Impressive progress

Apax Global Alpha (whose ticker is APAX, but has been abbreviated throughout this note as AGA) has made impressive progress over the first six months of 2021, as its interim results demonstrate. The pace of realisations and distributions within its private equity portfolio has continued since and we estimate that its NAV has made further progress. The record €131m of distributions from the private equity portfolio have been reinvested in both new opportunities and AGA’s derived investment portfolio. In his report, AGA’s chairman sounds a note of cautious optimism. We think AGA is well-positioned to continue to benefit from the widespread disruptive change underway in the global economy. The current wide discount may prove temporary.

Unique exposure to the global private equity investment expertise of Apax

AGA aims to provide its shareholders with capital appreciation from its investment portfolio (target NAV returns are 12–15% per annum) and regular dividends (5% of the NAV per annum, payable semi-annually). AGA invests as a limited partner in private equity funds raised and advised by Apax Partners LLC (Apax), and is a direct investor in debt and equity instruments which are sourced through leveraging the insight and global reach of Apax.

Progress in nervous markets

Readers may be interested to refer back to our initiation note – An abundance of alpha – which set out AGA’s investment philosophy and approach, including its growth-focused strategy of backing good companies with the aim of turning them into great ones. It also explained the thinking behind AGA’s use of its derived investment portfolio as a way of mitigating against the cash drag that can afflict private equity funds.

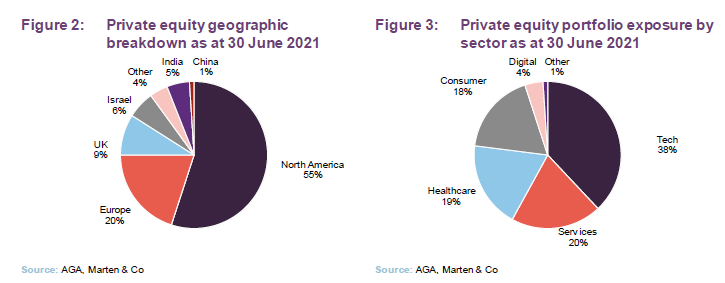

AGA’s focus remains on its core sectors of technology/digital, services, healthcare and internet/consumer (since we last published, online marketplace companies have been reassigned to this sector from services). Companies within these sectors were often beneficiaries of the enforced changes to working and shopping patterns imposed by measures taken to fight COVID-19. The pandemic is generally reckoned to have accelerated the pace of change in many industries.

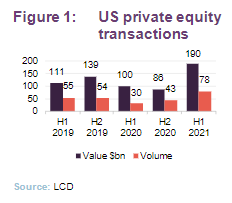

While COVID acted as a dampener on private equity transactions in the second half of 2020, as Figure 1 shows, the number and value of private equity transactions has rebounded over the first half of 2021.

Within listed equity markets, the promise of vaccines against the virus catalysed a rotation from growth to value last November which persisted well into the first half of 2021. Concern mounted that the significant stimulus injected into economies would trigger inflation and interest rises and the yield curve steepened. Nevertheless, credit spreads continued to tighten as defaults remained at relatively low levels.

However, towards the end of June, investors became worried about the impact of new variants of COVID on the pace of recovery and re-focused on high quality and growing companies of the type found within AGA’s portfolio. Yields on longer-dated bonds have fallen. The managers identify a tail-risk that inflation overshoots, leading to materially higher short-term and long-term rates.

AGA’s interim results for the period ended 30 June 2021

Over the first half of 2021, AGA has returned 17.4% in NAV total return terms and has announced an interim dividend of 5.97p in line with its policy of distributing 5% of NAV each year. The private equity portfolio was the main driver of returns, generating a total return of 24.5% in euros. The total return on the derived investment portfolio was 9.8%.

The NAV per share at the end of June 2021 was €2.81 or about 241p. We believe that a number of factors have helped push that higher to approximately 244.3p today.

The six-month period was a busy one, with 11 new investments closed, with a value of €85m on a look-through basis, and 12 full or partial exits achieved within the private equity portfolio and 13 new derived debt investments offset by five derived debt exits and one exit from the derived equity portfolio. We discuss many of these from page 6 onwards. The exits were made at an average 25.7% uplift to unaffected valuations (reflective of the conservative nature of AGA’s NAV).

