An abundance of alpha

Apax Global Alpha (whose ticker is APAX, but has been abbreviated throughout as AGA) has been listed for just over five years, but has been in operation for well over a decade. AGA provides access to the private equity expertise of Apax Partners. It also has a portfolio of derived investments, which provides a unique differentiator for AGA, reduces cash drag and helps support an attractive dividend.

AGA has built up an enviable track record since launch, with returns towards the top of its listed private equity peer group. In addition, its focus on sectors such as technology and healthcare, appears to have helped it navigate the pandemic successfully.

Recent deals have underscored the latent value within the portfolio. Exits achieved in 2020 came at a 40% average uplift to previous valuations.

Unique exposure to the global private equity investment expertise of Apax Partners

AGA aims to provide its shareholders with capital appreciation from its investment portfolio (target NAV returns are 12–15% per annum) and regular dividends (5% of the NAV per annum, payable semi-annually). AGA invests as a limited partner in private equity funds raised and advised by Apax Partners, and is a direct investor in debt and equity instruments which are sourced through leveraging the insight and global reach of Apax Partners.

Fund profile

AGA offers a way for investors to access private equity investments through a listed vehicle. It invests predominantly in funds advised by Apax Partners LLP (the investment adviser or Apax) and does not invest in private equity funds managed by third parties. AGA’s investments may be composed of both primary and secondary commitments to these funds. To avoid the problem of cash drag that is often associated with investment in private equity, AGA may also invest in what it terms as derived investments. These derived investments include investments in public and private debt, and may also include some investments in listed equities.

An investor in AGA has exposure to equity stakes in around 60 underlying unlisted companies and around 30 derived investments.

AGA is managed by Apax Guernsey Managers Limited (the investment manager), an independent company, and that company is advised by Apax. Apax has a nearly 50-year track record of private equity investment, initially in venture capital and, from 1993, buyouts. Over its history it has raised and advised over 30 funds. Its first fully global buyout fund (Apax VIII) was launched in 2012.

The Apax Partners funds are focused on four sectors: tech, services, healthcare and consumer. Over $60bn has been committed to Apax funds over the firm’s 40+ year history.

History

AGA listed in 2015, subsuming a pre-existing fund. The fund that would become AGA was created in 2008 and funded by partners and employees of Apax. By March 2015, this fund had direct and indirect investments and/or commitments to invest in four Apax funds as well as 27 derived investments. This portfolio was valued at €611m and had generated an IRR of 30.9%, 14.7% a year more than the net return on the MSCI World Index. AGA was created as a way of giving outsiders access to this fund.

At launch, existing Apax staff agreed to be locked in for 10 years from the date of initial admission (they are released from lock up from June 2021, when they can sell up to 20% of their holding at initial admission. An additional 20% emerges from lock up each year up to June 2025), and former Apax staff agreed to be locked in for five years. The latter anniversary passed in June 2020 and, with fewer shares locked in, AGA was deemed to be liquid enough for inclusion with the FTSE series of indices for the first time last year.

Proactive response to COVID-19

COVID-19, the measures taken to control its spread, the efforts to treat and vaccinate against it, and the fiscal and monetary policy response to it have overshadowed everything over the past 12 months.

In February/March 2020, the investment adviser’s priority was to work with portfolio companies to manage their liquidity requirements and shepherd them through the immediate crisis. It was soon obvious that there were opportunities for many of these businesses as well as challenges. Many were able to improve their operational leverage by paring back costs.

For the most part, the investment adviser’s sector focus dovetailed nicely with the sectors of the economy that fared best as the situation unfolded. In particular, sub-sectors such as software, tech-enabled services, and online marketplaces saw increased demand for their products and services. The part of the portfolio that faced some of the greatest challenges was the consumer sector. However, that sector represented less than 10% of the invested portfolio. Notably, AGA had no exposure to the two worst-performing sectors of energy and financials.

As the crisis unfolded, initially, volumes and values of private equity transactions fell sharply. However, confidence began to return towards the end of Q2 and a hiatus in transactions eased. In May 2020, the investment adviser announced that Apax X (see page 9) had completed a $550m PIPE deal with KAR Global (karglobal.com) a software and vehicle marketplace behind a range of brands including ADESA car auctions. A number of other deals followed, many of which are described in more detail on pages 10 to 14.

In NAV terms, as we describe on page 17, an initial – mainly mark-to-market – hit to the NAV was swiftly reversed. The NAV has continued to climb since and is hitting new highs.

Investment process

The bulk of AGA’s portfolio is comprised of limited partnership investments in seven of the investment adviser’s private equity funds (detailed information on the portfolio is given from page 8). Typically, these funds have a planned lifespan of about 10 years. Subject to the approval of the board and the investment manager, AGA makes legally binding commitments to new Apax funds as they are launched.

Over the ‘investment phase’ of a private equity fund, the money that investors, including AGA, have committed is drawn down and deployed by Apax into private equity investments. Typically, while predominantly all of the money committed will be drawn down, some money is held back to nurture the growth of the underlying companies where necessary. Over the next few years, the fund’s portfolio enters the ‘maturity phase’. Follow-on investments may be made and early distributions from the portfolio maybe reinvested. Consequently, the percentage invested may exceed 100% of monies raised. Finally, the private equity fund’s portfolio enters a ‘harvesting phase’. Investments are gradually turned into cash and money returned to investors, including AGA.

The derived investment portfolio, a unique approach to managing cash drag

Investors in private equity funds need to be conscious that, because it takes time for commitments to be drawn down and the timing and quantum of this is relatively unpredictable, liquidity must be available to meet commitments as they fall due. Keeping cash on hand to meet commitments would be drag on returns. To avoid this problem, AGA has adopted an overcommitment policy and, uniquely amongst its peers, invests its surplus liquidity in a portfolio of derived investments.

AGA’s derived investment portfolio may include both direct and indirect investments in equity and debt instruments, including equity in both private and public companies, as well as private and public debt. The debt portion of the portfolio may include sub-investment grade and unrated debt instruments.

The derived investment portfolio can hold co-investments with Apax funds or third-parties and AGA may buy investments from these funds.

An internal investment committee (see page 23) makes recommendations for the derived investments. It takes a top-down view of AGA’s likely liquidity requirements when selecting investments. The liquidity of the derived portfolio can vary significantly – from large syndicated first lien loans (traded daily), down to privately-placed second lien debt, which may trade by appointment.

The investment adviser has good insight into the likely future cashflows. Its visibility is enhanced as the underlying funds tend to have their own short-term credit facilities which allow them to fund investments at short notice and then call down commitments to repay the facility some months later.

