First section Index. The discount widened slightly so the share price fell by 3.9%. From 31 July 2014 […]

Montanaro European Smaller Companies, managed by Charles Montanaro (pictured) has cut its base management fee from 1% of market capitalisation to 0.9%. At the same time it has eliminated its performance fee. the change took effect on 1 April 2014.

Conygar Investment Company has sold Site 1, Aker Village, Aberdeen for £8m (a 6.1% uplift over the end September 2013 valuation). The site has a 64,500 sq ft warehouse and an 11,500 sq ft office let to Aker Business Services.

Please review our cookie, privacy & data protection and terms and conditions policies and, if you accept, please select your place of residence and whether you are a private or professional investor.

Due to data protection policies, USA residents can not access our data.

Your content has been curated