A number of the exits were achieved via IPOs – InnovAge, Genius Sports, Global-e, Baltic Classifieds and Paycor have all come to the market since we last published (Paycor after 30 June). In addition, Thoughtworks, AGA’s largest underlying holding, has submitted a confidential draft registration statement to list in the US.

The high level of distributions from the private equity portfolio (€131m over the period) was offset by redeployment into AGA’s derived investments portfolio.

Many of AGA’s largest holdings are now in listed companies. The chairman notes that, with €439.2m in derived investments, net cash of €29m and an unused €140m credit facility, the fund is already well-positioned to meet future private equity calls (outstanding commitments stood at €419.2m at 30 June 2021). However, AGA continues to put money to work, with a new $90m commitment to the planned Apax Digital Fund II announced during the period.

AGA’s board stresses the importance of responsible investment. We note that in July 2021, Apax became a signatory to the Initiative Climat International, a private equity industry initiative backed by the PRI. It aims to share best practices for measuring, managing and reducing portfolio carbon emissions.

Asset allocation – private equity

The AGA private equity portfolio has a bias to the US and Europe and only modest exposure to other parts of the world, including Asia. Regional weightings reflect the opportunities available. The portfolio is not managed on a top-down basis. The allocation to digital reflects the holding in the Apax Digital Fund (ADF), which makes investments in the software, internet and tech-enabled services sub-sectors.

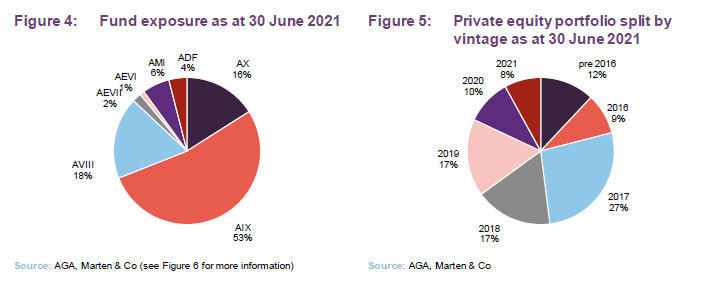

Apax X (AX in Figure 4) is relatively early in its life cycle. The exposures to individual funds reflect their relative maturity. AMI Opportunities is focused on investments in Israel.

On 27 May 2021, AGA announced that it had made a $90m commitment to the new Apax Digital Fund II. As yet, we do not know how big this fund will be.

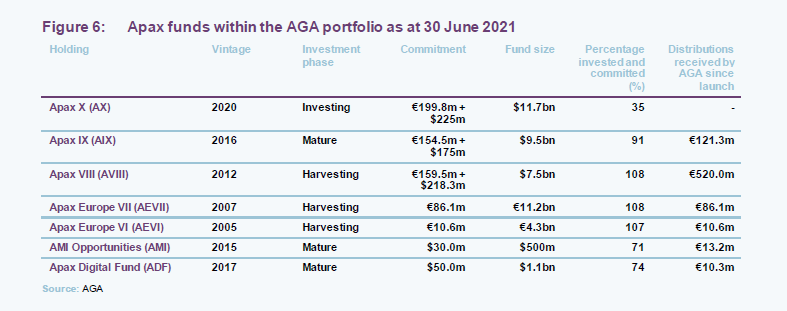

Apax funds within the AGA private equity portfolio

Since our initiation note was published, ADF has been reclassified from the investing phase to the mature phase. Over the past six months, AGA has received a total of €131m of distributions comprising about: €95m in distributions from AIX, €19m from AVIII, €1m from AEVII, €3m from AEVI, €3m from AMI, and €10m from ADF.

The outstanding commitment to AX is expected to be drawn down over the next two-to-three years.

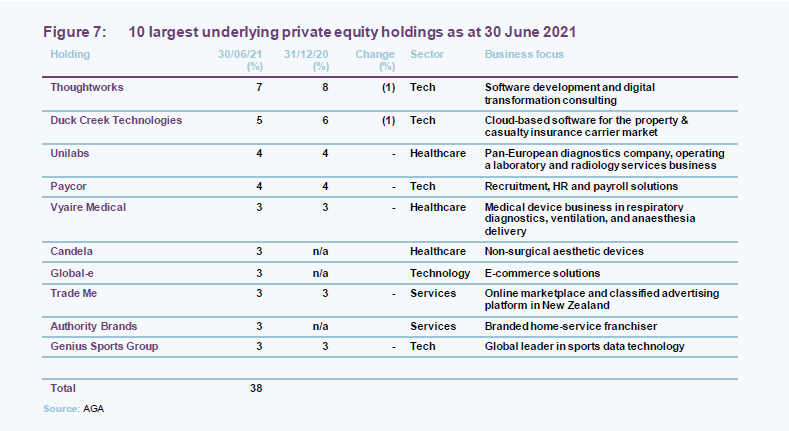

10 largest underlying private equity holdings

At the end of June 2021, there were 73 underlying companies in AGA’s portfolio.