As described on page 22, AGA also has a revolving credit facility that can be used to help it manage its commitments, if needed.

The Apax approach to private equity

The four sectors that the investment adviser has chosen to focus on – tech, services, healthcare and consumer – are all areas that offer secular growth.

Some private equity managers will look to buy best-in-class companies, often paying a high valuation multiple as a result. They will inject leverage into the corporate structure and bet that the company can continue to grow. This is not the Apax approach.

The Apax funds would rather buy good, solid businesses at attractive valuations, where it can develop a thesis around how to achieve operational improvement. Apax aims to transform these good businesses into great businesses. The approach offers greater flexibility – the investment adviser says it has ‘more levers to pull’ – and should enable it to deliver real added value. Usually the Apax funds will be the sole private equity investor in a business.

Value can be created through EBITDA growth, multiple expansion, and cash generation. This means looking to grow the top line, while keeping a lid on costs and, sometimes, looking to extract synergies from M&A activity.

The investment adviser has offices in New York, London, Munich, Tel Aviv, Mumbai, Hong Kong and Shanghai, but the team is organised along sector rather than regional lines. They adopt a truly global approach, sharing expertise and ideas, and leveraging experience. Within each sector team there is resource dedicated to specific sub-sectors, to ensure that there is sufficient depth of knowledge.

New investments, which are typically in the upper- to mid-market range of private equity transactions, can come from a variety of sources. For example, sometimes, they will look to carve out a business from a much larger company and sometimes they will step in when a founder is looking to exit.

Individual team members source deals and put suggestions to an internal investment committee for approval. Part of the committee’s role is to ensure that the portfolio is adequately diversified with regard to risk.

An operational excellence practice within the investment adviser’s team works with and supports the management of the underlying companies.

A focus on nurturing and growing businesses should mean that the investment adviser is well-regarded by the management teams that it works with, and this in turn helps drive introductions of potential new investments, in a virtuous circle.

For example, one of Apax’s first experiences of online marketplaces came when it invested in Autotrader in 2007. The knowledge and experience that the investment adviser gained from that investment led to similar investments in Canada and New Zealand and also helped inform the investment in idealista (see page 14).

As discussed above, average leverage rates are lower than for many other private equity companies, typically around 4:1 on EBITDA. The actual level is determined by the circumstances of the individual company, around 29% was leveraged less than two times at the end of December 2020.

Currency and market exposures are not hedged.

Investment restrictions

The following specific investment restrictions apply as at the date of the relevant transaction or commitment to invest:

- no more than 25% of GAV will be invested in any one Apax fund, unless that fund is restricted from holding more than 25% of its portfolio in one investment;

- no more than 15% of GAV may be invested in any one portfolio company on a look-through basis;

- no more than 15% of GAV may be invested in any one derived investment; and

- in aggregate, not more than 20% of GAV is intended to be invested in derived investments in equity securities of publicly listed companies. However, such aggregate exposure will always be subject to an absolute maximum of 25% of GAV.

Sustainability

The investment adviser believes that a focus on sustainable investing can lower risk and enhance financial returns for the funds it advises, while creating a net benefit to society. Consequently, sustainability has been embedded into Apax’s investment processes for over a decade. A sustainability committee (which meets monthly) coordinates the investment adviser’s sustainability efforts.

The annual assessment by the Principles for Responsible Investment (“UNPRI”) rates the Apax ESG programme as A+. ESG due diligence is undertaken for each new investment and the findings form part of the report to the investment committee that proceeds each deal. Aspects of ESG are monitored and reviewed for each investment at least annually.

From a practical perspective, it is easier for the investment adviser to exert influence over private equity investments than over derived investments. Nevertheless, the investment adviser remains focused on corporate social responsibility and considers this as part of its overall investment thesis.

Apax also highlights the benefit that efficiency improvements, championed by its operational excellence practice, can have on aspects such as reducing CO2 emissions. The practice is also working with businesses in its portfolios to improve diversity and inclusion within the workplace.

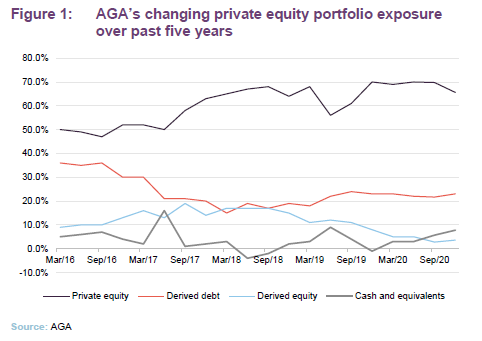

Asset allocation – overall

At the end of December 2020, the exposure to cash and equivalents was 7.8% of the portfolio, private equity 65.6%, derived debt 23.0% and derived equity 3.6%.

Generally, the exposure to private equity has been rising in recent years. As the portfolio becomes increasingly mature, and given the degree of the diversification of the underlying investments, AGA has been able to increase its exposure to private equity at the expense of the exposure to derived equity, without compromising on prudent risk limits. The board expects that the greater focus on private equity will continue.

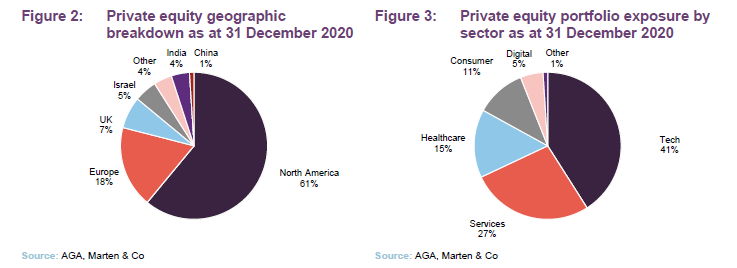

Asset allocation – private equity

The AGA private equity portfolio has a bias to the US and Europe and only modest exposure to other parts of the world, including Asia. Regional weightings reflect the opportunities available. The portfolio is not managed on a top-down basis. The allocation to digital reflects the holding in the Apax Digital Fund (ADF), which makes investments in the software, internet and tech-enabled services sub-sectors.

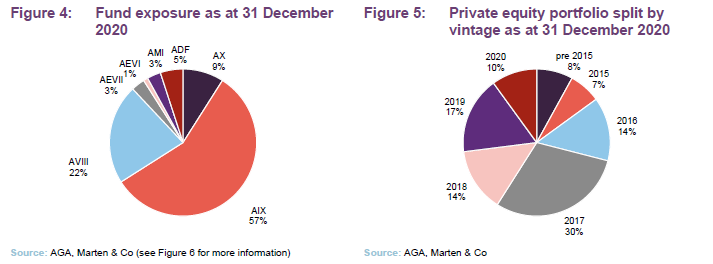

Apax X (AX in Figure 4) is relatively early in its life cycle. The exposures to individual funds reflect their relative maturity.

