Year to date, Aberdeen Emerging Markets (AEMC) has been performing well, outstripping both its benchmark and the average of competing funds by some margin (see page 9). The members of the investment management team, who predicted a resurgence in AEMC’s performance in 2019, believe there is more to come over the remainder of the year. They highlight that, globally, investors still have an underweight exposure to emerging markets. In addition, the recent interest rate cut in the US could signal a halt to US dollar strength, to the benefit of emerging market currencies and stock markets.

That said, as the US/China trade war rumbles on and accusations of currency manipulation are bandied about, Chinese growth is slowing. The best-performing markets of recent times have been in South America and EMEA (Europe, Middle East and Africa). Now is when a manager of a global emerging markets fund that can add value through its asset allocation decisions earns its keep.

Aims for consistent outperformance of MSCI Emerging Markets Index

Aims for consistent outperformance of MSCI Emerging Markets Index

AEMC invests in a carefully selected portfolio of both closed- and open-ended funds, providing a diversified exposure to emerging economies. It aims to achieve consistent returns for its shareholders in excess of the MSCI Emerging Markets Net Total Return Index in sterling terms.

|

|

Will the dollar weaken now?

Will the dollar weaken now?

Some of the factors affecting the performance of AEMC have not changed since we last published on the company at the start of 2019 (readers may want to refer to that note, which also provides much more information on the workings of the fund); the performance of smaller companies is still lagging larger companies and the value style of investing remains out of favour.

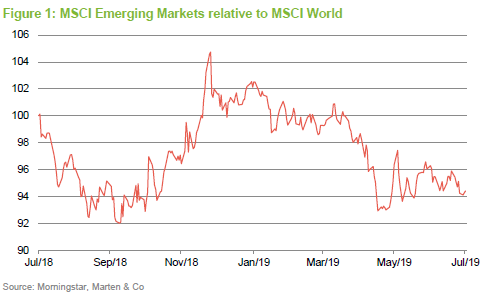

Perhaps most importantly for AEMC, as Figure 1 shows, emerging markets are still underperforming developed world markets and the US, in particular. It appears that – initially at least – US investors have focused more on the benefits of lower interest rates than on the slowing growth that had triggered them.

If emerging markets are to have a better run, it is important that the global economy does not tip over into full-blown recession. AEMC’s managers are cautious but not pessimistic in this regard.

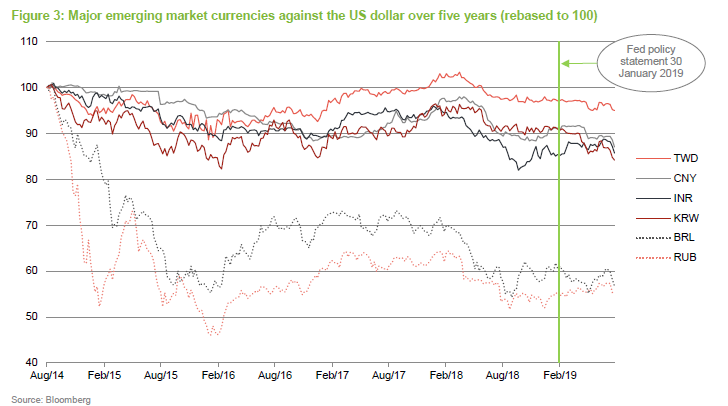

The abrupt policy pivot at the start of 2019 by the US central bank, the Federal Reserve (which shifted from a stance of trying to keep a lid on what it thought was a buoyant economy to loosening monetary policy to support what seemed to be faltering growth) raised hopes that the dollar would weaken, to the benefit of emerging markets.