Since we last published, Cole Haan, Assured Partners and Safetykleen Europe have been replaced on the list of the 10-largest private equity holdings by Candela, Global-e and Authority Brands. Global-e and Authority Brands represented two of the three strongest valuation gains over H1 2021 while Cole Haan, whose retail business was hit hard by the pandemic, was one of the worst-performers.

Apax say that Cole Haan’s business is recovering, launching into new categories and seeing improving sales while cutting costs to raise margins.

Thoughtworks

We discussed Thoughtworks in our last note. Since then, the company has taken steps towards an IPO in the US.

Paycor

Paycor (paycor.com) held within Apax IX and is a leading US provider of payroll and HR-related software, was discussed in our last note. However, since we last published it priced its IPO on 20 July 2021 at $23 and the stock has risen steadily since. At 18 August 2021, it was priced at $36.16 and this significant uplift is one of main drivers of the uplift in our NAV estimate for AGA since 30 June 2021.

Candela

Apax invested in Candela (candelamedical.com) in 2017. It is a leading global non-surgical aesthetic device company offering solutions in a range of fields from tattoo removal to the treatment of acne, leg veins and cellulite. The company has a wide portfolio of products including UltraShape Power, VelaShape, CO2RE, CO2RE Intima, GentleLase, VBeam Perfecta, PicoWay, Profound and elōs Plus.

Global-e

Global-e (global-e.com) is held within the AMI portfolio. It describes itself as the world’s leading end-to-end cross-border ecommerce solutions. It priced its IPO on 12 May 2021 at $25 per share.

However, since then the share price has soared (it was $74.55 on 18 August 2021) and this is another main drivers of the uplift in our NAV estimate for AGA since 30 June 2021. Apax did not sell any shares at the time of the IPO.

The strong share price performance may reflect the results that Global-e is achieving. Its second quarter 2021 results showed a 92% year-on-year increase in revenue and higher gross margins.

Authority Brands

Authority Brands (theauthoritybrands.com) was an investment that Apax made in 2018. It is the franchiser for a range of home service brands including ASP (swimming pool services), Mister Sparky (electrical repairs and replacements) and One Hour heating & Air Conditioning. Together, these brands provide home services through more than 1,900 territories operated by more than 1,000 franchise owners in the U.S., Canada, Latin America, Kenya and Indonesia.

Recent portfolio activity

Social good software platform

In June, AGA invested in CyberGrants, a leading provider of software-as-a-service (SaaS) solutions for corporate social responsibility, employee engagement, and volunteer management. CyberGrants’ network connects 10m employees and their employers with 650,000 not-for-profit organisations. AGA’s look-through investment in the business was about €13.9m.

Then in August, AGA announced that it planned to combine CyberGrants with EveryAction, an omni-channel engagement platform for non-profits, and Social Solutions, a case management software provider of data-driven insights to non-profit and public sector customers, to form the backbone of a new social good software platform.

Assembling the platform through a three-way deal is the sort of transaction that falls squarely into Apax’s investment approach. It is in the right subsectors – software-as-a-service, and Apax is not paying up for a fully-fledged business but instead using its expertise to build a business, thereby creating value. Apax has leveraged its extensive network to select suitable targets. This sort of complex deal – going the extra mile to create value – is also typical.

Infogain

Infogain (infogain.com) is a Silicon Valley based provider of digital platforms and outsourced software engineering and digital services. On a look-through basis, AGA’s share of the investment was about €22.1m. Infogain serves companies in the travel, healthcare, retail, consumer packaged goods, insurance, and tech industries. It supports them in their artificial intelligence, user-experience design and use of cloud-based services using advanced software technologies.

The manager sees Infogain as a reasonably-priced platform on which they can build a larger business. Its experience with Thoughtworks and other similar companies helped when it came to identifying and assessing the opportunity.