Apax funds within the AGA private equity portfolio

The recent Apax funds (AX, AIX and AVIII) held by AGA have both euro and dollar partnerships, hence the commitment figures in different currencies. Apax X (AX), the latest, announced on 29 January 2021 that it had raised $11bn (hitting its hard cap, excluding affiliate entities).

Like its predecessors, AX is seeking investment opportunities across the tech, services, healthcare and consumer sectors.

AMI Opportunities is focused on investments in Israel.

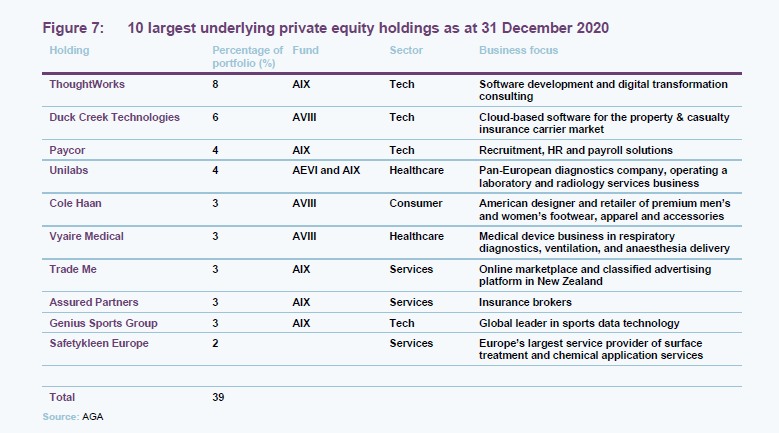

10 largest underlying private equity holdings

At the end of December 2020, AGA had exposure to 66 underlying portfolio companies.

The list of AGA’s 10-largest holdings is as at 31 December 2020. As we detail on subsequent pages, there was considerable portfolio activity, including some sizeable and profitable disposals, over the latter half of 2020.

ThoughtWorks

ThoughtWorks (thoughtworks.com) is a global software development and digital transformation consulting company. Incorporated in 1993 and headquartered in Chicago, USA, the company has grown from a small group to over 7,000 employees across 46 offices in 15 countries.

AIX acquired ThoughtWorks in October 2017 from its founder and has been driving sales growth by focusing on account management practices and further investing in new technology capabilities.

In January 2021, a consortium of GIC, Siemens AG, Fidelity Management and Research LLC, and Mubadala Investment Company invested $720m into the company and AIX reduced its stake.

The partial disposal of the position in ThoughtWorks was announced alongside the disclosure of a full exit of AIX’s investment in Boats Group (see page 13). Combined, the two transactions represented about a 30% uplift to the last unaffected valuation and added €29m or about €0.06 per share to AGA’s 30 September NAV.

Duck Creek Technologies

In 2016, Apax approached Accenture with the idea of carving out Duck Creek Technologies (duckcreek.com). AVIII bought into the company at a significant discount to comparable valuations of listed peers. Accenture retained a significant minority stake.

Apax then transformed Duck Creek into a SaaS company, a leading provider of software technology to the property & casualty insurance carrier market. Its cloud-based software products help back-end processing such as policy administration, claims processing, billing and rating.

Under Apax’s ownership, the company strengthened its management team and made four bolt-on acquisitions. In August 2020, Duck Creek was listed on the Nasdaq Global Select Market, valuing it at 8.2x the amount that AVIII had invested, equivalent to a gross IRR of 66%.

At the $40 closing price on 14 August 2020, AGA’s position in Duck Creek was valued at €82m. AGA had already received about €6m in cash from the investment and its share of AVIII’s proceeds from the IPO was about €3m. On this basis, The IPO added approximately €46m or €0.09 per share to AGA’s end June NAV. At 8 March 2021, Duck Creek’s share price was $42.25.

Paycor

Paycor (paycor.com) provides recruitment, HR and payroll solutions, partnering with businesses to optimise the management of their workforce. Paycor says that its personalised support and user-friendly technology ensure that key business processes, including recruiting, onboarding, reporting, timekeeping, compliance and payroll, run smoothly.

AIX invested in the business in November 2018. Apax had experience of investing in the sector, with deals going back to 2008. It hoped to grow the company by investing in product development and has had some success.

In January, a consortium consisting of Neuberger Berman, on behalf of certain funds for which it serves as investment adviser, Qatar Investment Authority and other new investors including ClearBridge Investments, Franklin Templeton, Leumi Partners, and Teca Partners, invested $270m in Paycor. AIX sold part of its stake. The deal valued AGA’s look-through stake in Paycor at about €50m, a 30% uplift to the last unaffected valuation (the value at the quarter end before the disposal process started and the prospect of an exit began to be reflected in the valuation) and added about €11.8m or two cents per share to AGA’s end-September NAV.

Unilabs

Unilabs (unilabs.com) is a leading pan-European diagnostics company, with around 12,700 employees across 150 imaging centres and 250 labs in 17 countries. It operates a laboratory and radiology services business. The company provides diagnostic services to public and private healthcare providers (e.g. hospitals, GPs, county councils, occupational health units), insurance companies, directly to outpatients as well as to the pharmaceutical industry and clinical research organisations.

AEVI invested in Unilabs in 2007 and in 2017, AIX made a further investment in the business such that Apax funds own the majority of the company.

COVID-19 has boosted the company’s diagnostics operation. It started large-scale testing in Q1 2020, set up more than two hundred drive-through and walk-through test centres to ensure safe COVID-19 testing, and, by December 2020, had the capacity to process 500,000 tests per week. The majority of the tests conducted are PCR tests.

Cole Haan

Cole Haan (colehaan.com), founded in 1928, is an iconic American designer and retailer of premium men’s and women’s footwear, apparel and accessories. AVIII bought the business from Nike in 2013 in a $570m deal. An attempt to IPO the company early in 2020 foundered as a result of the market volatility triggered by COVID-19. It may be that an IPO process is re-started later this year.

Vyaire Medical

Vyaire Medical (vyaire.com) is a global market-leading medical device business in the respiratory diagnostics, ventilation, and anaesthesia delivery market segments.

The company was formed in 2016 when the AVIII led the carve-out of the Becton Dickinson & Company’s respiratory solutions business. Initially, Becton & Dickinson retained a minority stake, but AVIII bought this in 2018. A new CEO was appointed early in 2020.

In May 2020, Vyaire Medical agreed a deal with the European Commission to provide approximately 26,200 ventilators to aid the fight against COVID-19, one of a number of contracts it picked up last year.