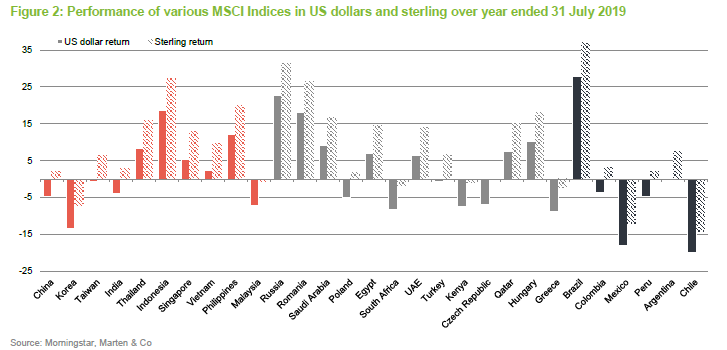

Emerging market hard currency debt (debt denominated in developed market currencies, usually the US dollar) has done particularly well since then. However, as is evident in Figure 2, there has been a wide dispersion of returns within emerging market equities.

Figure 2 groups the countries by region in the same order as they appear in AEMC’s asset allocation chart in Figure 4. The US/China tariff war has been a source of volatility and appears to be weighing on Chinese growth. Repeatedly, hopes have built that a resolution is in sight – only for them to be dashed by a tweet from the White House, possibly risking a hardening of China’s stance.

At the same time, the shine has come off China’s technology sector. Countries that supply components to Chinese industry have suffered, but some places have prospered as they fill the void left by Chinese companies affected by tariffs (in some cases, simply by transhipping Chinese goods). The best-performing market in Asia has been Indonesia, aided by the re-election of President Joko Widodo and a stronger oil price, which was a knock-on from increasing tension between the US and Iran. India, which sourced much of its oil from Iran, suffered.

Russia was another beneficiary of the stronger oil price. It is also ramping up exports of agricultural produce to China. Sanctions had left much of its stock market looking extremely cheap and this remains the case even after recent performance. The next best performing markets in the EMEA region were Romania and Saudi Arabia. Again, both oil-producing countries, but this was not the only factor at play here. Saudi Arabia has been promoted to the MSCI Emerging Markets Index and this is attracting inflows of capital. We discuss this more on page 6.

Brazil is the standout performer over the year. Again, it is a potential beneficiary of the US/China trade war, but its equity market has also been bolstered by October 2018’s election of Jair Bolsonaro. Investors see his government as business-friendly and are hoping he can reform the pension system. There is considerable opposition to many of his policies, however.

The other thing that Figure 2 shows is the difference in the returns experienced by US investors as compared to UK-based investors. Currencies have had a significant impact on returns. Figure 3 shows how some of the currencies to which AEMC is exposed have moved against the US dollar over the past five years.

Generally, US investors are underweight emerging market equities. When US markets are doing well and the dollar is strong, there is little reason to incur additional risk by investing in other countries. The Federal Reserve’s policy shift that was signalled on 30 January 2019 and has now been backed up by a 0.25% interest rate cut (the first in a decade) may eventually change all that. President Trump is signalling loud and clear that he wants rates to fall again and the dollar to weaken, particularly against the Chinese renminbi. US investors may now start looking elsewhere for returns, particularly now that the 2017 tax cut-induced boost to the domestic market is fading.

While many other developed market central banks are implementing rate cuts of their own, in the emerging world there is not often the scope to loosen monetary policy further. There is a carry trade available in emerging markets (it is possible to borrow at low interest rates in the developed world and invest at much higher rates of return in emerging markets) and AEMC’s managers are exploring ways of exploiting that.

Given the possibility that US investors might allocate more to emerging markets, the managers are broadly positive about the outlook for the second half of 2019.