Faculty

ADF made a £30m investment in Faculty (faculty.ai/), a leading British artificial intelligence company, in May 2021. The business was founded in 2014 and now has a specialist team that includes over 50 PhDs and experience of working with over 200 customers across the globe on over 350 projects. The manager says the management team is one that they know well, having worked with them in the past.

The funding from ADF will be used to create around 400 new jobs, developing Faculty’s ‘AI as a service’ model and accelerate Faculty’s international expansion.

Tide

Tide (tide.co) is a financial software platform for small businesses. The Tide business financial platform offers business accounts and related banking services, as well as a comprehensive set of integrated software solutions, such as expense management tools, electronic invoicing, and API connectivity with third party SaaS providers. Tide has experienced rapid and sustained growth since launching in 2017, with 2020 seeing the business more than double its user base in the UK.

Baltic Classifieds

Baltic Classifieds (balticclassifieds.com) is a position in AIX. It owns and operates twelve leading vertical and generalist online classified ad portals in Estonia, Latvia and Lithuania. The portfolio comprises four business lines – automotive, real estate, jobs & services and generalist. It IPOd in London on 30 June 2021 and its share price has performed well since.

Revolution Prep

ADF invested in Revolution Prep (revolutionprep.com) in June 2021. It is a leading national provider of online academic tutoring and test preparation services. The company’s online teaching platform makes high-quality tutoring inclusive and accessible – from any location, at any time – supporting students of all ages (from kindergarten to college). Revolution Prep has community of professional tutors, who specialise in over 100 academic and test prep subjects.

Nulo

Nulo (nulo.com) is a consumer-facing petfood business in the fast-growing US market. Its primary focus is on the dog and cat food segments where it differentiates itself by providing nutrition designed to combat the growing trends of fatigue, immunodeficiency and obesity-related diabetes. Rather than focusing on carb fillers, Nulo’s products have animal-based proteins to build muscle; low carbs and low-glycemic ingredients to maintain healthy weight; and probiotics to boost immunity.

Apax says that Nulo is offering a premium product in a very attractive end-market. The team had been following Nulo for some time before making the deal and became confident in the company’s strategy and the management team’s ability to execute on this. In addition, Apax believes that NULO’s business would not only be resilient in the face of an economic slowdown, but plays into a trend of a shift towards higher quality and natural brands in the space.

Guesty

Guesty (www.guesty.com) provides property management software designed to automate and streamline property rental activities. This covers the full range of property rental activities from pre-stay documentation, payments, multi-unit management, extended stays, accounting tools. However, a key advantage is that it allows professional hosts and property companies to manage their rental properties across a range of platforms, such as Booking.com, AirBnb, Expedia and the like, so that all of their inventory is in one place.

Rodenstock

Rodenstock (rodenstock.com/com) is a German manufacturer of ophthalmic lenses and glasses frames. Established in the 19th century, the company is a well-known brand, particularly in the German domestic market, that is renowned for the quality of its products (the company is a global leader in prescription lenses, for example). Apax says that the company has a strong management team, which they know well, that has refocused and expanded the business. The company completed a €75m capital in June 2020, all of which was provided by existing shareholders, reflecting their conviction in the company’s strategy. Apax says that the company has interesting technology and considerable experience in the medtech field.

Following the launched of its eye measurement device DNEye® scanner in 2012, the company has placed the “digital fingerprint” of each eye at the core of its strategy. Rodenstock says that its scanner enables opticians to determine the biometrics of the whole eye by measuring thousands of data points, which ultimately allows it to construct lenses that provide customers with the sharpest vision possible at any angle or with every gaze (both in the glasses’ peripheral zones and at distances from mid, near and far). It claims to be the first lens manufacturer producing glasses built on an eye’s individual “digital fingerprint”.

Lutech

Lutech (lutech.group) is an Italian IT services, software and technology company that is focused on digital transformation. Specifically, it is recognised for its capabilities in digital customer engagement, next generation IT infrastructure, cloud, financial services solutions, cybersecurity, IoT, Big Data and eHealth.

The Apax Funds, in partnership with Lutech’s management team, will look to drive the company forward through a combination of organic and inorganic growth, focusing on expanding key value drivers such as the company’s digital services offering while at the same time accelerating Lutech’s M&A strategy.

The Apax Tech team have a deep understanding of the IT services market, as well as specific knowledge of the Italian market through the Apax Funds’ prior investment in Engineering, another leading IT services provider in the country.