Trade Me

Founded in 1999, Trade Me (trademe.co.nz) is an online marketplace and classified advertising platform in New Zealand. AIX took the company private in 2019 in a deal that valued it at NZ$2.6bn. Trade Me is visited 1.9m times every day by an average of 650,000 New Zealanders. There are more than 9m listings onsite at any one time, and the company employs more than 500 people across Auckland, Wellington and Christchurch. In 2020, in an action designed to streamline the business, Trade Me sold its LifeDirect insurance operations back to its previous owner.

Assured Partners

Assured Partners (assuredpartners.com) claims to be the fastest-growing independent insurance agency in the US, with offices in 38 US states and also in London. It has been growing rapidly through acquisition, announcing four deals in February alone. AVIII bought the business in 2015 and, in 2019, it realised its investment but AIX took the opportunity to buy a stake.

Genius Sports Group

Genius Sports Group (geniussports.com) is a market leader in the high-growth sports data, sports media and regulated sports betting sectors, specialising in the capture and distribution of real-time data. AIX acquired the business in 2018. On 27 October 2020, Genius Sports announced that it would reverse into a listed SPAC (dMY Technology Group, Inc. II). AIX remains the largest single shareholder of the combined company. The deal valued AGA’s look-through position at about €30.2m, around double its last unaffected valuation (as at 30 June 2020).

Safetykleen Europe

Safetykleen Europe (safetykleeninternational.com) is the world’s leading provider of parts washing, surface treatment and chemical application services. The business was founded in 1973 and operates in 14 countries in Europe, as well as in Brazil, China and Turkey. AIX acquired the company in 2017.

Other recent portfolio activity

InnovAge

On 8 March 2021, InnovAge (innovage.com), which AX has an indirect shareholding in, announced the pricing of its initial public offering of common stock on the Nasdaq Global Select Market. Based on the closing price of $24.20 on 4 March, the IPO added 108% or about €21m to InnovAge’s fair value in APAX’s NAV at 31 December 2020. This represents an uplift of about 1.8% or €0.04 per share. InnovAge is a leading provider of value-based senior care in the US.

Herjavec Group

On 11 February 2021, AX announced the acquisition of a majority stake in a cybersecurity company, Herjavec Group (herjavecgroup.com), a global managed security services provider and cyber operations leader. The transaction is expected to close in the second quarter of 2021, subject to customary closing conditions. On a look through basis, AGA is expected to invest approximately €5.4m in the company.

Signavio

On 28 January 2021, ADF announced that it planned to sell Signavio (signavio.com), the company behind Signavio Process Manager, a web-based business process modelling tool. The transaction valued the business at an 80% premium to the last unaffected valuation. This added €3.9m or about one cent per share to AGA’s NAV.

PIB Group

AX announced that it was buying PIB Group (pibgroup.co.uk), a leading independent specialist insurance intermediary, on 25 January 2021. AGA’s share of the deal amounted to about €20m.

Boats Group

On 29 December, AIX sold its stake in Boats Group (boatsgroup.com) – an online marketplace and provider of software solutions for the recreational marine industry – to funds advised for Permira. AIX realised a gross MOIC of about 4.2x and a gross IRR of about 41% on the investment (see the comment above on ThoughtWorks).

Azentio Software

On 28 December 2020, AX bought the software products business of 31 infotech. AGA’s share of the deal amounts to about €5.4m. Azentio Software (azentio.com) offers a comprehensive set of core software products for customers in banking, financial services and insurance verticals and includes key products such as Kastle™ (universal banking platform), AMLOCK™ (compliance software suite), Premia™ Astra (core insurance software), Orion™ (enterprise resource planning software) and MFund™ Plus (asset management platform).

ECI Software Solutions

ECI Software Solutions (ecisolutions.com) is a leader in industry-specific enterprise resource planning software solutions for small and medium-sized businesses across the builders’ merchants, office technology, office products, business applications and manufacturing sectors, serving more than 22,000 customers globally.

AIX acquired ECI Software Solutions in 2017. At the same time, it acquired the specialised solutions division of Exact Software and combined this with ECI.

In November 2020, Leonard Green & Partners bought a majority stake in the company. AIX reinvested some of the proceeds to retain a minority stake in ECI. The disposal generated a gross MOIC of 4.2x and a gross IRR of 55% for AIX. It also added €4.3m or about one cent per share to AGA’s NAV.

idealista.com

Idealista operates idealista.com, the leading online real estate classified advertising marketplace in Spain. Founded in 2000 and headquartered in Madrid, Spain, idealista supports approximately 40,000 real estate agents and attracts around 38m unique monthly visitors, connecting buyers and sellers. The majority of the company’s revenue is generated from its agent listing fees with the remainder from new home developer listing fees, display advertising and paying private individuals.

AVIII acquired idealista in 2015, drawing on experience with other digital classifieds businesses. It helped the development of idealista’s mobile platform and supported a fourfold growth in traffic and a threefold increase in revenue.

In September 2020, the business was sold to EQT IX in a transaction valued at €1.3bn.

Neuraxpharm

Neuraxpharm Group (neuraxpharm.com) is a leading specialty generic pharmaceutical company focused on treatments for central nervous system disorders, such as neurological and mental health conditions.

In 2016 AVIII merged Invent Farma (based in Spain) and Neuraxpharm (based in Germany), and in 2017 bolted-on FB Health (based in Italy). Together these firms develop, manufacture and market generic drugs. A series of other acquisitions over the next few years helped build the company into a pan-European business.

In September 2020, Neuraxpharm was sold to funds advised by Permira, crystallising a gross MOIC of 3.5x, equivalent to a 35% gross IRR. The disposal added about €22m or €0.04 per share to AGA’s end June NAV.

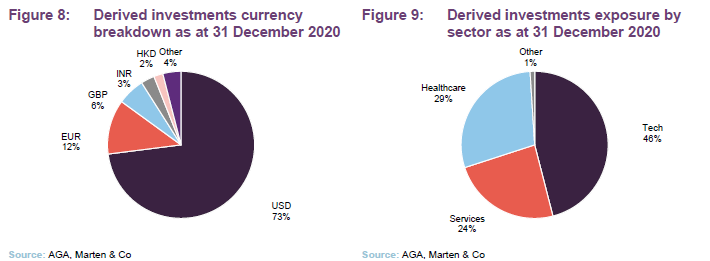

Asset allocation – derived investments

At 31 December 2020, 86.3% of this part of the portfolio was in derived debt and 13.7% in derived equity.

