Aberdeen Emerging Markets – A reversal of fortune

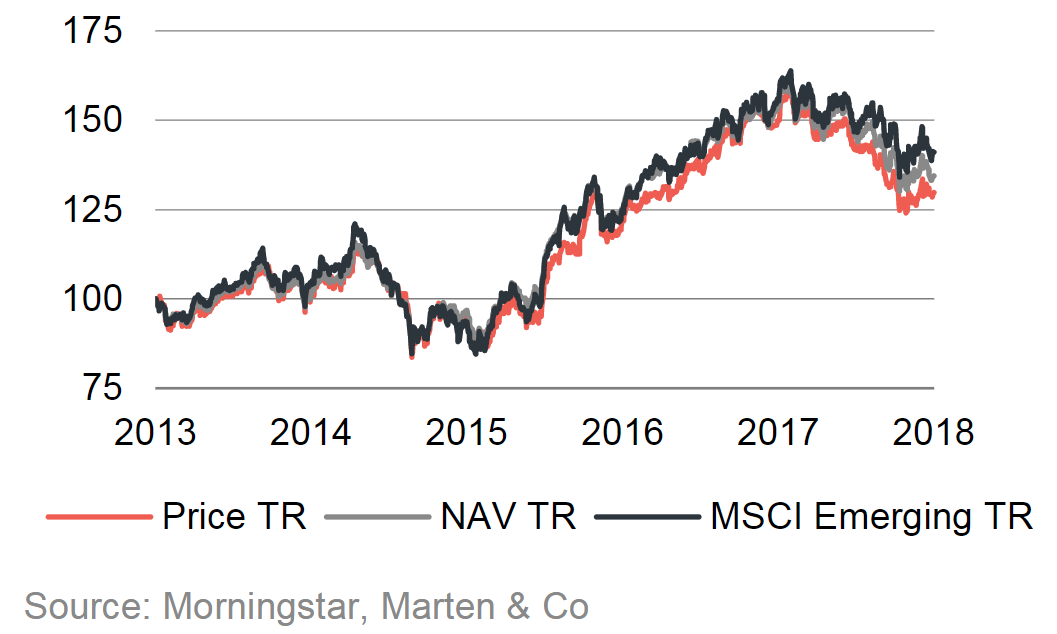

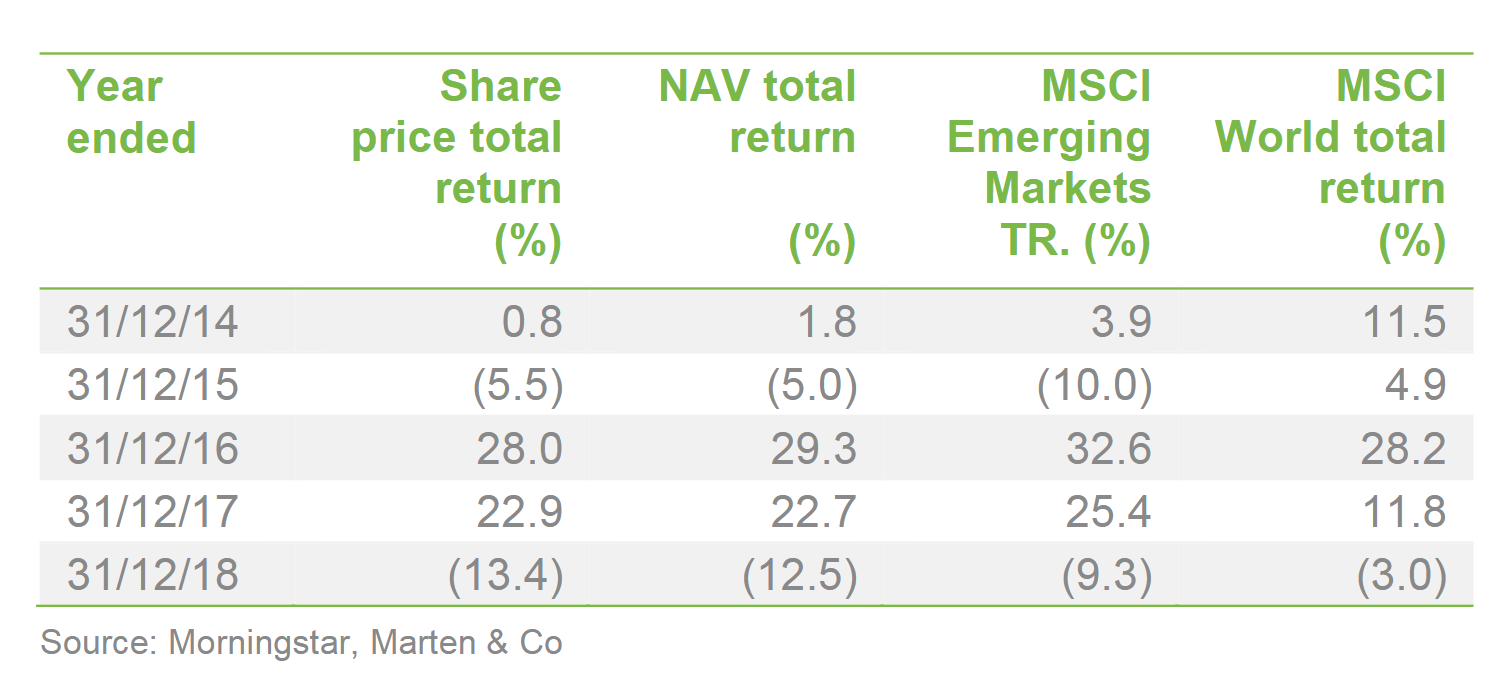

In 2018, Aberdeen Emerging Markets (AEMC) gave up the gains it made in 2017; this left it trading on a 3.9% yield (one of the highest in its peer group) and a wider discount. The shift was largely one of sentiment, investors were worried about the potential effects of rising US interest rates and a trade war with China on emerging markets. Emerging market currencies weakened and the sector experienced significant outflows. The underlying companies now trade on much lower valuations and AEMC’s managers believe that emerging markets have overshot on the downside. The potential is there for a reversal of fortune in 2019.

Aims for consistent outperformance of MSCI Emerging Markets Index

AEMC invests in a carefully selected portfolio of both closed- and open-ended funds, providing a diversified exposure to emerging economies. It aims to achieve consistent returns for its shareholders in excess of the MSCI Emerging Markets Net Total Return Index in sterling terms.