Innovage

Innovage (innovage.com), which offers home support to senior citizens, priced its IPO on 4 March 2021 at $21 per share. Apax did not sell any stock at this time. Its share price has fallen over subsequent months, and was $14.93 on 18 August 2021.

The company is forecasting revenue of about $627m for the year ended 30 June 2021 and adjusted EBITDA of about $84m.

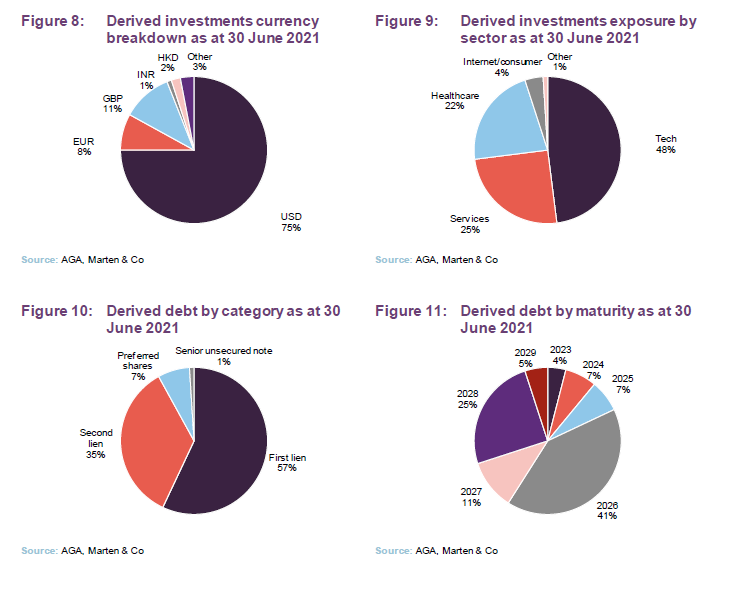

Asset allocation – derived investments

At 30 June 2021, 88% of this part of the portfolio was in derived debt and 12% in derived equity.

The derived debt is all floating rate and, at 30 June 2021, the weighted average income yield on this part of the portfolio was 6.4%, down from 7.3% at end December 2020, reflecting in part tightening credit spreads but also a higher proportion of the portfolio allocated to first lien rather than second lien debt. The yield to maturity was 6.8%. The weighted average maturity of the derived debt portfolio was 5.9 years, up from 5.7 years at end December.

One position in the derived equity portfolio was sold over H1 2021.

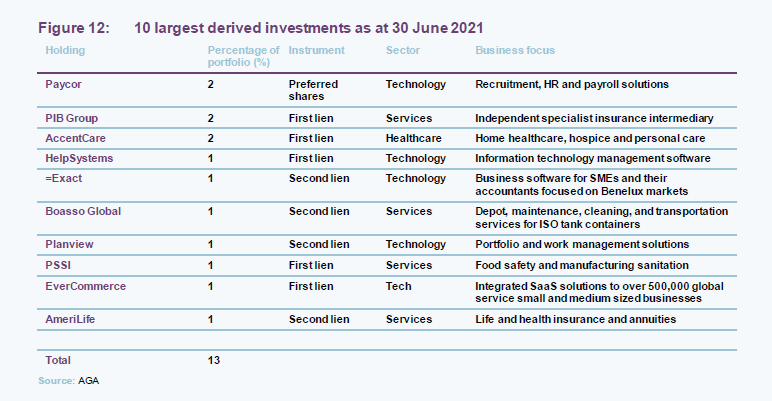

10 largest derived investments

At the end of June 2021, the largest derived equity position (ranking fifteenth, down from thirteenth at the end of December 2020) was Airtel Africa, valued at around 1% of the portfolio as it was in December 2020.

Operational performance for the underlying companies in the derived debt portfolio is good. Average EBITDA growth rose from 26.2% to 37.3%, mainly due to changes in composition of the portfolio during the year.

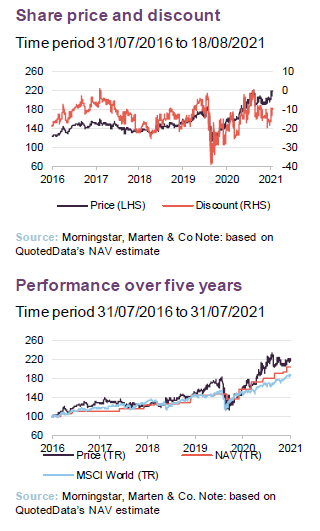

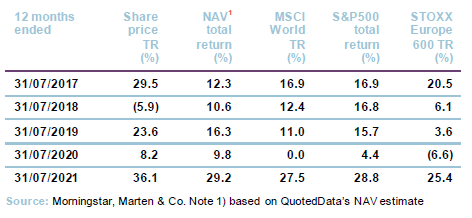

Performance

Note: AGA’s shares trade in sterling and it pays sterling dividends. However, its accounts are prepared in euros. All returns cited in this note are in sterling unless otherwise indicated.