Ideas for potential investments in the derived portfolio are generated on a bottom-up basis but the AGA investment committee and the investment manager take a top-down view of risk exposures within the portfolio.

The derived debt is all floating rate and, at 31 December 2020, the weighted average income yield on this part of the portfolio was 7.3%. The weighted average maturity of the derived debt portfolio was 5.7 years.

Within the derived equity portfolio, the average P/E ratio was 7.1x at the end of December.

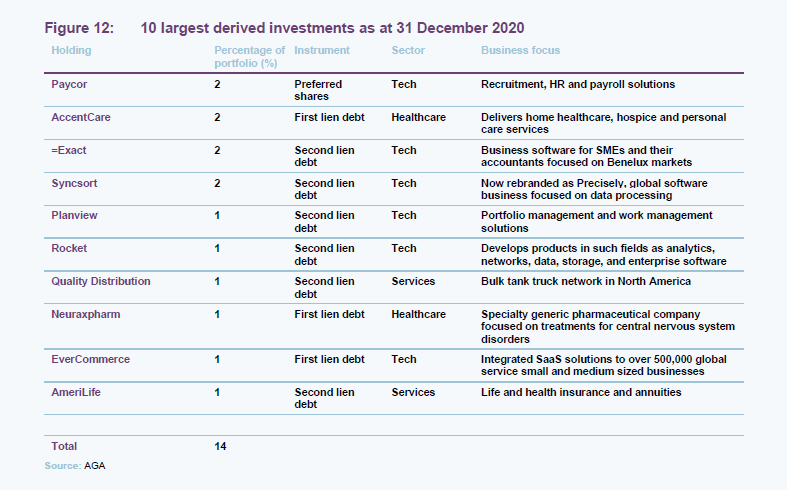

10 largest derived investments

At the end of December 2020, there were just over 30 discrete positions in the derived investments portfolio. The largest equity position (ranking 13th) was Airtel Africa, valued at around 1% of the portfolio.

Performance

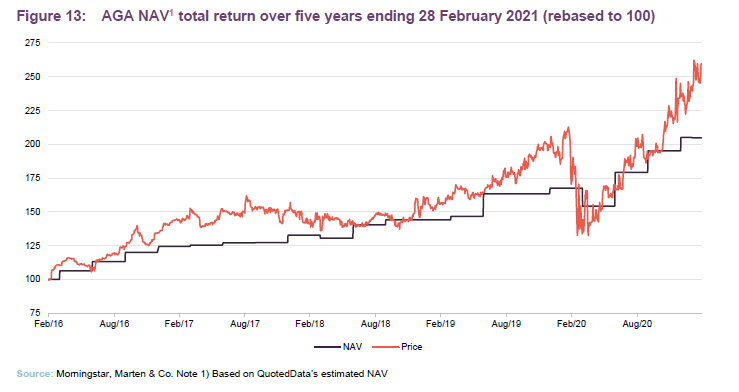

Note: AGA’s shares trade in sterling and it pays sterling dividends. However, its accounts are prepared in euros. All returns cited in this note are in sterling unless otherwise indicated.

For the purposes of this note, QuotedData’s analysts have estimated AGA’s NAV as at end January, end February and as at 8 March 2021. We have attempted to factor in changes in exchange rates, based on the distribution of the portfolio as at end December, announcements of events impacting the NAV and changes in the share prices of significant listed holdings. This is an estimate only and the actual NAV as at those dates may be materially different.

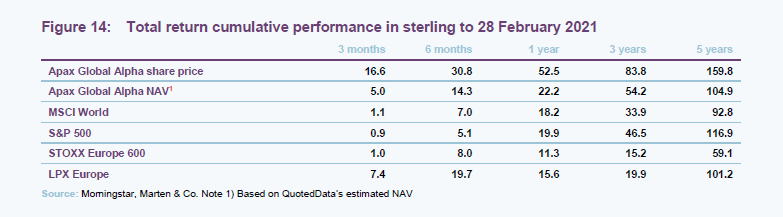

Over the five years to the end of February 2021, AGA outperformed the MSCI World Index in both NAV and share price terms.

It was perhaps inevitable, given the gyrations in markets, that AGA’s NAV would be impacted by market falls over Q1 2020. However, as nerves settled, markets recovered, and when this was coupled with a number of valuation uplifts within the portfolio, AGA’s NAV regained the ground it had lost and more.

In its recently published results, which covered the year to end December, APAX announced that it had generated an NAV return of 14.8% in euro terms (21.6% constant currency terms).

Breaking the return for 2020 down between the company’s private equity and derived investments portfolio, the private equity portfolio returned 25.4% and the derived investments portfolio returned -0.6% (both in euro terms). The return on the derived investments portfolio would have been 6.5% on a constant currency basis.

The private equity return was aided by improved operating performance within the portfolio (on average, EBITDA grew by 20.8% over 2020). Those investments that were valued with reference to listed comparators also benefited as market valuations rose, on average.

The portfolio also benefited from a number of valuation uplifts on the back of distributions. Seven full exits, three significant partial exits and two IPOs helped generate €207.3m for AGA. The average uplift in valuation on these deals was around 40%.

In recent months, currency moves and, in particular dollar weakness, have been weighing on returns.

The LPX Europe Index is an index of listed private equity companies in Europe. Its returns are driven by the share prices of those companies. A comparison of the LPX Europe and AGA’s share price suggests that AGA has done particularly well against its peer group.