Asset allocation

Asset allocation

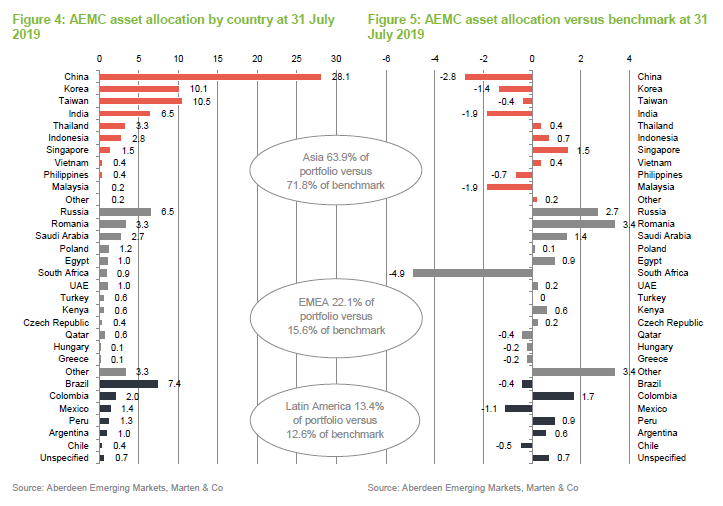

Figures 4 and 5 show the distribution of AEMC’s portfolio by country as it was at the end of July 2019. Figure 4 shows the actual weights (stripping out cash/debt) while Figure 5 shows how AEMC’s country weights compare to those of the MSCI Emerging Markets Index. The countries are arranged in three regions – Asia; Europe, Middle East and Africa; and Latin America.

AEMC’s managers have been fairly active over this period. Gearing (borrowing) has been maintained, as has exposure to frontier markets (those markets that are not represented in the MSCI’s developed world and emerging market indices, such as Vietnam and Kenya). The big shifts in asset allocation have been increased exposure to China and India at the expense of Russia and South Africa. These are discussed overleaf.

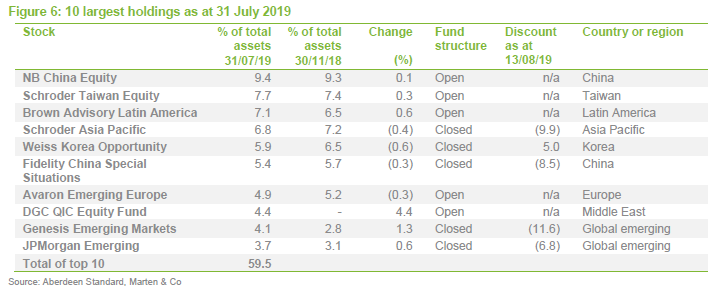

Largest holdings

Largest holdings

Three stocks – BlackRock Emerging Europe, SCM South Africa and Laurium Limpopo – have dropped out of the top 10 since we last published to be replaced by DGC QIC Equity Fund, Genesis Emerging Markets and JPMorgan Emerging.

The position in BlackRock Emerging Europe was exited as that fund was wound up, this accounts for most of the fall in AEMC’s Russian exposure. AEMC made a decent profit by buying the stocks at a discount and electing to exit at NAV less costs in the liquidation.

The managers sold the position in SCM South Africa at the start of the year. While the position in Laurium Limpopo has been retained, it has dropped out of the top 10 holdings on the back of relative performance. Without the Steyn Capital Management (SCM) fund, AEMC has no direct exposure to South Africa. The managers were disappointed by the returns that Steyn was achieving – it was caught out by a couple of high-profile stock-specific problems; Shoprite and Steinhof.

DGC QIC Equity Fund

DGC QIC Equity Fund

AEMC has not had a great deal of exposure to Middle Eastern markets in recent years. However, the managers had been using an index-tracking exchange-traded fund (ETF) to get access to the Saudi market, conscious that the market’s promotion to the MSCI Emerging Markets Index would encourage inflows of capital. After conducting a great deal of due diligence, including visiting the region, the managers selected DGC QIC Equity Fund. This c$100m, open-ended (Luxembourg SICAV) fund is advised by Qatar Insurance Company, the same team that runs the UK-listed, Gulf Investment Fund.