For the purposes of this note, QuotedData’s analysts have estimated AGA’s NAV as at end July and as at 18 August 2021. We have attempted to factor in changes in exchange rates, based on the distribution of the portfolio as at end June, announcements of events impacting the NAV and changes in the share prices of significant listed holdings. This is an estimate only and the actual NAV as at those dates may be materially different.

Breaking the 17.4% return for the first half of 2021 down between the company’s private equity and derived investments portfolio, the private equity portfolio added 13.4 percentage points to AGA’s NAV and the derived investments portfolio 2.3 percentage points (of which equity 1.0 and debt 1.3). Currency movements worked in AGA’s favour, adding 2.5 percentage points. Costs, including accrued performance fees, took off about 0.8 percentage points.

The private equity return was aided by much improved operating performance within the portfolio (on average, EBITDA grew by 42.7%) and rebounding valuations as the weighted average valuation multiple hit 18.0x.

The average gross IRR on exits achieved within AGA’s portfolio over H1 2021 was 52.4%. The average MOIC was 3.9x. The equivalent figures for the derived debt portfolio were 9.5% and 1.2x. The one exit achieved in the direct equity portfolio was done at a loss – an IRR of -13.1% and a MOIC of 0.6x.

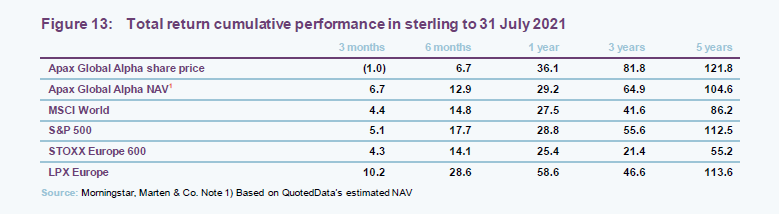

In Figure 13, the LPX Europe Index is an index of listed private equity companies in Europe. Its returns are driven by the share prices of those companies. A comparison of the LPX Europe and AGA’s share price suggests that AGA has done particularly well against its peer group over the long term but, has lagged in the short-term. Were, as we expect it will be, the recently announced uplift in NAV to be reflected in AGA’s share price, that situation would look quite different.

Discount

AGA announces its NAV’s quarterly. At 31 July 2021, we estimate that AGA was trading at a discount of 14.9%, and, at 18 August 2021, our model suggests that AGA was trading on a discount of 10.0%.

Both discounts may be this wide because investors underestimated the strength of AGA’s interim results. We think it is likely that the share price will move higher, narrowing the discount, now that the end June NAV has been made public.

AGA’s discount widened briefly as an additional tranche of 20% of its ordinary shares held by senior Apax executives was released from lock up. This has increased the liquidity of AGA’s shares.

Fund profile

AGA offers a way for investors to access private equity investments through a listed vehicle. It invests predominantly in funds advised by Apax and does not invest in private equity funds managed by third parties. AGA’s investments may be composed of both primary and secondary commitments to these funds. To avoid the problem of cash drag that is often associated with investment in private equity, AGA may also invest in what it terms as derived investments. These derived investments include investments in public and private debt, and may also include some investments in listed equities.

An investor in AGA has exposure to equity stakes in around 60 underlying unlisted companies and around 30 derived investments.

AGA is managed by Apax Guernsey Managers Limited (the investment manager), an independent company, and that company is advised by Apax. Apax has a nearly 50-year track record of private equity investment, initially in venture capital and, from 1993, buyouts. Over its history it has raised and advised over 30 funds. Its first fully global buyout fund (Apax VIII) was launched in 2012.

The Apax funds are focused on four sectors: tech, services, healthcare and consumer. Over $60bn has been committed to Apax funds over the firm’s 40+ year history.

Previous publications

Readers may be interested to read our initiation note – An abundance of Alpha – which was published on 10 March 2021.

The legal bit

This marketing communication has been prepared for Apax Global Alpha Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.