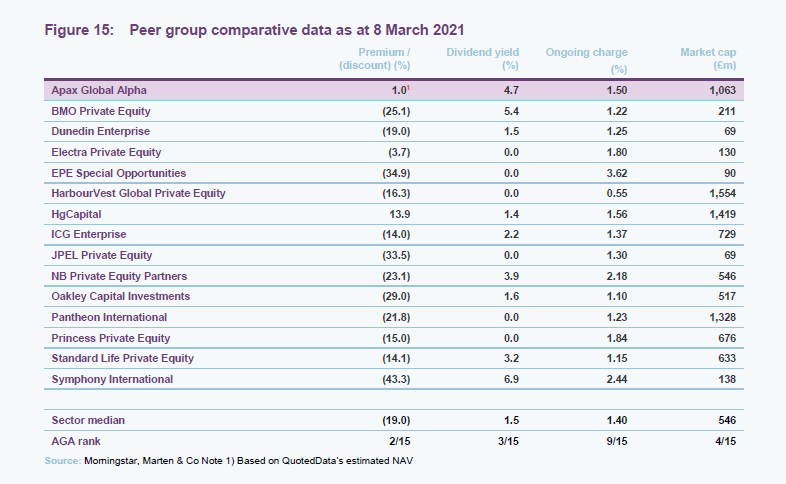

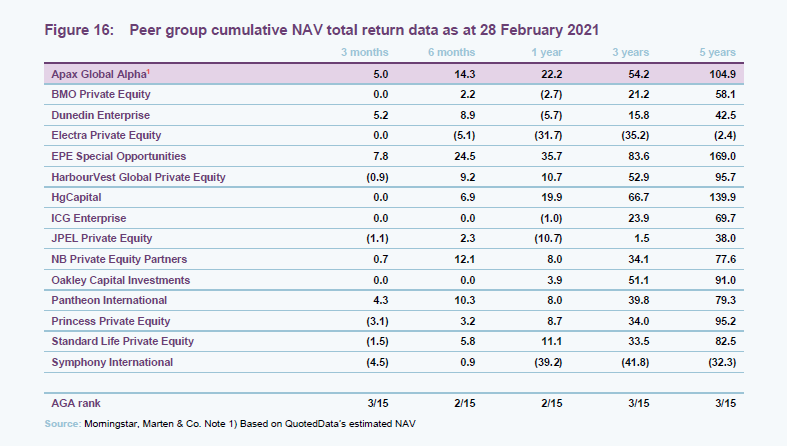

Peer group

AGA is a constituent of the AIC’s private equity sector. For the purposes of this note, we have compared AGA with the other members of this sector, excluding 3i (which has a substantial third-party fund management business) and trusts with market caps less than £50m.

Each of the funds has its own investment approach, ranging from funds of funds such as Pantheon International, to relatively concentrated directly invested portfolios, such as EPE Special Opportunities. They have varying geographic remits too. Symphony International, for example, is focused on Asia.

AGA’s shares are, based on our estimate of its NAV, trading close to asset value. The trust’s distribution policy, discussed below, places it on an attractive yield.

AGA is one of the leading trusts in its peer group in NAV performance terms. The returns of the leading trust, EPE Special Opportunities, can largely be attributed to just one stock within its portfolio.

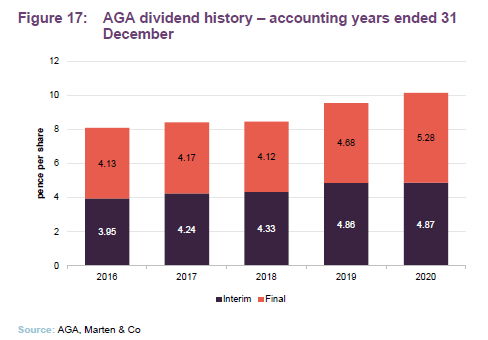

Dividend

AGA normally declares two dividends per year, an interim in September and a final in April. Each of the interim and final dividends is calculated as 2.5% of the company’s NAV at 30 June and 31 December, respectively.

As a Guernsey-domiciled investment company, AGA is not required to separate capital and revenue items within its accounts. Dividends are financed from the returns generated from the portfolio of derived investments and distributions from the private equity portfolio. For the year ended 31 December 2020, investment income totalled €18.1m, distributions from the private equity portfolio totalled €207.3m and dividends paid totalled €52.9m.

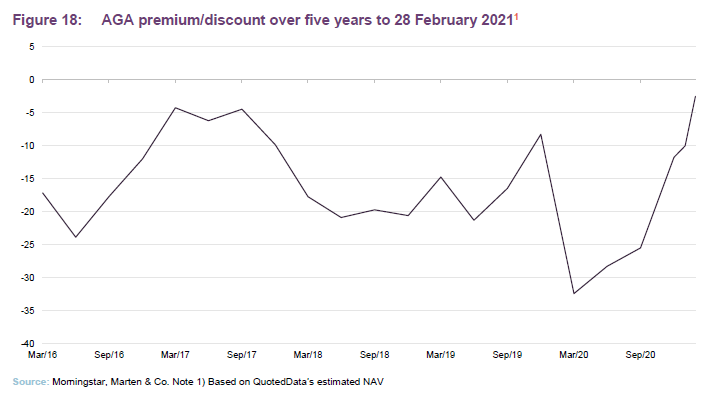

Discount

AGA announces its NAV’s quarterly. Figure 18 combines quarterly data and our estimated NAVs, for end January and end February 2021. AGA’s discount appears to be on a narrowing trend. At 28 February 2021, we estimate that AGA was trading at a discount of 2.5%, and, at 8 March 2021, our model suggests that AGA was trading on a premium of 1.0%.

At the last AGM in April 2020, shareholders gave permission for the company to buy back up to 14.99% of AGA’s shares in issue. AGA’s board monitors the level of discount and would consider buying back shares if it felt it was appropriate to do so, but felt that no shares needed to be bought back during 2020. The recent elimination of the discount has vindicated that decision.

Shareholders also authorised the board to issue up to 10% of AGA’s shares in issue without pre-emption. If the shares trade at a premium consistently, it may be that the board looks to moderate the premium by issuing shares under this authority. The investment adviser would like to see the company grow.

Fees and costs

Although AGA invests predominantly through private equity funds managed or advised by Apax, there is no double-layering of fees. No fee is payable at the AGA level on private equity fund investments where the private equity fund pays a fee. In addition, as a sizeable investor in each Apax Fund, it benefits from preferential terms which are available to other similar sized third-party investors.

During 2020, the average management fee paid on the company’s commitments to the Apax Funds was 1.3%. Where the Apax Fund is subject to management fee payments, there is no additional management fee charged to the company.

The management fee is calculated and paid quarterly in arrears at a rate of 1.0% per annum on the fair value of derived debt investments, 0.5% per annum on derived equity investments and 0.5% per annum on eligible private equity investments.

Eligible private equity investments are private equity investments which do not already pay fees at the Apax fund level. There is no double-layering of fees.

This fee arrangement took effect on 1 January 2020. Before this date, each of the three classifications of investment incurred fees of 1.25% per annum.

The investment manager is also entitled to a performance fee on the overall gains or losses, net of management fees and direct deal costs in each financial year, calculated as 20% of the excess return over an 8% per annum hurdle for derived equity and eligible private equity investments and 15% of the excess return over a 6% per annum hurdle for derived debt investments. Any performance fee payable is paid in shares.

Overall fees payable are capped at 3% of NAV.

The investment management agreement had an initial term of six years, which would have ended on 22 May 2021. However, in accordance with the terms of the agreement, as no notice to terminate the contract was served prior to 22 May 2020, the agreement automatically continued for a further three additional years to 22 May 2024.

For the 2020 accounting year, other expenses included €2.4m of admin and operating expenses.

The ongoing charges ratio for the year ended 31 December 2020 was 1.5%, down from 1.6% for the prior year.