DGC QIC Equity Fund invests in equities listed on stock markets within countries that are members of the Gulf Co-operation Council (GCC) – effectively Saudi Arabia, Kuwait, United Arab Emirates, Bahrain, Qatar and Oman. It may also hold other companies that derive a significant amount of their revenue from these countries.

Saudi stocks are being added to the MSCI Emerging Markets Index in a two-stage process in June and September 2019. Once the process is complete, Saudi Arabia is expected to rank as one of the 10 largest countries within the index.

The DGC QIC Equity Fund is managed in a stock-picking style, with an emphasis on quality and value. Turnover is relatively high, reflecting the volatility and liquidity within their markets. The advisers believe that the markets are relatively inefficient (meaning stocks are often mispriced), and this provides ample scope for active managers to add value. About 70% of the portfolio is invested in Saudi Arabia.

Often, the pattern is for markets to run up ahead of index inclusion and then underperform afterwards as the ‘hot’ money moves on. However, in this case the managers believe that stocks are not yet overvalued (some stocks trade on reasonable yields, for example) and the region is under-owned by global investors. It is worth noting that the region’s fortunes are bound up with the oil price and this has been weakening recently.

Additions to Genesis and JPMorgan

Additions to Genesis and JPMorgan

The managers have been adding to the proportion of the portfolio that is invested in closed-end funds. Genesis Emerging is trading on a 11.6% discount. Its performance hasn’t been great in recent years, although it has been improving over the past year. Genesis’s board has promised a tender offer for 25% of its shares at asset value in 2021 if it fails to beat its benchmark over the five years to June 2021. JPMorgan Emerging is trading on a 6.8% discount and has been buying back stock to try to ensure that its discount doesn’t widen beyond 10%. Other additions have been made to Indian investment trusts (see below).

Other portfolio changes

Other portfolio changes

The position that AEMC had in a debt ETF was sold in June, having performed well. The cash has been recycled into equity funds.

The managers are still happy to have an underweight exposure to India, believing it may be overvalued. However, they have been reducing the underweight. Over the first half of the year, positions in Aberdeen New India and JPMorgan Indian were increased. The latter fund has an added attraction in that it is has a performance-dependent tender offer at the end of the year. If the trust fails to beat its benchmark over the three years to the end of September 2019, it will hold a tender for 25% of its shares. At the end of July, JPMorgan Indian was 15% behind its performance target; the tender looks likely to go ahead.

Another position that they have added to is the Aberdeen Standard China A Share Equity fund. This fund gives AEMC access to China’s domestic stock market. The fund benefits from an experienced management team, located in the region, who have delivered strong performance. It comes with the added attraction of no double-charging on fees.

The managers have been adding to AEMC’s Colombian exposure by purchasing an ETF focused on that market.

Performance

Performance

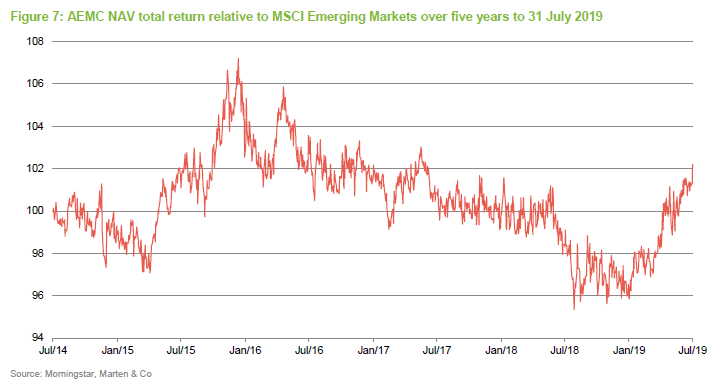

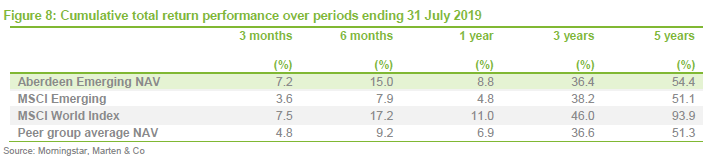

AEMC’s performance relative to its benchmark has been much stronger in 2019 to date, as is clear in Figures 7 and 8. As Figure 8 shows, it has also been outperforming its immediate competitors. However, emerging markets still lag developed markets, and this gives AEMC’s managers encouragement that there is more to go for over the rest of 2019.

The peer-group used in Figure 8 comprises the average performance of Fundsmith Emerging Equities, Genesis Emerging Markets, JPMorgan Emerging Markets, Mobius Investment Trust and Templeton Emerging Markets. These funds’ investment objectives closely resemble those of AEMC.

Drivers of performance

Drivers of performance

Within the investment company sector, discounts are narrow. This has helped AEMC’s performance. The manager’s asset allocation decisions have also been a net positive.

Many of the underlying managers of the funds in AEMC’s portfolio that were struggling in 2018 have had a much better time of it this year. For example, Ton Poh, a fund that the managers use to get exposure to the Thai market, has turned itself around, following a restructuring of the investment team. Similarly, Brown Advisory Latin American’s performance has improved, up 8.1% in US dollars for the six months ended 30 June 2019.

The Latin American region has been boosted by strong performance from the Brazilian market, following the election of Jair Bolsonaro. In particular, Brazil’s state-owned companies have rallied. Politics have had a big impact on markets generally. Faced with slowing Chinese growth and the headlines surrounding the trade war, Latin America and EMEA has been outperforming Asia (as we noted in Figure 2 on page 3).

In Romania, AEMC’s holding in Fondul Proprietatea has been performing well, reflecting the strong showing by that market in 2019 to date and a narrowing of its discount (NAV up 14.4% and share price up 21.2% at the half-year mark).

Peer group comparison

Peer group comparison

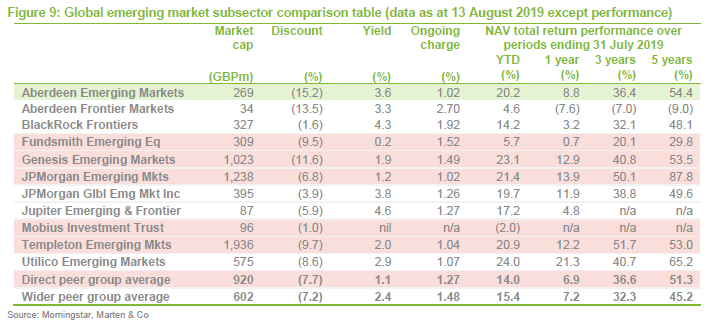

The constituents of the peer group identified above are highlighted in pink in Figure 9. The wider peer group comprises all the funds in the AIC’s global emerging markets sector, excluding Africa Opportunity, Gulf Investment Fund and Qannas, which are not global funds; and Ashmore Global Opportunities, which is in the process of liquidating its portfolio.

Perhaps the most striking thing about Figure 9 is AEMC’s discount, the widest in the table despite AEMC’s improved performance in 2019. AEMC’s yield remains competitive within the sector, especially against its direct peer group and its ongoing charges ratio is amongst the lowest in the table.

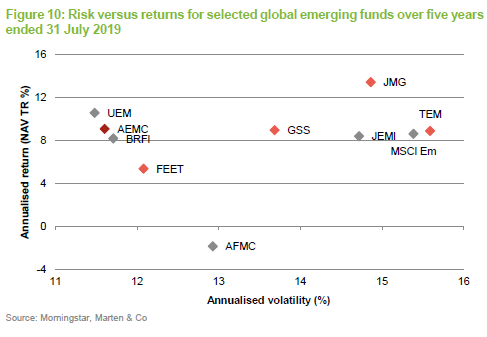

As Figure 10 shows, over the past five years, AEMC’s returns have been achieved with markedly less volatility than most competing funds. The direct peer group is shown in pink. Mobius Investment Trust and Jupiter Emerging Frontier Income do not have a five-year history and so have been excluded from the chart.