Capital structure and life

At 8 March 2021, AGA had 491,100,768 ordinary shares in issue. There are no other classes of share capital.

From IPO, certain investors were subject to a 10-year lock-up period. They may sell 20% of the shares they held at IPO from 15 June 2021 onwards and a further 20% each year thereafter so that 100% of the shares will be unrestricted from 15 June 2025 onwards.

AGA does not have a fixed life, but holds regular discontinuation resolution votes (which require a two-thirds majority to pass) on a three-yearly basis. The last vote was held at the 2018 AGM and was passed convincingly. The next such vote is due at the AGM to be held later this year. AGA’s financial year end is 31 December and its AGMs are usually held in April/May.

Gearing/liquidity

AGA may borrow in aggregate up to 25% of GAV, at the time of borrowing. However, this borrowing is not intended to be long-term or structural in nature.

AGA has a multi-currency revolving credit facility with Credit Suisse AG, London Branch, which is available for general corporate purposes. The €140m facility was due to expire on 5 November 2021, but on 19 January 2021, AGA announced that the facility has been converted to an evergreen structure. A loan to value covenant limits the maximum borrowing level to 35% of the NAV of the company’s private equity investments.

The interest rate charged is LIBOR or EURIBOR plus a margin of 210bps and there is a non-utilisation fee on the undrawn facility.

Over the year ended 31 December 2020, the facility was drawn once and fully repaid during the year.

At the end of December 2020, AGA had €93.5m of cash available for investment. This, combined with the €140m credit facility and the portfolio of derived investments valued at €319.4m, sat against outstanding commitments to Apax funds of €458.8m. The majority of commitments relate to AX and are likely to be drawn down over the next three to four years.

Major shareholders

At 31 December 2020, the following shareholders held more than 5% of the voting rights in AGA.

- NorTrust Nominees Limited 6.7%

- Witan Investment Trust 6.1%

- Berlinetta Limited 5.9%.

The investment adviser’s AGA investment committee

The AGA investment committee has five members drawn from the investment adviser’s senior team members. The committee is comprised of Andrew Sillitoe (co-CEO), Mitch Truwit (co-CEO), Roy Mackenzie (partner), Salim Nathoo (partner) and Ralf Gruss (COO).

Andrew Sillitoe (co-CEO)

Andrew joined Apax in 1998 and has focused on the tech sector. He has been involved in a number of deals, including Orange, TIVIT, TDC, Intelsat, Inmarsat and King Digital Entertainment. Andrew has an MA in Politics, Philosophy and Economics from Oxford University and an MBA from INSEAD.

Mitch Truwit (co-CEO)

Mitch joined Apax in 2006 and has been involved in a number of transactions including HUB International, Advantage Sales and Marketing, Bankrate, Dealer.com, Trader Canada, Garda and Answers. He is a partner in the Apax Services team and a trustee of the Apax Foundation. Mitch has a BA in Political Science from Vassar College and an MBA from Harvard Business School.

Roy Mackenzie (partner)

Roy joined Apax in 2003. He led the investments in Sophos and Exact and was responsible for Apax’s investment in King Digital Entertainment. In addition, he worked on the investments in Epicor, NXP and Duck Creek. Roy has an M.Eng in Electrical Engineering from Imperial College, London and an MBA from Stanford Graduate School of Business.

Salim Nathoo (partner)

Salim joined Apax in 1999, specialising in the tech space. He has both led and participated in a number of key deals including ThoughtWorks, Candela, EVRY, GlobalLogic, Sophos and Inmarsat. Salim holds an MBA from INSEAD and an MA in Mathematics from the University of Cambridge.

Ralf Gruss (COO)

Ralf joined Apax in 2000 and is a former member of the Apax Partners Services team. He has been involved in a number of deals, including Kabel Deutschland, LR Health and Beauty Systems and IFCO Systems. Ralf has a Diploma in Industrial Engineering and Business Administration from the Technical University in Karlsruhe. He also studied at the University of Massachusetts and the London School of Economics.

The investment manager

Apax Guernsey Managers Limited has four directors – Paul Meader, Martin Halusa, Andrew Guille and Mark Despres. Apax Guernsey Managers Limited is responsible for discretionary portfolio management, investment and divestment decisions, portfolio performance analysis and risk management.

Paul Meader

Paul has acted as non-executive director of several insurers, London and Euronext listed investment companies, funds and fund managers in real estate, private equity, hedge funds, debt, structured product and multi-asset funds. He is a senior investment professional with over 30 years of multi-jurisdictional experience, 14 years of which were at chief executive level. Paul was head of portfolio management at Collins Stewart (now Canaccord Genuity) between 2010 and 2013 and was the chief executive of Corazon Capital Group from 2002 to 2010. He was managing director at Rothschild Bank Switzerland C.I. Limited from 1996 to 2002 and previously worked for Matheson Investment Management, Ulster Bank, Aetna Investment Management and Midland Montagu (now HSBC).

Paul is also a non-executive director of a number of other companies in fund management and insurance. He has an MA (Hons) in Geography from Oxford University and a Chartered Fellow of the Chartered Institute of Securities and Investment.

Martin Halusa

Martin was chairman of Apax from January 2014 to March 2016, after 10 years as chief executive officer of the firm (2003-2013). In 1990, he co-founded Apax Partners in Germany as managing director. His investment experience has been primarily in the telecommunications and service industries. Martin began his career at The Boston Consulting Group (BCG) in Germany, and left as a partner and vice president of BCG Worldwide in 1986. He joined Daniel Swarovski Corporation, Austria’s largest private industrial company, first as president of Swarovski Inc (US) and later as director of the International Holding in Zurich.

Martin is a graduate of Georgetown University and has an MBA from the Harvard Business School and a PhD in Economics from the Leopold Franzens University in Innsbruck. He is a substantial shareholder in AGA.

Andrew Guille

Andrew has held directorships of regulated financial services businesses since 1989 and has worked for more than 13 years in the private equity industry. He has been employed in the finance industry for over 30 years, with his early career spent in retail and institutional funds, trust and company administration, treasury and securities processing. He holds an Institute of Directors’ Diploma in Company Direction as well as being a Chartered Fellow of the Chartered Institute for Securities and Investment and a qualified banker (ACIB).

Mark Despres

Mark has been employed in the wealth management industry in both Guernsey and London for over 16 years, principally as an investment manager to a number of listed funds (both open- and closed-ended), institutional and private client portfolios.

Mark has a first-class honours degree in Mathematics from Royal Holloway University of London and is a Member of the Chartered Institute for Securities and Investment.