Discount

Discount

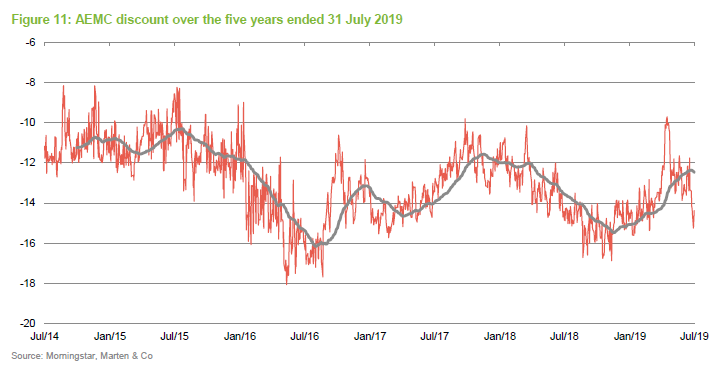

AEMC’s discount had been narrowing over 2019 but it has widened since the middle of July as markets have become more concerned about slowing economic growth and the impact of the US/China trade war. Over the year ended 31 July 2019, it moved within a range of 16.9% and 9.7% and, at 13 August 2019 the discount was 15.2%.

Fund profile

Fund profile

Aberdeen Emerging Markets Investment Company (AEMC) offers its shareholders access to a range of ‘best-of-breed’ managers, many of whom are inaccessible for most UK-based investors. These managers are investing in some of the most dynamic and fast-growing countries in the world. Investments are made through both closed- and open-ended funds, blending liquidity and access to a wider range of managers with the opportunity to add value through discount contraction.

Whilst benchmarked against the MSCI Emerging Markets Index, AEMC’s asset allocation may differ markedly from the benchmark, and is one way that the manager can add value relative to the benchmark index. Manager selection is also key to the success of the fund, and AEMC is fortunate to have investments in a number of funds that the average investor might struggle to access. The ability to add value from narrowing discounts and corporate actions in the closed-end fund holdings is another way of making money. The fund also offers a yield of 3.6%, which is paid from a combination of income and capital.

AEMC’s AIFM is Aberdeen Standard Fund Managers Limited (Aberdeen Standard) and it has delegated the investment management of the company to Aberdeen Asset Managers limited (AAML). Both companies are wholly owned subsidiaries of Standard Life Aberdeen Plc.

Andrew Lister and Bernard Moody (the managers) have been the lead managers of the fund since 30 June 2014. They have been involved with the management of the fund since October 2000 and August 2006, respectively. They are assisted by Viktor Broczko and Samir Shah (collectively, the team). All of the team members have personal investments in the fund. Aberdeen Standard has considerable depth of investment management and analytical resource, in both emerging market equity and debt, which is available to the team.

Previous publications

Previous publications

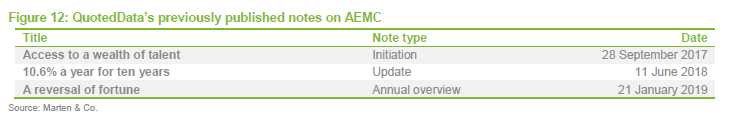

Readers interested in further information about AEMC may wish to read QuotedData’s earlier notes. Details are provided in Figure 12 below. You can read the notes by clicking on them in Figure 12 or by visiting our website.

The legal bit

The legal bit

Marten & Co (which is authorised and regulated by the Financial Conduct Authority) was paid to produce this note on CQS New City High Yield Fund Limited.

This note is for information purposes only and is not intended to encourage the reader to deal in the security or securities mentioned within it.

Marten & Co is not authorised to give advice to retail clients. The research does not have regard to the specific investment objectives financial situation and needs of any specific person who may receive it.

The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.