Board

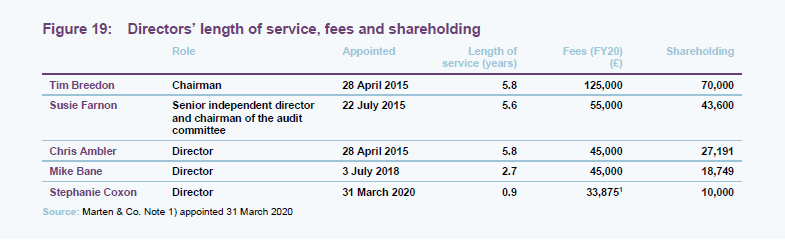

AGA has five directors, all of whom are non-executive and independent of the manager. Two of the directors share another directorship at HICL Infrastructure.

The board is responsible for setting business objectives and investment strategy, governance and risk management, and the appointment and oversight of the investment manager and other service providers.

Tim Breedon

Tim worked for the Legal & General Group Plc for 25 years, most recently as group chief executive between 2006 and 2012. He was a director of the Association of British Insurers, and also served as its chairman between 2010 and 2012. Tim served as chairman of the UK government’s non-bank lending task force, an industry-led task force that looked at the structural and behavioural barriers to the development of alternative debt markets in the UK. He was previously lead non-executive director of the Ministry of Justice between 2012 and 2015. Tim was formerly a director of the Financial Reporting Council and was on the board of the Investment Management Association. Currently, he is a non-executive director of Barclays Plc and Quilter Plc. He is a graduate of Oxford University and has an MSc in Business Administration from the London Business School.

Susie Farnon

Susie is a fellow of the Institute of Chartered Accountants of England and Wales. She was appointed as chairman of the AGA audit committee on 1 July 2016 and elected as senior independent director on 18 November 2016. Susie served as president of the Guernsey Society of Chartered and Certified Accountants, as a member of The States of Guernsey Audit Commission and as a commissioner of the Guernsey Financial Services Commission. She was a Banking and Finance partner with KPMG Channel Islands from 1990 until 2001 and was head of audit at KPMG in the Channel Islands from 1999 until 2001.

Currently, Susie is a non-executive director of: HICL Infrastructure Plc; Real Estate Credit Investments Limited; BH Global Limited; and Bailiwick Investments Limited. She is also a board member of The Association of Investment Companies.

Chris Ambler

Chris Ambler has experience in a number of senior positions in the global industrial, energy and materials sectors working for major corporations including ICI/Zeneca, The BOC Group and Centrica/British Gas, as well as in strategic consulting roles.

Currently, Chris is chief executive of Jersey Electricity Plc and non-executive director of Foresight Solar Fund Limited. He has a first-class honours degree from Queens’ College, Cambridge and an MBA from INSEAD. Chris is also a Chartered Director, Chartered Engineer and a member of the Institution of Mechanical Engineers.

Mike Bane

Mike Bane has had over 35 years of audit and advisory experience in the asset management industry and has been a Guernsey resident for over 20 years. He retired as an EY partner in June 2018 where he was a member of EY’s EMEIA Wealth and Asset Management Board. Prior to EY, Mike worked for PwC in London and Guernsey.

Currently, Mike is a non-executive director of HICL Infrastructure Plc and NextEnergy Renewables Limited. He is a graduate of Oxford University and a Chartered Accountant.

Stephanie Coxon

Stephanie has 15 years’ experience of audit and advisory with PwC in the asset management sector, specialising in listed investment funds in a multitude of asset classes. Over the past nine years, she has led the PwC capital markets team responsible for advising on the listing process for UK, Guernsey and Jersey investment funds. Stephanie has a wealth of knowledge in this area having advised numerous investment managers throughout the UK, US and Europe on initial public offerings and secondary offerings.

Currently, Stephanie is a non-executive director of JLEN Environmental Assets Group Limited, PPHE Hotel Group Limited and PraxisIFM Group Limited. She is a fellow of the Institute of Chartered Accountants of England and Wales.

The legal bit

This marketing communication has been prepared for Apax Global Alpha Limited by Marten & Co (which is authorised and regulated by the Financial Conduct Authority) and is non-independent research as defined under Article 36 of the Commission Delegated Regulation (EU) 2017/565 of 25 April 2016 supplementing the Markets in Financial Instruments Directive (MIFID). It is intended for use by investment professionals as defined in article 19 (5) of the Financial Services Act 2000 (Financial Promotion) Order 2005. Marten & Co is not authorised to give advice to retail clients and, if you are not a professional investor, or in any other way are prohibited or restricted from receiving this information, you should disregard it. The note does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it.

The note has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. The analysts who prepared this note are not constrained from dealing ahead of it but, in practice, and in accordance with our internal code of good conduct, will refrain from doing so for the period from which they first obtained the information necessary to prepare the note until one month after the note’s publication. Nevertheless, they may have an interest in any of the securities mentioned within this note.

This note has been compiled from publicly available information. This note is not directed at any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this note is prohibited.

Accuracy of Content: Whilst Marten & Co uses reasonable efforts to obtain information from sources which we believe to be reliable and to ensure that the information in this note is up to date and accurate, we make no representation or warranty that the information contained in this note is accurate, reliable or complete. The information contained in this note is provided by Marten & Co for personal use and information purposes generally. You are solely liable for any use you may make of this information. The information is inherently subject to change without notice and may become outdated. You, therefore, should verify any information obtained from this note before you use it.

No Advice: Nothing contained in this note constitutes or should be construed to constitute investment, legal, tax or other advice.

No Representation or Warranty: No representation, warranty or guarantee of any kind, express or implied is given by Marten & Co in respect of any information contained on this note.

Exclusion of Liability: To the fullest extent allowed by law, Marten & Co shall not be liable for any direct or indirect losses, damages, costs or expenses incurred or suffered by you arising out or in connection with the access to, use of or reliance on any information contained on this note. In no circumstance shall Marten & Co and its employees have any liability for consequential or special damages.

Governing Law and Jurisdiction: These terms and conditions and all matters connected with them, are governed by the laws of England and Wales and shall be subject to the exclusive jurisdiction of the English courts. If you access this note from outside the UK, you are responsible for ensuring compliance with any local laws relating to access.

No information contained in this note shall form the basis of, or be relied upon in connection with, any offer or commitment whatsoever in any jurisdiction.

Investment Performance Information: Please remember that past performance is not necessarily a guide to the future and that the value of shares and the income from them can go down as well as up. Exchange rates may also cause the value of underlying overseas investments to go down as well as up. Marten & Co may write on companies that use gearing in a number of forms that can increase volatility and, in some cases, to a complete loss of an investment.